Compared to Chicago, which is traipsing that way.

Wolf here: This is what happens to the economy of a city when some debts are lifted off its back. It can breathe again. But affected municipal bondholders, pension beneficiaries, and other stakeholders may not be so fond of this kind of treatment. Chicago has been contemplating a similar fate.

By Bill Bergman, Chicago, Director of Research, Truth in Accounting:

The City of Detroit filed for Chapter 9 bankruptcy protection in July 2013. How has Detroit’s economy done since then?

Chapter 9 is part of the federal bankruptcy law, providing relief to financially distressed municipal governments from creditor demands. Pros and cons of going down this route are hotly debated, and some parties warn of the threat to the local economy due in part to reduced trust among creditors.

This post is not meant to be an exhaustive analysis of the Detroit experience. But looking at employment data, it seems difficult to make the case that bankruptcy hurt economic growth.

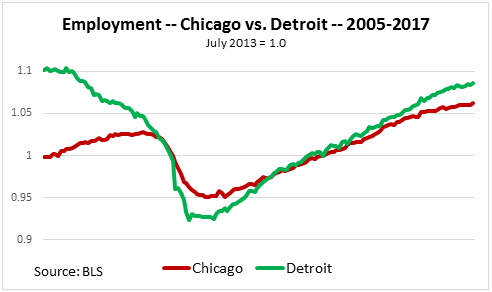

The chart below shows total employment from 2005 to 2017 in the Detroit-Dearborn-Warren metropolitan statistical area, compared to employment in the Chicago-Naperville-Elgin metro area. The chart indexes employment in both areas to July 2013 = 1.0, which gets both areas (one larger than the other) in the same neck of the woods in the chart and also allows you to compare the Chicago and Detroit metro areas since the latter declared bankruptcy. Employment growth in Detroit has outpaced growth in financially challenged Chicago, where in recent years growth appears to be slowing down.

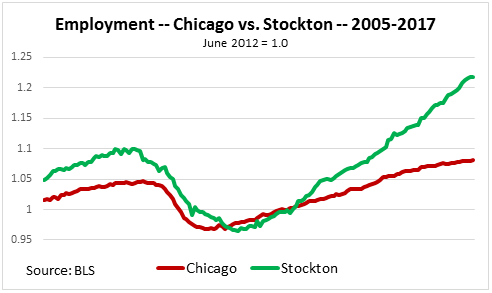

A year before Detroit declared bankruptcy, Stockton, Calif., declared the then-largest municipal bankruptcy in history. Comparing employment in Stockton to employment in Chicago since that bankruptcy tells a similar story.

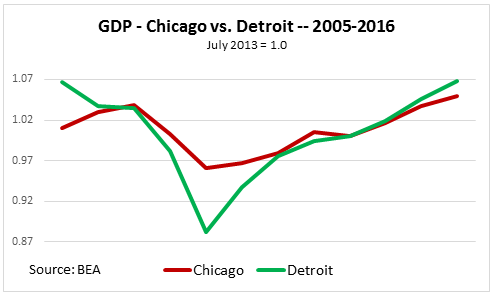

This is only employment data, but comparing Detroit to Chicago on a broader measure of “GDP” from 2005 to 2016 (the latest year for which GDP data is available) also suggests it is hard to make the case that declaring bankruptcy hurt the Detroit area.

By Bill Bergman, Chicago, Director of Research, Truth in Accounting

And borrowing money is not going to get cheaper. Bonds, junk bonds, spreads, commercial real estate, leveraged loans, over-leveraged companies… all get named as risks to the banks. This is why “gradual” tightening will continue for a long time. Read… Now Even a Fed Dove Homes in on the “Everything Bubble”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

San Bernardino, CA and I believe Stockton too, did not reduce pension benefits, even though the Federal Bankruptcy Judge gave the green light for them to do so. Those who “manage” these municipalities decide who to screw and who is made whole. Those managers are pigs eating from the same near-empty trough of taxpayer funded pensions. As long as those making the decisions of who gets what are themselves pensioners in the same unsustainable system, bond holders and other stakeholders will be the only ones to receive pennies on their dollars of “investment”.

yep — except no one cries for market participants who take haircuts on junk-rated bonds.

No evidence provided? Aren’t those pensions managed independently by outside providers and held immune from municipal bankruptcy? Isn’t there a giant and arguably corrupt statewide entity called CALPERS the California Public Employees’ Retirement System, that in fact manages those moneys?

Amen Gian… PJS

Well one would expect the lower indebted municipality to grow a bit faster than the heavily indebted one. They can improve roadways, offer tax breaks, permit and inspect things faster and all of the other activities businesses want and need.

And that faster growth means more taxes and the ability to carry heavier burdens of debt. So I would also expect bankers to happily buy their bonds when put on the market. The same things happened to Argentina and Iceland after they defaulted. Once the debt was cleared, they became good investments again. Though not long for Argentina. But bankers gotta bank.

Amen also……. MTK

I invest what little discretionary funds I can in Cal Muni’s and have for years. Now days though I do so with great trepidation! I pay a premium for AAA rated and insured bonds from what I (and my broker) considers ‘safe’. Still I worry a lot about most anything that comes out of California.

If your broker is a typical retail salesman, he probably doesn’t know very much about muni credits. A good rule of thumb is to avoid issuers where you wouldn’t want to live. Detroit was a troubled credit for over 40 years before it went bankrupt. On the other hand, Oakland County, MI has been an excellent credit for a long time. Moody’s currently rates its General Obligation bonds Aaa (highest rating). Oakland County has numerous high income communities north of Detroit.

