Banks have started to tighten lending standards for prime and subprime borrowers, and it shows.

Banks are further tightening their lending standards for prime and subprime auto loans. This process started in Q2 2016, when auto lending had reached the apogee of loosey-goosey underwriting that had boosted sales of new and used vehicles to record levels and had ballooned auto loan-balances outstanding to the $1-trillion mark. It also boosted risks for lenders. Inevitably, subprime auto loans started running into trouble in 2016, and it was time to not throw the last trace of prudence into the wind entirely.

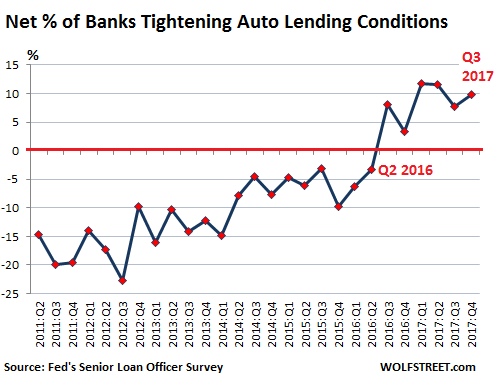

The chart below — based on data from the Fed’s Senior Loan Officer Survey on bank lending practices for the third quarter — shows the net percentage of banks tightening lending standards. The negative percentages below the red line signify net easing. It shows how loan officers have gradually, in fits and starts, dialed back their easing before Q2 2016 and ratcheted up their tightening after Q2 2016:

During Q3 2017, 10% of the banks tightened underwriting conditions, compared to the prior quarter, but 0% loosened underwriting conditions. In other words, the tightening is proceeding gradually, on a bank-by-bank basis, and the easing has stopped entirely.

“Banks reportedly tightened most terms surveyed for auto loans,” the report says. Specifically, here are some of the terms the banks tightened in Q3, which adds to the banks that tightening in prior quarters:

- 7% net tightened conditions on minimum required down payments.

- 5% net tightened conditions on credit scores

- 8% net tightened granting loans to customers that did not meet credit scoring thresholds

In a set of special questions, the October survey asked why banks were changing credit standards or terms for prime and subprime borrowers “this year.” The reasons were nearly the same for both prime and subprime borrowers, but subprime is clearly the bigger concern. Here is what banks said about their reasons for tightening lending standards for subprime borrowers:

- Less favorable or more uncertain economic outlook: 50% somewhat important; 30% very important.

- Deterioration or expected deterioration in the quality of your bank’s existing loan portfolio: 30% somewhat important; 40% very important.

- Reduced tolerance for risk: 30% somewhat important; 50% very important.

- Less favorable or more uncertain expectations regarding collateral values [used vehicle values]: 40% somewhat important; 40% very important.

- Lower or more uncertain resale value for these loans in the secondary market: 33% very important; 0% somewhat important.

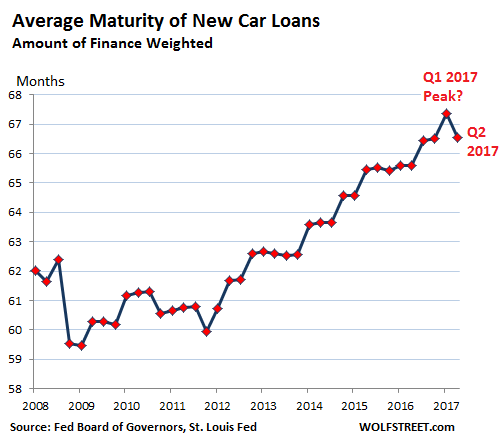

Some of this tightening is already showing up in the data. For example, the average maturity of new-vehicle loans peaked in Q1 2017 at 67.4 months, according to Federal Reserve data. The data for Q3 is not yet available, but by Q2 the average maturity dropped to 66.5 months, the first major drop since 2011.

Note on the left side of the chart how the average maturity plunged during the Financial Crisis as credit was freezing up and as auto sales collapsed, and it was hard to get anything financed:

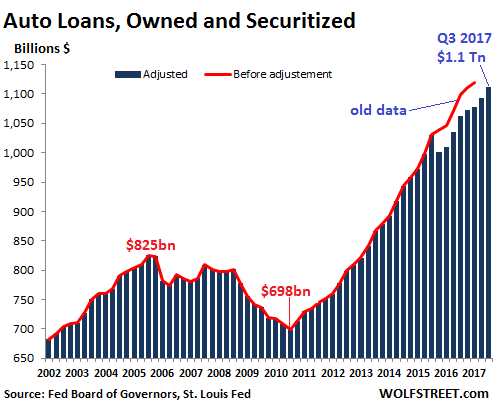

But the tightening hasn’t yet shown up in total auto loan balances outstanding, which jumped by $19 billion during the third quarter, likely boosted by the first batch of replacement sales from the hurricanes.

