Treasury yields don’t matter – until they do. Mortgage rates jump.

On Friday at around 1:40 p.m., during whiplash-inducing market moves, the S&P 500 index was down 1.9%, bringing the total loss for the week to 8.3%, which would have been the biggest weekly loss since November 2008, after the Lehman bankruptcy.

But dip-buyers jumped in courageously and saved the day. The S&P 500 ended up 1.5%, bringing to the total loss for the week to 5.2%, the worst week since, well, the selloff in January 2016.

Everyone has their own reasons why stocks plunged last week. Some blamed algorithmic trading. Others blamed the short-volatility financial complex that blew up. More specifically, Jim Cramer blamed “a group of complete morons” who traded in this space. Others blamed the stratospheric valuations of stocks that had been rallying for eight years with only a few dimples in between, and it’s simply time to unwind some of those gains.

Whatever the factors might have been, rising bond yields certainly had something to do with it. They tend to hit stocks, eventually.

Last week, prices of short-dated Treasuries edged down and prices of long-dated Treasuries edged down, and their yields edged up, but there was some turmoil in the middle, with some interesting consequences.

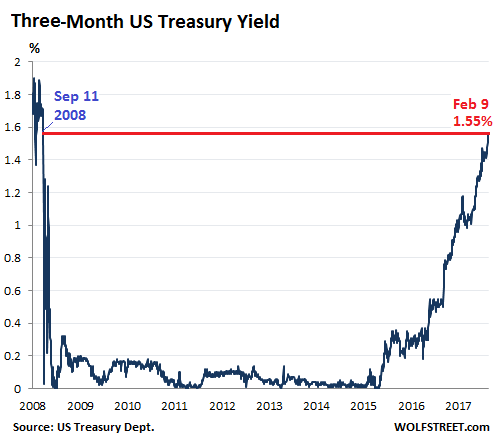

The three-month Treasury yield rose to 1.55% on Friday, the highest since September 11, 2008. Investors are beginning to price in a rate hike in March:

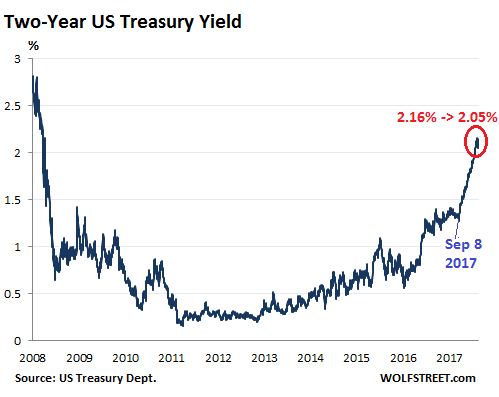

But the two-year yield, after having surged to 2.16% on February 1, got very nervous, dropping and bouncing during the week, and fell sharply on Friday, ending the week at 2.05%:

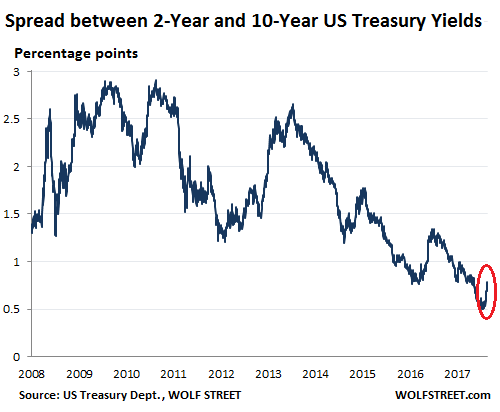

The 10-year yield closed on Friday at 2.83% and in late trading went on to 2.85%. The interesting thing about this is the difference (the “spread”) between the two-year yield and the 10-year yield. It surged.

This spread is one of the indications of the slope of the yield curve and was one of the most watched bond-data points during the scare last year over an “inverted” yield curve. This is a phenomenon where the two-year yield would be higher than the 10-year yield. The last time this happened was before the Financial Crisis.

