Having surged for years, quant hedge funds dominate stock trading.

Quant-focused hedge funds – they specialize in algorithmic rather than human trading – gained $4.6 billion of net new assets in the first quarter, and now hold $932 billion, or about 30% to the $3.1 trillion in total hedge-fund assets. At the same time, investors yanked $5.5 billion out of non-quant hedge funds. This comes on top of last year when investors had yanked $83 billion out of non-quant hedge funds and had poured $13 billion into quant funds.

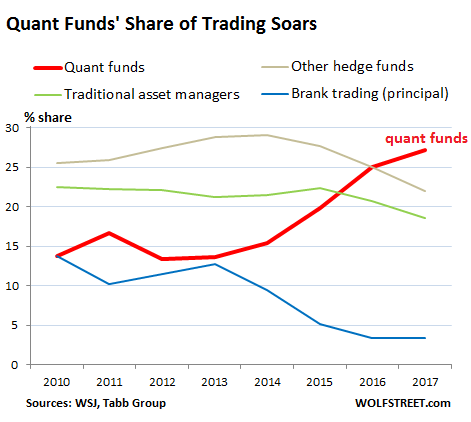

Trading by quant funds has soared to 27.1% of all stock market trading, up from 13.6% in 2013, according to a series of reports by the Wall Street Journal. These trades can last from minutes to months. Quant funds are different from algo-driven high-frequency trading (HFT) where trades last only milliseconds. And they’re different from ETFs which also use algorithms.

This chart shows the soaring share of trading by quant funds (red line), compared to the largest other types of investors – traditional asset managers, non-quant hedge funds, and bank proprietary trading. Another 25% to 27% of the trading is done by other investor types, including individual investors, not shown in this chart:

In addition, there are the fast growing “smart-beta” ETFs and mutual funds for mom-and-pop investors. They too are a form of quant funds focused on algorithmic trading. Assets in these funds in the US reached $760 billion so far in 2017, up from $108 billion in 2008, and up from $208 billion in 2011. In recent years, automated trading became available even for retail traders.

Algorithmic trading has been around for a long time – The WSJ refers to its 1974 article that “featured quant pioneer Ed Thorp” – but it’s just taking an ever larger share of the trading activity.

For example, Steven Cohen’s $12-billion hedge fund, Point 72 Asset Management, is moving about half of its portfolio managers to a “man plus machine” approach. The Wall Street Journal:

Teams that use old-school research methods are working alongside data scientists. Financial analysts are taking evening classes to learn data-science basics. Point72 is plowing tens of millions of dollars into a group that analyzes reams of data, including credit- card receipts and foot traffic captured by apps on smartphones. The results are passed on to traders at the Stamford, Conn., investment firm.

Point72 lost money in most of its traditional trading strategies last year, say people familiar with the results. The firm’s quant investors made about $500 million.

Quant funds follow all kinds of esoteric data, trying to gain some kind of advantage:

Hedge funds with quant-focused strategies have been poring over private Chinese and Russian consumer surveys, illicit pharmaceutical sales on the dark web—a network of websites used by hackers and others to anonymously share information—and hotel bookings by U.S. travelers, according to Quandl Inc., a platform for such data.

Today’s algorithms can make continuous predictions based on analysis of past and present data while hundreds of real-time inputs bombard the computers with various signals.

Some investment firms are pushing into machine learning, which allows computers to analyze data and come up with their own predictive algorithms. Those machines no longer rely on humans to write the formulas.

Not that is leads to huge returns. Quant funds earned about 5.1% per year on average over the past five years. While this beats average hedge fund returns of 4.3%, it lags far behind the 15% average annual total return (including dividends) of the S&P 500 over the same period.

But what happens to the markets when a few machines rather than millions of humans make more and more trading decisions? When too many of them use the same inputs and formulas by the same PhDs from the same schools?

“Will the market fall in lockstep, pulling every asset lower?” the Journal asks. These funds could give “a false sense of security about the market’s stability.” For example:

In 2007, what became known as the “quant meltdown” was caused largely by the similarity of strategies among quants, who simultaneously rushed to sell, causing losses at other firms and more selling.

Mathematician William Byers, who wrote the 2010 book “How Mathematicians Think,” warns that rendering the world in numbers can give investors a deceptive belief that predictions churned out of computers are more reliable than they truly are. The more investors flock to complicated algorithmic models, the more likely it is some algorithms will be similar to one another, possibly fueling larger market disruptions, some analysts say.

