It is rare that a housing market makes such a beautifully defined U-turn, after a long hard surge.

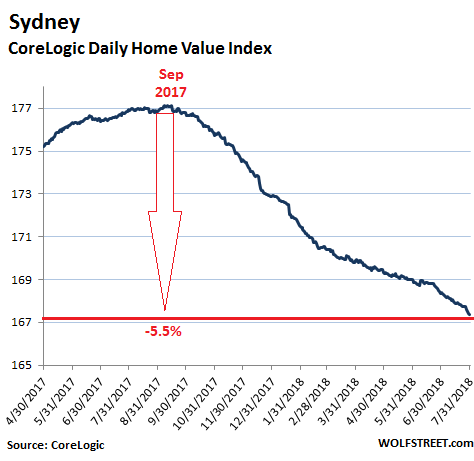

In Sydney, Australia’s largest housing market and one of the world’s biggest housing bubbles, prices of homes of all types fell 5.4% in July compared to a year ago, and 5.5% from the peak in September. Prices of single-family houses dropped 7.0%, and prices of condos (“units”) fell 1.6%, according to CoreLogic’s Daily Home Value Index:

The most expensive quarter of the market got hit the hardest, with prices down 8.0% in July compared to a year ago. Across the so-called “most affordable quarter of the market” – “least unaffordable” would be more appropriate – prices fell by 1.8%.

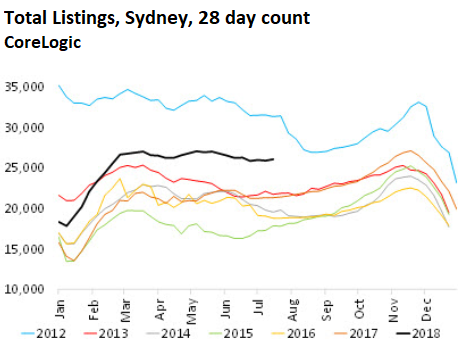

And supply in Sydney is starting to come out of the woodwork: Total number of homes listed for sale, based on a rolling 28-day count, jumped 22% from a year ago to 26,103 listings, according to CoreLogic, the most since July 2012.

In the chart below, the number of homes listed for sale in 2018 is denoted with the black line. It’s below only the blue line (2012), but creeping up on it. Note the seasonality, with listings getting pulled during the Christmas holiday period (chart via CoreLogic):

And so goes the rental market, where “conditions eased further in July,” CoreLogic noted in its report: In Sydney rents fell 0.4% year-over-year. While that might not sound like much of an annual decline, it is “the largest decline on record” in CoreLogic’s data going back over a decade.

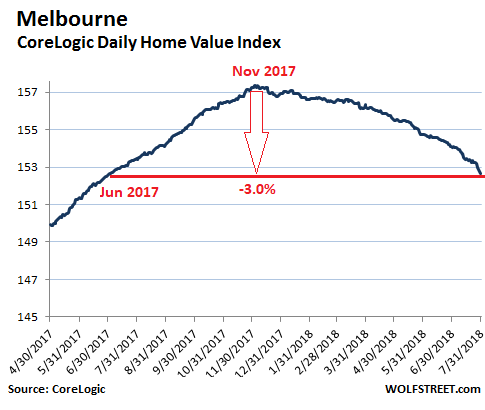

Melbourne lags a few months behind Sydney but is now catching up. Home prices in Melbourne fell 0.5% in July year-over-year, according to CoreLogic, and are down 3.0% from their peak at the end of November 2017: House prices fell 1.4% from a year ago while condos are still up 2.3%. The index is now back where it had been at the end of June, 2017:

The most expensive quarter of Melbourne’s market, as in Sydney, got hit the hardest, with prices down 4.1% from a year ago. In the “most affordable” quarter of the market, prices are still up 7.5%.

And supply is increasing: In July, there were 30,029 homes listed for sale, up 11% from a year ago, and the highest since 2014.

