Not all is well at this glamorous piece of real estate.

The iconic mixed-use 58-story Trump Tower, on 721 Fifth Avenue, in Midtown Manhattan, with top-dollar retailers such as Tiffany’s nearby, was the ultimate in condo living when it was built in 1983. Now it’s even more iconic as President Elect Donald Trump holds court there, among enormous security measures and the daily flow of potentates, moguls, Big Oil CEOs, the occasional Silicon Valley wunderkind, billionaires, retired generals, Goldman Sachs folks, and the like.

But not all is well at this piece of glamorous real estate.

Of its 238 apartments – located on the top 38 floors, including nine duplex and triplex penthouses on the top nine floors – 11 are actively listed for sale, according to CityRealty, and another 12 are listed for rent. Asking prices and asking rents have been slashed to get the units to move, and it’s not working very well.

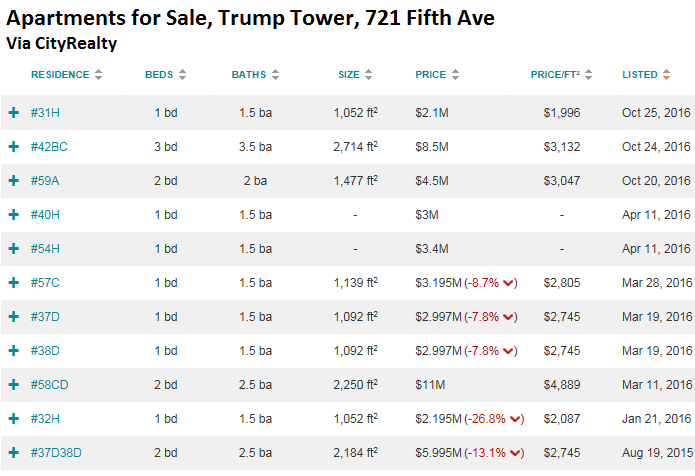

The table below shows the 11 apartment listed for sale. Three of them consist of two units that have been combined: 42BC, 58CD and 37D/38D. Five sellers have cut their asking prices, with reductions ranging from -7.8% to -26.8%. And note for how long they’ve been on the market (right column), in a market that isn’t exactly ideal:

For some units, asking prices have been cut more than once. For example, 37D/38D, with 2,184 sq ft, was originally listed over a year ago, in August 2015, for $6.9 million, according to StreetEasy. In February 2016, the asking price was cut to $6.5 million, in June 2016 to $6.2 million, and in October 2016 to $5.995 million for a total reduction of 13.1%. And still no takers.

The potential buyer can expect to pay common charges of $3,620 per month and taxes of $3,328 per month, according to StreetEasy. This would come on top of the mortgage. At current asking price, with 10% down, financed with a 30-year fixed rate mortgage at 4.2%, the monthly payment would be $26,400. So that would amount to monthly outlays of $33,348. But the views are nice.

Unit 32H was first listed for sale in January 2016 for $2.999 million. In March, the asking price was slashed to $2.5 million, and in May it was slashed to $2.195 million, in total 26.8% in reductions, and still no takers.

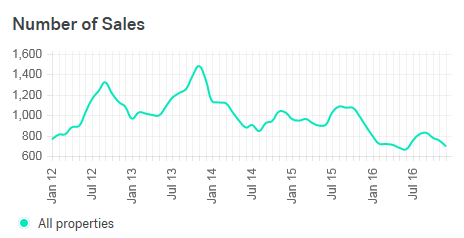

And there is a lot of competition. Zillow lists 6,330 apartments for sale in Manhattan alone. And the trend has not been the friend recently. Trulia figured that the median selling price of New York City apartments dropped 4.1% from a year ago, as sales volume has withered:

