There are a lot of them. It’s called “crisis” for a reason.

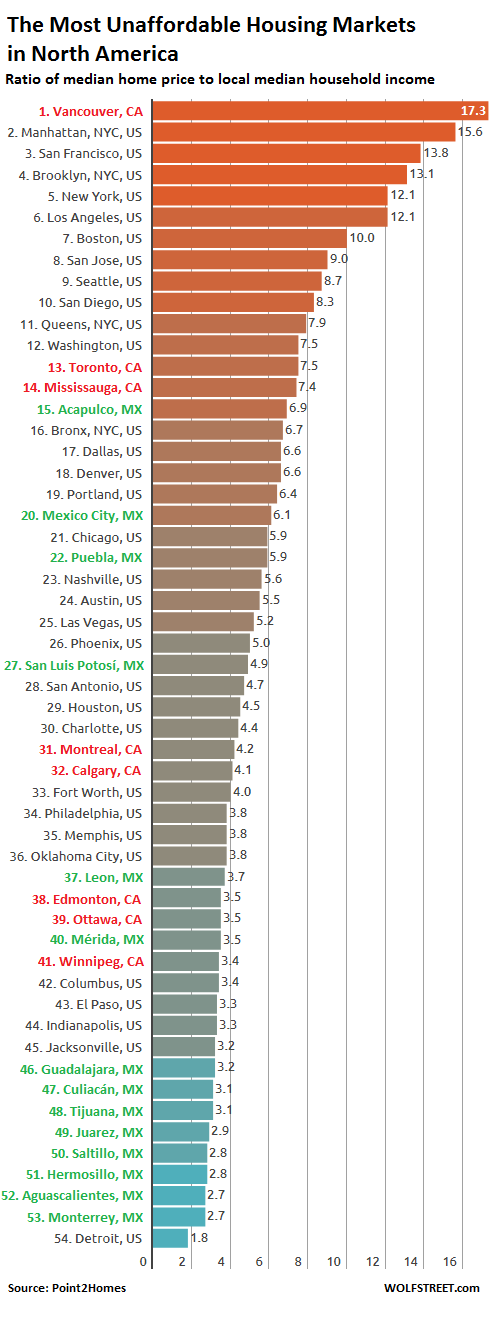

What is the most severely unaffordable housing market in North America as measured by local household incomes in relationship to local home prices?

By this measure, I’m happy to report that San Francisco, which sports the highest median home price in the US at about four times the national median, is off the hook. It’s off the hook because median household income is $92,100. It’s only in third place of the most severely unaffordable housing markets. California has four cities in the top 10 — San Francisco, Los Angeles, San Jose, and San Diego — but none is number one on that honor roll.

Number one is Vancouver, Canada, with a median home price of $1.11 million and a median household income of $64,000 (all amounts in US dollars at the exchange rate effective at the time of the study).

Toronto, whose formidable housing bubble is now under pressure, is the second most unaffordable market in Canada with a median home price of $471,600 and a median household income of $62,600. But it’s only in 13th place overall.

In second place overall? New York City’s borough of Manhattan, with a median home price of $1.27 million and a median household income of $77,600. Brooklyn is in fourth place, Queens in 11th place, and the Bronx in 16th place.

By comparison, the US median home price is $258,300 and the median household income is $56,500.

This according to a study by Point2Homes. The study used the affordability ratio, or “median multiple” – a metric for evaluating urban markets – to determine the rankings. This “median multiple” is the local median home price divided by the local median annual household income before taxes. A higher ratio means that the market is more unaffordable.

These are the housing affordability ratings and the “median multiples” from the International Housing Affordability Survey 2017:

- Severely Unaffordable: 5.1 and over

- Seriously Unaffordable: 4.1 – 5.0

- Moderately Unaffordable: 3.1 to 4.0

- Affordable: 3.0 and under.

Of the 54 major markets on this chart by Point2Homes, 32 are either “seriously unaffordable” or “severely unaffordable.” I color-coded the names of the Canadian markets in red and of the Mexican markets in green:

Note that the most unaffordable Mexican city is Acapulco, due to its low annual household income of only $6,170 – about half of the national average of $12,810 – compared to a home price of $42,800, a notch higher than the national average. In this market, as the report points out, home prices are “artificially pushed up by the prevalence of vacation homes.” This puts Acapulco in 15th place overall.

The second most unaffordable city in Mexico, and in 20th position overall, is Mexico City, with an average home price of $83,900 and an average household income of $13,800.

But there are a few housing markets left in North America that are considered “affordable,” meaning that they have a median multiple of 3.0 or below. Most of them are in Mexico. But the most affordable major market in North America is in the US at the bottom of the list: Detroit – with a median home price of $48,000 and a median household income of $26,000.

