Just as the Fed created money to buy Treasuries and MBS during QE, it now destroys money as these securities “roll off” the balance sheet.

It took the Fed five-and-a-half years to amass $3.4 trillion in Treasury securities and mortgage-backed securities (MBS) during QE, including the year 2014 when it was “tapering” QE to zero. The Fed is now reversing that process, including the opposite of “tapering,” as it is ramping up its QE unwind.

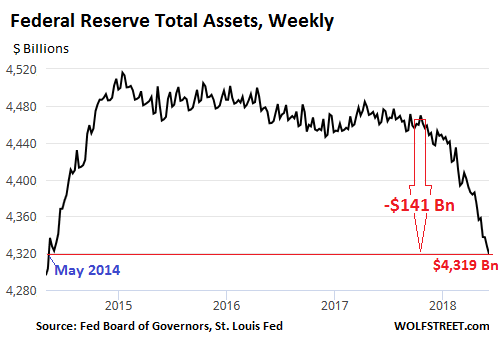

The Fed’s balance sheet for the week ending June 6, released Thursday afternoon, shows a total drop of $141 billion since October, the beginning of the era officially called “balance sheet normalization.” At $4,319 billion, total assets have dropped to the lowest level since May 7, 2014, during the middle of the “taper.”

If the Fed continues to follow its plan, it will shed up to $420 billion in securities this year, and up to $600 billion a year in 2019 and each year in the future, until it considers its balance sheet to be “normalized” — or until something big breaks. For May, the plan calls for the Fed to shed up to $18 billion in Treasuries and up to $12 billion in MBS. So how did it go?

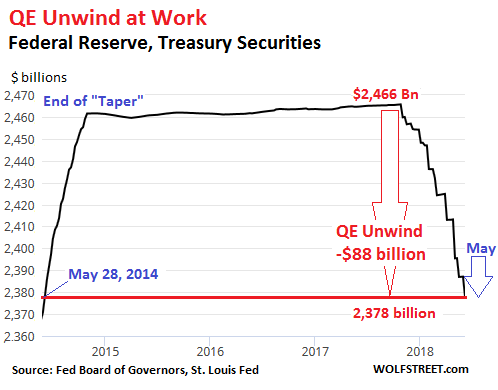

Treasury securities

The balance of Treasury securities fell by $17.7 billion in May to $2,378 billion, the lowest since May 28, 2014. Since the beginning of the QE-Unwind, $88 billion in Treasuries “rolled off.” The blue arrow indicates the amount that rolled off in May:

The step-pattern in the chart is a function of how the Fed unloads securities. It doesn’t sell them outright but allows them to “roll off” when they mature. Treasuries mature mid-month or at the end of the month. Hence the stair-steps.

On May 15, $26.4 billion in Treasuries on the Fed’s balance sheet matured. The Fed replaced $17.9 billion of them with new Treasury securities directly via its arrangement with the Treasury Department that cuts out primary dealers that the Fed normally does business with. In other words, that $17.9 billion was “rolled over.” But it did not replace $8.5 billion of maturing Treasuries. They “rolled off.”

On May 31, $28.6 billion matured. The Fed replaced $19.4 billion with new Treasuries. The remaining $9.2 billion of maturing Treasuries “rolled off” without replacement.

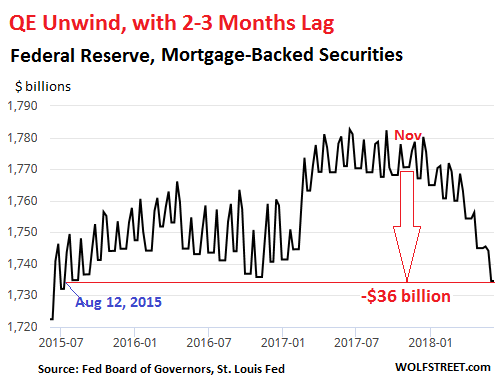

Mortgage-backed securities

First things first: The Fed only holds MBS that were issued and guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The credit risk lies with these government sponsored enterprises, not with the Fed.

Residential MBS are a little quirky as far as bonds go. Holders receive principal payments on a regular basis as the underlying mortgages are paid down or are paid off. At maturity, the remaining principal is paid off. Over the years, to keep the MBS balance from declining, the New York Fed’s Open Market Operations (OMO) kept buying MBS.

Settlement of those trades occurs two to three months later. Since the Fed books the trades at settlement, the time lag between trade and settlement causes large weekly fluctuations on the Fed’s balance sheet — the jagged line in the chart below. The lag also delays when MBS that “rolled off” actually disappear from the balance sheet. So the current balance sheet reflects MBS that rolled off around March and April [my detailed explanation].

Since the beginning of May, the MBS balance fell by $10.4 billion, to $1,734.6 billion, the lowest since August 12, 2015. In total, $36 billion in MBS have “rolled off” since the beginning of the QE unwind. Also note how the jags in the jagged line are starting to disappear as the Fed phased out its purchases, and the phase-out, after the time-lag, is now showing up:

The Fed’s total assets

QE consisted only of Treasuries and MBS. So the QE unwind only relates to Treasuries and MBS. Since the beginning of the QE Unwind, $88 billion in Treasuries and $36 billion in MBS rolled off, for a combined total of $124 billion.

The Fed has other roles that might impact assets and liabilities of the balance sheet, including that it acts as the bank of the US Treasury Department and holds “Foreign Official Deposits” by other central banks and government entities. So the overall assets on its balance sheet don’t move exactly in line with the balances of Treasuries and MBS.

