The Fed and the ECB believe they can tighten and taper without killing the market so long as they jawbone this constantly.

By Ben Hunt, Chief Investment Strategist at Salient Partners:

If you’ve been reading my notes immediately before and after the June Fed meeting (“Tell My Horse” and “Post-Fed Follow-up”), you know that I think we now have a sea change in what the Fed is focused on and what their default course of action is going to be. Rather than looking for reasons to ease up on monetary policy and be more accommodative, the Fed and the ECB (and even the BOJ in their own weird way) are now looking for reasons to tighten up on monetary policy and be more restrictive. As Jamie Dimon said the other day, the tide that’s been coming in for eight years is now starting to go out. Caveat emptor.

The question, then, isn’t whether the barge of monetary policy has turned around and embarked on a tightening course – it has – the question is how fast that barge is going to move AND whether or not the market pays more attention to the actual barge movements than what the barge captain says. I promise you that the barge captains of both the Fed and the ECB believe they can tighten and taper without killing the market so long as they jawbone this constantly.

This is the Common Knowledge Game in action, this is the Missionary Effect, this is Communication Policy … this is everything that I’ve been writing about in Epsilon Theory over the past four years! And as we saw with the market’s euphoric reaction to Yellen’s prepared remarks for her Humphrey-Hawkins testimony on Weds, which were presented as oh-so dovish when they really weren’t, this jawboning strategy could absolutely work. It WILL absolutely work unless and until we get undeniably “hot” inflation numbers – particularly wage inflation numbers – from the real world.

So what’s up with that? How can we have wage inflation running at a fairly puny 2.5% (Chart 1 below) when the unemployment rate is a crazy low 4.3% (Chart 2 below) and other indicators, like the NFIB’s survey of “Small Business Job Openings Hard to Fill” (Chart 3 below) are similarly screaming for higher wages?

Chart 1: US Average Hourly Earnings, annual % change

Source: Bloomberg Finance L.P. as of 7/13/17. For illustrative purposes only.

Chart 2: US Unemployment Rate

Source: Bloomberg Finance L.P. as of 7/13/17. For illustrative purposes only.

Chart 3: NFIB Small Business Job Openings Hard to Fill

Source: Bloomberg Finance L.P. as of 7/13/17. For illustrative purposes only.

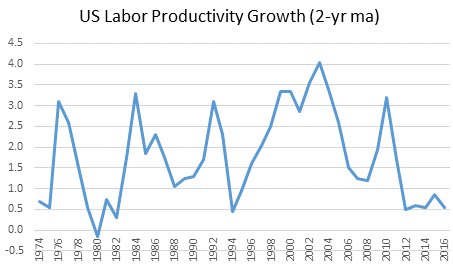

The answer, I think, can be found in Chart 4 below – vanishing labor productivity. Productivity is the amount of stuff that workers make (output) divided by the amount of time it takes them to make it (hours worked). You can have productivity growth for good reasons like in the 1980s and 1990s and early 2000s (more stuff made per hour worked as companies invested in things like the personal computer or the Internet) or bad reasons like in 2009 and 2010 (massive layoffs, so making a bit less stuff but over waaay fewer hours worked).

Productivity growth for the right reasons (I know, I sound like a contestant on “The Bachelorette”) is just about the most important economic goal that policy makers have, because it’s how you get your economy growing in a sustainable, non-inflationary way, and for the past seven years we’ve had none of it. By the way, if new technologies were really responsible for keeping wage inflation down (something I hear all the time), we would have seen that through increasing labor productivity. We haven’t.

Chart 4: US Labor Productivity Growth (2-year moving average)

Source: Bureau of Labor Statistics as of 7/13/17. For illustrative purposes only.

This is a huge question for the Fed, maybe the biggest question they have. How is it possible – with the most accommodative monetary policy in the history of the world, with the easiest money to borrow that corporations have ever experienced, with all the amazing technological advancements that we read about day in and day out – that companies have not invested more in plant and equipment and technology to improve their labor productivity, to make more with the people they’ve got?

The answer, of course, is the answer that the Fed will never admit. The reason companies aren’t investing more aggressively in plant and equipment and technology is BECAUSE we have the most accommodative monetary policy in the history of the world, with the easiest money to borrow that corporations have ever seen.

