Home prices jump to new record amid surging supply and declining real wages.

“The government, opposition, central bank (RBA), prudential regulator (APRA), FIRE sector (finance, insurance, and real estate industries) and their economists predictably deny the existence of a housing bubble. They firmly assert a severe downturn in the residential property market cannot and will not occur” — LF Economics.

So when home prices sagged on a monthly basis in May, the fretting began. But now it is ascribed to a seasonal quirk because in June home prices jumped again, according to CoreLogic:

- In Sydney, home prices rose 12% in June year-over-year to A$880,000, with house prices up 13% and prices of condos (“units,” as they’re unceremoniously called Down Under) up 9%. On a monthly basis, they rose 2.2% from May.

- In Melbourne, home prices surged 14% year-over-year, with house prices up 15%, and condo prices up 1.5% (more on that measly increase in a moment).

- Since January 2009, home prices in Sydney have skyrocketed 111%, and in Melbourne 95%.

- For the five capital cities – Sydney, Melbourne, Brisbane, Adelaide, and Perth – home prices rose nearly 10% in June year-over-year and are up 70% since January 2009.

- Home prices fell 1.7% year-over-year in Perth, which is impacted by the mining bust, and 7% in Darwin.

And Sydney and Melbourne “are seeing rents rising at around 4-5% per annum,” CoreLogic research director Tim Lawless told ABC News.

So how can people afford it all? Through soaring incomes? Hardly.

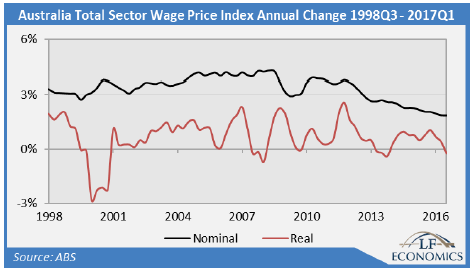

Nominal wages (not adjusted for inflation) are now experiencing record low growth. And real wages (adjusted for inflation) are declining. This chart by LF Economics shows those miserable trends in wage growth rates. Note how real-wage “growth” (red line) has now become a decline:

This real-wage problem arrives at a time of:

Surging housing construction, particularly of condos. CoreLogic’s Tim Lawless pointed out that these “higher supply levels in the unit market appear to be creating a drag on the performance of the unit sector in specific segments.” Hence the measly increase in condo prices in Melbourne.

Rising mortgage rates, just “when household debt levels have never been this high,” Lawless warned. “It suggests households are becoming much more sensitive to these rate rises.”

A crackdown by lenders on investors. Banks are now fretting over risks and record low rental yields in Sydney and Melbourne. Under pressure from regulators, they’ve raised rates for investors and are curtailing interest-only mortgages. “We are likely to see further tightening and repricing around investment lending and interest only lending over the coming months,” Lawless said.

And there have been some wobbles in home prices over the past few months, including the month-over-month decline of 1.1% in May for the five capital cities, now largely brushed off as seasonality, since the 1.7% rise in June.

The price increases of 12% and 14% in Sydney and Melbourne in June are down from the year-over-year surges in March of 19% and 16% respectively.

And homes are sold via auctions, and the auction results in terms of clearance rates have deteriorated. In Sydney and Melbourne, clearances rates in March were still in the high 70-percent to low 80-percent range. In June, clearance rates in Melbourne were barely above 70%, and in Sydney, they dropped into the 60-percent range.

“Although growth conditions have lost momentum across the largest housing markets, we are yet to see any signs of a material downturn,” Lawless said. The key drivers of the slowdown are gradual, he said, and they include “housing affordability – which remains a significant barrier for many prospective buyers.”

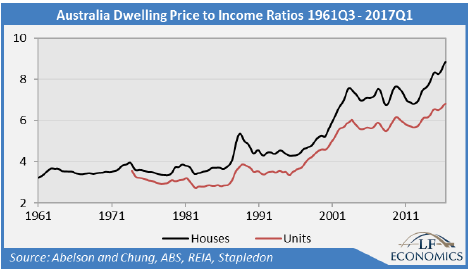

The combination of record low wage growth and surging home prices has created a nightmare in terms of affordability. The home-price-to-income ratio is one aspect of this affordability problem. For the country overall, the P/I ratio has more than doubled over the past 20 years, from 1996 when the median home price was 4 times median income, to Q1 2017 when the median home price hit 9 times income, as LF Economics points out in its new report on housing affordability:

While the P/I ratio for most cities is in the mid- to upper single digits, it has surged to 10x for Melbourne and to 13.7x for Sydney.

