It’s not subtle: Home sales plunge, inventory jumps, prices begin to react.

By Steve Saretsky, Vancouver, Canada, Vancity Condo Guide:

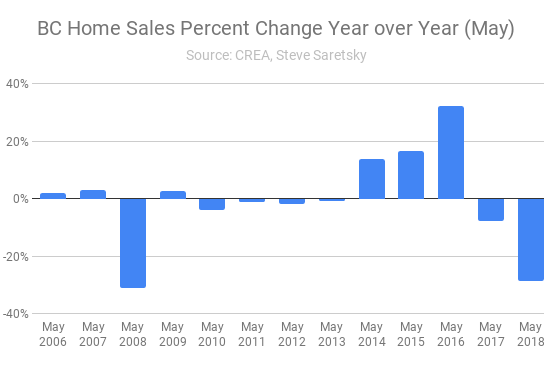

With National home sales declining by 16% year over year in the month of May, marking the worst year over year decline since May of 2008, we turn our attention to the province of BC where home price growth has grossly outpaced any other province in recent years.

On the surface the BC economy appears to be humming along, unemployment rates remain low, declining from 5% in April to 4.8% in May, with a plunge in the Vancouver metro area from 4.5% to 3.8%. Labour force participation rates and employment rates remain elevated which is helping pump Year-over-year growth in average hourly wages from 5.6% in April to a whopping 6.9% in May.

However, a recent slowdown in the housing market is beginning to test the province of BC. Fewer full-time positions drove a 0.5%, or 12,000-person dip in total employment from April. Overall, employment has eroded since a December peak, cutting year-over-year growth to 0.1% which was the weakest since 2015.

This might not be surprising considering recent data on the housing front. BC home sales dropped by a head turning 29% year over year in May. This marked the largest percentage decline on a year over year basis since May 2008 when home sales tumbled by 31%.

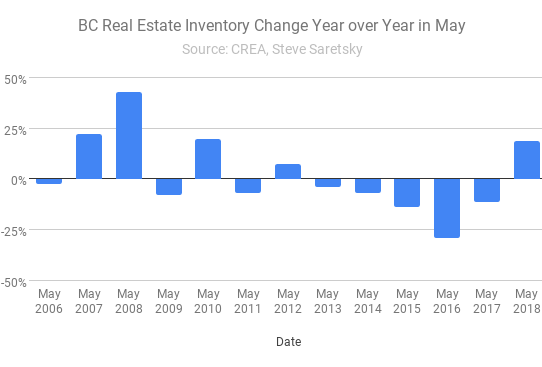

While falling sales might not be nearly as concerning to the typical homeowner as sale prices, it is important to see the clear directional shift in the real estate cycle. Sales have moved lower for two consecutive years, pushing inventory higher. Active inventory increased by 19% for the month of May. This was the first time inventory has increased on a year over year basis for the month of May since all the way back in May of 2012.

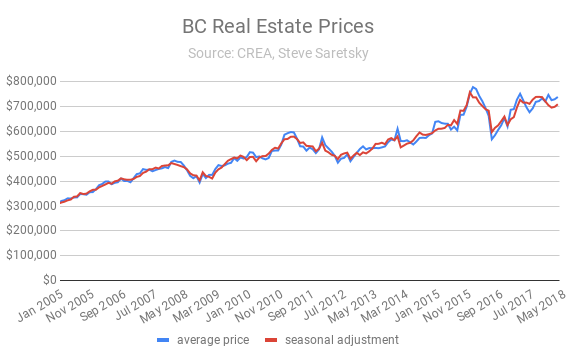

Two years of declining sales combined with an increase in inventory has arrested house price inflation. The average sales price dipped 2% year over year, while seasonally adjust prices dipped by 2.5%. As you can see in the chart below, home prices peaked in the spring of 2016, followed by a dip after the announcement of a foreign buyers tax, before retesting those peaks in the spring of 2017. Since then, growth has been effectively flat.

With the BC economy so dependent on the real estate sector the direction of the housing market will become critically important in the months ahead. By Steve Saretsky, Vancity Condo Guide

Despite persistent and false claims to the contrary, what happened in the US can happen in Canada and Australia. Read… Why a US-Style Housing Bust & Mortgage Crisis Can Happen in Canada, Australia, and Other Bubble Markets

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Is this what happens when the Chinese laundered money disappears from the market?