Why in the world would management take the risk – and it’s definitely a risk – of investing for real growth when they are so awash in easy money that they can beat their earnings guidance with a risk-free stock buyback? Why in the world would management take the risk – and it’s definitely a risk – of investing for GAAP earnings when they are so awash in easy money that they can hit their pro forma narrative guidance by simply buying profitless revenue?

Why in the world would companies take any risk at all when the Fed has eliminated any and all negative consequences for playing it safe? It’s like going to a college where grade inflation makes an A- the average grade. Sure, I could bust a gut to get that A, but why would I do that?

How does this apply to wage inflation? It’s the same thing. Why in the world would a company pay up to fill a position when it’s a risk they really don’t need to take? Yeah, we’ve got job openings, and yeah, our skill positions are increasingly going unfilled, and yeah, we’d like to expand and grow … I suppose. But, hey, we’re hitting our numbers just fine as it stands and, if you hadn’t noticed, our stock price hit a new high yesterday. Why mess up a good thing?

How does this change? As the Fed slowly raises rates, as the barge slowly chugs down the tightening river, it will force companies to play it less safe. It will force companies to take on more risk. It will force companies to invest more in plant and equipment and technology. It will force companies to pay up for the skilled workers they need. You want wage inflation? You want productivity growth? Then raise rates!

And god forbid if we actually get a tax reform bill passed. That’s the off-to-the-races moment.

My point is a simple one. In exactly the same way that QE was deflationary in practice when it was inflationary in theory, so will the end of QE be inflationary in practice when it is deflationary in theory. That’s the real world impact I’m talking about, the world of wages and output and productivity. You know, the real world that used to be the touchstone of our markets.

And here’s my other point. In the Bizarro-world that central bankers have created over the past eight years, raising rates isn’t going to have the same inflation-dampening effect that it’s had in past tightening cycles, at least not until you get to much higher rates than you have today. It’s going to accelerate inflation by forcing risk-taking in the real world, which means that the barge is going to have to move faster and faster the more it moves at all.

I think that today’s head-scratcher for the world’s central banks – why haven’t our easy money policies created inflation in the real world? – will soon be replaced by a new head-scratcher – why haven’t our tighter money policies tamed inflation in the real world?

My view: as the tide of QE goes out, the tide of inflation comes in. And the more that the QE tide recedes, the more inflation comes in. I know that this sounds like a nutty scenario today, with everyone talking about how inflation is dead and gone, and how the Fed will be “fighting” inflation by raising rates, but I gotta call ‘em like I see ‘em. It’s a scenario that neither central banks nor markets have contemplated in any serious way, but it’s going to be a focus for Epsilon Theory. By Ben Hunt, Chief Investment Strategist at Salient Partners

When it comes to unwinding QE, “We act like we know exactly how it’s going to happen, and we don’t.” Read… Unwinding QE will be “More Disruptive than People Think”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf you’re being nice….Three (soon to be) mega boom bust bubbles in the last 17 years and the public still thinks this is an accident or an error in planning….Each time the same people benefit hugely!??!?!?

The Feds actions have nothing to do with “profit” or running the finances of a country with fiduciary duty, they are literally trying to cause the largest catastrophes possible and everytime they do this they sink their hooks a little deeper in a way that yields them more an more control over your daily actions….

If these people arent in the business of making money, or in the business running a country in the best interest of its citizens, what then I ask the reader’s of Wolfstreet are they in the business of doing?????

Patriot Act, for what?

Everyones communication tapped for what

Ban on Cash for what?

Ban on 100 dollar Bills at Citi locations in Australia/500 Euro notes Germany?

Limit on cash transactions in France Spain and Germany….

Trade in and tax on 2 largest denomination bill in India?

Bank of Canada raising rates into a credit market where borrowers cant handle 1 %higher without going into default..

Negative interest rate on savers…..

This is a coordinated effort people wake up!!

that’s a Wolf dressed in sheeps’ clothing Concerned!

07/01/17

The Australian Government has no plans to withdraw AUD100 note from circulation. It continues to remain legal tender in Australia,” the Australian High Commission said in a statement.

Nothing is certain until officially denied.

Yep, Puppets working for the NWO come to mind !

yep

I have not said this, because it sounds too much like a “conspiracy theory,” but I agree. The billionaires that control the world by purchasing politicians, buying and controlling major media, and electing their cronies, e.g., Trump, profit from the collapses but that tactic is carefully ignored in the media.

Banksters use the old Roman tactics of “Divide and Conquer” to divide Americans by causing Americans to divide due to their race, gender orientation, etc. However, when banksters cause an economic collapse that harms most Americans, their allies can buy the shares and businesses of innocent Americans at rock bottom prices.

