A toxic trifecta for bondholders.

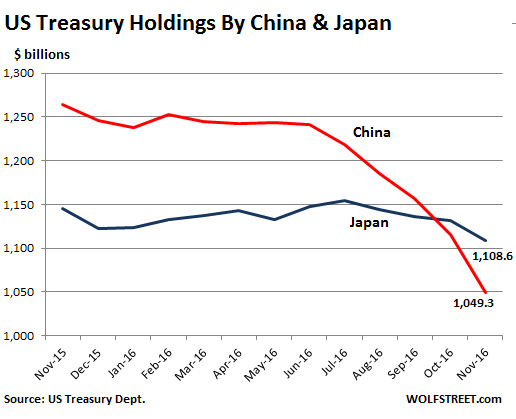

China’s holdings of US Treasury securities plunged by a stunning $66.4 billion in November 2016, after having already plunged $41 billion in October, the US Treasury Department reported today in its Treasury International Capital data release. After shedding Treasuries for months, China’s holdings, now the second largest behind Japan, are down to $1.049 trillion.

At this pace, it won’t take long before China’s pile of Treasuries falls below the $1 trillion mark. It was China’s sixth month in a row of declines. Over the 12-month period, China slashed its holdings by $215.2 billion, or by 17%!

Japan’s holdings of US Treasuries dropped by $23 billion in November. Over the 12-month period, its holdings are down by $36.3 billion.

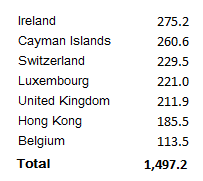

But we don’t really know all the details. We only get to see part of it. This data is collected “primarily,” as the Treasury says, from US-based custodians and broker-dealers that are holding these securities. Treasury securities in custodial accounts overseas “may not be attributed to the actual owners.” These custodial accounts are in often tiny countries with tax-haven distinctions. And what happens there, stays there. The ones with the largest holdings are (in $ billions):

The UK is on this list because of the “City of London Corporation,” the center of a web of tax havens.

Total holdings by foreign entities, including by central banks and institutional investors, fell by $96.1 billion in November. China’s decline accounted for 69% of it, and Japan’s for 24%.

This says more about China than it says about the US, or US Treasuries, though November was a particularly ugly month of US Treasuries, when the 10-year yield surged from 1.84% to 2.37%, spreading unpalatable losses among investors. This surge in yields and swoon in prices wasn’t ascribed to China’s dumping of Treasuries, of course, but to the “Trump Trade” that changed everything after the election.

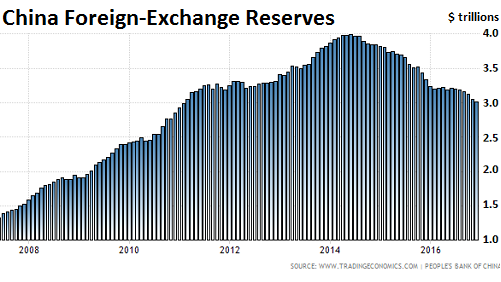

But China’s foreign exchange reserves have been dropping relentlessly, as authorities are trying to prop up the yuan, while trying to figure out how to stem rampant capital flight, even as wealthy Chinese are finding ways to get around every new rule and hurdle. Authorities are trying to manage their asset bubbles, particularly in the property sector. They’re trying to keep them from getting bigger, and they’re trying to keep them from imploding, all at the same time. And they’re trying to keep their bond market duct-taped together. And in juggling all this, they’ve been unloading their official foreign exchange reserves.

They dropped by $41 billion in December to $3.0 trillion. They’re now down 25% from $4.0 trillion in the second quarter of 2014. That’s a $1-trillion decline over 30 months! What’s included in these foreign-exchange reserves is a state secret. But pundits assume that about two-thirds are securities denominated in US dollars (via Trading Economics):

Japan and China remain by far the largest creditors of the US, and the US still owes them $2.16 trillion combined. But that’s down by $90 billion from a month earlier and down $251 billion from a year earlier. And it’s not because the US is suddenly running a trade surplus with them. Far from it. But it’s because both countries are struggling with their own unique sets of problems, and something has to give.

The fact that the two formerly-largest buyers of US Treasuries are no longer adding to their positions but are instead shedding their positions has changed the market dynamics. And both have a lot more to shed! This is in addition to the changes in the Fed’s monetary policy – now that the tightening cycle has commenced in earnest. And it comes on top of rising inflation in the US. These factors are forming a toxic trifecta for Treasury bondholders.

