And with impeccable timing, an immense flood of new construction.

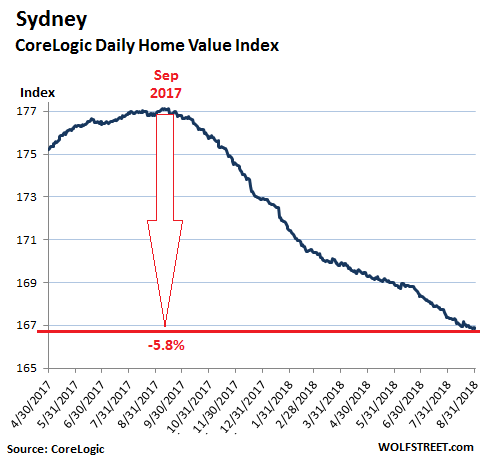

In Sydney, breeding ground for one of the world’s biggest housing bubbles, prices of single-family houses dropped 7.3% in August, compared to a year earlier. Prices of “units” — condos in US lingo — fell 2.2% year-over-year. Price declines were the sharpest at the high end, with prices down 8.1% in the most expensive quarter of home sales. Prices of all types of homes combined fell 5.6%, according to CoreLogic’s Daily Home Value Index. The index is down 5.8% from its peak last September:

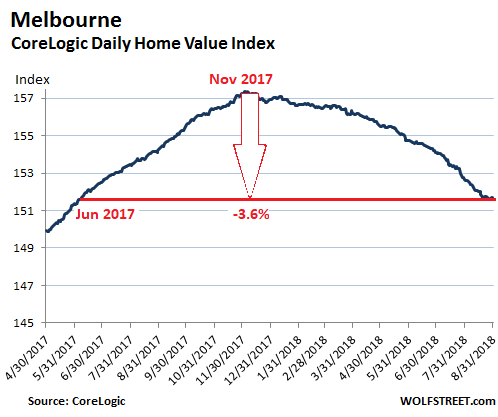

Melbourne, where the inflection point has been lagging a few months behind Sydney’s, is in the process of catching up. Over the three month-period, June-August, prices fell 2.0%, making Melbourne the weakest housing market among the capital cities. By segment, house prices fell 2.7% from a year ago while condo prices still inched up 1.5%. At the most expensive quarter of sales, prices fell 5.2% from a year ago. For all types of dwellings combined, prices declined 1.7% year-over-year, to the lowest level since early June 2017, according to CoreLogic. Prices are down 3.6% from their peak at the end of November 2017:

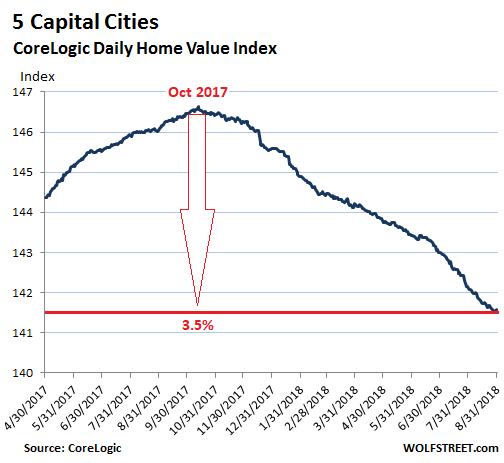

Corelogic tracks the largest five of Australia’s eight capital cities in a separate index. Due to the size of their housing markets, Sydney and Melbourne weigh the most. In the remaining three of the five capital cities in the index, prices were mixed in August:

- In Brisbane, home prices inched up 0.9% year-over-year.

- In Adelaide, home prices ticked up 1.0%.

- In Perth, home prices fell 2.0%, with houses down 1.5% and condos down 4.4%. Prices have been skidding since late 2014, when Western Australia mining boom turned into a mining bust.

