What’s Boiling Beneath the Surging Inflation?

Consumers are going to shell out more money for the same stuff, that’s for sure. Inflation as measured by the Consumer Price Index jumped 2.2% in September compared to a year ago, the Bureau of Labor Statistics reported this morning. All fingers pointed at energy costs: the index jumped 10.1% year-over-year. Within it, “motor fuel” prices (gasoline and diesel) jumped 19.2%.

Food prices rose 1.2% year-over-year, kept down by prices for “food at home” – the stuff you buy at the grocery store – which inched up only 0.4% year-over-year in part due to the price war currently tearing into the supermarket sector.

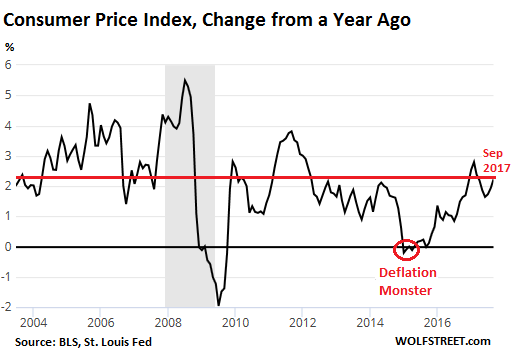

In the chart below of CPI, note the dreadful “Deflation Monster” – one of those rare and brief occasions in the US when the purchasing power of wages actually rose just a tiny bit on a year-over-year basis. It was caused by the energy bust. And it was “transitory”:

In the chart, note how CPI jumped 2.8% in February and then retreated through June. This retreat was brushed off as “transitory” by Fed Chair Janet Yellen and other Fed governors when they vowed to continue raising rates. She had specifically pointed out a few of those “transitory” factors. And they’re now turning around.

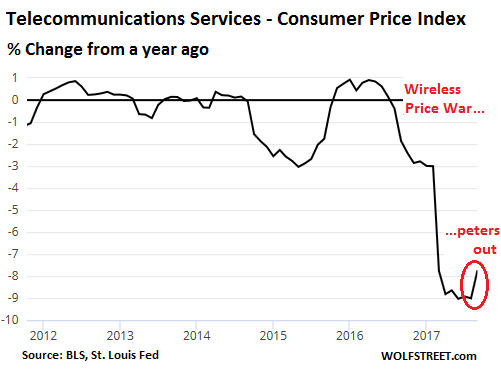

One of these factors that Yellen had pointed out was telephone services, which includes the monthly costs that consumers pay for their smartphones. Those costs plunged as a price war among wireless carriers had broken out in 2016. This summer, the price index for telephone services was down around 9% year-over-year. The wireless component plunged as much as 13%. But that consumer bonanza could not last.

In September, the price index for telephone services rose 0.2% from August, and for wireless services 0.4%. This chart shows the year-over-year percentage changes – and how the price war is now petering out:

Another “transitory” contributor to “low” inflation this year is the auto industry. Sales at new and used vehicle dealers and auto parts stores account for 21% of total retail sales. Under pressure from record incentives, new vehicle prices fell 1.0% year-over-year. And the CPI for used vehicles fell 3.7%.

Then came Hurricanes Harvey and Irma. Their effects on vehicle prices are not yet reflected in the CPI survey data, but they’re already showing up in the prices on the ground: used vehicle wholesale prices are now soaring.

New vehicle sales have declined so far this year and might come in at just under 17 million units. But used vehicle sales have boomed this year and may set a new record north of 40 million units.

Hurricanes Harvey and Irma damaged or destroyed an unknown number of vehicles. The estimates range from 400,000 to over 600,000 vehicles. Some of those vehicles will be repaired and recycled on the used vehicle market, either with flood titles or with clean titles (watch out!). But many ended up in the salvage yard.

This has the effect of taking several hundred thousand vehicles off the road that have to be replaced, mostly used vehicles – that’s all insurance companies are paying for.

There is a mad scramble underway to bring vehicles into the affected areas from other parts of the US, and auction prices are now surging.

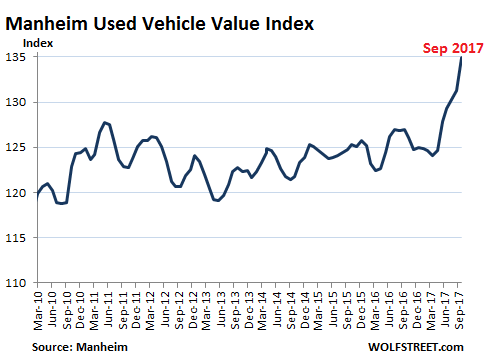

The Used Vehicle Value Index by Manheim, the world’s largest wholesale auto auction, was already rising in the months just before the hurricanes. But as soon as the hurricanes approached, wholesale prices spiked. The index (on a mix-, mileage-, and seasonally adjusted basis) jumped 6.3% year-over-year in September to a record 134.9, the fifth record in a row, and further price increases are expected:

Manheim adds some detail:

On a year-over-year basis, all major market segments saw gains, including midsize cars. Luxury cars, pickups, and vans outperformed the overall market.