In the broader sense, even in the most unaffordable markets, households are still buying homes, but many of them are stretching to extremes and spend an extraordinary portion of their income on housing. Record low mortgage rates have helped in the past few years, but they’ve also pushed these home prices further up without pushing up household incomes at the same rate. This has produced a sharp disconnect.

The end result is that households spend a greater portion of their income on paying the bank, property taxes, and insurance just for a roof over their heads, and have less money to spend on other things. For households in the lower 80% of the income spectrum, housing costs in the most expensive markets have turned into what is now called the “affordability crisis.” This is the result of rampant asset price inflation – including in the housing market. It’s not a free gift to the economy. It comes with a price: over-indebted consumers whose spending in the real economy is being strangled.

Here’s how the extraordinary asset price inflation is developing in all its beauty. Read… The US Cities with the Biggest Housing Bubbles

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The city of Santa Barbara is too small to be included in these surveys, but if it were it would pip Vancouver for the top spot.

Median house price $1,185,000; median household income $65,916.

So who is loaning a $63k/yr earner a $1.2M mortgage?

Answer: No one-at least no one born in Vancouver. Ever since the 80’s when one of the numerous corrupt governments that British Columbia allowed Lee Ka Ching to buy a very large portion of Downtown Vancouver. The end of British rule of Hong Kong was occurring, and money flowed from China to Vancouver and has never stopped. We buy cheap stuff from Walmart, made in China, and the smart Chinese invest the money in Canada.

That is incredible. But note that a median income household should never be buying a median priced home in the first place. After all, historically, 40% of the US population have been renters.

It’s unaffordable and yet you don’t see migrations from those cities. It has to be affordable for someone.

Living in one of the top 20 ( Denver ) Trust me . For most … it is not . The hoops people jump thru .. the debt they incur .. the ‘ dark money ‘ they get involved with .. the number that borrow from family members .. the number of multiple generations living within one home .. the financial shenanigans they pull … the illegal things they do .. the ones leasing single rooms in their homes ( owned or rented ) in order to stay afloat .. all those with multiple jobs and incomes ( including their kids ) .. all just to stay in a city that they cannot afford in the blind hope they’ll rise above the fray with zero hope on the horizon as the majority of ‘ new ‘ jobs pay well below what it takes to live here .. is almost unimaginable as well as tragic

And then there is the rapidly rising homeless rate in Colorado growing exponentially by the day due to the fallout of low paying jobs versus high rents and home prices

This from an upper middle class in many folks opinion elite … who can afford to live here … but in all honesty would rather not . Suffice it to say unless you have all the moral character of a pit viper gentrification is a very ugly and destructive thing indeed wearing on one’s very being by the day .

Sounds just like Portland

I would like to see how the top 20 housing markets looked if they put a massive tax on non-citizen purchases and took away any tax incentives related to purchasing second homes.

And take away polices that prevent the fluid transfer from old to young.

It’s just such a corrupt industry because there is so much money to be made if you are willing to cheat just a little. Entrenched bad policy is protected by those made wealthest by it.

“And take away polices that prevent the fluid transfer from old to young.”

If I pay for my house, pay all my taxes, all in a legal manner why can I not give it to my children when I die?

Dave, step up in basis. Huge loophole, especially on rental properties. RE lobby has fought for years to keep it. There’s a reason The Donald doesn’t show his tax returns.

Vancouver? what is so special about that city, what is the main industry, why would any one want to live in 8 months of pouring rain and misery with traffic jams everywhere? I could understand Seattle with great job opportunities and infrastructure, but Vancouver, give me a break, smth doesnt add up…

Of course, Seattle has the same pouring rain and horrible traffic.

In the 90s it attracted a lot of Californians (a significant portion came back after enduring one or two winters), because housing was way more affordable but the gap has narrowed considerably.

other than good job market,,, I don’t understand why anyone would punish himself in Seattle..

I hate Nor-cal and north west coastal..

It is rarely “pouring rain”. During the rainy season which can sometimes be most of the year, it’s usually just continuous drizzle. Most people who work at a job have to live in one place most of the year. Given that, there are much worse places to live than Seattle or Vancouver, BC. As a rule, it isn’t too hot–most people don’t have air conditioning (MO), and as a rule, it doesn’t get terribly cold. There are many lefties, but they are both very lovely places to live. JMO

Chinese Investors. Wolf has numerous articles on Vancouver worth reading. Here’s a quick one to get the jist of the reason why demand and prices are skyrocketing http://m.huffingtonpost.ca/2017/07/13/chinese-investors-to-spend-1-trillion-on-real-estate-in-next-de_a_23028408/

Since Toronto is a hellhole of a city most of the Chinese choose Vancouver. Vancouver used to sell lumber but the only industry now is residential housing. The new B20 OSFI rules should have a profound affect on the locals trying to compete with the Chinese for homes. It’ll be interest to see what happens since the Chinese never buy into falling markets of any type.