By early January, the spread between the two-year yield and the 10-year yield had dropped as low as 50 basis points (0.5 percentage points), the lowest since October 2007. As the two-year yield kept spiking (see chart above), the 10-year yield had started rising, but not fast enough. All this has changed, and the 10-year yield has been rising faster than the two-year yield and the spread has widened to 78 basis points on Friday:

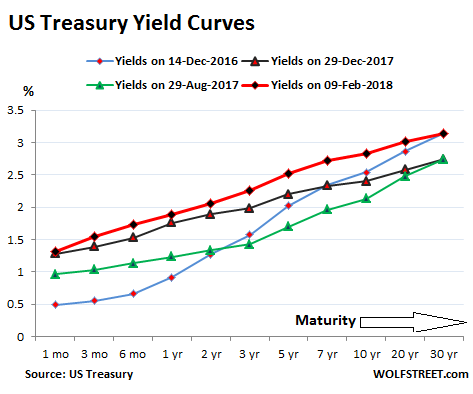

The 30-year yield rose to 3.14% on Friday. For the first time, it is now back where it had been on December 14, 2016, when the Fed stopped flip-flopping and started getting serious about raising its target range for the federal funds rate. The market responded to each rate hike with increases in short-term yields but defied the Fed on longer-term yields, which fell until September 2017.

So what happened last week was that the two-year yield fell, while the yields of most longer maturities stayed put or rose, steepening the yield curve from the two-year yield on up.

The chart below shows the “yield curves” as they occurred on these four dates:

- Yields on Friday, February 9, 2018 (red line)

- Yields on December 29, 2017 (black line)

- Yields on August 29, 2017 (green line) two weeks before the QE unwind was detailed.

- Yields on December 14, 2016 (blue line) when the Fed stopped flip-flopping, raised its rates, and became a clockwork.

Note how the spread has widened at the longer-dated ends between the black line (December 29, 2017) and the red line (Friday), and how the slope of the red line has steepened, with the 30-year yield surging 40 basis points over those six weeks. That’s a big move:

The 40-basis point move by the 30-year yield and the 43-basis point move by the 10-year yield since the beginning of this year have some consequences for the real economy – and it added to the nervousness in the stock market when investors finally took note of it. And here is one of the consequences:

The average interest rate for 30-year fixed-rate conforming mortgages for top-tier borrowers rose to 4.5% on Friday – “with more than a few lenders up to 4.625%,” according to Mortgage News Daily. The costs of other consumer debt is also rising. Corporate borrowers too are facing higher costs of borrowing.

These higher borrowing costs also mean that investors are now seeing more attractive yields in bonds, and there is less pressure to chase risk. The stock market last week reacted fairly suddenly to what has been in the works for months. As they say, Treasury yields don’t matter to stocks – until they do.

How can the media be so gullible – and pliable? Read… What the Headlines about Tesla, Snap, and Twitter “Earnings” Should Have Said

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Paul Tudor Jones, the famous hedge fund manager, who made a killing during the 1987 stock market crash that was brought about by portfolio insurance, has been worried about the leverage in risk parity funds for the past 2 years. Risk parity funds depend on an inverse correlation between bonds and stocks. The opposite is happening. Both bonds and stocks are going down. Risk parity funds are getting hammered and liquidating huge leveraged positions.

Then there is the all time high in stock margin debt, carry trades, and a small $1.3 quadrillion of notional value in derivatives. No sweat!

Paul Tudor Jones very waspy sounding name I have some Jones on my mother’s side of our family in Wales

Thank you for this pertinent information.

the bank of international settlements has a neat stat on dealer and other financial institutions in equity linked derivatives. the dealers have been pushing positions to the ofi’s (whoever they may be) and the ofi’s are net short a fair amount of options premium. equity linked is relativel small in the universe (think its under $ 10 trillion). haven’s had time to get around the interest rate and forex universe but betting it is a best seller

OFI? Other financial institutions? CC companies? The majority of derivatives are interest rate sensitive and currency based, and most of the interest rate type are registered, and almost none of the currency type.

Derivatives where written when interest rates would never go north and business deals never south

Actually the current total notional amount of outstanding derivatives is only about 650 trillion. It has never been above 1 quadrillion. The people that have been saying it is 1.2, 1.5 or 1.7 quadrillion are making the mistake of double counting each contract (counting each contract twice, once for each party).

What we are witnessing is the great rotation out of bonds and into stocks.

If mortgage rate break 5% that is going to be a huge physiological blow to the housing market, especially SALT being capped making deducting interest less likely. I don’t it will change pricing much because existing owners will stay put and inventory will get even more scarce.

Lance

Can the Flip its hold on to there houses or will they have to lower there prices ???

If rates climb quickly, ARM’s will result in plenty of housing being put on the market by people who can no longer afford them.

Buyers typically have a maximum allowable payment based on their financial circumstances, so as rates rise, what they can pay for a house drops inversely.

Further, as rates rise, they will gradually increase what consumers spend on their other debt, reducing disposable income.

I expect to see dramatic drops in home prices.