Though wholesale market values continue to show strength as a result of growing retail demand, most of this price strength can be attributed to the recovery following Hurricane Harvey and Hurricane Irma. Replacement demand combined with a reduction in available supply is causing wholesale inventories to tighten.

This is what an independent used vehicle dealer in central Texas told me:

We are having a hell of a time acquiring inventory since Harvey. The first week after the great flood in Houston we watched cars bring retail at Manheim Dallas! Things have settled down a bit since, but prices are still very high.

The problem is, by the time you add auction fees and transport you’re almost at retail. The book [used vehicle prices] has not reflected the vast price increases at the wholesale level.

This surge in used vehicle wholesale prices doesn’t immediately translate into higher retail prices. These vehicles may sit on the dealer’s lot for a while before customers buy them. The dealer has to push the higher wholesale price into the retail price, but the current used-vehicle book values are only gradually picking up on those price increases. So all this will take a few months to wash out before the Bureau of Labor Statistics can pick up the higher retail prices with its surveys.

Used vehicle prices also support new vehicle prices because they compete with each other, often on the same lot. This will likely turn around the decline in the new-vehicle price index as well.

The three factors mentioned here – telephone services, new vehicles, and used vehicles – account for nearly 8% of the total Consumer Price Index, and for a much higher weight of the “core” CPI (without food and energy). A turnaround in those three sub-indices, from falling sharply to rising, will have a significant impact on the core CPI, as well as on the core PCE measure of inflation that the Fed looks at for its policy decisions. And those folks at the Fed, such as Yellen, who’d stated, against a flood of protests in the media, that low inflation was “transitory” will be vindicated. This inflation has legs.

Next year is a wild card for the Fed. Yellen may not be reappointed, and there are three additional vacancies, and no one knows whom President Trump will appoint to fill them, and the new Fed could be off the chart. Read… The Fed will be a New Creature Soon, and No One Knows What It’ll Look Like

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sorry. The Fed and inflation. Cartoon time. You can’t be serious.

Inflation in areas that attract lots of money, such as asset prices, education, and medicine I accept, but the Fed has little to do with any of them except asset prices. Bernanke accepted responsibility for high asset prices while guessing somehow trickle down economics would benefit the 99%.

The Fed and inflation in normal everyday life is like assuming chicken bones can foretell the future.

Don’t people understand that the ‘trickle down’ they were talking about really isn’t related to economics, but how the elite take care of the underclasses by ‘p***ing ‘ on them?

That has worked exactly as they said it would.

I call it dribble down economics…the rich people take a piss and the little people think it’s manna from heaven raining down on them.

I’m with you cdr, on this one.

I’ve stated more than once that a wholesale inflation OR deflation scenario is too simplistic.

It is going to be a two-track economy:

One side is inflation (even hyper-inflationary) on core necessities and yielding assets. i.e.) dividend stocks, REITS with good DPU, real estate, utility stocks, core medical stocks etc. That explains on the entire stock market breaking new highs for the past few years.

Why? because the whole world is aging rapidly and Maslow’s hierarchy and common sense tells you money first goes to where basic needs are mandatory; such as a roof over your head, medicine for your aged, and much needed income for everyday sustenance till the day you caste away your earthly shell.

Even old folks who are independently wealthy won’t buy that bling bling sports car because they got no ladies to impress anymore, nor will they spend to buy an i-Watch when they have to squint their eyes to see the tiny fonts; besides they rather spend money to buy prescription glasses or adult diapers for their incontinence problems.

The other track will be Deflationary for everything else that is non-necessities. i.e.) your high-tech, whiz-bang mobile plans, your i-Whatever gadgets (which are mostly useless and obsolete after about 6 months anyway), your fanciful LuLulemon or Under Armour sweat-wicking, heat-retaining, UV-protection sweatpants….these non-essential product categories will be getting cheaper and cheaper because of over-production and the overstretched middle-class consumers unable to and/or unwilling to fork out money for them…..unless they happen to see them at some closing down sale with 50% discounts. Hence, the deflationary pressures.

You are right too that trickle-down will never happen because BIg Banks, Big Corporations and Big-Governments will always siphon off the money for themselves first. Afterall, these Big organizations are led by humans just like you and me.

Helicopter Ben should have lived up to his nickname. He should have thrown all the printed money to the bottom rungs instead. That will drive spending by the masses from the bottom-up instead of from top-down. Perhaps, the many guaranteed income schemes may come to pass as the younger generations gets further displaced by automation and AI and the consumerist cycle breaksdown inevitably.

