A very inconvenient connection.

Brazil is in the middle of a political and corruption crisis blooming on the verdant pastures of an economic and fiscal crisis that has now produced a second year of recession in a row, with the financial curse of the Olympics still hanging over the country for years to come.

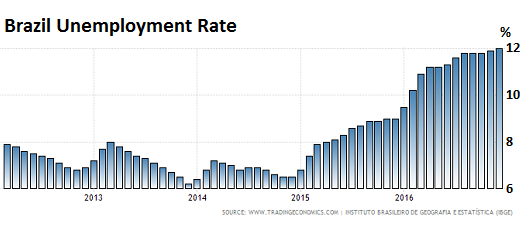

Nearly 12 million people were counted as unemployed in December. The number of employed fell to 90.4 million, from 92.1 million a year earlier. The unemployment rate has steadily climbed to reach 12% in December, up from 6.5% in December two years earlier (via Trading Economics):

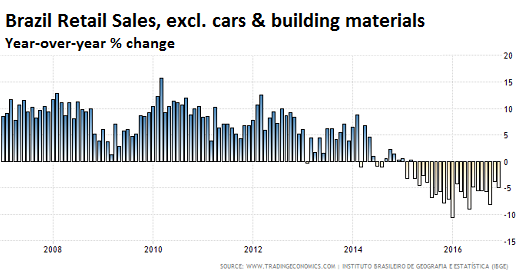

And consumers have reached a breaking point. The government’s statistics agency IBGE reported today that its narrower measure of retail sales, which excludes cars and building materials, dropped 4.9% year-over year in December, “frustrating hopes that end-year markdowns would boost demand for electronics and home appliances,” as Reuters put it.

In all of 2016, this narrow measure of retail sales dropped 6.2%, the worst decline in the IBGE’s data series going back to 2001.

This chart shows the year-over-year changes in retail sales, excluding cars and building materials (via Trading Economics). The weakness in retail started in 2014 and deteriorated sharply from then on:

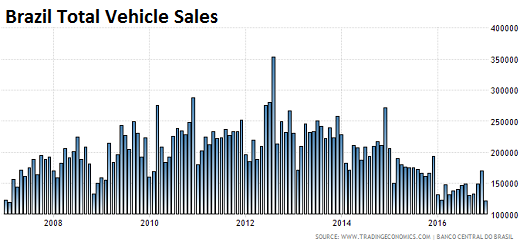

A broader measure of retail sales, which includes cars and building materials, plunged 8.7% in 2016, according to IBGE. This is in part due to the steady collapse of vehicle sales.

In January, total vehicle sales dropped to 121,400 vehicles, the lowest in over a decade.

In December, typically one of the best months of the year, sales plunged 10% to 170,000 vehicles from 190,000 a year earlier and were down 37% from two years earlier. This compares to the record in sales, set in August 2012, of 353,000 vehicles, when the “Buy BRICS” was still pandemic Goldman Sachs hype (via Trading Economics):

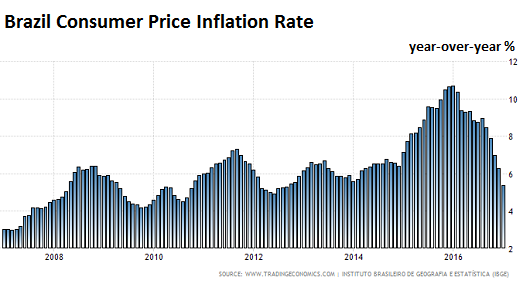

But for those economists and thinkers who keep believing that inflation is somehow good for the economy, or necessary for growth, or a symptom of growth, and that more inflation is better, and that more inflation is therefore needed in the US to fuel growth, here’s a tough and inconvenient reality:

Despite the sharp economic decline over the past two years in Brazil, consumer price inflation has been red-hot, ranging mostly above 6% year-over-year, and peaking in the double-digits at the end of 2015 and early 2016. As far as inflation is concerned: no demand, no problem.

