Um, no. Central banks not enthusiastic about the renminbi.

Global central banks are not dumping US-dollar-denominated assets from their foreign exchange reserves. They’re not dumping euro-denominated assets either. And they remain leery of the Chinese renminbi – despite China’s place as the second largest economy in the world and despite all the hoopla of turning the renminbi into a major global reserve currency.

This is clear from the IMF’s just released “Currency Composition of Official Foreign Exchange Reserves” (COFER) data for the first quarter 2018. The IMF is very stingy with what it discloses. The COFER data for each individual country – each country’s specific holdings of reserve currencies – is “strictly confidential.” But it does disclose the global allocation of each major currency.

In Q1 2018, total global foreign exchange reserves, including all currencies, rose 6.3% year-over-year, or by $878 billion, to $11.59 trillion, within the upper range of the past three years (from $10.7 trillion in Q4 2016 to $11.8 trillion in Q3, 2014). For reporting purposes, the IMF converts all currency balances into US dollars. This data was for Q1. The dollar bottomed out in the middle of the quarter and has since been rising.

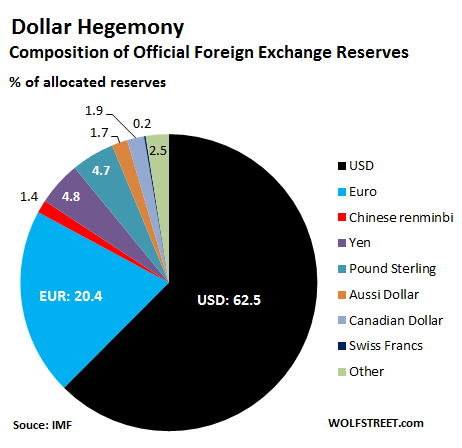

US-dollar-denominated assets among foreign exchange reserves continued to dominate in Q1 at $6.5 trillion, or 62.5% of “allocated” reserves (more on this “allocated” in a moment).

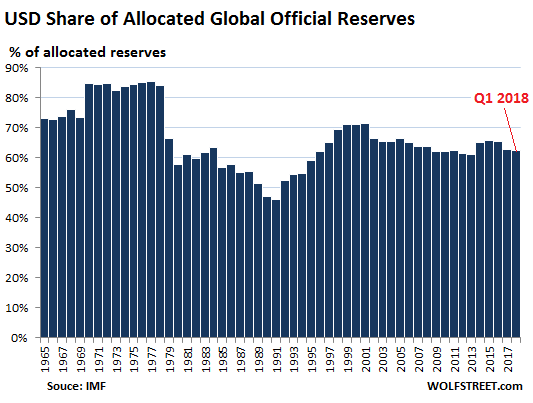

Over the decades, there have been major efforts to undermine the dollar’s hegemony as a global reserve currency, which it has maintained since World War II. The creation of the euro was the most successful such effort. The plan was that the euro would eventually reach “parity” with the dollar on the hegemony scale. Before the euro, global exchange reserves included the individual currencies of today’s Eurozone members, particularly the Deutsche mark. After the euro came about, it replaced all those. And its share edged up for a while until the euro debt crisis spooked central banks and derailed those dreams.

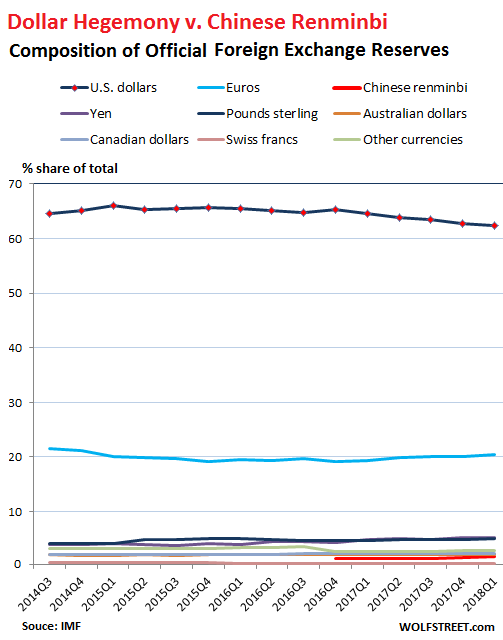

And now there are efforts underway to elevate the Chinese renminbi to a global reserve currency. This became official on October 1, 2016, when the IMF added it to its currency basket, the Special Drawing Rights. But watching grass grow is breathtakingly exciting compared to watching the RMB gain status as a reserve currency.