In May, total assets on the Fed’s balance sheet dropped by $37 billion, to $4,319 billion, the lowest since May 2014. Assets are now down by $141 billion since the beginning of the QE-Unwind:

Just as the Fed created money to buy Treasuries and MBS during QE, it now destroys money when Treasuries and MBS “roll off” the balance sheet. The money just disappears to where it had come from – nothingness. Just like QE added liquidity to the markets, the QE unwind is draining liquidity. QE was associated with enormous media hoopla for maximum “wealth effect” in terms of asset price inflation; but the QE unwind happens quietly, on autopilot, and the media is silencing it to death.

The “waterbed effect” of money flows. Read… How Chinese Investors Inflate Housing Markets in the US, Canada, and Australia, as Governments Try to Stem the Tide

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sellers need buyers. This is where the scheme loses me

While on the same subject; Could somebody prove or disprove that the taxpayer made money on the GM bailout?

If you live in an area where GM workers are employed it probably helped your area by not creating a flood of unemployed people.

If you hold any broad market US stock index funds you probably own some GM stock. In which case if saved you some money. But the effect of them going belly up probably would have lost the average investor much money.

I don’t think either of the above are necessarily arguments for the bail out. I am just noting that there is a non zero impact for many people.

But realistically that is how it should be. The average person should not be noticeably effected by the fate of any single company unless that dependence is clear and voluntary. As when we chose to work for a company.

Apparently you’ve forgotten about the minor issue regarding the raping and pillaging of GM’s stock and bond holders during the Chapter 11 reorganization…

There is no selling. The securities are simply maturing.

There is no buying and selling. The Treasury gives the Fed the bonds’ principal as they come due and the Fed throws that money down a black hole.

If those securities were owned by the public at large then the principal would be paid to a “real someone” and that money would stay in circulation.

Begbie,

The Fed does NOT sell. There is NO selling going on in this deal. And there are NO BUYERS in this deal. When Treasury securities mature, the Treasury Dept pays them off — it gives the money to the Fed where it disappears. This is the “roll off.” This is a principle people have got to understand. There are no sellers and no buyers.

However, to get the money that the Treasury hands the Fed to redeem the securities, the Treasury Dept sells bonds into the market at its planned auctions. Thus the market gives the Treasury Dept the money (for the bonds it sold), and the Treasury Dept gives some of that money to the Fed, and the Fed makes it disappear. That’s how the money gets drained out of the market.

Same principle but different actors with MBS.

But when “the market” gives the Treasury Dept money for the bonds it sold with one hand, doesn’t the Fed create money from thin air to buy other bonds at the “planned auctions”? It drains with one hand and fills with the other.

I believe that what Wolf is noting in the article is that it is draining and filling, but draining more than filling. So the balance sheet is working its way down.

No. The Fed stopped buying bonds with the end of QE in Oct 2014. It never bought bonds at auction. It bought them from its primary dealers who bought at auction or in the secondary market. But all this is finished as of Oct 2014.

So in essence the Treasury is converting the QE unwind into long term debt, in the form of Treasury bonds, right? And the purpose of the original QE was to shelter or hide some of that debt during periods of economic disruption so that the federal government could stimulate the economy by boosting spending or cutting taxes, thus generating more debt, without the extra debt weighing down the economy. Not unlike kiting a check, QE is an interest free loan that one branch of the government gives to another branch for several years to use interest free. We, the taxpayers, give a gigantic multi-trillion dollar check to the Fed as a loan, the Fed gives the money to the Treasury to spend, but hides the check and nobody collects interest on that loan until years later.

There is NO change in terms of the Treasury Dept’s bond issuance or outstanding bonds. The only change is WHO buys and owns them. The Fed is shrinking its holdings, so the public will have buy the bonds. The Treasury Dept now has to find real buyers for all its bonds since the Fed has stepped away from the table. But the amount of outstanding debt will not be impacted by the QE unwind, only ownership changes.

Wolf, yes, that is my point. When the Fed is holding on to the bonds, does the interest still accrue on them? There can’t be any interest value assigned to the QE debt held by the Fed because they haven’t been auctioned off at market value. They’ve just been “taken out of circulation” for a while, until the QE unwind essentially releases them back to the bond market and they get assigned an interest rate value by the Treasury auction. Meanwhile, Treasury has been able to spend the extra money created by that QE debt, but isn’t paying interest on it while the Fed is holding on to it as QE. So this is sort of like kiting a check. You give a financial institution a check and expect to earn interest on it, the financial institution puts that money to use right away, but tells you that your check won’t clear and earn you any interest for another two weeks or more. QE isn’t about creating new money out of nothing, it’s about taking debt out of the bond market and hiding it for a while so that the Treasury won’t have to pay interest on it. That interest debt doesn’t pay interest until the QE gets unwound.

Gandalf,

To respond to your first question: yes the Fed is collecting the interest (coupon payments) on the bonds it holds. Given the amounts it holds, this is a lot of money. Over the years, it ran between $75 billion and $100 billion a year! It remits almost all of it to the US Treasury (tax payer).

The Fed reports these remittances (along with interest payments to the banks on excess reserves and other things) every year (January). Here is my explanation of the 2017 remittances. The article also has a chart of the annual remittances to the Treasury Dept going back to 2008:

https://wolfstreet.com/2018/01/10/fed-pays-banks-30-billion-on-excess-reserves-for-2017/

Why does the Treasury not simply say “thank you” to the Fed when the bonds mature? If the Treasury actually redeems the bonds, then that cash should show up as an asset on the Fed’s balance sheet, same as if the Fed sold the bonds on the open market. Granted that cash on the Feds balance sheet is not available for normal economic, “free market” activities, so liquidity is drained. But if the Fed forgave the Treasury’s debt, no liquidity would be drained.