Now, if the “Federal” Reserve (hereinafter the “Fed Banksters”, actually a bankster monopoly owned and truly controlled by the banksters that caused the 2008 collapse and profited from the sale of fraudulently securitized mortgages that they knew would fail) sells its GIGANTIC holdings of treasuries, who will buy them? That was the hidden problem with the trillions in treasuries bought during the QE.

Even J.P. Morgan’s Jamie Diamond, who I have no trust in, has warned about the “surprise” disruption to investors that will follow: by which he probably means the plummetting in the sale prices of the treasuries that are outstanding, due to a low number of buyers. http://www.marketwatch.com/story/jamie-dimon-says-qe-unwind-could-catch-investors-by-surprise-2017-07-11

In other words, if the U.S. government keeps selling treasuries, as it needs to regularly as its existing treasuries come due, when Fed Banksters decide to also sell their gigantic treasuring holdings, who will buy them? Other countries are decreasing their holdings of treasuries. Perhaps, if the CIA or other agency gets involved, a crisis can be arranged in some other countries (e.g., a North Koran incident) that will panic investors and cause them to flee to U.S. treasuries.

Absent such an arranged foreign 9-11, when the Fed Banksters truly start to sell their treasury holdings, the average rate that the U.S. government pays on its known debts will spike past the point at which the government can service its debt (absent massive spending cuts) and foreign investors may panic and divest their U.S. holdings. That will cause the price of U.S. shares and securities (e.g., corporate bonds) to plummet– not just the selling price of treasuries.

Once that happens, the dollar will be avoided and any investors burned in such a stampede, e.g., the oil producers, may demand to be paid in more stable currencies, such as the yen or euro. Once the “petrodollar” demand ceases, a vicious cycle will begin when the interest rates that the U.S. government has to pay rise and rise and it is less and less able to afford its debts.

The loss of reserve status for the dollar has already started, but the sale of the trillions of treasuries that the Fed Banksters hold will speed up the process. The billionaires and billionaire families (who own and control the Fed Banksters) will then buy out desperate Americans at rock bottom prices, because the dollar will be on the floor and they will be able to sell their Chinese factories and use the proceeds to purchase enormous assets in the U.S.

Is that an actual plan? If it is not planned, it is foreseably what will actually happen. The billionaire banksters (not just the officers but the controlling group of shareholders that actually orders around the corporate officers of banks by electing the board of directors of those banks) will just claim “surprise.”

That is what they claimed in 2008-2009, when they claimed surprise that the defective mortgages that they sold to gullible pension plans and investors failed, even as they bet using derivatives that such mortgages would go unpaid. http://www.nytimes.com/2009/12/24/business/24trading.html?pagewanted=all

See also http://www.mcclatchydc.com/news/politics-government/article24561376.html

How does Wolf Blitzer play into this? Oh right ” Very fake news” to keep the sheep in line and moving forward

The problem is the ENERGY, at 46 dollars / barrell the oil is expensive and moves the world.

The cheap power time is over.

The force that gives the productivity is the ENERGY, the world has worked with the oil of 20 dollars (adjusted to inflation). The only way to continue with this equation is to lower wages (except for strategic jobs)

There is no shale gas, no thigt oil, no carbon or anything, plugging renewable energies, that make back to times of cheap energy.

What happens then … we enter a crazed spiral of recession produced by expensive oil that causes the price of oil to fall and makes the energy companies do not invest and barely reach prices without investment or profits .. so and so .. Injected with money that will make things look like a Ponzi scheme

Sorry by my bad english, best regards

It seems like the major central banks around the world, decided to have these secret meetings to develop a new theory as to how to move forward with their monetary policies.

As a saver, I’m okay with that. However, I wished they made their new views known loud and clear a few of years ago when all of the asset bubbles around the world started to accelerate, and retail investors overleveraged themselves thinking ‘this time it’s different’.

One more thing for the Fed to ponder: we’re used to political instability in Southern Europe, now it’s emerging in the US.

Political instability is a side-effect of the creation of social instability, and that serves their purposes.

It keeps the general population distracted.

Right-wing extremism gives them a tool to attack popular liberal and progressive resistance. Militias are already used for ‘protection’.

These instabilities will increasingly provide them with pretexts for dismissing citizen rights and locking down the general population.

