But what’s happening with mortgage-backed securities?

Thursday afternoon, the Fed released its weekly balance sheet for the week ending November 1. This completes the first month of the QE unwind, or “balance sheet normalization,” as the Fed calls it. But curious things are happening on the Fed’s balance sheet.

On September 20, the Fed announced that the QE unwind would begin October 1, at the pace announced at its June 14 meeting. This would shrink the Fed’s balance sheet by $10 billion a month for each of the first three months. The shrinkage would then accelerate every three months. A year from now, the shrinkage would reach $50 billion a month – a rate of $600 billion a year – and continue at that pace. This would gradually destroy some of the trillions that had been created out of nothing during QE.

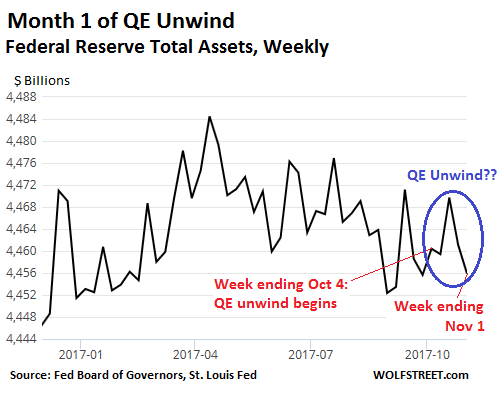

Over the five weekly balance sheets since the QE-unwind kick-off date, total assets rose initially by $10 billion from October 4 to October 18 and then fell by $14 billion, for a net decline of $4 billion. By November 1, total assets were $4,456 billion:

The Fed is supposed to unload $10 billion in October. Instead it unloaded $4 billion. And the variations from week to week are entirely in the normal range of the prior months.

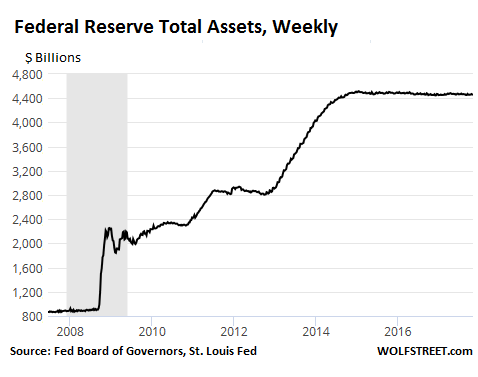

The chart below shows the Fed’s total assets since 2007, covering the entire QE period from the Financial Crisis on. The tiny $4-billion decline in October gets lost in the massive table mountain of assets:

But a first real step has happened.

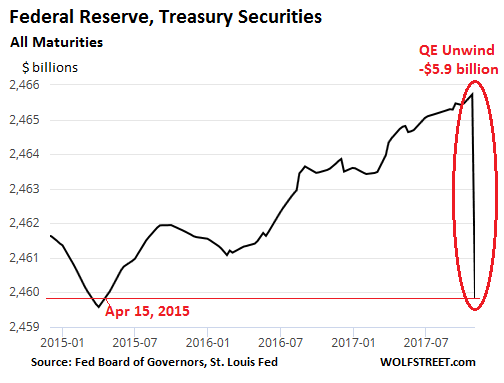

As part of the $10 billion that the Fed said it would shrink its balance sheet in October, it was supposed to unload $6 billion in Treasury securities.

The way the Fed undertakes the balance sheet normalization is not by selling Treasury securities outright but by allowing them, when they mature, to “roll off” the balance sheet. In order words, when they mature, the Treasury Department pays the Fed the face value of those securities. Then, instead of reinvesting the money in new Treasuries, the Fed destroys the money. This is the opposite of what it had done during QE when it created the money to buy securities.

On October 31, $8.5 billion of Treasuries that the Fed had been holding matured. If the Fed stuck to its announcement, it would have reinvested $2.5 billion and let $6 billion (the cap for the month of October) “roll off.” The amount of Treasuries on the balance sheet should then have decreased by $6 billion.

And that’s what happened. This chart of the Fed’s Treasury holdings shows that the balance dropped by $5.9 billion, from an all-time record 2,465.7 billion on October 25 to $2,459.8 billion on November 1, the lowest since April 15, 2015:

So the QE unwind of Treasury securities has commenced.

But mortgage-backed securities?

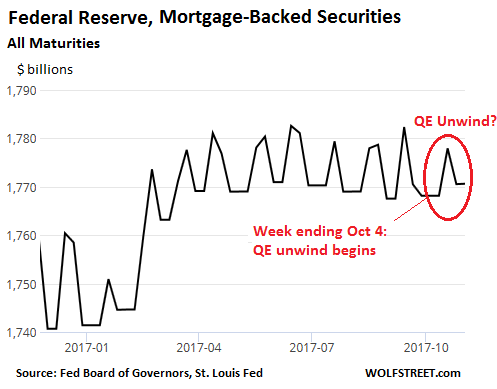

As part of the $10 billion unwind in October, the Fed was also supposed to unload $4 billion in mortgage-backed securities (MBS). How did that go so far?

On October 4, it held $1,768.2 billion in mortgage backed securities. On October 18, this spiked by nearly $10 billion to $1,777.9 billion. Since then, it has fallen by $7.3 billion to $1,770.6 billion, but remains $2.4 billion higher than at the outset of the QE unwind:

Clearly, the Fed has not yet kicked off the unwind of its MBS portfolio. Since the end of QE, the Fed’s Open Market Operations (OMO) has continually purchased small amounts of MBS in the market. Residential MBS are different from bonds. They regularly forward principal payments to their holders as underlying mortgages get paid down or off, and the principal shrinks until whatever is left is redeemed at maturity. To keep the MBS balance steady, the Fed has to buy MBS in the market.