The aggregate five capital cities index fell 3.1% in August year-over-year. The index has declined month-to-month for 11 months in a row and is down 3.5% from its peak in October 2017:

With impeccable timing, there is a flood of new condos expected to be completed over the next two years, something avid crane-counters in Sydney and Melbourne have been swearing for a while. Here are some of these astounding numbers that CoreLogic estimates based on data it collected from the industry:

Greater Sydney: In 2019: 31,500 new condos are scheduled to be completed. In 2020, another 45,500 condos are expected to be completed. This brings the two-year total of new condos to 77,000 units, which will increase the total stock of condos by 9.3%!

Greater Melbourne: The oncoming flood of new condos is expected to reach 29,000 units in 2019 and nearly 50,000 units in 2020. Over the two years, this will increase the total stock of condos by nearly 79,000 units, or by 11.5%!

As it becomes harder to find buyers for these projects, developers may delay or cancel some of them. So not all of these units may be completed in the two-year period.

In some of the other cities, the stock of condos is expected to increase over the next two years in similar fashion:

- Greater Brisbane by a whopping 18.4%

- Greater Adelaide by 12.5%

- Greater Perth by 5.7%

- Greater Hobart by 3.8%

- Greater Darwin by 9.9%

Nationally, 94,500 condos are estimated to be added in 2019 and 2020, which would increase the existing stock by 9.3%! And so CoreLogic explains:

Over the past five years there has been a significant increase in overall unit supply. At the same time, housing market conditions have deteriorated over the past year, particularly in Sydney and Melbourne, with dwelling values falling and rental growth slowing.

In the face of weakening housing market conditions, both of these cities still have a high volume of unit stock to be completed. As the new supply comes on line over the coming years, it is anticipated that this could lead to further softening of both dwelling values and rents in Sydney and Melbourne.

In its home value report, released today, CoreLogic has a somber outlook:

[I]t’s likely the spring season will be a challenging one for the housing sector. Advertised stock levels are already 7.6% higher than the same time last year across the combined capitals, despite a 5.7% reduction in ‘fresh’ stock being added to the market. The rise in inventory is simply due to a lack of absorption; with fewer buyers, homes are taking longer to sell and clearance rates [of homes sold at auction] have trended into the mid to low 50% range.

One of the reasons for the downturn is the fairly sudden exit of investors and speculators, which for banks are among the riskiest elements. Starting in 2014, Australia’s banking regulator (APRA) and the Council of Financial Regulators introduced “macroprudential policies” (summary) that were designed to cut down speculation in the housing market. They initially produced no results. Speculation increased, and prices jumped. But as they were tightened, including the imposition of a 30% limit per bank on interest-only mortgages and higher interest rates on mortgages for investors, they suddenly began to bite.

After publicized scandals, shenanigans, and the findings by the Royal Commission investigation into the banks, lending standards have been tightened on the margins for potential homebuyers as well, some of whom are now being sidelined by the new focus on sustainable debt-to-income ratios and the crackdown on mortgage fraud, particularly in the most overpriced markets, Sydney and Melbourne.

As prices are declining and rental yields are historically low, investors and speculators will be further discouraged because now, the quick and easy gains have moved out of view.

All this is happening even as mortgage rates remain at historic lows. But mortgage rates too are expected to tick up as funding costs for the banks have risen – and will likely continue to rise. Smaller banks have already lifted mortgage rates, and now Westpac has become the first of the big four banks to increase its rate for variable rate mortgages. The other banks will follow. And according to CoreLogic, this “is likely to send a chill through the housing market.”

Real estate is local and prices tend to move slowly over many years, on the way up as well as on the way down. But the housing markets of Sydney and Melbourne, ranked globally in the top housing bubbles, have passed a clearly visible inflection point late last year, when price moves changed direction and have formed well-defined U-turn.

New York condo prices fell again. Historic spikes slow in Seattle and other metros. Read… The Most Splendid Housing Bubbles in America

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Interesting test ahead of the ‘pent-up demand’ theory wherein crashes are adverted due to stacks of frustrated buyers sitting on the sidelines and piling in as soon as they see a few percent off (ie prices go from ‘insane’ yo ‘laughable’), and create the much-hoped for ‘soft landing’.

