This Fed is getting seriously hawkish: It revealed that instead of thinking about backing off rate hikes, it’s replacing the yield curve.

In the minutes of the FOMC meeting on June 12 and 13, released this afternoon, there was a doozie, obscured somewhat by the dynamics of the rate hike plus the indication that there would be two more rate hikes this year, for a total of four, up from three at the prior meeting, with more hikes to come in 2019, along with other changes – a phenomenon I called, This Fed Grows Relentlessly More Hawkish, Gone are the Kid Gloves.

But the doozie in the minutes was about the flattening “yield curve.”

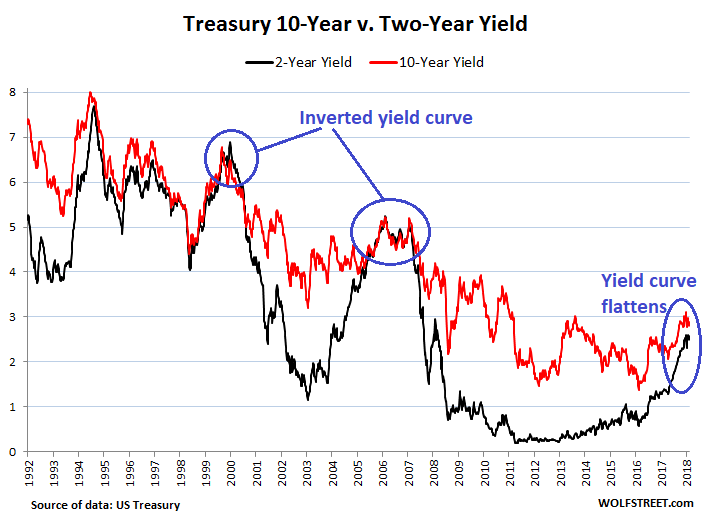

The yield curve is formed by Treasury yields of different maturities: normally, the two-year yield is quite a bit lower than the 10-year yield. Over the last several decades, each time the yield curve “inverted” – when the two-year yield ended up higher than the 10-year yield – a recession followed. The last time, the Financial Crisis followed.

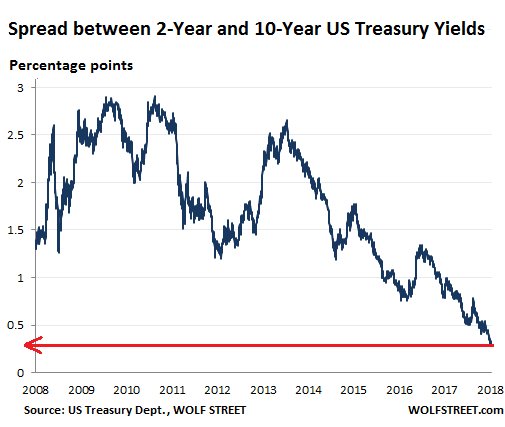

So this has become a popular recession indicator that has cropped up a lot in the discussions of various Fed governors since last year. Today, the two-year yield closed at 2.55% and the 10-year yield at 2.84%. The spread between them was just 29 basis points, the lowest since before the Financial Crisis.

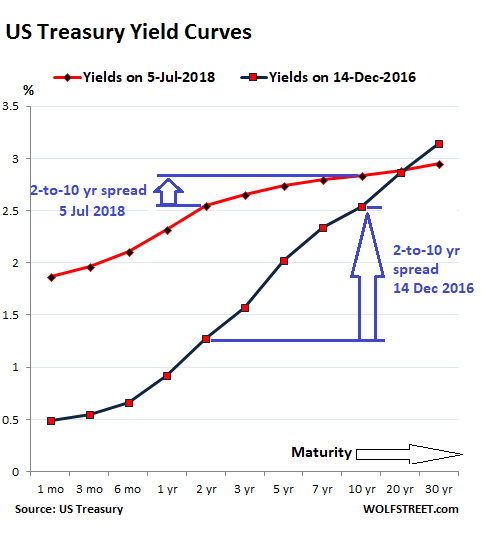

The chart below shows the yield curves on December 14, 2016, when the Fed got serious about raising rates (black line); and today (red line). Note how the red line has “flattened” between the two-year and the 10-year markers, and how the spread has narrowed to just 29 basis points:

The chart below shows the two-year yield (black) and the 10-year yield (red) going back to 1992. Note how the spread has been narrowing in recent months (click to enlarge):

The chart below tracks this spread for every day back to 2008. Today, the spread, at just 29 basis points, is the lowest since before the Financial Crisis:

There has been a lot of handwringing about this being an indicator that the next recession is nearing and that the Fed should back off with its rate hikes.