And it has continued buying them in October with stoic routine.

This bifurcation – that the QE unwind is happening with Treasury securities but not with MBS – is curious. But MBS take a while to settle, which could explain some of the delay. After the on-target $6-billion drop in Treasuries, however, I’m tempted to think that the QE unwind of MBS will also eventually materialize, and that the overall package will proceed as announced.

For now, the amounts are small. By next year at this time, the QE unwind, if it happens as announced, will proceed at a rate of $600 billion a year, a momentous monetary policy change, partially reversing the effects of QE, including QE’s effect on asset prices.

And the surge in asset prices has been a doozie. Here’s the extraordinary home price inflation in all its beauty. Read… The US Cities with the Biggest Housing Bubbles

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“For now, the amounts are small. By next year at this time, the QE unwind, if it happens as announced, will proceed at a rate of $600 billion a year, a momentous monetary policy change, partially reversing the effects of QE, including QE’s effect on asset prices.”

With Powell as the next Fed Chair I’d say that none of the above will transpire.

Instead of saying “reversing the effects of QE, including QE’s effect on asset prices” –

you could also have said – “The Fed decided to undermine a major contributor to GDP today, and will push hard for increased unemployment and lower stock prices.”

I invest in stocks because the second statement will never be true again. You really think the civil servant elite will ever take a pay cut? They are insulated from their decisions.

See Japan……..

The Fed doesn’t care about your stocks — or even GDP. Among other things, it cares about the banks. When asset prices get inflated too much, the banks’ collateral values are inflated, and this puts the banks at risk. Worries about inflated asset prices have figured prominently in some speeches of various Fed heads. The Fed doesn’t want to preside over another financial crisis.

You are absolutely right these central banks should only care about the soundness of their banking systems, but they have convened a completely different message to the market in the past few years……Consequently, bad economic (or whatever) news are interpreted as positive news for stocks these days….

It seems the FED presides over every financial crises.

:-]

I’ve heard they are outsourcing the next one to Europe or China.

In the recent decades, the FED has been the source of instability, and main enabler of bubbles.

It would be time to end it. The replacement is easy to see: the LIBOR could be a template, or it could subsume the role.

I know, LIBOR is trans national, but the central bankers have moved to the same tune like a herd, so the difference would be negligible.

That my friend is the problem,the “Fed”,a Club of over educated Academicians and sponsored by the banking system has and always will be blindsided by Reality.the “Models” created in their laboratories are just that. the next Black Swan will again scramble their theories all to pieces except this time it’s name will not be Lehman Brothers. not to worry.their 200 K pensions will be secure and they will move to very lucrative professorships at the hallowed swamp of “higher education”. life is good,for them… for all you lowly peasants stuck in rush hour traffic,the clock is ticking……..

The Fed cares about stocks but only when they belong to the buddies of the Fed. Once stocks are in the hand of Mom and Pop and pension funds, the Fed will flip the middle finger at you.

Also, if the Fed does not care about stocks, how about a 1% interest rate increase in one go?

“Also, if the Fed does not care about stocks, how about a 1% interest rate increase in one go?”

GET REAL

A 1 % increase with a less than 2% fed funds rate

= 50% + INCREASE IN 1 STEP in interest rates.

Unless you have a huge problem, Swiftly developing, or want to shock an economy. A Responsible CB simply dosent do things like that.

Consensus seems to be “Powell” is “Dammit Janet 2” on rates and the Sheet but p 45’s, buddy on relaxing regulations. Hence p 45’s selection to head teh fed.

Dammit had to massive black marks against her for p 45.

1 she was appointed buy p 44.

2 She said bad things about p 45 during the early part of the election.

p 45 has a very thin skin and enjoys revenge.

By replacing Dammit he unwinds (what there is of) P 44’s Legacy and appointees further. Repays Dammit for her unkind word’s. Get’s himself a guaranteed minor mention in the annuals of the FED. As a POTUS who replaced a FED chair after 1 term. Which is not a very regular occurrence at all.

@d, a responsible Fed will simply take a look at itself and disband.

So LOL at the concept of a responsible CB. It’s what’s called an oxymoron.

The Fed doesn’t want to preside over another financial crisis.

Au contraire. The Fed’s engineered boom-bust cycles are the most efficacious means of transferring the wealth and assets of the middle and working classes to the Fed’s bankster accomplices. The Fed creates giant asset bubbles, fools rush in using borrowed money, and then the Ponzi collapses under the weight of its own fraud and mark-to-fantasy accounting, as it did during the recent tech and housing bubble busts. Then the Fed prints up trillions in “stimulus” so its rapacious investment banker cronies can hoover up all the distressed assets from the pauperized bag holders. Wash, rinse, repeat.

We’re about due for another pump & dump that will further the Fed’s prime directive since its creation of concentrating all wealth and power in the venal hands of its oligarch cohorts.

You forgot to use the word venal. It’s just not a Gershon post without it. ;)

Speaking of words to be avoided, “rapacious” is another one. It does sound too much like a filthy libertarian pamphlet from your daddy’s bottom drawer. Otherwise love you, Gershon :-).

@Gershon:

– Did you prepare for Jennifer Lawrence’s visit to your house ? You said that the chance of the FED reversing QE was smaller than the chance of Mr. Lawrence visiting your house. Or did she already visit your house ?

– If you would know how money/credit is created then you would stop this kind of ranting against the FED.