Canada has a great visa system for entrepreneur/or digital nomads(Those who earn via working remotely) for up to a year. Vancouver is in the same time zone and only a couple of hours flight from SF/the bay. So rather than deal with US immigration. They can just work form Canada, and pop to SV/ for business meetings with investors or anywhere in Washington state for doing business in the US. Would not be suprised if some SV firms have people there, they can’t get into the US.

Seattle has screwed up its waterfront and an Interstate through the middle, not close to comparable to Vancouver.

Despite these being unaffordable

Houses are still being sold in days

The market defines the price and they are priced to sell at this time at least

The market defines the price and they are priced to sell at this time at least

“The market” has become completely distorted by the Fed’s deranged money-printing and ultra-easy monetary policies for its bankster cohorts that encourage reckless speculation while exacerbating wealth inequality and pushing more Americans than ever into homelessness and poverty.

The volume is low though that is why the prices are high. No one wants to sell because they can’t afford to buy anything else. It is much cheaper to rent though but people are so in love with their stuff that they don’t want to downsizem

The ‘market’ doesn’t define the price of a house–as Michael Hudson always says, the banks do. If banks will loan money for a house at a certain price, then that’s the value of the house.

I can tell you in Southern Ca which has very very high real estate prices, the homes are getting sold like hot cakes in most of the listings.

I agree when you compare median income ot median home prices, the prices are out of whack but the bottom line is.. houses are indeed getting sold at asking or above asking prices.

It does not matter whoever is fixing the price, the point is: Houses are being sold at this ridiculous prices.

One in five renters was unable to come up with the full months rent within the past three months.

https://www.apartmentlist.com/rentonomics/rental-insecurity-the-threat-of-evictions-to-americas-renters/

***Detroit*** is unaffordable? Someone seriously wants to live in Detroit???

Much of Detroit is still in terrible shape, but Downtown Detroit is hopping with tech and development. That started years ago. I know a guy who moved there from San Francisco in 2007, one of the SF housing refugees. Bought a huge loft for $80,000 in cash, settled in, and started coding. QuickenLoans is there too. So there is this pocket of revitalization and success.

QuickenLoans… I see what you did there. :-D

So how much does he pay in property taxes. I understand they were giving away houses in Detroit but the tax liability was a deal breaker, and various covenants.

Whole neighborhoods in Detroit have been razed because homes that had been abandoned many years ago just collapsed and couldn’t be given away. When the population shrinks like it did in Detroit since its heyday in the 1950s, that’s what you get.

But google >> Detroit downtown << ... it's a different world. And I'm glad to see that there is revitalization and new energy. Part of this has to do with ample space and low costs. It's just a relatively small pocket of the city, but it's a start.

Maybe I am being stupid but the average (yes I know they use median but this is not readily available) house price in the uk is 222,000 quid. The average salary is 27,000 and change. This is a ratio of 8.2. A long way from 4.6 and I suspect this difference, on such a large sample, is not due to the median/average error. If the ratio was genuinely 4.6 then we wouldn’t have such an affordability crisis. The 8.2 seems more believable. Is this more statistical BS to keep us confused or is it just me confused?

It seems to me that in Europe as a whole real estate is comparatively much more expensive than in the US. It has been ages since I lived there but I am am in the EU often on business and am frequently amazed every time I see some real estate office in a more or less deserted French village listing small run-down things for 500,000 Euros or whatnot.

I suspect land use regulations and the overall difficulty of building new stock has a lot to do with all that.

But aren’t whole villages sold in France for just a few million?

Ok, well this one is abandoned…

http://www.businessinsider.com/this-abandoned-french-village-was-finally-sold-to-a-korean-photographer-for-663000-2012-5

But here’s what’s prolly a nice one Depp couldn’t sell for $26MM.

https://wolfstreet.com/2017/10/26/the-most-unaffordable-housing-markets-in-north-america/

I have been looking to move to France for a couple years now, mostly for job reasons, so let me tell you this.

France has basically some pockets of insanely expensive real estate. You can usually tell them by the nearby presence of horrifying tenements built by the local government to provide subsidized housing with their corollary of urban squallor, such as long closed shops. If you drove the A8 highway behind Nice and Cannes you know what I am talking about: insanely priced real estate near the coast and some of the most depressing tenements this side of ex-Soviet Central Asia behind.

I won’t even go near Paris because it may be the heart and brain of France but it’s effectively a parallel universe.

Most of France however is still depopulating. It means there’s a lot of real estate for sale if you don’t need to live too close to a city and, in Toulouse’s case, you may get lucky as long as you can stomach the daily commute.

To this it must be added there are many, many foreign home owners in France, chiefly from Britain and The Netherlands. While they tend to drive up prices in some highly localized markets (Vaison-la-Romaine is an excellent example), it also means there’s a steady supply of freshly renovated houses with all the amenities you can think of hitting the market every year as the former owners either move to Mexico, Spain, Thailand or pass on to the Elysian Fields.

