But What’s Going on with Used Vehicle Retail Prices?

Been reading misleading headlines about low inflation again? That is was “softer than expected” or whatever?

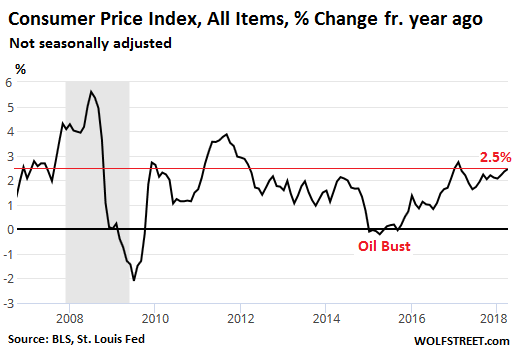

So here are the numbers: The Consumer Price Index (CPI) for April, which the Bureau of Labor Statistics released this morning, was 2.5% higher than a year ago. That increase may have been “lower than expected” – who’s doing the expecting? – but it was the fastest increase since February 2017.

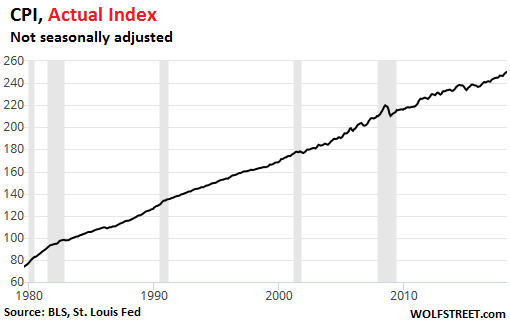

This chart shows the rising trend of inflation as measured by CPI:

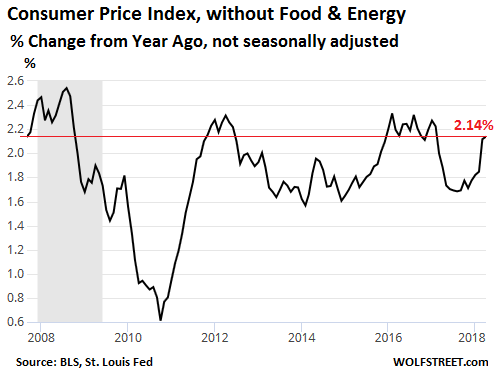

Core CPI, which strips out the volatile food and energy components, was up 2.14% compared to a year ago. This may also have been deemed by the headlines “lower than expected,” but it was the fastest increase since February 2017:

In the BLS press release near the top, which is where much of the media got hung up, it says this:

The indexes for household furnishings and operations, personal care, tobacco, medical care, and apparel all increased in April, while those for used cars and trucks, new vehicles, recreation, and airline fares all declined.

This refers to the seasonally adjusted changes from March to April. Monthly numbers are very volatile, and once they’re seasonally adjusted, they’re only as good as the seasonal adjustments. Making a headline out of seasonally adjusted month-to-month numbers can be misleading because headlines are all many people read.

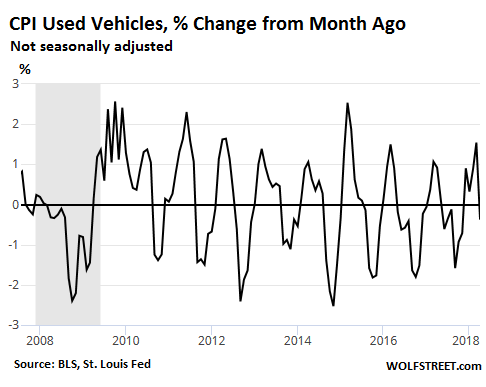

For some perspective: Used vehicle CPI, which was one of the items mentioned by the BLS in the quote above, fell 0.4% in April from March not seasonally adjusted. The measure of used vehicle CPI is very volatile on a monthly basis. This chart shows the month-to-month percentage changes of used vehicle CPI not seasonally adjusted:

This chart illustrates that, in order to hammer this into a smooth line on a month-to-month basis, the index must be heavily seasonally adjusted – and what emerges at the other end is only as good as the seasonal adjustments.

