“It feels like we’re about 12 months away, but we could get into extended innings.”

As corporate indebtedness in the US has reached precarious heights, and as risks are piling up, in an environment of rising interest rates and a hawkish Fed, the smart money is getting ready.

The smart money is preparing for the moment when the air hisses out of the exuberant junk-bond market, when liquidity dries up for over-indebted companies, and when their bonds collapse. The smart money is preparing for the arrival of “distressed debt” – it’s preparing now because these preparations include raising billions of dollars for their funds, and that takes some time.

“Distressed debt” is defined as junk-rated debt that sports yields that are at least 10 percentage points above equivalent US Treasury yields.

Distressed-debt investors can make big returns by buying bonds for cents on the dollar during times of economic stress, of companies that they believe will make it through the cycle without defaulting. In this scenario, a distressed bond might sell for 40 cents on the dollar, and two years later, the company is still intact and the credit squeeze is resolved, and now the bond is worth face value. For those two years, the bond paid a huge yield to investors that bought at 40 cents on the dollar – and the profit might be 200% in capital gains and interest.

The thing is: The junk-bond market has been booming. There’s no credit squeeze yet. And the riskiest end is flush as the “dumb money” is still chasing yield. And for the smart money, there’s not much to pick at the moment; but down the road, the future looks bright.

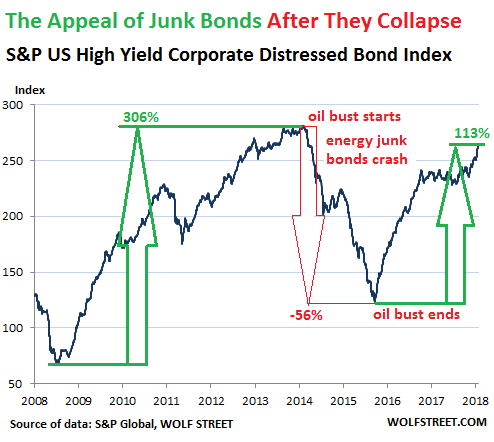

S&P Global tracks distressed debt in its US High Yield Corporate Distressed Bond Index. The index peaked in early July 2014, on the eve of the oil bust. Over the next 18 months, it plunged 56% as the oil bust was wreaking havoc on oil-and-gas bonds. But on February 11, 2016, the index bottomed out. New money began flowing into the oil-and-gas sector. Banks started lending again. The surviving bonds soared. And the index skyrocketed 113% in 28 months:

The index’s gain from February 11, 2016 through June 19, 2018, of 113% was more than double the gain of the S&P 500 stock index — a phenomenal 46% — over the same period.

The smart money that got the timing right made huge gains. But the hypothetical buy-and-holder, whose portfolio mirrors the bonds in the index, would have seen their investments plunge and then recover mostly, but they would still be down 6%.

And now investment funds – they’re all aware of the dynamics in the chart above – are setting up for the next big selloff in the junk-bond market.

In total, seven distressed-debt funds have raised about $15.4 billion so far in 2018, according to the Financial Times. GSO Capital Solutions Fund III, which closed in April, raised $7.4 billion, the fourth-biggest distressed debt fundraising ever. The FT:

Jason Mudrick, founder of $1.9-billion Mudrick Capital, is marketing a second distressed investment fund, according to people with knowledge of the matter. The new fund will lock up investors’ money for five years and only charge fees once the capital commitment is invested, according to the people. The fundraising is set to close on December 1.

“This economy is roaring right now,” said Mr Mudrick, who declined to comment directly on the fundraising, citing US regulation. “It’s rocking and rolling. But that’s just not sustainable . . . My job is not to predict exactly when [the turn in the cycle] happens but to have the platform ready when it does.”

Mr. Mudrick believes it is a backdrop that will create ripe conditions for distressed debt investors when economic conditions do worsen. The New York-based fund generated returns of almost 40% in 2016 wagering that energy bonds hit by a declining oil price would recover, according to a hedge fund performance document produced by HSBC and seen by the Financial Times.

Among the other funds is Strategic Value Partners, which raised nearly $3 billion.

Another distressed-debt fund, DSC Meridian Capital, was launched at the start of this month. “I think we’ll be doing a lot of distressed stuff when there’s distressed stuff to do,” the founder, Sheru Chowdhry, formerly co-portfolio manager of the Paulson Credit Opportunities fund, told the FT. “It feels like we’re about 12 months away, but we could get into extended innings.”