What has shown up is a massive adjustment of the data going back to Q4 2015. Since I keep the old data, I overlaid the prior unadjusted data (red line) and the current adjusted data (blue columns) in the chart below. The adjustment retroactively wiped out $39 billion in auto loan balances in Q4 2015. By Q1 2017, the adjustment had wiped out $41 billion:

Adjustment of data happens all the time. These are estimates that can be off, and occasionally, adjustments are made to try to put them back on track. But it does show that auto loans did not suddenly plunge in Q4 2015, as the chart based on the blue columns alone would have otherwise indicated.

That banks are tightening their auto-lending standards ever so gradually is another headwind the auto industry is facing. The hurricanes, by destroying or damaging a few hundred thousand vehicles, created some temporary replacement demand for new and used vehicles, some of it financed by insurance companies.

This replacement demand is now papering over the underlying problems of the industry that are constraining demand:

- Too much auto debt

- Too much “negative equity” in vehicles after years of loosey-goosey lending, which makes trading difficult

- New vehicle prices that have moved out of reach

- And incomes that have been stagnating for a large part of the population.

And these headwinds will still be there after the replacement demand from the hurricanes settles down.

Carmageddon for Tesla, Fiat Chrysler, Hyundai, and Kia. But not for all automakers. Read… Pickup Sales Boom, Cars get crushed, Tesla Deliveries Plunge

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Since I keep the old data, I overlaid the prior unadjusted data (red line) and the current adjusted data (blue columns) in the chart below.”

I enjoy these articles but I don’t understand why you’re analyzing this data. Is this all part of your secret investment strategy?

I assume you write this column as a sounding board for ideas that might generate revenue elsewhere. I’m not sure how to profit from these articles, although there is a ‘car wreck’ schadenfreude quality to my fascination with them.

WOLF STREET is a media company. We try to present interesting articles and analyses that help readers understand. WOLF STREET doesn’t trade on what we write, and we’re certainly not powerful enough to move the markets. We make our money selling advertising not financial advice. If we were selling financial advice, it would be a lot more expensive than free :-]

There was no “Reply” button on your response below about keeping your comments section in-house, but for this reason alone, I will be visiting/commenting at Wolf Street more often.

When I started reading Wolfstreet several years ago, I kept looking for investment tips. But that’s not Wolf’s agenda. He writes about certain economic topics–the auto industry, real estate bubbles and the fate of bricks and mortar businesses. Federal Reserve policy, central banks in general and the vagaries of Wall Street are other favorite topics. It’s useful information presented with a highly individual point of view. Other than cautioning readers against shorting stocks, he really doesn’t give investment advice. And that’s a good thing, because it allows him to air some very negative takes on Wall Street.

I see interesting things about the economy here that I don’t see from other media venues.

You mean like the truth?

“(Investment tips are not) Wolf’s agenda”.

Good thing too, as far as I’m concerned, because I’m not the least bit interested in conventional “investing” (Read “gambling” these days).

I need to know where global money, credit and banking are headed and that’s well laid out here …

Close parenthesis after first “not”, supra.

We need editing, Wolf. Why are you so stubborn about that? It’s provided for commentary on most sites, in the interest of accuracy. Why not here?

To allow editing, I need to switch to third-party commenting software. This means all your comments will be stored on a third-party server (not my server) and controlled by that third party, and your login data will be with the third party. In other words, I’d surrender control of the comments to them, and if they shut down, all comments disappear from my site. Plus, the third party can monetize the login data (email address). No way.

I’ll keep your comments and login data on my server :-]

His reason for this is possibly, what you said/ wrote, is what you said/ wrote for ever.

many other sites have issues with creature’s going back and changing their original content, in disputes.

As you cant do that here, you need to think about what you say before you say it, as you will be stuck with it.

Which works for me any way.

Even though I suffer from a huge number of “fat finger” issues.

Below: Good reasons, Wolf.

I agree.

*Chuckle* delete “Below”, below.

If dodgy borrowers are a problem for auto dealers, then why don’t they offer an actual reduction in price for cash buyers?

I have never bought a vehicle on time, but once I asked a loans officer about the stated low Dealer rates. She replied that she had never been able to figure it out, either. However she left me with this gem, “Go and get the numbers in writing of all the details offered/included in the auto financing offer in order to figure out the total financing costs over the entire term of the loan, we’ll then sit down and go over it, and then we’ll beat it”.

It is pretty obvious that the Dealers want to finance, or lease, just to improve their profits. As far as I’m concerned if they get burned, tough noughies.

It is also my understanding that every car buyer gets screwed when buying a car off a lot. It is just a question of ‘degree’. I read several books on car sales tactics and the biggest scam is the idea of a relative getting a deal from a salesman/woman. Apparently, they rub their hands at the prospect knowing the buyer is more gullible and less likely to walk away.

What a crappy industry.

If you pay sticker price for a new car, you’re not getting screwed any more than if you pay sticker price for an iPhone. It’s only in the car business that people have always thought they needed to dicker over price, and dealers have to play the game or lose customers.

Dealers act as broker when it comes to financing, just like a mortgage broker does. Dealers make money on this service, just like a mortgage broker does. So yes, they do want you to lease or finance the vehicle. Dealers usually don’t carry credit risk. That’s the lender’s fate.