I agree except regarding real estate Aging boomers are downsizing and Millenials don’t have the money or just simply aren’t interesting in buying houses The single family house in a high tax high cost area will likely not see a lot of inflation in my opinion examples Illinois Conn Rhode Island and most of New York State

Are boomers downsizing in large numbers? I am curious if there is actual data on this- I just don’t know. Just based on people I know (and the people they know), a significant chunk of boomers seem to be staying in their houses as long as they can, unless they have a lot of assets and can strategically move somewhere warm to retire.

If anything, it seems like younger generations [who as you say, can’t afford to buy] are moving back into the family home, which might prop up the home prices of the bigger homes.

Nice thinking, but disagree about Maslow. Money toward health care has more to do with the availability of money for health care than the needs of those who need health care. To be blunt, nobody cares about the sick and needy except the sick and needy and their relatives

If spending money is involved. A Maslow’s hierarchy of greed would put health care near the top if easy money were available and it could be flooded towards treatments with no upper limits to cost and open ended payment systems. Then health care becomes a basic human right and essential need.

Thinking classically, Malthus has more in common with today except food is not the problem. Population growth combined with technology and little innovative job producing investment is deflationary without support for spending by the masses.

Creative investment pushes the growth curve outward. Low rates, money printing, and junk investment are an expression of Malthus’s warning. Deflation results, not food shortages. Higher rates that promote capital formation and investment that creates jobs contribute towards growth and potential innovation. In other words, the central banks are more pro-Malthusian in their thinking than growth oriented.

Health care, housing and education have had rampant inflation over the last 40 years and especially in the last 20 because they have pricing power – they generally cant be offshored and are fairly protected from immigrants and those industries have bought the politicians and abused their pricing power to an extant that they’re destroying the country.

I’ve always said, if you want to know the true rate of inflation and economic growth, just switch the two numbers that the govt publishes, they have an incentive to lie.

And I dont see the pricing power of phones going away. Smart phones seem to be mandatory all over the world now, even in relatively poor places. Other areas – like food – are suffering and you can see it in obesity rates. Humans are morphing into blind blobs, like some cave dwelling creature only made out of GMO pus.

The box of pasta I buy every week is short 2 ounces, I finally weighed it out of frustration. The full price is up 50% to $1.50, on sale it’s $1. Even if I buy only when it’s on sale, they are still shorting me 12.5% of the product. If I buy at full price, I’m being overcharged $0.69 on every box. The entire supermarket is like this. It’s hyperinflation to me.

1) Are you reading the label to see what they’re claiming the weight to be ? I’m asking because I’ve noticed being a serious pastaholic myself that many brands have gone from 16 to 10-12 ounces albeit in the same size box . Suffice it to say though if they’re claiming 16 ounces and you can prove less you’ve got a case any law firm would gladly take up on a commission basis

2) What you’re seeing with your preferred brand of pasta is happening across the shelves with just about every product wet or dry being sold at supermarkets today especially among the generic brands . The same sized box with less content within … with manufactures abiding by the less is more principal . As in you get less but you pay more . But as stated above they must accurately state the weight !

3) My personal pet peeve is NW putting half the amount of viti’s etc in a bottle and then selling them at a mandatory two for one making the unaware consumer think they’re somehow getting a bargain when in reality they’re paying more for the same one bottle amount while filling landfills with even more trash

Is it just me or the 80 Advils in the large bottle that used to contain 100? A lot of air at the top of the bottle.

100 before vs 80 now is a 25% bump in price. That is, of course using the old math.

Petunia –

Yes… and price of services, particularly if you are in a bind, are HIGH. part of it is the skim & scam biz models…

After 100 years or so, the package of bacon went from a pound (or here in Canada rounded from 454 gms to 500) to 375 gms.

I’ve bought bacon but refuse to buy 375 gm. package.

However: As much as I agree with you, note this stealth price- rise per unit is not the same as the usual inflation. They are trying to sneak it by because they can’t do it any other way. In times of real inflation they just increased the price and people sucked it up.

Every fast food chain is coming out with budget stuff, like KFC rediscovering mashed potato. Gillette is advertising lower prices for the first time ever- it used to be all about ‘new’ blades.

I was just in Super Store yesterday and they were offering big savings if you would buy two or three of an item.

My point: we feel like they are squeezing us but they are being squeezed themselves. Some big ones in the food biz won’t survive. Higher prices cant be passed on like they used to be.

This has been going on for years. Find a “pint” or “half gallon” of decent ice cream that’s actually still a pint or half gallon. The minority that still are brag about it, but their price is higher, of course.

Food Inflation Kept Hidden in Tinier Bags

March 28, 2011

Chips are disappearing from bags, candy from boxes and vegetables from cans.

As an expected increase in the cost of raw materials looms for late summer, consumers are beginning to encounter shrinking food packages.

With unemployment still high, companies in recent months have tried to camouflage price increases by selling their products in tiny and tinier packages. So far, the changes are most visible at the grocery store, where shoppers are paying the same amount, but getting less.

For Lisa Stauber, stretching her budget to feed her nine children in Houston often requires careful monitoring at the store. Recently, when she cooked her usual three boxes of pasta for a big family dinner, she was surprised by a smaller yield, and she began to suspect something was up.