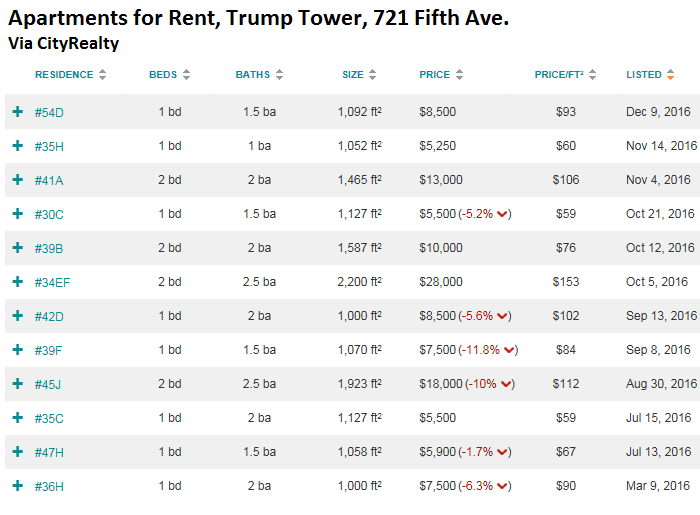

There are another 12 apartments for rent at Trump Tower, including one with two original units combined (34EF). In the table below by CityRealty, note the reductions in asking rents, ranging from -1.7% to -11.8%. These are just asking rents and do not include any concessions:

These units have a lot of company. Apartments.com lists 11,014 apartments for rent just in Manhattan. As I reported earlier this month, according to Zumper, the median asking rent for a one-bedroom in New York City dropped 7.4% from a year ago, and for a two-bedroom 7.9%.

But that’s just the asking rent. They’re kept as high as possible for appearances’ sake. To motivate potential tenants, rent concessions are piled on separately. These rent concessions just set a new record in Manhattan, according to the Elliman Report, with concessions now offered on 25.1% of all new rentals, up from 13.5% a year ago.

Is all this just a dip in New York City’s real-estate boom? Maybe not – as ominous clouds are forming. The New York Post, citing data from Attom Data Solutions, reported the foreclosures are once again surging:

More than 1,100 NYC households fell into foreclosure in October, a 32% increase from September, and a 37% increase from last year. Queens, which has been hard-hit since the foreclosure crisis began in 2007, had 400 new cases last month, nearly double the number of a year ago.

Brooklyn also took it on the chin, with 365 new cases, a 20% increase. Statewide, the number of new cases jumped 15%…..

“We’re definitely seeing a spike,” Westchester-based attorney Linda Tirelli told the New York Post.

So Trump Tower may be getting hit a little harder than other buildings in New York, given the brouhaha about the election campaign and now the even greater brouhaha around the President Elect holding court in it. But the entire Manhattan housing market, after years of booming at a blistering pace, is seeing the sudden and very unpleasant arrival of second thoughts.

And not just in New York, but now also in San Francisco, Boston, Chicago, Washington DC, and perhaps a city near you. Read…. The Great Unwind Unravels Hottest Rental Markets in the US

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“So that would amount to monthly outlays of $33,348.”

Remarkably affordable for such terrific views! And the highest rental is $18K/month! This just shows how smart the 1% really are.

Your definition of “smart” is paying $33,000 a month to live in Trump Monument Towers in NYC. Is that a joke?

Yes.

Trump Tower. The biggest bullseye in the world for all of the disaffected people we have been “winning” over with “air power” for the last several decades.

Who in the heck would want to trudge through the security gauntlet every day. Not to mention all of the protesters.

Be interesting to see what the occupancy is in a year or so…

I not sure about that. Rich people, and other hangers on, like to be in the company of — or at least seen in the company of, so-called celebrities. ( I celebrate them not ) .

Only as an example, look at that big man with a self-image problem, meaning the Big O, who has surrounded himself with celebrities for 8 years. Summering every year in Martha’s Vineyard just to be surrounded by H’wood glitterati and ultra-millionaires — especially after the damned Clintons came to Martha’s Vineyard for EIGHT LONG YEARS as well, for many of the same reasons.

It has been exhausting to live here in Massachusetts ( my whole life ) and watching the Obama-Clintons spend sixteen long years summering in only one state of the fifty.