Investing successfully in distressed debt is a special expertise. When the bottom falls out, distressed debt becomes an illiquid market. When forced selling sets in as bond mutual funds and others that have to meet redemptions by nervous retail investors, while buyers simply evaporate, incredible deals can be made. But the risk of total wipeout is large. Many distressed bonds get crushed in bankruptcy. This is a fate to be avoided.

To succeed, investors – usually teams – have to do some heavy manual lifting. They must not only do a solid credit analysis of the company and have a grip on the fine points of the industry, but they must also be able to understand the nuances of debt covenants, the details of the collateral, and a million other things. And they must have a deep understanding of global market trends and industry cycles. This is the smart money, and it’s setting up for the next credit event.

Emerging market “turmoil” is already brewing as the Hot Money is fleeing. Read… Chasing Yield during ZIRP & NIRP Evidently Starved Human Brains of Oxygen. Now the Price Is Due

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

what can an average mid-40s sub $1M investor like me do to prepare for this? I’m in Toronto btw, and still renting!

Mobile middle-age sub-milionaire in Canada? You may not make it, sorry to say.

Otherwise, what is there to do? Traveling, skiing, fishing, dating?

Hahaha. Thanks for the laughs.

Smoke some weed. It’s legal eh?

Sorry, weed is not legal yet.

Please wait 8 to 12 weeks until the law has been passed.

https://www.cbc.ca/news/politics/senate-passes-government-pot-bill-1.4713222

Thank you,

From, your friendly Canadian, from the True North.

Many residents of Toronto have become a victim of the city’s success. Think about moving if a good job opportunity comes up elsewhere. Or, just be satisfied that you have a rent controlled apartment. Once upon a time, the Harbord Village neighborhood (a name made up by real estate sales people) was the first stop on the economic ladder for recently arrived immigrants from Europe. Many moved to the suburbs within a few years, as their incomes improved. But like the Old South, those days are gone with the wind.

Thanks for the input. It’s a bit distressing because being careful and doing a conventional fundamentals analysis has been a losing strategy in Toronto RE the past few years. This city’s housing market has become globalized speculative asset class and no one in power seems to want to stop that.

obviously get into one of these distressed bond funds

See https://finance.yahoo.com/quote/HYG?p=HYG

Learn about shorting. Have gold? Cash heavy?

Alex – I dabbled in PM’s (precious metals) during the dark years of 2009-2010, buying rolls of silver dimes etc. At the time a friend was into going to garage sales and he had a car. I found that speculating on silver dimes was a loser, while at garage sales I could often buy PMs cheap or in one case, as I looked and looked at squinted and squinted at the strange (to me) numbers on a chain, free. “Just have it”, the lady said. I got $140 for it at the “we buy gold” place and tried to find the lady again, but the garage sale was a pop-up, as it were, set up in front of an abandoned house.

I’d love to set myself up as a buyer, but unless one has a pawn license, one is strongly advised not to go into this – receiving stolen goods is a serious charge.

A guy I knew years ago used to go door to door selling insurance – this was in the 90s – and he said the main benefit was getting into older people’s homes, getting their confidence, and being able to buy things like guns and coins and jewelry from them that they no longer wanted or wanted to get some money for. Whether he was offering that old widow $50 for his late husband’s Weatherby is another question …

Then there’s “coin rolling” where you ask your bank for rolls of dollars, half-dollars, quarters, dimes. You go through said rolls looking for silver coins, then re-roll and “sell” back to your bank. I suspect this is known enough that it’s probably not worth it around here, being a major metro area.

If I didn’t have the time or energy to scrounge garage sales, I’d probably just buy “junk” silver coins on a “dollar cost averaging” plan. Not like I do it right now, myself, mind you. My metals investment right now is, I look through my pennies for copper ones and save them in a McCann’s oatmeal can. It’s a fun little hobby and it’s a real kick to find, say, a 1945 penny in my change.

Not a game or a strategy for working people, right ?

Just buy what the “smart money” funds buy.

People may not have enough to make it worth while, but short high yield etf has been moving sideways for the past year, so seems a bit early.

We working people have to invest in food, clothing, shelter and transportation. I guess technically that’s not investing, but it is a strategy.