We have seen this before. It’s how it’s done.

You can tell the Financial Industrial Complex is as disconnected from political and social instability as it is from the actual performance of the economy, and for analogous reasons. It won’t affect them, and certainly won’t affect their policies. Per plan, they control all likely outcomes, and they care not at all for what you or I think about it.

When will all this come down! That’s the big question. Everything is flashing red, but they are still keeping the illusion going. It needs to come down immediately. The more we have to wait, the more will be the impact!

Doesn’t matter, if they managed to engage Russia in a war by then. Then economy is not actually a worry!!!

Regardless of points made in the article, interest rates must rise to realistic levels. If this puts people who borrowed too d*mn much into dire straights, then too bad.

As for companies echewing real production as opposed to using risk free/free money to goose the egg, that assumes said companies actually have a product and market to sell into. Does the world need more stuff? I don’t think so. We need less complexity, and fewer regulations for affordable housing. A case in point, I have been involved in construction on and off for 40 years. The price of new homes could be cut in half with a return to municipal/city building inspection as opposed to engineering oversights, and a return to common sense building practices. I have built homes 40 years ago that are in excellent condition vrs modern tightly wrapped time-bombs with condo disease. Does every new development need curbs, gutters, and sidewalks? What’s wrong with mortgage helper suites in the basement? Where my sister lives, zoning restrictions assure there can be no walkable local corner store. Instead, when people run out of milk they need to drive 20 minutes to the nearest plaza. It is mandated that she must have her septic tank drained, inspected, and certified every 3 years. Her tank is new and made out of concrete. It will last decades without this unnecessary expense. It’s gotten crazy with regs and complexity. Cars with sensors? Do people even learn how to parallel park anymore? Maps? Can people find their ass without a GPS?

When I was a young realtor in the early 80’s I had a small subdivision listed. You could buy a decent lot for 20- 25K and to meet the building scheme you would have to spend 60-75K.

Construction cost three times lot cost.

Today the same lot would be 150K and so roughly would construction costs (spec grade not granite counters etc. but decent/ nice) This also assumes careful shopping for the builder. It is a tight budget.

The construction cost has only doubled the lot is up 6 times.

Oh my God, you were a realtor! That explains everything.

Babe, move on.

Curbs, gutters, streetlights, etc. That is my point, or one of them. With the exception of large cities, in Canada it isn’t the land that is expensive, it is the amount of regs and complexity. Take down Island where you live, there is a virtual unlimited supply of private lands available handed down from the old CP Grant…mostly owned by Timberwest and Island Timberlands. Common sense development could move inland. This isn’t possible under the current regime.

That is why I live in a rural valley without all the crap beyond a small RCMP detachment. If I build a woodshed on my property line, it is between me and my neighbour. :-) My buddy in Campbell River suffered a drive-by inspector heading home one day and was soon forced to tear it down. His neighbour did not mind one iota. Nice rolled curbs, though.

I believe a lot of timber land is frozen by the Forest Practice Code which I believe is something like an ALR for trees.

Growing trees is the least productive use of land, and there is no shortage of them.

The ALR (ag reserve) is of course a motherhood issue and I like driving by farms too.

However, do not justify it as a ‘food security’ need.

BC has the population of Paris and the land mass of Western Europe.

The ACTUAL bottlenecks to production are marketing boards i.e. supply management.

I think there is room for a political movement if not a party, ‘Land to the People’

If you are looking as I have been for a small acreage, and are browsing Craig’s etc. and you suddenly see a not too bad deal, it will usually be in Washington.

Oregon has 30K deals with owner financing (at 8 %!)

The reason is most of these states is not state owned ( our Crown owned) At least half is private and so available for development.

In the bla legalese about Crown owned, it will say something ‘like in right of the people of BC’

What are we on a reserve?

Why can’t the people of BC own it directly or at least more than the tiny fraction they do now?

Raise interest rates and cut off credit.

Those underwater should be allowed to pay back their loans over a longer period, the next generation and those that follow somehow have to gain a foothold in society.

We have to break this somehow and get back to common sense financial practices.

High house prices, easy credit, QE and low interest rates have painted us into a corner that have left them with none or few options.

What a mess.

“us” and “them” may include the majority of U.S. citizens, but not all.

The “not all” are watching all this angst from the sidelines: “They” are not indebted.

There was never a need for “them” to “get back” to “common sense financial practices” They never deviated from them in the first place.

