SEC, are you checking into this?

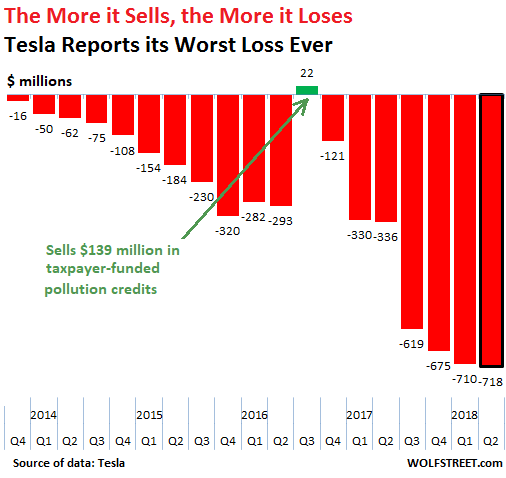

Tesla never ceases to astound with its hype and promises and with its results that are just mind-boggling, including today when it reported its Q2 “earnings” – meaning a net loss of $718 million, its largest net loss ever in its loss-drenched history spanning over a decade. It was more than double its record loss a year ago:

The small solitary green bump in Q3 2016 wasn’t actually some kind of operational genius that suddenly set in for a brief period. No, Tesla sold $139 million in taxpayer-funded pollution credits to other companies, which allowed it to show a profit of $22 million.

Tesla (TSLA) adheres strictly to a business model that is much appreciated by the stock market: The more it sells, the more money it loses.

Total revenues – automotive and energy combined – rose 43% year-over-year to $4.0 billion in Q2. This increase in revenues was bought with a 113% surge in net losses. When losses surge over twice as fast as revenues, it’s not the light at the end of the tunnel you’re seeing.

In between the lines of its earnings report, Tesla also confirmed the veracity of the many videos and pictures circulating on the internet that show huge parking lots filled with thousands of brand-new, Model 3 vehicles, unsold, undelivered, perhaps unfinished, waiting for some sort of miracle, perhaps needing more work, more parts, or additional testing before they can be sold, if they can be sold.

But these thousands of vehicles were nevertheless “factory gated,” as Tesla said, to hit the 5,000 a week production goal. And so they’re unfinished and cannot be delivered but are outside the factory gate, and Tesla didn’t totally lie about its “production” numbers.

Now it put a number on these “produced” but undelivered vehicles: 12,571 in Q2 on top of the 4,497 in Q1, for a total of 17,000 vehicles sitting in parking lots. So here we go:

It said it “produced 53,339 vehicles in Q2 and delivered 22,319 Model S and Model X vehicles and 18,449 Model 3 vehicles, totaling 40,768 deliveries.” The difference between what it “produced” and what it delivered is 12,571 vehicles.

Sure, some are in transit, etc.

But this discrepancy started with the Model 3. In Q1, Tesla “produced” 34,494 vehicles and delivered 29,997 deliveries. In other words, it “produced” 4,497 more vehicles than it delivered.

But in Q1 2017, before the arrival of the Model 3, Tesla produced 25,418 vehicles and delivered 25,051 deliveries. The difference was a logical 367 vehicles.

In Q1 and Q2 combined, Tesla “produced” 87,833 vehicles and delivered 70,765 vehicles. The difference: 17,068 vehicles. They’re now stuck on various huge parking lots somewhere. How unfinished or problematic are these cars? When can they be sold? Can they all be sold?

If they’re all Model 3 vehicles with an average cash price of $50,000, then Tesla has $850 million tied up in these unfinished cars.

This is the result of its unabated “manufacturing hell,” as CEO Elon Musk had aptly called it, combined with the absolute and existential necessity to do whatever it takes to pump up its stock price.

Those touted production numbers of 5,000 vehicles a week were used to keep shares from collapsing. So 17,000 unfinished vehicles were “factory gated” over those two quarters and are now sitting outside the factory gate but cannot be sold. Compare this to the 18,449 Model 3 vehicles Tesla claims it “produced” in Q2.

SEC, are you checking into this?

Then there’s the horror story of cash flow. Tesla burned $812 million in cash in the quarter: $130 million in its operations and another $682 million with “capital expenditures,” “payments for the cost of solar energy systems, leased and to be leased,” and “business combinations.”

It also raised $399 million in various financing activities, including from borrowing and the sale of asset-backed securities.

On net, its cash-burn less the money it raised pulled down its total cash-on-hand by $436 million in three months, to $2.24 billion as of June 30.

Tesla has borrowed a lot of money from a lot of folks: $942 million from its customers via deposits; $11.6 billion in long-term debt and capital leases, including the current portion; and $2.6 billion in “other long-term liabilities.”

Oh, I almost forgot: In the overall global auto market, Tesla gets lost as a rounding error. It’s total deliveries in the quarter of 40,768 vehicles amount to a market share of about 0.2% of the 20 million or so cars delivered in Q2 globally.

Tesla is just an amateur niche manufacturer in a world full of pros. And that would be OK, except for its idiotic market capitalization of around $50 billion, its ballooning mega-losses, its cash-burn, and the fact that it is jimmying its production numbers in an existentially desperate effort to pump up its share price.

