$2 billion just went POOF, from one second to the next.

This is just too funny. Longfin [LFIN], my favorite “blockchain company” and hero among scam stocks that I have lambasted since December, is at it again. But this time, it’s likely the last time.

On April 2, I published a piece titled, “What Kind of Hyper-Enthusiastic Market is this that Blindly Keeps Pursuing Scams to Make a Fortune Overnight, even if They Already Crashed the First Time?” It was all about Longfin, which went public on the Nasdaq last December, though it has nothing in the US, and whose CEO lives in Singapore.

On Friday, April 6, at 10:30 a.m., the Nasdaq halted trading in LFIN after shares had tripled in three days, reaching a market cap of $2.1 billion. The tripling occurred after shares had crashed 89% in the prior seven trading days.

Minutes after the trading halt, the SEC announced that it had “obtained a court order freezing more than $27 million in trading proceeds from allegedly illegal distributions and sales of restricted shares of Longfin Corp. stock involving the company, its CEO, and three other affiliated individuals.”

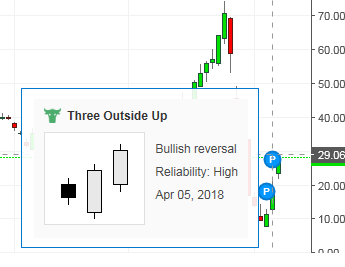

Take a look at the chart, depicting the last two weeks, including the 89% seven-day plunge and the 250% three-day surge, with the trading halt Friday morning. In terms of dollars, shares went from $73 to $8 in seven days, and then from $8 to $28.19 in three days, when trading was halted:

The chart below shows the short and glamorous life of the stock from its IPO in December until its trading halt on Friday:

The blue circles with “P” inscribed in the chart appeared on April 4 and April 5. When you hover over them on the Investing.com website, a box pops up with some technical analysis: “Bullish reversal. Reliability: High,” just before the dream went POOF at 10:30 a.m. on April 6. Here’s the April 5 box:

And the SEC on Friday went on in its calmly brutal manner:

According to a complaint unsealed today in federal court in Manhattan, shortly after Longfin began trading on NASDAQ and announced the acquisition of a purported cryptocurrency business, its stock price rose dramatically and its market capitalization exceeded $3 billion.

The SEC alleges that “Andy” A., Dorababu Penumarthi, and Suresh Tammineedi then illegally sold large blocks of their restricted Longfin shares to the public while the stock price was highly elevated. Through their sales, A., Penumarthi, and Tammineedi collectively reaped more than $27 million in profits.

According to the SEC’s complaint, Longfin’s founding CEO and controlling shareholder, Venkata Meenavalli, caused the company to issue more than two million unregistered, restricted shares to A., who was the corporate secretary and a director of Longfin, and tens of thousands of restricted shares to two other affiliated individuals, Penumarthi and Tammineedi, who were allegedly acting as nominees for Meenavalli. The subsequent sales of those restricted shares violated federal securities laws that restrict trading in unregistered shares distributed to company affiliates.

“We acted quickly to prevent more than $27 million in alleged illicit trading profits from being transferred out of the country,” said Robert Cohen, Chief of the SEC Enforcement Division’s Cyber Unit. “Preventing defendants from transferring this money offshore will ensure that these funds remain available as the case continues.”

The SEC’s complaint, which was filed under seal on April 4, charges Longfin, Meenavalli, A., Penumarthi, and Tammineedi with violating Section 5 of the Securities Act of 1933. The complaint seeks injunctive relief, disgorgement of ill-gotten gains, and penalties, among other relief.

The LFIN scam started on December 13, following its IPO. On December 15, LongFin announced that it had acquired a “blockchain-empowered solutions provider,” as it called it, namely a website that belonged to a Singapore corporation that is 95% owned by Longfin’s CEO. The SEC called this website “a purported cryptocurrency business.” Nevertheless, shares skyrocketed 2,700% to an intraday high of $142.55 on December 18, giving it a market cap of $7 billion, after which the insiders started selling shares illegally, according to the SEC allegations.

The whole thing was a stock manipulation scheme from day one. And the shares collapsed.

But then on March 12, it started all over again, when index provider FTSE Russell announced that LongFin would be added to some of its indices, including the Russell 2000. That caused the huge surge in March. But on March 26, Russell announced that Longfin would be removed from the indices because it had misrepresented its free float of shares. And shares re-collapsed.

On April 3, Longfin finally disclosed that the SEC had been investigating it since March 5 and admitted that it has no accounting controls because it “lacks qualified personnel who fully understand GAAP reporting requirements,” and that therefore any financial disclosures it does make are fabrication. That day, shares plunged another 31%.