“Whole wheat pasta had gone from 16 ounces to 13.25 ounces,” she said. “I bought three boxes and it wasn’t enough — that was a little embarrassing. I bought the same amount I always buy, I just didn’t realize it, because who reads the sizes all the time?”

Ms. Stauber, 33, said she began inspecting her other purchases, aisle by aisle. Many canned vegetables dropped to 13 or 14 ounces from 16; boxes of baby wipes went to 72 from 80; and sugar was stacked in 4-pound, not 5-pound, bags, she said.

The price of meat and chicken has climbed in the past year too. I buy large cuts and make several different meals from it. Along with meatless meals. Shampoo and personal grooming items prices have climbed. Laundry detergent costs an arm and leg now. I grow my own spices and vegetables in my garden. Lucky the winters aren’t too bad here.

This is the era of the 30 ounce quart!

Plus, inflation, as measured by the Fed re Core Inflation, is inflation with everything inflationary removed. Inflation is like beauty – in the eye of the beholder. All one can be assured of is prices will rise if cash is directed towards the availability of the item. School loans cause education to rise in price. QE causes asset prices to rise. Japan has clearly proven massive cash inflows do not affect much of anything in a general way. Ditto with the Eurozone, except they pay bills with their printed money.

Understood. But I’m looking at inflation from the Fed’s point of view to figure out how it might impact the Fed’s decisions.

The Fed doesn’t care one iota about my point of view on inflation, so my point of view on inflation is useless in trying to figure out what the Fed will do next :-]

The Fed chief is undersecretary of Treasury, the bureaucratic policy model is to follow government policy in the absence of that they follow data, and conclude that the economy can absorb higher interest rates. If the Fed is a private bank it has a public guarantee. Janet Yellen has been losing weight because while it is it’s de rigueur to look the part when you are a fat cat banker, (even while you hold trillions in deferred assets) it’s c’est dommage for a high level bureaucrat.

Wolf:

I understand we have to look at bogus numbers because the Fed does.

I always wondered if they know the numbers are ridiculous, some of their models are downright embarrassing as well as silly, they are creating asset inflation and a dangerous credit and bond situation but are basically scared and flummoxed as to what to do. Actually they are in such a box they cannot do much of anything. Raise interest rates companies will go bankrupt, housing market will get worse, stock market will go down, pension funds oi vey, etc. Derivatives meltdown?

They have destroyed the middle class, made a mockery of capitalism, and I think have contributed greatly to the current anger and divisiveness.

Do you think they have a clue? I think they are petrified.

There are people whose rent doubled over a period of five years, and their healthcare expenses doubled over the same period. And those two items are 60% of their expenditures. For them, inflation as measured by their annual cost-of-living increases is going to be in the double digits.

Very few people see these kinds of wage or salary increases. More likely, their wages are creeping up at a much smaller rate. So for these people, life gets very tough. And they will cut their spending on other items.

The people at the Fed are very smart, but the way they see things, it’s not their job to care about this or anything else related to consumers. They have other priorities. And they have no problem sacrificing consumers, workers, savers, millennials, and whoever else at the altar of their priorities.

Wonder no more. The banks which own the Fed would love nothing more than to obtain funds virtually interest-free forever, to the extent the national debt can be expanded through TARP, QE and the like, and in so doing justify paying savers virtually nothing. That is all you need to know.

Janet Yellen’s acting coy about the inevitability of rates eventually having to go up is a smokescreen for the above. But all it would take to upset the applecart is when someone else regarded as trustworthy raises rates- say a Switzerland, currently paying negative rates, or Germany- or even China. Paying savers as little as 1% APR, after all, would be over ten times the return savers are getting in the U.S.!

Msshell, That perspective appears gullible. The beatings will continue until morale improves.

The Chinese were the first to introduce the concept of “paper” money – sort of – about 1k AD. Humanity will always have its issues – that isn’t going to change.

Under no circumstances can anyone grant to anyone else the ability to “create” units of measure – that happen to be “money” – and expect a different outcome.

This is averaging behaviors – across a large group – and is best described in laymens terms as giving a Mc Laren F1 to a teen ager and expecting them not to wreck it (in 30 to 40 years – as is the historical average).

If I may vent, in more colorful terms – could NASA launch satellites and explore the solar system with a devaulating meter, liter, and gram? Are y’all shitting me?

I don’t picnic on low tide beaches in my neck of the woods – just common sense.

Things are totally screwed up right now – and one day they will revert to their averages.

Just needed to vent.

And, to be honest, I really expected reality to set in about five years ago – so I hope I am funny, but do NOT trade my advice – I suck at gambling.

But, I will be right.

Regards,

Cooter

The Fed doesn’t care one iota about robbing the 99% through its currency debasement and the stealth tax of inflation, which it deliberately understates using manipulated data that does not capture the true extent of asset or consumer inflation, by design.