A high share price is the crux to Tesla’s survival. Given its cash burn, Tesla must constantly find new investors and creditors to hand it more fuel to burn. Without this fuel, Tesla will burn out. This works only if the share price is very high: Creditors think that a high share price guarantees the debt because Tesla can always sell new shares to raise more money to service its debts; and shareholders think that a high share price begets an even higher share price. And the institutional crowd has too much invested in Tesla, and they cannot bail out without causing the share price to collapse, thus hurting their own gains. So the circularity must be kept alive at all cost.

GM, Fiat Chrysler, and Ford all got ugly in unison, in one day, something we haven’t seen since the Financial Crisis. Read… Carmageddon in Detroit

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Well done Wolf. Great summary.

TSLA is less of a mystery than the people and institutions buying its shares.

With the share price up more than 9% here in the first hours of the aftermarket I guess all I can say is that this crazy stock market is not yet ready to roll over.

Agreed, great writing here.

I remember reading an interview a year or two back with the Magna CEO and he was asked about Tesla and its stock price. His answer sounded very bemused and was along the lines of “Hey, I just make car parts, I don’t price or value companies…”

“TSLA is less of a mystery than the people and institutions buying its shares. ”

On the earnings call Tesla effectively promised they’d be profitable in Q3/Q4, with positive free cash flow.

I’m skeptical given who is making the promises, but it’s worth pointing out that most analysts DO have Tesla turning profitable in Q4 (most have them taking a small loss in Q3), and historically their earnings estimates have been relatively accurate.

Wall Street expects them to dramatically expand market share in the future while traditional carmakers like Ford are expected to shrink. That is the basis for their valuation, not current earnings and market share.

Manyana oh manyana…manyana is good enough for me.

Now it’s up over 14%.

He added 8 Billion to the market cap of the company just by apologizing to the fellow he insulted at the last quarterly report press conference which resulted in a 5 Billion loss. The lesson: be nice to the analysts.

There doesn’t seem to be any other good news, just the standard prediction of future profitability.

Chris, how many decades has it been since the stock market ceased to be a mechanism for determining “value”? And became a casino rigged for the benefit of the Players.

And how many decades since Price was correlated with Utility? Instead of being manufactured by Advertising and Fraud?

I saw one of those model 3’s on the road this afternoon. Honest to God, it reminded me of a Saturn sedan. Ironically, Saturn had the same cult following, and the same hype early on. I always thought it was a overhyped POS for lame fad followers.

Yep. As bland as Saturns. Yet 10 times the price ! Those 17000 cars are not going anywhere since they are most likely being used as some sort of “collateral” to bring in more levered loans, so he can keep the lights on, since the cash they are burning isn’t providing enough ‘light’ from the bonfire. (just kidding on the cash burning for light, but not kidding on what they are trying to do to keep cash coming in). This company is in such big trouble it should have been declared insolvent long ago, as its clearly the world’s most obvious and worst ponzi scheme, poorly disguised as a ‘car company.’ Musk only knows Ponzi’s. His Ponzi’s have the hall mark, of targeting government subsidization, where he can hide behind super hyperbole, and never really having to deliver anything profitable or self sustaining. Solar scams (federal government), tunnel boring scams (local and state governments), hyper sonic transport (local governments), and rockets in space (federal government.) they are all pipe dreams and fantasy and he is a silver tongued fast talking con man of epic proportions.

At least rockets go into space and, we should believe this, even get returned, partially. But it is still a scam. Space X claims it sends payloads into space for something under 50 mln, but its own projections show that it has orders for about 70 launches, which should should earn it (according to its own projections) 7 bln. So the cost of each launch should be 100 mln. And that is probably net of insurance costs.

Tesla uses CGI graphics on every launch and return. Very obvious. Nothing but total scam artists.

I recently watched, on YouTube, an hour-long documentary on Ponzi. Yes, he was an actual guy, and his “hook” was that you could go overseas and buy “postal return coupons”, say a US postage stamp is 50c these days but the return coupons are 13c. But you can exchange them for stamps worth 50c here. It went something like that (Obviously it was something like 5c vs. 1.5c but you get the idea).

So, there was money to be made and Ponzi used that to convince people to invest. To buy more postal coupons over in Europe, don’t you know.

But, in reality, well, it was a Ponzi scheme. There were nowhere near enough of these coupons printed, worldwide, for Ponzi to do what he said he was doing.

The big funds are “Trapped” now. Elon, in a sense, is not too big to fail or too big to bail But “Too Widely Held by Big Funds Too Sell” without capsizing the ship. The name is Bond as in “Junk Bond”.

The Tesla designs grow on you. The higher trims of the model 3 look good, though still weird. The wheels on the base model look really stupid but you can pay for nicer ones.

The interior at least looks very nice from the outside. But you are pretty much in luxury car price range so all cars over $30k have a pretty nice interior.

Of the “affordable” electric cars it is one of the nicest looking. But still kind of an ugly duckling next other gas models.

I can see why you compare an old saturn. I think it is probably because of the awkward almost 90’s Era curves. But I still think once you get used to the grilless look you can tell it’s a premium design.

Just about anything can grow on people as they try to mentally justify their purchases. If the point is to draw quick envy from others, which is the sure but unstated goal of any luxury purchase, the Tesla Model 3 fails. It’s plain hideous to the average walker by. You draw sympathy instead.

I think your opinion is the outlier, but I always appreciate when people assume that their solitary opinion represents the opinions of millions of other people.

Forbes has it on their list of “coolest cars in 2018.”

Popular Mechanics has it on their list of “best cars 2018.”

US News has it ranked as the 4th best luxury small car, ahead of every single BMW, Lexus, and Mercedes on the list.

