NIRP is dying.

Markets are suspecting that central banks are in the process of exiting this fabulous multi-year party quietly, and that on the way out they won’t refill the booze and dope, leaving the besotted revelers to their own devices. That thought isn’t sitting very well with these revelers.

In markets where central banks have pushed government bond prices into the stratosphere and yields, even 10-year yields, below zero, there has been a sea change.

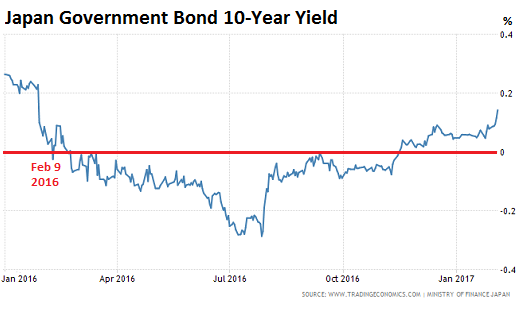

The 10-year yield of the Japanese Government Bond (JGB) jumped 2.5 basis points to 0.115% on Thursday, the highest since January 2016, after an auction for ¥2.4 trillion of 10-year JGBs flopped, as investors were losing interest in this paper at this yield, and as the Bank of Japan, rather than gobbling up every JGB in sight to help the auction along, sat on its hands and let it happen.

And on Friday morning, the 10-year yield jumped another 3 basis points to 0.145%!

In September last year, the BOJ started the now apparently troubled experiment of trying to control not just short-term interest rates but also the entire yield curve. It targeted a 10-year yield of about 0% (it was negative at the time). Analysts believed that this would mean a range between -0.1% and +0.1%, and that if the yield rose to +0.1%, the BOJ would throw its weight around and buy.

But the fact that the BOJ allowed the yield to go above that imaginary line signaled to the markets that it no longer has the intention of capping the yield at +0.1%, that in fact the BOJ has stepped back.

This happened even as BOJ Governor Haruhiko Kuroda, on Thursday, once again was trying to jawbone the markets with a verbal commitment to his yield-curve targeting strategy and his mega-QQE of ¥80 trillion ($710 billion) a year in asset purchases.

The 10-year yield had fallen below zero for the first time on February 9, 2016, as the BOJ began dabbling with its own negative interest rate policy (NIRP), because its zero-interest-rate policy and its mega-QQE bond and stock buying binge somehow wasn’t enough, and because everyone in Europe was doing it. But that’s like so ancient history now (via Trading Economics; red marks in the charts below are mine):

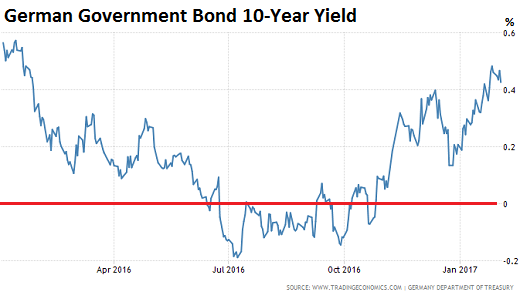

Germany, the second largest NIRP fiefdom, is subject to the ECB’s crazed NIRP absurdity and asset-buying binge that includes government bonds, corporate bonds, covered bonds, asset backed securities, and what not.

But there too, bonds have fallen in price despite the ECB’s purchases, with the 10-year yield emerging from negative la-la land just before the US election and soaring after it. There are now rumors that the ECB will announce sometime later in 2017 the untimely and slow death of QE (via Trading Economics):

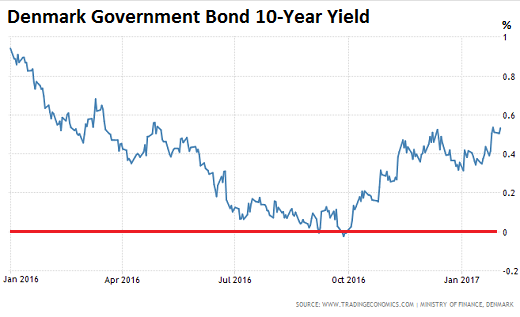

Denmark, whose households are the second biggest debt slaves in the world, still has its own currency and therefore its own monetary policy, and therefore its own NIRP. But the 10-year yield only briefly dipped below 0% and has since rumbled higher (via Trading Economics):