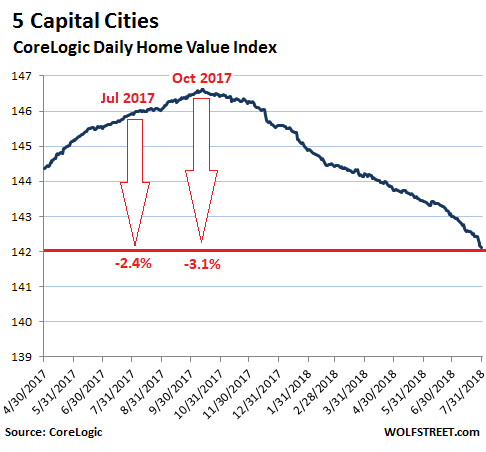

Corelogic tracks the largest five of Australia’s eight capital cities in a separate index. Sydney and Melbourne, due to their enormous size, weigh the most. In the remaining three of the five capital cities in the index, prices were mixed in July:

- In Brisbane, home prices rose 1.2% year-over-year.

- In Adelaide, home prices ticked up 0.7%.

- In Perth, home prices fell 2.3%, with houses down 1.8% and condos down 4.6%. Prices started skidding in late 2014, when Western Australia got hit by the mining bust.

In aggregate, the five capital cities index fell 2.4% in July year-over-year. Note that May was the first month with a year-over-year decline since October 2012. The index has now declined month-to-month for 10 months in a row and is down 3.1% from the peak in October last year:

Across the country, home prices dropped 1.6% year-over-year, the largest annual fall since August 2012, according to CoreLogic, and are down 1.9% since the peak in September.

This is “a relatively mild downturn to date considering values remain 31% higher than they were five years ago,” said CoreLogic head of research Tim Lawless in a report titled, “Housing Downturn Gathers Momentum In July.” With the implication that there’s a lot more room to fall?

[T]he weakness in dwelling values is being driven by the long running declines in Perth and Darwin along with an acceleration in the rate of decline across Sydney and Melbourne and slowing growth rates across most of the remaining regions.Even the Hobart market, where the annual pace of capital gains has held in double digit growth territory since January 2017, is starting to slow down. Dwelling values were steady over the month and the annual rate of growth slowed to 11.5%; still strong but the slowest annual growth rate since February 2017.

To tamp down on the excesses in the housing market and to keep banks from exposing themselves to even more risks, Australia’s banking regulator (APRA) and the Council of Financial Regulators started in 2014 to introduce “macroprudential policies” (summary) that were at first completely ineffectual but now are pulling the rug out from under housing speculators and investors – domestic and foreign alike.

These policies include a 30% limit per bank on interest-only mortgages and higher interest rates on mortgages for investors.

Investors and speculators are now also getting rattled by declining property prices, on top of historically low rental yields (though they’re now creeping up as prices decline).

In terms of owner-occupied homes, banks have been pushed – after publicized scandals, shenanigans, and recent findings by the Royal Commission investigation – to look at debt-to-income ratios, a new emphasis that has effectively taken many potential buyers off the market, particularly in the most expensive cities, Sydney and Melbourne.

These dynamics are being accompanied by a surge in new construction coming on the market, according to CoreLogic:

Unit construction remains well above average across most states, and is at record highs across Victoria [Melbourne] and South Australia [Adelaide] and only marginally below the record high in New South Wales [Sydney].

Coupled with high supply, key segments of demand, including domestic investors and foreign buyers, have thinned out which could see downwards pressure on prices in those areas where new ‘investment grade’ projects are numerous.

Real estate moves slowly and price changes drag out over many years. It is rare that a market makes such a beautifully defined U-turn, after a long hard surge, as the markets in Sydney and Melbourne.

A historic home price spike in Seattle, sharp increases in other metros, but New York condos fall. Read… The Most Splendid Housing Bubbles in America

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“CoreLogic’s listings counts are based on a rolling 28 day count of listings”.

Thought people might like to know that the active listing counts, and also new listings counts, are based on a 28-day a moving (a.k.a “rolling”) average.

PS: Awesome data. All MLS systems in the US should be required by law to make such data publicly available.

The data is juked though. Since property is not officially classed as an investment in Australia, RE agents and others are not required to be rigorous with their submitted data. Poor sales figures are omitted or moved across periods to massage the data. But there’s only so much finagling they can do before it becomes unrealistic.

