Resting Happily on Smoldering Powder Keg.

There is nothing like a big shot of leverage to fire up the stock market. And that’s what the market got in 2017, when the S&P 500 surged 26%, and in January 2018, when the index soared another 7.5% through January 26 – until suddenly something happened.

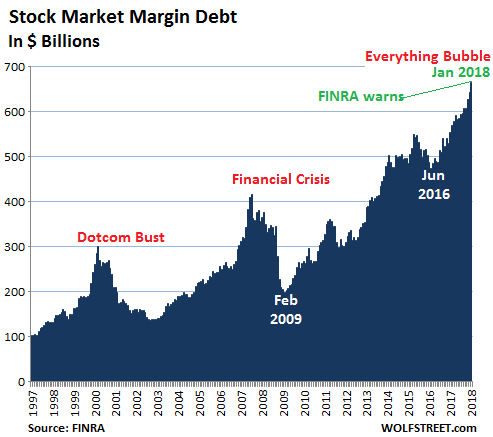

One measure of leverage in the stock market is margin debt – the amount individual and institutional investors borrow from their brokers against their portfolios – which surged $22.9 billion in January to a new record of $665.7 billion, according to FINRA (Financial Industry Regulatory Authority), which regulates member brokerage firms and exchange markets, and which has taken over margin-debt reporting from the NYSE.

For the 12-month period through January, margin debt soared $112.2 billion, among the largest 12-month gains in the history of the data series, behind only the 12-month periods ending in:

- December 2013 ($123 billion)

- July 2007 ($160 billion)

- March 2000 ($133.7 billion)

- November 1997 ($132 billion).

But it’s not just the recent surge; it’s the length of the surge. With only a few noticeable down periods, margin debt has soared for nine years in a row and now exceeds the prior peak of July 2007 ($416 billion) by 60%.

By comparison, over the same period, nominal GDP (not adjusted for inflation) has grown 32%, and the Consumer Price Index has grown 20%. In other words, margin debt has ballooned twice as fast from peak to peak as GDP and three times as fast as the Consumer Price Index.

The chart below shows margin debt based on the FINRA data, which includes margin debt from its own member firms and from NYSE Member firms, and is therefore more complete and larger than the NYSE data was. For example, NYSE margin debt in November 2017, the last month available, was $580.9 billion while FINRA’s data for November showed margin debt of $627.4 billion.

And in January, FINRA warned about the levels of margin debt – marked in green on the chart. Note the spike that started in June 2016:

Rising margin debt creates liquidity out of nothing, and this new liquidity is used to buy more stocks. When stocks are dumped to pay down margin debt, often in a bout of forced selling, the money from those stock sales doesn’t go into other stocks or another asset class. It just evaporates.

Stock market leverage, such as margin debt, is the great accelerator for stocks — on the way up and on the way down. It’s thrilling for investors on the way up, and treacherous for the market on the way down.

Margin debt is so out of whack apparently that even FINRA – which “self-regulates” the very entities for which lending against securities is an important profit center – issued an alert on January 18. It was “concerned,” it said, “that many investors may underestimate the risks of trading on margin and misunderstand the operation of, and reason for, margin calls.” It added:

Investors who cannot satisfy margin calls can have large portions of their accounts liquidated under unfavorable market conditions. These liquidations can create substantial losses for investors.

And it listed these specific risks:

- Your firm can force the sale of securities in your accounts to meet a margin call.

- Your firm can sell your securities without contacting you.

- You are not entitled to choose which securities or other assets in your accounts are sold.

- Your firm can increase its margin requirements at any time and is not required to provide you with advance notice.

- You are not entitled to an extension of time on a margin call.

- You can lose more money than you deposit in a margin account.

FINRA issued this alert before the recent sell-off. Just how volatile a highly leveraged market can get was amply demonstrated days later when the Dow dropped over 1,000 points a day, on two days, and the S&P 500 index dropped over 10% in five trading days. This sell-off was barely big enough to be visible on a long-term chart. It was just a reminder of what a highly leveraged market can accomplish in no time. But hey, stocks surged since, and nothing is going to happen to that smoldering powder keg.