I think you are say they should monetize the Treasury’s debt, which they in theory could do. But it would cause people to loose faith in the currency. BTW: This is about the only way that Japan will ever get a handle on its debt problem.

Yeah especially MBS, so are new MBS going back onto the balance sheets of the original GSE’s? Or is mortgage paper contracting (I don’t think so) And if the Fed drops QE linked treasuries, new treasuries have to be issued, just to keep the credit bubble from collapsing. This is the same gambit as the Tax cut law, the money isn’t going anywhere it sits on the Fed balance sheet where it always was, what changes is who can access it for purposes of borrowing (Europe lost control of the money and LIBOR went up) QE was assembled to give a lift to corporates, and if you check the corporate high yield market you’ll see that nobody in corporates is worried about higher rates because nothing is happening except the old shell game, and despite the teeny weeny bit of a credit squeeze in US markets that the ROW is running a far accommodative policy. By degree the US tightening is a bucket of water over Niagara Falls.

These MBS aren’t going anywhere. They’re being paid off at maturity (Fed receives money from the GSEs as the MBS are redeemed and disappear). In addition, principal payments made by homeowners are passed through to the GSEs and then to the Fed , and thus the principal of the MBS are constantly shrinking. There are no sales involved.

I thought I was/am the only blank brained one on the site!! Thx for that comment!! I still don’t understand how the Fed can make the “garbage” just disappear….But, I’m trying, i’m trying.

Please read my reply to Begbie’s comment. There are NO buyers and NO sellers in this deal. That’s what this is all about.

just use emerging market currency-stability news pieces selectively every couple months as a proxy to drive indirect buyers into treasuries, then prop up housing by having corporations tied innately into inventory, create reits, leverage at 10-1, hold up fannie, freddie paper,…and wala…

lets be honest, the biggest heist in the history of the world happened in 2007-2013…pottersvilles and specs made whole..

Had no buyers at the beginnings of Q.E. And no buyers during the unwind? Dont fight the fed! The fed has a dry powder monopoly?

No need for buyers. If a security/bond matures, the Fed just prints the money out of thin air and hands it over to the security/bond holder. That’s how inflation starts …. if one does this too quickly, you go Venezuela, Zimbabwe or Weimar.

I would have thought Treasury yields would have gone up a lot more than they have. Perhaps the big banks with all their cash reserves parked at the Federal Reserve are now beginning to roll that money back into Treasuries? I read somewhere that the the FED is now cutting the interest rate it gives on those reserves so maybe there is more money to be made in treasuries?

Give it some time. The process is, as the Fed keeps pointing out, “gradual” so that the economy can adjust.

In terms of your second point:

The Fed will likely announce at the next meeting that it will cut the interest it pays banks on excess reserve. The proposed cut will be minuscule. Currently the Fed pays 1.75% on the reserves. It will likely propose to cut this to 1.70%. This is to solve a problem: the Fed has trouble keeping the federal funds rate in the middle of the Fed’s target range. It has been bumping into the top. For example, yesterday the effective fed funds rate was 1.70% but the Fed’s target range is 1.50% to 1.75%. So the fed funds rate should be in the middle (about 1.625%), but it’s not.

The Fed is worried the fed funds rate might actually go over the top of the Fed’s target range. So it hopes that by lowering what it pays on excess reserves, it can nudge the fed funds rate back to the middle of the target range.

What is the cause of the high funds rate? Is it not the rate the banks charge to each other? So there must be banks that are not flush with QE money, and there is some stress in interbank lending?

I’m not sure even the Fed fully understands all the dynamics. That’s what I get from reading their statements about this problem. This whole thing is experimental. The Fed never had to deal with these huge excess reserves. It never had to unwind QE. Everything is new. It’s trying to figure out how to do all this without turning over the apple cart.

However, one thing I’m sure of: there is no stress in interbank lending. Interbank lending has dropped off to almost nothing in the US after the Financial Crisis as bank funding shifted to other sources (that’s a good think because it diminishes contagion). And banks are well capitalized and very profitable.

Thanks for the best descriptions of these processes available anywhere.

The way I think of QE: money was printed, but no “real economy money”. The money printed stayed in the financial/banking system. As such it had odd impacts on the system- financial asset appreciation and anemic real economy improvement. This adds to the income inequality, etc.

So yes, it’s a big experiment, and clearly QE didn’t really play out as the Fed experts, economists, etc., had hoped. There are many macro indicators that show a good economy, but many of the more “micro” indicators that still show way too much stress and suffering by the average person.

What a scam! The banks can borrow at 1.7, then redeposit those same funds with the Fed and get paid 1.75. Risk-free, free money.

Ive never understood why the Fed paid interest on reserves in the first place since the whole point was to force banks to use reserves to lend, not just hoard them on their own balance sheets. The only conclusion was that it was a stealth way of stuffing cash into banks: simply handing them bags of cash would have been too unseemly, so they decided to do it in a way that the public would never understand.

These are not insignificant sums either. Last year I believe the Feds paid $20bil in interest i.e. More than the combined profits of the banking industry.

How can I incorporate as a bank so I can get in on this scam? It can’t be too hard. Goldman got a commercial banking license in less than a month for the specific purpose of giving it access to all the Fed cash that strictly wasn’t available to investment banks. Socialism for me, not for thee?

“What a scam! The banks can borrow at 1.7, then redeposit those same funds with the Fed and get paid 1.75. Risk-free, free money.”

No, the scam is even worse: banks could borrow from depositors at near-zero and deposit it at the Fed currently at 1.75% and in the near future at 1.70% :-]

That’s why all depositors should now shop for higher interest rates. They’re out there. Don’t hand the bank your money for free.

Trying to borrow a rate cut from the future!