What the Fed will do next? Just ask what any criminal private banking cartel will do to most efficiently facilitate the oligarchy’s financial strip-mining of the middle and working classes.

There, fixed it for you.

“Japan has clearly proven massive cash inflows do not affect much of anything in a general way.”

Japan is a weird case.

Japan is relatively isolated from the world and markets in many aspects and yet fully integrated in others.

For example, immigration. A very small number of foreigners live and work in Japan. (They are quite lucky there.) Many of the so called foreigners are of Korean descent that have lived there for a very long time and are still deemed ‘foreigners’ by the government.

Tourism? A huge change over the past 30 years. When I first visited Japan there were about 1.5 million visits by foreigners in one year. When I lived there the number had increased to around 2 million a year. Last year the number was over 24 million.

In August this year there were more visits to Japan than there were in the entire year of 1988.

Japan is now a cheap place to visit compared to when I lived there. Is is also safe (The Economist has rated Tokyo the safest city in the world again for 2016.)

Go figure: massive QE has worked in the tourist area attracting a huge number of people which has helped out the country’s economy quite a bit.

Investment in Japan is also very different from other countries. Yes, people buy Japanese stocks and bonds, but again that amount owned by foreigners is very small especially in the bond market.

Direct investment in physical assets is also small compared to other countries.

In the financial M & A arena it is small as well. You can probably count on one hand the number of foreign takeovers of medium to big sized Japanese companies on one hand over the past 10 years. The takeover business is usually the opposite: Japanese companies buying foreign ones.

Real estate – the same things except in the commercial , office, and hotel sectors there is very little foreign buying of real estate. Ever hear of a foreign bigwig billionaire plunking down US$20 or $30 million for a house in Tokyo?

Me either.

How about the Chinese real estate invasion in Japan scooping up property like they have in Canada, the USA, and here in Australia? Doesn’t exist. A few brave individuals and companies have tried, but found out that they are not welcome.

Individual small RE holdings are also weird. Lot’s of money going into RE in the big cities and recently prices in some places have surpassed the previous peak during the bubble. Lot’s of tall, fancy skyscrapers and high residential construction along with hotels in the big cities – that money had to go some where.

Out in the smaller cities and country areas – real estate is cheap as chips and is much cheaper than renting. Of course in many places it is going to continue to get cheaper as those areas die off because of depopulation.

Asset value growth in the cities destroyed in the countryside.

Inflation as measured in Japan is fake as well. People have seen wages stagnate and fall and basic costs increase over the years. The results are simple to see in that pocket money for husbands has fallen almost every year since the bubble popped. There is not much extra for many people.

And finally believe it or not Japan now has a big poverty problem – who would have thought!

Considering they still haven’t dealt with the triple meltdown at Fukushima I’m surprised anyone is dumb enough to travel to Japan I certainly would not

Ridiculous comment – not informed about japan at all are you.

Fukushima was a bad accident compounded by a lazy company and human error.

It affected a small part of Japan and in an area that tourists seldom visit.

Yes, please stay away.

Japans problem is their history of how they treated other Asian countries in their neck of the woods – coupled with the fact they are very old and not knocking out kids – and surrounded by nations that are younger and knocking out kids.

That said – historically it is a tough neighborhood – but that doesn’t change the current math – won’t be pretty – but will happen in time.

Maybe they will be treated better than they treated others.

Or Not. <— Reality

Regards,

Cooter

Lee, I would like to pick your brain. I was in Japan a few years ago, I wouldnt say I fell in love but there are some places I really liked and was recently looking at maybe trying to find a long term rental in case I get a contract where I can work remotely. In the search I found a place for sale that was relatively inexpensive. Would sort of hoops would a gaijin have to jump through to buy a place in Japan? I’m not likely to pull the trigger but I figure’d it might be worth investigating.

And I noticed the tremendous number of chinese and korean tourists. Saw the same thing in Thailand last month – they’re enjoying their new found prosperity.

supply/demand of currency

More money in circulation, more money chasing everything equals inflation.

Less money in circulation, less money chasing everything equals deflation.

More money printed QE 1-2-3(maybe more coming?) helicopter money along with essentially 0% interest creating more money via debt (our currency is based on debt not assets since 1971). This added such an incredible amount of currency that many assets hyperinflated and all followed suit in some fashion. Now they threaten to normalize their abnormal balance sheet and normalize their abnormal interest rates which would great deflationary event. This deflationary event would cause many to walk away from their upside down asset and all banks would be great trouble.

Catch 22

When it was related to a finite asset it was somewhat controlled from inflation.

I also agree with Petunia that many many tricks have been used to hide inflation, I have experienced the amount changes as well.

My simplified opinion, let me know your thoughts.

Here is a more complicated model to explain what had happened by Andy Xie’s recent post quoted by Zero Hedge.

In this model, there is two prices, asset and CPI. There are two groups of people, the rich and the mass. The rich own assets, the mass care about CPI. For the CPI, there is supply and demand. With all of these parameters, the model goes like this.

