The two-year yield, now surging, is a leading indicator.

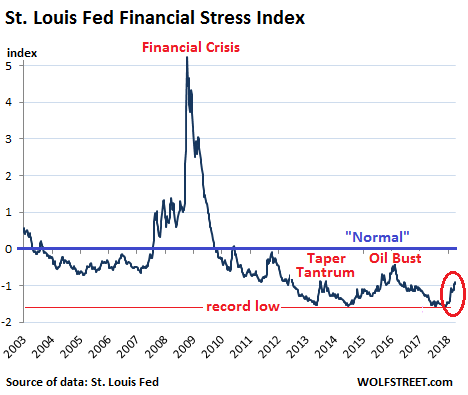

The Financial Stress Index, released weekly by the St. Louis Fed, is designed to track financial conditions that companies face in the markets. It reached record lows in November – meaning that there was extraordinarily little “financial stress” in the markets after years of ultra-easy monetary policies. The index then ticked up a little and did a mini-spike in February, but was still far below the historical “normal.” Then it zigzagged higher. Last week it had risen to the highest level since the Oil Bust two years ago, though it remained way below historical “normal.” In the current release, the index backed off again.

The index is designed to show a level of zero for “normal” financial conditions (blue line). When financial conditions are tighter than normal, the index shows a positive value. When these conditions are easier than normal, the index is negative. Note the recent rise (circled):

After years of ultra-loose monetary policies, financial conditions in the US economy have been dominated by risk-blind investors chasing any kind of yield, which resulted in minuscule risk premiums for investors, ultra-low borrowing costs even for junk-rated companies, and immensely inflated asset prices.

Even the Oil Bust and the Taper Tantrum, while they increased financial stress somewhat, couldn’t push financial conditions back to “normal” levels, given the Fed’s stimulus at the time. The chart also shows just how long the easy-money conditions have endured since the Financial Crisis, with the Financial Stress Index below “normal” since late 2009.

So now there’s also some response in the market to the removal of accommodation by the Fed, but it isn’t much. The response hasn’t even reached the level of the Taper Tantrum, when the Fed had suggested it might eventually “taper” away what had been called “QE Infinity.” Now at -0.97, the index remains solidly below “normal.”

The index, made up of 18 components – seven interest rate measures, six yield spreads, and five other indices – takes a broad measure of how markets perceive and price risk. And currently, the markets are still somnolent.

By “normalizing” its monetary policies, the Fed effectively attempts to tighten financial conditions in the markets to bring them back to historical norms: raise yields, widen spreads, increase risk premiums, etc. – in other words, make credit more expensive and harder to come by, and increase the price of risk.

But the market is slow to react to a shift in monetary policies. And when it does begins to react, the adjustments can be eye-popping.

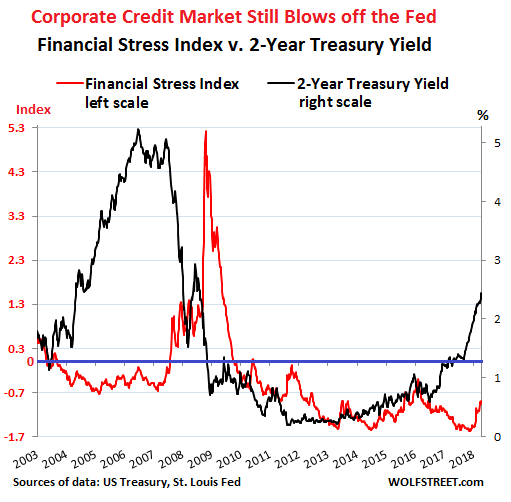

The Financial Stress Index and the two-year Treasury yield move roughly in parallel, but with a large time lag. The two-year yield is very responsive to changes in monetary policy and tends to overshoot late in the rate-hike cycle. This makes it a leading indicator by years as to where many of the financial stress components will go: junk bond yields, spreads, risk premiums, and the like. They will follow – but way behind.