The central bank has been trying to tamp down on inflation by raising its benchmark interest rate above 14% for a year through November 2016, though it has since lowered it to 13%. With some success: inflation has been dropping to a still withering 5.3% in January (via Trading Economics):

That combination of high inflation and economic decline is an all too common occurrence and a devastating one because it destroys the purchasing power of consumers (workers), who, with surging unemployment, cannot demand wage increases to compensate them adequately for the loss of purchasing power. Hence the collapse in real wages – of the lucky ones who still have jobs – and the collapse in the standard of living. And hence, the collapse of consumption and more narrowly, the collapse of retail sales.

Inflation – and it doesn’t have to be hyperinflation – can be vicious for workers, consumers, and creditors (though it’s the best thing since sliced bread for heavy debtors). This connection between inflation and consumption in a declining economy with high unemployment is something inflation-mongers in the US should keep in mind.

Here is the effect of “supply shocks.” Read… This is What Happens to Inflation when a Currency Gets Unpegged from the Dollar

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– It’s similar to what happened/happens in Britain right now. Keep an eye on that country as well.

– I think A LOT OF (US) “investors” will get hurt. They played the “Reach for Yield” game with brazilian bonds. In the US the 10 year yield is at ~ 2% while the brazilian 10 year yield was (past tense) at say 7 to 8%. A brazilian company could lower its interest costs form say 8% down to say 4% when that company borrowed in USD instead of in BRL. And US investors were very eager to gobble up that 2% extra yield.

– But now that the BRL has lost value against the USD those brazilian companies are in deep do-do.

Check headline

See reply to Cybil for scientific explanation.

Bazil Falte?

Yeah. I moved the word around and the R fell out when I did. It just fell right out of it. That’s why it is correct in the URL, and in the email update I sent out, and in the tweet. I never thought an R could just fall out of a word like that. But I swear it did.

Rs are a slippery letter and will quickly jump out of your words. However, if you keep an eye on your Ps and Qs, the Rs will stay in line.

So what is driving inflation in Brasil, USD exchange? Are they heavily dependent on imports for consumer goods?

Top 10 Imports:

Machinery including computers: US$21.1 billion (15.4% of total imports)

Electrical machinery, equipment: $16.9 billion (12.3%)

Mineral fuels including oil: $15.1 billion (11%)

Vehicles : $10 billion (7.2%)

Organic chemicals: $8.3 billion (6.1%)

Pharmaceuticals: $6.4 billion (4.6%)

Fertilizers: $6 billion (4.4%)

Plastics, plastic articles: $5.9 billion (4.3%)

Optical, technical, medical apparatus: $4.8 billion (3.5%)

http://www.worldstopexports.com/brazils-top-10-imports/Other chemical goods: $3.8 billion (2.8%)

Wolf, I’ve always challenged the notion that inflation was a good and necessary in my own mind when I hear these central bankers and economists talk about the necessity of it. Where does this come from? Is it simply these people mistaking something that is symptomatic of demand and growth, for a prerequisite of growth? It seems rather absurd to me.

As I understand it the inflation has the effect of deflating debts making us all able to borrow more and more and more thereby keeping the fiat currency, US petro dollar ponzi scheme going.

If the inflation stops, repaying the debt is harder. If we go into deflation we may not pay our debts at all and the whole illusion evaporates.

Looks like the beginning of 2016 was an inflection point. I remember the interest rate at that time hit 12%.

EWZ was a buy about 1 year ago.

What really hurt Brazil….besides the political corruption was the drop in commodities…..oil, suger, coffee. Oil is now up 100% from the lows around 2016 and so is surgar. Coffee is up about 50%.

From Belem, Brazil. Commercial rentals as storefronts and industrial parks started losing renters and putting up signs “For sale or rent” late in 2015. Now residential real estate has followed. People are giving up their rented houses and moving in with relatives. Malls are losing renters. I know guys who having been looking for jobs for over a year. But I hear that jobs are available in Rio.