It had to be the celebrity angle , because there are dozens of fine places to summer in the USA, without going every year to Massachusetts, d’ya think ?

So — using that as an example — I see the same celebrity worship driving small people with big egos to flock to the Trump Trophy Tower — just to see and be seen with “celebrities” .

But I could be wrong . . . . .

SnowieGeorgie

They come to my neck of the woods way too often as well Georgie so dont feel too bad Sag Harbor N Y I once had to tolerate a then Senator Clinton promoting a water protection project at my village beach while out to walk the dog Terrifying I tell you

Well those Small people would I presume also have SMALL wallets…lololol

They went for the Pizza

Care to bet that some of the new tenants are folks on the no-fly list?

Good point. Wouldn’t want to live within a country mile of the orange cartoon character

Manhattanites are hoping Trump will vacate the premises, the sooner the better. But I don’t think that is going to happen. What seems clear is that Trump never wanted (or expected) to be president. He just wanted to win the election. Now he’s stuck–Cabinet meetings are going to cut into his Twitter time.

Bet he is ruing the day he encouraged the Russians to hack swing state vote counts.

Oh the politics of envy.

I believe he campaigned on the politics of fear.

So much silence when Bernie Sanders was fooled, tricked and cheated…..so much silence.

Ask yourself, who would do better dealing with Putin? Hillary or Donald?

AND, Donald warned us all, and said repeatedly, the elections were dishonest and everybody laughed at him and called him a poor loser…..until he wins…….and now, everybody who laughed at him are saying the elections were rigged.

What a bunch of pathetic losers.

They “forced” him to say he would support the Republican candidate….while the other 12 losers stood there on the stage with their self-centered little smirks…..until he won, and then the fat one, Bush, ran…the little one ,Ted, ran away too, and the Cuban ran back to Little Havana.

Interesting, is it not?

Trump did say the election was rigged. I guess he knew what he was talking about, since it was his outfit doing the rigging.

Yeah right, let me ask you, do you think Bush won in hanging chad Florida?

Gore won and Clinton stole it for Bush, the goal was to make Hillary president, cant follow Gore now can we?

The Clintons and Bushes are in cahoots, glad to see they are both gone.

I am glad you are so happy and content with a con man – clown as president. I also hope that our country is saving a big pot of gold to deal with Climate Change. The Planet Earth operates in reality and the laws of nature.

PS: 70% of the invertebrates that were alive in 1970 will be extinct by 2020.

100% of the neanderthals that were alive 40,000 years ago are extinct. Climate does in fact change.

Trump said there was voter fraud. That’s different from election fraud. Voter fraud is rare in the US. Election fraud, on the other hand, is not (although it’s not always called fraud and is sometimes legal). IMHO, redistricting, Crosscheck, and voter identification laws are examples.

“Bet he is ruing the day he encouraged the Russians to hack swing state vote counts”

come on……we Americans have to stop being so gullible. And stop trolling or don’t forget the /sarc at the end of the “fake news” comment.

Ahh ita those pesky Russians again Im hoping Marys post was sarcasm but somehow I dont think so Isnt it alittle early for that koolaide girlfriend?

Maybe Trump hopes to get many Manhattanites of a certain kind to live in the tower, as ‘protection’ against accidents from disgruntled elite. Much better insurance than vacating the premises.

If I were him I would check who profits from the insurance policy when the tower gets an ‘accident’ though, just to be sure.

Somebody may “pull”it

Anyone know what those condos went for originally when that place was built?

Wikipedia: “The residential units were more successful [than the retail and commercial spaces], and 95% of the condominiums were sold in the first four months after it opened, despite their high prices — the cost of condominiums at the tower started at $600,000 and ranged up to $12 million, attracting many rich and famous residents…”

https://en.wikipedia.org/wiki/Trump_Tower

The article also describes some of the allegations, shenanigans, controversies, and lawsuits during construction and early on.

I went to look at a one bedroom at the time they were selling and it was $150K. It was a nice apartment but not out of this world in any sense. The only upgrade I remember was marble tile in the bathroom. A similar apartment in a nice neighborhood in Queens was probably $30K at the time. I thought the prices were ridiculous but he sold them all.

