Where the heck is the hyped “replacement demand” from Hurricane Harvey?

Auto dealers in the Houston metro sold 23,720 new vehicles in May, down 9.2% from the dismal oil-bust levels of May last year, with car sales plunging 17.6% and with even truck sales – SUVs, pickups, vans, and compact SUVs (crossovers) — dropping 4.9%.

Even used vehicle sales plunged 13.5% in May from a year ago, to 67,239 vehicles. This is not a propitious indication. If there had been a shift from new to used, it would have been a different scenario. But both declined.

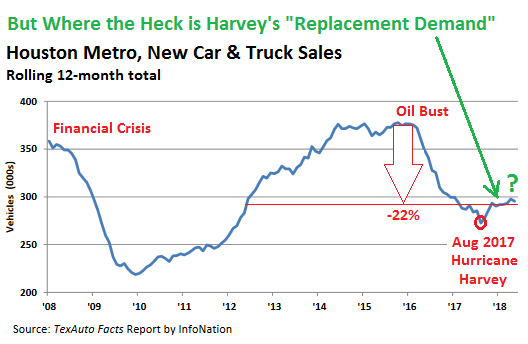

Auto sales in the Houston metro were battered by the oil bust. Between late 2016 and mid-2017, new-vehicle sales plunged by 20% to 30% a month compared to the same month a year earlier, to levels not seen since the Financial Crisis. Then, just as the effects of the oil bust were bottoming out and hopes were lining up that this would end Carmageddon in Houston, Hurricane Harvey slammed into the area. It shut down all dealers for days, and some of them for weeks, and new vehicle sales collapsed (down 45% year-over year in August from the oil-bust levels a year earlier).

But instantly, stories cropped up on Wall Street that the “replacement demand” from Hurricane Harvey would cause a boom of indescribable proportions in auto sales in the Houston area that would be so large as to fire up the declining auto sales in the US overall. And in Houston, though not the rest of the nation, auto sales did rise for a few months, but not nearly as much as promised, before starting to peter out again late last year.

And now Carmageddon is back.

The Houston situation has been fascinating to observe, in part because there is good and timely vehicle sales data available, gathered by the Houston Auto Dealer Association from its member dealers, put together by TexAuto Facts, published by InfoNation via the Greater Houston Partnership. Few other metro areas offer this kind of granular data.

For the rolling 12-month period ending in May, dealers sold 295,373 vehicles — up only 1.5% compared to the oil-bust levels a year earlier but down 22% from the happier era before the oil bust (chart via Greater Houston Partnership, red and green marks added):

Year to date, total sales are up 4.2% from the oil-bust levels last year, with car sales down 7.3% and truck sales up 10.1%. But this includes the tail-end of the infamous “replacement demand” earlier this year that has now completely disappeared.

Sales of “trucks” — that is, SUVs, pickups, vans, and crossovers — accounted for 70% of total new-vehicle retail sales in May, as cars are simply dying out in Texas even faster than in the US overall.

Despite dismal unit sales, prices continue to rise: The average retail transaction price rose 2.2% to $37,258, largely due to “truck” transactions where the average transaction price reached nearly $40,000, compared to the average transaction price of cars at $31,090.

This dismal scenario in auto sales is not reflected in the overall economy in Houston, though it remains spotty. Some sectors are still getting crushed from the oil bust, including commercial construction, where activity has collapsed. Year-to-date non-residential building contracts, measured in dollars, have plunged 32% from the already terrible levels last year. But residential permits have surged 29%. And the total is down only 2.1%. Total employment rose 2.4% year-to-date through May, with employment in the goods-producing sector rising 3.7% and in the service sector 2.2%. And the unemployment rate in May declined to 4.2% from 4.8% a year earlier.

So the continued crisis-level new-vehicle sales in the Houston metro – still down by over 20% from their range before the oil bust – are in contradiction of other economic data in the area. To a much milder extent, this has also been the case in the US overall, where the economy has been growing a relatively decent pace, while new vehicles sales have been on decline since 2016. But it pales compared to the situation in Houston.