Never happened anywhere before, but HEY it’s different in [insert city name here] because of [insert straw-clutching reasons here]; so let’s wait and see!

Thats just what the estate agents say to get you to put in a bid 5% below the ask

There’s a name for the unlucky individuals who purchase soon after the top. They are called Bagholders. They are necessary to markets, like dung eating insects to the environment. Their existence cannot be denied.

Ah, yes the “buyers waiting at sidelines for prices to drop”. I’ve heard they live in the same land where Sasquatch, the Loch Ness monster and positive real interest rates reside.

There are quite a few up here in Sasquatch land!

It certainly will be a test, my brother took out a home loan in Australia when they were 17%, and they increased further to about 25%, in about 7-8 months! Argentina’s rates increased over nite to about 40% just recently, and other Emerging Market Countries are have had massive increases also, just to stabilize their currency, looking at the depreciation of the AU dollar yesterday, it has lost over 6.5% to date for the year, by years end 10% would not be unreasonable. That in itself is a sizeable devaluation, yet the real bonfire of our worthless money, is yet to come, as the blow back from US policy enters the Developed Markets. Australia has been sold a “narrative” by the Main Stream Media, the Bankers, and Government, call it a “sales pitch” in their quest to sell debt as an instrument of prosperity & growth for all. The signal of the reset has arrived, as Wall Street shifts the risk they have accumulated since 1971, is shifted to the Main Street Arena (you & me), when that shift is complete, the reset will take place.

I am disappointed with this article. As we all know Australia and Canada are DIFFERENT!!!! They are part of the Commonwealth!!!!

RofL.

FYI: manufacturing and transportation in Canada have overtaken resource extraction as GDP component. The best selling non- truck in the US is built in Canada (Toyota Tahoe)

Magda Auto parts employs 30,000 people.

The OZ govt operates many aircraft built by Bombardier as do short haul airlines everywhere. There are about five thousand Bombardier rail vehicles operating in the US.

Not sure why this is relevant. What you are describing is the changing components within the economy. Manufacturing, transportation and resource extraction are middle class jobs. In a sense that’s good i.e. the new jobs aren’t a step below, but then again it does not mean that Canada has invented a new class of jobs that are recession proof. Another way is if income gets higher and higher, but when that happens, people also tend to splurge …..

The US also had tons of manufacturing but as we all know those can be taken away too. Heck some of them by Canada. And that’s where NAFTA comes in.

I thought you were lumping them together. My point is the C economy is more diversified.

It does have a problem in having too much trade with a single customer.

Bubble implodes. 2-5% price drop from the top in one year. Is that less than average realtor commission?

Housing Bubble 2.0 is in the early stages of its implosion. Don’t worry, prices are going to start cratering very shortly as the fools who over-extended themselves to buy at the peak panic and try to chase the market down.

That’s what I’m seeing A slow deterioration in the market Surely to accelerate shortly unless they reverse course and initiate QE 4 ( Peter Schiff ) will be Correct again Early but correct

In the market… early is wrong. Schiff has been smoked on the USD and fairly smoked on Gold. And there is more where that came from. The $$$ is so strong it will knock your breath out. And gold has another beating coming to it.

Schiff is 180 degrees the wrong way around…. since 2011.

(and he’s hated stocks since then too.)

That’s how it started in the US housing bust.

Illiquid markets CAN turn on a dime. Not every housing downturn is a slow bleed.

It seems as the banks cut back on mortgage lending, the non bank lenders are ratcheting up their lending. Where is the money coming from, as you might suspect, the banks. The hall of mirrors grows larger.

The most interesting thing happening in Australia is the tracking of normal expenses being incorporated into the mortgage lending process. I heard they even suggest what the customer should cut back on and make them agree in writing to do it. In order for this to work, all expenses must be paid for digitally. So much for freedom.

Wolf, not sure where these ads that apear just above the comment section are from, but they look weird and/or gross, to the point that I would hesitate to open your site at work. Just FYI.

The ads are re-targeted and are always an extension of our browsing history. For examplei got furniture ads because i was looking for furniture the par past few weeks.