It seems that paying interest on excess reserves was simply another massive handout to the banks that has gone on for more than half a decade longer than initially forecast. And to go a step further revealed how synthetic FFR is.

Lucky_Lui,

“It seems…”?? You’re being gentle :-]

Actually, taxpayers pay for this interest on excess reserves because the Fed remits most of its income to the US Treasury Dept, and whatever it pays the banks gets deducted from those remittances.

Wolf,

Could you elaborate more on how the FED acts as the banker for the US Treasury and holder of Foreign Official Deposits of other central banks and entities?

This explains some of the things that the Fed does. In terms of bank to the US Treasury, go down to “Deposits of the U.S. Treasury” and the section below it is on “Foreign Official Deposits”:

https://www.federalreserve.gov/monetarypolicy/bst_frliabilities.htm

They also act as the banker for various government agencies.

Brilliant. Thank you. That’s the site I needed to see.

The Fed/Treasury is the agent behind the Treasury Bonds for dollars in the BIS forex exchange with China. Bernanke famously called it “sterilization” because it meant those pseudo dollars wouldn’t return in the form of inflation. The PBOC in turn pays out to their own people in their currency which is redeemed in dollars to buy US RE. Capital controls are a joke. The bonds are just cusip numbers registered on the Fed/Treasuries computer. There is no there there. China could demand cash in payment for reserves, (though not once they accept bonds, bonds cannot be repatriated, they can only be sold in the secondary market which we control, or rather we could buy the old bonds with new bonds, through a secondary, with money printed out of thin air, but you see that would put pressure on rates, anyway you slice it).

What we are seeing with rate hikes at present is pressure on the dollar denominated debt in the EM. Its really just the first inning of the great unwind.

On an other FRED chart, so far the unwind looks a little less impressive. Does ” how far the FED will make it” say anything on how far the ECB will make it, if they start to unwind at all?

https://fred.stlouisfed.org/series/TREAST

that is a better chart, it shows that what the fed is doing right now is tiny potatoes in the big picture.

Looks like that wont be normalized in my lifetime, but then what is normal nowdays anyway?

Memento mori, you’re also being silly. See my explanation below.

Jon t

You’re being silly, and you know it. It took the Fed 5.5 YEARS to buy these securities. Do you expect the Fed to dump them in one week? Just as the Fed gradually tapered, the Fed is gradually ramping up. It’s nearly symmetrical, with the QE unwind being slightly slower. This will take YEARS, just like QE took 5.5 YEARS. Have you already forgotten?

While Wall Street is riding high, thanks to the Fed’s provision of trillions in funny-money “stimulus” to its .1% cohorts, ordinary Americans are sinking deeper into debt bondage as essentials such as housing, medical care, and transportation become increasingly beyond their means.

Database firm Experian notes U.S. Monthly Auto Payments Reach Record High in First Quarter.

New vehicle loans averaged $31,455

The average monthly payment for a new vehicle hit at record $523/month

Consumers are lengthening loan terms, with six years being the most common, to adjust to the higher costs and rising interest rates.

Outstanding loan balances reached a record high of $1.108 trillion

Loans for used vehicles reached $19,536, also a record

If wishes were fishes.

The Goldie Locks Fed wish.

Balance sheet normalization. Not too fast, not too slow.

Rate hikes. Not too high, not too low.

US dollar. Not too strong, not too weak.

Inflation. Not too much, not enough.

Walking on glass, one small miss step and there are consequences.

All it will take to knock this train off it’s tracks is an exogenous shock.

And this time around its NOT different. Just a matter of time.

When we wish, we just wish. When the FED wish, it is reality. Because they have guns, they have the printers and they make the rules. If you do NOT obey, you get hurt. Goldilocks is low volitility. Those who obeyed the FED and shorted VOL has made lots of money in the last decade until early this year. I do NOT think the FED specifically cares about Goldielocks or low VOL any more. I think they want two things now. First, stop borrow money and create businesses, other wise, labor cost will rise and hurt the existing businesses. Make sure lahore is under control of capital. Second, let the EM know who is the boss, destroy their wealth/bubble and let them begs for mercy and gain geopolitical advantages. Financial war.

The unintended consequence (and I do think it is, as US officials rarely take their hegemonic responsibilities seriously) of the Treasury needing funds to pay off the bonds (and cover the exploding deficit–thanks Republican deficit “hawks”) is that capital is being squeezed out of the Third World and screwing up their currencies. Thus instability is exported to places which have the least resilience to such instability. But never fear, the IMF will imposed draconian austerity measures so that life chances and life expectancy will fall in the periphery so that bond holders can be made whole.

What a way to run a planet.

“…the IMF will imposed draconian austerity measures so that life chances and life expectancy will fall in the periphery so that bond holders can be made whole.” Isn’t that why they call it a “bond”? Lenders expect to be paid back after all. Furthermore, the IMF wouldn’t need to be involved at all if various governmental and quasi-governmental agencies (like the IMF) weren’t screwing things up in the first place.

Let’s not forget that the Treasury received all the interest on those securities it sold to the Fed. About $1 Trillion worth over the last 8 years.

So the Treasury not only received a $3.4 Trillion loan from the Fed, but also the interest on that loan. Capitalism is great. Creating money out of nothing and earning interest on it to boot. Wish the bank would give me all the interest that I paid on my mortgage. But that only works in the land of government.

https://www.reuters.com/article/us-usa-fed-payments/fed-2017-profit-payments-to-treasury-fall-to-80-2-billion-idUSKBN1EZ228

Do we have confirmation that the Treasury actually transfers cash to the Fed for these maturing bonds? Or is it just charged against the interest the bonds make at the Fed.