1. Zero rate and QE would boost asset prices. Encourage rent seekers to pool money and suck up consumption buying power from the mass by raising rent, insurance and tuition. Besides asset and CPI, what differentiate rich and the mass is that the rich pools money from market while the mass trade the labor for salary.

2. All the created currency units do NOT go to mass buying power, it goes to over capacity production, AKA, over supply on a weakened demand, therefore CPI remains low.

3. Fed’s excuse to print is that CPI is low, so they keep printing, encourage more rent seeking, creating more supply of goods and pin down CPI.

Based on above, the central banks basically hijacked the market and your good old fashioned deflation will NOT happen simply due to market force. Andy’s conclusions is that the only way to stop this in-equality economics is through political conflicts. The class struggle type of politicians will rise and the rich will feel the wrath of the mass. Until that day, NO deflation.

Maybe we’ll have some of that good ol’ Stagflation.

That is what i’m seeing,feels very 1970ish. all we need is the oil shock to complete the picture. channeling Jimmy Carter right now,hey Jimmy,whassup!

We’ve had stagflation for awhile now Low growth and high inflation That is unless you believe Yellens numbers I dont

I am not sure if I missed it, but did any of the elected representatives of the people ask the FED when reporting to congress, why higher prices were such a great thing for the people they supposedly represent?

You have got it wrong. People do NOT select representatives because the representatives will serve. People select them because without them, people will lost their jobs, mortgages, EBT cards, medicaid, insurance coveragge…

They own the sheeple because the sheeple depend on them as opposed to depend on themselves. They serve nobody although they make you feel they are serving.

I know, was only curious of any of them read the ABC of Quack Theories, or was educated in one of the (very expensive) institutions of higher learning.

The Republicrat duopoly gets elected by the sheeple by conning them with trite and empty slogans, but once in office is solely focused on doing the bidding of its billionaire donors and corporate lobbyists while enriching themselves through various patronage and graft rackets. The sheeple sanction this with their votes for the crony capitalist status quo.

Maximas seems to share the misconception that the Fed is formulating its monetary policies in the interest of ensuring sound money and honest markets. Nothing could be further from the truth. The Fed is focused solely on concentrating all wealth and power in the hands of its oligarch wire-pullers. The role of our “elected representatives” is to facilitate the Wall Street-Federal Reserve Looting Syndicate’s swindles against the 99%, not look out their so-called constituents.

One thing Yellen doesn’t know is that raising rates causes inflation.

It appears that bitcoin is the asset to own right now. Crazy. I thought $5k was going to be the peak. How high is it going to go.

The home price inflation is the most damaging. It’s a large expenditure, and people need a place to live. My rent went up 5% this year.

The rent equivalent in the CPI should be rising at a fast clip. If not, the Fed’s computations are not accurate, which is perhaps intended as the Fed stabs the general population in the back.

Insurance may come in to play and mess with the real numbers. How many did not have their homes insured, and how do they buy a car as well as repair their homes?

Have to think like Puerto Rico, the whitehouse of pain is giving them nothing but a loan.

We know not to expect any reality in a fed statement, but will credit go up to those that have just had credit scores drop several percent due to the new reality on the ground still saturated around them?

The alt-rock FM station in Houston has given Saturday mornings post-Harvey to an internet-based used car dealer who runs a call in show, wherein he chats with people about what their cars are worth. It’s hysterically funny, at least partially because he has the sort of high-pitched voice you never hear broadcast. I suspect he will be banished back to AM soon, but I am enjoying it.

At least some new car dealerships are offering to pay off difference between insurance settlements and remaining loan. The ‘underwater’ puns took less than a month to emerge. Numbers as large as $12k have been advertised (if you buy a Dodge Ram 1500).

Bernanke is very proud of himself for having saved banks that should not have been saved. He had the perfect opportunity to clean out the banks of derivatives and other trash. But he couldn’t, because he still doesn’t understand how the banks actually work. But book wise and street stupid describes the Fed since Greenspan, and no matter how much they furrow their brows, they can’t seem to figure out money or inflation, and they have admitted as much themselves. So trying to figure out what the Fed will do by looking at the data is probably pointless. Maybe they think they have a magical mathematical formula they found in some ancient economics textbook, or maybe they’re reading the entrails of a slaughtered goat in the basement of the Eccles building. The way they have run things, the goat may be the better option.

Transitory for sure.

Hurricanes created some temp. shortages.

Short term % rates are rising, because the Fed is expected to

raise % rate.

The stock markets keep moving up.

But, it ‘s very likely to be only transitory, because we are topping.

Falling 10 years and 30 years rates show no signs of future inflation.

The commodity market (DBC) and oil ($WTIC) are flat since mid 2016.

Once we enter a recession, things will go downhill.

It might be a long slog down.

Wolf,

I don’t think that my comment is extreme, but you can delete my name if you want !

Why do you think that I think it might be “extreme?” Am I missing something?