This trade was just waiting to unwind. Read… The Dollar, “the Most Crowded Trade,” Gets Less Crowded

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

all those ghost cities catchin up with their ass,throw nasty double digit inflation ,zero demand for their cheap crap and now their only “real” customer for their cheap junk has a president that cannot stand their ass.lol memo to Beijing trump comin and he’s bringin hell with him

The piece makes it abundantly clear that the Chinese are unloading Treasuries for a very simple reason- they need the money.

But it is almost a certainty that at least one comment will claim this is some kind of nefarious plot aimed at doing something to the dollar.

Or something.

It used to be the Russian reserves that were the looming danger. Now they’re almost gone.

And the Chinese reserves are now down to a trillion-not exactly lunch money even to the Fed but no big deal. Not that long ago the Fed was buying 85 billion a month of treasuries. Or a trillion a year.

And of course if there was some plot to drive down the dollar, the Trump regime ( or any US gov) would say ‘please do’ because the high dollar is its biggest problem.

No matter- there HAS to be a plot.

“No matter- there HAS to be a plot.”

Mao’s tomb is a communist plot.

I think you’re right (that was bound to happen someday). Those commies are just having their first taste of a capitalist-style economic crash and simply need the money.

The dollar is in large part protected by its status as the worlds reserve currency, and is in no more danger from Chinese manipulation than it is from Fed manipulation. Loss of reserve status would require serious changes in the face of heavy institutional inertia, and those do not seem to be on the horizon.

China sells US Treasuries.

Buys off shore yuan and supports their currency.

They take their yuan to Russia and buy Russian oil.

The Russian’s then buy gold bullion at the Shanghai Gold Exchange.

China supports the yuan.

Replaces fiat reserves with tangible value crude oil reserves.

Take the yuan recirculated from Russia and buy cheap western gold.

The Russians fly home with gold bullion.

Saudi Arabia is financially pressured into dropping the US Petro dollar and selling oil to China for yuan, to try and maintain their market share.

The US dollar is suffering a death by a thousand cuts.

But wait…. Trump said, the dollar is “too strong.” And “it’s killing us.”

The US dollar is suffering from the abusive husband syndrome.

Yeah, those sweet dreams about oil for yuan… Sorry, buddy, Russia and others are only taking greenbacks and nothing’s changed. You forgot to add about Silk way btw, it’s been quite popular among Chinese optimists here lately

Chinese optimists? NO just realists because it’s a great idea that WORKS I traveled to the Polish border with Belorussian in November to see it in action and all I saw was snow and hail buts it’s still a great idea

The fed is tightening its grip on shadow banking insurance and SWF ? Once they are eliminated large chucks of free cash will disappear along with current wages and Future prices?

Ltcm enabled the fed to steal 1.5 trillion? TARP will net 7 trillion?

International wage disparities will always make the dollar seem too strong?

Lower American wages softer dollar?

nick kelly,

Russian dollar reserves went actually up a whopping 12 bn in November. Eussia has an excellent financial position. The same is true for Saudi Arabia. For these countries current oil prices are a fantastic position to make good profits and increase market share.

>>> “Russian dollar reserves went actually up a whopping 12 bn in November.”

Actually, no. Russia’s foreign exchange reserves have fallen for the past four months though December and are down nearly 30% from early 2014 – though they’ve recovered some in late 2015 and early 2016. That said, at $377 billion, they’re still in pretty good shape.

http://www.tradingeconomics.com/russia/foreign-exchange-reserves

Wolf,

According to the official website http://ticdata.treasury.gov/Publish/mfh.txt

Russia increased its official holdings from 74.6 bn in October 2016 to 86.6 bn in November. This comes at rather low oil prices in November. High oil prices in December make much higher dollar reserves likely. The reserves you are talking about are total reserves including euro, yuan…., which are also in a good shape.

OK, we’re now mixing data.

Foreign exchange reserves held by Russia are reported by Russia and covers all foreign-currency denominated securities (the link I supplied).

US TIC data is reported by the US Treasury and only covers US Treasury holdings by Russia in US custodial accounts. So if Russia sells euro-denominated securities and buys Treasuries for that amount, it won’t impact the foreign exchange reserves total, but will change the composition. So that might explain the divergence.

Since you were talking about the “excellent financial position” of Russia, and the “reserves,” I assumed that’s where you were heading.