Declining mortgage rates have been credited for making everything possible, but now mortgage rates are unlikely to fall further, and there are pressures for mortgage rates to head the other way. The P/I ratio also ignores a number of other factors, such as high transportation costs, as people are pushed further out into the suburbs and commutes lengthen.

Then there’s the problem of down payments, which are increasingly difficult to scrape together for first-time buyers, who are hobbled by low wage increases and high costs of living, such as surging rents.

So what options do first-time buyers have? Their parents. With consequences for their parents. LF Economics:

Many First Home Buyers (FHBs) are dependent on their parents for financial assistance for deposits, mortgage payments, co-buying and using the family home as collateral (guarantees). This fast-tracks ownership for the children of the more affluent regardless of their ability to meet mortgage repayments over the long term. These forms of parental assistance allow some FHBs to enter the market dangerously over-leveraged with minimal equity and savings.

The parents’ financial future is at risk should their children experience difficulties meeting mortgage payments, let alone defaulting and suffering foreclosure.

“Buy property in Sydney and you’re ‘pretty well set for life’”: Government to first-time buyers. Read… Housing Bubble in Sydney Soars to New High, Politicians Promote Scheme to Bitter End

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– The largest reason why houseprices have risen so much is the (large) immigration into Australia. In the last say 10 year some 1 million people have moved to Australia.

Its ironic that you say that because on another website I occasionally comment on its the Antipodes that are constantly pointing the finger at the US when it comes to immigration problems . Perception or Fact … that is the question ( I have no answer for )

– This australian immigration does come with A LOT OF other related problems. Traffic in both Melbourne & Sydney has become a nightmare. It puts more pressure on roads, trains, trams.

– The immigration program is a federal program but the burden of this program has to be carried by local & state governments (Australia is a federation, like we the US). Think: schools, hospitals, infrastructure, etc.

– And currently more & more people (even in government(s)) are “pushing back”.

– Yes, australian GDP is growing as a result of this immigration but the change of per capita GDP is negative. And do combine that with anemic wage growth and the outcome is “not so funny”.

Source(s): MACROBUSINESS

https://www.macrobusiness.com.au/

(A truly excellent website from “Down Under”, run by people who have proven to be very intelligent).

– And currently more & more people (even in government(s)) in Australia are “pushing back” on this (federal) immigration program.

I would say all cash purchases, yes by forengers, and cheap mortgages. Increasing interest rate will collapse this house of cards, thatis why they will never do it.

Willy2, immigration has been almost 4 million in the last 10 years! ‘Official’ figures might say otherwise, but immigration employees state this figure is more accurate.

This not only has meant no recession, but has also changed the dynamic of the country to its detriment as well,as causing major issues with transport, medical and social integration.

All this just to avoid a downturn! How stooopid are we!

In 2015-2016 185 thousand immigrants arrived in Australia, but that would not be a problem, if state and local governments made land available at a reasonable price.

Here in a rural area, the local government charges to subdivide a block of land is $100,000 per block, I imagine it is much higher in Sydney and Melbourne.

The NSW state Government charges $40,490 plus $5.50 for every $100 exceeding $1,000,000 on every sale.

The Government restricts land availability for housing, to push prices up, and collect more tax.

185,000? That is false. Victoria alone took on 146,000 according to abs data and the majority of them settled in Melbourne.

It might explain the 14% year on year rise, or at least partially.

If every race of people moved there except the Chinese, home prices would still be about the same as they were ten years ago in Australia.

I bought a unit in Manly in 1974, it cost me 22 grand, I sold it in 1980 for fifty grand. I bought a block of land near Grafton, in 1978, cost me 7 grand, sold it in 82 for 22 grand.

Real estate has always been like this in Australia.

Sinbad.

No it hasn’t. Check out prices back to the 1870’s. A good recession, built on the back of speculative debt, does tend to smash property prices. This is why our current situation is seen as so dangerous.