But this Fed is getting seriously hawkish: In the minutes today, it revealed that instead of thinking about backing off with its rate hikes, it’s throwing out the flattening yield curve.

It explained what factors – in addition to the “gradual” rise in the federal funds rate, as per the Fed’s rate hikes – cause the yield curve to flatten that make it unreliable as a recession indicator:

- A “reduction in investors’ estimates of the longer-run neutral real interest rate”

- “Lower longer-term inflation expectations”

- “Lower level of term premiums in recent years relative to historical experience reflecting, in part, central bank asset purchases” – meaning that QE are artificially repressing long-term yields in relationship to shorter-term yields.

And according to “some participants,” these types of factors “might temper the reliability of the slope of the yield curve as an indicator of future economic activity,” the minutes said.

In other words, the Fed’s massive balance sheet, nine years of near-zero interest rate policy, and other factors might be distorting investors’ thinking. And this distorted thinking causes investors to pile into long-term Treasuries at these low yields, and thus push down these yields further.

Hence, the “information content” of the yield curve – the signals of a coming recession – might be distorted.

There was no consensus among FOMC members about the lack of “reliability” of the yield curve as a predictor, but there was a “staff presentation” about a new recession indicator to replace the yield curve:

This new indicator – rather than looking at the spread between longer-term yields of two years and 10 years – is looking at the spread between short-term yields. It’s “based on the spread between the current level of the federal funds rate and the expected federal funds rate several quarters ahead derived from futures market prices.”

The staff noted that this measure may be less affected by many of the factors that have contributed to the flattening of the yield curve, such as depressed term premiums at longer horizons.

This “staff presentation” took place during the meeting on June 12 or 13. On June 28, the Federal Reserve Board published a note that explained in greater detail why this new recession indicator would be superior to the yield curve.

The note by two staff economists, Eric Engstrom and Steven Sharpe, tracks the market’s expectations of the next rate cut, based on the logic that the Fed will cut rates when the next recession begins.