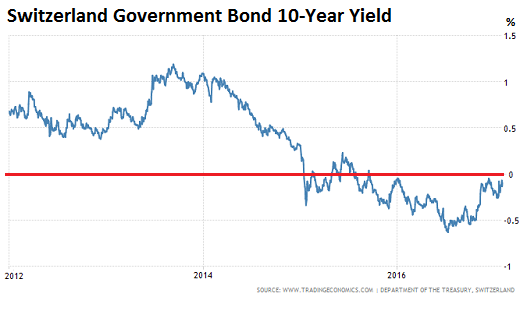

And that leaves Switzerland, whose households are the Number 1 debt slaves in the world, as the lone straggler in the 10-year negative yield absurdity, but it too is about to exit.

Its 10-year yield plunged below 0% in January 2015, the first sovereign debt in that maturity to do so, when the Swiss National Bank scuttled its currency cap against the euro, and at the same time cut its benchmark interest rate from -0.25% to -0.75%. It was a day of chaos that those who got tangled up in it will likely never forget. A lot of wealth was transferred, by dint of a central bank decision.

The charts above covered one year because that was the time frame of negative 10-year yields in those countries. But in Switzerland, the story started two years ago hence the five-year chart. On Wednesday, the 10-year yield rose to -0.10%, and on Thursday, it rose further to -0.024%, getting perilously close to 0%, before easing back to -0.04% (via Trading Economics):

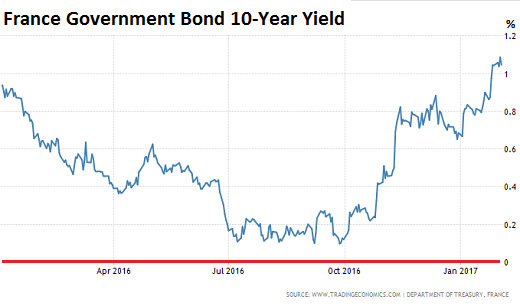

In France, the 10-year yield never quite made it into the negative. The French government would like nothing more than to maximize its profits from its debts, which the negative-yield absurdity allows it to do. But it only got within a hair of it in September 2016 when the 10-year yield reached an all-time low of +0.10%. Close, but no cigar.

France, I believe, was the country whose 10-year yield got the closest to participating in the NIRP absurdity without actually making it. Alas, since then, bond prices have tumbled as the 10-year yield has soared over a full percentage point to 1.05% (via Trading Economics):

These 10-year yields are still very, very low at a time when the annual inflation in the Eurozone has shot up to 1.8% and is threatening to tear higher. Financial repression at its finest continues.

In the US, 10-year Treasury prices have also fallen and the 10-year yield has surged by over a full percentage point since last summer. Unlike the central banks in Japan and Europe, the Fed is on a path of raising rates and is also thinking out loud about unwinding its big-fat balance sheet by shedding some of its Treasuries or mortgage backed securities or both.

So it would make sense for US yields to rise. But why are yields in the bailiwicks of the other central banks so jumpy? Because markets smell a rat – as central banks, despite ceaseless jabbering, appear to be sitting on their hands after years of iron-fisted market domination.

But markets have gotten so used to central-bank booze and dope that they “cannot believe” it will ever really end. Read… “Watch Out for the Shock”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

” central banks, despite ceaseless jabbering, appear to be sitting on their hands after years of iron-fisted market domination.”

It’s hard to say they’re “sitting on their hands” when the BOJ & ECB are printing a combined $140 billion a month and the US Fed has real short-term rates set at negative 150bp! A year from now it may be a different story (except for Japan, which has so much debt it can’t afford to allow rates to rise, and thus will eventually death-spiral the yen), but you really can’t put “sitting on their hands” in the present tense.

The BOJ could have offered to buy every JGB out there over the past three days, offering to buy at whatever price, thus driving up the price until the yield drops to -1% or even -2% or whatever. It COULD have done that, but it didn’t do anything. It just let prices slide and yields spike. That’s what is meant by “sitting on its hands.”

But, but…the BOJ is supposed to be independent, like the FED, ECB, etc. Otherwise, why go through the charade of public auctions? /s

Looks like the BOJ did finally step up to the plate Friday afternoon and start buying to bring yields back down.