I’m up slightly from tax reform and wage increase(see my comment further down). This increase has helped us stay even with increasing expenses. We are renters and always have the option to move, but if we owned a home, with the decrease in purchasing power becoming ever larger, we would have to sell at a loss or walk away. I have been there, done that, and this time, I can see it coming down the pike.

TomYungGoong

WOW good point I forgot about those Arms ! People who can barely make it with these low rates will get clobbered as rates go up and foreclosures will cause housing prices to go down .

ARMs are not nearly the issue they were during the bubble, there is a certain quality to “blood in the streets” that does change behavior.

At least in the short term, remember the “Option ARM”. As far as below where there is talk about boomers wanting to downsize. There is a big difference between “wanting” and “needing”. Let me put it this way, lets say I am sitting on fixed rate mortgage paying 3.25 meanwhile inflation spikes to 4.5. Who is sweating bullets more, me or the greater fool that bought the MBS my mortgage is packaged in?

Given most fixed rate mortgages with close to 3% or 3.5% are set for 5 yr terms, and the last couple bull cycles went 10 yrs. The home owner would feel 2 rate increases before anyone started shorting the investors position. You could try a 10 yr fixed rate but then you would be at 4.5% anyway. If rates stay below 4% for those 10 yrs the gamble would be a loss.

The homeowner loses until the debt is paid everytime.

I suspect volume of ARM sales has been low enough to prevent a large supply increase due to resets. A far bigger risk would be a recession, however minor. Still no clear sign of one. Barring a recession and the increase in UR I don’t see what will force people to sell, especially now that so many homeowners are stuck in their current homes due to the massive price increases in their area.

If prices do start to drop it will be interesting to see if people are now more prone to bail quickly after the experiences of 2006/7/8.

A lot of boomers wanting to downsize and payment determines housing prices.

I see falling prices, not collapsing, but a downward trend. Of course the leverage

used in the housing market could force weaker hands to dump property.

IMHO….Housing seems to be a little frothy in certain markets……but because of low interest rates the past 8 years people can buy more house for the same mortgage payment.

If the economy stays fairly healthy during rising interest rates then I do not think housing prices will drop very much overall. It may go sideways. Remember that housing prices went up as interest rates shot up from 7% to 18% in the late 70s and early 80s. A person that can afford a $1000 a month payment will see their purchasing power drop from a $200k house to a $170k house. This just means new housing coming onto the market will have to be priced accordingly. Maybe someone looking for a start home will have to buy a smaller condo instead.

Anyway most people taking out mortages the past 8 years took fixed loans. That cost is now fixed…unlike the ARMs of the mid 2000 housing bubble. Also there are not as many HELOC too.

Just some rambling on my part but I could be wrong.

Now a bad recession can always cause housing prices to go down because of lost jobs, foreclosures…etc.

You are probably right on the current number of ARMs being smaller.

Good point.

Spork – I think I agree. Unless half of China’s going to move here and buy houses, all those Boomers will want smaller, simpler, single-floor places. The people I work for will need to put serious thought into installing an elevator for the Mrs. if they’re going to stay in their house.

IIRC historical “normal” mortgage rates for typical people in typical owner occupied single family residences, were about 6%, with a few points upfront.

When I first became a Realtor in CT in1986, mortgage rates were about 12%. Sales were brisk, averaging 18 days on market (DOM). Later, the rates had dropped into the high 8%’s, but it was a the biggest real estate market boom ever. When there are jobs, REAL jobs, and the economy is healthy, high mortgage rates are not a deterrent.

This is not the case in America now. People are so indebted and so leveraged that if they break a shoelace, they lose everything.

I like the cut of your jib. Capped SALT is what’s different this time. A huge blow but not to pricing. I guess everything else absorbs the huge blow. For example raw materials, building companies and holders of undeveloped land inventory.

Imagine the pressure that puts on renters. It will set the stage for the next leg up. And more two tent homeless camps : one tent for the beds the other to garage the car.

Mortgage availability, or the ease thereof, is what is keeping housing prices so high and so scarce. When rate break 5% or higher, these epic housing and rent bubbles we have all over the country will pop.

Dynamic Yield Curve

Nothing ever matters, until it does.

“How can the media be so gullible – and pliable?”

I recall a survey that concluded that 50% of adult Americans did not know which CENTURY the Civil War was in.

The MSM financial news is partially for the entertainment of the masses.

More serious, however, is the government propaganda agenda.

The real situations with employment, inflation, GDP changes, etc., are all deliberately misrepresented.