The Treasury’s cash is already on deposit at the Fed, which acts as the bank to the Treasury Dept. I posted the Fed’s link on that topic in a comment above.

So when Treasury securities are redeemed, the Fed takes this money out of the Treasury Dept’s deposit account and it disappears.

Did everyone notice that the Indian Central Bank chief is asking the Fed to slow down? He thinks the $1.5 trillion tax cut and the Fed asset decline are causing a shortage of dollars.

I don’t know if the Fed will care too much about what EM Central Banks think, since that’s not the Fed’s mandate.

But I guess this is a sign of where the stress is and will be . . .

There is no “shortage of dollars.” But folks are having to pay a little more to borrow them. That’s the purpose of tightening. These higher interest rates on dollar debt are bad news for EM countries with dollar obligations.

What you say makes sense. I think the fifth paragraph in Gillian Tett’s FT opinion piece is, then, quite wrong.

https://www.ft.com/content/a072a4b0-697b-11e8-8cf3-0c230fa67aec

Well, it is an FT opinion piece, so….

A liquidity crisis is essentially a shortage of dollars, as money markets seize up because no one knows what the counterparty risks are. There can be an infinite number of dollars to lend, but if no one wants to lend them, that number might as well be zero. Rising rates are definitely bad news for EM’s whose eyes were bigger than their stomachs. There’s no shortage of dollars now, but as higher rates reveal more and more zombie companies, and even zombie countries, the risk of a crisis increases. There are other things that could cause a crisis too other than higher rates, but matters have only been made worse by rates being kept so low for so long. The bubbles are much bigger than they would have been if the Fed weren’t run by a bunch of bumbling fools. Yes, it would be nice if the media reported these things, but as usual, people will be shocked that the financial system isn’t as healthy as the Fed and the press told them, just like last time.

There’s weeping and gnashing of teeth originating from Emerging Markets (EM) these days, and there will be a lot more over the next few years.

The reason is not a lack of US dollars. There’s plenty of them, starting from the massive overseas profits Indian conglomerates such as Mahindra and Tata have stashed abroad. What, you thought only Alphabet and Apple were doing it?

The reason is the costs of servicing those bonds denominated in foreign currencies that both governments and corporation throughout EM issued with gusto over the past few years is rapidly rising, and the Reserve Bank of India, Banco de Mexico and the rest of EM central banks can do nothing about it but very short term fixes, such as sending interest rates up or selling US dollars to prop up their currencies.

The present Fed is a completely different animal from the Greenspan/Yellen Fed. They have already made abundantly clear they care nothing about EM entities which issued US dollar-denominated bonds, and rightly so.

Nobody forced these governments and corporations to issue bonds in a currency their central banks have absolutely no control over and when their business it’s chiefly conducted at home.

It’s one thing when Grupo Bimbo issues US dollar- or euro-denominated bonds: most of their business is in those currencies anyway and it makes a lot of sense for them.

But it’s another when Liverpool (a well known Mexican retailer and mall operator) issues US dollar- and euro-denominated bonds, as their business is pretty much entirely in pesos.

He who has ears to hear, let him hear.

The multi-national corporations will be struggling with profitability as the countries that based their borrowings denominated in dollars, ie Brazil and Mexico. This may ultimately impact stock market valuations.

Who or what “motivates” the Fed to unwind QE?

QT drains dollar liquidity. By itself, that should explode the trade deficit, with dollar exports having been made more expensive with reduced dollar supply. Putting up tariffs just so happens to be a convenient way of heading off such a deterioration in the trade balance; funny enough the Administration is already openly wielding that instrument against competitors for wrecking us on trade.

Assets in the US valued in foreign currency would rise in value with a rising greenback, but at lower effective yields and increased currency risk. That all should seriously impact organic foreign demand for investment in such assets, driving many foreigners other than speculators out of the stock market, the housing market, the bond market, etc. We’re probably already seeing this happening.

The Fed’s Board of Governors gets tapped by the President, and these appointments strongly determine the composition of the FOMC…

…Wouldn’t it be safe to speculate the Administration is the main impetus behind QT, a result of it probably exercising conditionality over Fed re-appointments in order to get a stronger dollar and more favorable trade balance, when coupled with the Administration’s stated goals on trade? I don’t remember hearing any big rumbles about QT prior to the 2016 Election.

I have given up on asking what “DRIVES” the policy. Domestic interest? International interest? Deep state? Current President? Bank Cartels?

If I can stay one step ahead of how everybody else would “RESPOND” to the policy, i would already be happy.

The FED being serious about QT and thus draining dollar liquidity while at the same time federal borrowing is increasing, thus gobbling up dollar liquidity.

How will it affect over all dollar liquidity when corporations at the same time are “bringing home their cash from abroad” due to the tax cuts, the corporations selling off mainly USTs to free up the funds for other things than investments in production and research. This sell off gobbles up liquidity, too, although this liquidity is returned later in form of stock buy backs or M&A.

Emerging markets are apprently already feeling the pain of reduced dollar availability and having to pay back dollar denominated debts with weakening currencies, but what will happen to the US economy with less available dollars sloshing around ?

Not much difference between the FED, vampires and parasites.

So what wolf is saying is that instead of limiting lending and growth by crowding out lenders etc from the bonds they need to lend against which is where excessive QE has taken us with enormous monthly rollovers, we now have the fed limiting growth by draining cash out of the economy and disappearing it, instead of that cash circulating in to consumption, wages, jobs, production, investment, and savings.

It has been clear from Japan that QE has issues with deflation. Yet the fed and the rest jumped in. Assets prices are out of touch, money is so cheap there is no incentive to invest in productivity. fecundity is collapsing, the workers are rebelling against migrant driven low wages and skilled migrant driven falling social mobility.