It seems algos are programmed with a bias to buy. Individual stocks have risen to ludicrous levels that leave rational humans scratching their heads. But since everything always goes up, and even small dips are big buying opportunities for these algos, machine learning teaches algos precisely that, and it becomes a self-propagating machine, until something trips a limit somewhere.

And suddenly things happen that weren’t part of the scenario. To deal with it, the machines, perhaps in lockstep, revert to a part of the code that says “sell.” Plunging markets trigger more sell signals, and so on. And in this paroxysm of selling by the machines, there might not be enough human traders left – they’ve been sent to pasture years ago – to jump in and buy. Sure, it cannot happen, we’re told. Until it does happen.

And are they all jumping into the same handful of stocks? “The new 1%” of these stocks gained $260 billion since March 1, while the remaining 99% lost $260 billion. Read… “The Great Narrowing” of the S&P 500

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Ah, the wonders of technology. Why rage against the machine ? / S

The Knight Capital programming fiasco was in 2012. Some claim that the half billion dollar loss in 30 minutes was due to one line of code. It was really due to too much confidence in digital systems. It’s not magic, it is computer code written by people, and the truth is not every scenario can be tested because it has to be foreseen by a human.

Steve Cohen’s name is enough to make me think the new “system” is a cover for the usual insiders game.

Yes I think you’re absolutely right about it being a cover story.

Also: “Those machines no longer rely on humans to write the formulas”

But who wrote the code that instructs the machines to write the forumulas? It’s just one big illusion IMO.

Methinks this is the key phrase to be paying attention to in the article ;

” It seems algos are programmed with a bias to buy ”

Think about that for a moment within the context of an ever escalating market with no substance or foundation behind it … and perhaps in one simple sentence Wolf has hit upon the answer to all our collective confusion ;

0’s and 1’s floating and trading merrily along in the cloud programmed by wonks who wouldn’t know the virtual from the real if their lives depended on it

@ Wolf .. this one demands serious investigation with an in depth article to follow . Cause brother .. I do believe you nailed it by intent , inference ..or by happy coincidence

That “bias to buy” is everywhere … from the way short sellers are treated legally and otherwise, to the whole philosophy of mutual funds and the entire media circus. So any algo would reflect that bias.

the disconcerting aspect of this narrative is that this new breed of hedge funds might mine your personal data for patterns and trends. A local supermarket has tried diligently to have me register for their discount card . To obtain your info they have you swipe your driver’s license . Can you imagine all the info they can obtain from that ! I have the check out clerk use the “house card” to obtain my discounts.

This supermarket then could sell my purchase details to a “hedgie”. The amount of bananas i buy will make the quants

go long bananas and increase my price . OK maybe an exaggeration but you know where i coming from .

Steve Cohen was an outside Sacrificial lamb and the SEC still ultimately lost as he Neve severed a day.

Most of the convictions and rulings again st him were overturned on appeals.

Cohen is still around. And P Bharara NO LONGER HAS A JOB.

Most of his insider convictions, have been overturned on appeal.

The basis he used to prosecute most of them, has been ruled on Appeal as FLAWED.

Cohen was picked on as he was very good, very successful, and not one of the pack.

I’m not sure what your point is? What a bizarre post.

Cohen almost certainly participated in insider trading. I don’t think anyone in the industry really doubts that.

He was just smart enough to separate himself from any actual trading. He was very good, very successful at not incriminating himself. OK…?

“He was just smart enough to separate himself from any actual trading. He was very good, very successful at not incriminating himself. OK…?”

NO.

Cohen didn’t do anything anybody else didn’t.

in fact he was nowhere near as bad as many other.

HE dint have major entities sitting behind him, so was the victim of a witch hunt and extorted from. BY an overly aggressive prosecutor.

He settled as it was cheaper and safer in the environment of the time.

Note they the court did not as the overly aggressive prosecutor wanted. ban Cohen from trading. Permanently.

It simply banned him from taking public money for a period of time.

This indicate show thin the Persecutors case was.

The SAC with hunt, is an excellent example of, selective, soft target, persecution.

Steve Cohen is and insider trader, and Jamie diomon, along with the heads of every trading bank, and hedge fund, in New York aren’t. BS.

Steve Cohen was a small soft target, in a massive swamp.

Great way to blame Mikey the algo to sidestep legal liability

“the machines, perhaps in lockstep, revert to a part of the code that says “sell.” ”

I doubt that the various codes are written in such simplified manner. They are more likely to be written in a way that induces selling and then takes advantage of the buying opportunity.

You neglected to ask why so much money is in these non-human strategies. Does anyone see the big picture here?