I was in Sydney three months ago. Luxury condos everywhere. I lived in an AirBnB, off Paramatta Road, prime real estate owned by Chinese, almost everyone living there was Chinese. Many young/middle-aged people with kids, many of whom did not speak English.

I have friends renting a hole in the wall in Burwood in a very old building that is on its last legs. The landlord refuses to conduct any repairs ‘cos he is waiting to sell it to a developer. My friends make very good money, but this is all they can afford.

Hmmm. I have yet to encounter any prime real estate “off Parramatta Road” but there you are.

What staggers me about the recent stupendous influx of Mainland Chinese into the somewhat more leafy-and-genteel northern suburbs of Sydney is the well documented total lack of originality and imagination. (Confuciusism? Communism?) Every one of them drives a shiny black Porsche SUV. I use the word “drive” advisedly. No problem though. The kids will be fine. It’s just the dopey, recently-arrived, very loud, money-drenched, parents. I guess someone had to benefit from all that cheap plastic crap exported to the Western world over the last decade or two.

I thought the waterfront near he ferry terminal was prime.

http://www.theaspiringdigitalnomad.com/parramatta-ferry-sydney/

What do Chinese exports have to do with capital flight from China? Nothing. The real culprit is the sheer amount of money creation taking place in China over the last 15 years.

https://www.zerohedge.com/news/2013-02-08/china-accounts-nearly-half-worlds-new-money-supply

So the next time you gaze over at all those magnificent bubbles being creating in trophy cities all over the world, you’ll know where it all comes from.

International finance is not quite my bag but I would have thought that at least part of the process would include the following:

… Mr Wang builds a factory and produces plastic crap which he exports to the US

… he gets paid in USD which he gives to the PBOC who in turn print renminbi and give them to Mr Wang

… PBOC use the USD to buy US Treasuries

… Mr Wang finds ways to get part of wealth out of China and into Sydney and houses and black Porsche SUVs.

Aussie Aussie Aussie it has been sold resold and in motion as all false kingdoms found.

Market analysts! An amazing building community, democracy trades.

Gangs of concrete building up up up and taxed values yields.

Enjoy your day!

Prices in Australia are ludicrous and also the states each have their own taxes on top. We live in New Zealand but can buy in Australia, as we have an agreement with them, bit like the EU set up. But we looked at a property there a few years ago in New South Wales, and were told 5% stamp duty and then a state levied 7% “foreign investor tax”! We told them to stick it and said we’d go back to NZ and buy in a country that didn’t want to financially screw us. Which we did. No stamp duty in NZ so we saved alot more and are glad we did. Not only are property prices high in Oz but alos the ongoing taxes levied by the states and central government are high.

I simply don’t understand why so many people want to live there, apart from the nicer weather (except in Melbourne!). For most people it is simply too expensive.

Taxes, yeah baby, the local Government wants 100K from every block you subdivide. The property next door but one got chopped up into 22 blocks.

They are still doing the earthworks and road, and have already sold 4 of the blocks. People seem to have money to burn.

Find Cairns North Queensland Australia. The real estate market is just starting to recover, a tourist City, Reef and Rain forest. The low A$ is helping.

I hope prices fall, but around here, the north coast of New South Wales, prices are still rising, properties are selling within days of being listed.

It seems a lot of baby boomers are selling up in Sydney, moving to the north coast and retiring.

The local Real Estate agent has a smile from ear to ear.

Amazing to me how much this sounds like Toronto and Vancouver. Is there something about Australia and Canada, besides their size and safe-haven status, that has led to similar housing bubbles in the largest cities? Have the politicians in these two countries been more willing to stake economic growth on RE rather than home grown business development? I know that productivity growth has been very slow in Canada, and it seems there isn’t the courage to implement changes that will encourage productivity improvement. Friends and family in the U.S. suffered a severe correction 10 years ago, but Toronto and Vancouver just kept going up for the most part.

What’s similar is that politicians are invested in RE market, so they do anything and everything to keep it up.

“Safe haven status”….there is your answer.

https://www.theguardian.com/cities/2016/jul/07/vancouver-chinese-city-racism-meets-real-estate-british-columbia

Open markets, no questions asked, come launder your money here, and snag an inflation-protected escape hatch to boot. And in some cases get citizenship…

The scary part is that Australia and Canada finally saw that something was wrong, and put some restrictions in place (BC/Toronto tax, and Australia housing stock restrictions). The West Coast of the U.S. is now in the middle of the same speculative spike of offshore money. Will we do something to stop it? Common sense would dictate that housing stock should be used to house residents, and not to store funny money….but I am not holding my breath for any restrictions.