“deliberately misrepresented”.

The current situation is backed by a technically bankrupt government, run by corrupt politicians who serve as well paid puppets, for the banking and corporate interests who control them.

It is the aim of the elite to further enrich a very small percentage of very wealthy people. Allowing their greed and short sighted stupidity to imperil the future well being of entire nations and indeed that of the world.

What I want to know is a) who is first on the information chain and b) how does one know if the info companies are reporting is true?

I see that as the major problem with stocks. There is a new flock to fleece with every generation.

Gotta love Cramer. A group of complete morons took profits and bet against the market at all time highs?! What a riot!

If they bet inverse VIX they sure can’t have taken profits. Cramer is a blowhard but the short vol crew bled to death last week.

Ah, Cramer.

Financial markets have really not behaved according to the rules they more or less followed during his actual career as a practitioner for generations. Yes, in 1986 if one’s daughter and all her friends eschewed company X and bought heavily of the product of company Y (I suppose) you would presumably want to own stock X. But could an actual sentient individual anywhere around finance really believe this today?

In other words, is he a complete imbecile (figuratively) fighting the last war or OTOH a smart entertainer pushing messages that his relatively unknowledgeable audience would intuitively think made some sense? For 10 years now I haven’t been able to decide.

The looming tax cut was what kept the market rising the last year. Everytime there was a small wobble, some spokesperson would come out and highlight the coming tax cut and markets would soar. I can’t count how many times markets rose on tax cut rumors. It was quite insane to see the same news move the market every time. But who said markets are sane.

The tax cuts are in the books … and now there is nothing to look forward to to boost markets. Then as always the little guy flooded the market in January (biggest etf inflows) just as a peak was reached. The market went into a feeding frenzy of FOMO sucking the little guys in.

So … no more fuel for the market (little guys all in, no big earnings or economic news), and it has only one direction to go in. All at once everyone started saying the emperor has no clothes (they had noticed it before … but why make a fuss while you are cashing in). Unless the market recaptures its old highs (unlikely this time), BTFD will finally not be a good strategy. And once the algos switch to sell from robotic buys, the market will not perform well.

Was the market testing the Fed’s resolve, after all on previous occasions the markets had the Fed running with its tail between its legs. After all, BoJ had just run away on Feb 2 (https://www.cnbc.com/2018/02/01/bank-of-japan-offers-unlimited-bond-buying-to-curb-rising-yields.html).

The action last week raises a lot of questions…

How are ALL the central banksters going to pull off this feat of increasing interest rates ALL AT ONCE along with reducing their balance sheet? What is going to happen to the markets then? Is this just a prelude? How long will the Fed’s resolve last. What happens to its resolve when a few thousands of points more, “small potatoes” becomes “big hot potatoes”.

Some of the wage gain seems to be related to those wonderful new minimum wage laws in the big cities. So that trend may prove transitory. The Fed can always postpone rate increases. The various Fed singers seemed to be tilting against FAANG froth in the past week but I also doubt their resolve. Where is Bullard this time?

Bullard was on show on Feb 6. Got the Dow its 700 points. That was probably a dress rehearsal!

Then Dudley came out and said the stock market losses were “small potatoes.” That seems to represent the majority view on the Fed, as several other governors seemed similarly unconcerned.

“several other governors seemed similarly unconcerned.”

Right on cue, the FED always dials back support once Joe Sixpack begins showing enthusiasm.

There was no wage gain, it is all spin.

Total wages paid actually went down, total hours worked went down more.

Lower paid hourly workers lost hours, higher paid salaried workers did not, thus the average wage increased.

Your point about legally mandated wage increases in 18 states plus some cities is also correct and part of it.

None of that translates into upwards wage pressure.

Read the details of the jobs reports. Full time jobs are being replaced by part-time jobs with no benefits by the tens of thousands every month.

I still find it hard to believe that Amazon, one of the biggest retailers in the world, it is crushing competition, has 10% of it employees on Food Stamps. I though Tech companies paid very well.

I guess they are following Walmart’s model of getting the government to subsidize their employee’s living expenses.

It’s a bizarre employment situation. Almost every business begs for McJobs help, even offering first day health insurance (unheard of in the past for a McJob). Meanwhile lots of kids have a couple fun years on student loans, fail at college and move into Mom’s basement with their Xanax. So we stealthily import some more friendly Mexicans to get some work done. Oh the profits!

ru82 – Firstly, there’s a very good chance 10% of employees at *any* major company are on food stamps. Low-level employees, like warehouse but consider the whole range of blue-collar occupations, do not pay well and if you’ve got kids and work one of these jobs, you’re going to qualify for food stamps (and often “food stamps” means WIC, for Women, Infants, and Children, a program that provides staple foods).