BTW, according to the TIC data, yes, in Nov Russia’s holdings rose, but they remain lower than a year ago.

Whats is the point of your post Nick? Is is to say most things that happen financially and politically are NOT motivated by ulterior motives, but the results themselves are actually the result of coincidences!?!? Yeah cause no one is ever trying to mold the outcome to their benefit… I’ll go with the other guy, thanks…

The Chinese and the Japanese have been selling Treasuries at close to their peak values. Nothing wrong with buying low and selling high. But just wait until big foreign U.S. stock shares holders, like the Swiss National Bank, start selling off U.S. stocks at their peak prices. Now that could be something to worry about.

The yields are going up fast; I hope it will keep going and keep going faster; no more cheap money. If 10 year treasury goes up just 100 points, so many of asset bubbles will implode.

Yellen is a weight lifter!

She is able to hold the long and short end of curve with one hand?

Watch how she makes long paper (treasury bonds) disappear and reappear as ten times that amount in treasury bills!

Watch how she takes 6 months of minor paper losses to enable a 4.5trillion dollar slight of hand as she hands out equal dividends to here loyal regional presidents and makes that balance sheet nitemare (roflol) disappear ( once and for ALL?)

Well, there are enough yield-starved investors out there who are ready and willing to buy those bonds and hence drive yields down.

BofA and Merrill-Lynch recently had an analysis which showed US Treasuries yields have been dropping all throughout 2016 during Tokyo trading hours. This means somebody active during those hours is buying US treasuries, and buying a lot of them.

Given how interconnected the world is, this “somebody” doesn’t need to be somebody physically based in Eastern Asia but given how yield starved Japanese investors are, the suspicion their colossal insurance companies, elephantine pension funds and other investors that need/want to stay conservative have a hand in it is strong.

MC: This is not about yields; as Wolf had mentioned in one of the articles, some of the firms buying treasuries are shadowy companies in some islands. The only organizations who can buy such massive amount of bonds are governments and central banks.

The suspicion about who is buying can easily be solved. This is not Russian hacking. The US has ample intelligence to find who is buying- not that this is likely to be necessary.

Any US insurance co or pension fund would have to disclose its holdings.

Can’t wait for the sound of the thing imploding to be honest Cyrus It’s gone on FAR too long already I’m sure many experts will disagree but I couldn’t care less

If it had gone this long naturally and by sheer forces of the market, then we would not have had any right to complain; but the thing is that it is fake. The only people who will get burnt huge if the market crashes are speculators, and idiot who believe their bull market will continue another 5 years.

Aloha friends..Always willing Speculate and to Jump into ‘Uncharted Waters’…This water Being the South China Sea….let’s for arguments sake,just speculate, that come the 4th of July..a Few Fireworks go Off…! Why,by golly…it Seems Coincidentally and Interestingly enough, that Two Big Holders of Treasuries..would Have Ring-side seats….! lololol thanks for reading,aloha

Cyrus,

It is the cheap money that is keeping the economy propped up. Share buy backs, acquisitions and fake businesses that spend lots of capital but do not make any money. I suspect the FED will go to extremes to keep the bubble alive.

Combating deflation by blowing out short duration paper – re-educating hoarders by juicing velocity?

When you plan to retire trillions from excess reserves prices will perhaps notice?

Printing press on gusher mode – oh-klahoma!

According to Prof. Steve Keen, I believe Kingston U. in London, the world’s private debt is the highest ever recorded in human history and Chinese private debt is off the charts.. Keen’s take is when central banks raise rates to stave off inflation when private debt is extraordinarily high a crash always follows.. We are now in uncharted waters..

I just checked out Keen.

Interesting

Does anyone know if China’s total foreign reserves are declining at a similar rate and also what percentage the treasuries are as a proportion of overall reserves ? Thank you.

What we know for sure is about their willingness to save the face by sticking to the $3 trillion mark (the same way as they prop up their stock exchange index while Chairman is at Davos). What we don’t know is the quality and liquidity of what’s left (there are huge doubts about that)

Straight from Bloomberg: https://www.bloomberg.com/quote/CNGFOREX:IND

I expect the good folk at the Bureau of Statistics in Beijing to get to work soon because that’s one really ugly chart.