– Commercial banks can create as much credit as they want without the help of a Central Bank like the FED, BoJ or the ECB. That means that the $ 52 trillion of US debt (in mid 2008) was created by the commercial banks. The balance sheet of the FED in mid 2008 was “only” at about $ 800 billion. Quite a difference, I would say.

“Commercial banks can create as much credit as they want without”

NO

Unfortunately they can lever their customers deposist, to exorbitant level’s though.

I always love it when they talk about “policy errors”, such as 2000, 2008, etc.

The policy errors occurred: 1995-1999, and 2003-2007.

I made (and saved) a lot of money during those bear markets and the subsequent recovery years. (because it was easy to tell we were in for a problem). The Fed Chairs said stuff like ” …no bubble…”, “…real estate market is sound…” “…it’s impossible to tell when you’re in a bubble in real time…” Twilight Zone stuff.

Are we currently experiencing another such error?

The Fed is [suddenly] worried about inflated prices? After surreptitiously inflating those prices for over then years? Now they’re worried? I do posit that the Fed may at some point use PPT to dampen or sell S&P futures, in the rubric of stability, but they are NOT worried about high asset prices, they will offer to back those prices under any circumstances. To undermine asset prices would be like Trump appointing Mother Teresa to the Fed.

In my understanding of the Fed, there is a limit to everything, up and down. Asset price inflation, past a certain point, can engender terrible risks and side effects. The Fed is well aware of it. Earlier this year, Boston Fed gov. Rosengren gave an entire speech with slides on asset price inflation in US commercial real estate and its risks to the banks, naming names and numbers.

Other Fed heads have touched upon similar topics. They’re not blind to the risks, though they’re WAY behind the curve.

“Other Fed heads have touched upon similar topics. They’re not blind to the risks, though they’re WAY behind the curve.”

They are always behind the curve, and always will be.

WHY

Simple:

As soon as the FED says anything, the credit promoters, dont like, the credit/Bubble promoter’s scream “YOU HAVE NO DATA TO SUPPORT THIS”

By the time the FED gets the data, and can use it to support their position its historical and the Bubble has already been blown, by the bubble blowers.

Both they FED and the bubble blowers, know this old game well.

The FED, is always wrong, as no matter what it does, somebody will get hurt, and scream about it. The MSM will always pick up, and amplify, that anti FED scream, AS IT SELLS ADVERTISING.

Barney Frank and his Keynesian party boys, threw a really big party (in US housing) in the nineties. They kept it running with OPM until 2008 ,then went home to play with their new husbands.

leaving the normal working peopel, the mess and the bills.

It will take generations to pay off the “party boys” bills and clean up their mess.

QE in the US was part of the price it avoided a depression that would have made 1929 – 44 look like a blip in the chart but has left us in a stagflation recession, that still has no real end in sight. Far to many peopel refuse to accept that reality.

I dont expect any real change until 2024 possibly 2028 plus, if p 45 gets a second term. There are to many black swans on the horizon, to be other than optimistic, for anything, but status quo. Till then.

I was speaking to a govt official yesterday, on this issue she said “I tell my grandchildren” ” Those born in the west between 1942 and 1955 are the most privileged and prosperous generation ever in recorded history, Its OVER” “They dont believe me”

I hope everyone interested in the Fed watches the excellent documentary “Money for Nothing: Inside the Federal Reserve’

It’s on YouTube, for one.

It covers various Fed blunders, some admitted to by maybe the head blunderer, Allan Greenspan.

But it also shows that far from being a nexus of evil aimed at world conquest, the Fed is actually trying to please a very demanding customer: the US voters via their politicians.

As someone has said of Californians (but it’s everyone) they want services and not to pay for them.

On the federal level, this was the decision to not pay for the war in Vietnam while at the same time increasing social spending, and just print dollars.

Fairly quickly, no one wanted dollars.

People who think the Fed is omnipotent may not be aware that at one point the US had to sell bonds denominated in Swiss francs and German marks.

The resulting double- digit inflation was finally crushed by a Fed hero. Paul Volcker, who had to drive the Fed rate over 20 percent.

It recession was painful but it laid the foundation for Allan Greenspan to coast for more than a decade, gathering accolades all the way as he cut rates.

Everyone will have their own take-away, but it’s unusual to see a well researched doc that isn’t grinding an ax.

“As someone has said of Californians (but it’s everyone) they want services and not to pay for them.”

I’m pretty sure I pay handsomely for the services OTHERS receive. Otherwise, I’ve certainly been overcharged a venally rapacious amount on a consistent basis.

Ask not what your country can do for you, ask what you’ve done for your country today.

Being French it is amazing to see American people in the perpetual rethoric of “cutting taxes which will boost the private enterprise”. Like it’s not obvious enoug you live in an oligarchy run by maybe 30 000 people. We actually have the opposite system. Both ways, no one seems to get the simple idea that budget is to be balanced otherwise everybody pays through inflation. Rich guys don’t care and folks suffer. So, if inflation need be considering our money system , lets have folks benefit from the money spending, rather than the few.

“The Fed doesn’t care about your stocks — or even GDP”

I don’t see how that statement can be true. The Fed, in an attempt to inflate bank assets and monetize government debt (and make us all “feel wealthy”), already created another financial crisis. Wildly inflated assets are a crisis because either 1) the assets will need to crash (or maybe just sink) back to earth or 2) the currency will need to crash (or sink) to prevent assets losing value in nominal terms. Central banks have chosen option #2 at every turn. Talk is cheap but actions are what matter. When inflation takes a bite, simply tell the people there is no inflation – problem solved!