But by April 4, the true believers, morons, and spaghetti-code algos piled into the shares again and drove up the price 250% in three days. Of course, this is only a theoretical value. In reality, they’re stuck with the shares, now most likely worthless if they ever start trading again, at a time when the company in the US, given the SEC’s actions, will likely disappear.

Astonished at all the nonsense going on in the market, of which Lonfin is just one example, I wrote on April 2:

But what kind of hyper-enthusiastic market is this that blindly keeps pursuing the latest scam, knowing all the things that are wrong with it? How can the people and algos that make up this market drive these shares so high as to give a nothing-company with the iffiest disclosures a market capitalization at one point of $7 billion? And after it crashes, how can these players in this market try to do this all over again?

The irony, well the funny part, is that a few days after my words — uttered in total disbelief about these morons, true believers, and spaghetti-code algos that make all this possible — it happened all over again, and with a vengeance. But this time will likely be the last time for LFIN.

The Fed’s QE-Unwind is clicking along at the pace that accelerated in January, despite the sporadic stock market sell-offs. Read… Fed’s QE-Unwind Proceeds Despite Stock Market Sell-Offs

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Only Natives can scam! E.G. Goldman Sachs

Just another day in wall street.

Anyway, here’s the pretty face of the Longfin CEO, Venkata Meenavalli :

https://static1.businessinsider.com/image/5ac7be3c146e7124008b47af-1200/b17%201.jpg

His corporate tagline says it all… “Calculating the Incalculable”. lol

Love the terminology ‘Spaghetti-Code Algos’. Having spent 25 plus years in the IT field, I would say that it’s very fitting. Lots of times, it’s much too expensive to rewrite very old code from scratch in newer technology, which is probably what should be done. It’s surprising how much of our financial code is so frigging antiquated. It’s much cheaper to put an object-code wrapping around it so that it appears on the outside to be modern. But as the old saying goes: “Putting lipstick on a pig doesn’t change the fact that it’s still a frigging pig.”

Well said!

You remind me of the day when I rewrote someone else’s probable 2000+ character SQL select. I understood what it accomplished overall, but the way it did it was beyond incomprehensible. The problem it solved was complex, but the original programmer decided to treat it like one big monolith, as opposed to decomposing it into several steps and making it flexible enough to be called from more than one program. That’s what I did when I rewrote it. The end result was easy to use, read, understand, and maintain.

This was nearly 20 years ago. I’m sorry to hear people still write junk like that.

I spent 6 months converting about 20 pages of spaghetti basic to OOP(Delphi) it was mostly astrophysics, what a nightmare.

Something about a Fool and his money…?

In a couple of decades, people will write books that tell a similar story, only they will write about central banks, QE, rate manipulation, asset purchases for the purpose of price manipulation, debt monetization for the purpose of covering daily national expenses, kick the can, empty cities, and how nobody cared about all the inherent fraud implied and executed. People then will be baffled by concepts like these and why people were stupid enough to go along with the massive accumulations of debt these programs caused and how the 99% got stuck with the bill. Cryptos will only rate a couple of paragraphs in that story.

In a couple of decades, once environmental destruction and its effects have set in, it will be the Hunger Games.

Your story of QE, etc have existed before i.e. empires have risen and fallen, hyperinflation has happened before to great civilization like China, etc.

Don’t worry. The final victory will belong to the muppets. If anything, the story of human beings has always been the story of muppets with its attendant ignorance, etc. The wise, etc are the exception.

Let’s raise a glass to muppets!! May they continue to muppetize everything!!

Even in universe is explained that the Hunger Games are just a Roman Circus to control people and that’s actually more expensive that fixing the food problem would be. But they keep at it to keep control of people.

“When all the trees are cut down, when all the animals are dead, when all the waters are polluted, when all the air is poisoned. Only then will they know you can not eat money.”

Cree

Haven’t all these books been written already. It’s not like this is anything new.

Just get out of bed? The story is maybe half over. The free lunch didn’t work but the debt still needs to be repaid with real money.

Even with the Fed, the building of the balance sheet was called a ‘tool’. Today, it’s called a ‘problem’ to reduce it, and we’re the cleanest dirty shirt by far. China has empty cities and fake wealth funds and is going more totalitarian to deal with their ‘problems’.

The Eurozone is still whistling past the graveyard, and hoping gravity does not apply to them, or at least no news media types actually ask questions that someone who took econ 101 would think interesting. The Eurozone will be the big show when they finally face rate normalization. China has a thousand year history of totalitarianism. They’ll survive.

Perhaps the fall of the Roman Empire was caused by lots of dirty money, in addition to other causes, such as incompetent leadership who lived for the free lunch and saw the table empty. Today’s parallel is EU Kick the Can. This, I believe, will be what the Eurozone looks like after rates rise and ECB QE stops working, no matter how much they decide to print. A mess for the history books.