The RMB is the thin red sliver in the pie chart below with a share of just 1.39% of allocated foreign exchange reserves. Minuscule as it is, it is the highest share ever, up from 1.2% in Q4 2017. In other words, its inclusion in the SDR basket hasn’t exactly performed miracles as central banks seem to remain leery of it and have not yet displayed any kind of eagerness to hold RMB-denominated assets.

The Swiss franc, with a share of 0.2% of allocated reserves is the barely visible black line in the pie chart above.

Note the term “allocated” reserves. Not all central banks disclose to the IMF how their overall foreign exchange reserves are allocated by specific currency. But over the years, more and more central banks have disclosed their holdings to the IMF, and the mystery portion has been shrinking. Back in Q4 2014, unallocated reserves – the undisclosed mystery portion – accounted for 41% of total reserves. In Q1, only 10.3% of the reserves remained undisclosed. So the COFER data is getting more complete.

The chart below shows how the share of various reserve currencies has changed since 2014. The black line with markers, way at the top, is the hegemonic US dollar, whose share has edged down a tiny bit. The euro (blue line) vacillates at around 20%. The dollar and euro combined accounted for 82.9% of the allocated foreign exchange reserves in Q1, unchanged from the prior quarter. Each of the rest of the currencies is inconsequential. The Chinese RMB — which is supposed pull the rug out from under the dollar – is the bright red line at the very bottom, just above the Swiss franc:

So folks who’ve been eagerly anticipating “the death of the dollar” or similar scenarios will have to be very patient.

Since 1965, the dollar’s share has fluctuated sharply, and the current share of 62.5% remains in the middle of the range. The chart below shows the dollar’s share at year-end for each of the past 52 years, plus for Q1 2018. Note its low point in 1991 with a share of 46%. And note that the Financial Crisis made no visible dent:

There are many people who contend that the US, as the country with the global reserve currency, must have a huge trade deficit with the rest of the world, by definition. While the US does have a huge trade deficit with the rest of the world, it doesn’t have to be this way. This is proven by the fact that the Eurozone has a large trade surplus with the rest of the world, and yet the euro is the second largest reserve currency.

However, having the largest reserve currency does allow the US to run a huge trade deficit, at least for a while, though the major cause of it – offshoring production by US companies – has a long-term deleterious impact on the US economy.

After decades of relentless offshoring, the equation may change for automakers and component makers. Read… Beyond the Hysteria about Auto Tariffmageddon

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What is happening now is not quite like the Euro. What is happening is that a critical mass of nations have become critically angry and frightened as a result of the US government’s systematic abuse of its privilged position with regard to the dollar.

Any nation that depends on the dollar is terribly vulnerable to ill-will on the part of Washington. But control of the currency and the economy are fundamental to sovereignty. What countries like Russia and China have done is to resolve that, in future, they will cut the strings that allow the US government to jerk them around at will. Others are ready to join them: Iran, Syria, Iraq, in fact all the rest of Asia – and Africa and Latin America can see the merits too.

It won’t happen overnight, and it won’t be painless. But it’s a matter of survival. The dollar’s reign as global currency is drawing to a close. It may boil down to that or WW3 – and the demise of the dollar is the safer of the two.

In economic terms, it’s not a good idea to lump Russia and China together. Russia’s economy is smaller than California’s. The ruble is a joke. In terms of economic weight globally, Russia doesn’t really matter all that much, but China does.

That said, Russia and China are neighbors.They SHOULD have a good economic relationship, and they SHOULD trade with each other using their own currencies. And they’re already doing it, and they will expand doing it. Makes perfect sense. But it has no impact on the dollar.

Wolf You as a German should know better than to take Russia for granted They are small economically speaking but still a major force to be reckoned with Underestimating them is a mistake many have made throughout history much to their dismay

I made sure to put “economic” all over my comment for just that reason ;-]

Normally I’d agree with your line of reasoning. However, in this case Russia is the world’s largest producer of oil and natural gas. China is the largest consumer of of oil and natural gas. They have an energy pipeline between the nations. Both are global super powers. That’s a relationship that can threaten the Dollar not just because of their economic production, but because of their spheres of influence.

Wolf,

Respectfullly disagree on Russia’s position. Yes small economy; however, very powerful military and very active president who expects Russia to play on world stage because of that and other past sacrifices (WWII comes to mind). And Russia has huge natural resources.

Russia is trading with China (oil) and bypassing the dollar. While you are correct in that this has no real dollar impact currently, the precedent is very significant.