Warren Buffett only made one large deal in 2017. And this is why his “recent drought of acquisitions,” as he says, is likely to continue. Read… Why Buffett Pulled Back: Companies Overvalued after “Purchasing Frenzy” Fueled by “Cheap Debt”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Margin Debt, Consumer Debt, Corporate Debt, The National Debt…does anyone want to venture a guess as to what the next major crisis is going to be called? Great analysis Wolf.

No one has more leverage then the Fed. And with propping up the stock market their number one mandate, there should be little worry about any lasting downturn. After all, every Goverment budget, 401k, pension, ira and 529 depend on an ever increasing stock market. They will make it happen. One way or another.

With all that printing people will eventually lose faith in the currency. So it can’t go forever.

Imagine a world where the FED decides to take profits.

Whats the point in taking profits when you have the ability to print as much currency as you want, at will.

The profit motive has no effect on the fed.

Exactly, you beat me to it Haus.

That’s where you’ve got it wrong: the banks that own the Fed, and every other central bank, have, to the extent their nations can be saddled with additional debt, been getting money virtually interest free the past 10 years, with which they have been accumulating hard assets- for themselves- and at the same time using it as an excuse to pay savers next to nothing. The problem is they have all been doing it, which means prices have nowhere to go but up. The Fed, as you say may have no profit motive, but the banks sure do.

You have to be precise about the “leverage” of the fed. They have 8000 tons of gold, well, certificate. But still, on paper, FED has claims of 8000 tons gold physically in the US treasury. 8000 tons at 1300$ per ounce is 350 billion. say the FED has balance sheet of 4.5 trillion, that is only a leverage of 15:1. That’s the gold alone.

You could not be more incorrect.Among the goals of the Feds tightening policies is a lower stock market and higher credit spreads.Just look at the St Louis financial stress index.

Companies have buying back stock at a record pace during the past few weeks.But much of this buying has been centered in those companies with highest cash balances.Eliminate those companies and you will find much of corporate America up to their necks in debt and facing insolvency during the next downturn.

Ah but it’s different this time I’ve heard that before. LIKE HE’LL IT IS

Wolf.

If there is a “fat fingered” fall in the stock market of 20% in the middle of the day, but the market rebounds back to where it originally was before that fall by end of day. Does the brief, intra-day low trigger margin calls.

Such a scenario will be incredibly chaotic. Margin calls will be triggered for sure. Brokers will try to execute them. I’m not sure they will all be executed because this is just too fast. If they’re all executed (by machines), the market will not bounce back for a long time because the forced selling, and the destruction of portfolios that this causes, isn’t a fat-finger thing. If margin calls are executed automatically, this would lead to a classic crash that will take a long time to work through.

For that reason, I actually cannot envision that the S&P 500 crashes 20% and bounces back within hours.

Wolf,

Why I agree with your thoughts here, take the scenario in your head … the market tanks 20% and Powell gets on TV a few minutes later, its on Fox Business, CNBC, CNN, MSNBC, Fox, ABC, NBC, CBS and he basically says the Fed is ready to purchase an unlimited amount of equities to “stabilise” the market.

Would the above change the outcome of your analysis?

I never tracked, but Inwould imagine Venezuela’s Maduro must have gone to TV and ensures everybody with the full faith of Venezuela’s government power. And what happened to Venezuela? I am NOT suggesting US is in the state of Venezuela, but hey, the man in TV ensuring everybody is basically the same trick. What I kept hearing is the total US asset is like 100trillion, XX trillion in real estate, XX trillion in stawks and XX trillion in bonds. Now you have a 5 trillion FED goes to TV and ensures the 100trillion will NOT fall? One day people will realize how pumped up the thing is and all the US glory/faith/confidence in the past is simply a CON.

The inevitable scenario in which the market quickly drops %20 is one involving an exongenous event combined with a” short volatility “ panic.

What will this exogenous event be?

Military confrontation?

Major terrorist event?

Political disruption?

A major company failure?

Hacking of a major system?

“For that reason, I actually cannot envision that the S&P 500 crashes 20% and bounces back within hours.”

She brakes 20% in this HORRENDOUSLY over-leveraged environment, she will keep going a long way after that.

IMHO

“You can lose more money than you deposit in a margin account.”

If you have that type of account. You can get “No loss” beyond deposited funds, Accounts.

But it crashed 10% in 2010, and recovered intraday, on what was allegedly a fat-finger.