Is there a reason why the Fed is prioritizing unwinding Treasury holdings over MBSs? Is it just easier to let treasuries roll off, where they need to either find counter parties or early repayment on MBSs? Are they worried about impact of quicker moves on housing market? Some combination of the two?

Probably just because govt bonds make up a greater share of the Fed balance sheet than MBSs.

I don’t understand. I’ve tried but I don’t get it. I need a visual, can someone draw it up on whiteboard? I’m frustrated, the world seems to be passing me up. So many changes.

I would describe it visually as follows (comparing a real person owning a bond and the Fed owning one during QT):

Bob Public owns a 10 year government bond and the bond comes due. On the due date Bob gets the cash for the bond’s principal from the Treausry and spends it; thus distributing it to the rest of economy.

Fed owns a 10 year bond on its balance sheet. On the due date the Fed gets the cash for the bond’s principal from the Treausry and then simply shreds that cash. Said cash is gone forever. It won’t be spent in the economy.

Thank you. Your explanation on how the cash ‘disappears’ made sense.

Theres a lot of BS here. Mortgage credit is retired but assuming the housing market is firm, (and firmer still) then new credit replaces old, the only caveat is that the Fed won’t be holding that paper. Wolf would have you believe that the QE transfer never meant anything, and that the Fed did not assume the taxpayers liability for GSEs, and that may still be a matter for Congressional debate.(while they still hold most of that paper) You hold it , you own it.

What’s important is how much credit is being created in aggregate and how it is being leveraged. The fact that interbank lending is nonexistent is not a ‘good’ economic sign. The banks are a lot worse off than the Feds boilerplate, and DB is right at the top of the problem list. If their US affiliates can go out of business, how about Citi and Chase? The point of paying higher interest rates to depositors without any income from loans written at a premium to those dividends issued means you are losing money (what happened to S&L). Minus the lucrative carry trades and income from trading desks the road ahead is rough. As per Noland the rise in interest rates makes the cost of derivative insurance higher, and tends to cause (global) risk aversion. https://creditbubblebulletin.blogspot.com/2018/06/weekly-commentary-q1-2018-z1-flow-of.html

DB is not a US entity, and it’s troubles are mainly self-inflicted. Otherwise, major US banks (Citi, Wells, JPM, BAC, etc.) are well capitalized (some argue too much so) and are profitable.

Your notion that 1.75% interest on deposits poses an existential threat to the financial system is ludicrous.

That is exactly what I mean by BS. When the Fed has US banks buy DB derivatives, and DB is operating in the US its a US bank. And the interest rate is a problem if you can’t lend money at that rate add a premium, thats the business they are in. Goldman has FDIC and no retail banking business? These acronyms are not banks they are financially engineered ponzi schemes. The banking industry is where automakers were twenty years ago, bankrupt, and clueless and depending on the kindness of government strangers, ie the Fed, which is allowed to monetize deficit spending for a small fee, which at the level it has become is no small pittance.

You need to take some classes online like coursera it edX. You need to take two classes. One is basic accounting and one is money and banking in order to understand what’s going on. Drawing on white board may help, but it can NOT replace the education on fundamental concepts.

Between December 2008 and October 2014, the Fed borrowed money from banks and used that money to purchase securities in the open market. Some of the securities purchased were longer-term (at least two years remaining maturity) Treasury notes, bonds, and inflation protected securities and some were residential mortgage-backed securities (RMBS) issued and guaranteed by a government agency (GinnieMae) or a government sponsored enterprise (FannieMae or FreddieMac). When principal payments were received the Fed, through September last year, was reinvesting all of them in similar securities. Since then it is only reinvesting a portion of the principal payments and paying back the loans from the depository institutions with the rest of the payments. (Technically the loans are deposits in the accounts of banks and other depository institutions, also called reserves, at Federal Reserve Banks.)

The reason the Fed borrowed the money and invested it was to rescue homeowners hard hit by the collapse of the housing market in 2007 and 2008 and to support employment in the building trades. $1.8 trillion of the investments were in RMBS consisting of mortgage loans that financed or refinanced owner-occupied one to four family homes, almost all of them middle-class because of caps on the maximum loan size. Its purchases drove down mortgage loan interest rates. The first part, rescuing homeowners worked very well. In the first quarter (Q1) of 2006 households held owner equity in real estate of $13.4 trillion. In Q1 2009, it was down to $6.0 trillion. In Q1 2018, household, owners equity in real estate was $15.0 trillion.

Central Bank would before the active engagement in QE engage in protecting interest rate policy through its Open Market Operations, wherein they acted as THE buyer of T-bill auction so as to actively particate in the market to assure targeted interest rates in T-bills did not get disrupted by lack of buyers. Heavy hand/thumb on the market scale.

The Fed has never participated in Treasury security auctions. During World War I, at a time when the Secretary of the Treasury was also the Chair of the Federal Reserve Board, the Federal Reserve Banks were forced to make loans to the Treasury at below market interest rates. In 1935 this was prohibited by law and the Federal Reserve Banks were only permitted to acquire Treasury securities in the open market, meaning the secondary market open to all sellers. That is why open market operations have that name. During World War II a provision allowing the Fed to acquire up to $5 billion in Treasury debt directly from the Treasury (but not at auction) was added to the law and it was extended several times, but allowed to expire in 1981.

The law has been interpreted as allowing the Fed to rollover debt it already holds at the time of an auction receiving the yield determined by the auction. It does not participate as a bidder and the amount it reinvests is over and above the announced amount of the offer. That said, the Treasury knows in advance what the Fed will be reinvesting and in planning its funding takes it into account. Currently the Fed allocates its reinvestment among securities with terms of at least two years in proportion to the amounts offered by the Treasury.