Yes, the designs sort of grows on you…fungus does also. To moi, it looks like an iPad Pro on wheels with a build in crematoria.

The front half of a Tesla Model 3 looks more like a Porsche than a Saturn.

I’m not a huge fan of the side profile of the vehicle, but they still look pretty sleek in my opinion. And I don’t know a single person who has looked at one and thought it was anything other than a luxury vehicle of some sort… except you, but I digress.

All I see is a mildly updated and overpriced Saturn with goofy looking wheels. I saw the Model 3 in pictures on the internet and remember thinking it was OK looking, but when I finally saw one on the road I thought it was very plain and a little awkward , like a Saturn sedan. Everything looks different when you see it in person.

Looks like it was styled by art school dropouts who had undergone frontal lobotomies.

And from the same company the Model S— the best looking 4 door automobile on the planet. The explanation: The original Model S design was stolen from Fiskar and smoothed out by the Tesla design staff before they received their lobotomies.

I’ve seen Model X with embarrassingly misaligned door handles and water condensation inside the rear-light casing.

I can only imagine the questinable quality of a considerably cheaper Tesla assembled in a rush by inexperienced workers.

Anyway, that hardly matters. Perception, illusion and hope are stronger than reality. Stock up 16%.

Four months ago, I traded in my 2002 Saturn SC2, due to the A/C going kaput. It was a great car. Few repairs, plastic body (hence, no rust). Saturn had a keep-it-simple philosophy combined with a very friendly, almost family, atmosphere at the dealerships. I still rue the day I traded it in, rather than pay $1,400 for the A/C repair. Admittedly, from a safety standpoint, the car had become obsolete due to its small size and only two airbags.

The front looks like a 1962 Renault Caravelle!

OK, I need to visualize what 17,000 Model 3 Teslas parked next to each other bumper-to-bumper would look like.

Each Model 3 is 8.7 square meters surface area (1.8542 m x 4.6939 m). Multiply that by 17,000 parked cars = 20.7 FIFA regulation-sized soccer pitches (105 m x 68 m).

That is simple— they look like a perfect ordnance testing range.

ps: The irony of the Tesla Ponzi is that Musk is almost singlehandedly responsible for moving the automobile into the electric century. The company Tesla may roll up in a giant tent and Musk make it disappear by waving his magic wand and then fly off to Mars accompanied by 20 breeding females, but the electric BMW’s, Mercedes, and Gov. Chevy’s that are the future of private transportation all will have grown from his vision.

The SEC is too busy monitoring porn sites to worry about Tesla. The party continues until the music stops.

Tesla is TOAST

Probably.

Every one of the hundreds of car companies started in the US has gone bust, all of them, and only half a handful still survive. Tesla can carry on that tradition.

https://en.wikipedia.org/wiki/List_of_defunct_automobile_manufacturers_of_the_United_States

Besides, several articles have complained that Tesla can’t manage its production properly and basically doesn’t know how to run a car company, which has been typical of upstarts, making it that much easier to eventually fail. Too many mistakes have turned into expensive path dependencies. Tesla would have to spend tons to clean it up so it can fly straight, but the management just doesn’t seem up to it. Financial gamesmanship can prolong the agony but it can’t make manufacturing operations viable.

They’re not going to make it at this rate.

I guess the question is whether EVs are viable generally without subsidies.

Bigger car companies with a variety of models can sustain losses on EVs for longer until it is clear whether they are viable at all at this point in time and within which business model Nissan even claims making them profitable (mostly by leasing them or using them in car sharing or as taxies). What is clear for now is that there is very little economic sense in EVs.

This is all, of course, is complicated by lack of automotive experience at Tesla (they still have no idea what it would cost to roll out proper servicing infrastructure) and the US automotive industry continuously failing to master modern automotive manufacturing processes – from design to marketing – in general. I would have expected other cash-rich techs like Alphabet or Apple to buy them out. But no more. They probably realized by now that the technology is not commercially viable.

The once chance is to sell out to some of the big guys like Daimler maybe.

The internal combustion engine is not commercially viable or sustainable beyond a period of two decades in the future.

No amount of delusion can change the nature of physical reality.

EVERY car company in the US has gone bust. Chrysler, Ford, and GM may still be around, but if it was not for Federal money they would have shutdown.

As I recall, Ford did not get a bailout

Re: “Every one of the hundreds of car companies started in the US has gone bust, all of them,”

Wrong in several ways. First, mergers and phase-outs are not “going bust”. So a lot of companies on the list made profits for their investors, and/or contributed value through equipment and expertise to succeeding companies, even if they aren’t brand names today. Tesla itself makes cars at what used to be NUMMI, a “defunct” auto company that isn’t even on your list. (https://en.wikipedia.org/wiki/NUMMI)

Before that the site was GM’s Fremont Assembly plant.

Second, it’s not the number of companies that counts, but the amount of capital they either earned or burned. 100 small flameouts and a few multi-billion dollar successes is still a net win.

Third, you could make similar lists for any other industry, from computers to restaurants to food products. It’s axiomatic in venture capital that failure is likely. This promotes a careful approach to new ventures, but doesn’t prevent anyone from trying. Your list shows capitalism at work.

Finally, a good case can be made that the U.S. needs more than 2-3 domestic vehicle manufacturers, for military and national-security reasons. If you believe the MIC has a stake, TSLA may not be allowed to fail, although individuals within Tesla could get tossed aside.