In real impact terms, I would say Russia is having more impact on the world that China even though their economy is quite small. That all has to do with Putin and his view of where world order should go.

‘A very active president’

Yes. In everything EXCEPT the economy which has stagnated.

He had a run of luck in the early stages when oil took off to over 100 a barrel. He became in effect, an Arab oil king.

And as in Saudi Arabia, some of this was distributed via pensions etc. (now being cut back in both but Russia was never as rich as Saudi per person)

Incredibly, during this windfall era, Russia did not become self sufficient in oil and gas field equipment. It imported a lot of it.

The wells are mostly Soviet legacy wells.

Joint partners like BA needed to develop new ones exited after becoming dissatisfied with being extorted. The rep of one partner showed up at a BA meeting with a gun.

Needless to say, consumer products (i.e., the rest of the economy) has if anything gone backwards from the Soviet era.

The Lada is still hammered out at the Togliatti factory, mostly by women, each taking 30 (thirty) times the hours of a normal car plant.

BTW: a used one in good condition is preferred to a new one.

All the new ones have defects that take time and money to iron out.

Bribes are required at every stage of life. All transport is shaken down by everyone from traffic cops to higher ups.

The former minister of finance. Alexei Kudrin (fired for saying Russia could not afford a 500 billion arms build up, but since partly rehabilitated by a worried Putin) has joined the head of the Russian central bank in saying: ‘there is no alternative to painful economic reforms’

This is pretty gutty, because they are in effect calling for an end to Putinism, for an end to kleptocracy (rule by thieves)

One measure: Russia has a GDP similar to Canada’s.

But it has roughly 4 times the population.

So with the average Canadian being four times richer than the average Russian, Canada should have 4 times the number of billionaires.

But it’s Russia that has 4 times the number of billionaires: the oligarchs. Simple math means this concentration of wealth (16 times more so than Canada) can only be possible at the expense of the rest of the Russian people.

When the Soviet Union collapsed, the publicly owned industry was seized by the security establishment and those connected to it. We could call it the African Peoples Republic model, except there the military does not always bother with a pretense of civilian rule.

After all, how else does a operative with no education beyond KGB school, who has never operated a business, become one of the world’s richest men?

Russia’s oil wealth is about $1400 per capita. Big whoop

“But control of the currency and the economy are fundamental to sovereignty” Of course the countries in the eurozone do not control their currency. They are also, at least the small ones, bound by fiscal rules they do not set. This makes them rather like German colonies, does it not?

Let’s not forget big exporting nations don’t want to hold a big position in the reserve currency arena. China has a different kind of system using bank credit guidance which allows it flexability to build infrastructure and its is just starting to play a bigger role in the fake financialised economy.

The dollar will not die as a reserve currency due to problems, instability, and as to China, a system without true checks or balances that is coming to resemble Orwells 1984 state but will be far worse. However, if a viable alternative is offered, the prob!ems in our corrupt government will make investors jump ship.

We are just lucky about the other messes in other major countries… For now. Europe may eventually deal with its Euro and banking problems… Even if no solution seems possible now.

China could have a revolution like in former communist countries. There is a serious possibility or the crooked commies would not be buying so much foreign real estate.

The trend is clear, IMF included yuan in the basket of currencies that make up Special Drawing Right, more central banks are choosing to adopt the yuan — all the expense of the Dollar.

Going by GDP PPP, China’s economy has already surpassed the US, and they’ll be the overall largest economy before 2030. Change is good.

the US economy surpassed the UK economy in the 1870s but sterling remained the dominant currency for international trade for another 50 years – there’s no automatic connection between the size of an economy and the extent to which it ‘goes global’, which is one reason why the euro hasn’t come anywhere near to replacing the dollar despite the eurozone being approximately larger than the US economy for the last two decades. and that’s despite the fact that the euro is allowed to float freely and can be traded freely, unlike the renminbi, of course

We seem to be having a rather odd day ‘comment- wise’.

Eg. ‘Euro- elites profit from schemes to bring in refugees…’

But the prize goes here: after a well- researched exposition of the data showing beyond a shadow of a doubt that the yuan is NOT becoming a world reserve currency, and that even SDR status has failed to let it overtake the Canadian or Australian dollars, the commenter concludes the opposite.

I agree. I also thought hios comments were weird

‘There are many people who contend that the US, as the country with the global reserve currency, must have a huge trade deficit with the rest of the world, by definition.’