As a renter in San Francisco who wouldn’t mind owning a home, we can only hope that CA will entertain some similar restriction on non-resident ownership. Every open house I attend seems to have a broker from China willing to pay all cash, and can close immediately, without even an inspection. Not even trophy properties either, for those that think this is the same thing the Japanese did in the 80’s and got burned. They are out in the (formerly) middle class starter home market with suitcases of cash. It’s become a joke at this point.

And it is still under-reported in the media around here as a key cog in the affordability narrative. Easier to spit on the Google bus and blame tech, but God forbid someone points out that 1 out of 5 homes sold around here over the last few years go to offshore buyers and you risk being called xenophobic. No politician will want to go near that third rail.

At some point this merry go round has to end, right? (famous last words)

Ask your liberal representative to get rid of the E5 visas which allow foreigners to buy their way into the country through a real estate purchase. But don’t hold your breath.

My time would be more wisely spent putting my head in a blender.

The solutions are pretty straightforward, but sadly our ancient politicians will not to do anything about it, no matter how many actual CA residents are shut out of the RE market.

I’ve got a better idea, I’ll move to China, let’s say Shanghai. I’ll somehow get a corrupt banker, there are a lot of them over there, to lend me 20 million yuan. I’ll use crypto and the gambling rackets in Macau to launder the money out of the country. Move back to San Francisco, attend an open house for a house I like and offer the owner’s agent an all cash buyout.

That’s how Jared Kushner is making his nut. Never going to happen. http://www.businessinsider.com/sec-launches-probe-into-kushner-companies-for-use-of-eb-5-visa-program-2018-1

Grifters gotta GRIFT.

Yikes, you are such a xenophobe, next, you’ll want to separate families at the borders. Quick, call the people at FB and GOOGL, have them start a fund raising site to protest your xenophobic comments.

Seriously though, there is a tough question to consider, let’s use your 20% number as a baseline for the bay area. There is still that 80% that is not external, the concern is not so much for the off shore buyers, but when the market tanks, it’ll hurt people who bought their homes at these higher prices.

Now, you might say, they were suckers, but somebody has to pay either way, whether its through affordability of homes or lose of equity. That really sucks.

Tech worker do not have the money to buy property in San Francisco. Yes, the EB5 visa is a real issues in allowing Chinese and people from a handful of other counties run up real estate in San Francisco. It’s a fact. Curtailing this visa would help, putting a 15% foreign buyers property tax would be better.

In a sense you are a xenophobe, because as you yourself pointed out that “1 out of 5 go to offshore buyers”. What about the other “4 out of 5”?

Restriction will not help. What’s also required is that the (should I put the color here?) people at the Fed stop printing money that’s inflating the stock market to crazy levels. The employees from the tech companies are using their overvalued stock as collateral to buy homes. Why is that not a problem? Just because they are not Chinese.

This country deserves to go to hell.

I think when he used the 1 of 5 he was doing that to not seem to be exaggerating. I have a friend that bought in a nice area here in socal and he is the only non Asian in the whole hood.

in his hood it’s 59 out of 60.

@interesting. Maybe, but I still don’t see why this is a Chinese only problem. We had a huge housing bubble last time as well, and no one was complaining until it burst that is. But of course the buyers who were buying 5 6 houses were w****? So no problems right?

Are the Chinese buying a ton of real estate here? Yes, but they are not the only actors. Had the locals not piled in as well, prices would not be this high either. At this point, both locals and foreigners are engaged in a stupid arms race.

Also in Florida, a lot of the buyers are Canadians, and no one is complaining. If that is not xenophobic behavior, I don’t know what is.

Seriously, this country needs to go to hell.

What’s also required is that the (should I put the color here?) people at the Fed stop printing money that’s inflating the stock market to crazy levels.

Bingo. “Zimbabwe Ben” Beranke and Yellen have waged a scorched-earth financial warfare against savers and the responsible, while shoveling trillions in printing-press FedBux to their favored bankster accomplices to engage in reckless speculative excesses, with any and all losses covered by taxpayers or printed away by the Fed, debasing the purchasing power of the 99% in the process.

We will not have honest markets or sound money until these fraudsters and their central banker accomplices are in shackles and orange jumpsuits in front of an honest judge in a post-collapse tribunal.