As for Tesla’s future, I’d go with Yogi Berra’s “it’s difficult to make predictions, especially about the future”. At this point Tesla is powerfully motivated to improve, and that’s how capitalism succeeds.

P.S. Per the wikipedia link, the NUMMI plant was a GM/Toyota partnership which produced an average of 6000 vehicles/week over 26 years. Peak production was over 8000/week in 2006.

Go long horses, donkeys, and carts !

As for those 17,000 and the attached ‘invested’ .. ?? It’s like being shackled to a tetherless anchor, heading straight down to Davey Jones Locker !

When did Ford go bust?

TOASTLA

Bullshit. Q1 had the worst loss of 1B

Kevin,

Bullshit. Q1 had a net loss of $710 million. However, it had a negative cash flow of $1.1 billion. Huge difference between net loss and cash burn. You need to understand the very basics of accounting and finance before you use technical terms like “Bullshit”

:-]

When this thing burst, it will be rapid. I bought some OTM put options in the morning. No doubt they will expire worthless, but then again it’s only 400 bucks. I think I’ll buy more tomorrow morning.

Yes, average down, it always works with options. You likely know much more now than those taking asymmetrical risk selling puts.

Here they are:

Tesla holding lot at Lathrop, CA:

http://www.invtots.com/tsla/drone-flyover-video-of-lathrop-ca-tesla-holding-lot-tsla/

Tesla holding lot at Burbank, CA:

http://www.invtots.com/tsla/videos-of-acres-and-acres-of-tesla-cars-in-burbank-ca-tsla/

They were all over the place saying they were going to “announce earnings” today and look what we got. The SEC should crack down on these misrepresented “earnings announcements” and make them call it a “losings announcement”.

It counts as earnings if monthly active users (MAU) is going up.

Is that in Freemont or Bangladeshi MAUs?

+100

I just finished working at a software project where the Tesla model and this joke make a terrifying baby. Hundreds of people making a simple app that won’t start, and from a giant company you all know. At least none of my paychecks bounced.

LOL

So, I note that after the earnings call, Tesla is actually up. Now what I don’t get is where is the difference between Tesla and a Netflix. Both are losing money. Yet NFLX is blasted after its earnings, slow growth, whereas TSLA is even worse than that, and yet it keeps going up. I just don’t get the difference. As for institutional money, given the volume daily, no reason why an institution could slowly bleed out their Tesla shares over the period of a couple of months. Daily volume is 7M, Let’s say an institution dumps 100k shares a day, in two month, that’s about 4M shares. How can anyone realistically track this even except through quarterly filings.

If I had to guess, Elon Musk has more sex appeal than Reed Hastings

There is way more Digital TV content producers than Electrical Car makers. So Netflix flaws are more apparent now that it has some serious competition on Amazon and Disney.

So that means Elon has more sex appeal than that old turd Reed. The warts on Reed are more obvious. Oh and bigger market cap. I can buy that.

But I think there are more dangers to Tesla out there given the market for EV. Lots of Nissans, BMWs, and even VWs now

Does anybody know what share of the EV market is owned by Tesla. Is it growing or shrinking? I’ve been seeing a ton of those blue accented BMWs.

A decline in that metric could kill the story.

That’s a good point, my son (age 4) is obsessed with spotting electric cars and recently I’ve been amazed at the sheer variety of them out on the roads all of a sudden – seems like every manufacturer has come out with one (or more) in the past year or two. Saw (rather, my son saw) a plug-in hybrid Cooper on the way home today – never seen that before. I looked it up just now, and the first article I saw said that BMW is basically putting out an electric version of every model they have.

This is what Tesla says:

“In July 2018, Model 3 not only had the #1 market share position in its segment in the US, it outsold all other mid-sized premium sedans combined, accounting for 52% of the segment overall. The popularity of Model 3 is a true testament to the product. Based on trade-ins that we’ve received so far, we can see that the total addressable market for Model 3 is much larger than mid-sized premium sedans. We are drawing customers from many other segments, including non-premiums sedans and hatchbacks.”

Anybody else doubt this statement? I’ve only seen one Model 3 on the road, but I’ve seen tons of other EVs from other makers. Sure, Tesla’s only been selling the Model 3 for a short while, which might explain why there aren’t any on the road, but I have a hard time believing they are getting 50% of the EV market right now.

Perhaps Tesla is defining the “segment” to be a very narrow one that includes one or two other comparable EVs. If so, these market share figures provided by Tesla would be misleading.

The SEC should look at this as well.

In Seattle I see plenty of model 3s. Definitely more than the EV BMW.

Tesla sold 16,000 Model 3s in July.

BMW sold 12,811 2,3,4,5 Series.

Audi sold 9,282 A3, A4, A5, A6, A7’s.

Lexus sold 6,866 Lexus ES, GS, IS, RC’s.

Cadilac sold 4,382 ATS, CT6, CTS, XTS’s.

This is a company that has a huge public relations asset in the form of climate change propaganda, despite the net carbon footprint of their product being greater than that of a Volkswagen diesel.

Too bad what you are saying is not true. Climate change is not propaganda and the net carbon footprint is not larger than a VW Diesel. But your comment is not as off the wall as the guy upthread who thinks SpaceX fakes their launches/landings with CGI. Where do you guys come from?