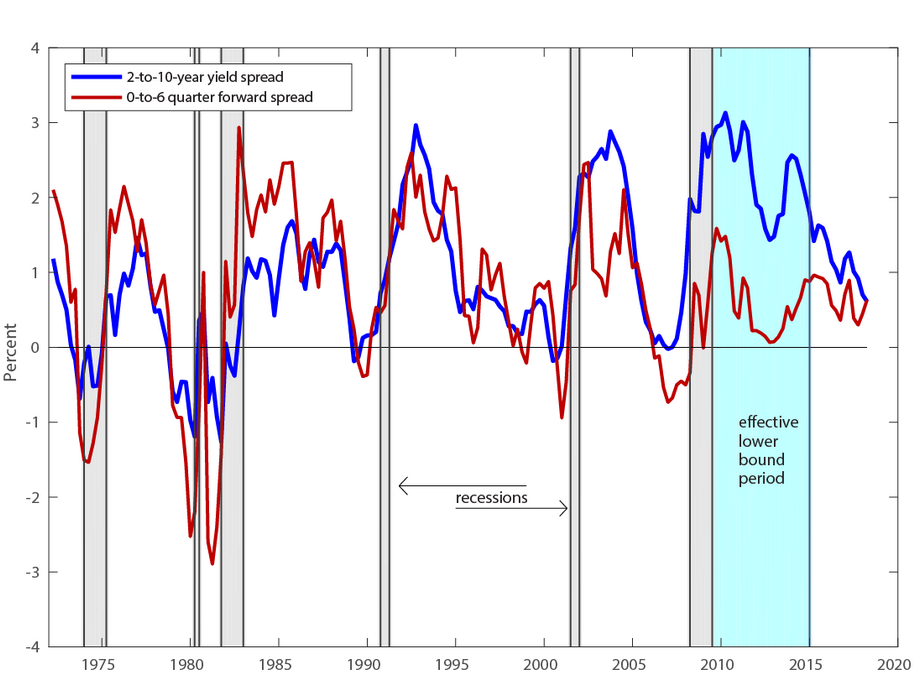

The note included the chart below that compares the “long-term spread model” (the yield curve, blue line) to the new “near-term spread model” (red line). It shows that the new model accurately predicted the last five recessions, similar to, but perhaps slightly better than, the yield curve. This occurs when the lines drop toward and below zero. The chart also shows that the spread of the new model is well within range of the past few years and pointing in the right direction (up), while the spread of the long-term yield curve is at the lowest point in 10 years and seriously pointing in the wrong direction (click to enlarge):

To convert this into an indication of recession probability expressed in percent, as the market sees it, the Fed economists offer the chart below (click to enlarge):

It shows how the yield curve (blue line) is indicating a rising probability of a recession – while, according to the new indicator, “the market is putting fairly low odds” on this scenario.

So just in the nick of time, with the spread between the two-year and the 10-year yields approaching zero, the Fed begins the process of throwing out that indicator and replacing it with a new indicator it came up with that doesn’t suffer from these distortions.

And I have to agree that the Fed’s gyrations over the past 10 years have distorted the markets, have muddled the calculations, have surgically removed “fundamentals” as a consideration for the markets, and have brainwashed the markets into believing that the Fed will always bail them out at the smallest dip. And the yield curve, reflecting all those distortions to some extent, might have become worthless as an indicator of anything other than those distortions.

There are no more excuses for the Fed. Read… Rate Hike Ammo

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Very interesting article. I am wondering just what contingency plans are being discussed behind closed Fed doors if this tariff fiasco leads into a crisis? The interest rates aren’t really high enough to make lowering rates effective for much of anything, plus the constant back patting words of how great the economy is gets in the way of doing anything. After all, if trade wars are easy to win, and the economy is doing so great, why make any changes?

Full speed ahead, and damn any icebergs and torpedos.

Tonight, the next round of tariffs and the Chinese reaction awaits. Mexico just increased their duties….and tomorrow is Friday? Would you hold on over the weekend? I wouldn’t.

That yield curve doen’t look too optimistic, either.

regards

Oh yeah, the jobs report is supposed to be down as well.

The actual mandate of the Fed includes controlling inflation, “stable prices”. So even if the tariffs hurt growth but still spiked inflation there would be a lot of explaining to do as to why rates are being dropped into an inflationary environment.

My guess: The effects of the tariffs will be somewhat gradual and won’t be noticed right away by workers–‘hidden inflation’ has been with us for years–but $100+/bbl oil will hit quickly and shock the economy. I’m astounded by the number of Americans who have gone all in on massive SUVs and pickup trucks, whether they need them or not, and even the newer more ‘efficient’ ones are gas–and parking space–hogs. When the thrice-weekly fill-up goes from $50 to $75 there will be blood.

The upside: This might be the one thing that could shake the blind devotion of Trump’s ‘base;’ I just drove through Montana and I’d guess two-thirds of the state drives massive pickups or SUVs (to be fair, it is a mostly agricultural state and many truly need large load haulers, but distances are long and the cost of fuels will be a major hit).

Wolf

Why can’t the treasury issue 30 year bonds to fund the tax cuts/deficits? Will have the benefit of (1) locking in low rates and (2) start lifting the long end of the yield curve.

Thoughts?

vm

Ven,

It’s doing that. Here’s the list of recent 30-year bond sales (click to enlarge); the link for more details is below.

For further details:

https://www.treasurydirect.gov/instit/annceresult/annceresult.htm

So basically the Fed is saying “believe me (we will raise rates) and not the markets (the Fed cannot raise rates)”. As of now, the raise in rates has not damaged the markets much, so the Fed is winning.

Ultimately the outcome depends on how the markets will react when they believe the Fed and whether the Fed will blink when market reacts. Also there are other QE players around the world with the money shovel ready at hand. Let us see.

I remember the old saying “don’t fight the FED”. So things are different this time? Seems like ‘fighten words’ to me.