So, how does the Treasury collect enough in taxes to pay to the Fed as they roll off the bonds? The government is still spending more than it collects without the Fed engaging unwinding. The Treasury only has as much money as it can tax or borrow. Who is buying our debt if not the Fed? Me thinks something is rotten in Denmark.

Where were you during the last couple dozen debt ceiling crisis’?

Watching the Fed buy the debt. They are not doing that now. Get it.

The Treasury does not collect enough in taxes to pay its current expenses let alone pay off any debt. It pays the Fed and every other holder of a maturing security by borrowing the money. However, the Treasury is no where close to the limit on how much it can borrow. The odd thing about government accounting is while liabilities are carefully accounted for, assets are not. How much is all the land the Federal government owns worth?

What is a big advantage to the American people when the Fed owns federal debt instead of other investors is that we get the interest we pay back. In 2017, the Fed collected $64.267 billion in interest on Treasury securities, but it paid the Treasury $80.559 billion. (In the old days this payment was labeled “Interest on Federal Reserve Notes” which are loaned by the Treasury to the Fed. For some reason they dropped that description in 2013.)

We should note that if everyone is confused by how all this works, that’s because it was designed that way. They robbed us blind in 2008 and now they’re trying to fix the books.

No, the Fed did not rob us blind in 2008. When the Dodd-Frank Act required that the General Accountability Office audit the Federal Reserve’s emergency programs, the report the GAO issued found that as of June 29, 2011, all of the assistance the Fed had provided had been paid back except $13 billion in loans from the Term Asset-backed Loan Facility (TALF), which made loans to not just banks but anyone investing in Asset-backed securities, $22 billion in loans to Maiden Lane the special purpose vehicle that assisted JPM Chase in acquiring Bear Stearns when it collapsed, $9 billion in loans to Maiden Lane II and $12 billion in loans to Maiden Lane III both of which assisted AIG. Subsequent to that report all of those loans were paid back in full. The GAO report says:

“In setting program terms and conditions, the Federal Reserve Board sought to make loans available on terms that would be effective in addressing market strains during crisis conditions but onerous compared to terms available during normal market conditions.”

You can find the report at:

https://www.gao.gov/new.items/d11696.pdf

In 2007 the Fed had returned to the American people (the Treasury), $38.716 billion. Over the next five years the average annual return to the people was $66.262 billion.

You did NOT get robbed by numbers, you get robbed by the “meaning” of numbers.

What about excess reserves of depository institutions? Since peaking at 2700 billion in Aug 2014 they have dropped to 1894 billion in May 2018. Is this not banks taking back money from the Fed and lending it into the economy? If that is the case, then net liquidity is increasing; not decreasing.

The asset purchase programs did not create money in the normal sense of the word. It created reserves at banks and other depository institutions, which are part of the “monetary base” sometimes called M0, but they are best considered potential money. Depository institutions and their customers can use reserves to create M1 money (most of which these days quickly changes to MZM money) but this did not happen because of a lack of demand. If you use a credit card to purchase a plane ticket the balance in transaction deposit account of the airline increases. Currency and balance in transaction accounts at depository institutions make up M1 money, so the decision of the bank to extend credit to you and your decision to use that credit have created M1 money. By the end of the day the airline will have swept that M1 money into a commercial money market account which is MZM (money zero maturity) money. What most folks are completely unaware of is that for more than nine years we have had a fractional reserve banking system with an improper fraction. That is the reserves that depository institutions have set aside, mostly as deposits at the Fed but also as vault cash, has exceeded the total deposits customers have in transaction accounts at depository institutions. Before the financial meltdown in the fall of 2008, reserves were generally around 7% of deposits. Since December 2009 they have been more than 100% in every month, except July 2009, when there were 93.311 cents in reserves for every dollar of deposits. The reserve percentage peaked in 2014 at 181.837%. In April it was down to 101.135%.

The Fed and its central banker accomplices are convening next week. Be afraid, members of the 99%. Nothing good can possibly come from such bankster confabs.

https://www.bloombergquint.com/global-economics/2018/06/08/world-s-big-three-central-banks-to-meet-with-different-agendas

One minor correction. Ginnie Mae (the sister that stayed home) is not a GSE. It is a federal agency so its guarantees are backed by the full faith and credit of the United States. While Fannie and Freddie are GSEs and technically private corporations they have been held in conservatorship by the Federal Housing Finance Agency (FHFA) since before the Fed started investing in MBS. At the present time their guarantees are backed by their remaining draws on the senior preferred investment lines at the Treasury which are $140.2 billion for Freddie and $113.9 billion for Fannie. Of course all MBS are also backed by the mortgages.

When you adjust the decline in the treasury security portfolio for the additional principal payments from inflation compensation on maturing Treasury inflation protected securities and net sales of $200 million in “small volume” operational readiness testing, the decline through May comes to the $90 billion scheduled. For MBS adjusting for reinvestments that had not yet closed at the end of September and had not yet closed at the end of April as well as the effect of “small volume” tests the decline in reinvestment through that month comes to $48.023 billion just over the $48 billion scheduled.