1937… again… Will the Fed get it wrong again?

apparently and in two years Germany will invade Poland

Wrong theatre. Substitute with China and Taiwan.

I am nearing 4 decades as an expat in Asia and I see fragility everywhere in the region. Credit expansion in both the consumer and commercial sectors has been explosive during the era of ‘free money’ and the reckoning, whenever that might be, is going to be equally explosive.

Maybe the next QE will buy corporate debt and stocks.

Wouldn’t Junk Bond Inverse Yield ETFs be a possible alternative.

Liked Pro Shares (SJB)?

I’ve been looking but not sure if there are anymore.

Any info and wisdom on this alternative would be greatly appreciated,

Bond funds in general are incredibly risky (except closed-end bond funds, Treasury bond funds, and the like). A big part of the risk is that they offer instant liquidity to their investors, but the bonds they hold are not liquid. This is also true for inverse bond funds, just in the opposite direction.

Because of this liquidity mismatch, when you can get a “run on the fund,” the fund can collapse, and the late movers lose 60% or 70% or more of their principal while the early movers got out, laughing all the way to the bank. Numerous bond funds collapsed during the financial crisis and afterwards. A bond fund that offers 5% yield or more is full of illiquid junk bonds and EM bonds.

Inverse bond funds are even riskier, for other reasons as well.

I like bonds. They’re a great investment if you get the timing right. Even in a downturn, you can hold on to them, and if the company survives, you collect interest, and in the end, you get your money back.

But I don’t like bond funds of any kind. Google class action bond fund.

Wait… why inverse bond funds are riskier? If there is a huge sell off in “long” HY bond funds, it means the inverse bond is gaining some ground right?

Bond funds are risky because of the way they’re structured, the liquidity mismatch, the possibility of “runs on the fund,” etc. That was my point.

Also, 2X or 3X levered funds (in either direction) DO NOT work as intermediate or longer term plays (anything over a few days) on a broader bullish or bearish trend because they are reconstituted daily. Read up on these derivative funds; they don’t to what you think.

This is a great story, but it is probably not for us locals?

I agree. This is perilous territory. Also, most retail brokers don’t allow their customers to buy non-investment grade bonds.

Open an account with a junk rated Austrian or Italian bank and before you know you will be offered the bank’s very own financial junk without having to move from your house. If you are super-lucky your bank may even offer to you selected financial toxic waste from their honorable partners, which include equally shaky banks, leveraged-to-the-hilt real estate speculators, no-name low cost airlines taking on Ryanair and Easyjet and that old staple, euro-denominated securities issued by Turkish companies.

And I so wish I was making this up…

Ha ha! Exactly – retail bailing out the institutions/corporate clients. Clearly you learned a lot of what I did after 20 some years in retail. Total scam!

Junk debt is junk for a reason, most of the junk bond zombies will not only default but also crash and burn.

Does junk hide out amongst investment grade?

Todays investment grade can turn out to be junk 2 or 3 or 5 years from now. Bond ratings are bs in my opinion. Do your own research. Know the company you are buying inside and out. Oh and also the economic cycles etc. Junk bonds are a good investment. The trick is to do as mentioned and also buy a lot of different ones so as to still come out ahead even if one or two fail

Good luck. It’ll be like watching a World Poker Tour match. Somebody else always wins…..

Crystal balls and inside information and heavy lifting. I have neither, nor the willingness to risk. It’ll be interesting, though.

So what are the red fkags, the indicators to watch? First we will probably watch for inverted yield curve. This can happen in 2-4 months. But this usually precede recession for 6-12 months. Give or take…

So what are you gals and guys planning to watch to get better idea when it will start?

I plan to take 50% of my equity position off the table once the 10 year minus 3 month inverts. I’ll halve the position again 6 months after the inversion occurs. When high yield spreads start to widen/accelerate widening during the YC inversion, I’ll sell off the rest and ride out the storm in short duration Treasuries.

For now, I remain 100% invested.

Thanks!

So first watching yield curve to invert, then later action in high yield spread.

I have a feeling though that this time all money, smart and dumb alike will get burned.

It will be a zig zag like market where everytime participants will just find another bottom.

I sort of agree. I stopped worrying about it a few years ago. I focus on being indispensable at work and investing in “non-tangibles” – like a good book or certification or similar education.