The best part is, today, you might not even need to make a trade to crash the market. According to a ZeroHedge article (so maybe, maybe not), all that counts are bids and offers in the deep-out-of-the-money options markets which drive the VIX. If in fact VIX is computed not from actual trades, but only from the bid/offer stacks on those options, then anyone can trigger a market crash whenever VIX is really low and the S&P is floating on thin air.

For those not paying attention back in 2010, here’s the primer.

https://en.wikipedia.org/wiki/2010_Flash_Crash

Interestingly, in 2010, market participants who stepped in to provide liquidity during the trough (when the algos had all bailed out), and thus prevented the carnage from being even worse… were sometimes rewarded by having their winning trades arbitrarily revoked after-the-fact. Calvinball rules were made up on the fly.

I wouldn’t trade an intra-day dip in today’s market, because the 2010 experience shows that when the SHTF, it’s entirely likely that only closing prices will be allowed to “stick” on trades. And even this past month, the markets broke down and were unable to execute trades in many many cases. Hard to be a buyer if there’s no guarantee that your trade will be considered valid, and if there’s no guarantee that you’ll be able to see.

Circuit breakers would be triggered multiple times before a 20% drop intraday. There are many measures to prevent the stock “market” from trading like a true free market.

Not if it occurs in the last hour of trading.

The players know where the stops are, the circuit breakers, even where the Fed will draw the line before using “illegal” PPT capital infusions. (15%) In 2008 it was Paulson not Bernanke who pulled the rabbit out of the hat. The Fed is a bunch of academic savages, next time they will be brushed aside with alacrity, and heavy handed measures designed to restore domestic “tranquility” to US markets will end the global experiment in money printing, which the US has been the least egregious pursuing, and from that some policy direction should be assumed during the rollback. Speculation is a side show, like GDP growth and CPI. At some point the margin call rate will be adjusted (as global speculators try to corner the stock market). Don’t get in the way of that train.

Circuit breakers would halt all trading after 7% market index drop and the market will remain closed until there is an uptick. This was instituted after the 15% five minute flash crash and recovery.

The Futures market halts trading after only a 5% drop, such as what occurred after Trump was elected. As soon as it was certain Trump was going to win stock futures fell straight to the 5% loss and the circuit breakers halted all trading until there was an uptick. As soon as there was an uptick buy the dip momentum was off to the races – and has been ever since.

20% drop in a single stock, sure still happens all the time. 20% drop in the broader market, not allowed. It’s no wonder investors won’t own individual stocks anymore – losses in the SPY are capped at 5% on any given day.

Ray Dalio said there’s lots of cash in the sidelines guys. Better jump in before it’s too late. Plus this year will see the biggest share buybacks in history.

Cash on the sidelines is a myth.

Looks like this market is heading for 30k before the summer.

There is so much data out there to support any kind of narrative, if you think the market will go down, available data makes it look like a sure thing. It has been so since 2013 yet the markets keep going higher . Same with real estate.

There must be smth more insidious going on that escapes our understanding.

The weekend before last we were out shopping the big President’s Day sales. The sales weren’t especially good and the stores were mostly empty. This past weekend we were out again. The sales were extended because the merchandise still hadn’t moved . This time the stores were packed and you could barely find a parking space.

The difference was tax refunds. I expect the increased activity to continue throughout tax refund season. Our refund in the past has taken at least 3 weeks to process, this time it took 9 days. Extrapolating our experience, I think there will be a spike in the economy until April/May. The summer will probably see a slowdown.

That $665B of margin debt represents about 2.25% of the total US stock market capitalization which doesn’t seem that enormous. Everything has been so greatly inflated that hundreds of $billions may not be that much in the scheme of things.

Isn’t it all about the interest rates? The Fed funds rate rose to over 6% to end the dotcom bubble and over 5% to ignite the housing/financial crisis. Is the current 1.5% FFR a large enough match to light that smoldering powder keg?

Don McLean told us about the day the music died. When the Central Banks were allowed to commandeer the global financial system and print $trillions, purchase assets, unleash financial repression and transfer wealth, that was the day free-market capitalism died. Hopefully, one day it can make a comeback.

https://www.youtube.com/watch?v=CzxPgM4A0Xs

Maybe so, but I guess the standard of living is a bit higher in 2018 than it was in 1912. so I’ll live with it.