The Central Banks have shown a willingness to put their currencies at risk in an effort to guarantee assets won’t fall. Even small 3% corrections bring about endless dovish statements and policy reversal. We have witnessed 9 years of “emergency monetary policy” and there has been a lot of talk but nothing much has changed – the Fed funds rate is still at emergency levels (1% to 1.25%) and the balance sheet is still 4.5 trillion. If there was any substantive change in policy, liquidity would start to drain from the system and asset prices would start to fall. They will never allow assets to fall. Given everything that has happened I don’t know how you can believe otherwise.

Nine years ago Ben Bernanke announced emergency interest rates and a 600 billion QE asset purchase program, to save the monetary system. How is it possible that a 600 billion program added 3.7 trillion to the balance sheet and interest rates are still at emergency levels nine years on? We have reached the point of no return – normalizing rates would be a return to policy that can never happen – invest accordingly.

Your articles are very informative and could one day prove to be a valuable historical record of why/how societies suddenly chose to debase their currencies and bring about so much anguish and misery. When we emerge from this you should write a book.

…. ahhhh .. but the more relevant question/topic in light of todays announcement should be ;

What happens .. ‘ When January Ends ‘ ?

Do we wake up as the bard ( Billie Joe Armstrong ) said … or are do we become … ‘ Drenched in our pain again ‘ .. only worse ?

Wolf

The Fed has a bigger problem than the Stock market with yield curve starting to invert. They walking the same way they did in 2005-2009. This will be an unholy mess. They’ve got a doozie of a mess coming when it all goes wallop.

http://stockcharts.com/h-sc/ui?s=%24YC2YR&p=D&st=2003-11-04&en=2009-11-03&id=p93160127305

2003-2009

http://stockcharts.com/h-sc/ui?s=%24YC2YR&p=D&st=2015-11-04&en=2017-11-03&id=p09321713219

2015 – 2017

“I invest in stocks because the second statement will never be true again.”

I hope you use trailing stop losses.

Won’t Work!

The traders* gets all of their beer and stripper money from taking out trailing stops.

Works like this: On the opening of the market, the first “Sell/Buy” combo in the order queue sets the market price below the stop. That “Sell/Buy” is entered by one of the traders, they come in early for exactly this. The stop order executes, traders buys the stock at the market price he/she/it just set, then sell 10 minutes later at the normal market price. An Easy 25 bux or so.

*) Well, Robots. They still take your money and blow it on better silicon and more cooling.

When the Chinese owned Sino-Forest listed in Toronto suddenly collapsed, one guy had a ‘stop loss’ in at 16 and change.

The price gapped past this in a second or two.

He got out at 6 and change, which was better than the zero it was a short time later.

Note that this was not a general market crash, just a big move down in one stock. The ‘stop loss’ imposes no duty on the broker, except to try and execute the order, which in this case he couldn’t.

If the record daily crash of 23 percent in October 87 is taken out or even equaled, most ‘stop loss’ orders will turn out to be wishful illusions.

“If the record daily crash of 23 percent in October 87 is taken out or even equaled, most ‘stop loss’ orders will turn out to be wishful illusions.”

Unless you have a no bill trading account, with very little margin buffer in it, in which case they will close you before the available margin hits zero. As they do not wish to be stuck with any potential losses.

NO BILL accounts are the only type of brokerage accounts to have.

The MBS chart is surprising. Does anyone know what tranches it buys? Do they have a minimum rating requirement? Or do they just scoop up whatever is left on the table after the large pension funds pick through?

If it’s the latter, they may not be able to dial it back without crushing housing demand due to tighter lending standards.

The Fed only buys “Agency” MBS. The underlying mortgages are guaranteed by Fannie Mae and Freddie Mac.

Here’s a list of their recent purchases:

https://www.newyorkfed.org/markets/ambs/operations/lastTwenty.html

There is a crucial typo: its $4,456 billion not $4.456 billion

Who in their right mind would buy MBS from the FED? Those MBS have to be the most toxic crap ever.

The Fed isn’t selling MBS. It’s only buying MBS. It buys in order to keep the balance roughly level. MBS principal constantly shrinks as principal payments are forwarded to the holder. So all the Fed would have to do to shrink its holdings of MBS would be to quit buying new ones.

What happens if/when a new crisis in real estate happens and a significant portion of the people default on their mortgages? The mortgages will not be paid and FED is left holding the bag? How do they recover the remaining amount even after foreclosure proceedings are forwarded to them? Do they simply write it off? How will it affect the balance sheet then?

per wolf:

“The way the Fed undertakes the balance sheet normalization is not by selling Treasury securities outright but by allowing them, when they mature, to “roll off” the balance sheet. In order words, when they mature, the Treasury Department pays the Fed the face value of those securities. Then, instead of reinvesting the money in new Treasuries, the Fed destroys the money.”

what’s to stop them from “pretending” the mortgages were paid, and then destroying, by the same mechanism, the “pretend money” with which they were paid?

full disclosure (obviously!): i am not a finance expert…

Wish I knew the answer to that question as well.

“…and FED is left holding the bag? How do they recover the remaining amount even after foreclosure proceedings…” By definition, the Fed is NEVER left “holding the bag” because their liabilities can always be covered with cash created out of nothing. This was their “solution” during the financial crisis, and it is finally winding down. Over the last decade, all the bad mortgages (and $ billions in derivatives attached to them) have been washed through (i.e. made whole or nearly whole) by the Fed’s magical money creation system.

+1.

But I believe the Fed is only allowed to buy agency backed conforming MBSs. While being a problem, I don’t think they were anywhere near as bad as the private investment bank backed NINJA loan infested MBSs. I’d suspect those are still rotting in my pension fund.