At least in the Denver Metro area parents already have ‘ skin ‘ in the game .. along with grand parents – extended family – loan sharks – pawnbrokers – dark money – multiple mortgages on a single property – etc – et al … precisely because the salary rates are not keeping up with the cost of housing ..

And then there’s the additional factor of all those homeowners taking out home equity loans in order to come up with the downpayment on investment properties

So yeah baby … when our Denver bubble bursts … everyone’s gonna feel it … from coast to coast and north to south no doubt … [ because so many currently here come from somewhere else ]

I go through phases. Over the past year i have really enjoyed reading articles on this site.

10 years ago, i would furiously inhale any information coming my way from Jeremy Grantham.

Here is what he said about the Australia property bubble in ……. June 2010.

http://www.theaustralian.com.au/business/housing-market-a-time-bomb-says-investment-legend/news-story/4a2a50abe1324fac50b0e63b661cf9e8

What he meant to say was that the Australian housing market is a small time bomb that will be a much bigger time bomb in seven years from now.

My question :

Does anyone here, per chance, have a fancy chart they could refer me to that shows the correlation between forecasting and guesswork ?

No one knew that central banks , the Fed, the ECB, the BOJ and especially the Bank of China would double down again and again like a gambling addict desperate to recover his losses.

They have now reached the point where even they must call a halt. China has constructed as many empty cities as even it’s bizarre credit creation will allow.

At some point interest rates must regress to the mean, in the case of the Fed this means rates at least 2.5 % above the present rate.

This is why the bears got the timing wrong, they thought the central banks would accept the inevitable recession. Instead like the gambler or the stock speculator, they went ‘all in’ in an attempt to create inflation.

The Fed’s target was 2 %. In any normal economy the huge 4.5 trillion stimulus would have created double digit inflation.

The Fed still hasn’t got to 2% (using its metrics) and now has begun boosting rates and unwinding its 4.5 trillion in bonds. The official line is that things are so rosy it can withdraw the medication.

The reality is the strategy failed and could not be pursued much further without surrendering any shred of credibility, and turning the job of money supply over to politicians as in Argentina, Venezuela, Nigeria, etc. etc.

This still may happen of course. There may be ‘helicopter money’ and hyper- inflation. But it will end with deflation.

and

That’s a great way to describe it . The Fed is currently run by gamblers with no view of long-term consequences.

Bobber!

Do you think the FED and its boom and bust economy (even have a name for it) are accidentally building huge bubbles every decade on cue, all the while making a killing when it collapses, and you think this is an accident??? Really??? How many times will they do they same thing to you before you man up and face the facts that they are cold calculating gangsters….No different than Madoff….Seriously wake up guys this IS the business model……

Central Bank money has inflated assets- stocks, bonds, housing etc, which has compounded annually far in excess of the GDP benchmark of less than 2%.

So if housing is doubling every 4 to 5 years, and your income is doubling every 20 years, then the question is who hits the wall first? Who knows.

But it will be your fault. Central Banks will save their friends and blame you.

Trudat. Wage growth has not been enuf to drive the CPI. They should operate with a different index that tracks assets,etc.

THOSE inflated prices come down with a crash, not the slow unwind of consumer prices.

Price change in the ‘shopper’s basket’, or CPI, is not necessarily inflation, but even the 2% annual rate we’ve been told is bogus anyway.

However, annual ‘inflation rate’ to triple the stock market in 8 years: 14.7% compounded, and to double house prices in 8 years: 9%.

Where did the 4+ trillion go? Speculation, and it can vanish very quickly, viz: 2008. The trouble is that nasty debt that’s left over.

BTW, Q3 or Q-thisorthat is just the old open market operations on steroids albeit with much bad paper instead of good.

It’s important not to overlook one important feature in the Fed’s current tightening…bank profits. Banks rely on SOME kind of spread to do there traditional loan business. Near zero rates don’t allow for a spread…so the banks must go into other, risky areas for their profits.

Don’t forget the Reserve boards are mostly bankers.

They also have to leave some room for stimulus when the next downturn inevitably shows up…

BS. The banks spreads have gotten much wider since 08. I had a line of credit for many years at 2% over prime and then in 09 the banker quoted me at about 3.5% above. I told him no thanks and havent been back to any bank since.