I think I’ll rent an apartment in Trump’s Monument for…..oh say…three minutes.

When’s the honeymoon going to end? Inauguration Day ?

It’s not a honeymoon. It’s a droit de seigneur.

I meant droit de prélassement. Sorry.

what does that MEAN??? did a search and nothing came up. i always feel socially unintelligent when people throw french out beyond “rapprochement” or “pied a terre” or “frera jacka.”

http://www.todayifoundout.com/index.php/2014/09/jus-primae-noctis-fact-fiction/

He wants to keep producing the Apprentice- he hasn’t figured out that in the other gig you get to say ‘you’re fired’ a whole bunch of times

My main takeaway from this article:

” Now it’s even more iconic as President Elect Donald Trump holds court there, among enormous security measures and the daily flow of potentates, moguls, Big Oil CEOs, the occasional Silicon Valley wunderkind, billionaires, Goldman Sachs folks, and the like.”

So much for the suckers telling us Trump is an outsider.

LMAO!!

If he was a real insider why would he need all those (extra) visits? Wouldn’t he already know exactly what the establishment wants, and have his plans ready to profit from it? It doesn’t look like that to me, he is making it up as he goes and discovering the harsh reality of modern politics which is very different from controlling a business empire.

All those extra visits? Do your friends visit you much?

So do his. Time to wake up, you’ve been had sucker.

The market would have to unwind a lot more than it has before the building operators started losing money.

Building operators tend to mostly make their money on the first sale of units, not on resales, and on building fees. So resale prices aren’t particularly important to the building operators, except so far as they affect occupancy. While occupancy is down somewhat, it’s unlikely to be anywhere near what would result in operating losses. For now, they’re just not making as much money as they have been, and that has been a lot. The margins in this game generally pretty fat: hence the billionaire real estate developers. So forgive me if I’m not particularly impressed.

Of course, a softening market could be catastrophic to new investment, but the present article doesn’t discuss that. Previous articles have pointed out that new investment in other soft markets, like Miami and the SF Bay area, could be in a great deal of trouble.

I work in Long Island City, Queens, just over the bridge from midtown Manhattan, and there is a phenomenal construction boom taking place, both hotels and rentals. Huge buildings are going up all over the neighborhood – among the most heavily polluted on the city – which, though well-served by mass transit, can be a hard place to buy a quart of milk. Thousands of units within a couple of square miles, and new development parcels continually being assembled…

It’s hard to imagine someone not taking a big hit on this stuff in the not-too-distant future.

Very true. The bankruptcy courts will be busy.

That said, your new president will no doubt face certain economic realities which may compel him try to actually live up to some of his vaunted campaign promises. His party is known to resent them, he does poorly under compulsion, and really, he’s no politician, so this will be interesting. Should be fractious.

You have a very nice insight on the difficulties for wannabes in actually trying to live in the more rarified strata.

Odds of a rate increase are currently 100% how much of a surprise would it take or how many in a series would the fed have to raise to bring odds down to a 50% probability?

That number is how far behind the fed is in raising rates?

The FED has never raised rates when the odds weren’t 100%

Fed has never faced a market expectation of 100%?

Now how many times more will it take until the market gets back to 50-50?

Forward guidance be damned, if the tail starts wagging the dog?

The fed is being painted into a corner by the rabble?

The fed needs to cause a fresh recession to get back in front of the yield cycle?

The past few years have gone as follows: Fed threatens to raise rates (we’re REALLY gonna do it this time, guys!) > yields and dollar spike > international/emerging market sell off > domestic market sell off > Fed doesn’t raise.

I believe most of the ‘street’ is projecting 2-3 raises in 2017, in addition to one tomorrow.

I find that to be delusional. There is an obscene amount of dollar denominated debt out there right now. Any real rise in rates is going to crush EM and dollar strength is going to hit multinationals and domestic earnings.