I’m not so sure about the price of existing homes staying at current

levels. A lot of boomers need to downsize but buyers buy payment

Will the race to cash out before further rate hikes gain stream ?

In the past, the yield curve was telling, at least in the sense of a recession occurring within a year or two of a flat curve. Unfortunately we now have much more central banker influence on the long end. The predictive nature of a flat yield curve has been muddied. With the Fed being a seller at the long end now, the 20 and 30 year yields will be artificially inflated. The HY (junk) credit spreads may be more telling this time around, and they are widening. Watch the labor market, any uptick in unemployment claims (that can’t be justified by natural disasters) is the next red flag regarding economic recession. Unfortunately the labor data (and insider selling) is a bit old be the time we get it. As Joan of Arc notes above, near term there are a lot of positions that need to be unwound, and without some near term stability, it could get out of hand like 1987.

>>With the Fed being a seller at the long end now,

FRB is not a selling at the long end. FRB is just letting holdings run off (not rolling them into new bonds).

I still think it’s a rinse job, bluffing the plebes out of the market. That’s proverbial stock market “wisdom.” If there’s obvious gain to be had, it should never be shared. Add a little “rot” cleaning by liquidating some leverage and now the tax cut bonanza can be carted off by the deserving rich.

Eh, when it comes to the market, no one knows what’s going to happen, not even the experts — too many variables, too many players. What the experts do know is what the risks are; what COULD happen, and if you wait long enough, very likely will. Of course, you never know when a warning will become correct . . . and when it does, it’s often hard to say whether the person who warned you was right, or lucky.

It’s the risks that even the experts don’t see coming that kill the market — it’s when everyone suddenly finds that they’re exposed to things that they didn’t expect that you get a real crisis. So far, the last couple of week have just been a little warm-up punch in the face.

The 29 Crash is the real ‘proverbial’ and after it took out the little guys it took out the big guys. It busted Whitney, the deputy head of the exchange, and Charles Mitchell was arrested.

Further into the Depression it took out nearly 10,000 banks, WITH their deposits.

If ever there was an event and aftermath to destroy the ‘wisdom’ that the rich and connected can control everything to their advantage it was 29.

It’s hard to know if the “really big guys” actually get hurt. JP Morgan back in the day, and Warren Buffett, more recently, benefitted big time from the bear markets of their day. It all depends on what they how they are invested, and also, unfortunately, whether they are in the areas that essentially get bailed out (as Buffett was).

The idea that there is some kind of control over the markets and they will not be allowed to go down is laughable. I have been hearing that for decades. The only problems are 2000, 2008, etc. I think there was some control lost then.

I think it was just this simple … Jerome Powell took control of the Fed while the remaining members said nothing in support of more QE if the equity markets diddle a little.

Perhaps Powell was being tested by those who run the big algo funds. They might have been seeing if he would blink and look weak. Personally, I think this is a strong possibility. They then could use it as a big dip to buy … icing on the cake.

So far … he’s showing them and the world the party is over and the rest of the world they are not too big to fail. It remains to be seen how strong or weak he looks if/when the Dow drops a few thousand points more. To that end, Fed weakness with that drop, or anywhere along the fall, will brand the Fed owned and operated by Wall Street, and perhaps the globalists and the Utopians, and completely controlled by a few jiggles in a line on a graph. They will never regain any credibility after that point.

Looking ahead, QE and rate management only works if EVERYONE does it at the same time with similar intensity. This explains why central banks have been able to print with reckless abandon and see little currency devaluation as a result. Everyone has been junking their own currency in tandem causing all to remain in the same relative valuation with each other. It’s basically an arithmetic problem … the equation does not change in value if both sides are multiplied by the same amount.

The Fed ending this charade put ALL other central banks at risk. This is the big show to come late this year and after. This is when the screaming algo babies will try and try to get the Fed to let loose again, while Draghi tries to think up new ways to use the ECB to kick the can a little longer.

Oh, oh… this does not bode well for the buyback machine on Wall Street.

The markets are hugely parabolic. Way above normal level of supports that usually had been touched in pullbacks in previous years. Straight up for 16 months is a blow off top in the making and on negative divergences. Bad news ? More buying

Good economic news the sell off to NORMAL levels of support. Wallstreet finally got retail investors back in the market just in time to make them bag holders again. This isn’t a “move” to shake out weak hands. There are no bids.