Is it? I’m not convinced it is More complicated YES more indebted slaves sure Better not so sure

It most decidedly is. The vast majority of American lived in abject poverty.

Now, we might agree on some decline since 1965.

When I attended elementary and high school, we were issued textbooks. In the public school, it was YOUR textbook. In the private (Catholic) school, you had to return it in good condition to be reused. Shortly after I left school, public schools started retaining the textbooks.

Now, they specifically do NOT even issue textbooks for most classes. You are lucky if you get a copyright-infriging mimeograph. Saving money and all, right? On top of that, students are now required to do 90% of their homework on the internet. You don’t think wealthier families have a HUGE advantage in this environment? What about kids that may not have internet access at home (this is prevalent where I live)? The standard of living has declined markedly in my lifetime.

The washing machine was a huge labor savor. Mechanized farm equipment, too. What do we do with all of this extra time? Watch netflix on the smartphone? Attend 12 hour Super Bowl bacchanalia? Spend hours on social media? Even when the smartphone is useful for work, are we better off responding to emails/texts in the evening hours? Our standard of living is screaming for a reset.

And please tell us where and when “free market capitalism” ever existed.

Was it when John D. Rockefeller was putting Standard Oil together?

Or was it when slave-holders were given special political dispensations under the Constitution’s 3/5 clause?

Or when the British East India Company was free-marketeering in Asia, with a bit of help from the British navy?

Or was it back when the Brit aristocrats were enclosing the village Commons, and driving farmers into the cities?

Some myths don’t die hard; they never die at all.

Thank you.

Sure Michael, no system is truly perfect or free but all the examples you cited were from a long time ago. We’ve made a lot of progress since then. The issue now is the wealth distribution of the country is becoming too uneven. We’re getting a little top heavy to say the least. That was the gist of my post. Anyway, thanks for your feedback and I’ll try to keep my myth spreading in check. Cheers

The GINI coefficient is currently the highest on US history.For many our current economic system resembles the feudal system of the middle ages more than any ideal of capitalism

Great comment. It’s a rigged game always has been.

China has pulled 700 million people out of poverty, and created some unreal amounts of infrastructure in a span of twenty years. Using marxest values not capitalist values.

“Using marxest values not capitalist values.”

china is a TOTALITARIAN not communist state.

china pulled those peopel out of Poverty, using Capitalist systems in a 1 Party Totalitarian Dictatorship.

It was a great achievement, do not try to attribute it to Marxism/Communism, when Marixism/Communism did not cause the achievement

“By comparison, over the same period, nominal GDP (not adjusted for inflation) has grown 32%, and the Consumer Price Index has grown 20%”

By comparison, over the same period, my nominal income has gone down 20% and my consumer price index has gone up by about 25%. I was just talking with a counterpart at one of my main customers and he’s had 1 raise in the same time period.

I don’t know how much longer this trend can continue it’s entering decade #3 but I don’t see it changing anytime soon.

There is no future in the United States of America IMHO, well at least not for me.

Not too long ago (last year?), you mentioned that your revenues actually turned around and went up, if I remember right. Was this just a blip or has there recently been an uptick?

that was a couple years ago actually. 2013 (can you believe it’s been 5 freaking years!!!) it was a “great” year in that I finally had sales close to equal of my best year ever which was 1997……yes 1997. And then the bottom fell out again so it’s been a struggle ever since. I’ve said I’ve been in recession since Q4 2014.

2016 was a disaster, 2017 was a bit better but stalled big time right around Halloween and 2018 isn’t turning out to shabby….but we’ll see.

The thing is I have no pricing power but I’m lucky i’m still in business as many in my industry are long gone.

the other grip is, thanks to 3D software ($4,500 a year in maintenance) i’m providing 10 times the information than I did in 1997…..which is partly why I guess I still have the work. But still.

So, since the stock market is run by bots, how long until they get “hacked” by false data?

Considering the fact it can take hours for fake news to be revealed as fake, that’s something to worry about.

When it goes off it will be so load America will be deaf instead of debt.