Stock market started out as investment vehicles. Place to pool money for good business ideas and “create” wealth. Then some day, people have figured out this can be a wealth “transfer” place as well. If you keep looking from business investment perspective, you will get puzzled by TSLA. If you look at it from wealth transfer perspective, it will make sense. You do NOT make sense why one dice throw turns out to be 4 while the other throw it turned out to be 1. What’s happening to TSLA and NFLX are just dice throwing and people are transferring from each other like they do in Casinos.

Remember, whats important…ROI…Radio On Internet…from that wonderful ditty from Silicon Valley: https://youtu.be/BzAdXyPYKQo

Enjoy!

Tesla makes a fantastic car, that hasn’t been in doubt for years, it’s just a question of making the business work. They have spent billions getting ready to mass produce the model 3. Another quarter or more will settle it. Either they’ll mass produce them at a rate that allows for profits, or if they don’t they’ll start to fail. If they can reduce car manu. related infrastructure costs and make lots of 3’s they’ll thrive, otherwise they’ll struggle

Tesla just announced $5 billion China Gigafactory….they aren’t going bust any time soon.

There was a huge consolidation and failure of independent auto companies in the ‘50s and ‘60s. Does anyone remember Studebaker, Packard, Hudson or Nash? The last independent (AMC) was absorbed by Chrysler in 1987. Anyone who starts an auto company now must either be delusional, extremely optimistic, mentally ill, on drugs, or maybe a combination of all of the above. Tesla is a cult of Elon Musk. The closest parallel to Musk I can think of is Howard Hughes.

Howard Hughes made something people really needed, namely rotary drills for the oil industry. I think up to the 60’s 75% of the worldwide market for rotary drills was owned by the Hughes Tool Co and companies using their designs. Granted, it was Howard Sr who had created the company, but it was Howard Jr who expanded it immensely by signing contracts, among many others, with Burmah Oil and Royal Dutch Shell to supply their operations with rotary drills.

Hughes also effectively started the post-WWII trends in airlines: by ordering the then state-of-the-art, Art Déco Constellation from Lockheed he put into motion a sequence of events nobody could have foreseen.

People will still talk about Hughes with a mixture of amazement and scorn for decades to come. He belonged to the category of men Latin writers called stupores mundi.

But Musk? He’s just a child of his own time with either some very slick PR people or some frankly disturbing groupies.

The Tesla is a fantastic car, that’s the only reason they got this far.

He needs to start living in a hyperbaric chamber and grow his beard and fingernails 2 feet long. That might bump the shares up 50%.

“The Way of The Future ….. the Way of The Future …. the way of The Future … the way of the Future .. the way of the future ..”

Yes Hughes ordered 60 + Constellations with a small down payment. He had no idea how he was going to pay for them, but pretended he could without financing.

The jet order threw management at Hughes Tool into panic. They had put up with Hughes one- off planes, his failed movies, but this jet order exceeded the cos resources.

When the first two were approaching completion and Hughes still didn’t have financing he actually seized them to prevent them being finished and delivered. This was especially annoying to Constellation because it had the only prototype of a newly designed seat in one of them.

But they had to put up with it because he was the only customer.

The plane was called the Constellation 888, one wag in Lockheed saying it was because of the number of meetings with Hughes.

But the meetings were all on the phone or via Hughes reps because Hughes was well into his reclusive mode and refused to meet in person. This was a problem when inevitably the deadline to obtain financing drew near. Asking one banker over the phone to submit a proposal, he was told: “I don’t do business that way, I like to see who I’m dealing with.”

I don’t have the excellent Hughes biography on hand but in the opinion of the co- authors his dalliance with the Constellation severely hurt the plane’s prospects in a biz soon to be dominated by Boeing.

As for his signing deals to sell drill bits, no doubt, but after his father

patented the rotary bit, the company relentlessly bought any and all

rival patents. So it’s not clear what choice the customers had.

PS: re seizing the planes. This was not via legal process. It was a physical coup where Hughes guys arrived and towed the planes out of the hanger.

I am impressed with the young Howard Hughes’ skill for engineering fast airplanes in the 1930s. The 1935 Hughes H-1 was revolutionary.

https://en.wikipedia.org/wiki/Hughes_H-1_Racer

Another brilliant aero-engineer was R J Mitchell who originated the Supermarine Spitfire. Mr. Mitchell died in 1937, but his work lived on to say the least.

“The jet order threw management at Hughes Tool into panic. ”

The Connie was piston-powered:

https://en.wikipedia.org/wiki/Lockheed_Constellation

Thanks Bob. Its been a year since I read the Hughes biography ( of course there are several but this co-authored one is a landmark.)

I had forgotten the Connie was a piston job.

And so of course quickly obsolete.

‘The ultimate Constellations, the Lockheed 1649A Starliners, began flying coast-to-coast non-stop for TWA in May 1957. Called Jetstreams by the airline, these ultra-long-haul airplanes were designed for overseas routes but also provided the most luxurious accommodation of the day on transcon non-stops.

However, their competitive advantage was short-lived. Within two years, Boeing 707s cut travel time in half and piston-powered airliners quickly became obsolete.’

Its those who provide credit to Tesla who need their heads examined.

It is beyond me that a company with Teslas track record manages to retain any support whatsoever

Kaiser-Frazier??

(My folks lost a “bundle” (for those days) on that fail….)

GM or Ford can buy Telsa IP in bankruptcy court for pennies on the dollar. The Too Big To Jail Era marches on…

“Tesla makes a fantastic car, “

A fantasy?

Point of fact…. the Tesla’s are not being stockpiled… Tesla lost use of its rail transport, so they must be trucked out, which obviously takes longer. No conspiracy.