This means French real estate prices are among the most sane I’ve seen in recent years: while they aren’t low at least there’s some logic behind them, unlike in Spain.

In the meantime, the Bank of Canada kept the interest rate at 1%. The top honchos, like in the family, are puzzled by low inflation, and lack of wage growth despite strong job market. Yeah, 2% CPI is “price stability”, and the models are out of whack. The question is: can they teach this, or do you have to be born this #$%^&?

We left south Florida because of unaffordable rents. The last increase put us over 50% of take home pay. This is now normal in Florida. The courts are clogged up with evictions because people are being priced out of the rental markets.

The state has ignored the problem, but with the new immigration coming out of Puerto Rico, they will have to deal with it. It will come down to busting the state budget with welfare and food stamps for the newly unemployed residents or rent control. Rent control is a lot cheaper and probably the reason the guy from Colony Starwood unloaded his stake recently.

Petunia, I worked for a scientific R&D company in Miami for a year before returning to Tampa. This was in 2012. What I saw in Miami as far as rentals went was that you had a choice between an affordable slum or an unaffordable luxury apartment with barely anything in between.

With the invasion of the REIT’s happening here in Tampa now it is rapidly devolving into the same thing. Developers build nothing but ultra-lux, REIT’s buy the rest and slash amenities to the absolute bone to extract maximum cash while moving in any undesirables who can cram 5 people in a 1 bedroom to make rent. Within a few years all of these formerly decent places are now trashed and the neighborhoods they are in have garbage on the ground, abandoned mattresses and crime rates way up.

Even if the renters in REIT properties are good neighbors and take care of the homes, the renters don’t put extra money into the homes and the REIT doesn’t invest more than absolutely necessary. This translates into all these properties eventually becoming less desirable than the owner occupied homes.

Communities with large numbers of these home will live to regret allowing the consolidation. None of these homes will ever get a $50K kitchen upgrade or a new pool with the corresponding larger tax bill.

RE: It will come down to busting the state budget with welfare and food stamps for the newly unemployed residents or rent control.

—–

A third alternative is the construction of massive amounts of affordable housing by the state.

Standardized plans and large scale purchases of furnishings such as stoves, refrigerators, drapes, etc. will substantially lower unit costs, and can improve quality/durability.

Such a program can also solve another problem by employing surplus labor while they learn a trade. If structured correctly this will be a self-liquidating investment if the homes/condos are sold to their occupants with inflation adjustable mortgages, and would be a good place for the state/municipalities to invest some of their pension funds as the investment would be backed by real assets and should provide a steady cash flow. Most likely would need to construct a mix of single family, condos, and 2 floor above retail shops, to provide for changes in housing needs v tenant age/life cycle.

Not happening in the Sunshine State. We have a Balanced Budget Amendment to our constitution. Plus the vast majority of jobs are in service to the gasping for air middle class. Also no income tax. Also, MORE RETAIL, George? I know you comment regularly here, so you must’ve forgotten Wolf’s numerous articles on that particular subject.

how about this folks for an example as how far we’ve fallen. In 1948 my dad bought a house in Atlanta for 14,400.00 when he was making about 10,000.00 a year. 15 year mortgages were common and people had parties to celebrate paying off their home!

We know someone who bought at the height of the bubble in Florida right before the financial crisis. They are now trading up, but taking a $35K loss to do so. The place they are buying was also purchased at the height of the bubble, by its owner, and he is taking a $120K loss in order to unload his property. People have been sitting on their losses and the system isn’t as cleared as many would like to believe.

My buddy just got back from Vancouver with a report that many businesses cannot staff due to the high costs. His daughter lives in the west end in a small apt. She pays about 1500/month and splits the cost with her boyfriend. They seem to be doing quite fine, but they are also well educated and have good jobs.

Momento: Vancouver does not pour rain for 8 months of the year. Winter is wet and grey, but winter from northern California on up is always pretty dismal. Have you ever been to the Oregon coast? Summers in Vancouver, + spring and fall, quite lovely. Certainly better than most other North American cities. Houston? DC? Atlanta? (Come on). Anyway, forecast for the wet coast is for another 2 weeks of sun which puts us into November. And that breaks the back of winter. In February, the lawn mowers start to come out. I once mowed the lawn on January 1st, just to scare my Sask neighbours.

Having said that, I wouldn’t live in Vancouver if I were a billionaire. Or, in any city for that case. My friends say it is great, but I don’t see it. But, people who like it wouldn’t live anywhere else.