The two year yield (black line, right scale) started rising ever so slowly in 2014, as QE was ending. But in late 2016, it surged and hasn’t looked back since. The Financial Stress Index (red line, left scale) began rising just four months ago. The chart below shows this relationship. Look at the years leading up to the Financial Crisis:

The two-year yield shot up in 2005 and 2006 as the Fed was raising rates and it overshot late in the cycle, when investors penciled in more rate hikes than were forthcoming. It peaked in June 2006 and then settled down some. By about that time, the Financial Stress Index started stirring. A year later, in July 2008, it reached “normal.” In September 2008, it began to spike with the Lehman bankruptcy.

So what we’re seeing in the chart above in the current cycle is the lag between the two-year yield, which has been shooting higher, and the actual tightening of the financial conditions, a process that is just now gradually starting to take off.

The Financial Stress Index is not a leading indicator. It just shows what’s going on in the credit markets right now. But the two-year yield is a leading indicator of financial stress in the credit markets.

The hope is that there won’t be a repeat of 2008. The huge spike in the Financial Stress Index was a sign that credit had solidly frozen over, and this had huge consequences in a credit-based economy.

The Fed has been indicating that it wants to “normalize” financial conditions – thus bringing the Financial Stress Index into positive territory near the zero line. There have also been suggestions recently that it may want to tighten beyond “normal,” in which case it would want to see the Financial Stress Index in positive territory. At the current pace, it has quite a ways to go, and rates will have to rise quite a bit further before the rest of the markets gets it and catches up with the Fed’s intentions.

Bonds, junk bonds, spreads, commercial real estate, leveraged loans, over-leveraged companies… all get named as risks to the banks. This is why “gradual” tightening will continue for a long time. Read… Now Even a Fed Dove Homes in on the “Everything Bubble”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If rates keep rising, in a couple of years the Fed might be able to publicize “We Run an Honest Game Here”. Of course, ‘honest’ is situational and your definition might be different from mine, but we’re recovering from the Fed being the house bank for the globalists. Glad they’re gone. New management is making a difference.

My MM fund is close to the 3 month treasury rate. It’s nearly 1.8% 7 day average with no capital gains/loss risk. It might double in 2 years. Success! We won. Funds with more risk will pay more yet still be very safe.

Income is being paid and it will be spent. The economy will flourish from it. This is called a positive feedback loop, applicable to the 99%.

Sorry for the schmucks who borrowed themselves into oblivion because they thought rates would remain low or go even lower forever. Not really. On another note, the ECB stated today QE will remain in place for longer as it’s hoped for recovery is not yet noticeable. What a shock!

Repo 105 and Repo 108 is how CEO Richard ‘the Gorilla’ Fuld blew Lehman Brothers up. The 08 crash manifested due to SEC incompetence on leverage limits of the ‘BIG Five’ Wall Street Investment Banks of which Lehman was leveraged 44:1, and Bear was about the same. Repeal of Glass-Steagall Act. was the structural change that facilitated the force of the financial destruction that was wrought post-Bear Stearns & Lehman Chapter 11. Only Benoit Mandelbrot understood the ‘Misbehaviour of Markets’, and the concomitant fallout. Geithner alone took us all in the wrong direction when he made the remaining marquee Investment Banks & Bank Holding Companies even bigger so that they could withstand the naked shorting and ‘calm the markets’.

Markets may look calm on the surface, but the VIX is slated to hit high numbers shortly. Volatility is everywhere IMHO, and we can expect even higher volatility given the debt overhangs on a global scale.

MOU

Speaking of Mandelbrot and a dynamic system entering a chaotic phase, this WH could be the tipping factor.

We know one thing: none of the expert advisers know what will happen next, which sudden shift in policy will be tweeted while they are asleep.

They are advisers in name only.

Trade tariffs are lurking to set things in motion if a correction needs a small push. That old ‘unintended consequences’ guy is driving the bus.