New and used vehicle transaction prices have been surging across the US. But don’t expect this to show up in inflation data where “hedonic quality adjustments” perform miracles. Read… The Dollar’s Purchasing Power Drops 2.9% in May from Year Ago, Fastest Drop since Nov 2011

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Houston, we have two problems.

Obviously, people are saving money to make Houston housing prices great again !!! :)

J/K.

Before 2008-2009 GFC autos turned down. Expect that to ripple through the supply chain. Consumers never truly recovered from GFC; easy money for some just propped up the Dog and Pony Show. Will the FED go back to QE???

Alex: I tend to agree with you. So many people living paycheck to paycheck before the great financial crisis; getting back to normal doesn’t put you in $40,000+ truck buying territory. Nor does the modest rises in income seen with the recovery.

Don’t really see this as a trend nationally. The consumer confidence is almost all time high and discretionary spending is not decreasing

I am not completely clear how the insurance process works. Could people be accepting checks for cars that the insurance companies consider “totaled” and simply fixing them, putting the money in the bank?

That has happened to me a couple of times. I got a check and fixed the car up to keep it running but I didn’t buy a replacement vehicle.

I can see this. The oil bust and Harvey could have had the same effect The Great Recession had on me: Made them very, very cautious about money and debt. Much more inclined to fix things themselves, scrounge things up, etc.

When an insurance company pays out for a “totaled” car, this shows up on the title. So these cars have “flood” titles. Many of them could still be drivable after some repairs. Those that were submerged for a few days in toxic liquid up covering the electronics near the top of the engine compartment and inside of the car, including the dashboard will be impossible to fix properly. But if the water just went a few inches past the floorboard, why not? And plenty of those cars are now running around out there.

But many older cars didn’t have comprehensive-type coverage that would have paid for flood damage in the first place. And so they don’t have a “flood” title. These people did with their cars whatever they could, from cleaning them up and driving them to trying to sell them in another state where unsuspecting buyers might not look for flood damage.

I heard that a fairly good-size industry popped up to buy and fix flood cars and resell them.

Not sure of this, but in CA the way titles work, if you drop the registration after a period of time the car is no longer in the DMV’s computer, anyone can claim title to the car by filing a lien and reregister that car. The lien provides proof of ownership, no bill of sale is needed. In short it may be possible to make a salvage title disappear.

Yes, it has always been possible to “launder” titles. But CarFax made this harder in the 1980s because the title history appears on it (this goes by VIN). So if you pull a CarFax on a vehicle that has been dealt with in the manner you describe that has a clean California title, you still see the Texas salvage title show up in the history. This makes for some good moments, when you, as a potential buyer, have a clean paper title in front of you and a salvage title in the car’s history on the screen in front of you.

Two things: #1-Texas is one of the states that allows you to launder a title through a mechanics lien (unpaid car repair bill or impound yard). #2-I think part of the drop in purchasing demand for the Houston area is that homeowners & flood insurance policies offer less than 100% replacement coverage. When your $200k house is only $160k covered, that $40k deductible to rebuild is not going toward a new $40k Chevy Silverado.

Maybe the flood-damaged vehicles were shipped overseas and sold to ISIL, like that Texas plumber’s truck a few years ago —

https://www.pri.org/stories/2015-12-15/how-texas-plumbers-truck-wound-isis-hands

you can see a lot of them on copart.com. there are active auctions with flood/salvage titles every day. houston is very active. there is a process that varies from state to state to have them registered for use. many states prohibit dealers from selling them but individuals can and do. it can be a good deal for both the buyer and seller. i suspect a lot of people do this as a side business.

I think you nailed it. People still need to get to work, and Houston’s expansive metro rail system is mythology. Underinsured, many people are likely to use their auto flood payments to fix their uninsured flooded house.

The news media still rarely touches on the fact that water in the living room is flood damage, regardless of how it got there, and most Houston homes lacked FEMA insurance for that. Pity the the poor SOB who buys one of these restored flood cars.