I attended UBC in the early ’70s, and again in the ’90s. In 73 it was called Hongcouver. It only increased with the Hong Cong repatriation. Residents who left HC wanted to link into British roots and influence. In the ’90s UBC was referred to as University of a Billion ________. (You get the idea.) And that is why it is so expensive, which we all know. Hong Cong money flooded in first, and now it is a laundering site for mainland China. I haven’t even driven through there for 15 years. In fact, I may never leave the Island. I live on the north Island and will be in shorts for the next 2 weeks. A wee bit chilly in the morning, but great after 11:00.

I have a freind who has been married to a Vancouver/Hong Cong Chinese lady for +25 years. He says it is all about money and appearances with her relatives. To quote: “money money money”. They had a $50,000 wedding, $10,000 more than my first house. Go figure.

It’s a different world and hard to fathom, for sure.

regards

The world still suffers from trickle down lies. With wealth and income inequality at all time highs, the nation looks like it is going to pass a law to eliminate the estate tax and allow corporations to repatriate money near tax free. House are now investments for the 1%, who will trickle down only a rent increase every year.

The high price of housing can be interpreted in part as a supply/demand imbalance. The pivotal point is the price of vacant land. Example: a lot costs $200k, and construction costs $200 per square foot. If you build a 1,000 sq. ft. house, the total is $400k ($200k lot, $200k house). If you double the size of the house to 2,000 sq. ft, the total is now $600k ($200k lot, $400k house). So you get twice as much house for only a 50% increase in price. This force is irresistible to the builders, with the result that the average size of new houses has gone from 640 sq. ft. in 1908 to over 2400 sq. ft. today, driven by the price of land. A lot of people would be happy with a 640 sq. ft. house, but they’re not being built.

Another route to ownership used to be sweat equity. You purchase a lot and build the house with your own labor to keep the price down. But almost all development, at least here in California, is in the hands of house-building corporations who have the capital to buy up large parcels of open land and develop them, and they keep all the lots for themselves without releasing any into the open market. So it’s almost impossible to find a building lot here.

I bought my first house (on the beach, in Sarasota, FL) in 1975 for $12,000. It looks like the era when you could do that is gone for good.

“Another route to ownership used to be sweat equity. You purchase a lot and build the house with your own labor to keep the price down.”

It’s still possible, Old Farmer – just not in the places you mention.

It’s an ironic twist of the old saying that’s used to justify the lot prices you are witnessing where you are: “location, location, location.”

Me, in the last generation, and my son in contemporary times, have built our own houses, in the Appalachian Mountains region.

It can be done, I’m sure, in many rural ares in the U.S.

Rule of thumb is the lot should be 1/5 of total cost of home. Some lot developments are done by a single builder entity. Some are done by a land developer who sells to a multitude of builders. To keep the value of the whole development, it needs size and building standard minimums. Why would I want to invest in a million dollar home next to a 400K home? Same reason for not allowing sweat equity.

Hence the reason that older, smaller house neighborhoods in prime areas are slowly being bought out to tear down to build new larger homes. You can definitely do sweat equity on those lots. Once it starts the whole neighborhood eventually goes that direction. Down side is now there are no longer any affordable small homes and the taxes go up for the last holdouts.

One additional comment about housing and the price of land: With a few exceptions, Americans don’t really have urban values, even though most live in cities. We still have an agrarian mindset in which the house is isolated on its own land, with windows on all four sides, making no acknowledgement of its neighbors. Suburbia, and even the dense residential parts of cities, are essentially compressed rural landscapes. Most would be appalled by sharing a common wall with a neighbor. However, when the price of land is high enough, the only way to build affordable house is to put up multi-unit structures. Europeans live with this; Americans aren’t quite there yet.

Some of us never will be “there yet”, Old Farmer.

Wolf: Anyway way to show a historical look at this, going decades back? This is an awesome graphic. Thanks.

Seems to me, part of the problem has been the 30 year mortgage itself.

It’s a collective mindset, no? Does a 30 year mortgage really fit the modern lifestyle? It seems to me it only works in a rising market. But in a flat to falling market where many people are moving in and out of homes every 5 to 10 years, it doesn’t make sense. In such a market you build zero equity and/or you have a significant loss.

“Seems to me, part of the problem has been the 30 year mortgage itself.”

You may be right. 30 year careers are not as common as they used to be, nor are 30 year marriages. Divorces can be expensive too.

Lenders know you are not going to own the house for 30 years, it is a way to keep the payments low. Most owners sell in less than 10 years, which is why derivatives sold on mortgage pools are a scam. They sell the 30 year income stream knowing it won’t be there.

Petunia, some of us have owned our houses for thirty years and more. Lenders have never had their hooks in us.

Correct.

But you could keep the payments even lower with a 50 or 100 yr mortgage.

The point of buying a house… a long time ago… was to actually / eventually OWN the house. And thus stop paying someone else money.

What’s the diff between a >=30 yr mortgage and and renting if your going to move in 10 years?