Perhaps the new members actually go shopping and realize that 2% inflation is a lie, and their paycheck are not buying as much as ‘last year’.

It would be interesting indeed to know what the Fed internally talks about the buyback and M&A circus in progress. That is apparently the main factor keeping the stock indexes happy.

The Federal Reserve Bank – which is about as “federal” as the Federal Express is, is owned by the banks to do their bidding and maintain power over the purse strings of the nation and it’s economy.

The “Fed’s” methodology has always been plain to see:

1/ Estimate

2/ Assume

3/ Infere

4/ Adjust

5/ Guess

Now we add – Outright statistical substitution! Another layer of opacity.

The FED doesn’t make decisions with the interest of the economy, so no surprise. The FED, like all central banks, blows bubbles and pops them as they’ve been doing since inception, but with increasing regularity and severity for a few decades.

So, when it’s time to pop the bubble, any old excuse will do in order to dismiss any data that clearly suggests they should not be raising rates. If necessary, the FED would claim the moon cycles are expected to raise inflation and thus they need to raise rates.

I’m glad to see they finally seem to realize that an inverted yield curve is just an indicator, not a tool to forever avoid recession.

Japan had recessions without inverted curves plenty of times, their zero interest rate policy didn’t prevent them.

Now hopefully they acknowledge that asset inflation can be a problem. This seems obvious to most of us here as we see that retirement plans can’t get decent returns, housing is out of reach for many, and labor simply isn’t worth as much.

The fed kept praising the “wealth affect” of an inflated stock and housing market throughout the Greenspan, Bernanke and Yellen years, as if the philanthropy of the newly minted billionaires would then push the economy forward. One can always hope.

John Taylor,

“The fed kept praising the “wealth affect” of an inflated stock and housing market throughout the Greenspan, Bernanke and Yellen years, as if the philanthropy of the newly minted billionaires would then push the economy forward.”

I have wondered forever about this. Common sense would tell you that $100000 spread among 10000 people would lead to better spending in the economy (if you do not count a couple of yachts that would not get purchased) than 1 guy with a $1 billion. But then these economic whizkids KNOW OTHERWISE and since they are at the wheel they can plough it over the savers, prudent people and retirees at will.

Saw a post somewhere years ago where a guy said “what’s better? a trillion dollar economy where 1 guy has a trillion dollars buried in his back yard, or everybody has 10,000 dollars and are scrambling to buy stuff from each other?” The economy is a flow, not a stock.

True: Economies foundations are “flow” – Net flow consumes ENERGY, which transforms resources into products, and work (Services etc.) So the foundation of all economies are Energy and Resources first. Consider that High/Consuming “middle class” populations are booming – Each Middle Class consumer “eats” many times the Energy and Resources that a “poor” citizen would use. So, not only is population climbing, more critically – High user citizens are decimating the world. More than anything else, this will stress the system to breaking.

I still don’t understand why the Fed doesn’t decide that there is a minimal 2-10 spread they’re willing to accept, and then adjust the Fed Funds Rate as needed to maintain that spread.

If I’m Powell, there’s no way I’m letting the curve invert on my watch, and then take the blame for the long deferred recession that should’ve happened during Bernanke or Yellen’s terms. I’m amazed the Fed is so cavalier about causing an inversion of the yield curve. It does matter.

Or they could “adjust” the spread by selling off their long-dated Treasuries that they have on the balance sheet. That would goose the 10-year yield. Just talking about doing this would goose it. They have the tools to do this (their big-fat balance sheet), which they never had before. So if they want a 200-basis-point spread between the 2 and the 10 year yield, they can get there no problem.

Wolf,

I wanted to make this point as I have read it in your post many times i.e the Fed controls the long-term too now and can increase the spread whenever they want. But what is of interest to me is what could be unintended consequences of that?

Also is that the reason why they are sanguine about the lack of spread.

The problem is that a lot of that is “imaginary” money that if used instead of being allowed to “unwind” would raise inflation too high and too fast.

Hence why they went with a new new indicator instead.

Exactly. Their Balance Sheet De-Abnormalization efforts (:-]) require them to sell bills/bonds/notes on their books, but doesn’t constrain them to choose any particular duration, so they can sell only longer maturities to keep the curve from inverting.