Profit margins on US-branded new vehicles are very thin, despite what you may think. Most dealers cannot live off it. Finance and insurance revenues help out. Dealers make decent profit margins on used vehicles and great profit margins on parts and service.

I thought the dealers were carrying their own financing GMAC zero APR? Dealers are offering discounts to MSRP aren’t they? I know auto sales are traditionally an economic indicator, and I know that the Fed can buy as many cars as it wants. At that moment you are in deep doo doo.

GM Financial, Ford Credit, Santander USA, JP Morgan, etc. are lenders that approve and grant the loans. Car buyers will make payments to them. Dealers sell the car to the customer but in terms of financing, they’re just loan brokers that put the deal together and arrange the loan.

Leases are different. In a lease, the dealer sells the car to the leasing company, which then leases it to the customer. At the end of the lease, the leasing company has to deal with the used car.

Discounting is as old as cars. Manufacturers offer rebates or discounts and other incentives, and those are not negotiable. Dealer discounts are negotiable.

The Fed cannot buy cars. It cannot even buy auto loans. But in its function as lender of last resort, it could bail out auto lenders by lending them money. That won’t happen because auto loans are not big enough to threaten the US financial system. Auto loans don’t even threaten the big banks. They only threaten specialized auto lenders, and they can go to heck without bringing down the financial system.

The following may not work in todays market – but… I have bought several cars using this method.

Years ago I learned a very good lesson from the F&I man at the dealership I worked at. You can beat up the sales person on the price of the car (down to or below “invoice”) but the F&I person will make it all up – and then some – on the “bank financing” and the “insurance” part of the deal.They tell the buyer to skip going to their bank because “I can get you BANK financing at a better rate.” A better rate for the DEALER – NOT YOU. The “Bank” is a small “bank” that kicks back a substantial sum to the dealer for the contract. The same snow job was done on insurance.

Sooo – whenever I try to buy a car I get all google eyed and beat them to death over the price of the car – after all, THAT is the “important” part of the deal… And for me, it really is. I let them beat ME up on the trade in value and let them jack me up on all the “extras” but I keep the “base sales price of the car” front and center. After I get beat half to death by F&I I tell him I have to get my wife on board and I will be back. That ticks them off because a high percentage of the “be backs” do not return.

We wander in and go to the F&I office. My wife asks to look at the paperwork, verifies the cost of the car, looks him/her in the eye and says we will buy the car outright. Here is a bank check for it.

The F&I person goes apoplectic and starts to sputter that the car can’t be sold for that price. After a few choice words of wisdom from my wife they take the check and do the paperwork – and she drives off with the car.

Beat them any way you can….

Yes, that works. That’s how I do it, minus the wife part (no reason to drag mine into this).

“We wander in and go to the F&I office. My wife asks to look at the paperwork, verifies the cost of the car, looks him/her in the eye and says we will buy the car outright. Here is a bank check for it.”

Since about 1996, we’ve been paying cash for all of our vehicles. Our method skips the “Mop & Glo” guy in the F&I office entirely. Back in the old days, before the internet had taken off and you could get good invoice price data from the likes of Edmunds, we had the Pace Guide to Car Prices. It was an excellent reference and explained all of the nuances of car sales, including details on dealer holdback and floor financing. Anyway, once we’ve settled on the vehicle we want, and the price we want to pay we head to the dealership and find the vehicle we want to drive. We never do trade-in, that turned out to be more of a hassle (so we sell the old before we get the new). Once we have a test drive and good discussion, we’ll return to the salesperson and hand them a check for what we are willing to pay. Of course it “isn’t enough” and they figure they can squeeze a little more out of a cash buyer. After the first trip to the “Sales Manager’s” office, I start following the salesperson in. I explain that I want to save them all steps and time. That’s my offer, and if it isn’t sufficient, then I’ll take my check and leave. Do you know how hard it is to get that check out of their grubby little paws? Heh.

I am what the industry used to call a “grinder”.

How is it helpful to agree to a lower trade-in value and extras that you maybe do not want? Otherwise, I agree. I’ve always paid for cars in full, before driving them off the lot; negotiating the new car first, then the trade-in. I tell them at the end that I’ll pay in cash; not bothering to visit the F&I office. I keep cars as long as they’re mechanically reliable. My current car is a 2002.

Why not just get the financing then pay the loan off right away?

“Profit margins on US-branded new vehicles are very thin, despite what you may think. Most dealers cannot live off it. Finance and insurance revenues help out. Dealers make decent profit margins on used vehicles and great profit margins on parts and service.”

These people dont understand there is no money for the dealer in selling New models for cash unless, they are absolute non-moving dog’s. In which case it is simply getting dead money back with no profit.

I’d feel a lot more accepting of the comments in support of Dealers if the newly rebuilt Dealerships in our area were not so oppulent. They look like the Mormon Tabernacle, complete with columns and 2 story showrooms.

That money came from somewhere.

Borrowed money. A showroom is a big empty space. It really doesn’t cost all that much to build. It’s a warehouse with plate glass on three sides.

I dont support dealers.