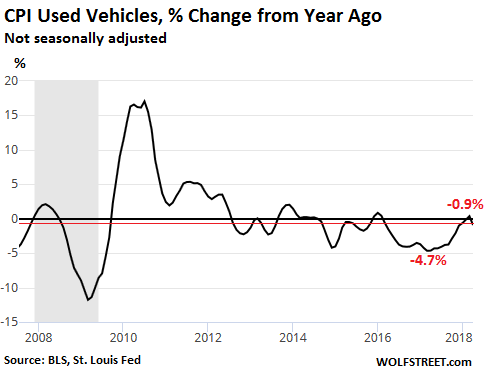

On a 12-months basis — not seasonally adjusted because there are no seasonal factors to worry about — the used vehicle CPI fell 0.9%, but that’s way up from year-over-year declines that were over -4.0% during the 12-month period between August 2016 and July 2017, and as steep as -4.7% in April 2017. So now, those price declines are disappearing, but given the volatility of the used vehicle CPI, they’re not disappearing smoothly, and there are going to be zigs and zags, and we just had one of the zags:

Two days ago, I wrote about the surging wholesale prices in used vehicles [What’s Going On in the Used Vehicle Market?]. I also pointed out that it takes a couple of months on average between the moment a vehicle is sold at auction to when it is retailed by a dealer to a customer. In some cases this may be a week, in other cases this may be several months. Then it takes some more time before the price-data gatherers at the BLS pick up on any price increases that the dealer, in negotiating the deals, was able to push through to the consumer.

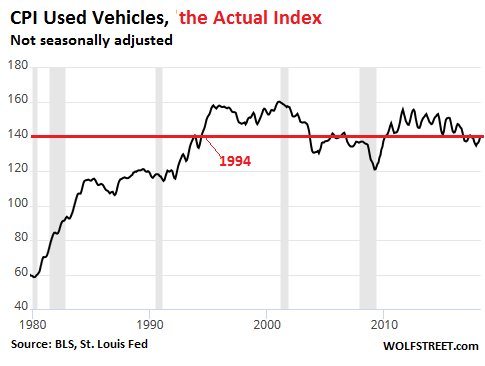

This number is then adjusted in the manner of all CPI data, including with “Hedonic Quality Adjustments” that will lower CPI data compared to actual price changes. These adjustments hit used vehicle CPI particularly hard, and this is why the used vehicle CPI — the actual index value — is at the same level it had been in 1994, confusingly for used-car buyers, given how much more expensive used vehicles have gotten over the past 24 years:

By comparison, below is the actual index for the overall CPI. While the used vehicle CPI is now at the same level as in 1994, the overall CPI, which includes the used vehicle CPI, is up 72% over the same 24-year period:

So I don’t expect the surge in used vehicle wholesale prices in April to show up in the CPI data until about two months later, at the earliest. Maybe June, but more likely July. And when it does show up, it will be in softened form as per hedonic quality adjustments and other adjustments.

There are similar inflation pressures building up in the pipeline that are only gradually seeping through, including surging transportation costs that many consumer-goods companies have been griping about and that I have covered over the past few months.

And there is nothing in this CPI data that would encourage the Fed to slow down its “gradual” rate-hike machine. Meanwhile, the Fed’s QE unwind is ramping up, and the amounts are getting serious. Read… Fed’s QE Unwind Accelerates Sharply

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I don’t really believe that oil will rise as much as some experts think, the economy simply cannot tolerate $4 gasoline, so either oil comes down or oil company profits take a hit. The days when corporations routinely ripped off the consumer are over (he says hopefully) The real issue is wages, teachers? nationally? WOW. What’s next? Well its a giant service economy and so the rules of supply demand and value added don’t apply. We could easily go hyperinflationary on wages alone.

I’m not seeing any signs of hyper-inflating wages out there.

https://fred.stlouisfed.org/series/CUSR0000SASLE

The teacher wage movement is government wage inflation. Colleges raised the bar on inflation, now that inflation trickles down.

The problem is that at current prices there is no profit to be found in oil until crude hits $100+ per barrel * and gas exceeds $4 a gallon with all of Big Oil’s current profits as they drill more and more wells whilst sitting on a glut of oil in storage coming solely from Tax Payer bought and paid for Federal subsidies

So either gas and oil prices go up or this administration is gonna have to come up with either a helluva a lot more cuts to federal spending or rescind much if not all of the tax cuts it recently passed .. cause as the saying goes … ” There is no free lunch ”

As for hyper – inflationary wages … like Kent I aint seeing that ever happening anytime or in any sector in the near or distant future either … especially when it comes to our most valuable albeit vastly underpaid and under appreciated resource … e.g. Teachers

You can’t get wage inflation without labor having bargaining power. The Neoliberals have made sure over the last 40 years that employees have no ability to collectively bargain for higher wages. While at the same time allowing employees to collude on wage suppression.

Wage inflation isn’t going to happen.

If price inflation picks up we may see stagflation again.