Like I wrote a week ago, this is the crash inoculation phase of the market cycle. Big dramatic drops followed by highly touted recoveries. Three or four more of these and those with short memories will not only ride the market through any gyrations, they will buy heavily into the dips. Until the big one hits and guess who will be left holding the bag

In technical terms we could call this system “resonant”. The FED rate increase is a dampening mechanism, but seems to be insufficient as there always cash to burn (the system inertia is too big). These systems increase their energy state until such a time when the material gives in to fatigue or a complete system breakdown is achieved. There is still time to turn around…

Just the other day, “Uncle Warren” was interviewed on CNBC and one of his sage pieces of advice was never to buy stocks on margin. Interesting timing. Coincidental? I doubt it. Warren is the mouthpiece for the men at the controls.

Margin interest is a risk, yes, but probably considered manageable at or below these levels. Remember, margin interest’s benefit is primarily to help levitate stocks AND a nice source of income for the brokerages and banks. So it’s a balancing act.

“They” might have to do another round of market selloff similar to a few weeks back to keep the boil down to a simmer. You can pretty much expect that. Sort of like pulsing the system to keep it in line. And the selloff may have to be a bit steeper than last to put a sting in the “margineers”.

The Institutions can buy on margin to their heart’s content. They are insured by the Fed and the taxpayer as 2009 taught us.

Dave Kranzler has an article today stating that the Fed must keep the stock bubble inflated or the pension funds, which are heavily invested in stocks, will all be hopelessly insolvent. Pretty safe bet then to go leveraged long, unless it isn’t . . .

Not such a safe bet unless you’re in the club. The minnows are periodically washed out in the rinse jobs. The club will flourish because of the pension need, though.

The Fed is most certainly propping up pensions by rigging US indexes ever higher. It’s required, not only to make up for past shortfalls, but to keep pace of future expectations. Not only that, 7% of the US Government budget comes from capital gains taxes. By rigging US indexes higher, more federal taxes are paid and the Fed doesn’t need to monetize so much government debt. Add in to that state capital gains taxes, 401K’s, IRA’s, 529’s and the increased consumption associated with the TRILLIONS in newly created wealth, courtesy of the Fed rigging, and it should be no surprise at all how rigged US markets are and NEED to be.

wolf, when they say margin debt, is that debt from brokerages? My understanding is that hedge funds don’t margin that way, they borrow from banks.

One other thing not factored in is what I would call “other margin”. This is money borrowed from 401k’s. This is certainly not margin, but it would be critical to maintaining liquidity in a market collapse. These are the types of investors that sell bottoms.

Finally, one last “leverage point” would be people in inappropriate investments. This one is HUGE. It’s 70 something retirees that are in JNK and HYG for the yield. These people are not risk averse until their investments start to fall. Then they go into ein Herzinfarkt.

Yes, stock market leverage is much larger than shown by reported “margin debt.”

— Institutions can borrow at the institutional level (loans, bonds, etc.) and invest in equities.

— Then there are “Securities-Based Loans” (SBLs) where brokers lend money to individuals. These SBLs are secured by their portfolios. The individual can do whatever they want with the proceeds, including paying for a vacation. The total amount outstanding is not tracked in the US, but it’s very large and growing.

— There are other forms of stock market leverage, as you mentioned.

To me the tracked margin debt isn’t that important as an absolute number, but as a gauge of direction and speed.

the interest rate of ten years bond in the last 30 years is decrees from 15% to actual 2,8% the liltle incrementens of federal reserve genereate crisis and drop very fast the interest rate again, looks like we will go ha kondratieve cycle, remmember when eeuu emerge like super power , all bigeing in the crisis of 29 , and if you look now china looks like unite state in 1929

Interesting points. My memory is foggy on that last one “China is now like US 1929” Can you explain a little more?

Great report! I wonder how much longer these monkeys can be juggled.

Most of the brokerage houses are charging +8% margin interest. The market has to appreciate greater than 8% to make money. Talk about a squeeze when the market rolls over. Not only impairment of value but also 8% interest expense. With the new tax law an individual would be limited to what they could deduct for margin interest when they itemize. YIKES

Arnold, you have probably noticed that the spread between between the Fed funds rate and the interest rate at which retail customers can borrow from their brokers has widened out considerably since the start of the Great Recession. Margin lending has become a lot more profitable for the brokerage firms even as retail brokerage commission rates have fallen. There is no positive carry (borrowing on margin to buy longer term bonds) for retail customers.

Yep. Used to be able to borrow below Broker Call. Now it’s way above. They bury the rate in the fine print using a lot of jargon other than Broker Call.