Maybe they should make it automatic. I would go further, replace central banks with a computer program. Now, that we have seen how they work, a self-driving car is a sophisticated machine compared to what they do. I do not know if computers can collude, though.

China takes the week off and rates backup …. Japan has a huge hunger for its own equities and maybe Chinese soon?

China would like to own more of the Japanese real economy……. Let that FXY go up and its Japanese fireworks but…. The dollar must test the up side first so the dumb ” smart money” can pick up the last steamroller dime?

American market crash would be false break lower? IMHO.

The 1923 Bank of the Weimar Republic could have done the same- until people finally realized they were going to be paid, in the end, in marks.

“And on Friday morning, the[Japanese] 10-year yield jumped another 3 basis points to 0.145%! What a thrilling investment! In 10 years, in a wildly inflationary scenario, investors get back less than one yen on a 1,000 yen investment. (Could they all be radiation-addled, do you think)

The theft from my generation ( 65-ish ) , and most especially my parent’s generation, by NIRP and ZIRP over the last decade beggars the imagination. This is an outrage, but few complain, protest or condemn it,

Bernanke and Yellen, and their bankster brethren ( and sistern if that be the case ) are thieves of the highest order and should be imprisoned for life for their ECONOMIC CRIMES AGAINST HUMANITY.

Except for bailing out their commercial and investment banking charges, the FED’s ZIRP and NIRP have done nothing good for the citizens of this country. The 99.995% if you will.

ECONOMIC CRIMES AGAINST HUMANITY.

Worthy of a Nuremberg-like response, but none will be forthcoming. The Big O had the perfect chance to strike a blow for the 99.995%, but he and that worthless Attorney General Holder were beholden to the banksters — and I cannot imagine why !

SITTING ON THEIR HANDS, indeed ! Would that that had been true for the last decade. One might do well to recall that Central Planning was totally discredited by the Soviet Union.

The link below demonstrates just one special example of our ( you and me and that fellow over there ) continuous abuse at the hand of the sitting FED.

http://www.zerohedge.com/news/2017-02-02/unacceptable-congressman-slams-yellen-prioritizing-foreign-banks-over-domestic-inter

Would that the faker Janet Yellen would sit on her un-calloused hands. She needs to get a real job ! For the first time in her coddled life.

SnowieGeorgie

George, instead of striking a blow for the 99.995%, he gave a blow to the 0.005%. At least now that he’s retired, he can work on his golf game.

Well said.

SG, I’m all in and you are correct. The earners and savers have been robbed blind by the criminals that control the financial levels of power.

This is not just the last 8 years, which should garner hard time in prison for their thievery, but ever since 1913 when the FED seized control of the entire US economy.

The wheels are coming off and not by accident. They will have their perfect storm. What they did’nt steal on the way up they will steal via equity short positions on the way down.

The financial raping of the American Citizen will be complete.

… and it’s even worse in Europe thanks to ECB ZIRP and QE.

Don’t know about the US, but in Europe most government workers haven’t been ‘robbed’; they only had their incomes increase a little bit less than expected. But lately most government workers (and to a smaller extent people on social security) are seeing income increases far above official inflation; so there really is no reason to complain.

The only group that has been robbed on a massive scale are savers, small businesses and some people with private pensions. For the larger pension funds there were sometimes symbolic cuts that nobody would notice, but it is still undecided who will pay for the fallout from the last 8-9 years. Some politicians are arguing that pensions should go up again despite ZIRP/NIRP policy, just assume that 8-10% ROI will return soon and nothing to worry about for the young contributors to the pension funds ;-)

Yup you got that right It’s a comin

Thank you Snowie

Did you read the mainstream media? Didn’t they tell you that they saved the world?

I guess, I gave you the answer why the revolution isn’t round the corner.

If you think the theft from our generation is bad, wait until the millennials get the bill.

Well said. A vast wealth transfer borne with hardly a peep of protest by the middle class. Swiss RE estimates the interest foregone by savers in USA to be USD 440 billion over the years 2008-13. They refer to this as the “unintended” consequences of financial repression. I wonder about the unintended bit – rather the gentle introduction of the middle class to their neofeudalization?

http://www.swissre.com/media/news_releases/nr_20150326_financial_repression.html

There is no such thing as free money it has a price sooner or later. The celebrity and will blame trump but it not his fault the boggy man was let out along time ago and last Jan they got a big fright .