I really don’t think that’s what they say (or at least, what they mean). If foreigners stockpile dollars either as central bank reserves or to facilitate international trade then ceteris paribus the US will run a financial account surplus which by definition means it also runs a current account deficit – that doesn’t have to be a trade deficit but it will almost always will result in one. but ceteris paribus doesn’t have to hold – if Americans stockpile foreign currencies or other financial assets to the same extent that foreigners stockpile US assets, the US won’t have an imbalance on either its financial or current accounts; the reason the US has a trade deficit is that that isn’t happening. similarly if foreigners stockpile euros then the eurozone can only run a current account surplus (which it does) if Europeans collect an even larger stockpile of non-euro assets. and I’m sure that’s what people mean, even if they sometimes take shortcuts for convenience

Not only that. The reasoning why it doesn’t have to be that way seems a bit fatuous i.e. because the zone with the second biggest reserve currency has a surplus? First of all, comparing a zone and a country is not an apple to apple comparison. And maybe the Eurozone has a surplus because America is running a deficit?

Reserve currency should be gold. We don’t have to have the old style of using gold. Currency should be able to float against gold, but the reserve itself need to be actual gold.

capital account.

Most peopel in international finance are realists.

Realistically how can a highly opaque currency from a one party dictatorship state that does not play by WTO rules and more importantly where political considerations outweigh rule of law every day even be considered for a global reserve currency.

Buy and sell it, conduct trade based in its current quoted spot price, yes hold it, let alone hold it in reserve NOT A F*&^Ing chance.

A broken clock is correct twice a day. In due course the US $ WILL be replaced as the major global reserve currency.

The CCP CNY/CMB may one millennium become the global reserve currency.

What the CCP CNY/RMB will NEVER do. Is directly replace then US dollar as the Major reserve currency.

Saying Never in FX trading is generally very dangerous, the above is completely safe.

The deciding factor for the reserve status of the USD is the oil trade. As long as the majority of oil trade is settled in USD, the status of the USD will hold.

To be a little conspirational and digging forth my tinfoil cap, I have always wondered about the role of Saddam’s decision to accept only € as payment for Iraqi oil did play in W’s Iraqi war

The Constitution, Declaration of Independence, and Bill of Rights has the most to do with our reserve currency status!

Grill something and celebrate!!

While the markets like to portray their style as emotionless and mathematical, tradition (for want of a better term) plays an enormous part. Old habits die hard. Systems are set up, traders are taught by their mentors and funds have policies that say, “buy the buck”.

Note: a very large portion of the US trade deficits over the years is due to imported oil. The US could/could have reduced its trade deficit by doing something as simple as increasing gas prices so that they resembled those of other oil importing countries (and so decreased demand dramatically). But NO, that would be an attack on the american life style. Well the result is a huge trade deficit and debt owed to everyone. At some point profligacy will have to be paid for.

@james wordsworth – i would venture that it is even more insidious than than keeping imported oil cheap. maintaining the foreign oil supply line is very good business for the military industrial complex. manus manum lavat.

It gets more ridiculous; lowest fuel prices on the planet, and military budget orders of magnitude bigger than any other country, a good part for the security of oil shipments. And there is no attempt to connect the two.

Also, one of the biggest polluters per capita despite outsourcing the polluting industries.

Somebody somewhere is going to pay for it, but there is little chance the right connections will be made.

As the disturbances and conflict continue to rise within the US including stuck or falling living standards, and division increases with its ‘allies’, (and I use this term loosely in an America 1st policy environment), I believe that the only possible reason the decline of the US dollar as reserve currency will not accelerate is if the rest of the World is sliding down the tube even faster.

Climate change induced migration may be the sleeping bear in every country’s closet, and while walls will protect sovereignty for awhile, they cannot stop desperate people forever. The need for reserve currencies will also lessen as trade volumes and activity slows in a tit for tat tariff environment. Clearly, migration upheavel is producing real and observable change in Europe right now, and how that plays out is anyone’s guess. (History may be a clue). The US is currently playing with matches in the magazine and getting its own people so roiled up I cannot even imagine what kind of an event might bring citizens back together for common purpose. How can this be good for any economy or currency?

Meanwhile, China appears to still have control of a command economy while harnessing the desire of its people’s drive for enterprise and increased living standards into a growth surge in both quantity and quality unparalleled in history. They are building high speed bullet trains while the US works on figuring out the latest Amtrak rail disaster. US companies are still engaged with building a new comapny store and the factories to stock them, in China, itself. Multi-Nationals, by definition, have no allegiance to any one country. If this trend is reduced by tariffs and threats, the Chinese will just start up their own industries and forget about being another US company division. Meanwhile, trade wars lessen all trade and the need for a reserve currency even faster.