However the Consumer need to understand, what they are dealing with.

As to the buildings , those sort of buildings are required by the Manufacturer, for the dealer, to simply “retain”, the Franchise.

One of my previous incarnations was a car salesman, after I left real estate. You are right, everybody gets screwed. However, buyers are really stupid and totally uninformed about what they are getting into. You make the most money on a used car sale. All the dealers send you to a school to learn to sell cars. There you will see new salespeople from competing dealerships. They are all in it together. It’s easy to change dealerships. The product is unimportant: the ability to push a customer’s buttons and get them to sign their name is what counts. You have to lie to every customer, whether it is necessary to close the deal or not. The sales process is a tightly scripted process.

Yes, it is a crappy industry.

A smart person buys a 2 year old car. It is half the new price, but it is not half worn out. Pick a make that does not have frequent body style changes and nobody will know.

I am in the market for a new SUV. Or maybe a 2 year old one, now that I have read your comment.

2 thoughts: I bought a RAV4, 6-cylinder, in 2007. I now have 120K miles on it, have serviced it religiously. It’s selling for about 25% of the original price. The power of the 6-cylinder and its gas mileage is surprisingly good. I’d personally recommend buying one of these. Due to a lack of sales, they’ve discontinued the 6-cylinder. The only drawback is that it’s a bit noisy.

NPR has a weekend program it airs, “This American Life” and there’s a great show dedicated to the car buying phenom. My takeaway is that if a dealership doesn’t make their sales numbers, especially if its been two months or more in a row, they are in a panic. So, shopping the last two or so days of the month is optimal for buyers.

Customers know more about the car than salespeople now. They don’t make any margin on new and used car sales. It’s 2017 and the internet has changed how cars are sold.

Financing in dealerships is usually a better option because of the multiple lenders and a captive lender. Car folks get a bad rap from customers because it’s usually second largest investment. Customers walk into bad deals.

When I was looking to replace my vehicle of 16 years, I looked at used but the prices were very high — very close to new. It didn’t seem to pencil out, at this point in time. I assumed it was because of sub-prime auto loans.

I’ve been seeing mechanically inclined YouTubers as of late doing the following:

Buys two cars from copart or ridesafely, one flood car and one wrecked car.

Combine the two so as to get late model low mileage accident-free cars for the cheap while parting out the donor to recover costs. Best iteration of this I’ve seen was a 2015 Tesla Model S P85D for $14,500 after donor part-out and misc.

While the Tesla is an interesting beast as the part market is controlled — I’ve seen the same thing done with Toyota Tundras where out the door price is less than $8k for a two-year old Tundra with 20k miles.

If you are mechanically inclined — have a lift and tools and another car to use, your ability to capitalize on the hurricanes is truly amazing.

I have done this in a slightly different manner for decades, and it’s simple as long as you have room to store a ‘donor’ car.

I fell in love, so to speak, with Datsun 240Zs and fuel-injected 280Zs. But without a lot of cash, I bought cheap used ones and replaced them fairly quickly; while keeping parts and the one last driven.

Then, I moved up to Lexus SC400s, and believe me having a donor car for parts on one of these is a hell of a lot cheaper than buying parts at a Lexus dealer. Since I live in Minneapolis, the Dunlop Winter Maxx snows go on her next Tuesday, eh?

Roddy

“A smart person buys a 2 year old car. It is half the new price, but it is not half worn out. Pick a make that does not have frequent body style changes and nobody will know.”

The problem comes about when you want a Toyota Tacoma. They never get discounted unless there is a GFC going on. Even the used ones are sold for extortionate amounts. Don’t take my word for it. Check out used prices on Tacomas and you’ll not believe your eyes.

FWIW, we’re running at about 200,000 miles on our Toyota 4Runner from 1996. We’ve spent some money on maintenance this year (only because) I want to replace it with a 1 year old Tacoma for what I would call a reasonable sum of money. I need a GFC to come along soon to bail my plan out. The next GFC will almost certainly be along shortly.. Just gotta wait!

I used to work in the automotive industry in Marketing in the Detroit area (Big Three). During the heyday (05-07), we would artificially show improved residual values in order to improve the monthly payment on the vehicles. I don’t know if the cost of that subsidy was accounted for at the time of program or later written off as real numbers came in at a later date, but it was a way we reduced the cost of the payment with the loan terms. How else could we have a $299 monthly payment on the 2005 Grand Cherokee when people didn’t want it in the numbers we had sitting on the lots? Not sure if that is done today however. Some of the company’s debt (Fiat Chrysler in this case) may be related to past decisions.

Just a ‘simple’ question. While I understand the implications for many with the banking industry tightening their ‘standards’ I’ve always wondered that if it is change on the margins that tends to cause problems, would it not be what happens within the shadow banking industry–particularly as it pertains to mortgages–that will knock the wheels off the cart?

In at least some housing bubble markets, rents are finally starting to fall. That could mean, in theory, that at least some renters who are financially hard-pressed due to the price of keeping a roof over their heads might finally get some relief, potentially freeing up more of their income to replace older cars. Of course, if you are an investor in REIT or homeowner (mortgage holder, more like) who bought at the peak of the bubble, you might want to think about mailing in the keys and walking.