Nick, people have known Exactly that (your 1st sentence) since the creation of the Federal Reserve…..The Book Creature from Jekyll Island by Edward G Griffin, that i read when i was a teenager, will show you that plenty of people have known EXACTLY what they were going to do (CB’s)….Doubling down again and again = they were not willing to take the loss on a bad bet…>Heads they win tails you lose….

Venezuela, argentina, nigeria… and every single european country before the euro. Even in the usa the money supply is in the hands of politicians. Bernake said once that the fed would do whatever congress told it. Too much for fed’s independence.

Always the same bullshit about venezuelas and hyperinflation. As if only government money could be inflationary. I have news for you, banks also create money, and they create almost the entire monetary supply.

Excuse me, are you sure about the FACTS here? Doubt it, no offense. Congress is the tail (since 1913), the FED the dog wagging the tail. Look who has real power!

Assuming that banks create money by extending a loan, then by definition they destroy this money when the loan gets paid off.

If governments create money (“print” money, instead of borrowing it or collecting it via taxes and fees) to pay for goods and services and keep the government functioning, they permanently create this money and dilute the monetary base permanently.

And the price of the main export iron ore has just relapsed again and may be heading below $40.

“This is why the bears got the timing wrong, they thought the central banks would accept the inevitable recession. Instead like the gambler or the stock speculator, they went ‘all in’ in an attempt to create inflation.”

So… global central banks repealed the business cycle ?

“So… global central banks repealed the business cycle ?”

No. But they repealed financial sanity.

No. The business cycle can’t be repealed. That is my point. They thought they’d ‘repealed ‘ it, but it was only temporary. Or to put it another way, instead of settling for the normal business cycle, with a natural recession every few years, they’ve bottled them up to the point where a huge deflation looks inevitable.

When Allan Greenspan began this policy of cutting rates at the merest hint of a recession, and was basking in the adulation of (some) analysts, it was actually announced that he had ‘tamed the business cycle.’

This was the beginning of the disaster. When the long overdue crash arrived in 2007-08, there was almost no room left to cut rates, so the FED had to inject 4.5 trillion, putting this on its own balance sheet.

The question is whether these five or so delayed recessions will add up to a severe recession or something worse.

Or we could move from opium to heroin and do helicopter money.

Yup, they could create as many US Dollars as they want to and it won’t make a difference for inflation. They could take the Fed funds rate back to 0%, buy up the entire market for US Treasurys and set the rate at 0%. Real estate and stock prices could inflate to infinity, but the wealth effect would only be felt by the top few percentiles of the population with a large portfolio and multiple properties (you still have to live somewhere). These people already have more than they can spend and will want to reinvest the proceeds, not spend and create inflation. Meanwhile, the lower 95% (who would actually spend and create inflation) experience an anti-wealth effect as the prices of assets they don’t yet own quickly rise away from affordable levels.

This is why there’s no inflation…people who would spend an additional few hundred dollars a month if they had it, aren’t getting any benefit from the Fed’s policies. Those who do don’t spend, they speculate on real estate and tech stocks.

Hear, hear!

I am from Ireland and remember all to well when economic commentators both home and abroad began to warn about Irish property overheating in 1997.

The air finally began to come out of the much inflated bubble 10 years later.

Sure it can be risky, but bubbles can be terrific places to make a few bob.

And did it ever ‘come out’… it took the Irish banks down with it.

It might have been worse, like if Ireland hadn’t been part of the EU, which gave it a huge loan.

Wow I can’t let that one go. The EU forced Ireland’s government (people) to eat the private banks loss, they socialized it. That “loan” was a huge screw job to the Irish people, courtesy of the EU

Oh agree at least in part. As Michael Lewis points out in ‘Boomerang’ there was no need to bail out the bondholders.

The depositors sure.

One big bond holder had tried to sell his bonds back to the bank for 50%. No dice. Next day he wakes up and reads he’s been made whole!

Irish lore has it that Irish gov guarantee of EU loan was faxed from a pub.