1 out of 5 was being very conservative – that’s the rate that can be confirmed to be offshore buyers. In reality, like the rest of the West Coast, its a murky mix of faceless LLCs and shell companies that make the purchase. That way, the RE industry can say they can’t confirm where the money is coming from, but anyone looking for a home these days knows that a ton of it is coming from overseas.

I agree that there are several other causes to the affordability problem, including inflated equity markets and tech compensation, as well as California’s raging NIMBYism. Its a perfect storm. My point is while we are deflating the tires on the tech busses, or calling for the heads of any politician who wants to loosen zoning laws, we always seem to whistle by the foreign ownership part; every other first world country seems to have at least acknowledged it’s a key issue and proposed a solution (be it a ban, tax, limit, etc.). Even Mexico won’t let non residents buy land outright within fifty miles of the coast.

@GSW. I too live in San Francisco Bay Area, so I understand your frustration. I do. I literally live in a rat hole for 1050 a month and I have NO kitchen. I should count myself lucky for having a bathroom.

Here’s my belief. In the next crash (both here and China), it will be so bad, no Chinese “investors” will ever touch CA real estate with a pole for a generation. This is just something we’ll have to grit though for now. The Chinese thinks this place is heaven in times of chaos. Boy, will we have a surprise for them.

Rates – you want to see xenophobia? Just picture a bunch of rich people (or should I say “highly leveraged” people) flying into Chinese cities and pushing up real estate prices. Wrap your mind around that for a second. Yeah, how do you think that would go over? Do you think the Chinese people would be stopped by cries of “racism”? Not on your life. They’d tear their leaders to shreds. It simply would NOT be allowed. Get a grip.

Same with the rest of Asia. You cannot buy land there if you are a foreigner.

The foreign Chinese buying of residential real estate is TOTALLY different than Japan in the 80’s. Japanese bought large commercial buildings then, and the Japanese buyers were probably groups or businesses or extremely wealthy individuals.

Individual foreign Chinese are buying houses and condos this time in normal residential neighborhoods. Very different from Japanese in the 80’s. Way different. And I’m sure foreign are also buying a ton of apartments and commercial buildings too of course.

Jeff Sessions sees no problem with Chinese embezzlers and money launderers parking their ill-gotten gains in West Coast real estate.

Interning the Japanese-American population on the West Coast following Peal Harbor was one of the most shameful miscarriages of justice in American history, and trampled on these citizens’ Constitutional rights. But it still happened, albeit during the exigencies of wartime, and their property was expropriated without due process while they were packed off to internment camps. Some of the Japanese-American regiments recruited out of these camps became some of the most highly decorated American combat units fighting the Germans and Italians in Europe, by the way.

If the U.S. and China ever go to war over the South China Sea or Taiwan, God forbid, will Chinese immigrants be targeted for similar treatment? I hope not – I would like to think we’re better than that – but at a minimum they would have to deal with a lot of public distrust and xenophobia that might make their property holdings in America a lot more problematic, and might cause them to be regarded as potential threats to national security. Not an enviable position for any group of people to find themselves in, and a situation that I hope never arises.

For many years, charges of racism and xenophobia were loudly mooted by the RE industry to silence anyone who dared suggest that foreign buying might be a factor in the extraordinary price appreciation of Vancouver’s residential RE:

http://vancouversun.com/opinion/columnists/douglas-todd-vancouver-real-estate-and-the-xenophobia-question

GSW, watch trends in inventory, when you see inventory growing price drops will follow, with a lag.

Here is why it won’t happen. Chinese buying up real estate is what happens when the USA runs a huge trade deficit with China. Since the US dos not sell enough to China the way to get all the money back that was spent on Chinese crap, is to sell of parts of the USA (in the form of houses). It is the counterbalance to the trade deficit. In the same way, Chinese companies have been buying up US companies as well.

Want to stop it? Stop buying Chinese crap.