I wouldn’t put too much faith in the bond insurance companies, especially if they have a lot of exposure to Puerto Rico debt.

This is why we should forgive all student loans tomorrow. So the kids can thrive. Isn’t leverage, then debt forgiveness wonderful? Then colleges can raise tuition, and more kids can get loans, once we clear the books of that pesky existing debt.

Let’s get Chicago, NJ, and Connecticut thriving again as well by forgiving their debt.

What could go wrong? Why didn’t we think of this earlier?

There is this meme out there that muni bonds aren’t risky, and that therefore yields should be really low (in addition to the special tax treatment they get). This allows cities to borrow too much at very little cost. Muni bondholders should realize that these things ARE risky, that they have a chance of losing a lot of money with them, and that therefore they should demand big-fat yields to compensate for the risk. Then a bankruptcy every now and then would be OK because bondholders were compensated for the risk they took, and so now they eat the losses. Just like with corporate bonds.

Also interest payments should not get any kind of special tax treatment. This would add to the cost borrowing for cities and make them a little more careful.

So what I got from this is that Chicago is likely to enter bankruptcy.

It has been thinking about it for a while.

Is Chicago gonna get any benefits from “Save Coal and Nuclear Because I Say So” plan? Because if it does the current US president is gonna look bad.

Actually, pointing out what cities are benefiting more from that would make a good article.

Because with Nuclear plants shutting down or just working at low power because the shut down is too expensive to do and Coal power plants shutting down… I don’t think even the locals know for sure if it affects their city or not.

I think a much better comparison for Stockton is Modesto. I don’t believe Modesto declared bankruptcy. they are close by each other with similar economies. Each is a county seat Stockton is 300K while Modesto is 200K.

Another good comparison of BK’s is Iceland and say Ireland or Greece. A bit tougher, but in general Iceland did much better to default on its debt.

I don’t really see how this can be very debatable.

With regards to Chicago going BK, I would offer this up. Michigan became a right to work state so, and despite being a Union town the handwriting was on the wall. So BK was much easier, despite its corruption. Stockton, in CA was held back for awhile because of CA being so leftist, but there was no real big group holding it back. I think Chicago is a different story. It has deep seated corruption with Dems and Labor still controlling things. Rahm Emmanuel is still trying to flood Chicago with immigrants to get re elected. And the whole State has huge problems and corruption that prevents it from facing the truth. I suspect they will hold on. If the people were smart and in charge, it would happen, but it’s not. Chicago and its population is similar to Boston and its Irish voting population. The Irish haven’t gotten much from the Kennedys or the Dems, but they keep voting for them. Not at all rational, but they do out stupid stubborness. they will only go BK when money dries up completely and they have no choice.

All the major towns in CA are going to follow Stockton’s path into bankruptcy due to the exponentially increasing chance of a trainwreck by CALPERS. Most if not all of the public pensions are run by CALPERS whose corruption is increasingly evident to anyone who reads the Naked Capitalism blog regularly which makes a point of tracking the shenanigans that the top officials (including most of the Board members and staff) at CALPERS go through to hide their flouting of the CA public records laws.

The fact that CALPERS won’t lower its “expected” fixed income portfolio assumptions (which are highly unrealistic) maintains the fiction that the pension system isn’t even more underfunded that it really is (officially its only 32% underfunded…lol). However, CALPERS is finally (two decades too late) starting demanding that the towns and cities whose pensions they run start ramping THEIR contributions to the plan….which blows a hole in the town/city budgets. (Consultants have pegged current contributions by cities at 8.3%….but say that will jump to over 15% in just 6 years.) It’s like a roach motel (can check in, but can’t check out)…since the towns/cities can’t afford the lump payments (financed by additional debt) they would be REQUIRED to make to CALPERS to take back control of their own pension management.

Why do you think you yanks did so well after WW11? All those military bonuses, free college, and most of all, all that war overtime in the mills, factories and shipyards cleared their depression debts and gave working people savings and war bonds to spend thus creating the affluent years of the 1950s onwards. Debt is not a moral issue, the students should be forgiven their loans, and the municipalities their debts, you need the kids to build the future and the cities built the past for goodness sake.

I am just reading “Detroit, An American Autopsy”

How does it possibly get worse?

Well, yeah…..If you can spend like a drunken sailor, and then shirk the bill, life is grand……except of course for the bag holders…..

After Detroit taxed off most of its tax paying real estate homeowners, it then stiffed its pensioners who thought that Detroit would continue to gouge other taxpayers for their benefit….oops……

Maybe bond investors should demand the same rights as credit card companies, that the government debtor, cannot bankrupt their way out of the debt…….LMAO!……..

I understand the Illinois Supreme Court would not allow the state to restructure its pension obligations as it violates the state constitution. This may lead to a default sooner rather than later; I’m not sure whether this decision also impacts Chicago.

Why not limit all public pensions, Federal, State, Municipal, to a maximum amount equal to that of social security benefits, and not payable until age 62 or higher. Of, course politicians will never do this as they too pig out at the public pension trough.

I know retired cops receiving pensions GREATER than the salaries they earned, many of whom retired with full pensions in their late 40’s to early 50’s. Oddly, many are strongly anti-union!