Economically speaking, Japan and its antics with the BOJ, QE, almost complete Japanese debt monetization and massive, almost total ownership of Japanese ETFs is more of a comic book sideshow. They used to matter. Their public debt will be ‘paid off’ by book keeping entries with the BOJ. Any losses on the ETFs will also be book keeping entries to dismiss.

The same with the Swiss National Bank and their nearly $100 billion equity fund. Anything purchased with printed money has a cost basis of $0.00. Publicly acknowledging this is embarrassing only. The Swiss can’t lose money on this as long as anyone outside of Switzerland will accept Swiss currency.

They’re both comic book sideshows. The real action will be the Eurozone when QE ends, either by choice or because world economics forced it upon them.

More of a comment to cdr’s reply to you….

The operative statement you made (and it applies equally to Japan or the EU) was “as long as anyone outside of Switzerland will accept Swiss currency”.

The entire edifice is predicated on PUBLIC CONFIDENCE in the gov’t….something that has been eroding at an exponentially increasing rate in many countries. While exponentially seems to be alarming….an exponential increase on a very small base can occur for awhile without reaching a point where it becomes bothersome….witness how long it took confidence in Venezuela to collapse despite crazy economic policies for over a decade.

High unemployment isn’t necessarily a trigger…unless it triggers and is accompanied by high inflation. This is why the EU policies haven’t triggered a collapse in the Euro (yet)….so far they have kept inflation in check.

However…a trade war is likely to trigger higher global commodity inflation…not to mention disruptions in supply chains which can engender bankruptcies…and adversely affect the banks. This causes them to pull back on lending….and starves businesses which are over leveraged…..creating a vicious cycle. So the gov’t steps in to bail out strategic financial institutions….but what happens when the gov’t is Italy…who gov’t bonds NO ONE wants to buy (even the ECB…though it has been the buyer of last resort)….can’t find a palatable bailout package?

i.e. Minsky point….

“Those friends thou hast, and their adoption tried,

Grapple them unto thy soul with hoops of steel,

But do not dull thy palm with entertainment

Of each new-hatched, unfledged comrade.”

Polonius advising Laertes, Hamlet, Act 1, Scene 3

Check out the documentary China Hustle which can be seen on Netflix.

“… true believers, morons and spaghetti-code algos…”

Very nice, Wolf, very nice…

This story has some application to the overall stock market, which also relies on an earnings fairy tale.

Everything is fake these days. Stocks are fake, companies are fake, 90% of gold in circulation is nothing but paper gold. And you have an app such as MakeApp which removes makeup from celebrities, and suddenly you find out that your favorite singer or actress in reality is so ugly that you won’t even hire her as a maid.

Everything is fake.

Not Wolf!

That, I’d have to agree with. Wolf is in love with numbers :).

:-]

I agree with you, I would only hire fakers as well b/c being fake qualifies for social reward and anything else requires going out on a ledge, especially so in the case of non-minorities.

I’m not sure where or if Native Americans fit in there but judging by their tiny DC museum I’d guess oddly enough, not very high.

After watching CEO Venkat Meenavalli on CNBC’s fast money, the last tiny bit of my faith in the possible legitimacy of the market evaporated.

Just watch the performance of this person who was allowed to run one of our public companies. https://www.cnbc.com/2018/04/04/controversial-crypto-stock-longfin-surges-then-halted-after-its-announced-ceo-to-appear-on-cnbcs-fast-money.html

If this guy Venkat Meenavalli can manage such a massive scam, I’m in the wrong business. I should be multibillionaire by the end the year.

Imagine what sort of moron is buying shares of this company? I bet they don’t even know who the CEO is, or how many employee the company has. It seems as if this guy has been running one of the Indian outsourcing companies, and suddenly have decided if I just claim I’m working with crypto, I can extract millions from those stupid Americans; little did he know that he could extract billions from us.

“spaghetti-code algos”, Wolf, I don’t think it’s nice to make fun of my extremely late night coding.

Be interesting to know exactly who was buying and selling and win? I smell a “pump n dump” exit strategy being executed.

Credulity of those who want to believe is unlimited, like the man who caught his brother in bed with his wife and, when asked what happened, said: “He lied out of it”.

And how much jail time are these clowns going to get:

Zilch!

Like what Don Henley said, “A man with a briefcase can steal more money than any man with a gun.”

Or –

Its easy to steal money. Just own a bank.

While fines for violation Section 5 are usually modest, the Securities Act does indeed call for jail time for most violations. Similar Section 5 violations in the past resulted in anything between two and five years, to be served in a Federal jail.