When ‘liquidity’ is nearly unlimited, the stock of “money” and credit has expanded relentlessly for years (so much so that the definition of ‘money’ is itself in question) and when so many are desperate for yield, what happens?

More and more “investors” are chasing dramatically less actual “growth”, thus less bona-fide investment, while driving nominal returns lower and lower, decade by decade. Real returns? Non-existent.

Desperation. In the total absence of meaningful market-determined scope for actual “investment”, money is now cannibalizing itself. We’re all speculators now, reduced to trying to front-run or outrun other speculators.

This is not even genuine insightful speculation. It’s BETTING.

You wrote: “You neglected to ask why so much money is in these non-human strategies.”

Why is there so much money in hedge funds in general, when they’re underperforming so badly? I cannot figure this out either.

Why do pension funds waste so much money on hedge funds? There is no logical reason. High fees and lousy performance … and yet, they are all are neck-deep invested in hedge funds. This is a mystery to me.

People that manage pension funds don’t make anything close to what a Wall St. money manager makes. It is very easy for them to take that free trip to the super bowl, a vacation on a private yacht, or accept an invitation to a ski trip in the Swiss Alps. In the end it’s not their money and they don’t have to stick around to see the results.

Indeed, there have been a number of scandals of this type that came out.

Why? The answer is easy to understand, and infuriating when you do.

Put yourself in the place of someone with excess cash. It has to go somewhere and few understand basic personal finance. Experts are available to handle investing. Most people have no idea that today’s expert advisers are the modern equivalent of old time insurance salesmen.

The people who handle investments have to do something with the $$$ collected. It’s all OPM in the final analysis, but a percentage of it goes to the firm and it pays the bills. The rest goes into investments.

And what’s there to invest in? This is the crux of the problem.

Ma and Pa depend on main street advisers who only have what’s available to put money into. Rates and asset prices are now under full control of the central bank rate and QE policies. Those who flip paper leveraged in huge amounts are the clients of the central banks. The rest of us get what’s left, which is highly inflated in price today and this price is subject to artificial central bank provided liquidity.

Thus, bad monetary policy is the root cause and the solution would cause a crash in asset prices, temporarily. Also, the eurozone would fail if euro-rates normalized. Thus, their public finance fraud will not end until it can’t go on any longer.

Bad returns are all there is. Cash has to go somewhere. Central banks are the root cause of this problem and they won’t admit a problem even exists.

“Why is there so much money in hedge funds in general, when they’re underperforming so badly? I cannot figure this out either. Its maybe a better place than a bank and it might make some money.”

Once you get past the FDIC limit in all the majors where your money devalues any way, you run into where to put it Issues.

Are they underperforming that badly, compared to a lot of other places.

Most Hedgefunds make money, BEFORE expenses.

“Why is there so much money in hedge funds in general, when they’re underperforming so badly? I cannot figure this out either. ”

Many are used to diversify, particularly with valuations as high as they are. Given ultra-low interest rates, fixed income– the traditional diversifier– is relatively unattractive to many (I still maintain long treasuries are where it’s at right now). That basically leaves hedge funds, and non-liquid alternatives like private equity/debt, private real estate, VC, etc., if you qualify.

“Why do pension funds waste so much money on hedge funds… this is a mystery to me.”

Poor governance is at the root of all pension problems in the US, public and private. Borderline criminal negligence.

Piece in the Globe and Mail today conclusively demonstrating that index funds outperform actively managed funds.

And what about no fund? Lots of Canadians have Canadian banks in a mutual fund, but you can buy Bank of Montreal shares from BMO online with no fee. Current dividend over 4%.

I’m not sure about the Depression years but BMO (and Royal etc.) haven’t missed a dividend in a VERY long time.

No large market decline will occur unless there are large numbers of assets for sale from a multitude of sellers in order to raise cash that MUST be raised. Some sellers will be frightened. Some will be on the bad end of a margin call. Others will be hamstrung and desperate for cash at any loss. The latter will set the slope of the decline in prices.

In other words, no sell off occurs unless there are sellers who need to sell to raise whatever they can for inelastic reasons.

With interest rates as low as they are and ‘knowledgeable pundits’ claiming rates can’t rise in this economy without shattering it (note to pundits: yes they can go up and overall the economy will improve from it), the pundits are calling it correctly.

The ECB and other central banks intend to flood the world with free money forever. The Fed as been captured by those who need free money and will not raise rates appreciably or fast unless they have to, and even then, slower than molasses flows.

Assets will retain their artificially high prices for a long time. Bulllard will come out every time they drop a couple of percent and jerk them higher.