Stan,

This has been going on in Canada for a long time now, starting with 2010. The previous provincial gov’t was very much complicit in this activity.

https://www.macleans.ca/economy/business/the-ideal-crime/

https://www.macleans.ca/news/immigration-hearing-reveals-how-asian-gang-crime-works-in-canada/

http://vancouversun.com/news/local-news/more-and-more-chinese-cases-target-property-in-b-c-say-lawyers

https://www.msn.com/en-ca/money/topstories/how-vancouver-became-a-cautionary-tale-in-the-battle-against-

money-laundering-and-drugs/ar-AAw3Fdf?li=AAgh0dA&ocid=mailsignout

https://globalnews.ca/news/4149818/vancouver-cautionary-tale-money-laundering-drugs/

The numbers are showing a dip in inflation and sales according to Stats Canada also. Without bumping up the interest rate in the spring the Canadian version of the Fed was expecting to keep the numbers positive but Canadian debt loads have crippled the buying power of consumers. Take away foreign money and the Canadian economy will be more in line with it’s 75 cent Dollar, a 25% correction is coming.

Now to wait for the “it’s different this time” crowd, you know you wanna say it. As a saver and not a borrower I must say “Raise those rates!”

I was brought up to be a saver, to be disciplined, to be responsible, and to respect the law; too bad, we should’ve been brought up as gamblers.

Government and banksters respect only gamblers who break the law and don’t play by the rules. Behind the scene they are laughing at us, and I bet they have hundreds of jokes about poor schmucks like us who play it by the rule.

I live in a very rural area based on Ag and Oil. I have been surviving on frugal savings and smart spending habits long before the oil crashed — raised by broke farmers puts financial fear in a person. A lot of my neighbours have disappeared, with their houses on the market for years – years, not weeks and not months. Following the rules has kept me afloat, it just won’t make me rich.

I have the same feeling as you. It’s clear that we were brought up that way so that we won’t be competitors to certain people.

The next generation should be brought up to continuously disrupt the disruptors so the later will know the feeling we have.

Yup – and that’s totally a result of the shift away from real engineering – ie manufacturing and export for sustainable wealth creation – into a massively over-financialized ‘get rich quick’ economy in which the most important activity is the extraction of economic rent, which creates only debt.

– One also should take into account that the BC government has introduced a “Vacant Home Tax” earlier this year. That also has an impact on the amount of real estate sales and prices.

– How reliable is the author of this post ? One real estate analyst (Mr. Ross Kay) says that real estate prices on the top end of the BC market already have dropped significantly. But it seems “Organized real estate” is fiddling with the real estate statistics in an attempt to hide the drop in prices.

These are average prices and include condos. Condos have been very strong, but detached house prices have fallen. Detached houses are generally more concentrated at this high end, and there has been serious price deterioration. But in the overall numbers, condos weigh heavily since they sell at such a high volume.

The “Directional Shift” is most noticeable in the mortgage market.

According to the Canadian Real Estate Association (CREA) sales are down 15.03% when seasonally adjusted. However, when unadjusted the decline is 16.42%.

Throwing gasoline on the RE fire, Canadian’s are once again using their homes as an ATM, as personal loans against real estate escalate.

While banks and other traditional lenders have seen a 27% drop (year-over-year) in mortgage originations.

Private lenders with steep mortgage rates are stepping into the gap.

Sub-prime borrower’s that couldn’t qualify at traditional lenders are rising in numbers. What could go wrong?

We should start to see some defaults related to persons that bought using leverage in 2016 and later. They are now underwater by a decent amount.

I’m sure there already are, especially builders who planned for a busy spring with spec houses that now sit unsold and unsellable due to prices falling.

But don’t hold your breath waiting for the mainstream media to report on defaults. Their primary job is to hide the facts when it comes to downturns.

The “dip” is worse than Steve says, as he quotes official real estate board stats, which uses tools like their “Home Price Index” to hide the true fall in prices.

House sales in greater vancouver are down 50% and more, depending on the municipality. Tha’s a 50% drop in transactions, which means a 50% pay cut to almost 100,000 people.

There will be blood….

Terrific news states this BCer, (me). It has been insane the past few years and the push of new people on to Vancouver Island is threatening to destroy our way of life.

It always seems to go like this: A new arrival reaches a Vancouver Island oasis. They soon tire of the slower pace and turn to RE as a job and/or something to do. Often these people have cashed out and relocated from Vancouver, Victoria, or Kelowna. Town council membership follows. Then boosterism of we need this and that, (which always entails new development). They trot out the old and worn out, “We need growth for the kids”. Then, 20 years later they look around and ask, “What happened to_________? It’s ruined”.

That is one reason why my wife and I moved away from Campbell River 15 years ago and relocated to a small valley west, (one hour drive). All larger parcels of land are tied up in the ag land reserve, or are forestry lands. It cannot be ruined by unrestrained development.