“I’d suspect those are still rotting in my pension fund.” I would suspect not. The Fed hoovered up EVERY failing asset class (including non-agency MBS) with the first tranche of QE back in the winter of 2008-2009. (Remember the emergency “alphabet” soup of programs – TARP, TALF, AGP etc?) This stuff was bought at some value between market (zero in many cases) and par and then quietly subsumed in succeeding years in the ever expanding Fed balance sheet. Whatever losses realized at the Fed simply disappeared into an (eventual) $4.5 trillion colossus.

As Wolf pointed out, the MBS, on the Feds balance sheet, is insured by Government Sponsored Entities which are (implicitly) insured by the government and government debt is (implicitly) protected from default by the Fed.

Around and around in a circle, each party insures the other – so as you can see nothing can ever go wrong.

It’s an implicit guarantee to the investor. The homeowner goes underwater and stays there until they sell at a loss.

I wouldn’t call falling housing prices to much lower levels a ‘crisis’. It’s in fact what needs to happen to get this disastrous economy out of the mire.

Fed will stop shrinking balance sheet in Q1 2018. But it really doesn’t matter as the reduction is so low and the crisis will hit us before any normalisation can happen.

QE will start again and at that point the creditor nations well loose the confidence in the dollar. It will be the end of the dollar standard. The US is biggest debtor nation in history and monetasing debt will be appealing.

Maybe not the end of the dollar but a big QE devaluation 2018!

“QE will start again and at that point the creditor nations well loose the confidence in the dollar. It will be the end of the dollar standard. The US is biggest debtor nation in history and monetasing debt will be appealing.”

The only nations seriously in the hunt to replace the dollar now are, Russia, iran and the other anti US Islamic Terrorist supporting States, DPRK, china, and some loonies like Venezuela. That push for change, is about transferring global power to them, not global financial stability.

80 plus years after the huge US push to replace “Sterling” “Sterling” is still in the SDR basket.

CCP china, bullied its way into the SR basket, making the whole SDR system worthless.

With what do you propose the US $ is replaced.??????

There is currently no viable alternative apart from CHF, and they like the Japanese (for different reasons) dont want their currency to be the Official reserve, as it will cripple their citizens financially, if that occurs.

Hurt the Americans all you can, replace the $ NOW. Scream the US Haters.

Show me a real viable alternative to the $, and then a real starting point in the process exists.

There was a lot of “euro as the reserve” talk.

Currency union, with out fiscal union, is an unworkable, insanity. This has been Historically proven in “Club Med” before. 23 + years later, there is still no definite “Fiscal Union” on the horizon, for the undervalued “Deutschmark in disguise”.

It will remain undervalued and unstable, as long as it is hamstrung by, france, greece, Club med and no “Fiscal Union”.

“With what do you propose the US $ is replaced.??????”

I can think of lots of possibilities – to name a few:

1) A new dollar (once again a Federal Reserve token system) to be valued at 10,000 old-$ for each new-$.

2) Chinese RMB with partial gold backing and exchangeable for gold for the purposes of international trade.

3) Adoption of a crypto currency by the masses.

I see the first choice as the likely outcome (enforced under threat of prison time for individuals who try to avoid the new dollar), but a new dollar would likely be a domestic currency no longer used as a reserve/trade currency (it would inflate away quickly – own hard assets)

When the financial domino’s fall how will they land?

Virtually, all U.S. creditor’s are also in massive debt?

//////US$\\\\\\

The last man standing will not be Iran/China etc…

P.S. I took my bitcoin token down to Walmart, to buy up the lot and they threw me out?

What about gold?.crypto and gold backed credit cards have solved the liquidity issue around it.

Private Cryptos (Tulip Bulb’s) are a scam.

China is going through the process of outlawing them all (Once they also made paying in gold punishable by death also) Starting with ICO’S

A state crypto is simply a new FIAT.

Gold ( I own some Kgs of physical) has diverged from silver (traditional 20 multiple.) Considerably.

Silver has not been suppressed down, it is up X 10 of its 1970’s values.

Until the false gold price is unwound, it has become useless, as it is untenable to BUY Physical at this false price. Any currency based on it at this price, is grossly overpriced.

Note. That the word value appears once here, and where.

“CCP china, bullied its way into the SR basket, making the whole SDR system worthless.”

1. China talks big, but carries a small stick. The yuan is pegged to the USD, not the other way around. The USD is not pegged to the Yuan.

With what do you propose the US $ is replaced.??????

2. For a long time yet the USD will remain the world currency. Virtually every country in the world recognizes the USD, especially in the black market. Take a suitcase of rubles out of Russia, or a suitcase of Yuan out of China into any other nation’s black market and let me know how you make out.

By default, despite the reckless actions of the Fed, the USD is a giant among weaklings. The USD is even used by America’s enemies to buy weapons to kill Americans- ask Iran what they did with all those pallets of cash.

In order to generate even anemic growth they have had to pump trillions into the system. I read somewhere that it takes $18 of debt to generate $1 of GDP growth at this point, under some kind of insane law of diminishing returns. I don’t think a return to full-bore QE can bail out the system next time. We’ll get contraction until at some point new money is sufficient to stabilize the system at a much lower level of production and living standards. If a person has a disease, a certain amount of medicine will help. Past some point the medicine no longer helps, and very soon after that it can become a toxin. That is where, I think, we are at today. The only way additional money might spur growth and improve overall standards of living is if it were given directly to those with the highest marginal propensity to spend, and the Power Elite will do anything, try and cockamamie scheme, rather than do that.