I think capital flight is actually a minor reason that China is selling U.S. Treasury holdings, although it does need every dollar denominated asset it can get its hands on. China’s financial system was built around the dollar trade, and the assumption that the trade surplus would keep growing at an exponential rate. Now its exports are actually shrinking, and all those dollars it counted on to pay off its massive debts, both internal and external, are getting harder and harder to find. It has no choice but to continue to sell its U.S. assets, because if it stops, financial chaos will result.

In 2008 when the US was about to enter a graveyard, China saw

it as opportunity to take over the world.

They piled up debt, in the same dimension of their GDP, a lot of

it from the wholesale pipe line of credit card debt.

And now they are sorry about that speculative move.

Since 2008 & 2011 “events”, this pipeline suffered corrosion

and gushing holes, dollars are hard to get, and the PBOC, China

central bank had to sell UST to get dollars, or lend to the big

banks, so they can use UST as collateral for borrowing more

dollars, swap debt.

When the want of dollars on the rise, interest rates are rising.

Interest rate is rising not because of inflation, but because of

debt problems.

Central banks have no influence on the rise of interest rates.

Many Pundits think that the PBOC is dumping UST in order to

protect their currency, or to punish speculators, but the real

problem is that the Big Chinese banks have problems to

pay, or swap their wholesale credit card debt.

In order to keep the markets sane, the PBOC filled the gap,

the reduction of foreign assets with RMB assets and the total

assets is constant, at about the same level.

But of course it doesn’t solve their dollar problems.

Gold will be dump, too !!

Much of the oil that China gets from her suppliers, like Angola,

or Venezuela is not imported for consumption, but is sold to

in order to pay debt. Much of the Chinese oil is being used

as currency, as dollars source. GDP source.

Many suppliers are sending oil to China as debt payment

for construction projects, or other loans. When oil price was cut by half, from $100 to $50, shipments had to double and that

stripped the suppliers of foreign currencies and their people

starve. Not enough money to import food and stores shelves

are empty.

Going to get all there money and then their gold and than vaporize their coastal ghost towns?

It will be another century before we worry about chiiiina!

Starting in 2008 China had about one generation to take over the world. After that the demographic time bomb of an aging population aggravated by the one child policy naturally turn a society more inward looking. China isn’t normal.

What’s different about China is they are centrally planned communists that don’t react well to bad news often pretending there isn’t any. The current leader looks more and more like Mao with every turn in the road.

We will see what happens, the clock is running.

This. The latest anecdote from China is they’re suspending local meteorological bureaus from issuing smog alerts. Simple as that and smog is eradicated!

That’s an interesting theory.

The liquidation plays right into the feds long term scheme?

Up to 2014 Japan and China added nearly USD 200 bn of Treasuries per year. Now they are shedding USD 300 bn of Treasuries per year which leaves a gap of USD 500 bn in dollar demand per year. For the US this has been sort of a free lunch as central banks of China and Japan were not supposed to sell any of these Treasuries. The US Treasury market is now completely dependend on hot money searching for a yield advantage. If the US economy cannot bear the higher interest rates and interest fall again, the USD is set for a massive collapse.

Another parallel development, trade denominated in Chinese yuan is making up a greater proportion for goods and services. How long will China need the mighty USD$?

I think this issue needs additional emphasis :

Since the great ole USA is broke — we can safely assume that the bonds China has reduced from its portfolio were not “cashed in” ( at the US Treasury ) or “retired” . I am unsure of the precise language to use here as I have nothing to do with bonds, etc.

So here is my point that I thin needs emphasis : If China “reduced its holdings” then it must have sold its bonds.

TO WHOM , PRAY TELL ?

I am serious, someone bought the bonds, but who ? ( And perhaps there is a related question here, “why?” )

SnowieGeorgie

I think you are getting close to the essence of the matter, SnowieGeorge.

My own hypothesis is that “China” (China-based banks, really) effectively is selling its own holdings of UST to its own citizens, for payment in RMB. The whole thing is basically China banks doing the transactions needed to facilitate the ongoing China capital flight from RMB into USD. It seems mildy illogical on the surface, but nevertheless true, that in order to strengthen the RMB, PBOC and its underling banks are in fact selling UST to its own citizens.

In order for the accounting to balance, someone inside or outside of China must then buy RMB, or rather RMB-denominated assets (bonds). The demand for RMB could come from somewhere else, but with China exports fairly flat, the buyer of last resort for RMB is PBOC itself, or its member banks.