When you buy a house you will live in only for 5 or 10 years you are doing two things, one is speculating that the price will go up and the other is locking in the rent on a long term lease.

Perhaps a more meaningful measure of “affordability” , in an economy based on debt, is the amount of the monthly payments? In some markets, mortgages in the 4.2% range Cost less to purchase than to rent. On a monthly basis.

Quicken Loan Affordability AP says a $100,000 income with $700 /month debt and a $50,000 down payment is worthy of buying a $460,000 house! We are so doomed!

Not surprising that both the right and left coast cities are the most out of kilter with the average America’s financial situation.

They’re out of touch socio-politically and most every other way, too.

Noticing this morning that each of the FAAG stocks are galloping towards a $1T Market Cap.

I wonder if Janet’s team are actively arguing the importance of keeping interest rates nailed to the floor for a while longer to stimulate some growth.

Thereby creating new buyers for the housing market. It’s the gift that keeps on giving.

This discussion is based on affordability measured by the gross purchase price divided by gross family income. The real cost of ownership is much higher than portrayed.

In 1940, my parents built an 1100 sq ft cape cod (excluding 900 sq ft of livable basement space) in a village outside of Buffalo, NY for $5,500. They put $500 cash down and financed $5,000 for 20 years at 5.25%.

At that time, my dad made 56 cent/hour as a laborer in a chemical plant. Annual wages were around $1,100. So, per the chart, their affordability ratio was 4.5. We lived in a desirable middle class neighborhood with good schools, good infrastructure etc.

However, back then, personal income taxes were very low; payroll taxes close to zero; real estate taxes – low; fire insurance -low; Etc.

Today, net spendable W-2 income, after taxes, is 80% of gross income, at best, for families earning less than $60,000. The chart should be adjusted to reflect that.

The cost of homeowner, ex-mortgage payments, is high. The gross price of the house is an imperfect measure of the true cost.

For a person in 2017, the affordability number should be boosted by at least 30%. And, it is confusing to mix residential real estate in Mexico and Canada with US real estate. Because the tax systems impacting real estate are much different.

It would be more useful to calculate number of persons per square foot versus price. High end houses are a lot of empty space, while there might be eight people living in 1500 sq feet down the road. The effects of overcrowding are more important than affordability. Important for health, for children to have room to play so they don’t grow up thinking staring into a 3.5″ screen is a life.

What is the volume of sales? Here in Seattle, it is very low because no one can afford to buy anything else if they sold so they just stay put. This drives up prices on whatever is available. At some point we will hit the tipping where everyone decides they can get enough when they sell then it all comes crashing down.

Yes, no one wants to move since they’ll be stuck in a bidding war for more debt. I have some friends [family/2kids] that have decided to move out of the Seattle area. Dual income with decent jobs & they can’t keep up with the prices, housing, childcare & all…

Off topic, but just checked Fed Total Assets from your article fast week which got my attention. They came in at 4,461 vs 4,470 from prior week – down about 9 billion.

Yes, right in the same range, zigzagging up and down in the same range, just like it did before the QE unwind was commenced. And it’s still higher than it was in August.

There are about $8.6 billion Treasuries maturing on Oct 31. If they stick to their QE unwind announcement, about $6 billion of them should be allowed to “roll off” (not be replaced) to get the October QE unwind going for Treasuries. This is going to be the key for seeing how they handle Oct in terms of Treasuries (MBS are different). We should know in early Nov.

There are about $11 billion in Treasuries maturing on Nov 15. $6 billion of them should be allowed to roll off. If instead, all of them are replaced, I might revert to calling them “flip-flop Fed,” as I used before the summer of 2016.

My hope is that the Fed will allow maturing securities to roll off as per its announcement. But as you could tell from my last article on this, I’m very nervous about my Fed hopes. And I’m going to keep my eyes on it until the trend is clear and consistent.

My hope is that the Fed will allow maturing securities to roll off as per its announcement. But as you could tell from my last article on this, I’m very nervous about my Fed hopes.

Just this once, I’ll refrain from commenting :-)

Why buy it when you can rent it for half the monthly cost? Buy it later after prices crator for 75% less.

So.. I spoke with my older cousin, who’s a homeowner in Walnut Creek, CA. I suggested there may be another housing crash coming soon.

He replied “Naah, I don’t think so. You see, home prices aren’t rising to ludicrous levels overnight like they did in 06/07. It’s stable this time.”

I’m not a housing expert so I didn’t know how to reply.

Thoughts?

I can’t say much about Walnut Creek, but I do have some anecdotal sense of house prices in (parts) of San Francisco over the past 25 years or so. Early 90s, our 1450 square foot would’ve sold for 300k or so (in fact it did if you look at the sale history), by 2004 it was selling for double that (600-700k). By 2012, 900k seemed to be the going rate and by 2015 1.2m.