Who needs cars in the age of Uber?

This is a good thing except for those in the auto industry.

Most vehicles are just sitting doing nothing but the environmental cost of building them are immense – extraction of metals, refining, rubber and more so with the exotic battery/electric cars.

Most people in the world keep cars for decades because that is all they can afford. See Cubans keeping American cars in working shape after 60 years.

This is not to discount the improvements in safety, fuel efficiency etc. But i think that there are no further gains in these areas.

People would be better served to not driver newer cars every few years.

If you use them for work – taxi, pickups for business etc. or commercial you may breakdown the vehicles or get advantages in tax law to have newer vehicles.

But for everyone else – it is wasteful expenditure.

Agree can’t wait until ppl Uber everywhere for super cheap since Uber won’t have to pay for a driver

Hmm, that point may manifest some validity. Since we are heading to a more “delivery to home” based business model and relatively cheap “for hire” personal transport mechanisms, the cost of and need for vehicle ownership will becomes less cost effective. Could it signal the end of car ownership ?

Hopefully. It’s one of the largest expenses for an American after a home. Mandatory auto insurance by the scamming insurance industry. Time to put many of them out of business as well as scamming auto mechanics. Have all that in house by Uber or Google and build it into the cost of a fleet. Over all it will simplify so much for the average American and free to tons of hidden productivity when they can work instead of drive places and sit in traffic everyday. So much untapped savings and untapped potential tied into automated driving. It can’t get here soon enough.

I think you may have a point in urban and large suburban areas. But many folks in this country live in areas where having a vehicle is necessary due to distances driven and things that need to be hauled or towed around. Not a one size fits all kind of deal. But some places ownership may phase out.

Even in suburban areas (I’m in suburban DC), it would be hard to do without a car. I wouldn’t want to bother with an Uber vehicle every time I make a spur of the moment trip to W-M, Home Depot, the supermarket, or to a recreational area. I suppose a light-rail system might work, but the cost of the infrastructure would be far more than this country can now afford. Nor do I want everything, or even a majority of things, delivered to me.

About Cubans and their cars, a car that was registered before Infidel did kick out Batista and Uncle Sam can be freely sold and owned. Cars newer than that are a restricted commodity. Thus it has been a sensible choice to keep those old cars in good running condition. Btw, the engines are seldom the original gas guzzlers, usually they have been replaced with Russian or Romanian diesels. Skilled SOBs, everything in the car measuered in inches, the new engines are metric, requires quite some skill to fit them together.

I still miss the Cuba Libres over there. Generously with rum, very sparse with cola :)

Since the 70’s engines have largely been Japanese and in the 90’s were joined by Korean ones, but old Toyota B and H diesels remain the most widespread and sought after, not just because they are pretty much indestructible, but because they are easily available from Venezuela where the Series 70 Land Cruiser is still sold.

Until 2011 only three categories could buy brand new cars in Cuba: government officials, medical doctors and military officers. The cars were often sold to them at large discounts or even nominal prices but the waiting list was usually years long.

Everybody else had to make do with used cars, and used prices were often absolutely insane on newer stock (more of which in a minute) so keeping older cars on the road made a lot of economic sense.

When Castro and his barbudos nationalized the economy, they allowed small private firms to operate, as long as all the persons working there were closely related by blood (typical example: husband, wife, their eldest child and a couple of nephews). Most of these firms have evolved over the decades into keeping not just cars but many other Batista and Soviet-vintage machines working.

You could run into some of these small workshop casting gearbox housings or completely rebuilding compressors from 70’s refrigerators… as an engineer friend of mine said “you don’t know if to be positively or negatively impressed”.

Starting in 2011 every Cuban citizen with a clean penal record could apply for a permit to buy a brand new car. While this permit was often given without problem, the waiting list could be up to five years long due to very limited imported stock: the Cuban government at the time mostly relied on Toyota’s from Venezuela they could get at discounted prices from Castro’s old pal Chavez which became rarer and rarer as Chavismo started to fall apart.

Since 2014 everybody in Cuba can buy a brand new car but stocks are still limited and prices tend to be highly variable due to be set by the State more or less at whim.

This means after decades older cars are being slowly but finally retired but the ever resourceful Cubans are not breaking them up for spares: many are being turned into tourist attractions and others are being slowly and laboriously restored to as original as possible conditions to be sold to foreign collectors, invariably through mediators.

Japanese cars started to be appear in very small numbers in Cuba in the 70’s already. This shouldn’t surprise as trade between the two sides of the Iron Curtain was far more common than most believe.

As Soviet supplies started to dwindle, Korean cars appeared as well, but until Chinese manufacturers arrived recently, no manufacturer really picked the slack left by the Soviets as Cuba was supplied from stocks earmarked for South American markets. As said Toyota’s are relatively common because of the old Cuba-Venezuela connections.