But even beyond that, there’s nothing stopping them from piling on a little Operation Twist, only in the other direction from the way they twisted in 2011 (and 1961 https://www.investopedia.com/terms/o/operation-twist.asp).

So I agree with your point that they can manipulate the spread to be whatever they want. And if they are going to be manipulating it like that, everyone _should_ throw it out as an indicator, because they’ve broken it’s predictive value.

Plus we’ve got Japan and Russia dumping treasuries, and who knows what direction those atypical actions are twisting the curve.

Perhaps the fact that they have thrown it out as an indicator is a tell that they _will_ be manipulating it, and the markets better not get in their way.

The average slope on the graph of the 10yr yield keeps trending down, thereby making it easier for the 2yr yield to pop above it, producing an inversion.

To illustrate this effect, suppose you were a non-instrument rated pilot, and every time you climbed up to the cloud layer, you would lose orientation, and panic. The 10yr yield is the “cloud altitude”, and the 2yr yield is the plane altitude. In the past, the cloud altitude was high enough so that you had plenty of room to maneuver up or down while still staying out of the clouds. Now, the cloud layer (10yr yield) has gotten so low that it is much easier for the pilot (2yr yield) to climb into trouble. The FED was responsible for bringing down the cloud altitude so low that it has become easier to penetrate, so I suspect that an inverted yield curve is no longer the indicator that it once was, or at least penetrating it is no longer a need for panic (recession). I hope I am right on this, or the FED will need to drop short term rates by next year, or wait for the cloud elevation to increase. Shouldn’t the unwinding of QE cause the long yield to increase, allowing our pilot more room to maneuver, or will he be forced to descend?

Good analogy. As a decades long west coast float pilot who has had many friends over the years in the situation you described….. the end result of that lack of maneuvering room has often ended in a fiery or debris strewn crash, or an oil slick on the water. Seriously.

The news reports are always, “What could have happened”? “Why did he make that decision”? and finally, “Pilot Error”. (no smiley face)

I bet the pilot knew what happened. One thing for certain is the count of takeoffs no longer equaled his number of landings.

The FED seems to experience repeated “accidental” landings and the excuse of making mistakes is an old worn out one older than my used dog.

The question is, what’s the price for accountability?

https://www.thisamericanlife.org/536/the-secret-recordings-of-carmen-segarra

A very good blog article, Wolf, thanks for posting it.

If the yield for two year bonds is higher than the yield for 10 year bonds,

this means that the market views two years bonds to be more risky than 10 year bonds. Normally, one would expect lower yield on shorter maturities, relative to longer maturities. Therefore is the market really saying that it views 2 year debt to be more risky than 10 year debt? According to the yield, it is reasonable to say that the market does say that 2 year debt is “riskier” than 10 year debt.

The problem here is that both sets of maturities might well be far more riskier in the themselves, and relative to each other.

The past 10 years has shown that asset prices have become entirely debased, due to deliberately manipulation by central banks. The Fed is now trying to discredit a leading indicator. The indicator doesn’t suit the Fed narrative, so instead of addressing what the indicator states, try to discredit the indicator instead.

If I can use a sailing analogy, you commence a voyage 1 degree off-course. After 400 miles sailing along that 1 degree error, you find yourself in the middle of nowhere. Your map (indicator) tells you where you are, and instead of trying to plot a corrective course, you decide that what the map is telling you is wrong instead and you rip up the map.

Or to better describe the Fed, the map is declared outdated, so a new revised map is issued, and all the passengers are told there is smooth sailing ahead, and to ignore those dark clouds on the horizon

Here is my understanding of 2 and 10 year bonds. 2 year rate higher than 10 year is NOT based on market “perception” of risk.

The short term yoeld is for “liquidity”. You basically have bills to pay but your income will be available 1 week later. You go and borrow money in short term market with a yield. You are NOT intending to wait 10 year to pay it back, you pay it back 1 week later. So even the yield is 10%, for like 1 week, it is 10%*7/365 = 0.2% interest. This is liquidity, short term or money market. The 10 year is capital market. You do NOT take 10 year loan to pay it back 1 week later. You use it to invest in production quirky, R&D.