In the 2008 crash we never saw the prices go much below below 2004 levels. Sure, sale prices were maybe a 10% to 20% discount compared to the previous high, but for people holding onto a place 5-10 years the dips in value seem only temporary, because that is how it has worked in San Francisco for a number of decades–prices go up and down, but even the bigger falls in prices are recovered within a few years after the temporary dip.

Will it always work that way? Who knows, but many people mistake recent history for the future because what other way do they have to predict the future? If the Bay area had a prolonged recession those dynamics might be different, though. Or other changes might make that pattern break.

The dynamics in Walnut Creek might be different than SF. SF has none to very little space to build single family homes and so the supply for that type of home is constrained. SF is also considered one of the most desirable cities in the Bay Area. Desirability varies by neighborhood, too. Because of those factors, the prices went down less as a percentage in 2008 for some nice neighborhoods in SF than for some more borderline neighborhoods in the bay area. The dynamics are different for condos than single family homes, too.

Walnut Creek is generally a nice middle class suburb. Prices could go down and probably will at some point. The questions many ask in the Bay area are how much prices will go down the next time, how long prices will stay down and how much they feel they can ride out the lower prices.

Could there be a permanent decline in prices? Sure, but since people haven’t seen it happen in at least 30 or 40+ years, they may not pay so much attention to that scenario. You may be wasting your breath trying to convince your relatives since it sounds like they don’t want to hear it and also the dynamics might be more complicated than you think.

You must be in a different San Francisco because prices here fell 40% during the last minor correction. A 40% decline doesn’t come close to reversion to the mean and with the current correction well underway, I wouldn’t expect anything less than a 75% reversion.

Hold onto your hat because you’re in for the ride of your life.

Sir John Templeton said that when prices drop to 10% of their former level in bubble areas, then you buy. Bubbles don’t last forever…

If you’re a renter, you’re paying the assessed real estate tax in your rent. Those taxes are higher in states that have no personal income tax.

I rent from the Chinese owner I sold my Vancouver house to. They wanted to park funds and I wanted to sell at or near the short term top. It was a deal that benefits us both. Because Mainland Chinese owners have different motivations and cost structures (lower taxes, less regulations on their businesses, want to park money ahead of Yuan devaluation) their need for return is lower than a local owner. In the first two years we saved over $50,000 in property taxes, house insurance and low rent. The non resident landlord gave us a decent discount for our property management function. They informed us we can have a ten year rental contract. So far we executed a five year one but they have no plans to develop for ten years.

My kids and wife didn’t want to move out of the city, so this was the solution.

Divergence between consumer delinquencies and unemployment rate

https://3.bp.blogspot.com/-sE58wej9T7Y/We-LcAWKBGI/AAAAAAAAWZ8/GBvhq8DibBsY9B1GNsMup38Oj0848yZywCLcBGAs/s1600/divergence%2Bin%2Bunemployment%2Brate.png

New Zealand have banned foreigners from buying property in NZ to try and slow down house price rises.

Is this something which should be adopted elsewhere as well?

Yes, if you don’t live in a country, you shouldn’t be able to buy a house. They are not assets. They are places to live. It’s fundamental human need that is being screwed up by people chasing yield.

Here in Santa Monica prices are heading down with more and more for sale signs in all 4 directions.

Thanks for sharing guys!

The people with inflated housing prices use home equity loans to spend, which boost GDP.

This strongly supports that Dec’s raise in rates will be the last for a long time. No one wants to turn off the GDP spigot.

Plus I’m starting to hear “I gotta get into the stock market NOW, in my daily travels”. Expect the dow to be near 30,000 by the end of next year. The small guy is rushing in.

As long as rates are low, the market will go!

“Whole neighborhoods in Detroit have been razed because homes that had been abandoned many years ago just collapsed and couldn’t be given away. When the population shrinks like it did in Detroit since its heyday in the 1950s, that’s what you get.”

==============

Very unfortunately for the capitalist, profit-motive system, the human population must decrease in size, not increase. The environment of Mother Earth will over the long haul not support even the present population, let alone one that continues to expand.

The “fundamentals” of a potentially hard-working, dedicated, productive, EDUCATED workforce are right here, right now, so what exactly is the problem?

The fundamental, unavoidable, ultimately-fatal problem is that investment-capitalism cannot function (cannot “find” enough “profit” for a historical build-up of “investments” and “wealth” such as real estate) in an economy that has stable, let alone shrinking population. Each member of an increasingly-impoverished, shrinking population bears more and more of the “weight” of providing a profit on the 0.1%’s investemnts.

The solution is NOT to force an increase the population (and, by so doing, increase “growth”), but to reject the capitalist system and design and institute one that is suitable for a stable or, hopefuly, shrinking population.