Right now the Cuban government is replacing their patchwork bus fleets with brand new Chinese vehicles. Emergency vehicles (ambulances, fire trucks etc) are rumored to be next and Airbus and Ilyushin are replacing the aging Soviet-vintage airliners used in Cuba.

And this is just a small part of the change, I don’t know if for the better or worse.

Who needs Uber?

1. People who don’t live in cities.

2. People who need to ship kids around. Not all school districts have buses and even if they do, they are sometimes not available for all schools in the district. I have seen people offload this activity to child care folks but it is not exactly cheap.

3. Those who find that Uber prices are not very different from taxis. I needed to use taxi regularly for some time vs using a car. I found that Uber was cheaper than a taxi but not much.

An implicit argument with Uber is that the user is not taking long trips for vacations. The Uber travelers I know now avoid driving about and would rather spend a lot of money flying.

Besides, I am not sure how people who use Uber for a drive everywhere can even afford it as costs add up to big numbers quickly. The ones I know using Uber so often are those whose trips are paid by the office.

I know people who use scoop but those trips are loss making for the company.

The point is that there are costs involved. And people optimize based on costs and their budget. There’s a lot more to the story than what a well fed reporter sitting in a major newspaper, sipping cognac, will tell us. Let them eat cake? :)

I would never exchange the freedom of going anywhere I want, anytime I want with having to deal with Uber, and Uber drivers.

At lunch time, I sleep in my car for half an hour to get all refreshed and energized for the afternoon work. I don’t think I want to call Uber for that :).

I can’t remember if I wrote about this before……….

Oz has many immigrants. Some are very wealthy and drive around in nice paid for with cash Mercs and BMW’s.

Others need financing for their car and this is where the story comes from.

My former employer sold a car to a young Asian lady and wrote the finance contract at around 12 per cent interest or so. The bank and the car dealer have an arrangement that pays commission and some other alpha for the loans written……….

When the lady actually signed the loan papers the rate wasn’t 12 per cent, but around 21 per cent…………………..

What can you say?

I no longer work for them and had nothing to do with the transaction, but IMO the whole thing stunk and left me feeling quite bad and sorry for the person.

What is the lowest life form in Au, Politician, Lawyer, Pedophile, Used card dealer?

Au used car dealers will keep doing thinks like, that until they cant.

Myself, I never sold Used cars retail off a lot, as to make money Lying to old ladies, is a prerequisite. And I just cant do that, as she is somebody’s grand mother.

You rob my grandmother, I use you for fish bait.

d: I think, at least in North America, you should add doctors and dentists to the list. These days dentists in US and Canada are far worse than and sleazier than used car salesmen. I’ve heard many who taught at used car salesman colleges, now teach at medical and dental schools.

The comedy show Last Week Tonight did a show on Auto Lending focusing on sub prime and used cars. Its both funny but also had some interesting information about how used cars can be sold, repossessed, and sold again. This show is posted on Youtube.

Last week John Oliver focused on the incentives states give industry to locate in them and often how few if any jobs are created. Very enlightening.

Wolf. I was telling my dad the very same thing last night before I read your article this morning. He works for a co that accessorizes work vans, , puts lift kits on trucks, work cages and stuff in Bucks Co outside Phila. He gets to go all over the tri State area to all kinds of dealers. PA NJ DE. Pick the vehicles up for them to be worked on. He was telling the lots are stuffed to over flowing. All of them . Yet the 2017 models are flying out the doors with what he said is incentives and markdowns that he has never seen in his 79 years of living ..He can never remember seeing the lots so full. yet they still keep delivering the 2018 with nowhere to put them

Just leased a 2017 rav 4 -0 interest for 3 years – about $ 300 per

month.

This is not the first website comments section I have read where the topic of Toyota trucks and SUV’s has popped up seemingly at random. Is this part of some kind of lame ass online ad campaign?

I doubt it. gorbachov has posted here for a while. He’s sharing a deal he made that he’s happy about. When it comes to cars, people do that.

Thanks Wolf.

Because they’re one of the only brands that really have no issues and last forever. People love them

My 2007 Toyota has 205,000 miles and I’ve done nothing but standard maintenance on it. Love it.

People tend to like their Toyotas. Twice, when my friend and I were going around in his wife’s Corolla, we’e had people offer to buy it. And her Corolla is nothing special; the clearcoat’s got “taken to the carwash too often” syndrome, and there’s a dent in one fender.

I’m a big, consistent Wolf Street fan. I’m also an autobroker.

That said… wow, a lot of bad info in these comments.

– Make no mistake about it, dealers make money selling cars, period. Not only is there holdback and advertising built into each car, but they just about never sell a car at a loss. They just want you to think they do. Next, just as any sales person in any industry might earn a bonus for sales volume, so do dealerships. If a store hits 300 cars sold for the month, for example, they get a bonus from the automaker.

– Finance is often done by the automaker’s financial arm. For example, if you lease or finance a Toyota, you’re doing so with Toyota Financial Services. And as Wolf said, dealers get a reward for signing a customer up for lending, maintenance agreements, etc.