“Trade tariffs are lurking”… Agreed in part

Now tie the package together;

1/ Trade Policy

Attempt to equalize trade through; Tariffs, Trade deals, and trade deficit reduction

2/ Monetary Policy

Federal reserve balance sheet reduction

A depreciating dollar

3/ Fiscal Policy

Government deficit expansion

A weak international debt demand

Three economic forces all pulling in different directions, when they’re supposed to act together in concert. A recipe for disaster in the making. Just a matter of time.

Serfs might get restless. I keep forgetting there is no midterm results risk.

“The hope is that there won’t be a repeat of 2008.” -Wolf

I think they will probably get their wish. — I think when you take into account just how highly leveraged the western financial system really is now compared to 2008… think hundreds more trillions of unregulated derivatives much of which is interest rate sensitive and all the other trillions upon trillions of debt that now exists including private, corporate, government, etc., etc., etc…. I just read that the total U.S. student loan debt has now climbed to $1.48 trillion!!! If only that meant we were really getting that much more intelligent – hope always burns eternal, don’t you know.

Add to all that, the fact that two very intelligent ladies, Nomi Prins and Danielle Di Martino Booth have both kind of implied that the people at the Fed are pretty much running things by the seat of their pants — in other words, a hopin’ and a prayin’…

Hoo boy, howdy! I think what might be somewhere up ahead might make the Fed wish it was just a repeat of 2008, don’t ya know.

Well, there’s a positive side to all this. Wolf just taught me a new word “SOMNOLENT” Wolf, that puts you right up there with Mr. Paul Craig Roberts. Several months back, he taught me a new word too. That word was “INSOUCIANT. It seems to me, that both these words kind of go together, don’t you know. ;-)

You don’t want to even think about a mark- to- market on that trillion- plus student loan debt.

Goldie might nibble at 5-10 cents, but only if a number of ‘secured campuses’ are allowed to ‘secure’ defaulters.

Any Goldie offer will exclude the Kaplan portion of the loan book. However much the family may love the student who has borrowed six figures to pursue cosmetology, they are unlikely to be able to ransom them from the concentration…..campus .

Good one!

The flipside of that is of those cosmologists, e.i. the ‘Quants’ …. making bank with their algobots !

A tax payer bail out of student loans is baked into the cake. For now the congresscritters are biding their time, because free money to other people is usually unpopular. However, once most people know someone who has defaulted on student loans and that generation gets more leaders in power…. loan forgiveness for all!

Loan forgiveness requires that the student loan program be discontinued. Short universities. If no, I will go back to school and party – drinks on me at my Ft Lauderdale hospitality suite.

In a sane system that makes sense… but this will be tied to the victim culture. I’d expect to see loan forgiveness happen in the least efficient way possible and with the largest moral hazard. Next recession this is a lock. After all, that entire 1.5 trillion is looking more and more like a rounding error with the US government’s spending orgy.

“You don’t want to even think about a mark- to- market on that trillion- plus student loan debt.”

Depends on what levers you have on the debtors. With SJWs in charge, not so much. With debtors prisons, chain gangs, and rental workers: a lot.

Student loan debt slaves will soon be voting for their protectors (masters) to relieve them of the ball and chain. And $1.5 trillion is a heckuva ball and chain. Even more than all the car and truck loans combined. Lizzie is already warming up to play her role and she has all the intellectual double talk prepared to sell it.

Ironic how cheaply people will sell what was purchased with the blood of their ancestors.

I know 3 people off the top of my head who are in the Public Service Loan Forgiveness Program. Ones a lawyer who will work 10 years for the Government and have his $180,000 in loans erased. Not even paying 1 cent towards the principle. And then will go on to earn big $ debt free courtesy of the tax payer. The second is a girl with $90,000 in loans working for a non profit college. Also will not pay 1 cent towards the principle of her education. The lady owes $100,000 and works for the local school. Is currently paying $0 per month towards the loans and getting credit for each $0 payment towards the required 120 payments for forgiveness. She’s going on a trip to Costa Rica soon and drives an SUV. But will pay back not even the interest on the loans. The United States is a great place to milk the system. There is no accountability whatsoever in the land of the free money.