Today, July 1 is Canada Day. I plan to watch the wee parade in our village, specifically, my wife in the Garden Club contingent as she marches in front of a plant laden atv trailer and throws candy to the kids. It is also day one of the Canadian tariffs on US goods, value of 16.6 billion Canadian. It is election day in Mexico and the weather forecast for us west coasters is for a clearing trend complete with wind warnings. It all kind of fits. The construction of a new pipeline terminal for petroleum export to the Asian market continues in Canada while the US has officially requested Saudi Arabia to boost output by 2 million barrels per day and stated she has agreed to do so (which likely isn’t possible.). Why? Whatever happened to energy self- sufficiency?

What to believe? But its day one of Tariffs and we have blue skies and a parade to attend; that’s for sure.

Migration does not succeed because people are desperate: it occurs because others – smugglers, the European controllers, GO’s of dubious origin, corporations – know how to make money from it and want it.

Fundamentally, it’s just business; and when push comes to shove, Europe can shut the gates with ease.

Cynic – totally agree. If Europe’s elite had wanted to close the gates, they would have. These are economic migrants, and they are coming because THEY CAN. They are being aided and assisted by the very people you mentioned above. Good call.

Ya the Italian elites just luv it when an big inflatable life raft with a hundred people arrives just off their shore.

They are economic migrants? No doubt. That doesn’t mean anyone in Italy or Greece wants them.

If SOME of the economic elites had their way, the rafts would be sunk before reaching the national waters.

Nick Kelly – “Ya the Italian elites just luv it when an big inflatable life raft with a hundred people arrives just off their shore.”

Yep, the elites (throughout Europe) would have put a stop to it right from the get-go if they didn’t want them. Cheap labor, holds down wages, they consume. Like Cynic said, “It’s just business.”

Of course “western democracy” bombing the shit out of the Middle East has nothing to do with anything.

fajensen – yes, bombing the shit out of the Middle East did have a lot to do with the refugees coming, but most of the refugees were safe in Jordan and Turkey. The vast majority were not living in refugee camps; many had already secured apartments and jobs in Turkey. What brought them (and they were predominantly young males) were the NGO’s who went into the refugee camps and the cities and solicited them to come. It was very well organized, and they are doing the same thing with the Africans from Libya (who are predominantly young males again).

It’s business and it’s lucrative.

The refugees in Turkey are from Syria. The bombing of the urban centers is 100 percent by the Assad regime, the chemical bombing very likely with Russian help.

None of it was done by ‘western democracy’ which opposes the Assad regime but has never bombed urban areas under his control.

The Syrian refugees are fleeing a civil war. The Western democracies have had little to do with Syria, which is one of the last Russian client states.

‘The vast majority were not living in refugee camps; many had already secured apartments and jobs in Turkey. What brought them (and they were predominantly young males) were the NGO’s who went into the refugee camps’

So the NGO’s missed the vast majority, because they were in their apartments.

Reality check: my sister has visited Turkey many times. Years after a large earthquake demolished apartment buildings in Turkey, the displaced Turkish citizens were still living in tents.

Gee, I wonder why Italy refused to let the last batch land until after they were beginning to die, Spain let them land,

The Italian elites must be so jealous. All that cheap labor, all that consumption lost to Spain.

And grandstanding Spain had the gall to say they were doing it humanitarian reasons!

But you have to hand it to the Italians for their acting skills. They (and Greece) have been saying to the rest of the EU and the US that all these refugees are an intolerable economic burden. “We have to feed them, clothe them, house them,teach them out language, police the social disorder…”

And all the time they’ve been secretly rubbing their hands at all the wealth that just floated in!

nick kelly – the average Italian has been saying it’s a burden for a long time. The politicians (the ones who just got dumped on their butts) loved it because they were bought and paid for, but the politicians who just got elected are finally listening to the people and can see the destruction that this is causing the country.