But.. but.. there are the terms of the loan and then there is getting the loan at all. With it suddenly becoming obvious that the country’s RE was only worth at best half of appraisal and the banks clearly insolvent it was either the ECB or the IMF.

If you don’t want to deal with lenders of last resort, don’t go broke.

Lewis describes the root of the problem: ‘The Irish were going to get rich buying houses from each other’

it was the ECB who blackmailed the country into bailing out the (junior) EU creditors. Those 30 bn € were sent right back to EU banks. And the Irish taxpayers had suddenly xx % higher debt to GDP.

The same happened to Greece with 200 bn € of that 240 bn “rescue parcel” years ago. Who got bailed out? A: NOT the Greek borrowers & taxpayers, but the EU creditors!!

If there is NO loan, with banks insolvent, Ireland goes into a depression.

As it has turned out with this nasty loan, the place turned the corner pretty fast.

The EU loan terms are not that bad.

The one to Greece (or one of them) is 3 % with no payments for 10 years.

” but.. there are the terms of the loan and then there is getting the loan at all. With it suddenly becoming obvious that the country’s RE was only worth at best half of appraisal and the banks clearly insolvent it was either the ECB or the IMF. ”

I was not commenting on the crisis or the bailout.

I was bringing attention to the start and end of the 10 year bubble.

Here is one way i look back at the celtic tiger bubble :

In 1997 the median house price in Dublin had bubbled to 100,000 euro.

In 2007 the median house price in Dublin continued bubbling all the way up to 350,000 euro.

I do not disagree with you when you say that house prices were worth half of the peak value at best.

I think my point is twofold, to wit :

(1) Bubbles often test the credulity and patience of highly logical and analytical people.

(2) It can be a wonderful thing for an investor to catch a bubble early.

Lastly, i followed the Irish financial crisis very closely for several years. I had some family and friends in Dublin impacted by it. Even the worst hit by it have been made whole at this point. As for the future. Who knows ?

Wolf, another great article.

As an American living Downunder, I am envious of the quick money being made all around me. Today, Real estate agents with their suits and leased Audis, are heros.

Talking about leverage, and generations. I will tell you about some leveraged millenials here in Australia. I have a mate, who works for one of the big 4 banks here, and rightfully has a mathematician to do the job. 26 years ago, his father purchased a property in Melbourne for $400k, now they estimate it may be pushing $4 million.

Australia just surpassed the Holland record for longest economic growth period without a recession……a generation of millenials without an knowledge of a recession. Without any experience of….

What does the next generation do after their parents generation get 10x return from Housing? Leverage the hell out of themselves and their future! My mate, prior to recent cramp downs on has a $2.5 million dollar of interest only loans (units in Brisbane) and another $500k in stocks in a margin account.

30 years old and with over $3 million in loans…..sounds a little too amazing. (His wife is a doctor, and the banks loaned them both more).

-The housing market will eventually crash, and the stock market will fall in tandem.

Yes, highly leveraged and motivated to gamble the future. Having sold my house in Denver prior to the GFC, and watch as other lives were torn apart by the downturn; I feel like Chicken Little saying the sky is falling, while it’s beautiful weather Downunder

JJ Great comment!!

I just had a talk with my 33 year old son who is making firm commitments to sell his property (near me) in order to buy a place in town, a 45 minute drive away. He was informing me about the size of mortgage available to him now that his girlfriend/partner has started work as a nurse.

It was like there could be no downside in possibilities. I felt it was my duty to inform him that this was a growing bubble (Vancouver Island) and to be modest enough with expectations to be able to afford the mortgage payment if there was only one available salary to count on. I can only hope some of the unwanted advice stuck…if just for a little bit. :-)

I didn’t add that the ‘Bank of Dad’ has closed for any future ‘loans’. I helped both my kids with aa downpayment for their first homes many years ago. But. That. Is. It. Now, they will have to figure things out themselves. I only hope he doesn’t learn the hard way.

I was wondering when the next article would appear on the magical world of the Australian housing boom!!

Yes, house prices have gone up. In some places near the Melbourne CBD they have soared.

That property your friend’s father bought way back when was probably in either Brighton or most likely Toorak which have both seen prices soar. Prices that go up by $1 million a year in those areas distort the entire market.