– If you buy a car for MSRP, you most certainly are getting ripped the f off. Recent deals I’ve done would be $9K off sticker, $7K off sticker, etc. Now there are rare exceptions like Land Rover where getting the car at MSRP is actually a good deal because most sell for over that. (Why anyone gets a Land Rover is beyond me. You had better be very rich.)

– There are just about no extras that you should ever buy for a car, especially the stupid chrome wheels.

– Sales is sales. For some reason, our society has decided that the paragon of slimy sales is a “used car salesman”. All sales in any industry can get slimy whether it’s appliances, real estate, software, your dentist, etc. And in general, in any industry, including even Wall St, sales people generally make the most money. Someone has to get the job done. Sales people get rewarded for it. Are there slimy sales people? Yep. Are there less slimy sales people? Yep. To hate sales people is to hate economic activity, to an extent.

– Not everyone who gets a car gets screwed. My clients get fantastic deals and never have to step foot into a dealership. Their cars are delivered to them at their convenience.

– There’s so much info online now for car seals. Incentives are at Edmonds. TrueCar and other sites tell you the general market. I mean, come on. So yes, if you go into a dealership and start negotiating with a random floor sales person, you’re likely to get a bad deal. But with all the info we have available today, who wouldn’t shop around before buying?

Wilbur58, here are some facts:

Holdback is about 3% for domestic brands. That’s not exactly a huge add-on to profit margins.

For some sense of reality, check out Auto Nation’s Q3 earnings report. Auto Nation is the largest dealer group in the country. So you don’t have to guess – and be off the mark. This data is publicly available:

Gross profit margin in Q3 on new vehicle sales = 4.7% (includes holdback). And they have a lot of import and luxury brands with relatively high profit margins. Dealers with only domestic brands have even thinner profit margins. But for a retailer, a gross profit of 4.7% is still paper thin.

Gross profit margin in Q3 on used vehicle sales = 7%, which is better, but still thin for a retailer.

It makes money in F&I. About a quarter of its total company-wide gross profit is from F&I. That’s why F&I is sacred.

Gross profit margin in part & service = 44%. That’s why Parts & Service is so important.

72% of its total gross profits are from F&I and Parts & Service!

Its net profit margin (net income / total revenues) was 1.2% in Q3 and 1.8% YTD … paper thin, and it took the fat profit margins in Parts & Service and F&I to get there. New vehicle sales as a stand-alone business (given the expenses involved) might have lost money.

So this is exactly as I explained it. Check out the actual numbers:

http://investors.autonation.com/phoenix.zhtml?c=85803&p=irol-newsArticle&ID=2313740&highlight=‘ target=

Also, you said:

“If you buy a car for MSRP, you most certainly are getting ripped the f off.”

1. No one buys domestic-brand cars at MSRP.

2. And if you buy an iPhone at MSRP (which is how it is sold), you’re not getting ripped off? Look at the HUGE profit margins Apple is making. Now that’s a rip-off, and people love being ripped off by Apple. No auto dealer or automaker makes these kinds of profit margins.

Gross profit on new vehicles is $144.8 million dollars. Not bad. The 4.7% you’re citing is percentage of total revenues.

But in the Gross Profit mix, new cars is 17.1%. Again, not bad.

Also, I don’t see how you detangle the new car sales from the F&I. It’s not like you can sell F&I without selling a car. For example, they say that restaurants make most of their money on drinks. A person could potentially point out, “They’re getting killed on food!”. But not really, it’s the food that makes it a restaurant in the first place. Otherwise it would be bar.

Finally, i see a distinction between “getting ripped off” and “buying a good that’s a ripoff”.

Getting ripped off means you paid more than other people did for the same item. Joe got his Audi A7 for $8K off sticker while Bob paid MSRP. Bob clearly got ripped off, especially if other people bought in a range at least $5K under MSRP.

However, when buying an iPhone, that scenario can’t play out. The thing costs the same no matter where you get it. You might resent the margins that Apple gets for its phones… or think a competitor offers better bang for the buck, like LG or something. But it’s not like Person A pays $800 for their iPhone while B paid only $500. Apple’s got it on lock.

If anyone buys any car at MSRP outside of a Land Rover, an exotic, or something brand new to market and only 1-2 months old, they got ripped the f off. I move several cars per month as a side hustle. Anyone buying a BMW, Audi, MBZ, Lexus, Infiniti, Jag, etc… for MSRP… paid much more than they should have, period.

You really don’t understand franchised dealer operations, finance, and accounting, and that’s OK. I ran a big Ford dealership for ten years and had to deal with this stuff on a daily basis. I don’t expect people to know the nitty-gritty of the business. I don’t expect you to know this stuff. And I’m happy to answer questions about it when I’m asked. But I don’t like it when people post misleading things about the industry here.

Let me just say that F&I is for new AND used vehicles, and it’s not allocated to just new. It’s a profit center. It’s always “new, used, and F&I.” That’s the “front end” of a dealership. And F&I is the big money maker on the front end: just a few people, a small amount of space, no inventory, and lots of profit.