In order to accomplish the relentless offshoring you mention, in the early 2000’s, China, with the help of European banks, had to obtain dollars, and to some extent euros, to pay for it, which European banks gladly provided. The problem is, those banks didn’t actually have dollars to lend. But that didn’t stop them from creating those offshore dollars, as if they were backed by the full faith and credit of the United States. That was fine pre-2008, when it seemed the world economy would achieve parabolic growth. Fast forward to 2018, and all those dollar liabilities are still on the books. Trillions and trillions worth. Nobody knows for sure, not even the banks themselves. China still needs dollars for this reason. Lots and lots of dollars. But as it gets harder and harder to source dollars, the yuan becomes weaker and weaker. People think this intentional, but they are wrong. If you want to see something scary, look at the recent and relentless weakening of the yuan against the dollar. The yuan is not even within spitting distance of being a world currency. In fact, China keeps moving closer and closer to being Argentina.

What happened the last time China devalued, it sent a deflationary wave through the global economy.

“Moving closer and closer to being Argentina” is a big exaggerration, but everything else you wrote is spot on.

Step one: Change the name renminbi for “Yuan” since that’s the name people outside China use.

Step two: Force the rest of Asia to use Chinuse currency or else…

Step three: Get more gold and silver and less US treasuries dear China.

Step four to 98: ???

Step 99: Profit!

China is a trade surplus nation with US, and EU. Therefore, accumulations of renminbi/yuan in the respective central banks don’t make economic sense. The USD is a natural ‘reserve’ currency, as it is trade deficit with so many countries! So of course there are massive accumulations of USD/treasuries in many central banks.

And of course the power of the US has something to do with why the US is trade deficit.

If all trade were balanced there would be no accumulations of any country’s currency in other countries’ central banks. (Of course this has no impact on central banks accumulating something, for example gold.)

Sounds too simple? Think about why the currencies accumulate in other central banks.

“This is proven by the fact that the Eurozone has a large trade surplus with the rest of the world, and yet the euro is the second largest reserve currency.”

China is trade surplus with EU, therefore it makes sense that there are also accumulations of euros in other central banks.

And I do agree with above comments about needing to include both the current account and capital account. So modify the above with that.

The Euro, Yen, Pound Sterling and to a lesser extent the Aussie and Canadian dollar are just satellite currencies to the U.S. dollar. Their governments take orders from Washington and have little in the way of independence.

You are confusing basic concepts such as “stock and flow” or “balance sheet vs income”. You are basically saying, if net flow is zero on the income statement,

my balance sheet should be zero.

Not at all, what it reads like to me is, I’m saying that there will be no net change, not that the balance sheet will be zero. Also, it is pointed out about the capital account. But even that is not necessarily correct, or all there is to it. Central banks are not bound by the same rules as firms subject to finance regulations.

The lender of last resort in the next crisis, when central banks on speed dial crashes, is the IMF, which will print SDRs (just like cash) or so the thinking goes. They are already in Argentina propping up US dollar based bonds. So just wait the paint will dry.

The balance of payments deficit in the U.S. dollar was initially a result of military spending abroad from the Korean War through Vietnam in the 1960s, which forced President Nixon to end the dollar’s convertibility to gold in 1971. Since then, deficits are recycled into U.S. treasury debt.

Trade imbalances with Europe and Japan are recycled into loans to the U.S. government, funding Washington’s continued occupation of these vassal states. Without the U.S.’s ability to fund its trade/investment/military spending imbalances with debt denominated in its own currency and run up its national debt without limit, we would basically be Argentina.

@todd h – that’s it in a nutshell. the reason the u.s. can get away with this is because treasuries are considered reserves that can be used as collateral. they exist in huge quantities and are almost as liquid as cash.

Well, not quite. My disagreement has to do with the facts about US power. In order to be just like Argentina, the US would somehow have to give up or loose its’ superpower status. So it’s not just the ability ‘to fund’ but the ability to coerce. There are also some other things like international institutional power, as at the IMF, World bank, etc.

Wondering if the Asian countries will want the IMF since it is more aligned with the West.

Also I find it interesting the countries who wanted to sell Oil for anything other than dollars, the U.S. has or had a problem with-Iraq, Libya, Iran, Syria and Russia.

Oil might be “priced” in dollars, but actual transactions take place in any currency the seller accepts.

So tired of reading so much guff about the dollar hegemony going away- when in fact as we pile on tariffs the dollar keeps on rising in value?

Meh, gold has gone from $1200 an ounce on Jan 20, 2017 to $1350 in April of this year, since then it has cratered $100 an ounce to $1250. Inflation? This ain’t it. Silver is the same story- $16.90 to $16 today.

And Platinum is down to $850 an ounce? WTF?

Copper is at least a little rosier- a gain from $2.68 to $2.96….but will it hold?

Wheat is barely holding $5- and with tariffs and full storage, I would not be long….

Cows and pigs are going to be cheap.