Sydney prices are ridiculous. FYI the median price in Sydney is now over A$1 million and not A$880,000.

Melbourne prices in and near the CBD and those areas where the Chinese have bought have gone way up as well and are ridiculous as well.

Even areas like Oakleigh where 20 years ago you could have bought the entire street for A$1 million are now in the A$1 million level.

Further out in the ‘sticks’ prices are more reasonable by those standards and if one looked at those places then wage to house prices would be half or less of the figures quoted.

As far as auction clearance rates they ALWAYS fall in winter. It is seasonal, but since it was brought up, the clearance rate so far this winter is higher in Melbourne than it was last year.

In any event, the 2.2% increase in the population of Melbourne last year (146,000 people) is the real reason for the increase in demand for housing. With immigrants making up much of that increase, the normal factors regarding price and income can be ignored when they pay cash.

Mortgage rates have only been increasing for interest only loans. P & I loans have fallen over the last year. Not as much as the RBA interest rate decreases, but they have fallen.

In any event, one day prices will fall and as I have posted before it will be either be a result of

1. Banks and government action; or

2. A decrease in demand as a result of fall in immigration

And as usual today, the wonderful, most liveable city in the world, Melbourne, had another meltdown on the trains with 5 of the lines having delays of up to 20 minutes………

A wonderful winter day here too with a nice warm 7 degrees C with a brisk wind making the place oh so wonderful. Yes, we have daffodils blooming in the middle of winter!

No, the prices are ridiculous because of the stuff that JJ refereed to. A 30 years old with 3 million dollars in debt. I can’t even imagine having 3 million dollar debt unless I have 6 million in the bank account.

These are all gamblers. I remember when I was a kid, I would here this man or that man lost a lot of money and had hanged himself leaving his family without anyone to care about. 3 million debt at 30? I can imagine 10s of thousands committing suicide in Australia when this bubble bursts.

“According to analysis from UBS’ Australian economics team, comprising of George Tharenou, Scott Haslem and Jim Xu, debt-to-GDP hit 254% in Q1, taking the increase in the ratio since 2010 to 50%.” That was in 2016, now I imagine the ratio is well above 265%.

And where do you think those extra 146,000 people that came to Melbourne are living?

In houses and units.

Some of them were bought and paid for by the few idiots that have excessive debt.

Most were not.

Yeah, the bubble was going to burst 20 years ago, 18 years ago, 15 years ago, 12 years ago, 10 years ago (Well it actually went down during the GFC, but no pop), and every year since then.

It’ll burst when there are more houses than people need to live in which will come about as i posted before.

debt-to-GDP is over 260%. When do you think it is gonna blow? When debt-to-GDP is 500%? Feds are tightening and little banks like Australia’s central bank will have no choice, but to follow whether they like it or not.

As I said, once this bubble bursts, I expect to see news of dozens of people hanging themselves daily given that their debts are of such proportion that there is no way they can recover from it.

Crooked bankers, politicians, real estate people have no problem with 10s of thousands of people committing suicide as long as they make their cut.

From markets live 1:04 pm post today:

http://www.theage.com.au/business/markets-live/markets-live-oil-rally-in-reverse-20170705-gx5mcu.html

“Soaring home prices in Australia’s biggest cities are driven by strong demand and a lack of supply, rather than indicating a “bubble,” according to HSBC’s local chief cconomist Paul Bloxham.”

(Note: Put up on the Age AFTER my comment to you regarding demand.)

The RBA won’t follow the Fed until the Australian economy can handle the increased rates.

In fact with the increase in rates for interest only loans, the commercial banks have already tightened for the RBA. They are doing the RBA’s job

I doubt that many of the 100,000 immigrants that came to Melbourne over the last year had the cash to buy outright. They are putting downward pressure on wages as they are willing to be paid less than the locals…Hardly an indication that they are swimming in cash. However they do put pressure on rents which have increased whilst vacancy rates have dropped. Of course mainland Chinese do have money but they tend to focus on particular suburbs in the east of Melbourne. Apparently the Chinese influence should be slowing down due to stricter capital controls.