This is THE warning shot over the bow as markets can go much much Lower. In the near term bounces back up to levels of resistance over the coming weeks maybe months to set a bull trap. Greed will wipe out an account. Wallstreet has always said the markets will lead the economy by 6 to 9 months. Take heed. It’s never

But it’s different this time

Equities could fall 50% and still be overpriced by conventional, long term metrics.

Wolf,

“Then Dudley came out and said the stock market losses were “small potatoes.” That seems to represent the majority view on the Fed, as several other governors seemed similarly unconcerned.”

Agreed. In fact the market resumed its fall because of this! If market had sensed that the Fed will come to its rescue the moment it sneezes it would gone north.

The bigger question is for how long will the Fed hold this view? And is it even possible to do it as market falls (as someone said recently, market stops panicking only when the Fed starts panicking)?

Also how are all of them going to do it? My guess is they cannot… Hotel California!

Hopefully when (not if) the market cracks and the “small potatoes” becomes “big hot potatoes” and the central banksters intervene, I hope people recognize them for the wolf in sheep’s clothing that they are and give them the rope and lamp post treatment that they deserve. Add to this the gall of the central banksters in saying that it is done for common man as they would be worse off otherwise.

They have been allowed to get away with murder for the last 30 years (since 1987 -using their ability over money and interest rate as they please) and hopefully it will stop this time.

I hope so too, but will not be holding my breath. Occasionally I try talking about the Fed to otherwise educated, intelligent (?) people, and their eyes glaze over.

It’s hard for me to understand why people care so little about something so fundamental to their existence and future.

All manner of central banks hold NYSE stocks on their balance sheets, or the collateral for this rally. The FED with not nearly as much skin in the game, is leveraging up the pressure on global rates (see LIBOR) to make the US bond market attractive when the huge wave of deficit spending hits. (Congress agrees to another debt ceiling raise, no coincidence the global markets see that as hawkish for rates, and their leverage far exceeds ours) If the global CBs were to manage to catch up to Fed policy things might settle down, they are still in QE.

Wolf .. I take it you were being sarc. by saying brave dip buyers ‘saved the day’ on Friday pm.. the Dow is manifestly rigged by the PPT who make an appearance whenever required.. I just wonder if their account is ever settled or if it is settled with as much QE as is necessary .. As for bonds well they can be taken care of in the same way that Dragi uses for Italy, spain etc. by buying everything required with more QE. Basically you print the money and give it to yourself to spend on whatever is needed… and that takes care of everything .. until it doesn’t ..

Back in the real world where most of us don’t have portfolios, wages are indeed up a bit from tax reform. Between the tax cut and a small raise we are up a whopping $200 a month. GEICO wasted no time in taking $50 bucks of that with their increase, and rising utilities are also taking another cut. If we hadn’t gotten the increase we would be cutting back further on spending, cable tv would have to go.

Employers are signaling that they want to cut back and anybody we know about near retirement, is already planning to bailout before they get pushed out.

Housing prices, in my southern town, have bifurcated. The low end is coming down because affordability there is hard and they have risen about 5% on the higher end. Th rich end is higher than ever but selling below astronomical asking prices, a recent sale sold for $3M asking $4M.

I think in the near term, maybe 6 months, interest rates will rise. At that point it will be obvious that they are not sustainable and they will drop.

Three million What a steal lol I’m renting a new three bedroom apartment for 180 dollars a month in Marmaris Turkey with solar hot water My electric bill was 25 dollars last month which included running the heat pump at night So glad that I escaped that hampster wheel called the states

Want a roommate? We can post on Wolfs blog all day together.

Wow, Looked it up on Google, nice town. May I ask are you a Turk? How long could a Yank stay there? Any info you’d care to provide I would appreciate. Thanks

Tom I’m American married to a Turkish girl since 2008 and sure you can absolutely live here NO problems whatesoever CNN would have you believe otherwise I’m certain( fake news)

I have been to Marmaris years ago. It is beautiful. I would be a little hesitant to live there currently with crazy things going on in Turkey. Glad you feel comfortable .

Dixie Peach Not Really There are nearly as many Brits living here as Turks and the local people are very friendly and generous NO problems whatesoever and my wife is a Tatar so nobody dares mess with her including me lol

It’s fascinating that an economy as stretched as the US thinks it deserves a tax ‘cut’ Since the ‘cut’ can only be achieved by putting it on plastic, how is it cut? I guess you could call it a tax delay, but that delay costs interest.