“Most of the brokerage houses are charging +8% margin interest.”

This sounded too high, so I looked it up, and sure enough… you’re right. TD Ameritrade starts at 8.75% and goes down as your loan size increases.

I’ve never looked at margin trading, has that ~8% rate always been typical or is it higher than the historical average?

Should the investor consider buying deep in the money call options instead of paying 8% margin?

Let’s see how much enthusiasm there is when the Fed funds rate is .75% higher in six months and the 10 year is yielding 3.4%, and mortgage rates are over 5%.

Unless stocks drop 20%, that’s where were obviously headed. Given the market looks 6 months ahead, I wouldn’t be surprised to see another 10% drop tomorrow.

There seems to be an un-requested margin tutorial every ten years or so for those who haven’t yet had the opportunity. It’s just a little chastening for hot hands rolling hot dice. If you really want to hit the jackpot there’s nothing like concentration and some leverage.

I am always amazed (or depressed) to see when a market is peaking, the margin debt spikes as well. It would be useful to somehow turn margin debt levels into some form of predictor of a market crash, however looking at the absolute number is not helpful, since it has a tendency to increase with increasing market prices, and decreases only after a price crash, thereby serving as a lagging indicator. Perhaps the rate of rise, if analyzed mathematically would offer more predictive value.

I remember back in 1999 when Schwab and others were sending emails to their clients with new “margin debt limits” and other restrictions on using margin debt recklessly–now THAT was a true contrarian indicator that I should have used to sell half of my equities. Currently, I am on the lookout for these type of new margin requirement emails, but I have not gotten them. I suspect there are many new rules on margin debt since 2000, and 2009, so maybe there will be no out of control use of margin debt like in the past.

Investment writer William Bernstine had the best description of how to tell if we are in a financial market bubble. His four signs were:

1. Everyone around you is talking about stocks (or real estate, or Bitcoin, or whatever the fad asset of the day is). And you should really start worrying when the people talking about getting rich in certain investments don’t have a background in, or understanding of, finance.

2. When people quit their day jobs to become a mortgage broker, stock investor, or Bitcoin trader.

3. When someone exhibits skepticism about the prospects of whatever the hot investment is, and the crowd not only disagrees with them, but admonishes them as being an idiot for not understanding things.

4. When you start to see extreme predictions. An example was that best selling book in 1999 was Dow 36,000. A more recent example was when Bitcoin was $19,000, there were people saying it could go to $1M.

So are we in a bubble that is near popping in equities? Probably not, but when all your neighbors are talking about stocks, and no longer fearful of the market, watch out.

Buy (on margin) and hold portfolio, the 401K is the old skool way.

667 billion dollars in leverage is chicken feed compared to the US stock market’s over 28 trillion dollars in capitalization.

Everything is relative.

667 /28000=2.4% of total US market capitalization.

https://data.worldbank.org/indicator/CM.MKT.LCAP.CD?locations=US

1. Margin debt is only part of total stock market leverage. But it’s an indicator of the direction of stock market leverage.

Here are other forms of stock market leverage:

— Institutions borrow at the institutional level (loans, bonds, etc.) and invest in equities. This is HUGE. And no one knows the magnitude.

— “Securities-Based Loans” (SBLs), offered by brokers, are secured by the portfolios of their clients. Their clients can do whatever they want with the proceeds from the SBL, including paying for a vacation. The total amount outstanding is not tracked in the US, but it’s very large and growing, and might be close to margin debt. Some brokers disclose their SBLs on an annual basis, but not all.

— There are other forms of stock market leverage, such as people borrowing against their 401ks or their credit cards.

2. A large part of equities are held in portfolios that rarely trade (pensions funds, investors with large stakes, etc.). Prices are determined by investors who buy and sell. This is a much smaller part of the stock market.

So careful: comparing margin debt (which is only part of stock market leverage) to the entire market capitalization, even though much of this market capitalization will not trade, no matter what the market does, leads to misleading results, such as a false sense of confidence.

Yes, a bit like in 2007 when all the “experts” decided that the close to one quadrillion in derivatives all netted out to about a net exposure of fourteen dollars and 92 cents. But somehow Citibank ended up needing trillions in guarantees from taxpayers (kept secret for several years) and the rest of the criminal banks were all bankrupt (which they still deny, but they sure took the Billions offered).