CBs seemed to think that the move into NIRP was more of the same: motivate banks to lend and borrowers to borrow. Not to mention lower the cost of Govt debt.

It was never going to work> the missing link they forgot: NIRP is not more of the same, it is a mirror image of positive interest rates.

Specifically, banks lose money instead of making money on CB/Fed deposits, and investors lose money on bonds held till maturity.

Game over NIRP.

Its Plan B (is there one?) for CBs whose policies since 2008 are now proven false/ineffective for growth.

Bond prices now exposed high and dry – the end of the 35yr bull run, with inflation driven by money printing set to take over.

eg Japan prints each year QE $710bn = 18 times its national gold reserves of 750 tonnes.

But that $710 billion just sit as bank reserves at the BOJ and never enter the real economy. So they can’t cause inflation. They do allow for an expansion of bank lending, but that would require credit-worthy borrowers who want something expensive and new. Which is where the real problem lies, one that the BOJ can’t fix.

A seventy year old 100 billionaire is taking a 100 thousand dollar a year cabinet position to learn about saving the future economy?

Just because you are down on the future doesn’t mean a billionaire gives a rats ass!

A fearless industrialist is riding coattails of a politician instead of leading the charge?

There is a rat alright and he is looking for easy cheese instead of a better life for all citizens!

Taking social security and a cabinet check to close down commerce?

can’t talk about nirp and threaten our buds over currency manipulation!

We are nirp. We still have a fed acting as a hedge fund and besides you had to call something nirp Instead of explaining to congress what maiden lane was about!

We can always drop the QE bomb to revisit NIRP with one last punchbowl facial?

The Fed can’t stop and nobody knows enough to stop them so buckle up ……

The fed needs to get its face out the punchbowl so it can take it away???

The all powerful central banker is fast becoming the Wizard of Oz after the curtain has been pulled back.

Little men (and women) pulling on their interest rate and QE levers but nothing much happens.

Please define “fast”. Been eight years and there could be eighty years more.

Also please define “nothing”. It certainly allowed companies to buy back stock, etc. Wouldn’t exactly call the asset market levitation “nothing”.

Please be concise.

The bottom 50% of all workers OWN NO STOCKS ! NONE ! ! ! !

So clearly they have not benefited from “asset price levitation” .

And since 70% of all workers have total savings of $1000.00 or so, they certainly do not have enough “financial assets” to have benefitted in any way from asset price inflation.

Please do not buy into the propaganda stream emanating from our corporatist elite owner class. Doing so puts you into bed with them.

http://www.oftwominds.com/blogfeb17/central-banks2-17.html

SnowieGeorgie

In most EU countries the percentage of the population that doesn’t own stocks directly is much bigger, probably 80-90% (those with a pension own stocks trough their pension fund obviously, but they have no control over buying or selling). So in Europe it is even more clear that the asset inflation that central banks are causing primarily rewards the elites / speculators.

However … the average citizen has a home with a mortgage, and as such is invested with leverage in RE – and has benefited tremendously from pumping up the housing bubble again over the last few years. Those without a (big) mortgage and renters had less or no profit, but in most countries they are a minority so who cares ;-(

Of course it remains to be seen what happens to all the small speculators when asset inflation stops, but I fear that again savers and tax payers in general will get the bill and not the speculators (if you include the small ones, they are usually a voting majority).

Interest rates will move a bit back and forth but there is no way we are going back up significantly, short of an international crisis.

Sustainable productivity growth is dead; has been for some time. And with the sea of “money” that exists, there is way more money chasing profits than opportunities for such.

Agree completely. Interest rates aren’t low because of the Fed, they’re low because of the lack of real investment opportunities. And that isn’t changing.

IMHO this is still mostly the result of FED policy, they have messed big time with the business cycle. The lack of real investment opportunities isn’t caused by some strange force of nature, or because people have suddenly stopped spending money or wanting new products. It’s all because of central bank policy.

Many companies and small speculators should have gone bankrupt in 2008, but the central banks printed loads of money to bail out the speculators. All that extra money is flooding the markets (stocks, bonds, RE etc.) looking for a safe place to stock it … and driving out sane investment opportunities.

If the central banks hadn’t acted, there should have been sufficient investment opportunities today with decent return; maybe not the kind of returns people have come to expect in the last 10-20 years of ‘financial engineering’, but good enough. Kill off the small and large speculators and start rewarding saving and true investment, and the real economy will recover (one can dream, of course politicians and central bankers will never let this happen).