Not sure what you mean by gross but perhaps instead of blaming the site you should start using incognito mode for “buying your Christmas presents”

I suggest hitting the microscopic “x” in the top right hand corner of the ad and marking it as inappropriate. It will usually stop showing it to you.

The ads are based on the internet usage from your computer.

The other answers skipped around the answer.

Somebody using your computer has been looking at articles are shopping for items very closely related to the ones the ads are showing.

The ad pool is gigantic and is not narrowed by the particular website you are on rather by recent websites/stores accessed.

I got an ad for a dire straits soccer tour that is touring Australia. Probably because I recently looked up Mark Knofler.

As a child blowing soap bubbles I always tried to blow the biggest possible one, mostly they would pop right away, but sometimes, for no reason l could figure, l would blow an enormous one. And then it would pop. I never had one stay a bubble.

You sound like a shoo-in for our next Fed chair.

Is Australia another country that has Christine Lagarde on speed dial ?

It amazes me how easy it would be for regulators to prohibit certain banking practices (interest-only mortgages, 100% financing, et al)…but they never do.

These sanctions would protect the taxpayers, but push demand for loan funding to non-regulated mortgage companies (BTW mortgage interest paid to non-regulated banks should not be tax deductible). Thus it also should be illegal for regulated banks to purchase any financial instrument (stocks, bonds, derivatives) from non-regulated banks.

You can’t stop people from doing incredibly stupid & risky stuff, but you can better protect the taxpayers who get stuck cleaning up this mess. Borrowers & lenders of unregulated mortgages can go blow themselves up all day long as far as I’m concerned. Just firewall this behavior from regulated banks & taxpayers.

Why would they though? The housing crisis is a tragedy of the commons situation. Many homeowners lament how they have become stuck on the ‘ladder’ and that their children are priced out, but when it comes down to voting for politicians who would fix the problem they won’t because they do not want to lose their own personal equity gains.

So instead we get politicians trying to satisfy both sides of the issue using supply side schemes such as help-to-buy and allowing first time buyers to take on ever bigger mortgages.

This is sadly just how democracies work. The idea of an independent central bank was meant to alleviate some of this feedback loop, but central bankers are in on the wealth effect game, and want jobs to move into when their tenures finish.

Regulators? Who are the Regulators? I will tell you who they are mate, and if you don’t believe me, do some research. The Regulators are, the Banking Cartel themselves. I kid you not. The whole Financial Miracle is a scam! The whoring Media has sold DEPT, as wealth & prosperity, to the commoners, that’s us mate, and like the Media whores, so is the Australian Government!

I hope when it’s all said and done and the Australian property market lies in shambles that they’ll let Steve Keen back from exile.

I think governor of the RBA would be an appropriate appointment.

“The major influences on Keen’s thinking about economics include John Maynard Keynes, Karl Marx, Irving Fisher”

Steve Keen is is believer in central planning and fiat money.

No change will come from his quarter it is going to be all same story: inflation, debt and deflation.

RBA should not exist.

Of course they will. Once he’s done fixing everything, they’ll exile him again because the next party’s about to start.

When you need Steve Keen, Jesus, etc to clean stuff up, the actual society itself is not worth saving.

Looks like a planned implosion of housing prices. With the Chinese gone they hiked interest rates instead of cutting them recently.

I believe the housing market will fall, but not until US interest rates rise substantially. People will pay, whatever they can afford to borrow, and home loan rates are still under 6%. The minor price reduction is mostly due to less foreign cash buyers, and they mostly stick to the upper end of the Sydney Melbourne markets.

The Perth economy is built on mining, and a slowing global economy and low gold prices has had an effect on prices in Perth.

Australian banks borrow from US banks, so you need to observe US interest rates to determine when the market will crash. When 10 year US treasury bonds hit 5%, then you will see some real price reductions.

I forgot to mention the supply demand part of the story.

Australia imports slightly less than 200,000 people a year. To get in you need to have a high skill level, doctors etc, or $250,000 in cash. Only 18,000 immigrants are poor refugees.