That being said, this market has consistently proven pretty much everyone wrong for the last seven or so years, so who the heck knows what will happen.

Wolf has been documenting a slow down at the upper end and that should impress you. If the wealthy are slowing down spending that does not bode well for housing at any level below. It is not different this time.

As far as I can tell there’s a glut in the higher end throughout the North East. Why build small units for the plebes?

I see apartment complexes going up, all with ridiculous rents. Possibly the high rents are to keep out the sub- six figure types, then the rents are brought down during the ‘discussion’ phase. North East rental market procedures are highly unregulated compared to California.

You can expect your land-lord to enter your unit without notice just about any time in the North East. Wouldn’t happen in California and some other states i’ve lived.

So yes, the high end is cracking. But I’m not so sure about the more modest abodes.

i’ve suggested this many times and it’s worth underlining and italicizing again because it’s an important book, although “unsexy” because it’s about non-rich places for people to live:

read EVICTED by Matthew Desmond. he writes a horrifying report about the low end of rentals in the midwest but it’s the FUTURE because they’re not building low- to medium- income housing any longer and there is going to be a shortage for all the new broke people coming online in america.

it’s why Warren Buffet is investing in trailer parks.

it’s a difficult read because when you’re preying on the broke, anything goes. one story was this legless father being told he could catch up on behind rent for painting the above empty apartment. the landlady only credited him something like $15 for 3-day’s work he did with his son. she kept him behind on the old company store model.

it was a verrrrry difficult read, like plunging your hands into a bloated corpse, but i forced myself to return and finish the book. Desmond admits he was depressed about humanity for a long time after writing the book and i get it. it gave me a new insight to what’s happening in san francisco and where “anywhere else USA” is, or is headed.

There is a immense disconnection in this country between those who are doing OK and the homeless. Oregon sure has its share. They are everywhere. In Medford there are so many that there is a task force trying to figure out how to help them. Here is one of their ideas. http://ktvl.com/news/local/the-future-of-hope-village

They have so many in Portland that there are entire villages of them. In other countries such as Brazil they are called Favillas or slums. They are on almost all the major streets anyway. Some estimates that there are over 21,000 homeless school aged children in Oregon alone. Just think what kind of a future they have. Our future leaders?

And the wealthy for the most part either don’t see them at all or have decided that it is their own fault. Their numbers just keep raising and I can not imagine that any person would choose such a lifestyle unless either mentally ill or an untreated addict. Yet it is easier to blame them than to accept that it is the priorities of the rich that have created this.

The homeless are a very sad commentary on this country that the elite want to believe is the shining star of the world. Some shining star. Such a great Christian country (in belief only, certainly not in actions).

Buffett’s mobile home business (Clayton Homes) has many under-reported problems (search for their scams and scandals on DuckDuckGo, for example). They are effectively predatory sellers/lenders operating under the guise of “We need to gouge customers because otherwise they could not get credit”. Their parents didn’t get across the message about ‘Just because they can doesn’t mean they should’.

If Saint Warren and his minions sacrificed a little return (look at his mountains of cash) and looked deep into their souls, they might not take such hard line positions with their fellow human beings.

ECONOMICMINOR:

“There is a immense disconnection in this country between those who are doing OK and the homeless.”

you said it. and it takes so LITTLE to find YOURSELF suddenly invisible untouchable as no one has any back up savings anymore. it’s the same disconnection that had people not understanding the trump phenomenon. it’s this constant, habitual DISCONNECT that worries me most. on BOTH and ALL sides.

i had NO IDEA how much grown folks STILL insist on believing in santa claus.

KL,

As I have posted previously, I rented from one of the mega single family home landlords in Florida. I am ready to predict based on my experience, that those houses are all headed for section 8 housing. The houses were not well renovated or well maintained. The rents are so high that only the highest earners can afford them, unless they double or triple up. The supply of above average earners that don’t already own in Florida is not that high. Last year the median income in Florida was under 60K.