Milk and cheese are in serious surplus, as the going broke dairy farmers are heading out the door. Only the large industrial dairy farms are going to make it.

Wanna buy some cheap farmland, it will have a dairy farm on it.

And those cows will soon be hamburger.

And sugar is dirt cheap- $0.1186 cents a pound- which is pretty funny when you see how expensive it is in the supermarket- then you see the 50 pound bags at $30, lol.

Mark up and moving it cost more dinero.

But still, inflation ain’t raging in commodities, just in MBA margins.

And we keep on thinking that it really is the cost of living.

Instead it is the overhead of corporate America that is the next hog up to be slaughtered, along side of real estate.

The last big bubbles to burst….baby.

In short,

The dollar is rising because the FED is tightening. Don’t lose sight of the forest for the trees. It’s a temporary phenomenon. This is a problem for emerging countries with debt denominated in dollars. Stall speed just ahead

Wolf, when I’ve tried to research the SDRs I have always gotten an incomplete or abstract analogy on the mechanics of the operations. The IMF seems to do this to make it difficult to quantify the SDRs. Maybe you could share some information on them.

China has a 2.5 billion population that is highly motivated to improve their standard of living and their income per capita. They definitely have a lot of room to grow.

As for China’s gold reserves they also seem to understate it, however, they are not even close to the U.S. China, as implied in the past, stated that they wanted to link the yuan/remnimbi to gold. Remember that they were originally pegged to the dollar.

2.5 billion. Ergggh. Where did you get that from?

That is more like China & India Pitt together.

Julian, should have been 1.5 billion. Typo error.

– As long as China doesn’t run a Trade Deficit and a Current Account Deficit the renminbi won’t make a (significant) dent in the foreign currency reserves.

Wolf, there must be some mistake with your chart. I can’t find bitcoin or even any cryptocurrency on there anywhere. Could you please rectify this situation?

Now that you mention alternate assets, Gold is not represented in any of the charts, though it is a well known reserve held by all the major central banks. Stocks and bonds aren’t shown either although many central banks hold those as well.

I think this is considered irrelevant in the data set as it only pertains to holdings of the major national currencies.

John Taylor,

Stocks and bonds ARE shown as long as they’re denominated in a foreign currency. Bonds (mostly government bonds, but also corporate bonds, and other instruments) make up a large part of the reserves. But they must be denominated in a foreign currency in order to count (the ECB’s load of euro bonds from QE does NOT count as “foreign exchange reserves” nor does the Bank of Japan’stash of yen-denominated JGBs).

phusg,

This is hilarious. Thanks. I was just just going to say that what make this artful sarcasm particularly hilarious is that someone is going to take it seriously, and before I could write that, John Taylor beat me to it and took it seriously :-]

Good article, although I’m not entirely convinced the dollar situation is quite so rosy as depicted here. Back in 2011, I did a study on the dynamics of the COFER data, using index number techniques to strip separate the changes due to exchange rate fluctuations from changes due to transactions.

What transpired was the beginnings of a “regime shift” in how central banks handle their portfolios. Up until the Great Recession, any changes in the dollar’s portfolio share due to exchange rate fluctuations were directly reflected in the actual portfolio shares held. That is to say, depreciation of the dollar made its actual portfolio share shrink proportionately and vice versa for appreciation. In other words, exchange rate fluctuations were not associated with, and did not appear to trigger, any transactions in and out of the dollar.

After the Great Recession, however, this pattern changed to one of “unstable portfolio dynamics”, meaning the dollar’s portfolio share started varying more than could be explained by exchange rate fluctuations per se. Differently put, any depreciation of the dollar now appeared to trigger transactions out of the dollar. Such reinforcing transactions are dynamically unstable and thus signal a new regime.

It’s been a while since I did this study and I’m no longer working on this, but if I were to update it, I’ll submit that the unstable-dynamics pattern remain in the data and are probably stronger today than they were right in the aftermath of the Great Recession. What makes me think so is that the dollar has appreciated considerably since 2011 yet the portfolio share has not increased significantly.

If I were to venture a prediction, I would probably say that another period of prolonged dollar depreciation would bring its portfolio share to new historic lows. What I’m saying here is that the beneath the surface, the dollar keeps gradually declining as a reserve currency, but this has been papered-over by the strengthening of the dollar over the past few years.

Per G. Berglund- Very interesting insight. Does this explain why the Fed is raising rates and unwinding the balance sheet at the same time? Afraid of the balance sheet losing value. But if economy slows with higher rates will that be viewed negatively? Seems like the Fed has a conundrum.