Surely no one will try to exhume the ‘laughter curve’ and say the tax cut will pay for itself.

They already have their flunkies out on tv talking about means testing the entitlements. The entitlements we are forced to contribute to. If any of you think Roths are staying tax free, you are in Dreamland.

They’re called entitlements to distinguish them from welfare. You’re entitled to the money because you paid in. You pay into welfare too, but, that’s um, different. Welfare is the bad one, entitlements are the good ones.

So conservatives are supposed, in theory, to want to slash welfare, but defend entitlements.

Conservatives do support entitlements and abhor welfare. But I have looked high and low in DC and most States and nary a conservative could be found.

The pathetic Republicans couldn’t manage a government for beans, and the Dems are too stupid and believe they can legislate away human nature.

I am not sure that the Fed is to unhappy with a risk off event that involves only the stock market, various VIX participants, and the risk parity crowd. A bit of froth blown of the top at this stage is probably welcome. They are likely facing a handful with the micromanaging of their QE unwind with this unplanned for fiscal excess. I agree with the above comment that the HY spreads may be more of a concern, should that happen, as that type of deleveraging foreign and domestic could impact bank capital. Losses in the bond market impacting repo positions might also be a helpful tapping on the brakes. Why get your hands dirty if you don’t have to?

With so much excess out there, perhaps this tightening cycle will consist of selective detonation of various parts of the mine field. Dangerous work I agree but what are the other choices? This inflation monster coming down the tracks may subside before the big guns come out.

“Treasury yields don’t matter – until they do.”

Why the ambiguity?

As far as I know the risk free rate (Treasuries) and the equity adjusted risk free rate (cost of capital) form the foundation for all reasoning in the financial world. Combine them with Beta and the related alpha and it’s hard to see how Treasuries ever ‘don’t matter’.

Reading through some trade data recently it occured to me that economists purposely use vague or changing nomenclature to keep the layman from figuring out what’s really going on.

“Treasury yields don’t matter – until they do.”

This is (I suspect) a tongue-in-cheek swipe at quotes such as Dick Cheney’s “Regan proved that deficits don’t matter”; or David Stockman’s “We’re not going to waste a lot of political capital on fixing someone else’s [social security] problem in 30 years.” (this quote lifted from Pierson’s book ‘politics in time’ since someone who reads this will want a ref I’m guessing).

Yields, like deficits, unfunded liabilities or ponzi’s (for that matter) “don’t matter” until an interesting party is unable to bear their costs, just like your price of food, housing, or education “doesn’t matter” until you can’t afford to live.

It’s a political perversion of reality at its finest. What did we think was going to happen – borrowing like there’s no tomorrow then trying to convince ourselves that interest rates or debt “doesn’t matter”.

This is what I would guess Wolf is getting at, and by the looks of your comments I suspect that you would wholeheartedly agree.

Hope this helps,

cheers.

In addition to interest rate rises, the fiscal deficits and debt are getting more attention. Negativity is starting to set in. Run for the hills.

Somebody should make a list of the dimwitted fools who are pitching this market so they can be thoroughly ridiculed when the time comes. There is a lot of uneducated guessing out there from fast talking heads.

Almost every talking head who features on mass-media financial TV is doing uneducated guessing. These shows select for telegenic “personality” and sensationalism, not knowledge or accuracy of predictions.

Are banks not loaning anymore?

https://fred.stlouisfed.org/series/IBLACBW027NBOG

What could this mean?

to each other**

The linked chart has nothing to do with bank lending to their customers. Bank lending is doing OK.

The linked chart is about interbank lending. Interbank lending has been plunging since the Financial Crisis, as the chart shows. During the Financial Crisis, it became very clear to the Fed and other bank regulators that interbank lending was one of the mechanisms by which credit problems had spread from bank to bank. In other words, it was one of the transmission channels for contagion. So now, banks no longer rely on interbank lending for funding. They’re flush with deposits (see excess reserves at the Fed), they can borrow from the Fed, they have cheap credit available in the credit markets (and from depositors), etc. etc.

Given the contagion risks associated with interbank lending, it’s a good thing that its importance as a funding mechanism for banks has gone from “critical” before the financial crisis to “nil” now.

That’s all it means.

However, doesn’t that remove the market mechanism from the system? The money the banks lent to each other had to be earned some way, whereas the FED does not make money; it prints. Granted that these are short term loans, but if that’s a good thing, why not extend it to longer term loans, as well?