Our banking watchdog has made banks decrease the proportion of interest only loans to decrease risk so to do this the banks are increase rates out of cycle with the reserve bank. Hopefully this will decrease demand from investors/speculators however in return the Victorian and NSW state governments have introduced stamp duty concessions for first homebuyers to keep the market prompted up. Apparently a concession of $10,000 in stamp duty allows a first home buyer to leverage an extra $100k. Hence last weekend properties under $600k were highly contested by first home buyers in Melbourne.

Thus for the time being house prices are going nowhere without a black swan. I guess it all depends on access to credit. Whilst it’s available people here are going to gear up to their eyeballs. It’s despairing for someone in my situation in my 30s, every year since I started working in 2007 I have not been able to save more than the house price increase. Except for 09 where it dropped. I thought it would continue to drop like Ireland and the USA but the government injected free cash into first home buyers and propped the market. In hindsight I should have bit the bullet but didn’t know what was going to happen.

It will pop one day but instead of a sharp crash early we a grinding towards an economic nightmare as our economy is completely leveraged into housing. 50% or more of our banks loan books are mortgages when it busts we turn into a Greece, Venezuela or Argentina…A banana republic.

We are now the B & E ‘capital’ of Oz too:

http://www.theage.com.au/victoria/victims-of-crime-melbourne-becomes-more-violent-sydney-less-so-20170706-gx651y.html

May I ask why your posts most of the times sound like an advertisement?

– In Brisbane (Queensland) the prospects are getting worse.

– Rents are feeling a downward pressure in Brisbane. Landlords are offering incentives to get tenants.

http://www.abc.net.au/news/2017-05-27/freebies-with-brisbane-rental-properties-amid-apartment-glut/8555420

– The amount of building permits/approvals peaked a few months ago and are now dropping in Brisbane. This will result in shrinking demand for construction workers and decreased employment in the (near) future.

– In Australia a private person can buy a house/apartment and become an “investor”. Then the costs are tax deductable if one loses money on that investment property/real estate. (e.g. an apartment). They are effectively betting on rising real estate/property prices.

– But now with falling rents and rising interest rates these “investors” (think: Brisbane Queensland) will get hurt in the (near) future. OMG & Ouch.

regarding interest rates , RBA kept rates unchanged .

http://www.cnbc.com/2017/07/03/reserve-bank-of-australia-policy-decision-on-interest-rates.html

your dollar took a hit.

– Yes & No. The RBA didn’t change interest rates but australian commercial banks did hike rates.

– The USD/AUD remained (more or less) flat since say early 2016.

http://www.smh.com.au/business/the-economy/demographic-tsunami-will-keep-sydney-melbourne-property-prices-high-20170629-gx1onj.html

If this is true, then the bubble has a way to run.

While everybody is focused on Oz, I just took a look at Japanese bond prices……………………

Rates have been slowly increasing with the 30 year and 20 year now trading under par.

The 10 year is almost at par and the negative yields on the 5 year and 2 year instruments are ‘up’……….

Looks like some big changes are coming to Japan shortly in the bond arena.

The Australian government’s objective is to keep housing rising at all costs.

So why is there all this doubt on this website? They have many tools.

The government can lower the down payment standards to 1% or just lower lending standards to the point where anyone can buy a home. Rates will drop as soon as the housing market swoons, because the government so wills it. Not sure why the people here think there’s a ‘housing police’ that regulate prices.

The Chinese show no fear with regard to high prices, they know that there are billion people trying to go down under. We’ll see direct offers to Chinese before its all over. This is the ‘ace in the hole’ that makes real estate a no brainer.

The global population is exploding and they need someplace nice to go. Since 1900 we’ve gone from about 1.7 billion to 7.4 billion in 2015.

https://ourworldindata.org/world-population-growth/

The population is increasing but the jobs are decreasing

It’d be interesting to see how long people can afford these prices and play along

The music would stop for sure

Everytime people think this time is different but we can never escape from boom and bust cycle

“The Australian government’s objective is to keep housing rising at all costs.”

There are definite limits. Consumers need to have the capacity to make payments. Banks need to be able to hedge their risks and remain profitable.

We are at the point of saturation and capitulation. The unwind will be brutal.