Our only hope for affordability right now is market forces (the CNY continuing to fall and money having to return to China if their domestic bubbles deflate).

commodities.j

Once the price drop appears obvious to the buying public, prospective buyers will wait thus increasing the rate of decline. Coupled with an economic burp it could really accelerate.

A year before the Irish RE crash that took down its three biggest banks, Economics Professor Morgan Kelly started seeing his former students (all highly paid by those banks) on TV predicting a ‘soft landing’.

‘But there is never a soft landing,’ he thought ( quoted from ‘Boomerang’ by Micheal Lewis) ‘as far as prices have overshot rents, they fall by an equal amount’

The end arrived in Ireland abruptly, with the shares of all three banks falling 40- 50 % in one day. This needs to put perspective however: there was no industry anywhere near the size of RE in Ireland. One quarter of the work force was in house building. It was building one- half as many houses as England that has 15 times the population.

Right now there is a narrative that this stock market, RE market and economy will have a recession sometime but not soon enough to worry about.

There is also an oft repeated thought that whatever money is lost in the stock market is gained by someone else: a zero- sum game less commissions.

So who’s got the 100 billion plus just lost by Facebook?

No one. (Almost. It wasn’t heavily shorted but no doubt there will be some)

It’s gone.

Was it just paper wealth? Not to the people who counted it as part of their wealth.

These times expect everything to happen with lightning speed, except the end of this bubble.

The ‘soft landing’ theory clung on to by the heavily invested/massively over-indebted relies on the associated ‘pent up demand’ theory which claims that there are lots of the priced-out waiting eagerly on the sidelines who are going to jump in as soon as prices reduce a few percent, for fear of missing out on the next surge (inevitable, natch).

This is all, of course, nonsense – no-one in their right mind buys a massively expensive asset which is falling in value, and there’s only clamor for real estate when its value is rising.

Wallstreet taught me in 2000 and 2008

What goes up hard and fast comes down harder and faster

What’s abnormal on the way up

Will be abnormal on the way down

Buckle up

– In some suburbs of Sydney houses came down ~ 15% and apartments/condos/units came down ~ 22% over a period of 12 months.

https://www.domain.com.au/news/sydneys-inner-west-bears-the-brunt-of-the-citys-steepest-annual-drop-in-house-prices-20180726-h136on-754957/

https://www.youtube.com/watch?v=DS7tcM5CfyA

Whats worse is, the banks let you borrow against the paper gains for holidays.

https://www.nab.com.au/personal/learn/investing-in-property/what-s-equity-and-how-to-use-it-to-buy-an-investment-property

Know friends who do it.

The housing bubble may be bursting but if we’re in the very beginnings of a new commodity cycle then the Australian economy and currency should benefit greatly. So hopefully for Australia, the bursting bubble won’t coincide with other strong headwinds as it did in the US. and the economy won’t nosedive.

I was reading somewhere there’s a million households who could potentially default on their mortgages in Australia by September.

Shares of huge realtor Countrywide in UK drop 60 % yesterday.

It’s on the Guardian site for the full story.

A re evaluation … before further borrowing ??

“We’d like to borrow more money please.”

“Sorry, no can do man.”

“How is that?”

“Simple, the real estate that you are sitting on is extravagantly overpriced.”

“What do you mean?”

“The building ain’t worth what you say it is.”

“But I need to borrow money to make the mortgage repayments.”

“Tough !!”

“What to do.”

“What to do.”

“Okay, if I lower the value of the house to a realistic price will you lend?”

Oh, just about every trick in the book is out there waiting to be ‘had’.

Q: Are some business losses Tax Deductible ??

Lucky hu.

The “tell” is the rental yield. Property owners are lucky to get 3% gross yield on a house. Then there’s all the costs and fees. Prices have much, much further to fal yet.

Baby Boomer Retirement Fund Go Boom.

Who will look after them while unemployed and without the property equity they had.

oh well