Australia imports way over 250,000 people every year. You’re only counting the permanent migration intake. Many students and 457 (H1-B) visa entrants also end up staying permanently.

LNP political manipulation since most of these rich arrivals will vote for them

Sorry, you are dead wrong! The shift of risk assets from Wall Street into the Main Street arena is now taking place, into superannuation funds, banks, insurance companies, etc, when the shift of this risk has taken place the reset will take place, it does not matter what interest rate the US Fed sets, because the businesses will close, banks will close, insurance payouts will vanish, warranties will become invalid, and MILLIONS of people will lose they jobs, AND their savings, as the Bail-in takes place to save the mega banking Oligarchs, that Mr Kevin Rudd so kindly put onto ALL Australian citizens. Interest rates will explode, as the market digests it all, and there will be FUCK ALL the US has to say about it!

My local council just upgraded the value of my house.

This means that I get to pay higher rates.

Maybe not.

What goes up must come down – hey !!

Tighter lending standards are certainly biting. The loan rejection rate went from 5% a year or so ago to 40% now. The average value of loans also declined substantially.

https://www.macrobusiness.com.au/2018/06/mortgage-rejections-soar-to-40-of-applications-as-lti-capped/

I just visited Melbourne to look at property and came away with the view that almost none of the established bricks ‘n’ mortar homes are up for sale. It’s all the split-block, plasterboard, aspirational, open design dogboxes that are on the market. Much of it is 1 hour from the city centre in suburbs, some built near disused landfill sites.

I would say 60+% of Melbourne isn’t really Melbourne. Those people are just making up the numbers and convincing themselves they’re a part of the scene when in reality they’re just the hired help coming in from shabby neighbourhoods. Melbourne may be voted the world’s no. 1 or 2 livable city but houses in the locale they reference would cost $2-3Million minimum.

The Banksters MUST be paid…….never forget that.

God created this Universe for two reasons only:

The profit of Banksters and the payment of shareholder dividends.

EVERYTHING ELSE IS BEHIND THAT.

The US dollar’s coming decline and the rise of commodity prices and commodity currencies should lift many Australian boats. Things may not turn out too badly for the Ozzies.

The Australian economy is built on the housing bubble. Not the mining or on the sheeps back. The amount of salaried people involved in the construction industry is enormous. This includes finance companies, land rats and those directly employed in construction. It will only take a relatively small amount of construction downturn to turn up the unemployment rate.

And then there’s the issue of the current personnel debt.

Credit cards and auto loans are a large part of the debt apart from mortgage.

I’m personally horrified at the number of people I know living off their credit cards. Their income is not enough to pay for their current living expenses so resort to the C.C.

To crash the Toronto property market in 89-93

it took interest rates of 20%.To crash the American property

market in 08 it took a near world wide meltdown.I see nothing

in the near future that will cause this world wide meltdown.

It won’t crash as this time is different !

Sept 4

J.P. Morgan’s top quant, Marko Kolanovic, predicts a “Great Liquidity Crisis” will hit financial markets, marked by flash crashes in stock prices and social unrest.

‘The trillion-dollar shift to passive investments, computerized trading strategies and electronic trading desks will exacerbate sudden, severe stock drops’, Kolanovic said.

He has a Ph.D in theoretical physics.

He says it will be the worst crash in 50 years.

Thinks 2019 but the X factor (Trump) could hasten it.

“He has a Ph.D in theoretical physics.” – So? Appeals to authority or credentialing weakens the argument and makes it easy to dismiss. I did find Kolanovic’s comments interesting, however.

Just recently, a house not far from where we are went for $1.25M.

Nothing spectacular, a weather board (timber clad) 3 bd room, 1 bath, without even a garage. Wont know who bought it till the transfer of ownership goes through, usually takes 3 months.

We are 6 miles from Melbourne CBD (City Centre) and are an established and well serviced area.

Although our MSM have only recently been admitting a housing downturn, I am not so sure the ripple effect is as pronounced as the data from the article suggests or is it that there are still plenty of fools out there who think prices will never tank.