It is crystal clear that the FRB now lives in its own bubble of perception and purpose, which is presently separated from the needs and wishes of the large majority of American citizens engaged in productive activities, who must indirectly and directly pay for the bank’s fantasies, illusions, hallucinations, and Potemkin villages [markets].

There is one, and only one group, accountable for this fantastical and fableist authority, and that is the American Congress, which in theory is elected by the people to represent their long-term best self interests.

It is apparent that if this rogue agency is to be controlled, and made useful to the majority in the “Brave New World Order,” Congress must establish ranges for the various rates which the FRB controls such as the discount/prime rate to force these back to “normal.”

Congress should also transfer many of the Federal Reserve Bank’s other functions, with serious “conflicts of interest,” to more appropriate government agencies. For example bank regulation and monitoring to the FDIC, and determination/regulation of exchange margin [speculation] rates to the SEC/CFTC. Much of the now inapproprate tasking of the private FRB occurred in 1913 when the “bank” was established, and the more appropriate governmental agencies did not yet exist.

When pigs fly in formation over the Capitol…

in 1913, the US was still on a gold standard and the Fed had every reason to tightly regulate banks. If the banks got so far out over their skis that the general population wanted their money back, the Fed had to pay it out of its gold reserves. The Great Depression simply showed that the Fed had no actual willingness or ability to regulate the banks properly. And nowhere near enough gold.

Once off the gold standard, the Fed is free to fix any problem with money creation. Which means banks are free to get into any crazy scheme they want.

Window dressing? Need some fresh paper to dilute the shiat paper the Fed can’t find origination credentials for the MBS it bought (for the taxpayer)? Going to be another unfunded entitlement liability?

When they decrease the MBS purchases does this mean reduced house prices?

– I can imagine that people are still interested in Treasuries.

– But who in his right mind would buy all those Mortgage Backed Securities/garbage ? In this regard I am not surprised to see this development.

– I think now the FED can/has become the US’/world’s largest landlord.

It seems the Fed has had many years to begin and achieve balance sheet reduction, and did not do so.

It also seems the Fed had many years to normalize interest rates – at least to some extent – and did not do so.

While it may be true the Fed represents banks, it seems to me Fed actions have also closing served the interest of inflating assets, for a very long time. Normalization of balance sheet and interest rates will probably deflate assets, and when/if that becomes apparent, my guess is the Fed will reverse course and re-inflate.

I might be totally wrong, but asset inflation has been going on for so long after it was needed, it’s hard to believe the Fed is reading from a new gospel book.

At this point, my attitude might be like the market when told normalization is coming:

“Show me the money!”

Exactly so, you nailed it.

Ben Bernanke said QE was a limited, temporary plan to print $600 billion to save the monetary system from collapse. But somehow Ben, with his self-proclaimed “courage to act”, grew this “temporary, limited program” to $3700 billion (over six times what he originally stated). QE will never reverse (in anything other than temporary trivial sums) but instead will grow and be the end of the currency (probably sooner than we all think).

The camel stuck his nose under the tent and now the tent is no longer in the village but can be seen many miles away romping through the desert.

With the Fed destroying money, this will all obviously lead to hyper-deflation. Sell your gold and other PMs as fast as you can!

Sarcasm of course. Just making fun of everyone who said QE would cause hyper-inflation.

Currency losing its value is no guarantee of gold holding its value. Gold is just a metal with little utility and lots of it is laying around. I would not count on it as a store of wealth, humans are fickle creatures.

Own productive assets.

Thanks for this article. Very helpful.

So the bottom line is that the Fed failed to reduce their balance sheet by the promised 10 billion dollars and only achieved a reduction of 6 billion instead. Sounds like the old Fed we all know and love!

The Fed has to have credibility with world governments if the dollar is to remain the kingpin. So reduction in QE was always in the cards; at least in namesakes. Same with ZIRP. And, as others have commented, these actions have to be taken in coordination with other developed countries; slowly and in methodical, planned fashion.

The stock market runup may well be nothing more than planned “cover” for these changes. In otherwords, the Fed having Wall Street pump the market to reassure all that bad things won’t occur there with these changes. So in that realm, I believe the Fed does care very much about stock prices.

Finally, I do believe that the increase in interest rates primarily will take a toll on the economy. Certainly the whole tax bill is designed to help stimulate and I suspect it is one of the legs that was devised for propping the economy. (Infrastructure being the other).

The Fed, Treasury and Wall Street have tremendous control over the economy. More than most could imagine. Still, they cannot solve social unrest caused by the ravages of high inflation or greatly reduced prospects for financial security on the part of many Americans. That is the wild card that will take time to play out.

“The way the Fed undertakes the balance sheet normalization is not by selling Treasury securities outright but by allowing them, when they mature, to “roll off” the balance sheet. In order words, when they mature, the Treasury Department pays the Fed the face value of those securities. Then, instead of reinvesting the money in new Treasuries, the Fed destroys the money.”

If the Fed wants to see higher official inflation numbers as it claims, instead of destroying the money, it could give the money to indebted students by buying their debt and announce all payments on the student debt the Fed now owns are forever suspended, or distribute grants to cities and states to fund vetted infrastructure improvements (NO “public-private partnerships” allowed!), or fund public pension shortfalls at the local and state government level. Some of these actions would have more fiscal stimulus and thus inflation than others, of course.

If legal objections arise for some of these (“only Congress can approve spending”) then the Fed can get around this in a similar way it does to give the money to fuel asset inflation: have the local governments issue debts which the Fed buys in full, and take the additional step of suspending for all time any payments be made towards paying them off.

The Fed could claim it has this power under it’s mandate of full employment, or price stability, or whatever, and the fiscal stimulus it is undertaking is needed to do what Congress and the President have not done.