US Treasuries yields are far higher than those elsewhere. And if they rise enough, as they’re doing now, investors will flock to them.

As long as the US can print its own money, it cannot go “broke” in the sense that it cannot redeem its bonds. It can, however, destroy the value of the currency :-)

2017 federal budget supports a 443 billion deficit. who will buys these bonds ? the feds OR the public/private sector ? stay tuned

You’ve got to keep in mind that many of the largest investors in the world (pensions, sovereign funds, etc.) are MANDATED by their investment policy statements to buy a certain amount of fixed income.

There’s no shortage of fixed income investors out there.

JB, The US twin deficits of a total of USD 1 trillion per year – FED budget and trade deficit – are financed by fixed income investors and institutions including Central Banks. However, this trade gets somehow crowded as China and Japan have huge capital outflows and have not anymore the capacity to invest current account surpluses. In addition, the Euro and the yuan want to be in the reserve currency status as well. This is in my view actually the main reason for the creation of the euro (the big dream of Charles de Gaulle to challenge the USD). As this trade gets crowded, the tensions between USD,Euro and Yuan are very high. Since Feb 2016 more bonds are issued in Euro than in USD. Finance in Euro and buy USD. Low Euro interest rates and falling currency are in my view also the reason for soaring commodity prices despite a strong dollar.

Yields are not going up in the long run. A secular bear bond market given the structural issues facing the world is more or less unforeseeable, and hard to believe that so many prominent and intelligent fund managers and economists support it.

There are two huge obstacles to rates going higher in the long term: the global debt overhang, and demographics.

(1) Unproductive debt: From the 50s to the 90s, approximately $1.70 in debt generated $1.00 in GDP. Today, it takes approximately $5.70 in debt to generate that same $1.00 in GDP.

(2) Excessive debt: global non-financial debt is 325% of GDP according to the IMF. China added $3 TRILLION in debt in just the first three quarters of 2016 (and helps explain why Chinese growth is faltering, the Yuan is depreciating, and capital is leaving). Excessive debt brings future spending into the present, and effectiveness is lost over time (see point 1).

(3) Weak growth: the World Bank estimates global growth was 1.1% in 2016, compared to the average of 7.2% since 1960. World trade decreased almost 1% in 2016. Again, this amidst a huge expansion in credit… see point 1.

(4) Demographics: in 2016, the US population increased 0.7%, the lowest amount since 1937 according to the Census Bureau. The fertility rate reached an all-time low in 2015. And the average age of an American, now at almost 38 years old, is a record high. Real disposable income per capita is decreasing and trending down. When births + immigration are increasing and income is also increasing, it’s a virtuous cycle. Today, we have the opposite, and we’re stuck in a negative loop.

(5) Exhausted demand: the current economic expansion is in its 79th month. This late in the expansion, demand runs out of steam. People have made their big purchases; as pointed out by Wolf recently, this is best evidenced by the collapse in auto sales and rise in delinquencies. It’s virtually unforeseeable for growth to “explode” up to 3, or even 4% (utterly laughable) as some in the incoming administration have suggested is possible.

Expect low growth, and yields to resume their downtrend– don’t be surprised at all to see 30-year yields back down to 2% this year.

Now, some of the vague things Donald Trump has talked about are definitely pro-growth in theory, but in a best-case scenario will take years to materialize, and that’s assuming no economic shocks in the mean time. And even then, all of these structural factors absolutely dwarf the potential benefits.

I’ll leave you with this… in response to stagnant economic growth, Japan implemented large tax cuts and huge infrastructure spending (sound familiar)? Government debt went from about 70% of GDP in 1997 to nearly 200% of GDP in 2016. Result? Nominal GDP barely budged. And that was amidst a better domestic situation (lower debt starting level), and a better global situation (much better growth).

I think you are saying that a stagnant, no growth economy can’t experience inflation.

But it can, in a situation called ‘stagflation’ a term first coined in the UK of the 70’s when the BOE under Labor direction, tried to combat low growth with money printing. But the UK economy of the time had too much structural rigidity to put the liquidity to use, hence inflation and stagnation at the same time.

Thatcher has been called a butcher, but when your limb is gangrenous, either it goes or you do.

She inherited a basket case. The much worse economies of France. Italy and Spain today are the result of never having a Thatcher.

Brazilian stagflation in 2015:

GPD growth -3,15%

Inflation 10,67%

2016, also, but in lower scale.

We missed hard some Thatcher here, by the way.