We are at a moment in history where there are many things that do not have precedent. (Almost) no one alive today grew up without indoor plumbing, electricity – and hell, frankly – internet access. People aren’t the same people as they used to be – for better or worse. There is all manner of unique things, not least of which is the “smart phone” which is an unparalleled source of data about each cell in humanity – sort of like a nervous system.

https://www.wired.com/1998/01/hillis/

Note the date …

Humanity is a funny, funny critter – and it was shaped to “survive” (collectively) based on 10s of thousands of years (per the rear view mirror).

That is changing.

Mr Hillis (way smarter than me) sees a positive future (in some manner) – but he strikes me as the optimist.

Regards,

Cooter

Glad to see you back, CC. Your comments are always worth reading, imho.

I would like to add (from experience) in addition to being indispensible at work, be prepared to move on as no one, anywhere, is indispensible (including the company you might work for). Owners come and go as do companies. It takes skills that others need to hire for a soft landing.

Plus, while always trying to be the hardest worker on the job site it is important to never do it on the backs of others. A reputation lasts forever.

Paulo and Cooter – My impression is that people here are investing in $100k chunks, at smallest. People here, are for the most part, talking about what to the average person, getting by on maybe, if they work hard, $30k a year, what you could call “stratospheric finance”.

And I agree with the both of you – Invest in skills that can’t be taken away from you, and understand that under capitalism, no one is “indispensable”. Money can be taken from you; skills area bit harder (basically they have to break your hands or bash your head in, not an impossibility where I grew up, which is why I got out).

As the little guy, all I can hope for is to maybe invest in Vanguard which I understand starts out in $1000 chunks, or in things like little snippets of land that I may be able to park an RV on or near in rotation, and may increase in value.

Bond. Junk Bond.

Wolf,

Thoughts on nuisances for bonds this time around? With so many covenant light issuances, won’t that change the negotiating positions of all concerned parties? Will more of this paper just evaporate since the companies that have issued it are operating in a more leveraged environment that is even weaker today than a decade ago?

Yes covenant lite will be a huge problem when the credit cycle turns and companies begin to restructure. But for each individual company, this is only a problem for creditors when the company gets into trouble (misses payments, tries to shuffle the collateral into another entity before it files for bankruptcy, etc.).

So if the company survives without a restructuring, covenant lite may not impact the creditors. And that’s the main bet by these folks. This is different than buying defaulted bonds and hoping to make money by being able to grab part of the company or collateral in bankruptcy court.

They still will have to contend with the potential of a fraudulent transfer or fraudulent conveyance clams being brought forward against them in bankruptcy court. This prevents assets from being easily looted prior to a bankruptcy filing.

Perhaps one might more accurately substitute the word “big” for the word “smart” to truly describe the situation of vulture capitalism. On the day when GE gets bounced from the DOW “industrial” average for a chain of retail drug stores this all seems a bit too telling about where we are and where we are headed.

The Dow Jones components are selected by the editors of The Wall Street Journal.

So no big surprise that now that Jeff Immelt has finally been “kicked upstairs” and his successors are left with the Herculean task of rebuilding GE as an industrial engineering company instead than a financial engineering company, GE has been dropped.

Immelt’s leadership was fantastic to prop up stock prices and dividend per share, and he could play Washington DC better than Ellon Musk, but when it came to running an engineering company he seemed mostly uninterested and he dipped his fingers into GE’s piggy bank far too often to fund financial wizardry.

Rolls-Royce now “owns” over 40% of the large diameter aero turbofan market, and that share continues to grow. All GE could do to stem the tide short term was to give Boeing half a billion dollars to help develop the 777X in return for being made sole engine supplier.

This is not so much because GE products are second-rate, far from it, but because under Immelt aircraft manufacturers had a hard time dealing with GE.

The telenovela of the Airbus-GE negotiations for the A350 engines is something Immelt could have solved with a phone call to his cronies running GE Aviation: sit down at the table and negotiate with Airbus or just walk away from the deal. He did neither and in the end a very annoyed Airbus gave sole engine supplier status to Rolls-Royce.

What happened there? The aero engine people being micromanaged from corporate and wouldn’t/couldn’t take action?

See GM etc. for other poster children of this structure.