The so called two consecutive periods of negative growth as a means to define a recession is political spin. We are already in a recession, it’s just that it’s creeping up on us Aussies a little bit at a time, day by day. No wage growth, energy costs sky-rocketing and house hold debt out of control. When the economy goes down the toilet it will be a nightmare to say the least. Particularly as so many young people don’t remember when mortgage rates were 18% and once the gravy train has run out of puff, armageddon.

There’s no way these price increases in Australia will stop anytime soon – at least not for another 2-3 years I’d suggest.

The bubble will be popped by politics, global politics.

No, the bubble will pop in accordance to the laws of reality. These gamblers are living in the dream world. Jobs decreasing, wages decreasing, the Chinese economy can’t build anymore ghost cities. All these will bring it crashing down to the reality.

Have you seen one of these people who keep borrowing and keep partying every weekend as if there is nothing wrong? So many of them these days. I have a neighbor who is $70K in the hole for student loan, and is working as a cashier; yet she is partying every weekend, and is driving a brand new BMW. These people are no an asset; they can never pay any of the money they are borrowing back; they are total morons. You think this is just gonna keep going?

Amazing what manipulated low interest rates can do to asset prices. The markets are rigged to benefit the rich and shaft the rest. Whatever happened to free market determination of interest rates?

– Rates are “manipulated” by a force called “Mr. Market” and the FED follows the 3 month T-bill rate.

Willy2, for the umpteenth time: It’s the other way around. The 3-month T-bill follows the Fed’s forward guidance as given in speeches by the Fed heads, its post-meeting press conferences, its minutes of the meetings, and to what extent markets believe this. By about a week or two before the Fed actually hikes its target range for the fed funds rate, there is rarely room for surprise. Getting the markets to anticipate the next rate moves and bake that into bond prices is a key aspect of what the Fed does. Others call it market manipulation, but that’s how the Fed does it. And it does it loudly and clearly. You’re one of a handful of people who are confused by cause and effect in this instance and just remain stuck there.

(How many more times do I have to tell you this?)

(At least keep this wrong idea to yourself. After having tried to spread this nonsense here for I can’t remember how many times, it’s enough!!!)

Wolf: I think Willy2 follows the following doctrine :)

“If you tell a lie big enough and keep repeating it, people will eventually come to believe it. …”

Australia is an asian country now. No big surprise. They still try to prevent it anyway. Too late to stem the tide.

Interesting about the auctions. I stood by and watched an auction here in the states. I was really puzzled. I got strange looks from the “participants”. I stored that experience away and now I realize that the auctions are akin to the Magician’s Hat. They can use the funny money to pay inflated prices for homes since no one else can afford the price plus the ~1% property taxes. Then they put them for rent (also inflated artificially). Voila! You can keep kicking the can down the road. A pivotal trick in keeping home prices artificially high.

Wolf,

A ‘free’ house in Japan:

http://www3.city.hakui.ishikawa.jp/akiya/2016/04/21/049/

Just pay the gift tax and registration and it is all yours!!!

Saturday’s auction results in Melbourne:

“There hasn’t been a significant fall in auction clearance rates so far this winter. On Saturday, the Domain Group reported a clearance rate of 72.1 per cent from 490 reported auctions. This was slightly lower than the previous weekend’s 73.5 per cent clearance rate and the 75.7 per cent recorded over the same weekend last year.

One in six of the auction properties reported sold on the weekend were sold before the scheduled auction. The fact that a high proportion of buyers are making pre-auction offers and the clearance rate is remaining above 70 per cent, indicates that the market is firmly favouring sellers.”

Other ‘interesting’ data from the article:

“The price equates to just under $12,000 a square metre, reflecting Albert Park’s standing as one of the dearest areas in which to buy land in Melbourne.’

So that works out to about 1 million yen per square metre in Japanese yen………..

Out where I live the land in the village area gets about A$1000 a square metre for the ‘best’ land with a knockdown house.

Ginza’s most expensive property this past year was priced at 40 million per square metre (Yeah mixing residential and commercial values, but it is interesting to see how they compare.)

http://www.japantimes.co.jp/news/2017/07/03/business/economy-business/japans-property-prices-rise-second-year-gap-cities-rural-areas-widen/

https://www.domain.com.au/news/melbournes-inner-suburbs-still-recording-auction-clearance-rates-above-80-per-cent-20170709-gx7opv/