Did you hear Jamie Dimon’s rant today? Someone is getting VERY nervous. And this someone is sitting on top of one of the largest banks in the world.

He’s now looking for Congress (for politicians!!) to perform a miracle. But performing miracles these days is hard.

Never stop commenting, Paulo. You are a treasure.

“Pretzel Logic” should be the title of this missive…I can almost hear the howls of heartbroken central bankers and corporate humanity while scratching their collective @$$€$–er, I mean heads as they agonize over excessive financial risk to themselves…Meanwhile, Mainstreet America is

riddled with enough craters, thank you, courtesy of the financialization bazooka…By the by, why no mention of the declining Dollar…The dollar is off a peak of 104 from January, 2017 to ~95 today, and on a downward slope…Talk about inflationary pressure…I take back my original title change. Let’s try “The Inflation Double Whammy” instead.

The A$ has proven to be the teflon currency this year. Iron ore prices tanked and the A$ went up. China announced bad data – the A$ went up. The US raised rates – the A$ went up. Wage increases at 40 year lows, growth – what growth – the lowest in years – so what.

Up about 10% from its low in December 2016.

Lee that’s NOT Australian dollar strength but rather US dollar weakness The dollar is down from Dec 16 in many currencies i.e. Euro Turkish Lira Polish Zloty Pound Ruble

Here’s another reason, maybe the reason, productivity hasn’t improved–the denominator is fake. If they used the real number of workers instead of the idiotic multi-millions of bartenders and waitresses they make up out of whole cloth every month, they might actually get productivity growth.

Begin by counting hours worked, not a job is a job, i.e., part time job equals full time job, which is equivalent to saying a pint is a quart.

Surely that data exists. Man hours and a break down of part time versus full time are all important.

Then in addition I would like to see the same analysis done seperately on different major employment sectors. At least break out, Tech, Manufacturing, Energy, Retail and maybe health services….

I doubt the productivity trend is the same in each.

https://www.bls.gov/news.release/pdf/prod2.pdf

Productivity by Industry. BLS has detailed data every quarter on their website.

I saw something like this mentioned in that book Rise of the Robots (2015), about how everything is being automated:

“In the same month that the total number of jobs in the US finally returned to pre-crisis levels, the US government released two reports that offered some perspective on the magnitude and complexity of the challenges we are likely to face in the coming decades. The first, which went almost completely unnoticed, was a brief analysis published by the Bureau of Labor Statistics. The report looked at how the total amount of work performed in the US private sector had changed over the last fifteen years. Rather than simply counting jobs, the BLS delved into the actual number of hours worked.

In 1998, workers in the US business sector put in a total of 194 billion hours of labor. A decade and a half later, in 2013, the value of goods and services produced by American businesses had grown by about $3.5 trillion after adjusting for inflation – a 42 percent increase in output. The total amount of human labor required to accomplish that was…194 billion hours. Shawn Sprague, the BLS economist who prepared the report, noted that “this means that there was ultimately *no growth at all* in the number hours worked over this 15-year period, despite the fact that the US population gained over 40 million people during that time, and despite the fact that there were thousands of new businesses established during that time.””

https://www.bls.gov/opub/btn/volume-3/what-can-labor-productivity-tell-us-about-the-us-economy.htm

(The second report, by the way, was about climate change.)

Thanks for info guys and of course someone has to be counting actual hours.

My point is we keep hearing about jobs numbers, not hours numbers, and as far as I know (not far) a part time job is included in those stats as one job.

A 42% increase in output after inflation with the same number of hours worked. This suggests a surprising large increase in output per manhour in 15 years. I suspect compensation has not increased in proportion to the increased output and hence a greater return to other factors of production. If Corporate America has achieved these kind of numbers I am not sure why there should be a concern about productivity. The problem could be insufficient demand perhaps related to the distribution of income.

I personally know many people with a propensity to consume far greater than one. I also know people who consume well under 50% of their income. The latter typically have much higher incomes. Could it be that the increased portion of income accruing to the higher brackets is suppressing demand and slowing down the velocity of money?This is not suggesting redistribution but it does suggest human capital be directed into a more productive spheres. Trump I believe is on the right track in emphasizing apprenticeships rather than so called higher education.

Right. Four hours per week should be 0.1 job, not 1.0.

Unemployment far higher than stats show because stats lie… Clinton didn’t like high inflation numbers, so he changed calc… if done same way as under Reagan, would be far higher.