The Fed Actually Begins its QE Unwind :

Good Watch ! Keep on ! Wolf Richter

The Fed, in trying to save banks that are mostly high risk casinos, has put itself in a position where it will have to save the banks yet again. China will probably crack long before QE is unwound in any significant way. It will be interesting to see how the Fed will save the banks after the next crisis. However it does, it will be couched in the language of “economic growth,” that will benefit only a chosen few. Just like last time.

Wolf, great site! I’m by no means a financial expert, but have been wondering if this would be a “convenient” point in time for the Fed to either engineer or allow a stock market crash. Wouldn’t that mean a flight to safety in US bonds? And wouldn’t selling into that demand be the perfect way for the Fed to offload securities on its balance sheet without driving up rates? I’d be interested in your opinion as well as that of others on this site.

I don’t think the Fed wants to “engineer” a stock market crash. I think it wants to tamp down on asset price inflation, particularly in commercial and residential real estate (where banks are at risk) and in bonds. It’s much less concerned about overvalued stocks, though that has cropped up too in speeches. So I think the Fed would allow an orderly decline of the markets, including the stock market. I think it will allow some turmoil in the stock market as long as the credit markets don’t freeze up. And if total financial chaos breaks out, it will step in.

But a 30% or even a 50% decline in stocks from peak to trough spread over, say, 5 years with many ups and downs wouldn’t qualify has “total financial chaos” on its own, unless credit markets freeze up.

The liquidity which QE put in the system isn’t going anywhere. I gave them junk, they gave me UST, [which they held] I leveraged up and bought stocks, and the gains I have booked are now collateral. Now the bond disappears and I keep the gains. Now the Fed opens the discount window, and I borrow all I want with the proposed rate of increase in interest rates programmed in I never get caught holding a lemon. As long as the stock market gains faster then their 1/4 point baby steps I am moving that collateral around. You may imagine the Fed has no method to get new liquidity into the market and keep the liquidity that is there circulating, that is the pinnacle of ignorance. Why isn’t this the Yellen rally? The Goldilocks economy redux? This woman is a goddess, the Fed is the last problem in this country, the problem as before is corruption and the lack of financial oversight.

Does the Fed receive the income on the MBS securities?

Yes. It also receives income US Treasuries. It sends most of this income back to the US Treasury department. For 2016, this remittance to the Treasury amounted to $92 billion, down slightly from prior years.

The MBS was offloaded from the GSEs, Fannie and Freddie, who were in parlance, toxic waste dumps for fraudulent mortgage paper. You the taxpayer picked up the bill, and so what benefits there are should revert to the UST. The Fed isn’t really a bank, but it regulates the banks and when policy gets out of balance, concerning asset prices, as Wolf has said, the banks start to complain, and the Fed as a USG bureaucracy finds ways to make it more profitable to be a banker, rinse and repeat.

The FED doesn’t have to worry about its balance sheet “unwind” monetary policy. The Swiss National Bank is doing all the heavy lifting for the FED as a majority shareholder in US risk assets.

Yep. All CBs are related, they can borrow each other’s balance sheet to pump each other’s assets.

Disband all CBs now!!!

I’m surprised we’re not talking about the US budget deficits from here to eternity.

http://thehill.com/policy/finance/354542-us-deficit-spending-reached-668-billion-in-fiscal-2017

I presume that the US congress and the US “treasury” (a misnomer if there ever was one) are going to “fund” that deficit the traditional, old-fashined way — by selling treasuries to those who will buy them as an “investment”. (My parents taught me that an “investment” is something that will INCREASE in value over time, as opposed to an automobile that will DECREASE in value over time.)

Just exactly WHO is buying those hundreds of billions of treasuries year after year after year and just exactly WHERE are “they” getting the “money” to do that? Here’s one person’s very informative answer: https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

What goes unmentioned in all of this is, naturally, what is THE most important factor of all that maintains investors’ “confidence” in printed-out-of-thin-air USD — the US’s proven promise to destroy any person or nation that refuses to accept USDs as payment for real things. In short, ever since Nixon took the USD off the gold-standard in the early 1970s, the USD has been on the “drone standard”.

Yes, trillions upon trillions of fiat USD are backed by drones, and perpetual war and fiat USD go hand in hand. For example, foreign puppet-government officials and regime-change mercenaries are paid by fiat USD. Just one example among many:

“How the US sent $12bn in cash to Iraq. And watched it vanish”

https://www.theguardian.com/world/2007/feb/08/usa.iraq1

Don’t you find those details fascinating?

So that there are no coffins flying back to Main Street USA to get the bewilderd herd of voters riled up, mercenaries now replace draftees. As far as the herd is concerned, the wars of fiat-USD-hegemony can go on forever.

All MBS, CLO and CDO will eventually assume their intrinsic values

Zero

At the present time in the US, every financial institution, investor pool, TBTF bank, the Fed and Treasury are hoovering up every single nickle of liquidity from every source world wide, trading for some of the worst investment classes seen since the Civil War

The investor classes are all desperate for yield at any price, any risk, buying any tranche of garbage bonds, loans or other offerings so long at it has at least a single digit positive yield.

The international investor class still thinks the US has the rule of law and it’s currency is backed by the full faith and credit of the (bankrupt) US government.

The domestic investors are just sheep waiting to be sheared.

The Fed will back off its program to unwind QE as soon as it significantly detracts from the profits of its owner banks, although it could be argued that it’s already doing that.