When crisis happen, people find it hard to get “liquidity”, so short term rate rise. On the other hand, nobody is borrowing 10 year to invest, so 10 year or long term rate naturally drops, therefore the inversion.

These two are NOT the SAME market with different perception of risk. That is the junk bonds VS investment grade, both long term, but different risk perception. The duration of the bonds indicates differences in money market liquidity stress and long term investment perspective.

This is my engineering understanding of the business, so I could be wrong.

Thanks for that! I’m an engineer and that was a perfect match to this mind :-)

Historically, even when yeld inversions predicted recessions, the recessions happened on the average about one year later.

Not such a useful predictor in my opinion, not even if it worked.

Jan 2006 is the last time the yield curve began its inversion. I agree with you. Even when it began to invert, it was 2 years later before the real pain was felt

Perhaps the yield curve has become more of a self-fulfilling prophecy; i.e., due to past experience, investors see the curve flatten, then jump out of investments in anticipation of ‘inversion,’ and a recession ensues. Reminds me of technical analysis of the stock market; you might as well read tea leaves, but the devotees see a mythical formation–‘head and shoulders double teacup triple whammy’ and jump on or off the bandwagon, causing the very result they anticipated.

You have to give them credit for courage to cherry pick their data to fit their needs.

It’s also nice for them to always say they cannot foresee/predict bubbles, bear markets, recessions. (begs the question of what good is the “science” of economics then….)

This kind of “communication” (obfuscation) works well for them.

If I have $100,000 to invest in bonds, why in the world would I buy a 10 or 30 yr if I can get a decent return on a 2yr? Knowing long bonds can drop about 7% for each 1% rise in the fed funds rate, and that the fed has broadcasted it intends to raise rates further, who the hell is buying this long-term crap, and why?

In the WSJournal today….

German 30yr bonds are selling well, and the current interest rate is 1%. Have people lost their minds? Is it because 5yr German bonds pay negative 0.3%? Their yield curve is not inverted, so no worries there. What about inflation effect on that 30yr bond?

Here is how long term bond works. Today, you buy face value of 100$ 30 year, 3% yield and the market “implied/estimated” discount rate is also 3%. So you pay 100 = 100*(1.03)^30/(1.03)^30 =100.

3 month later, due to depression, deflation, or what ever reasons, the market implied discount rate is 0%. Suddenly, your bond is worth 100*1.03^30/1=242$.

Get it? You buy long term bonds because there is “capital gain” if interest rate drops. The buyer is NOT looking for yield, they are looking for rate move.

The answer might be here, and I’m wondering if it isn’t actually a reasonable approach at least in terms of incentive:

https://www.wsj.com/articles/the-tax-wrinkle-that-is-making-pension-funds-buy-more-treasurys-1530783000

The Fed has a strong track record of fairly inaccurate predictions and is slow to recognize and react. Whether this is a flaw or intentional isn’t the issue. It’s what they’ve always done in the past. This looks to be “business as usual”.

Is it not more difficult for banks to make money when short rates exceed long rates, and hence a contraction of credit? However the Fed wants a tightening of credit therefore an inverted yield curve could be considered as part of the current tightening cycle. As mentioned the Fed and Treasury can manipulate the yield curve if necessary but have not been noticeably proactive in pushing up long yields.

The failure to address overheating of the economy would show up as greater inflation expectations not apparent in the direction of long rates currently, suggesting the Fed maintains credibility. The Fed is concerned with Inflation, containing asset bubbles and ensuring debt expansion does not exceed the capacity of the system to carry it. There is evidence that in many sectors, particularly offshore and in the corporate sector, this may have occurred already and the Fed does not want this to become more generalized. Financial stability is I believe front and centre in their calculations. With the current administration willing to pursue aggressive fiscial policies monetary authorities have more room to be aggressive on the monetary side correcting past substantial imbalances.

Who does the FED work for? Moving the goal posts in favor of special interest groups is standard mode of operation for criminal organizations.

Battelle memorial institute

Just like the stock market got disconnected from main street and a firm’s earning power, the interest rates are disconnected from the real price of money. It is another manifestation of financial engineering gone amok.