Supply Vs. Demand….

More data are available here:

http://tapri.org.au/wp-content/uploads/2016/04/immigration-and-housing-affordability-crisis-july-2018.pdf

The Reserve Bank of Australia is trying to find a scapegoat to lay blame for housing bubble they created.

Today’s reality indicates the housing bubble is a serious issue, amplified by the RBA cutting the cash rate too low.

highly questionable lending standards to homeowners and property investors, which regulators and government refuse to acknowledge, is a financial disaster in the making.

In America Alan Greenspan blame everyone and everything except himself.

Curiosity killed the cat, greed killed the pig. The squilling in the slaughter house will be heard far and wide.

Well written Wolf. Many components for a recession are in play downunder. It isn’t going to be pretty to watch. Stagnant wage growth, declining home prices, interest rates on the rise and our inability to have enough power for homes and industry with our summer around the corner. Not to mention we get a new Prime Minister every few years without having to have an election. Australia, a third world country in the making.

The bubble popped when our corrupt banks stopped lending to Chinese with 5% deposits and fake Chinese income. Now they have been forced to stop intrest only lending to everyone dumb enough to want to borrow, and are now using realistic expenses resulting in a 30-40% cut in borrowing capacity. With Aus banks having 40% of their loan book borrowed from international sources you can expect rate rises into the falling market. Perfect storm.

NZ cities beginning to feel the pinch too. I have personal knowledge of friends trying to sell a very nice house in Tauranga. No one going through their open homes. Have a son in law involved at high level in construction industry has noticed big drop in demand from home builders and he says a big load of new houses about to hit the market.

My son recently had to leave his rented accommodation in Waihi as the owner was selling his Auckland house and moving into the Waihi house. 6 months later the Waihi house is still empty because the Auckland house has not sold.

Now we have the Australian banks raising interest rates because they do their borrowing from USA banks. NZ banks are just sub branches of the 4 main Aussie banks.

Interesting times ahead

THIS NEEDS TO BE AT THE TOP: “Housing Wipe-Out: No Bids or Even Bidders at Numerous Australia Housing Auctions”

https://moneymaven.io/mishtalk/economics/housing-wipe-out-no-bids-or-even-bidders-at-numerous-australia-housing-auctions-l01MgvjMF0-RdXRBjO7gfA/

What a bunch of lying cheating deceitful criminals! And you can bet your bottom dollar the Government is supportive of this, obviously a Banking Cartel Scheme. So much for the Authority Watchdog, they probably getting a pay out as well!

A good dose of scare-mongering here.

Australian GDP posted growth of 3.4% over the past year – the fastest in 6 years!

Australia is booming and house prices coming off a bit is no big deal. So what? Unemployment is very low around 5%.

There is little to worry about except for a large external shock.

I can’t see a large external shock coming anytime soon. US is booming and as the US booms so the rest of the world booms with it.

US will boom through rest of this year no problems, and through 2019-20 as well.

There will be no financial “crash” or housing “plunge” in Australia or anywhere else at least for a good few years.

Maybe in 2021-22 or around that time period. Mean time – enjoy the good times!

Life is very good at the moment in the developed world – certainly cloudless skies as far as the eye can see.

Hi Julian, the gdp growth in Oz is based on people taking on increasing debt and increasing migration. Theres a million households who are massively struggling, add to the fact interest rates are rising, defaults are rising and the Oz banks are tightening their lending. Not scare mongering, thats facts.

It won’t require a large external shock to send the developed world into chaos, or even Australia for that matter. Something a small as an atom, if tampered with, can have a devastating effect. Using GDP figures are just a political ploy from all sides of Parliament. Australia continues to de-industrialise and become less self-reliant, believing home ownership is all that is necessary to acquire wealth. I admire your optimism, but then I suspect so did the passengers of the Titanic as they sailed away.

@ Julian

“I can’t see a large external shock coming anytime soon….”

OOPS! Look a bit closer to home, http://bilbo.economicoutlook.net/blog/?p=40266