I will assume that the fed’s discrepancy on mbs is not due to defaults and that in fact all the defaults have been resolved by the mbs issuer. Even when overlooking defaults you will have discrepancies between what they pay for a pool and what they ultimately receive from the pool. It all depends on the prepayment speeds of the mortgages in the pool. If they bought a pool priced at the 5 year spread and it prepays sooner, there will be a difference on the value. The difference is a gain or loss on the spread.

For the financially challenged: if you lend you brother $100 at 1% a month for a year, the longer it takes for him to pay you the more profit you have, and if he prepays you in a month, you make $1 instead of $12.

Given: 20 trillion seconds is about 631,000 years and current national debt is accelerating past $20T

Gravitational acceleration of Earth is 32.18 ft/s^2 and the circumference of Earth is about 25,000 miles.

Speed of light being186,282 miles/second, or 7 times around the earth in one second.

1) At current debt acceleration rate, in what year does compounded national debt exceed orbital speed?

2) In what year does debt accumulation surpass light speed?

Many nations are debt peons to the banks to some degree. But just as falling can be quite nice until you hit the ground, being a national debt peon to the banks may seem excellent until they pull a Greece on you, and then you’re totally buggered.

Economies of scale suggest that retail peonage of populations can’t be nearly so profitable as lording it over entire countries in toto. Banks have no interest in the opinions of their prey.

Fed numbers and the end of the month not coinciding with the maturity of instruments on its balance sheet is all.

Bet that if the dates are in alignment on the end of the coming months you will see the balance sheet reductions.

And by the way how is TESLA doing?

May be a stupid question, can fed do swaps with other countries such as the Swiss and get them to back stop the market? I was reading on zh today how the Swiss CB is loading more and more stocks — http://www.zerohedge.com/news/2017-11-03/swiss-national-bank-now-owns-record-88-billion-us-stocks.

It seems to me that the easiest way for Fed to move forward with the QE unwind and yet keep assets pumped up is to get somebody else to do the dirty deed and unwind the swap later. Will this even work? Can they do the same with somebody else buying up the MBSes?

Hi Wolf,

I heard a comment the other day didn’t take it in at the time but afterwards I thought hold on a second.

This guy on tv said US Corporate debt is 125 trillion dollars, if interest rates went up by 1% say over the next ten years, the tax cut being talked about at the moment would be wiped out by the interest rate increase.

Is that the case?

It’s complicated, the say. I also heard that one of the provisions currently proposed in the bill is to make corporate debt non-deductible, which would be a game changer. But at this point, we have no idea what the final tax bill will look like. They’ve unleashed the lobbyists.

On the surface, at its most basic level, 1% of $125 trillion would be $1.25 trillion, so that part is easy, but I have no idea how much in taxes corporations will save because they all use (legal) tax dodges now, and they’re already not paying the max corporate tax rate. No one is. So I think when people throw numbers out there to show what’ll happen over the next ten years, they might be right and they might be wrong, and no one will know until we get there.

As things Robotize further both Capex and interest deductions are for the chop.

As Robots brought through CAPEX, with loans, are shrinking the tax base.

Currently Corporations dont pay tax. they simply pass it on to their customers.

In the future Corporate tax will be based on GROSS margins. BEFORE ANY deductions.

Once the gross margin moves above a certain level, the tax rate will increase with it.

Then, finally, Corporations will start paying tax, as they will not be able to pass it on.

Downside once the Corporations start paying tax. The State/Nations will not need the tax contributions from the workers, so will cease to protect or provide for them.

On second thought, I also cannot duplicate the $125 trillion in US corporate debt. It seems there’s a decimal missing.

There are about $9 trillion in US corporate bonds outstanding in the US, $2.1 trillion in US C&I loans, $1 trillion in money market debt (short-term corp debt)…plus some corporate mortgage debt… plus US corporations issue bonds in other countries, but in smaller amounts and they probably don’t fit into this equation, plus there are some other forms of debt….

In other words, I can’t get to $125 trillion. Not anywhere near.

Just a brief “thank you” for these posts and for your insight into the markets. Thank you for continuing to follow these important issues and explaining them. Above all, thank you for sharing this with everyone, at no cost.

(I’m a bit early for Thanksgiving, but this post is a gem and truly deserves a special thanks.)

“The way the Fed undertakes the balance sheet normalization is not by selling Treasury securities outright but by allowing them, when they mature, to “roll off” the balance sheet. In order words, when they mature, the Treasury Department pays the Fed the face value of those securities. Then, instead of reinvesting the money in new Treasuries, the Fed destroys the money.”

So let me see if I get this. The taxpayers are paying taxes in order to pay the interest on the Treasuries the Federal Reserve owns, and when this Treasury matures the Federal Reserve is going to destroy both the Note plus Interest (which includes taxes paid)?

The Fed gets the interest income from the securities it holds (Treasuries and MBS) and remits most of this income to the Treasury. For 2016, the Fed remitted $92 billion of its income to the Treasury.

“After the on-target $6-billion drop in Treasuries, however, I’m tempted to think that the QE unwind of MBS will also eventually materialize, and that the overall package will proceed as announced.”

So, as I said here – https://wolfstreet.com/2017/10/20/is-the-fed-getting-cold-feet-about-the-qe-unwind/ :

“Why don’t you try doing something radical – like waiting until a full month has elapsed and then see what the Fed is doing? This is just noise!”

You’ve finally come round to my view, i.e. wait until the month’s figures are in instead of prematurely pronouncing because then it just becomes “noise”.

I look at the data and write about the data the way it is — I don’t really care about what you WANT the data to look like in the future.

Thats how it should be.

Thats why I read You, and not cramer.

What we hope, is that the DATA has not been adjusted to much (for what/who evers agenda) before you get it.