If the NDP in 1972 had not implemented the agricultural land reserve we would not have one piece of farm land left in BC. The entire Fraser Valley would be a sub-division; as dense as the SF Bay Area. I own the largest parcel of empty property in our valley zoned residential. It is 16 acres, and could be developed into 1/2 acre lots. People often ask what we are going to do with it and are astounded when I answer, “Nothing….walking trails, pond, and firewood. Oh, there is an apple orchard”. I bought the land for the price of two city lots in town and remember quite well how people thought we were stupid when we bought it. I haven’t heard those comments for almost 10 years. Now, it’s an heirloom taxed at $1500/year. For the price of one coffee per day in taxes our family has empty land to keep intact for the future.

Two stanzas from Joni Mitchell’s Yellow Taxi:

They paved paradise

And put up a parking lot

With a pink hotel, a boutique

And a swinging hot spot

Don’t it always seem to go

That you don’t know what you’ve got til its gone

They paved paradise

And put up a parking lot

Hidden patches of assorted berry plants among the trees? The best part of well treed areas is a row of strawberry plants here, and a row of raspberry plants there and you can go for a hike in July and August and have snacks on the trail that no one else knows about ;)

Outside a few ‘bubble’ cities like Vancouver, Victoria, parts of Toronto….RE in Canada is reasonable, and even cheap by global standards. I hear some wealthy Chinese are even flying to Calgary to sniff out deals there. I think the persistently cheap CAD$ and friendly migration policies will keep RE buoyant. RE correction? Sure….but no Crash.

Nicko2 – keep dreaming, Nicko. China is keeping its money inside China. A trade war is on. I expect to see a great depreciation of the Chinese currency. The Chinese aren’t wealthy. This is all being done on leverage.

…not true. The Chinese are mostly cash buyers… trying desperately to get money out of the Mainland, because they have little faith in their government. (p.s. – that’s why they pumped bitcoin… it was a Chinese effort to get money out of the country.)

says one agent “Chinese buyers are also unique in that they pay cash about 76 percent of the time. Investment-oriented buyers are increasingly discovering the power of leveraged financing, but cash buyers are still the majority.”

source: https://www.inman.com/2015/03/13/3-things-you-need-to-know-about-chinese-homebuyers/

how do you go about shorting the whole thing in the market?

You can’t, directly. Funds will likely emerge, too late, that will try. However, most inverse funds like that have inherent and awful slippage problems. You could identify banks most exposed to residential loans but you’d then have governmental bailout risk that could blow up your short at any time. My opinion is that stockpiling cash is better than shorting in almost every situation.

I wish someone had some solid numbers of how many homes and condos are unoccupied. My anecdotal evidence from Toronto friends living in new condos is that many are like a ghost town, with gyms, pools, and halls that are devoid of activity, never having seen a neighbour enter or exit. Wolf, could you do a piece on vacant housing supply in big cities during affordability crisis. It is unacceptable that our government does not have better data, almost like willful blindness?

bret – it is willful blindness. They do NOT want people to know.

“it is unacceptable that our government does not have better data, almost like willful blindness”

Yes, it is unacceptable in Canada – a so-called democracy, despite our PM’s admiration of China – and that blindness (of the citizens, not theirs) has for decades been willfully perpetrated by policy-makers at all 3 levels of government. The goal has been the driving of land prices, rents, and RE-related economic activity by increasing demand via immigration. They have evidently over-played their hand, but no matter, it is the taxpayer who will be on the hook for whatever financial damages that might arise therefrom, via CMHC mortgage insurance, subsidised housing, etc.

According to people that I know there are thousands of condo apartments in Toronto which are sitting empty and unsold. Toronto is a flat city where you can build tall condo buildings, and these buildings have been coming out of the ground like mushrooms. The price have to be cut down to half or even more to reach its real value.

Residents and merchants in Vancouver are often well aware that neighbouring houses and condo units are entirely or only intermittently occupied, but hard data have been deliberately kept sparse – the RE industry wants nothing to interfere with their proffered solution of more supply, especially by densification – do watch for the impending up-zoning in July by City Council of much of Vancouver.