Agreed.

Look at demographics. According to the CIA World Factbook, the global population is leveling off much faster than expected– we’ll be at replacement rate in less than 20 years, and with far fewer people than previously projected (maxing out around 9 billion people). The US birth rate is 1.87 (replacement rate = 2.1), meaning if it weren’t for immigration our population would actually be declining.

This all has huge implications for global growth.

IMHO this just means that the economy can no longer grow on autopilot, using all the old (dirty) tricks.

But I do not see why the economy should not be able to keep growing if we change course, e.g. if we produce more services and virtual products, or maybe biological products like enhanced health/genetics, instead of more bombs, more cars and ever bigger houses.

A declining population is very healthy, if only because there are limits to growth. The problem is endless entitlements, people who have worked 30 years and expect to have the same living standard as in their working years for the next 30 or maybe 60 years; sometimes including the spouse/extended family. And of course all those people from Africa, Middle East and Asia who are told that they can all have the same Western entitlements for free by just applying as a refugee in Europe.

It simply isn’t possible, more people means lower expectations in the current conditions (with many limits to material growth).

If you consider the Eisenhower interstate highway system allowed one of the greatest productive booms in history. It now made sense for everyone to buy automobiles. And those automobiles let people get to higher paying jobs. And it allowed for the suburban lifestyle with a housing boom, along with massive investments in household appliances and furnishings.

Nothing like that kind of investment environment exists today. So we have a lot of money chasing less investments. Lower demand for money = lower interest rates.

@Kent:

“Nothing like that kind of investment environment exists today.”

Of course not, much of these programs are a one time affair that will never be repeated. Highways and cars are yesterdays technology and on the way out, although slowly. Suburbs and million dollar mansions for the average Joe were a one time love affair too, probably. History moves on.

But why would this mean that the economy shrinks or that people stop spending?? What people spend their savings/money on has been changing for millennia and it will keep changing, no doubt about it.

We could easily spend $ 1 million per citizen on rejuvenation or upgrading our genetics (not yet, but probably within 10 years or so) without any material limits to growth. Or spend huge amounts of money on cleaning up the environment, reforestation, and reintroducing the species that we killed off during the last generation to make room for all those highways and cars ;-( Or maybe we are all going to spend loads of money on buying more friends on Fakebook and Twitter ;-)

In Netherlands rates on savings accounts are still declining. If you are lucky you can get about 0.3% on your private savings account, while our tax office assumes you get 4-6% and taxes accordingly. Most business savings accounts and short term deposits have had zero rates for almost a year now. ‘Saving’ in Netherlands means in reality losing at least 1-1.5% per year (and around 3% when taking official inflation into account).

Mortgage rates are up 0.1-0.2% from the lowest values in history and the housing bubble came roaring back, it is party like it’s 1999 again with home prices rising at 5-10% yoy (around 25% yoy in the speculative hotspots). Nobody is worried because – just like stock market speculators – they have learned that the government and the central bank always come to rescue. Well, some people in the RE sector are worried that they are running out of homes to sell …

After 2008 household debt (over 90% of which is mortgages) declined a little bit, but it has started to grow again. While some are paying off their mortgage because of the current low rates (the tax advantage has become very small), others are buying even more/bigger homes because that is the only way to get ahead in the game. And car loans and student loans are booming just like in the US, it’s free money after all …

Some economists associated with the RE mob suggested this week that the Dutch government should quickly end the ridiculous mortgage tax deduction (the most generous in the world), because with current low rates most homeowners would hardly notice. This is the best possible opportunity to end this crazy incentive that has existed for over 100 years. But of course politics is not interested, both conservative and socialist parties want the housing party to continue on steroids. All the bad housing incentives will continue until the bubble bursts and the Dutch state goes bankrupt as a result.

No sign at all over here of an end to the madness :-(

To me, there is a sense of futility when I think of the major problems associated with money, credit and banking (the name of a course I took at Michigan State College [now University] in 1956). 1956 (!!)