Teachers are not that much of a resource as you might think; at least not anymore. There are far better ways of learning than having to waste your time in classes which teach you nothing.

Teachers = Glorified Babysitters. Next.

Before you judge, both my parents were professors, the only advice they had when my brother and I went to college was “for gods sake please don’t end up teachers”.

Thanks dad.

Go check dailyjobcuts.com and see how many schools are shedding administration and teachers. So much for inflation coming from that source.

Wolf,

Was there a good reason why Fed doesn’t include house prices as part of CPI, or do i have that backwards?

That’s odd. The only reason I can find that $100 or $75 or $50 oil is because I was fortunate to have good teachers. Maybe what you do required less hands-on teaching than some fields. So maybe you could have reached the same place by a different educational method.

But education in schools with real teachers also serve to socialize their students to some societal norms. There is more to being “educated” than command of one or more subjects.

Night Train says “But education in schools with real teachers also serve to socialize their students to some societal norms.”

Now their is a load of crap…

Consumers can buy the $4 per gallon gasoline with their credit cards. The Fed assures us (somehow) that household finances are ship shape. Once the cards get a little full tap home equity. We’re all sitting on such wonderful equity courtesy of the technicians.

“The days when corporations routinely ripped off the consumer are over”

Really? I wish I lived on that planet.

Yeah, that must be some planet. Meanwhile on the planet Earth, corporations own us. They can kill, enslave, poison whoever, and whatever they wish to.

R2D2

I agree that corporations have done and continue to do what you laid out in your comment. And unless something changes soon, I expect those things to get worse. As of now, I don’t see anything changing.

Unfortunately, the so called elite have whole instruction books of how to dumb down public so that they will never be smarter than a smart chimp; and they have already implemented most of the steps in those instructions. The public will become dumber and dumber.

Take me; always a great student and a great learner; yet, I’m so illiterate with respect to money and economy; and I’m one of the good ones who works hard to learn. At the least 95% of the population are much dumber than me.

Maybe in the good ole USA, but here in Oz the price of gasoline has really, really big swings in prices. It isn’t uncommon for the price to go up 30 cents a liter in one day (US$0.85 a gallon) and then spend the next couple of weeks at that price or slowly decreasing until the next spike.

Prices of gasoline are roughly three times what they were when I moved here some 22 years ago and the price of oil sure hasn’t gone up three time nor has the Australian dollar changed in value from that time (75 to 80 cents range- yes huge swings in between from as low as 50 cents to over US$1.10!!!)

And regarding statistics, the pundits or ‘the market’ will pick which ever stat that it appear will help its case.

Again here in Oz the stats are reported on a trend basis and seasonal basis. Sometimes you’ll see huge divergences in the numbers.

Recent examples are a huge jump in the number of hours worked on a seasonal basis, but a big drop in trend numbers.

Or in retail sales when the new Apple phone was introduced there were huge differences in the seasonal number compared to the trend numbers.

The pundits just picked the ‘best’ number for their cause and ran with it……….

Gas is a tiny, meaningless percentage of the typical American budget. Lets say you drive a gas guzzling truck or SUV because you, being a typical American, enjoy wasting cheap resources like oil and you want to make sure you get your share. Your gas guzzler will average about 18 mpg, if you are the typical American you spend the day aimlessly driving around to buy fast food and entertainment (when not watching TV or internet) about 12000 miles per year. At $4 per gallon this works out to about $2600 per year – not a significant chunk of the typical budget and tiny compared to housing costs. And why should someone, who can afford to purchase a $60,000 truck, care about spending $2600 per year on gas?

Americans love to complain about the price of gas yet gas guzzlers are so popular in America that Ford has decided to stop making cars (except the mustang which will soldier on for marketing reasons). If Americans could not afford $4 gas they would not purchase gas guzzlers. There was a time when people bought Geo Metros that got almost 50 mpg – how sad everyone must have been without an enormous behemoth of a vehicle to guarantee their happiness. Thank god we now know better and have moved on to a super-sizes world. Life is good.

OK, let me put some perspective on that gas budget of $2,600/year that you say is “not a significant chunk of a the typical budget.” It’s about two months rent of the median 2-bedroom apartment in the US. So if you’re already squeezed by housing costs, well…

However, I do agree that gas prices in the US are cheap compared to many other developed countries.

Prior to the Iraq War I started the Free Gas For Everybody Party, and I pledged to take the money they were going to spend in Iraq, 1 trillion at the time, and give it to households, 100 million maybe, as an energy subsidy. It adds up to quite a bit assuming that war was about oil. Oh and we saved a few lives too.