The yield curve is pretty flat, short term rates are not pushing up the long end by traditional spreads. For the first time, I can see the possibility of negative long term rates, as the short end crowds out the long end. Distortions abound.

The 10-year closed at 2.96%, just a smidgen from 3% today, highest since Jan 2014. The short squeeze is over. This thing is ready for the next step up, well north of 3%. I think it will stay ahead of the 2-year yield, if not by much.

Forecasters have no credibility, Wolf.

You rarely make them. But i hope you are right.

I actually don’t look at this as a forecast, such as weather or stocks. The Treasury market is very heavily manipulated by the Fed. The Fed has much more direct impact on the short end than on the long end, but it’s working on the long end too.

So I try to read where the Fed wants the market to go, and I try to look at what it is doing to get it there (rates, QE unwind, jawboning, forward guidance, dot plot, etc.), and I try to assess how ready the market is to go there. Eventually, it will go where the Fed wants it to go, but not right away. So I try to sort this out and think about how long this will take.

This is very different from saying stocks will rise or fall x% over the next year. I have a feeling about that, but that’s not worth sharing, and if I shared it, it wouldn’t be worth much.

Also, akiddy111, more generally, as you might have noticed, I let my hair down a little more in the comments than in the articles, with more typos, opinions, and things that I’m just thinking about but for which I don’t have good data.

Some of those things that I’m thinking about might be in the future, and thus could be construed as a forecast, which would thus crassly violate my own rules :-]

The 3-month T-bill just hit 1.8%. Looks like a lot of loose liquidity sloshing around the system is being soaked up.

Another day, another TBTF bank being fined for egregious fraud against its customers, but thanks to its lobbyist payola to the corporate whores on Capital Hill and our captured and complicit regulators, enforcers, and DoJ, no senior bankster executive ever need fear criminal consequences.

https://www.cnbc.com/2018/04/20/wells-fargo-agrees-to-pay-1-billion-to-settle-over-loan-abuses.html

I do not think we really have to worry about this until 2019 unless a bubble bursts this year in a quite impressive way.

The housing bubble 2 is more like several different housing bubbles in different parts and as long as all don’t go down quite close by we will be fine for now. So far it seems that while in some places and categories is going down, in others is still up.

Carmagedom is not really that thanks to the trucks bubble.

Brick retail is going down due to a combination of Leveraged Buys Outs, borrowing too much thanks to cheap debt, market saturation and Online Sales taking an increasing slice of the cake.

And the markets are likely to keep ignoring the FED this year.

I mean if you see Uber, Nextfix and Tesla suddenly unable to sell junk debt then yes is time to worry.

Or I might be wrong and there could be a crash going right now.

Hey the POTUS tweets something and the stock market drops 500 or more points.

I think we’re due for another crash. That’s how it works now. Boom and crash, like any unstable system.

There are quite a few of us who, after losing it all in the last crash, have determined ourselves to “neither a lender nor a borrower be”, at least not with banks. I did some personal, no-interest, borrowing up to a few thousand at a time but always paid it off.

2008 showed us that it *can* get worse. Life’s not that Cold War Dick & Jane book world where it always gets better. I’d been worse off, the Starving Seventies were not fun, esp. as a kid who didn’t know as much about foraging and hustling for spare change etc as I do now. But it got better from then. But 2008 meant stepping back to living like I was 14 years old, with the exception that I had a small motorcycle which I’d sure have liked to have at age 14. But I was back to weeding yards and selling handicrafts for money.

So there’s a whole cohort of us who literally save string and live in fear of taking on debt.

But there’s a newer generation who don’t realize that the Great Recession hasn’t ended for the 90% and will sucker into more debt. And foolish old Boomers who are feeling their oats again. And that’s how another “everything” bubble gets pumped up, only to pop.

Wolf Street has done a fantastic job of analysis regarding Fed policy and interest.

Good data allows one to access policy and make policy choices.

Given the reaction of the markets to the very slow raising interest rates, is it possible a different policy would have produced better results?