Course, central banks like asset inflation, which benefits their class, and hate wage inflation, which they think hurts the rich… problem is, as wealth goes to the rich and middle class becomes poor, the poor can’t buy what the corporations have to sell, so only way for CEO’s to meet earnings/share targets is share buybacks, funded with zero cost borrowed money, weakening the enterprise same as private equity does.

next recession will not be mild. And crashing loan growth says could be soon.

John K of course it is I think everyone who follows Wolfstreet understands that fact

Wolf I have to disagree with you, at least partially.

The vast majority of companies cannot buy their own stocks since they are not public. But still I bet they are holding back new inversions or expansions plans. Why? Contrary on what eco101 might tell you, it is not the price of money which determines whether companies invest or not, what matters is the expectation of potential profits. That is to say, is money out there to be made? No? Why should we invest then?

With stagnating wages and anemic growth this is natural. On the other hand, there are other factors which keep wages down.

First of all, ask Alan Greenspan: indebted workers will not complain becasue they are one paycheck away from homelessness. On top of that add the weakness of labor unions. Finally, the fact that companies are reluctant to hire keeps wages down, because of this potential profits are low and markets shrink, it is a vicious circle.

Of course financial engineering and cheap money also play a role, but it is not the only reason.

Last but not least, and I am affraid that I am becoming so repetitive, the elephant in the room is that the disposable income of US citizens (and other west countries) is being sucked away. Debt overhead, real estate, utilities, monopolies, health care costs, big pharma and privatized (former) public services are sucking the blood out of the economy.

Poeple cannot afford to buy the goods and services they central produce. Markets shrink. Productive activities are not longer profitable. Money is diverted onto speculative activities etc..

Agreed. Karl Marx already explained this wall that capitalism will inevitably run into in 1848 and his subsequent trilogy. Of course, Karl could not foresee the role that technological advances, globalization enabled by it, and legal constructs such as intellectual property would play to keep this economic system going much longer. He also did not foresee monetary policy, without which the party would have been over by mid last century. And, as Karl admitted himself, capitalism did bring us tremendous good, and still is. But the core problem withit that he identified remain. The solution? Certainly not communism. It’s the most important open problem of our time; while it will never be fully solved, given human nature, surely a move to a better approach to ensure the economic wellbeing of humans, while nurturing individual talents and creativity, is inevitable. In the meantime, I am afraid, we will have to get by with evermore perverse monetary policy and stimulation measures to keep the plates spinning.

In his book Francis Fukuyama contends that the Western democracies are as good as it likely to get.

‘The triumph of the West, of the Western idea, is evident first of all in the total exhaustion of viable systematic alternatives to Western liberalism.’

There have been numerous versions of communism beginning with the almost insane Bolshevik variety, that apart from being murderous, was so inept that by the 20’s it brought about Russia’s first real Asiatic type famine.

Then we have Hungarian ‘goulash communism’ that watered it down, but not enough to prevent yet another Moscow- directed ‘fraternal’ invasion by Warsaw Pact forces.

Then Cuba’s, that many love because it annoyed the US, but had very large number of political prisoners.

I realize you are not advocating for Communism, I’m just mentioning Fukuyama.

As a parallel there are lots of areas in mechanics etc. where an attempt to improve a working system is counter-productive.

Fukuyama has been heavily criticized. Your quote is just one of the reasons, clearly the fact that western liberalism is/was pretty much the only system “standing” is no proof at all of its superiority – but it dies suggest that it has been great at demolishing other attempts at economically organizing societies. You may want to google “Washington consensus”, and its modern-day versions.

As for your remark on the futility of attempts to improve something, I hope that is not your general attitude in life!

Nick you are not being honest here. Yes the urss had lots of bad things and I would not live there whenin it existed. But to say that as an economic system it failed is oversimplistic. In least than 15 years russia went from a feudal rural country to second superpower on the earth… amid 2 world wars, a revolution, a civil war and a foreign invasion (just after the octover revolution).

Anyways, I am not defending this system. I would defend an old school version of industrial capitalism, with state intervention, welfare state and capital controls. Like former socialdemocracies in europe and the usa after wwII.

This is not about capitalism vs communism. The name of the game is financial casino style capitalism vs industrial capitalism.

Hiho,

I’m not exactly sure where we disagree. Maybe I’m not reading your comment correctly

:-]

I might have gotten it wrong when reading your article, but it seems to me that you have not considered other factors that also prevent companies from investing in productive activities.