We are living in Houston, but far enough north to have not be flooded by Harvey. Private car sales through venues such as Craigslist, Woodlands Online, etc have been a feast for buyers of non-dealer sold cars. I sold a used car (non-flood) in one day last summer. I don’t believe these sales are reported. Also, CL had many out of town dealers advertising cars for sale and would deliver to Houston area buyers.

I wonder how far people can really afford to buy a new vehicle. If folks are buying trucks at $40K a pop, I’d imagine they are going to keep it forever. For your average Joe making $50K/year, meeting that monthly nut, for 7 years, has to be painful. Especially along with rising rents and gas.

Could people just be wising up? Well, that doesn’t sound right, does it?

Maybe when those cheques came in people started to see and understand that whole tricky depreciating asset concept. You know what I mean, a $20,000 cheque in hand vrs a $45,000 sticker price for a replacement, and just in time for hurricane season.

Maybe they’re using the same strategy as me, cutting out the middle-man and buying their vehicles direct from the foreign manufacturer?

Estimates schmestimates. Anyone got any data from insurance companies on how many cars they totalled after Harvey?

Maybe it’s time to go out and invest in insurance companies if everybody believes they were hit harder than they were.

It could be that Harvey released a lot of late-model car owners from the underwater treadmill. (pun not intended)

Most new car buyers end up underwater on the loan for years. By the time they get any equity, they’re out of warranty. If one of the dozens of electronic controllers fails, they end up in the service department faced with a $2,000+ repair — or trade for another new car ($0 down) and start the process all over again.

A flooded, and thus ruined, car forces a break in this cycle. Regardless of what the insurance did or didn’t pay, the owner loses the car and can’t use its “equity” to trade out.

How many people just bought something for cash off craigslist after losing their car? The expense to travel from Houston to Dallas, New Orleans, Austin or San Antonio isn’t much compared to the upfront costs of buying a vehicle without a trade value that can be massaged to show a down payment.

The social costs are low in this scenario too. Telling your friends you got “hit” by Harvey and need to temporarily drive something that would be otherwise beneath you is acceptable. Trading down — without a good excuse — is not acceptable.

make america great again, one statistic at a time.

maybe the sales are coming from venezuala.

Will it ever dawn on them that one big reason new cars have dropped is they are so small you need one for each foot. I haven’t had anything but pickups for years. I don’t have to get on my knees to enter. I don’t have to pull myself up to get out. If I am a passenger I dont have to look through my knees. The back seat! Forget it.

That was the way it was with me. My wife was driving a 2001 Sable. I am 6’2″ and tip the scales @ 215 lbs in mid 60s. Getting in and out of that car was like a circus act. When I was young thin and limber, I used to laugh at the idea of owning a truck. Life happens and things change. SUV time.

These dealers are not thinking outside the box. When the subprime buyers dry up, they should go to the non-prime or super subprime buyers. Buyers who have no income but are alive and able to ambulate or be wheeled into the dealers. Voila! Problem solved.

There’s an old saying from Tuscany which migrated into the Italian language “A babbo morto”, “When daddy dies”.

It refers to the ancient practice by young and dissolute noblemen to borrow money and repay the debt in full, principal and interests, when their rich fathers died and they inherited the family fortune.

While the lender could wait years before getting his due, the high interest rates charged and the legally binding value of the contracts they held made it all worthwhile.

That’s something the car industry hasn’t thought of yet but which may come in handy as all other ways to squeeze growth run dry.

Or how about 30 year mortgages for cars? Interest only?

While the auto revival from the Hurricane Harvey wasn’t as much as some expected, I also think it was certain to be a very short-lived revival — helping auto makers through the end of 2017 but not much further. Unlike housing, autos are something that is quickly and easily replaced, especially when Detroit and Dearborn were stacking up inventory, and additional production was ready to roll.

Housing, on the other hand, takes a lot more time. First, you must clear all the debris; then you must rebuild washed-out infrastructure; then you must go through permitting and planning; and finally you start to rebuild, but only after the weather allows. So, I always expected the auto resurrection would be a brief flash, but housing would get a one-year boost.