The monthly maximum amount of reinvestment reductions increase to $40 billion a month in Q3 and $50 billion for every month starting in October and will continue at that level, unless economic conditions force the Fed to make significant cuts in the federal fund rate target, until the FOMC “judges that the Federal Reserve is holding no more securities than necessary to implement monetary policy efficiently and effectively.” But future balance sheet reductions will be much less than the maximum. That is because there will be many months in which the principal payments received will be less than the scheduled maximum reduction in reinvestment. The first month Treasury reinvestment will be impacted is September, when the plan’s maximum reduction is $24 billion, but only $19,006,781,300 in principal payments will be received. Starting in October the scheduled maximum monthly reduction in reinvestment in Treasuries will be $30 billion. In October only about $23.8 billion in principal payments are due and in December, $18.2 billion. So the Q4 runoff will be about $72 billion instead of $90 billion. There will also be less than $30 billion in principal payments in January, March, June, July, September, October and December 2019. The Treasury security runoff in 2019 will be about $271 billion plus inflation compensation accrued after May 30, 2017, instead of $360 billion.

MBS principal payments occur as households make principal payments on the underlying mortgage loans. Most of the principal payments the Fed has received in recent years came from loan prepayment due to refinancing or home sales. With mortgage loan rates rising prepayments have been declining. At the May FOMC meeting, Simon Potter, Manager, System Open Market Account, reported “reinvestments of MBS principal would likely cease later this year, although the timing is uncertain.” In other words, principal payments in 2019 will be less than the $20 billion scheduled reduction every month.

Mr. Singer,

I think you may be correct. The Fed robbed us between 1913 and 2008. In 2009 they began trying to manipulate the books to cover the crime. Thanks for the correction.

Stan

Stan,

The Fed has been waging financial warfare against the middle and working classes in this country since its 1913 inception. They did not stop robbing us in 2009; they ramped up their fraud and swindles with QE. Yellen, Bernanke, et al are what Thomas Jefferson warned would happen to us if we allowed the oligarchy to establish a central bank to facilitate its looting and asset-stripping of the population:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around (these banks) will deprive the people of all property until their children wake up homeless on the continent their fathers conquered.”

“The issuing power of currency shall be taken from the banks and restored to the people, to whom it properly belongs.”

Stan,

The Fed is the most transparent financial organization in the world. Not only do they publish every week their statement of conditions, they also publish a complete inventory of every security they hold. They are the only government agency that in addition to being audited by government auditors is also audited by private auditors, currently KPMG. The terms and conditions for all of their dealings are published in advance. Every day they report the totals for operations conducted that day and after two years every transaction is reported with complete detail. For example, on January 4, 2016, the New York Fed Open Market Trading Desk purchased $150 million face amount of Freddie Mac 3.5% 30-year MBS cusip #02R032620 from Goldman Sachs at a price of 103.027344 paying $154,541,016 when the transaction settled on February 11, 2016. That same day the Chicago Fed lent $22,000,000 to HORIZON BK NA

of Michigan City, IN, overnight at 1.00%, against total collateral of $90,215,880 that consisted of $89,675,343 of municipal securities and $540,537 of agency guaranteed MBS/CMO.

Sure, Enron was audited too remember? And a bunch of other companies that are now in the history book.

Heck, all those big banks were audited too up to the financial crisis.

I am not saying the Fed is this big massive conspiracy, but the big 4 firms should be the last to audit this thing. Instead, Ron Paul and Elizabeth Warren should appoint a couple of people to do the REAL audit.

Dink Singer,

Oh boy, reading all your seven comments in a row — this masterful mix of accurate, manipulative, and distorted — I’m starting to think that the Fed must be paying you to post these comments. The Fed has engineered the greatest wealth transfer of mankind, from labor to capital, from workers to asset holders, with the biggest asset holders getting most of the wealth, and here we have 7 comments explaining just how great this wealth transfer was for mankind — and how transparent and wonderful the Fed is. The comical seriousness with which you explain all this is actually funny.

Reminds me of Paul Crugman and Larry Summers. There is this group people specializing in “convincing” the crowd by manipulating concepts, definition of terms and trigger emotions and imaginations of the audience and if you try to debate them, you will get exhausted and you are likely to lose in the sense that the audience believes them more easily. Gullibility of the mass and existence of the people of this kind makes me pessimistic.

Is that the price that has been paid for refusing to allow capitalism to destroy the failed companies and banks back in ’08? Or is there more of a price yet to pay? Will what the Fed did result in hyperinflation and a currency crisis, or are we finished now, with the winners and losers celebrating or licking their wounds as the case may be.

Now the ECB says it’s going to scale back the financial crack cocaine it has been main-lining into the markets since 2008. I’ll believe it when I see it.

https://www.reuters.com/article/us-global-economy-weekahead/fed-ecb-to-tighten-policy-in-tandem-idUSKCN1J41ZF

“The credit risk lies with these government sponsored enterprises, not with the Fed.” Not true. As we saw in 2008-2009, when the “last resort” policy of QE (i.e.; buying every Treasury and mortgage bond in sight because markets were frozen by massive insolvency) was implemented, the TRUE “guarantor” of GSE debt became the Fed printing press. Still true today.

True or false: The Fed is required by regulation or statute to report all assets it owns on its balance sheet.

Help me understand this. But this seems like money that has been created hasn’t been destroyed and is just flooding the money base. Does the treasury truly pay the full principal to the Fed. Aren’t they already broke.

CNBC is saying that the Fed is already planning on walking back its supposed tightening.

https://www.cnbc.com/2018/06/08/fed-has-surprise-that-could-mean-early-end-to-interest-rate-hikes.html

CNBC was on the forefront of saying that QE would be permanent, and that the Fed could never raise rates. CNBC has been doing Wall Street’s bidding since day one. This CNBC article is about another Wall Street firm guy who doesn’t WANT the QE unwind to go on.

Must…not…implode….the…Ponzi.

https://www.marketwatch.com/story/feds-goal-is-to-signal-an-unhurried-pace-of-interest-rate-hikes-2018-06-08

Another very informative and easily understood article. Excellent work, Wolf and thanks for sharing these insights with us!