News today: https://www.forbes.com/sites/antoinegara/2017/02/03/with-a-stroke-of-the-pen-donald-trump-will-wave-goodbye-to-the-dodd-frank-act/#1929b11a1148

Old Jewish saying: “The more things change, the more they stay the same”.

currently the feds are dialing back their rate increase timetable for 2017 . This can be shown by the recent plunge in the dollar. The enemy

of ZIRP is inflation. Inflation is a zirp killer because it reduces real bond yields into further negative territory . low inflation is a zirp enabler. As WR has indicated in earlier articles inflation (PCE ) is rising. This will force the feds to raise rates . if the feds continue to suppress yields in a high inflationary environment money will flow out of bonds into other assets(stocks) . This scenario was witnessed by the dow hitting 20000. that’s the way i see it .

DOW hitting 2000.

There is so much money floating around due to CB printing. There is very few economies (countries) capable of absorbing such a flow of money without creating inflation. Where can this money go, US, Europe, China, Japan. I agree with everything you said except DOW 2000. I thing we are going to DOW 25000 and SP 2500 with collapsing trade due to lack of confidence in the concept of money or currency.

This heavy printing of money is now eroding confidence and CB planner and confidence in the value of currency.

dow 2000 was a typo . my bad

The bottom line is how to protect assets . Every option I can think of has significant

downsides. At a younger age I would be buying less liquid investments but not now.

Paying down what debt remains, even at these low rates, seems the safest action.

ditto on that sporkfed . place cash in rolling 6 month cd’s . won’t pay you much interest .5 % to 1

percent. i use a strong credit union to bank. they pay slightly higher rates with less fees. credit unions are charted differently than the TBTF mega banks . protect your principal. folks what the global centrals banks are doing is unprecedented. how long they can continue to push on a string is problematic . As other pundits have stated, the feds have entered a roach motel . the unwind will be painful.

0.5-1%? I don’t feel that’s enough of a return to even be worthwhile. I’ve been parking my excess savings in a Vanguard Federal MMF every month for 2+ years now. I’m 32 years old and am ~80% cash. I believe there will be another 2009-like year in the near future, where, if you have the cash on hand to buy stocks/RE, your long term returns will make anything you could make now seem irrelevant. It’s been hard watching the S&P go ever higher, and it may be a few more years until we see a bear market, but I have faith that my patience will eventually be rewarded handsomely.

Paying down debt, certainly. But less liquid assets might useful, if they can be directly applied to making life easier in hard times. E.g: rural real estate for refuge and local sustenance; Local production of food, firewood, etc.

If they are never needed for that purpose, one can enjoy ownership in its own right and appreciation of underlying value is possible.

being in debt has worked wonders over the last 20-30 years and still does today, probably even more than ever thanks to the fact that the cost of debt is almost zero now (or sometimes even below zero).

This Ponzi e-con-omy has continued for far longer than any sane person could have expected, and maybe it will eliminate all financially responsible players before the game stops. Being frugal and debt free will only work if sanity returns to the financial markets; good luck with that …

For the record, I have been debt-free all my life (with some minor hiccups due to business investments) but my feeling is that over the last 15-20 years that was more like financial suicide and definitely not a winning strategy :-(

What is Trump going to do about Dodd frank guys , bail in?

As usual WallStreetOnParade has some news on this:

http://www.wallstreetonparade.com

Thank you it was great link, wonder what Ellen brown has to say. Disk operating system- quick and dirty dos

Congratulation on your debt free status and sorry about your marriage George. Marriage is a blessing as long as both partners work as a team.

Sorry about the marriage too. Thanks for your kindness . I am in a new situation now that is what you said it should be, ideally.

As for the debt free: the next move is, of course, to rebuild my ( post-divorce ) asset base.

Making slow but steady progress, now that the debt monkey is off my back.

The only thing remaining that I still want, is a two-car garage.

That more than any luxury in the world, being stuck here in the occasionally dreary northeast for the remainder of my life.

Have a nice !

SnowieGeorgie

A human being instinctively knows that an “economic system” — a “system” in which Janet Yellen LITERALLY has the power to purchase every single thing that has a price, and every single person who works for “money”, on planet earth simply by holding down her computer’s zero key for longer and longer periods of time — is fundamentally flawed.

The most important question that we, the non-Elite commoners, have to be asking and answering BEFORE Janet’s house of cards comes tumbling down is bone simple. Upon what founding principle should any new economic system be based? That is, are we once again going to use Adam Smith’s “greed is good” — the guiding principle that has gotten humanity to where it is today, of will it be something else? If the latter, what will that principle be?