Maturities fund different types of businesses regardless of the rates. Mortgages are always 15 and 30 year, car loans are always 4-7 year, etc. This is what is driving demand for different maturities, not the rates. These maturities in turn feed the derivatives’ markets for shorter term products.

It’s the demand for the duration that is being expressed in the yield curve. It is not necessarily a reflection of economy, probably more a reflection of the industries the maturities fund.

The Federal Reserve cant sell its balance sheet and have an inverted yield curve! (Free money for all, just dont tell the parents)

One more benchmark tossed to the side of the road. Banks don’t lend money so that shouldn’t bother them.

Zero interest rates and even more “negative” interest rates (See Europe and Asia) really have distorted things. The problem is that while rates in the US have gone up, other countries still have negative rates and negative rates are a scam to those country tax payers.

Yet no one cares.

We do, but what can you do….

I believe the Fed (Powell) is very concerned that continued ZIRP was having some bad effects and thus the move up. I believe they will continue to move up until some of this crazy borrowing (e.g., corporate debt to stock buyback, apartments out the wazoo) slows signficantly.

They should not be concerned about the yield curve, inversion or not.

The reality is this economy is totally different in so many ways to that of prior decades. First off, the stock market is fully manipulated by the Fed and Wall Street. As long as there is not serious/crisis type selling, it will be “managed” up or sideways. Second, long term rates are not going up. There is too much money sloshing around the system for little or no productivity in the real world economy, including high tech which in many instances is actually negative productivity; although they’d be hard pressed to admit it. So longer term rates are going to stay low and flat, period.

I’ve maintained all along the the 10 year will not go appreciably above 3% and that seems to continue to be the case.

Looks like homebuilders think the cuts will be coming by early next year.

https://www.barchart.com/etfs-funds/quotes/XHB

It’s funny how the fed has drunk its own cool-aid and is removing an indicator based on supply and demand (bond yields) with an ‘expecations based model based upon its own actions.

I will be trying to replace my credit scores with a model based upon how good I feel about myself.

I say this new model is a vindication for everyone who’s in the camp that the rate hikes are going to end sooner rather than later. I think the Fed’s new model is a short term play to fool the market into believing that it will really really keep raising rates (to stabilize the dollar), while full well knowing it’s going to start cutting again soon.

It shows that actual price discovery is dead and that the Fed put is alive and well. It’s proof positive that they’re ignoring fundamentals.

T

Ponzi schemes cannot afford to have recessions. Ergo, with a $1.8 quadrillion dollar USD dark pool derivatives universe any sign of a slowing economy must be hidden from the great unwashed lest they catch on and panic whilst heading for the exits to participate in EM for safety reasons.

Secular Stagnation will destroy the goose that laid the golden egg in time.

RW

Ponzi schemes are all about picking up assets on the cheap, forced margin calls are but one mechanism. The FED is complicit with the rinse and repeat scheme that makes miracles possible, bring on the recession.

It’s fashionable to always speak of the recession in the past tense. We recognize it too late, then lament that the worst is over and go back to our business.

…beep…beep…beep…Breaking news…beep…beep…beep…wallstreet declares that quarterly and yearly profit reports are no more valid indicators and should not affect stock price…beep…beep…beep…from now on companies only required to send out postcard with cat and dog motifs to stock holders…beep…beep…beep…unicorn postcards pending approval…

– An inverted yield curve is NOT a recession indicator.

When the yield curve inverted right before the 2008 meltdown there was similar talk about how it may not be meaningful. We know in hindsight what happened next.

In 2000, they were saying high interest rates wouldn’t cause a problem for internet companies because they could just sell more stock. How did that one turn out?

In other words, the most dangerous words we hear from the fed or on cnbc bubblevision are “it’s different this time!”

Those little titans of finance at the fed whose answer for a solvency crisis is piling on still more debt gave us such doozies as:

1) “housing is not overvalued”

2) “there is no problem with mortgage debt”

3) “ok, there’s a problem with subprime debt, but prime debt is solid”

4) “ok, there’s a problem with debt and the stock market, but it will never cause problems for main street”

Whatever these jokers say, just invert it and you get the right answer. In other words, if the fed says “the sky is blue”, you had better immediately run outside to see if it’s turned green.