My most reliable source has 3 decades of experience in the commercial/multi-family RE development business in Europe and Canada; he estimates his waterfront condo building, about 8 years old, in downtown Vancouver to have 30 to 40 % occupancy.

of course if we had Zillow in Canukistan The RE boards wouldn’t be able to foist their fiction regarding sales, prices, trends on a compliant and somnambulist and trusting public.

Court case in the hopper currently, Canadian Competition Board VS TREB (Toronto Real Estate Board) is 10 yrs and counting. TREB has lost every case/appeal but keeps appealing the verdict to higher courts. End Game coming soon as the Fed Court of Appeal may refuse to hear it.

Abused Property consumers in Canada can only hold their breath and wait. At least our American friends can glean accurate unvarnished data from independent sources.

Condo beside me has been sitting empty and for sale for 2 months. DT Van, Yaletown. The worm has turned.

Sorry to disappoint you, but Zillow is fake as well; may not be as fake as TREB, but definitely competing with it. Zillow is part of the RE industry; their median rents, and median house prices are always at least 15%-20% higher than real numbers in order to prop up the market; they say prices high, and prices go up cause everyone believes them.

Just remember there wont be a crash – just a ‘directional shift’ into ‘softening’ or ‘negative growth’.

In this weird, financialized world we must get the newspeak terminology correct!

Doubleplusgood! (cf. ‘super awesome’ etc. etc.)

There are plans to increase annual Canadian immigration rate to just over 1% of total population over the next decade. This would mostly offset aging demographics and boost GDP growth by a point or two….also probably solve the housing crisis. For reference, that is over three times higher than the average US immigration rate. A few think tanks have floated the idea of boosting Canada’s population to 100 million, thus moving toward a super-growth model. But that might be a bridge too far for many.

Nicko2 – the way things are heating up, I wouldn’t bank on immigration numbers increasing. We very likely could see the government being forced to “cut back” on immigration levels. Of course, the lobbies (of which you may be a part) will continue to push for higher levels, but the government should decrease levels back to about 80,000/year (where they used to be) for at least ten years.

The goal of mass immigration is of course to destroy Canada as a nation with an identifiable and cohesive national heritage and to turn it over completely to globalist interests.

Multiculturalism and diversity, which are the ideological banners of globalism, are backed by totalitarian laws against traditional basic rights of free speech and freedom of association and is designed to allow different racial and cultural groups to be played off against each other.

It hardly seems to be a great advance to destroy the natural ecology, livability, and cohesive culture of the nation so that real estate agents, and multinational interests with no concern for Canada or her people can have a free hand to satisfy their in fact insatiable greed by destroying everything that had made Canada a good place to live.

Kim, very well said. I would add: while indeed “the goal of mass immigration is of course to destroy Canada as a nation with an identifiable and cohesive national heritage and to turn it over completely to globalist interests”, you will note that some parts of Canadian identity have survived much better than others, and even prospered. There was another, separate intention of mass immigration: the specific destruction of English Canadian identity. Noteworthy is the fact of Quebec’s success in retention of its French identity in the face of considerable immigration.

Sorry, but Canada is an immigrant nation, a modern 21st century country, the first post-national nation. Mass immigration — 1% of total population per year (which is nearly three times higher than the US), has been an astounding success, and given the fast aging population (senior citizens now outnumber children), immigration becomes even more important to maintain economic stability. Thankfully, whether the government is conservative or liberal (or even NDP), there is no chance this policy will change.

This change is mainly being driven by new mortgage lending rules: https://globalnews.ca/news/3897942/new-mortgage-rules-2018-canada-guide/

“Come Jan. 1, 2018, Canadians getting, renewing or refinancing a mortgage might have to prove that they would be able to cope with interest rates substantially higher than their contract rate.

New rules by Canada’s federal financial regulator announced in October mean that even borrowers with a down payment of 20 per cent or more will now face a stress test, as has been the case since January of 2017, for applicants with smaller down payments who require mortgage insurance.

……

The stress test means that financial institutions will vet your mortgage application by using a minimum qualifying rate equal to the greater of the Bank of Canada’s five-year benchmark rate (currently 4.99 per cent) or their contractual rate plus two percentage points.

……

The rules might force Canadians to set their eyes on homes that are up to 20 per cent cheaper. But since few homebuyers are stretching their finances to the limit when applying for a mortgage, the average target price reduction will likely be smaller, $31,000, or 6.8 per cent, according to Will Dunning, chief economist at Mortgage Professionals Canada.”