I assume you’re being sarcastic and forgot to add /sarc

If not, it’s just one more piece of nonsense to excuse Tesla’s failures. Tesla doesn’t have transportation issues with its S and X models, and it doesn’t with its Model 3. It has manufacturing issues.

Time to make some money. Lets go short, a lot. I can already eel it in my pocket.

This is a superb article which neatly summarises the absolute mess which Tesla is, and the stupifying reaction by the markets to Tesla’s financial and operational performance.

Tesla should be a penny stock

It is a superb and well written article.

Have you ever tried to explain some of these things to a Musk supporter? You can’t. In fact, I have been asked to no longer denigrate Musk who I consider to be an incredible flim flam artist; and an unabashed one. I think it will take dissolution of Tesla before Musk supporters accept the truth, and maybe even then the conspiracy theories will surface to defend him.

Musk has acquired, or managed to create, an “enfant terrible” cult of personality. He is perceived as being an “outsider” or a “maverick”. So be it. Many people are enthralled by such people.

I get why people support “mavericks” and “outsiders”.

But let’s be clear there is absolutely no financial evidence which shows why anyone, with critical faculties intact, would choose to invest in Tesla. Yes, Tesla’s share price may increase, but that increase is based on sentiment rather than cold critical financial evidence.

Support Musk, if you must. But do it for free. Don’t support him by investing your hard earned, after tax, wealth into his company.

Go on Electrik (aka the Tesla home page) with these facts if you feel like being abused on line.

What did Nicola Tesla ever do to deserve such bad luck? Sheesh.

Charles Ponzi, Bernie Madoff, Elon Musk…

Not official yet, but will be eventually!

With Madoff, 60% of the money has been recovered and distributed, with the potential recovery of 100% of principal, even after trustee’s and auditor’s expenses of billions …

“Charles Ponzi, Bernie Madoff, Elon Musk…Not official yet, but will be eventually!”

Don’t forget DeLorean.

Musk made a lot of money on PayPal. Manufacturing a physical product is a whole different ball game. But you have to hand it to the guy. Running a confidence game making cars and batteries is a lot more difficult than with a mere internet site (Facebook), a taxi service (Uber), or a movie rental service (Netflix).

The nature of human beings. Got a friend who made 1.7m dabbling in 3 properties in the late 1990ies in his country of birth. Decided to join his family in Sydney in 2015. From then till 2018 he accumulated 12 properties using all his savings and cheap loans there. Even though property prices were languishing from 1998 to 2006 he sat it out waited and cling on to his job. He is very happy with these property assets or so it seems. Refusing to believe the property bubble there he keeps on telling others how wonderful was his correct forecast and actions.

And of course he will never accept anything being said accept that property prices is going up and up.

Excellent article Wolf!

Seeing different headlines on the earnings report. One non-American site headlined that Tesla had a record loss topping its previous record. An American site was positive and pumping a share price rise.

About all that tells you is who is on the PR team and who isn’t.

While Ford earns 1.07 billion in the last 3 months its stock gets crushed, meanwhile Tesla loses 700million and its shares soar. Yes, the market makes perfect sense! If it wasn’t for the mountains of debt within the car manufacturers I might be investing..

The answer is simple, Elon should take over Ford via acquisition a la Steve Jobs coming back to Apple. That will help Ford shares go through the roof.

Stop the presses! Tesla is saved, they just sold out… of surfboards.

They sell 200 surfboards for $1500. Just another annoying PR campaign to distract buyers. The boards weren’t built in house so they actually got made.

Yeah, I am waiting for the Tesla toilet paper roll with Elon on it. Do a one time run, surely that will become an instant collector item.

Yes, indeed, made from the finest wood pulp from California’s famous redwoods inlaid with gold trim, inspected and tested by our genius Tesla quality engineers, it will be the definition in high end toilet paper. Forcing any buyer with the most difficult of choices. Use it or hoard it? Because if you hoard it, it might increase in value until you become a billionaire based on its soaring value as a collector item.

“……with easy plug in roll mechanism”…..

(another very good read WR)

‘Surfboards’

Is that the smoking, or non-smoking version ??

Interesting… thanks for pointing these issues out.

However – what about the comparison to the last quarter (Q1). Huge increase in sales and production (and lots of cost due to “production hell”, hardly any increase in loss. Couldn’t that be a sort of a turnaround?

About the cars in waiting: seems highly improbable to me that they are just produced to “sit around” and rust… maybe there are problems in the delivery process because they cannot yet deal with the increased production? At least thats’s what it states in the Q2 letter…

“…maybe there are problems in the delivery process because they cannot yet deal with the increased production?”

Then Tesla would be an even more incompetent auto manufacturer than I previously thought. They had years to plan this… they’re at least eight months behind their production goals as stated mid-2017. They had all this extra time and cannot figure out how to get the cars they’re making delivered? If that is true, there is simply NO HOPE.

“Then Tesla would be an even more incompetent auto manufacturer than I previously thought. They had years to plan this… they’re at least eight months behind their production goals as stated mid-2017. They had all this extra time and cannot figure out how to get the cars they’re making delivered?”

Even before Model 3 production, Model S/X owners complained about long Service Center wait times for an appointment. People saw this coming and have said Musk should have spent more capex on Service Centers and less on Superchargers.

Now, it’s obvious Tesla is building more Model 3s than can be delivered. Whether it’s because in a rush to get to 5K/week half-assed cars are leaving Fremont, there simply aren’t as many buyers as Tesla leads on, or both.