But you cannot make money in F&I unless you sell the cars first. So you have to move the iron before F&I can make the profit. That’s what causes some of the distortions in the negotiation process. If you can break even on the sale and make $2,000 in F&I, you’ve got a winner. That’s the thinking. This is what some of the commenters responded to. And it’s true – it clouds how business is done at the dealership level, and a skilled customer can take advantage of that.

The 4.7% profit margin on new vehicle sales that I mentioned is new vehicle gross profit divided by new vehicle sales. That’s standard. That’s how it’s done. It’s one of the most fundamental calculations.

Concerning your definition of “rip-off”: I like your definition, but that’s not how I would define it :-]

One other thing…

Because Auto Nation has a mix of dealerships including domestic, European, and Japanese, their books are a good reflection of dealer economic life overall. If that’s why you linked to them, good call.

Wolf – “People love being ripped off by Apple” no shit. Paying Rocky & Guido prices for stuff that’s the equivalent of PC/Android products of 3-5 years before.

But this is rampant in electronics. People play through the nose for “Beats” headphones that cost a few dollars to make. People pay through the nose and “get ripped the f off” for pretty much everything electronic. Hell, the business I’m in, charging people hundreds, at times thousands, of dollars for stuff we got for free or close to it, that’s routine. Are we ripping people off? I’ve been in this game for 20 years and I’ve never thought that.

Maybe I should sell cars (evil grin).

The place I used to work at used to plate a number of cars at the end of the month to show them as ‘sold’ in order to get their ‘bonus’ or make their quota for the month. Car dealers here get a special rate for plating cars which is not available to ordinary folks. Also they get to use those ‘dealer’ plates for driving a new car for test drives or moving them from place to place and for other purposes not intended such as a trip out to the country….

Some of those cars would be on the lot for months after plating. IIRC the manufacturer provided finance for a set period of time after which if the car hadn’t sold the dealer ‘owned’ it and had to provide financing themselves.

The bank would send around a person at random times during the month to check the cars’ VINs and to see if they were still on the lot.

Biggest discount I saw was on a car that had been in the new car showroom for months before I started work there, then moved outside for another period of time, discounted, and then when not sold and less than 500 klicks on the car moved to the used car lot and sat there until another A$10,000 was taken off the price. Finally sold something like a year after I started there.

Service was the number one con there, though.

Wolf told us Carmageddon was coming months ago. The tip he told to us was “Get out of that now before is too late” and “wait until after the crash to buy a car.” Maybe? That’s it.

This is 2017 the year Unicorns go under like nothing and everything gets hacked. And were we get warnings months in advance when companies are going to go under because despite the fact the stock market is managed by bots, their reaction time works at snail speed.

Just look at Juicero, yes I know Wolf explained why, but the fact the company still took that long to crash and burn is amazing.

Uber despite is terrible reputation is still alive because people don’t care if the companies they use are jerks and sexists, just how much they charge.

Nextfix is in red but as long as it can borrow money everything is A-Ok. Twitter is still struggling to monetize despite it has never been as popular as it is today and I have no clue why Snapchat still has investors since Facebook just cloned everything they do and has a larger user base.

And look at Facebook scandals! People don’t seem to care Facebook seems to have a scandal a week in average, they just keep using it due to inertia or something.

At least cheap credit has been ending since 2015 so these borrower companies that just live out of dreams, rainbows and investors money while getting more and more red are going to go under faster and faster.

I think 2018 is gonna be a expectacular year that is gonna make us wish to go back to 2017 even if this year has got a lot of bad things.

Then again I might be wrong. Think people and make your own choices. 2018 could just be the best year ever.

I’m still not even sure how Twitter works, and have only learned to use it to send disparaging comments to the president. I guess you get “followers” but I’m kind of fuzzy on how that works.

I’m kind of skeptical about the so called ‘hurricane replacement’ concept. No doubt many cars were destroyed, especially on dealers lots, but how many people in Houston or, to a much lesser extent, Marco Island and Naples in Florida, watched the hurricanes approach and left their car in the driveway to be inundated?

Wouldn’t the rational thing to do be to get in your car ( Houston was not experiencing CAT 4 hurricane winds) and drive to higher ground. You can’t move your house but you can damn sure move your car and in an emergency isn’t that what people will do?

I don’t have the Houston-area new-vehicle sales numbers for October yet (they’ll come out next week). But here’s what happened in September, according to TexAuto Facts: Houston-area auto dealers sold 28,246 new vehicles, up 22% from September a year ago (23,200). And that occurred even as dealers were still closed in early September!

From what I hear anecdotally, new vehicle sales in October were red-hot and are still so in November. I don’t know how long this will last, maybe another month or two before it will settle down. But for now, Houston area dealers are rocking and rolling.

I was in Houston at a vendor of ours on Wednesday and Thursday before the hurricane hit (I left early to avoid getting stuck there). The 30 or so people that live in Houston that I talked to said it was not going to be a big deal so they were not taking any precautions outside of buying extra water and checking their generators to make sure they were working. When I talked to our sales rep a few weeks after the storm he stated he still had no power outside of his generator and his house was probably going to need to be gutted since it had flooded. My guess is his cars were the least of his worries.