Falling asset prices are fun to write about. Not going to happen without the end of central bank manipulations. Bogus, fake economic theories support them, too.

If you or someone can figure out how and where a liquidity shortage can occur and, assuming it’s large, THEN you will know when and how a sell off of significance will occur. Without a shortage of liquidity, no selloff is possible.

What could make people want to hold onto their cash at all costs AND limit the flows of funds into flipping paper assets? When you figure that out, you will know when prices will begin to fall.

To put is most simply: Asset prices are a function of liquidity and have a direct relationship. High liquidity = high prices. Low liquidity = low prices. Everything else is bogus theory.

cdr,

Low liquidity will happen abruptly when everyone wants their money back all at the same time.

You can’t figure out when people will suddenly want to go into cash- that is psychology not math. All we know is it will be sudden. And when they all make their move in the same direction, like a school of minnows, or starlings or lemmings, there will most certainly be a shortage of liquidity.

Maybe someone with precise stats can fill in but banks typically have less than 10 cents available for every dollar of deposits.

And of all the assets out there- these have the most behind them.

In a real downturn, supposedly liquid assets like stocks will demonstrate the perils of high speed trading.

‘Stop-loss’ orders will turn into fantasies as the market gaps past them. In the Sino- Forest debacle (Toronto) one guy had a stop-loss order at 16 and change. Then there was a highly adverse development, referral to OSC or something and the run on the stock began. The guy got out at 6 and change, which is better than the nothing he’d got if he’d hung on.

The broker is not going to go broke to make a market.

Again if someone knows better, fine, but I suspect there is only a few dollars per hundred available for every potential demand for cash.

“You can’t figure out when people will suddenly want to go into cash- that is psychology not math.”

Its her/mass Psychology and Behaviour. One of the most basic point is still, Fight or Flight.

You can figure what the Herd will do, in various given situations. As yet it is still an infant area, as it grows from Group think Etc.

Today you need to figure when the Algos will see that, then what happens when the sell passes their Repurchase/Buy in point a high speed.

As there aren to enough human traders left to be of relevance which is a real danger when the Market moves outside the price bands Etc the Algos are programmed for.

Possibly why entities like point 72 are going to supervised Algo trading.

A lot of others won’t. But Cohen will. Have traders on the floor who know what to do.

As Cohen is not only a Jew, but a very wise, experienced, and clear one. He lives to fight another day, every hurdle so far.

Ein Jude! Mein Gott in Himmel!

Seriously Wolf, how you let this anti-Jewish drivel appear on your site…

Are you talking about d’s Cohen comment? I didn’t read it as “anti-Jewish.” I read it as pro-Jewish. d has made many pro-Jewish comments before (some of which I have blocked for the very reason I should have blocked this one because there is always someone that reads it differently). If I remember right, from what he is saying, he is of Jewish descent and had relatives that disappeared in the concentration camps.

d can you weigh in?

“Falling asset prices are fun to write about. Not going to happen without the end of central bank manipulations. Bogus, fake economic theories support them, too.”

Let’s see… we had a 20+% sell-off in 2011. Plus 15% sell-offs in 2015 and 2016.

Then there’s Japan, who have arguably been the worst for Central Bank intervention… sold off 18% between Summer 2015 – early 2016.

Liquidity isn’t an issue, until it is. The power of Central Banks to prop up markets is -way- overstated and overrated.

Agree. What would really set the cat on the pigeons would be be Germany leaving the euro and and going back to the DM.

Instantly the US$ turns into a POS and the FED has to raise rates to the average of the last century.

Mr Kelly, you said…

“Ein Jude! Mein Gott in Himmel! Seriously Wolf, how you let this anti-Jewish drivel appear on your site…”

How is the comment to which you replied Anti Jewish or Israeli?

I wrote: “A lot of others won’t. But Cohen will. Have traders on the floor who know what to do. As Cohen is not only a Jew, but a very wise, experienced, and clear one. He lives to fight another day, every hurdle so far.”

It is quiet complementary to Cohen, and Jews.

The rest of humanity has been trying to wipe out Jew’s for over 2000 years. The accidental result, has been something others sought to emulate. 2000 Years or racial purity, slowly breeding intelligent survivors together, as nobody else wished to breed with them.

Hence Jews hold more Nobel prizes in the sciences, than all other combined. Yet Jews are only approximate .2% of the global population.

Thats before we come to the Jewish domination in the financial industries, which Europeans in particular, are directly responsible for.