And then for the Model 3 buyers, people are complaining about cars being delivered with bad paint jobs, deep scratches on the undercarriage(from being carried by a forklift during production – no joke), and just general shabby assembly. It seems that an immediate return to the Service Center to fix a problem after taking delivery is the norm. Then there are the buyers that go to take delivery and the car is the wrong color they ordered or Tesla cancels the delivery last minute because the car hasn’t arrived. Some have complained about 2 cancelled deliveries for a Model 3 they put in a reservation for over 2 years ago.

The company’s logistics are a mess. Mechanic liens have been filed and there’s even someone on Twitter claiming to be a small sub contractor who’s been stiffed by Tesla and is trying to reach @elonmusk because going through the proper channels have been fruitless. If you have time to waste one can spend hours a day watching the Tesla soap opera.

It looks like things are coming to a head, but for all those reasons you mentioned there’s immense pressure to keep the stock price elevated. I wouldn’t be surprised if Tesla files for BK and the SP goes up that day.

Tesla stock up 11.7% today. Short squeeze on the balls???

I’m on record warning people NOT to short these shares. When something is idiotically and irrationally priced, there is by definition no longer a rational limit of how much further they can rise. Tesla’s market cap has completely disconnected from any sense of reality years ago.

Tesla is the most obvious short out there – and that’s why it is the most dangerous short out there.

steady, man!

you’re getting dangerously close to the answer of life, the universe, and everything.

… and it ain’t 42 …

I forgot…what was the question raoul?

How many roads must a man walk down…. 42

Mr. Richter

Gives truth to the old premise that the market can remain irrational longer than you can remain solvent….

Are you sure those 17,000 cars aren’t simply stuck in traffic on Hwy 80?

When you consider TSLA as an R&D arm of the Military-Industrial Complex, the behavior of the investors and the stock makes more sense.

MIC desperately wants autonomous and drone vehicles, cheaper space flight, and energy independence for national security. It needs a healthy base of US industrial manufacturing capability as well.

I suppose pyrotechnic battery fires which reduce any combat losses to slag would be a plus to the MIC as well!

NEW YORK (Reuters) – Short-sellers racked up about $1.1 billion in losses on paper on Thursday, pushing their year-to-day performance into the red, after Tesla Inc (TSLA.O)’s shares soared as much as 11 percent a day after the electric carmaker reported results, according to financial analytics firm S3 Partners. ”

As they say, ouch.

Go long Facebook and short Tesla seems to be the widowmaker trades for this quarter.

Wait! If you want to short Tesla, let me dip my toe in and buy 100 shares. It will certainly crash!

It’s simple really, they make it up on volume. Just look how the stock reacts when increased volume is announced.

the short’s are feeling’ it today! If all of this trading that’s been going on between 250.00 and 370.00 is just high level consolidation then the shorts are gonna really feel it!

Wolf is reading this wrong. It’s obvious that Ford, GM, etc are all losing sales to …. Tesla. That’s why they’ll profitable later this year …..

ROFL.

I just looked into something. Tesla seems to be doing 6 year financing in house. If they have a 20% margin then each car they sell will be a liquidity net loss for the first 5 years of payments.

In the end, by self-financing they get the interest which should increase their margins, but still… by this model selling more will simply increase their burn rate…

They’ve seemed to have “produced” vehicles and are hoarding them in different lots around California. These vehicles are apparently in various states of “completeness.” https://electrek.co/2018/07/20/tesla-stocking-model-3-lots-tsla-shorts-freaking-out/

Tesla always was and always is an obvious stock to short and a dangerous stock to short.

Amazon always was and always is an obvious stock to short and always is a dangerous stock to short.

Hence, the people who appear to make investing easy for themselves always go long obvious and dangerous short stocks.

The growth of Tesla is not surprising to me. The growth of Netflix is not surprising to me. Gosh, i lost count of the amount of short sellers who used to glibly call Amazon a “non profit” company.

I would not invest in Netflix because it reminds me of an AOL but i can see why the herd chase it higher. I do not know much about the auto industry so i cannot guess what will happen to Tesla.

What surprises me are the people who forever pay money to Investment newsletter writers in New Hampshire and Seattle, to guys who assail rapidly growing tech stocks year in and year out while at the same time recommending (circle the drain) gold mining duds to their subscribers and listeners.

Worse still, these guys never ever shut up bashing the Fed.

I suppose there is a market for all kinds of services.

I respect wolf and am grateful to read his stuff.

What no comments on the data in the 8-K?

Accounts payable increase from $2.39 billion to $3.03 billion from a year ago?

Cash fell from $3.36 billion to $2.23 billion from a year ago.

Inventory increased from $2.26 billion to $3.32 billion (there are your produced, but not delivered or sold cars).

https://www.sec.gov/Archives/edgar/data/1318605/000156459018018490/tsla-ex991_6.htm

Overall current liabilities increased from $7.6 to $9.1 billion from a year ago.

And maybe some one can explain what “Resale value guarantees, net of current portion” in liabilities are which fell from $2.3 billion to only $584 million are…

A little financial analysis of the number would go a long way, but then maybe all those ‘analysts’ on Wall Street don’t know how to do that anymore.

Cash: I covered it.

AP: When I looked at AP, they looked logical to me, given the ramp-up in production, and thus the ramp-up in payables to suppliers.