The only pool of renters left with the resources to rent from them are the section 8 subsidized renters. Those landlords will sell what they can and rent out what they can. They only care about income streams and with the poor they don’t have to provide any services, because the poor are totally unprotected. The taxpayers will be using the rest of their savings to bail out those landlords.

“because the poor are totally unprotected.”

Not under HUD. At least not in Oregon.. HUD makes yearly inspections and more often when tenant complains. If there is a discrepancy, HUD withholds the landlords money until rectified. And getting rid of a HUD renter that you haven’t documented infractions is also not easy. They actually have more rights than the owners. I really don’t like to rent to people on HUD because of all the rules. Many more than just the landlord / tenant laws.

that makes a lot of sense- regarding trashed/neglected rentals going section 8. especially in the suburbs which, as i’ve said before, feel like nyc in the ’70s to me now.

my friend in Santa Rosa won’t walk her dog in the park alone and gets followed by ominous men and there are loud bands of people living in the dry creek behind her house that she goes out and begs for them at least to be quiet if they’re gonna live there.

(and she and her girlfriend are gonna force themselves to suck it up and live together because it’s way too expensive to move.)

PETUNIA-

so i was thinking about you saying there’s going to be a bunch of houses that’re being mass-neglected and likely to become section 8 rentals—and i remember how ONE rental in a suburban neighborhood would anger the other home owners—so wouldn’t masses of neglected houses as section 8s in a neighborhood kill the value of those neighborhoods because if management is ALREADY neglecting them for higher paying tenants, then…???

and how would a home buyer or current home owner KNOW this was gonna happen (a whole pallet of houses becoming rentals)? it seems cruel because it seems like your home values would plummet.

and i’m not saying section 8 PEOPLE are to blame. there’s a lot of hate for the poor and they’re not the ones i’m talking about: i’m talking about the impersonal nature of such a company even doing that in the first place and then they’ll be worse when they’ve got po’ folks in there.

KL,

Most of these mega landlords have websites with rental houses listed and even mapped. If you are buying in an area with a large number of these homes, you can do a drive by and take a look. Most of the rentals are fixed up to look nice. It’s the upkeep that is a problem.

I rented a reno which turned out to have a lot of problems, one of which was an unpermitted and incorrectly installed garage door. I had to be home for 10 appointments just to get that one problem fixed. This was common for the other problems as well. Nobody with a job can afford to take that much time off, which is why the houses quickly fall into disrepair. I was a stay at home housewife and felt like I was working for the landlord, with literally dozens of workers coming to the house all the time, many with no appointments.

Most of the people they send are hired because they are cheap. Not only to they usually do a poor job but they create additional problems as well. The guys that came to attach the dishwasher to the counter, improperly installed the plumbing, which cause a bad flood in the house. That lead to 7 weeks without the use of bottom kitchen cabinets which had to be replaced, another cheap fix.

The problems I had were common problems with other renters and there are many postings on complaint websites. This is why I wrote about these companies not being good investments, or even good sources of new housing inventory.

Perhaps after the 10th NY condo, it’s time for a new yacht?

The herd’s expectations are low and still declining. Not to worry.

There is an article on Zerohedge today describing the ‘crash’ in the London (UK) property market. It is a fairly similar but more dramatic story. But don’t fall for the ‘crash’ word, as this only means that ultra high end property is now slightly below the listing price of one year ago, and the slightly less ridiculously priced properties close by are still climbing in price. Owners who purchased more than a year ago are still sitting on huge profits, often for properties that have always been empty.

Wake me up when prices decline enough to wipe out all the gains since the FED-sponsored rally from 2008 on. Such a ‘crash’ would be a good start to end this worldwide bubble for good. But what can be seen now in some ultra-high price markets couldn’t be further removed from a ‘crash’.

In Netherlands we haven’t had a housing crash since 1981; there have been a few -10% or -20% hiccups along the way, but they don’t mean anything given the total appreciation (+1000-1500% since 1990 or so; and I’m not talking about Amsterdam prices but the whole country). Oz hasn’t had a crash since 1991 I’m told and probably isn’t much behind the Netherlands in appreciation, although my impression is that much of Down Under still has relatively affordable housing and the problem is mostly confined to some of the big cities.