It is unusual for engineers or scientists to head large US manufacturers. They are more likely to be from finance, B School, and even law.

The reverse tends to be true of Japanese and and German cos.

Until recently neither country even had schools of business.

They done OK without them, especially after being pretty much rubble in 1945.

This seems espec

Sell the highly leveraged assets. Like real estate. The USD is gaining. I just finished selling all the houses I bought in 2013. Took me almost 2 years. I thought I was going to be at least a a year or two early. Now I feel like I dodged a bullet.

DK – A commercial place near me is for sale, right across the street from Fry’s Electronics.

They have a sign up with a number so I called. They want $2.6mil. The guy said he’d gotten an offer of $2.5mil. I told him to take it and run. Sign’s still up.

What do they call it? Calling a peak? Timing a peak? Very hard to do.

There is one scenario not discussed: that this downturn could resemble the Depression where the bottom feeders scoop up bargains at fifty cents on the dollar and then get wiped out the next leg down . Then the guys buying at 75 % off the original price are wiped out. This went on and on for four years until the bottom hit in 34. But by this time speculation was about as popular as a return to Prohibition.

It looks like the amplitude of these gyrations is increasing. Certainly the efforts of central banks have no precedent. Is the Great Recession the last of its kind?

Before World War Two, World War One was referred to as the Great War.

‘Great Recession’ was supposed to read ‘Great Depression’ but I guess the question could be asked of either.

I would love to see that scenerio play out.

Same in Japan to this day…so many people wiped out at the end of the 80s after risking everything and leveraging up to speculate, the echo of the crash still resonates 30 years later.

When high yield debt craters, the equity market will not remain intact. The transmission mechanism will ensure a big drawdown in equities. Why? because equity prices will have to come down in order to match the prospective returns on the deeply discounted debt.

Trade what you see, not what you think. Not sure but this might help:

https://owl.english.purdue.edu/owl/resource/588/04/

“The Smart Money Gets Ready for the Next Credit Event”

Huh? I wasn’t getting ready for the next credit event! Oh… wait…oh darn.

I don’t think you got the HY/Oil price relationship right. Low yields spurred fracking, over investment, Chesapeake Energy, and the oil price crash. Raising interest rates therefore raises inflation (not sure how people get that wrong) and helps put constraint on supply and boosts prices, cheap money equals cheap energy.

I expect the Fed to follow its 2008 game plan (it was wildly successful) and so buying distressed debt is a no brainer. The Feds intervention preceded the recession, and if it becomes obvious that recession is inevitable, why not? quick note: yield curve inverting, LIBOR rising, unemployment historically low, and Powell says the economy is in great shape.

Interesting reading through the comments on here. Strange how some think when the Big One comes (which it inevitably will), that it will be a rinse and repeat of 2008. It won’t! It will be an epic, breath taking collapse of a global financial system that has been riddled with corruption combined with ever more over issuance of debt. We may well find ourselves in a situation where even the best rotten currency in the world, the dollar, becomes virtually worthless. So what are you going to invest in then? Please don’t say Crytpos.

Crypto proxies? :)

Then it won’t be a repeat of the Depression. Then cash became King Queen and Ace.

In Canada the federal civil service had two 5 % wage cuts but their standard of living rose by more than that.

Awesome article Wolf! Thank you for producing one of the most intelligent economic blogs on the Internet.

“As corporate indebtedness in the US has reached precarious heights”

I don’t know which is correct, I’ve been hearing a lot that Corporate America is flush with cash?

or cash with flush?

Both are correct, on average. Some corporations are flush with cash. Apple, Microsoft, etc. have a huge amount. But all corporations have borrowed huge amounts of money, including Apple, and in aggregate have record amounts of debt. So, much of the cash they have is borrowed money. Aside from the cash-richest corporations, much of corporate America is precariously loaded up with debt. This can be seen in the large number of companies with BBB ratings and below.

Junk bonds as a diversified asset class have similar characteristics to stock indices. As such, properly managed investment in junk bond funds can have similar risks to said stock funds/indices. Individual junk bond funds are similar or more risky than individual stocks.

All investing is like that (real investing) over long periods. In real life/shorter periods, you always benefit by ” buy low- sell high”.

As a well-managed (i.e. not overweight) part of a properly diversified portfolio, junk bonds and junk bond funds can have a productive place.