I am happy to see there are people thinking about principle as opposed to “to whose interest at what time”.

The mother nature principle is simple, conservation of mass, energy. Since humans do not have natural enemy, they have to compete and eliminate themselves in order to stay balanced.

But humans do not want to stay conserved and balanced, they want grow and consume more. The civilization principle is basically “No one should encroach other people and other people’s property.”

This is the liberty principle. If civilizations follow this, it will advance, if they do not, it will go back to the mother nature’s principle which leads to elimination process.

My point is, the advance was NOT caused by the principle of “greed”. It was the “violence-not-allowed” which means one has to pursuade each other which leads to overall advance.

Fed, government, tax, policies are all using violent police and military power to encroach on other people’s property, that’s why civilization starts to degrade.

The founders of america understands this. But modern day people confuses liberty with democracy and they talk about to whose interest without any underlying principle.

The fed is their because the people allowed it. The people allowed it because nature’s principle won over founder’s principle of liberty.

I am not suggesting which principle is right or wrong. I have respect for both mother nature and America founders.

Congratulations president Trump I hope it was a fruitful bankers meeting

I will be thinking how wonderful your new life must be as my retail unloader position gets the axe!

Fair winds…..that’s Navy talk!

The Fed was born in 1913, with decent chromosome. The original Fed

was suppose to use good corp. bonds, like the “Real Bills”

Real Bills were used by mfg. to pay their workers every Friday. Only

for goods, like cars today, in 2017, that can be produced, ship to the

retail customers, being sold and paid for, all of that within 90 days.

But, at age 6 month the Fed was re programed to do a stealthy job

and it’s most important job, to serve the US national interest.

In 1914 it was to finance the Liberty war, the last war in history.

Today, it’s more powerful than the USAF !!!

It can hit a foe, assist a friend. Lady Zanet can punch hard.

The Real Bills were pushed aside and the Fed was filled with an

overload of gov’t bonds. Liberty bonds.

Real Bills exchange was shut and workers could not be paid for, in the

1920’s Germany and in the 1930″s in the US. Entered the depression

Fed main job is National Interest. The rest is side job.

Today, something like the Real Bills is being used by Dealers, money

markets, pension funds, hedge funds, getting loans for overnight, a

week, 30, 90 days or a year – providing good quality bond/ note, like

US gov’t bonds.

All at the service of the financial industry. Not mfg. ,not for workers.

In Denmark, traditionally most of that household debt is loans that are convertible i.e., when rates rise the borrower can go and buy the (now cheaper) mortgage backed bonds and pay off the loan by returning those to the lender. (You cannot however walk away from such a loan by returning the keys)

So fundamentally when rates rise, Danish home owners can convert down to a smaller loan; as long as the loan is still within 80% of the value of their house. The net effect is that the monthly payment stays roughly the same, but the loan itself is smaller.

This makes the Danish private-home mortgage market somewhat less risky than many other markets; and that’s the reason why the Danes are so debt loaded. It’s just not as risky to buy a home this way. It’s also more likely that a lender will get his money back.

That was the idea anyway.

In the last 15 years however, the market has been deregulated and we’ve seen a rise in the loans that are with a flexible (short term) rate because those rates (and thus monthly payments) are significantly lower. Banks have been making good money but now some ~50% of home “owners” mortgages are based on short term (1-5y) rates.

shh… don’t tell the Dutch down below about this. Just the horror of 80% loans would send the whole country in a depression: everyone over here is entitled to at least a 102% loan, even if you recently went bankrupt by buying too much home for your income (bankruptcy rarely happens in a rising market, but anyway …) or if you have 100K student debt or other ‘issues’ ;-(

Of course, people in Netherlands would tell the Danes that the Dutch housing market is way more solid because they have the National Mortgage Insurance, which means that almost everyone with a mortgage has a free put option on their home (you can never make a loss when you have to sell). The big question is how well all these financial tricks work in real life, when the biggest bubble in history really bursts (IMHO 2008 was only a hiccup on the long way up).