Thank you for the explanation =)

Are you in favor of this approach? Was there a benefit to the Interbank system they just did away with? Do you foresee any potential issues with having the Fed provide the funds?

If this system before froze credit because of bank to bank credibility questions, having the fed step in now, doesn’t it removes that layer of “self oversight”?

The fact that banks relied on each other for funding before the Financial Crisis was like a circular firing squad once things turned sour. I’m glad they no longer do. I think the industry overall learned a lesson.

Pam Martens suggests that prospective doubling of net

issuance of Treasuries is the culprit. Net Issuance was

$ 500 billion the last FY. For the coming FY ended Sept.

At the end of Jan. Goldman was predicting $ 1 trillion,

JP Morgan Chase and Deutsche Bank say even more.

Frightening increase in supply while Fed backs off.

Read last week that the feds sent a cease and desist order to Wells Fargo that they had to change the board and could not”grow”. It seemed to come out of nowhere and I’ve not seen any one comment on it. Nothing burger or more to it?

This didn’t come out of nowhere. WF has been under intense pressure from California, and the state of Cali urged US regulators to get busy. There have been all kinds of proceedings against WF.

https://wolfstreet.com/2017/10/17/california-treasurer-skewers-wells-fargo-muses-why-tim-sloan-is-still-ceo/

Only the Fed had kept silent. So now it has finally done something. Also WF has long been lambasted by Trump himself, so it was easy for the Fed to strike.

If WF fixes the things the Fed required, or negotiates its way out of it in a settlement, the Fed’s dictum of “no growth” goes away. This will likely happen in a few months.

I don’t think Treasury yields are the cause of stock market turmoil, but a symptom. There were trillions of “dollars” created by Asian and European banks over the last few decades, but they were not “real” dollars backed by the U.S. Treasury. Instead, they were promises to produce dollars at some future date, but treated at the time as money. This is the missing money that so confused Alan Greenspan, and economists in general. Now real dollars are in perpetually short supply as banks seek to wind down the dollar claims they created. And since they created trillions of dollar claims, there is no way this wind down will end successfully. The dollar will continue to rise with only temporary pauses because the demand can never be satisfied. As liquidity conditions vary, so will Treasury yields and stocks. But eventually, somewhere in China probably, the dollar shortage will reach critical levels, and suddenly credit markets all over the world will seize up yet again. Treasury yields won’t be nearly as important as the Yuan exchange rate and Chinese interbank rates as indicators of the next crash, but people won’t notice until it’s too late anyway. But if anyone has bothered to read Chinese papers, they would realize that Chinese officials are far more worried about a financial crisis than the BTFD investors in the rest of the world.

But nothing seems to have been resolved because yields haven’t really moved at all in the last two weeks – are they or are they not spooking other assets lower?

If yields are the root cause, then this sell off continues.

If they are not the root cause, then fixed income will rally and squeeze out the shorts their too.

5y5y Inflation expectations were at one point 13bps off the months highs … Were they to fall further towards 2% it would be valid to argue it’s no longer an inflation fear driving this move.

Because whilst you could argue the lack of reaction in fixed income confirms a bear market, you could also interpret this as complacency.

Perhaps, like in 2015/2016 etc, it’s just another multi asset consensus position squeeze…

It looks like Janet Yellen’s FED Speak Agreed with Alan Greenspan’s Bubble in Stock & Bond Markets.

Good Probability that it started the Decline.!!!!!

Judy Woodruff: “Former fed chairman Alan Greenspan said the other day

he’s seeing a bubble in the stock market and the bond market. Are you

worried about bubbles?”

Janet Yellen: “So I don’t want to label what we’re seeing as a bubble,

but I would say that asset valuations generally are elevated, and this

is a characterization that we’ve offered up, for example last summer in

our monetary policy report, for the stock market, the ratio of price to

earnings which is a measure valuation is near the high end of its

historical range. And if we look at, for example, commercial real estate

and other assets, we’re seeing high valuations.”

The US has 48 trillion in debt. A 1% rise interest rates does two things. It raises the cost of refinancing by 480 billion and creates a capital loss of 15% or $7 trillion in current duration space.

What could possibly go wrong.

I wonder if it had anything to do with the American stock market being the most overvalued of all time? I guess that was just a coincidence.

Sell the tax cut and buy 100 year treasury bonds?

https://www.zerohedge.com/news/2018-02-14/mortgage-apps-tumble-rates-spike-4-year-highs

For those that said high rates aren’t going to affect the housing market or the scarcity of housing. Well there you go.