2 percent inflation (based on whatever) would be no big deal if it wasn’t just after the largest stimulus in history.

That stimulus in anything like a normal economy should produce double digit inflation.

The asset inflation of housing although not directly in the Fed’s CPI must be helping to keep inflation higher via the ‘wealth effect’.

Surely a lot of Americans are buying cars etc. with a HELOC based on higher house prices.

Looks to me like risks are tilted towards deflation. Fed’s QE unwinding has just been announced and hasn’t even begun.

There has been a major shift in the tone of biz news lately. Much more about avoiding loss, defensive stocks etc. This conditions the psyche of stock market players to expect that the music is about to end.

This expectation: that buying on the dip won’t work one more time, sows the seeds for a mass panic move into cash.

“That stimulus in anything like a normal economy should produce double digit inflation”

it has, look at the DOW

Any inflation isn’t necessary, it’s basically an invisible tax.

Maybe we should go back to tally sticks ;]

Clearly health care is not included in her inflation calculations.

Perhaps, but the crisis, when it comes–driven by credit contraction and a collapse in the money supply–will be explosively deflationary. Show me a depression marked by inflation.

Remember when a roll of toilet paper was so big you had trouble putting it on and it just about turned.

Maybe I should call Yellen and have her pay that 11% increase in our health insurance premiums. Maybe she’ll send me some freshly Fed print Hedonic bucks. Those spend just fine. Thank you

So, could this finally be the launch of the Crackup Boom? If not, it’s only a matter of time.

It looks more and more everyday like stocks are right and bonds are wrong here.

Maybe Mr. Magoo had it pegged. To paraphrase Hugh Hendry,,,’ One trillion might not do it. Four trillion might not either. But some trillion some day will.’

I will provide 3 examples of costs, which I have incurred in the last 3 months:

Remove and replace a 22 year old 300,000 BTU steam boiler – labor and material – US$10,000

Labor value = 50%

Remove and replace a 22 year old 4 ton a/c condenser and air handler – US$10,000

Labor value = 60%

Remove and replace 60 linear feet of concrete sidewalk – $3,000

labor value = 80%

Most people can not afford these expenses.

Every year, costs rise and the quality of labor and material declines.

These are not discretionary expenses – you need heat in the winter and almost must have a/c in NJ in the summer.

Sidewalk replacement is a matter of safety and can not be deferred or avoided.

You must have earning power to pay these expenses, which are not tax-deductible against ordinary income and must be capitalized to hopefully reduce any possible capital gains in the sale of your casa.

“Food prices rose 1.2% year-over-year”

give me a break…..based on a basket of food nobody would ever eat. I wish my food inflation was 1.2%

I will say that Vodka has gotten cheaper so…….

A pet peeve of mine is whey protein. Those bottles should be shrunk by law. It’s been ridiculous for years, adding to tons of plastic waste and higher shipping costs.

Has anyone recently shopped in i. The Netherlands, ii. Germany and iii. Switzerland? The EU common market is clearly not working that well either. Most grocery products are like 40% dearer in Holland and don’t be surprised to see Swiss shoppers across the border piling their shopping trollies as high as possible.

What’s behind this? Debt and printing money, like it has already been behind inflation for the last 50 plus years. Add to that the imaginary money the FED created and you wonder why the inflation isn’t even bigger.

It should be easy to measure inflation. Since 2000, everything that is counted in USD, from groceries, to average home price, to major stock indexes, is roughly twice what it used to be. That would give about a 4% yearly inflation over the past 17 years.

Of course, real household income is about the same now as it was in 2000. The question becomes, what happens in another 17 years, if prices for everything doubles again, but household income stays the same. Would we be living in a totally different society? Would it resemble a developing country?

4% inflation over 17 years. The Rule of 72 says that if you take 4% inflation and divide it into 72 you get 18 years.

That’s how long it takes 4% to double everything within its grasp, whether a return on investment or inflationary price increases. With no appreciable increase in income, whether simply no pay raises to speak of or taxes reducing spendable income, this would account for a large number or people who simple dropped off the map.

That 50,000,000 on the dole; a few million homeless; 10 plus million Millennials living with parents or another 30,000,000 simple beaten down into abject poverty, jobless and without much hope because to make it in this country, the jobs are just not available for these people

The vast silent majority who’ve been kicked to the curb by the relentless erosion of the little bitty 4% inflation.

From the CBB:

“Federal Reserve Credit last week slipped $1.2bn to $4.419 TN. Over the past year, Fed Credit was little changed. Fed Credit inflated $1.608 TN, or 57%, over the past 257 weeks.”

Previous week:

“Federal Reserve Credit last week declined $3.7bn to $4.420 TN. Over the past year, Fed Credit was little changed. Fed Credit inflated $1.609 TN, or 57%, over the past 256 weeks.”

And the week before that:

“Federal Reserve Credit last week slipped $1.0bn to $4.424 TN. Over the past year, Fed Credit was little changed. Fed Credit inflated $1.613 TN, or 57%, over the past 255 weeks.”