What if the Fed raised rates faster? Or at almost the same rater except to start with a dramatic “bang” to grab attention (.50% or .75% to start with)? Then continued with the .25% baby steps?

There has been a dramatic explosion in asset prices during this long period of baby step tightening. I have a hard time thinking that this additional asset appreciation has not made things potentially worse or vindicates the Fed’s deliberately very slow pace, which was presumably to reduce the chance of a bubble popping. On the contrary, the more assets go up, the more likely it seems there will be greater to less pain from the bubble popping.

If that’s true, it does provide justification for the very slow pace of the Fed and suggests it is a worse policy option than a more usual, faster tightening.

Possibly a good time to add a small HEDGE of a QID nasdaq short? (Not that I would want to profit on others losses). I miss the old days of counterbalance of investments (ie.stocks down = bonds up, or vice versa appear to be long over. , everything seems to be pointing at some point to everything moving down, including tesla)

Breaking 3% in the 10 year will be a momentous event. If it happens, we’re right on the cusp. The Feds desire for more “normalized” rates Will probably mean the US$ up, all other things down. This cycle’s getting very old and rising rates will most likely be its down fall.

“The hope is that there won’t be a repeat of 2008.”

This kind of overstatement creates a villan and makes for good writing, but might confuse some readers.

2008 was a liquidity crisis, while the banks now have trillions on reserve at the Fed. The economy might tank but we won’t see a repeat of 2008.

https://www.federalreserve.gov/releases/h3/Current/

Not quite. Actually not at all. 2008 was a CREDIT crisis!!!

Credit froze up. You can see that in the chart of the Financial Stress index included in the article. Even highly rated companies couldn’t borrow anymore at reasonable rates because the money market and corporate paper market (short-term credit), on which these companies had relied upon to fund long-term projects, had frozen up. So as a secondary effect, among other things, the credit crisis caused a liquidity crisis because the borrowing entities couldn’t borrow anymore and ran out of liquidity to make payroll etc. POOF, gone was the liquidity.

This is the problem with liquidity: if credit gets tough, liquidity evaporates. The Fed stepped in not to provide liquidity, but to unfreeze the credit markets: Among other things, in its role as lender-of-last-resort, and under an alphabet soup of hastily conceived programs, it lent directly not only to banks but also to some of the biggest companies in the US, including GE. The Treasury too responded to the credit crisis, and banks, including those owned by industrial companies such as GE and Cat, were able to issue government-guaranteed bonds. All these actions combined unfroze the credit markets. And then liquidity started flowing again.

This was separate from QE, which was designed to inflate asset prices and create the “Wealth Effect.”

But wasn’t the reason credit froze in the first place was because the banks did not trust each other’s collateral. And they were using the MBS as money collateral but did not trust the others valuation of that collateral after Lehman collapsed.

Yes, in the beginning was a classic financial crisis. When mortgages began to pop, the confidence in the banking system evaporated — and credit froze…

If the Fed can do QE (“wealth affect”) on it’s own accord, it can and should learn from real world experience and do what Iceland did. That would have created wealth, not affected wealth

Like Iceland, the Fed should even now vigoursly punish/prosecute the fraudsters who deliberately created the credit freeze in order to enrich themselves (pardon my lack of correct phraseology but the Fed does in fact have complete power to mercilessly and hugely punish fraudsters despite the fact President Obama and Congress protected them).

Wouldn’t that have been a far more effective the QE?

That’s what Iceland did (prosecute and imprison the credit freeze fraudsters) and it’s economy surged, while Obama choose the opposite policy and goes down in history as presided over one of the most historically disastrous U.S. growth rates.

https://tradingeconomics.com/iceland/gdp-growth-annual

The hope is THERE will be repeat of 2008, because the Fed playbook works, their methods turned markets around, and kept the global economy afloat. They would rather fight this enemy than one they don’t know like capital moving into cryptocurrency, or events they can’t effect, like global trade wars, or fiscal lockdown, or loss of confidence at the retail level.