BTW, variable rate loans are popular among the elite in Netherlands, who borrow heavily against their home to make a quick and risk-less profit due to tax system and other artificial subsidies for debtors; although fixed rate is historically cheap, variable rate is a little bit cheaper thanks to negative Euribor. Supposedly all of these debtors can instantly pay off the mortgage when rates start rising; w’ll see about that, and I bet it is way more ‘clever’ for them to not pay off the mortgage, keep enjoying the good life and claim that they were duped by the banks (they could probably take a cue from all those Spanish home debtors, maybe the banks didn’t spell out the potential consequences in capital letters?), so the taxpayers have to make up the difference on the monthly cost ;-(

I know we’re all very concerned about the health of our Elite, but don’t worry. Many of Them have already made plans for the future, “just in case”.

http://www.newyorker.com/magazine/2017/01/30/doomsday-prep-for-the-super-rich

The IMF is out of this fraudulent ‘bailout’ and Greece will soon be out of the Eurozone – definitely within the next 18 months, most likely this year.

It won’t be politically palatable for Germany & Merkel to bail out Greece this year without IMF involvement.

Does anyone really think Trump will allow the USA to fund an IMF bailout of Greece?!?!

NO. OF COURSE NOT – and the USA still has veto power over all IMF decisions doesn’t it.

The Greek BS ‘bailout’ is toast – if you have any Greek Euros or Greek bank accounts you’d best be taking all that money out pronto.

Trump doesn’t do can kicking on IMF BS.

Just you wait, Henry Higgins, just you wait! Various forms of Fed can-kicking (everything from propping up domestic and foreign TBTF banks with fiat dollars, to propping up perpetual war with fiat dollars, to playing circle-jerk with other central banks to prop up stock markets with fiat dollars, to bailing out investors who have bought bonds issued by failed national governments with fiat dollars) are the “whatever it takes” measures that prevent the fake economy from collapsing.

Don’t worry. DT is attending daily classes in how the real world, carefully-planned, fake economy keeps going and going. Luckily, Donald a fast learner.

I have no doubt the Greek bailout theater will continue for many years, probably even after the Eurozone itself has ceased to exist. EU politicians will simply invent new tricks to let the taxpayers in Northern Europe pay for the good Greek life (mostly for the bankers and other elite playing in Greece, of course) without voters noticing it.

Just to be sure, a final decision will probably be postponed until after the coming elections in Netherlands, France and Germany.

IMHO the IMF is only ‘out’ because it wants more money printing and is trying to blackmail the EU into huge debt forgiveness for the Greeks (= more EU taxpayer money for EU+US banks), which of course would set an example for all other EU debtors to follow the same course. Paying debts is for financial dummies, it’s a completely outdated idea.

And speaking of can-kicking, the biggest “kick the can down the road” exercise of them all is just around the corner in March.

http://www.marketwatch.com/story/us-debt-ceiling-of-20-trillion-plus-to-be-reached-soon-in-next-presidency-2016-09-13

I have it from my secret insider living inside the White House that The Donald is going to allow that particular debt-can to once again be kicked down the road. Otherwise, how will Don fund the fence, “re-build” the TBTF MSIC, the new health care system, all of the new US infrastructure, etc., and, not only that, but give corporations and everybody else a great big wonderful tax cut?

The only question I’ve got about this great plan is as follows. To fund all the US government’s upcoming deficit spending, just exactly WHO is going to buy all those fantastic US treasury IOUs and on just exactly WHO’s behalf will this be done?

We have to have perpetual trillion dollar+ deficits to remain on our standard of living.

I like the exchange between Kent and nhz (about half way through the current stack of comments) that compares the building of the Interstate highway network with efforts to directly improve human health or to heal the environment. Should we expect that investments in these two different kinds of activity would have similar effects on economic growth or on the wealth available to a typical citizen? Wealth is still basically a largely physical thing, determined by how much food, shelter and mobility can be delivered to a population? Its easy to see how the automobile made all this physical activity easier, leading to spontaneous, self-reinforcing economic growth, but its not clear how improvements to medicine or the environment would have such strong effects, unless poor health and environmental quality are already serious limits bearing on the economy, which I doubt (maybe in Beijing). I suspect that the present “problem” of slow growth has more to do with the underlying physical situation: more capital required to obtain resources, and no new technologies since electrification and the automobile that really matter to the physical difficulty of providing wealth. The unsustainable buildup of debt and unprecedented central bank interventions are symptoms of our not living in 1955 anymore. Does anyone have the analytical tools to test this hypothesis?