Ambrose Bierce,

I suspect, given the priorities of this place, that you didn’t get very far :-]

It’s not easy building vehicles, the mote has deep foundations.

Since 1990 used car prices haven’t changed? No matter the hedonic adjustments a car for most of the used market is simply to get from point A to point B.

Garbage in, garbage out. I am absolutely convinced that the methodologies are tailored to support the false assertion that central banks are not impoverishing the masses. “It’s not that life is getting shittier for most, you’re just unlucky. You switched from steak to hamburger? No problem, it’s been adjusted away as your iCrap is cheaper.”

Thanks, Wolf, for explaining in depth why wholesale prices for used cars are higher, but CPI for used cars is lower. Although the whole thing sounds a lot like reverse reverse reverse psychology, i.e. convoluted and unreliable. I have for a long time believed that this data is less reliable than the old Pravda headlines.

Well Pravda means Truth, so those surely were correct…………..

In a soccer game usa vs soviet union the final score was 1:0

Pravda report:

In a soccer game betwee n the glorious soviet team and the capitalist pigs from the usa the su team achieved a good second place while the capitalist pigs were one spot before the last.

The Fed “rate-hike machine”.

As the Fed “gradually” raises interest rates into a stagnant economic climate, the result being added costs which translate into higher prices and higher inflation.

The US sovereign bonds (Treasuries) trade based on inflation expectations. When inflation is higher, so are Treasury bond yields.

When bond yields rise, bond prices fall.

When bond prices fall, the bond bubble enters a critical stage, since bonds are at the base and support all debt.

If inflation pressure continues, the bond bubble will blow.

Taking the everything bubble with it.

I realize this is a novice question, but if you hold a portfolio of bonds whose prices have fallen due to rising interest rates, why not just hold to maturity and avoid the loss? Then reinvest at the higher rates. Assuming no defaults of course.

Or is this an issue of collateral collapsing in value?

Eh, at least imported goods should get chea-.

Nah nevermind.

According to ‘economic theory’ when one country’s currency changes in value then that change should be reflected in the price of imports, for example. In the real world it rarely works.

When I first lived in Japan the US/Japanese yen exchange rate was around 250 yen to the US$.

Over the next ten years or so the value of the increased to a high of 85 yen per US$.

Did the price of things change much or was there a huge inflow of foreign goods into Japan?

The simple answer was no. Maybe you saw Coca-Cola being imported from SE Asia and for sale 20 or 30 yen cheaper than Japanese drinks or the price of such things as gasoline cheaper, but overall prices of imported consumer goods didn’t fall to 1/3rd of what they were before.

What happened was the purchasing power of Japanese in overseas markets surged.

That condo in Waikiki was suddenly very cheap and often the cost of buying it was cheaper than even paying the transaction taxes and fees on buying a similar unit in Japan.

Ever wonder why Japanese started buying everything in site across the world?

The cost of importing teachers into Japan was also cheaper. Universities could now import a teacher and pay them with yen which now bought a lot more.

Human capital could flow cheaply into Japan in certain areas.

That run of the mill know nothing brand new wet behind the ears Phd that used to cost 15 million yen plus now could be had for 5 million or even less as there were a huge number of unemployed them in the USA.

Hire them, make them teach three times as many classes as a regular professor and your profit margin goes through the roof. You get classes taught at 1/10th of previous price. (At the same time teaching quality fell through the floor.)

Translation that used to cost 25,000 yen a page could now be done for 8000 yen a page or less.

Our trips overseas were cheap and cost less to travel outside of Japan than in it.

When will the Fed’s balance sheet roll-offs start to have an effect on the M1/M2 money supply measures?

There is inflation because there is a lot of stuff that rose prices in the last twelve months, new taxes (and yes the imports taxes do count) and the end of cheap credit does mean rising costs for a lot of companies. What a stronger dollar does is making other currencies fall so is cheaper to buy from those countries. But US current Trade Ears means that we won’t see prices of some stuff you can buy lowering any time soon. In fact prices might rise even more on some things, mostly electronics since they depend on imports from Asia.

Fed tightening has already had an effect on M1/M2

The monetary base is shrinking which effects velocity.

PQ = MV

Yea, I guess to the extent monetary base is included in those measures. I would think the reduction in base money by roll-offs are eventually going to affect total checking deposit money by the multiplier effect. There’s probably a ton of excess reserves still parked at the Fed though.