The president is now tweeting about high oil prices and blaming the Saudis, after he made an arms deals with them. Of course oil prices are rising because interest rates are rising which puts the squeeze on low yield corporate debt. The real question is will the Fed bow to pressure, market and political? We need to consider how much rate hikes can THIS economy tolerate without recession? The crisis threshold is lot lower.

I wonder how the US frackers feel about this latest WH rant. I don’t know a lot about their balance sheets etc. but from what I’ve gathered from WS etc. the whole industry was only kept alive with credit when oil was below $50, and a spell of plus 60 is sorely needed.

Cheap credit pushed down the price of oil, (over supply through fracking, and Chesapeake Energy kept drilling because credit was cheap) now credit is dear(er) and oil prices are going up. If there was a national energy policy cheap credit was the catalyst which allowed the US to become independent, and to build out an LNG system that will keep Europe warm (and let Japan get off the nuclear) no matter what Gazprom does with supply. I don’t think the planners are that smart, but it seems to have worked out that way.

\\\

Two people are running a marathon. One cheats and gets into a car, and the other keeps running. After some time, the rules are again enforced, but they each continue from their current position without consequences or reward based on prior actions. Who will win the race?

\\\

My point being that taking cheap money off the market is only the first step. A good step, one that brings back some level of confidence into the government. The FED seems to be on the way to deliver its promise. But what is to be done to reverse the damage these rules have imposed upon the middle class and below? The FED can only do so much…

\\\

Wow, someone who thinks the FED even cares about the middle class. The FED wouldn’t give a hoot about the middle class. We are their livestock.

“The FED can only do so much…”

The Fed since its misbegotten 1913 creation by the robber barons of the era has had one prime directive: to transfer the wealth of the middle and working classes to its bankster accomplices. Every now and then the Fed has to mask its swindles by pretending to be a responsible central bank, but the true nature of this criminal private banking cartel will always come to the fore.

\\\

The issue at hand is a matter of self preservation. No middle class, no strong economy, no dollar, no FED. I mean not even they are that stupid that they can’t see the connection…or am I maybe wrong?

\\\

I agree, they could not care less. They probably never cared, with a potential exception of a member or two in the last 100 years.

\\\

Personally I don’t like the FED, and I think they should go to jail for conspiring against the people of the US in favor of big banks: conspiracy to commit fraud and theft.

\\\

Hi Wolf, as interest rates normalize-credit gets more expensive surely people-companies will try to reduce-pay off debts in anticipation?. In 2008 you had the credit crunch, the banks now if that happened would have excess cash to lend but be more careful who to lend to but less clients to lend to? Is that what will happen in the next couple of years?

Junk-rated companies will see much tighter conditions — and many will have to “restructure” their debts, either by putting the bankruptcy-gun to their creditors’ heads or by actually filing for bankruptcy. This is typical at the end of the credit cycle, and much needed. Bond holders will have to eat those losses. The junk bond market is immensely overvalued. So the losses will be very painful for those still in it when they occur.

The loans banks hold on their books are much better secured (collateral) than most junk-rated bonds, so banks will incur some losses, but not like bondholders. And that will be manageable for banks.

And yes, it will make the bond market and banks more careful.

But during the Financial Crisis, even highly rated companies had trouble borrowing. I don’t see this scenario on the horizon.

Same with consumers. I don’t think consumers with good credit will have trouble borrowing. But the loans will just cost more. The problem will be felt in the subprime market – where it has already started to play out, particularly in subprime auto loans.

There are a lot of non-bank lenders and smaller banks that have specialized on subprime lending – auto loans, credit cards, and mortgages. Quite a few of them will fail. Large banks are exposed to them by funding them via loans — and so there will be some losses too.

If this whole thing unwinds slowly with losses spread over several years, rather than all of a sudden, it will be manageable and is much needed.

Thanks Wolf yes hopefully things will unwind slowly. Normalisation of the interest rates is a good thing in the long term, bring a bit of sense of reality.