However… while the US and India have an extradiction treaty in place since 1999 India, very much like France, very rarely extradicts her citizens and usually only when either a lot of political pressure is applied or there’s an exchange to be made.

Unless one of these four individuals got a US citizenship (highly unlikely) all they have to do is get back to India and stay there to avoid any penalty bar seizure of their US-based assets, if they have any.

If these four men get convincted (most likely and most likely in absentia), any extradiction request by US authorities is likely to be ignored by Indian authorities, stonewalled by them or (again most likely) to get at the very bottom of the “to do” list of the fearsome Indian civil service and left there to die.

Unjust, I know, but that’s a situation most Western countries appear comfortable with, as they keep on believing India is the next China despite a decade of proofs to the contrary.

I really liked the part where they…

admitted that it has no accounting controls because it “lacks qualified personnel who fully understand GAAP reporting requirements,” and that therefore any financial disclosures it does make are fabrication.

April 15 is coming… Do you think I can use that with the IRS?

Could it be, at least partly, due to to shorts closings?

I don’t think Wolf’s readers are the right market for this offering, but what the heck

I recently acquired a golden unicorn that craps solid gold. Not being greedy, I am willing to share this opportunity through a private offering.

I have a goose that lays golden eggs and I can beat Night-Train’s price.

It’s a dog eat dog world.

Love the headline! As good as John Malkovich’s moron outburst in Burn after Reading.

How did this company ever get listed on the Nasdaq ?

I’d would love to know who approved Longfin’s initial listing

and how they benefited.

Longfin did its IPO under “Regulation A+” — meaning under the “Jumpstart Our Business Startups Act” of 2012. This act was designed to make it easier for companies to go public. Among other things, it sets lower accounting and disclosure standards. So this was bound to happen.

Here’s a pretty good piece on it:

https://www.wsj.com/articles/longfin-collapse-puts-focus-on-lax-ipo-rules-1522788520

If you don’t have access to the WSJ, you can Google the topic.

But I don’t want to blame Reg A+. I want to blame the scammers, and stock jockeys that played that scam.

“So this was bound to happen.”

Yes, and was predicted when the law was passed..

This legislation also shows that when bi-partisan agreement occurs, it’s often to deregulate finance, setting the jackals loose.

Thanks for the reply, Wolf. I would guess that

Longfin did not even meet the newer, relaxed

standards.

Back in the early 2000s I got a call from Schwab inquiring if I was trading penny stocks since that didn’t match my profile. I said no and Schwab reversed the numerous fraudulent trades. I had to create a new password and found that my Email alert was set to null. Turns out that scammers acquire large amount of worthless stock certificates and then hack accounts and purchase their shares to drive up the price and dump their worthless stock on the public who speculate in penny stocks. They also know full well that their illegal trades will be reversed. Schwab indicated a number of customer were also hit.

Wow!

I honestly can’t think of a country that is as full of sh*t as the USA. It couldn’t tell the truth even if the devil had hold of it.

You have to know what the “truth” is before you can tell it. The problem is that far too much of the “truth” in critical socioeconomic areas is subjective and highly dependent on the individual’s worldview, that is their objectives and experience.

I have to agree with Wolf on this one. Moreover, as one of a number of ‘morons’ that thought Long Blockchain Corp was at least as good as a Madoff Ponzi, I thought it would have a long run just like Madoff did, but this is the fate of a ‘moron’ & ‘true believer’ like moi.

I’m glad I keep up with this blog.

:)’

MOU

I’ve been a “moron and true believer” plenty of times in my investing life :-]

The trading & investing world is the best place to be in so far as error is a part of the business, and so is admitting it too.

You are someone that I can look up to, Wolf. The mark of a truly seasoned professional is their ability to admit when errors are made, or that they too can be subject to error. Even Greenspan had to admit his eventual ‘flaw’ in terms of worldview. I hope you or I never make that kind of super huge error, but at least Greenspan admitted it in the face of all out conflagration in the Finance world.

Investment & Trading are much more mature fields than Macroeconomics, Economics, or Accounting IMHO. Since 08 the Traders & Investment gurus have been able to articulate the waves of crashes whereas the Economists are still debating what went wrong pre-08.

Like the BIG three automakers we should be able to recycle our Economists into parts when they outlive their efficiency. Summers is still useful, but Greenspan & Geithner/Paulson should be sent to the recycling depot IMHO.

P.S. And if I ever win the lottery I will invest. So far I’m just learning for now thanks to you, and your blog, plus a few others. Lets hope I can pay-it-forward someday on something legitimate unlike Long Blockchain Corp.

cheers, MOU

meanwhile Martha Stewart was sent to prison for less.