That’s to say, cheap money is surely a distortion and an important cause, yet not the only one. Maybe even not the most important one.

Hiho, sure there are number of reasons why companies don’t invest. The article just mentioned a few that are important for publicly traded companies, and in relationship to monetary policy.

It didn’t mention the many other reasons, including those you mentioned. If my own little company doesn’t invest, it would be for those other reasons. We really don’t disagree on that. Those reasons weren’t mentioned in the article. The article wasn’t trying to give a complete list of reasons why companies don’t invest. It was making a point concerning monetary policy’s impact on corporate investment.

BTW-1, the author of the article was Ben Hunt, not me.

BTW-2, there were a few minor points in the article where he and I are not totally on the same page … but it’s good to read a different point of view.

I see.

I misinterpreted you, or more exactly I made my own (wrong) assumptions (;

Anyways, really interesting piece of writing, as always.

Wolf,

I agree with your column, companies are taking on less risk as you say what’s the point.

The companies who have taken risks to try and raise growth in the last 6-7 years are suffering. In fact a lot of these companies are now taking financial hits due to the risks taken. A lot of these companies have taken on new business at crazy prices where there is hardly any margin to be made just to stuff out competition.

We have a saying in the UK, less is more and I think a lot of businesses out there are realising that at the moment.

The insanely low interest rates serve to keep zombie companies still in business, particularly through low junk bond borrowing costs which don’t truly reflect the risk being undertaken by investors. This situation is leading to low productivity. Under a normal interest rate environment, these companies would go out of business and be taken over by more efficient operators, leading to an overall increases in labor productivity. Not under the current regime though.

Sir. You’ve made some good points, but get completely lost in the inflation argument. As long as you focus narrowly on goobermint statsplan inflation, you will miss your predictions.

Cool, so this is where the real ZH went.

Mr. Hunt talks of his Epsilon Theory and I took the time to visit his website (of the same name) to further explore his theory. I recommend this link that describes the core of his theory.

http://epsilontheory.com/notes/epsilon-theory-manifesto/

It is worth reading in that it does try to explain why the market of the last few years has appeared to defy logic. Which, ironically, it is not… however…

Go see for yourselves.

Thanks to Wolf and John Hunt for this. There’s a great deal of prediction and speculation about the upcoming financial unwinding. But what’s led us to this juncture is different than previous economic reversals, and it stands to reason that the mechanics of the unwinding will be different. The seemingly counter-intuitive predictions of Mr. Hunt make a great deal of sense. I hope I live long enough to see how his prognostications work out, and I hope to live through the mishegas, whatever its shape.

I like the comparison of “free” money from the central banks rising the tides of asset prices. Of course tightening will have ill effects as house-flippers lose money, bubble-building slows, then real people in the construction world like me lose their pathetic jobs, but eventually people working in an area should be able to afford to live there. As a project manager in tile, I’ll never be able to afford a home of my own – housing is an important investment class for the wealthy, not a place for working class shmucks to try and raise families. There’s no retirement plan, company health care, job security, or hope for a better future in the status quo, we need a reset of asset prices. Any tightening is better than none, though I doubt the fed would stomach a drop in any asset prices for the rich so I think physical gold and silver may be the only refuge for the inevitable reset.

The more asset prices rise, the greater the wealth inequality, and the more unbalanced our political system becomes. The only question is who will bring relief to the working class, along with how and when. It’ll happen and it’s best for the powers that be to go with it. They ultimately will – our democratic feedback signals are just strong enough for that, and the same rulers will still reign. Great news if you’re winning, sad tidings if you aren’t.

As far as emerging market stocks…

Trust me though when I say that I’ve learned the hard way in 2008-9 … there is no such thing as decoupling… emerging markets are driven by tidal waves of capital from the “first world.” I invested in Tata motors (TATA) Medco Crown casino (MPEL), and others, and I saw their values more than halve as I was selling covered calls. I didn’t re-buy when they were purchased, I lost a good bit of money, and both ended up way higher than where I started 5 years later. The bottom in those happened not at the August 2008 low, not at the March 2009 bottom, but a few months after as investors still sought better opportunities elsewhere.

If you want to invest in emerging markets, wait for a low in developed markets first … they aren’t a shelter from the storm, they just rise faster with the tide afterwards. Right now I couldnt recommend anything but precious metals and liquid currency until the great reset runs its course.

Enough ramblin for me, goodnight!