Swiss national bank holds a lot of euros.

https://www.snb.ch/en/iabout/assets/id/assets_reserves

https://data.snb.ch/en/topics/snb#!/cube/snbimfra

And Switzerland is third in foreign reserves

https://data.snb.ch/en/topics/snb#!/cube/snbimfra

This looks to me perhaps like the capital account aspect of reserves. Not a trade issue.

Current account ~18 B CHF

Reserves ~760 B USD

Edit, error: reference for the position in foreign reserves:

https://en.wikipedia.org/wiki/List_of_countries_by_foreign-exchange_reserves

Wolf needs to do another follow up on China related stuff because the Yuan has been tumbling effectively creating a “tariff”. But yeah all that Treasury thing is BS, but 30% devaluation and darn, we can start this party.

What are reserves? Looking at the balance sheets of the Swiss National Bank, reserves can certainly not be total assets as the SNB owes something like SFr. 700 billion to the Swiss private banks (the SNB one may think is a kind of a hedge fund, is it not?). That is why I ask what are reserves? Is it the actual networth of the SNB? Such networth may be contingent on asset values which in case of collapsing prices may push the exclusively foreign currency denominated assets funded with Swiss Franc then may affect big way such “reserves”. Thank you for helping me to understand the term reserves in above context….

They’re called “foreign exchange reserves” because these assets must be denominated in a foreign currency. For the SNB, most of them would be denominated in dollars and euros.

The SNB doesn’t actually disclose its detailed holdings. We only know about its holdings of US-traded stocks because it is required to file this data with the SEC on a quarterly basis. And we can get this data from the SEC.

Global reserve currency is really a bit of a museum piece.

In today’s world, where funds can be transferred instantaneously, and exchange rates calculated on the fly, why would you need the whole world to lodge security deposits in a New York bank?

You don’t and they aren’t. The US dollar can be held anywhere. The euro-dollar is US$ held in a European bank.

Not everyone who wants to hold US$ wants the US to be able to seize them.

A lot of US$ are held under mattresses in places where folks don’t trust banks=government.

Argentines learned the hard way when the govt swooped on US$ accounts and replaced them with Argentine currency or IOU’s.

A few year ago the US did a rare update of the US 100 bill, to make it harder to counterfeit.

This caused a brief panic in some places, e.g. Moscow, until the US Mint assured everyone the old bill was still good.

Yes, but why is the US dollar more valid than say the Swiss Franc?

In fact I would suggest that the safest under the mattress storage of wealth would be Gold Sovereigns and Krugerrands.

As the story points out, the number of dollars out there is increasing by about 6% a year. Other currencies follow suit, to maintain the exchange rate. So the dollar, and most other currencies are being debased by 6% a year. So even if you are earning 3% on a treasury bond, you are still going backwards at 3% a year.

However, if you happen to live in a small unstable country, yes the US dollar is safer than say the Zimbabwe dollar. The US dollar also has the advantage of being readily exchanged almost anywhere in the world.

But non of that has anything to do with foreign exchange reserves, which are usually in the form of US treasury bonds. Which means the worlds Governments, have effectively loaned the US Government 6.5 trillion dollars, for a very low return.

It’s dead money, just sitting there, it dates back to countries storing gold in the US, and has no real purpose today’s economy.

The reserves, in whatever form, are there to back the holder’s own currency, which is not as stable as the reserve currency.

No one sneers at gold as a reserve and it pays no interest. (I know some folks here do but no central bank does)

The US bonds, if that is how they are held, pay something and rising.

Reserves ARE kind of dead money. That’s kind of the nature of reserves in war too. If the reserve is in use, there are no reserves.

I don’t think anyone doubts that some advantage accrues to the US by being THE reserve currency.

One question is: do they have the discipline not to overspend by creating too many.

It’s beginning to look like the answer is ‘no’ so the long term trend is away from the US$.

But far weaker currencies will need SOMETHING besides their own currency if a run on it develops and it threatens to collapse.

Given that the D-Mark is blended with the euro, that Japan is indebted, that China is possibly unstable and indebted, the UK pound is… , well, let’s not go there, the US$ may soldier on as the ‘cleanest dirty shirt’

I think CBs weren’t interested in the US dollar either back in the 70s. But then Nixon closed the Gold window and Uncle Sam dared everyone to “come get me”

Let’s not read too much into these kinds of things. Having one’s currency be the reserve currency is not something to brag about.