Inventories: Your answer seems spot-on, though part of those inventory increases would come from greater parts and components inventories needed for the ramp-up in production.

This country tends to have an obsession and admiration for “Maverick” and snake oil salesman. Just look at the die hard followers of who’s in charge of this country right now, it really is a cult like mentality. The fantasy of this billionaire name Elon Musk that will save us all from pollution, global warming, traffic congestion is silly at best..good luck trying to explain that to the cultist though

$50B valuation for a company that burns through billions and survive and thrive on the promise of its leader, another company value at 1 trillion today…this is the kind of world we now live in folks…perhaps insanity is the new sanity.

Just received my September 2018 edition of Consumer Reports, which rates the Tesla Model 3. In short, it is middle of the pack. It ranks 3rd of eight vehicles in the luxury compact EV car category. The Model 3 has an overall score of 77 at a price of $59,000. This is handily beat by the Audi A4 with a higher score of 85 and lower price of $49,000. The BMW 330i also has higher score of 78 and lower price of $52,000.

Unless you are a die hard Tesla fan and must go with the arranged marriage to the Model 3, the Audi and BMW look like superior purchases.

Per CR, “The Model 3 delivers impressive acceleration and handling, a long driving range, and low running costs. But the thrill is tempered by its distracting controls, overly stiff ride, and uncomfortable rear seat.”

Also, factor in that purchasers of a Tesla have the additional worry about whether the company will exist in a few years. What would a discontinuance of the brand do to resale value? Will there be a safe supply of parts in the future?

Finally, CR’s score doesn’t factor in looks, but the Model 3 seems deficient in that category, and there appears risk that Saturn will file a design infringement claim. [I’m joking on this point of course, but many will undoubtedly see the Saturn sedan in the Model 3].

I’ll go on record in predicting that Tesla will not be profitable for the full year of 2019. They could line up a few decent quarters in 2018 and early 2019 because of pent up demand from enthusiasts, but once that initial demand evaporates this Model 3 will be viewed as a mediocre value, especially if reliability issues develop as a result of the hastened manufacturing process.

One other comment on Consumer Reports. It rates the Tesla Model S at the top of its class (the ultra luxury EV category). Thus, there appears to be a distinct difference between the competitiveness of the Model S and the Model 3. Tesla fans may be set up for a disappointment as the Model 3 rolls out.

I’ve observed that sales performance tends to correlate with ratings in consumer reports. The top rated vehicles sell very well if they are priced right. The others not so much, especially if they are overpriced for what you get.

Tesla found a loophole in creating the taxpayer-funded pollution credits – you only have to build electric cars, not sell them.

So the Tesla factories assemble the cars one quarter, then disassemble them, and assemble them again next next quarter.

Nice to see my taxpayer dollars at work.

So many words spoken. So many written. It is another repetition of the famous story “The Emperor’s New clothes”.

Yet a bigger emperor. Apple. If the latest results so good do check on Apple’s suppliers. Their stocks and revenue so fantastic?

Mister Richter:

May I make a suggestion?

As this Cult/Subsidy Queen/Crematorium-on-Wheels Racket begin to get less interesting as a viable Enterprise, may we have Quarterly Production/Delivery Numbers of other Alternatives such as PHEVs, BEVs, and HFCVs every Quarter?

We have plenty of new Alternative Energy Models rolling out; and would like to see how they impact the Automobile Market as they start to sell.

E.g., TM and HMC are rolling out HFCVs in a timid manner in the USA; but they actually plan to showcase them for the 2020 Tokyo Olympics.

Thank you.

IIRC, both the GMC Bolt and NSANY Leaf were about to outsell the TSLA Model 3 soon.

In the current era of increased corporate governance I would have thought that the accounts reflect an ‘untrue and unfair’ respresentation of Tesla’s financial condition.

If this many unfinished cars are really parked, then this represents WIP and should be written down to cost or market value whichever is lower (scrap)? I suppose they are currently accounted for at sales price as finished goods?

Shades of Carillion come to mind.

So do rocket ships and automobiles really belong to the last century? Seems to me there are working on a low power vehicle that can escape the Earths atmosphere (or wait for global warming to thin it down) and with greater miniaturization of electronics, large vehicle payloads are no longer relevant. In a world of self driving cars what does it matter what you are riding? Do you care what a bus looks like?

The day Musk is handed his just dessert could not come fast enough for the growing number of investors and Musk watchers that have become disenchanted by his erratic and sometimes capricious ways. Not only is the company burning through cash but it is having difficulty producing cars in the numbers and quality they promised. This has resulted in Tesla becoming one of the world’s most-shorted stocks. Unfortunately, for the shorts, shares are up mainly as a result of Musk’s antics and toying with those of little faith. More about this in the article below.

http://brucewilds.blogspot.com/2018/06/elon-musk-may-soon-get-his-comeuppance.html

And the Ponzi scheme continues…

The Tesla Model S is a good looking car and a friend of mine has one and loves it. But it is a luxury car at $80,000 plus. Only drawback is using it for long trips as you need to recharge about every 250 miles.

But the Model 3 is just average and I do not like that “ plain Jane” interior. Musk is using the “S” mystique to sell the “3”. I think he will have trouble selling the “3” if Tesla stays in business. Besides having dealerships would help push sales more in my opinion and have a center for correcting problems.

Tesla is not a car company, it’s an energy company. Did you forget they are building a Giga-factory? The stock reflects the public’s belief in future products, such as batteries that power homes.