For over 1700 years in Europe. Jews were forbidden to hold land or enter most trades, or any trade guild’s. Hence they gravitated to medicine and finance, as that is all they were allowed to do. After that much time, the good, tend to be VERY good.

The average European female university graduate, has less than 1 child per woman (In Italy its down to about .6). The intelligent (Frequently also wealthy) Jewish Female graduate, has over 2.

Europeans slaughtered the majority of their intelligent breeding stock, in the last two world wars. Those who are left, are not producing enough highly intelligent people to maintain their dominance in the sciences, or finance.

Jew’s don’t seek to take over the planet with some secret Cabal.. However, at the moment, the Europeans, along with the rest of humanity, are not leaving us much choice in the sciences or finance.

All I know is that these rigged, broken, Fed-juiced markets are so divorced from any underlying fundamentals that anything could happen. The lunatics are running the asylum.

I have mentioned this before…The Quantum computer is already trading. It looks for every , I mean every, possible trade possibility in every market it can trade in, based on millions upon millions of data points a microsecond. As long as the ‘owners’ can keep it at Kelvin temperatures, you are a duck in a pond.

Nice idea but fantasy thinking. Nobody with a good computer will put a dime into an investment unless they know the sale price and the probable gain before the trade initiates. This is how HFT works. Legal front running and spoofing. If you can’t control it, you don’t put money into it.

Market risk is for suckers like you and me.

I would imagine as the Amount of Data keeps increasing, the significance of each Data Bit keeps decreasing. Pretty soon the Algos will be trying to extract information from Noise. I think I need to listen to my FM radio’s inter station noise for a clue to what the Markets will do.

Imagine, you are the Fed. Your friend, Ben Bernanke or somebody else, is working at a Hedge fund such as Citadel, so you have an inkling or two of this sudden drop problem. If not, you read Wolf, and realize that this kind of doomsday scenario may come true. So what do you, the infinitely talented PhD economist, do?

You enable some of these quants, like your friends at Citadel, to do compensatory action whenever you fear somebody is selling off. At a later date, you sell when these quants are buying; you may even make a handsome profit.

Look at Yellen’s flying monkeys with their incessant jawboning about supposedly pending rate hikes, then when the FOMC meeting rolls around Yellen pulls out her played-out “Lucy and the Football” routine and comes up with some marble-mouthed lame excuse to punt yet again. And again. And again.

How much are the Fed’s insider cronies making from this racket, and why hasn’t Yellen the Felon and her Fed partners in crime been charged with currency manipulation and racketeering?

No one manipulates their currency higher. A big problem for the US now is the high dollar. So if Yellen is currency manipulator she is an odd one.

But re: currency manipulation, I’m a little surprised our own dear Canada doesn’t come in for US attention. I think we’re at 72 cents right now, down from 85 or so in 2014 when I sold my house and Royal asked me if I wanted a US$ account.

Is there an equation for a random number?

Answer- there is no equation for a truly random number.

No matter what the Casinos in Vegas tell you about their ‘fair slot machines’

Random numbers are artifacts of the ‘natural world’, they cannot be manufactured. You don’t generate random numbers, you monitor the background temperature or other natural phenomena to record them. (big big big difference)

Hence all the Quant funds are based on a deterministic world that does not exist. They are bound to fail.

True and a guy has come up with one that uses natural background radio (EM) noise to generate random numbers.

Good story. Take CNBC where shills rule supreme.

– AAPL is gonna be worth 1 trillion Dollars soon

– TESLA will be worth “multiples”, because it’s a player in the autonomous vehicle market (the author’s company owns TSLA stock, of course)

– “buy the dips”, the chorus shouts.

Trump failed to have a single adviser tell him about a) Wahabism and ideology of most terror groups and b) who has been funding it for decades? Mmm. Let’s lambast Iran instead! This won’t end well.

Everybody is using it: enormous leverage for subpara gains.

Quant funds make 5%/year.

The US Government has to create $10 in credit to generate One Dollar of new GDP, with a leverage ratio of 352% of debt to GDP.

http://www.zerohedge.com/news/2016-06-09/it-took-10-new-debt-create-1-growth-first-quarter

Now we got ETFs with multiples of leverage. Greater and greater risk-taking is the norm.

The bias to buy will be their undoing. Probably the great achievement has been to create a bull market that runs on low volume, which is perfect. You leverage gains and maximize investment capital. Soon programs will figure ways to make other programs sell, (using low volume) so they can buy the dips they create. (We used to blame the Fed for this kind of thing) Its cyber warfare, just not the kind you imagine. Remember there is no honor among thieves, or robots.