So three weeks in a row Fed credit has fallen……………

Wanna guess what ti will do next week as well?

Give it a few weeks…

The Fed announced that it would kick off the QE unwind in October. Oct 1 was a Sunday, so on Oct 2. And it takes a while to get all the parts moving without spooking the markets. The Fed promised to ease into this in order not to disrupt the markets.

The first three months it will let $10 billion a month roll off. And it will increase the rate after that until it hits $50 billion a month a year from now.

So it’s too early to see what’ll happen. Nevertheless, the balances sheet for the latest week available , ending Oct 11, showed that its assets dropped by $1.2 billion from the prior week.

https://www.federalreserve.gov/releases/h41/current/

Thank you Mr. Richter

Could the balance sheet reduction be related to the Yen and Yuan strengthening this week?

Wonder how they calculate the value of securities? Mark-to-market or mark-to-model?

Actually, neither.

On the Fed’s balance sheet, there are several lines for US Treasuries (Bills, Notes, TIPS). In these lines, it values the Treasuries at face value, which is the amount it will receive when the securities mature.

It values mortgage backed securities (guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae) at the “current face value,” which shows their remaining principal balance. Unlike regular bonds, MBS get paid down constantly as the underlying mortgages are paid off (as mortgage principal payments are made or when the mortgage is paid off), and the proceeds of these mortgage principal payments are passed on to MBS holders.

On the balance sheet there are also separate lines to account for premiums and discounts of those securities. This is the difference between the purchase price and the face value.

These values don’t change as markets rise or fall. Changes in the market won’t impact the balance sheet since the Fed will let these securities mature and thus will receive the face value, which is guaranteed by the US government.

What a larf- back to inflation again, as someone in New frickin Jersey- New York suburban expensive hole in the ground complains about the costs of homemoanership again.

And then they move to Florida and spend nothing on a crap shack and then try to clip coupons to grow their nest egg.

Face it, wages suck. Until that reverses, nothing matters except watching speculators build another tower of paper dreams on the next ponzi spec.

And then splat.

Lather, rinse, repeat- American capitalism.

The really funny part is that if you accept your poverty, it gets so much easier than to try to hold on to that middle class bushwa.

Sell it all, and find out what it is really worth- the contents of your home are most likely worth less than $5k, excluding jewelry and anything else good enough to pawn for cash. (Guess what- it ain’t much folks!)

So now you begin to hope your home is worth a fortune, because if it ain’t then what do you have to show for your lifetime of efforts?

Now, back to the complaints of MBA engineered higher profits through short fill shipping. Because margins always increase and PE needs to strip moah equity. Look at the commodity markets and tell me that $4.30 a bushel wheat is galloping inflation, or $3.53 corn- oil at a whopping $51 a barrel- where is the big push from the bottom from overwhelming demand? Um, Potash is $220 a ton- nice crater to look at- real metal demand is meh- only the low cost mass producers are making bank at this point- $3 a pound copper is just making enough to keep going….

In short, when China devalues again, we is gonna get another big wave of deflation.

And yet, house prices in California shoot to the moon.

Considering the recent price war either for retail or energy the question here is what held that inflation low but not negative all this time? This is the structural inflationary component and a nontransitory problem as well. Housing?

Taxation for administrative and defence services and products? Health costs?

You know, fuel prices here in Texas have been affected by Harvey. I think that’s true also for much of the south. The refiners were hit pretty bad. Many of them got swamped and damaged, since they’re right on the coast and it rained and rained and rained.

If gasoline is the big item in that higher inflation number, I’d be cautious.

Yes, as pointed out in the article in the first paragraph. But gasoline is not part of “core” inflation (inflation without food and energy). So it will be ignored by the Fed. However, new and used vehicle prices and telephone services are part of core inflation. And those three are what the article was about.

My bad, sorry. I focused on the interesting charts.

Michael Oliver of OliverMSA.com uses his momentum structural analysis as his technical indicators on the market, etc. At the beginning of the year he said ” we’re finally going to see that commodity inflation the Fed has been trying to bring about.”

Across the board, almost all commodities have bottomed and are headed higher. The last to join the party will be grains.

– No, this inflation doesn’t “have legs”. Consumers – as long as they all don’t get significant wage increases – will be forced to cut back on other spending items.

– One also has to look at what makes up the largest part of consumer spending. That sector will take the biggest hit as a result of this “inflation” spike. I assume that then home prices will be put under more pressure.

– One also has to look at a thing called “credit growth”. That will determine how much producers will be able to raise their prices.

– When credit growth (a.k.a. “Inflation”) remains sudbued then “Price Inflation” (or simply “Higher prices”) won’t go up too much.

The FED is ringleader of the criminal enterprise pump and dump circus. Prove me wrong!

The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations. Each central bank…sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world.”

– Carroll Quigley, Tragedy and Hope