I hate the whole idea of hedonic adjustments. If a vehicle goes from $20K to $25k because of increases in “quality”, but I can’t buy a $20K car without said quality increases, then I’m just out $5K. What if I don’t value those adjustments or they don’t improve my quality experience?

People talk about a lot of scams in inflation measures, but hedonic adjustments are the biggest in my book.

Kent,

I’m with you. I get the principle of hedonic adjustment and I understand why it make sense on a theoretical level. But there are at least two issues with it.

One, the issue you raised, that there is no choice for the consumer;

And two, that with used vehicles, clearly the adjustments are wrong. There is no way that the dollar has not lost ANY of its purchasing power for used vehicles. This is just not possible. The chart shows that there was inflation in used vehicles until the 90s, and suddenly it stops?

I need to look into this further.

And, one person’s quality can be another person’s anti-quality in vehicles. For example, I do not seek a vehicle with Wi-Fi and Bluetooth, but many other consumers do. Those qualities add purchase price cost, but they also add complexity and potential repair costs.

Much agreed, Kent. Similar examples abound. My ISP raises rates by 10% y-o-y along with increases in speed or data allowance that mean nothing to me. The service with the previous speed and data allowance at the previous price is no longer available. That’s 10% inflation period.

Interesting that the airline fares declined, there must be pressures building up somewhere currently with the price of jet fuel rising. I wonder how the dow transportation index is doing, if margins could get squeezed

According to the year-over-year measure, airline fares have declined consistently since 2014. I can see some of that because fuel prices plunged from mid-2014 to early 2016. But more recently, it’s hard to figure out where the fare declines came from.

Qantas still has huge fuel surcharges on tickets as a result of the surge in oil prices from years back. You don’t see them on regular ticket prices as they have been ‘folded’ into the ticket prices.

Where you will see them is when you buy a ticket with your frequent flyer miles and they will be even higher on those type tickets as well.

For example, if you buy an economy class ticket on Qantas with your miles you’ll pay about four times as much for the surcharge as you would on a Singapore Airlines Business class ticket purchased with their frequent flyer miles.

One good thing about Qantas frequent flyer miles is that as long as you have any kind of activity within 18 months your miles will never expire.

The only other thing that is good about airline tickets here is that international tickets are exempt from goods and services taxes as they are considered international goods.

My guess is that some of it has to do with low- (or lower) cost carriers (JetBlue, Spirit, Allegiant, Frontier, etc.) slowly making inroads into the mid-tier US markets, which are very lucrative to the big 4 for feeding passengers from these smaller markets to and through their hubs. Until a few years ago these smaller carriers either didn’t exist (or existed at a smaller scale) and mostly competed with the big carriers on routes between the mega airports (say NYC/Boston/DC to Miami or Orlando). As a result, the mid-tier markets had little competition and high fares, while many small markets lost airline service altogether.

A typical example of the recent trend might be Richmond, Va. A few years ago if you wanted to go from Richmond to say Orlando your only choices pretty much were to take DL through ATL or AA/US through CLT. Now you can fly direct from RIC to Orlando on either Spirit, Allegiant, or Frontier.

In Europe this trend has already made huge inroads in the smaller markets (think places like Krakow and Nuremberg) and eroded the competitive position of the old flag carriers.

In addition to the BS about hedonic adjustments and bogus “basket substitution” of less expensive goods when the good stuff gets too expensive, the CPI is also deeply flawed in its measure of housing costs (aka “shelter”). The whole thing is based on a survey, in which the vast majority of respondents will be unable to produce accurate answers. (e.g. “If you rented your home out today, how much would you get?” – How many homeowners even think about this?) Don’t even get me started on “normalized rents” or “age-bias factors”, “class-mean imputations” or the whole issue of “where” the surveys are done.

Given that the shelter component is 32.8% of the CPI-U (April 2018 report), this means that 1/3 of CPI-U is statistically massaged bunkum. The CPI-U weightings are also deeply suspect.

If you’re willing to cringe your way through the details, look here:

https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.pdf

Ladies and gentlemen, we are currently flying through the Bermuda triangle. The airplane is flying in automode and the pilots are going to try and take back control. But, chances are we will crash. The copilot is trying to make sense of the readings, and we will timely inform you when the descent starts. If you look at the ticket fineprint, it states that you are obliged to help make sure our business and first class passengers are safe and sound. I will be passing around silk cloth, so please sew the parashutes for the first class passengers, and patch all holes with your own garments. If you have no more material, please talk to first class passengers as they will provide you some for a reasonable price. If cabin decompression ocurrs, oxigen is overrated, just breathe and all will be fine. We wish you a pleasant flight.