For a good example of what I’m talking about, just look at Japan — the “canary in the coal mine” of capitalism. I propose that the inhabitants-of / participants-in a properly-designed, technologically-advanced, highly-automated economic system in Japan would experience a Utopian lifestyle compared to that of those who are working themselves to death in present-day Japan’s non-growing capitalist system. Add to that the unavoidable fact that the “chickens” that are the BoJ / government-of-Japan’s debt machinations over the past 25 years will soon “come home to roost” in every Japanese home, onto the shoulders of every Japanese person, young or very old. IMO, that burden will be literally unbearable.

The ultimate question is, just exactly WHERE does a capitalist investor, who wants to make a profit on his/her investment (to be able to “sell” that investment in the future for more than he/she/it paid for it) , “invest” in an economy that has a shrinking population? Certainly not real estate. http://jpninfo.com/22498

In short, if big investors even for an instant think that the human population is going to remain stable or, heaven forbid, cross-my-heart-and-hope-to-die, shrink!, the price of homes will become much more affordable for everyone very shortly thereafter. (After the big investors realize what’s going on, the term “hot potato” will instantly pop into billions of other human minds, sign-making businesses will do very well for at least a short period of time and bright fall colors will be found on most residential streets even in the middle of summer.)

Yes, unfortunately, some excess wealth and money and investments that are owned by “somebody” are going to have to go somewhere to die before the profitable excess investments in war machines and perpetual war “accidentally” cause a nuclear Extinction Level Event.

Some how, some way, some WHERE, “we”, and I mean “we, the people”, not “We, the Elite”, have to begin discussing amongst ourselves the specific features of a future world that we want to live in. Because we have been raised in a 24/7, all-encompassing Matrix of public education, MSM propaganda and “entertainment”, this will be a very difficult discussion/debate to conduct. We’ve been carefully trained to let “someone in authority” make those decisions for us.

For increasingly obvious reasons, we MUST NOT CONTINUE TO ALLOW the Central Bankers and their TBTF banks and their TBTF corporations to continue their self-serving, ruinous control over our lives.

Hard as it might be to realize, human beings do NOT have to go back to a subsistence, low-tech, non-automated way of life without the 24/7 control of an Elite, even though that’s exactly what the Elite threaten us with if the Elite lose control of our lives.

What economic experiment are the 0.1% Elite going to force down our throats as a result of their next “financial crisis”? We must not wait for them to tell us. We must tell them what we are going to force them to do BEFORE their next crisis befalls us yet again. Hard as it is for us to believe, we have the political power to do so. But, unfortunately, for lack of a better expression, we have to know what we want ahead of time. That’s the tough part.

“In every moment there is the possibility of a better future, but YOU people won’t believe it. And because you won’t believe it, you won’t do what is necessary to make it a reality. So you dwell on this oh, terrible future. You resign yourselves to it for one reason — because that future doesn’t ask anything of you today.” —Governor Nix in “Tomorrowland”

Great point if some too investors do expect the human population to go down then you expect to see demand for everything go down, so supply needs to decrease to maintain monetary value. So you would get a boom in multiple asset classes as the out of the know investors keep moving money about chasing yield you can’t get. While in the know investors are hoarding the cash and fretting that it has nowhere to go. Govs have to keep inflating money supply to pay for all that social security (taxes won’t since most are designed on the idea of 2-3 working people per retire during the baby boom. Eventually something gives…..

Why aren’t the Twin Cities on the above list? Minneapolis (population about 420,000), St Paul (pop. over 300,000), Metro area over 3.5 million, is the 3rd largest metro in the Midwest, only behind Chicago in economic impact, and is on the World Class Cities list (Beta). Please note that we are also very unaffordable, not only in both downtowns, but especially near the lakes in Uptown, St Louis Park and Edina. We’re always on the top 15 most expensive lists in USA and 24th worldwide. Please visit us, but don’t move here. Our traffic is choking us daily. By the way, Tony, Toronto is not a “hellhole”. It beats most American cities by a landslide!!

I’m guessing that Toronto’s’ ability to beat most American cities has something to do with the quality of it’s public transit.

Yes, they retained more electric streetcars than any other North American city. Now they seem to be coming back just about everywhere! I also like their heavy rail rapid transit and regional commuter rail system. I just love their Union Station. People in Toronto seem much more polite and have more culture than people in most American cities. I do like living in St Paul and also love our recently restored Amtrak Union Depot, which is a great classic, built in the early 1920’s. But I greatly miss the great streetcar system we had in the Twin Cities until the early 1950’s, when it was dismantled by gangsters and sold to local junk dealers, receiving criminal kickbacks for which they were later convicted of in Federal Court. It was a sad time in my young life. At least now we’re trying to bring more rail transit back to the Twin Cities, including extensions to our existing light rail lines. We also still have great cultural institutions in both downtowns, but I fear for their future, with the general hustling, polluting, dumbing down and gross vulgarization of American life.