In both cases heavy government support for the housing/mortgage market is the real cause with the low rates of the last years adding more fuel to the fire. This will only stop when the RE market crashes so far that government is unable to rescue all the small speculators. I would love to see this happen and wipe out all the entitlements and dumb speculation, but the RE market seems as cocksure today as the stockmarket. They have learned that the government / central banks always come to the rescue.

In my little corner of the world there is also a slowdown in high end properties, which is anything above 1 million euro or so. Many of the listed properties have been on the market for years, sometimes slightly reducing prices every few months or so but not much is moving. Many properties have been pulled from the market over the last year (despite record RE sales in Netherlands), probably because owners found out that there dream sales price isn’t going to happen. And here to, a big chunk of those trophy homes are empty, have been for years.

Just hold on a bit longer, home prices always go up so sooner or later the owner will win the lottery ;-(

“Crash” on Zero Hedge means a 0.1% loss. If gold goes up 0.1% it is “sky-rocketing”. Just a little culture issue at that particular website.

The ongoing apartment building boom is Obama’s gift to the poor as he leaves office. Much of this is financed by Fannie/Freddie and will ultimately be made into low income/subsidized housing when the economy tanks.

Mel Watts was moved into a key role to support this plan. Obama decided if he had to deal with Bush’s McMansion bust when entering office, at least he was going to have a housing boom that would benefit poor folk.

His gift to the underemployed masses was rent seekers. He had his chance and blew it, IMO.

you’re missing a whole sector of society that Petunia was mentioning that still seems somehow invisible: the formerly middle-class who’re stacked into still-decent dwellings like cords of wood.

it sounds cute to think all these new condos will soon be used by section 8 folks, but what we’re seeing here in the older (still expensive) apartments is that middle aged people are living 6-up to a place, living in large victorian closets or crashing under stairs and on sofas.

i know in the suburbs that families are living 2 families to single-family homes and kids aren’t leaving their parents or are returning home.

they NEVER talk about all this in “the papers” but look around.

and it does weird stuff to people socially to have no privacy or live too closely….

just heard the next new couple that moved into the studio downstairs having their first loud, crashing fight downstairs the other week.

forget the “american dream” as regular human mating connection friendship and reproduction is taking a beating.

Advances in the price of real estate way beyond the means of modest people has been an intrinsic part of modern capitalism.

People who were once ‘productive members of society’ become marginalized as the speculative advance of land pricing out-strips the ability of those who made the village or city to afford it.

The interesting thing is that although the Fed and its free money policies have exacerbated housing inflation, its been happening for as long as people have been observing it.

Read “Progress and Poverty” by Henry George. He observed San Francisco’s accelerating land markets in the 1800’s. (so he beat Wolf by quite a few years).

The book sold millions of copies in its time (in the 1800s!)

Now free on a few sites as copyright has long since expired

http://www.henrygeorge.org/pcontents.htm

Mr COUCH SURFER! thank you for that. i pulled it up and will look at it later.

Indeed. That’s why rents for low-income citizens have skyrocketed. Obama is so benevolent.

Looking at those rents and apartment costs I really understand how far down the economic ladder I am. Just a peon. Obviously some people spend as much in a month on a roof as my total expenses are for six months.

Thing is I am well off and have plenty to give and travel and enjoy my life. Unless something really awful happens, my wife and I should be able to leave quite a sum to our children and grand children.

I just don’t understand why enough isn’t enough for some others.

There is a story about the author of Joseph Heller. apparently he was at a party in the presence of some fabulously rich person. JH said ” I have something he’ll never have “. His friend asked him: what’s that ? Joseph said “enough “.

May you long enjoy your genteel sufficiency and love.

“enough”

I was never so rich, and never since, as when I found a five-pound piece lying in the street. As a five-year-old of a pauper it was wealth I couldn’t imagine.

I was ready to buy the guildhall. Mum would have sent me to Cambridge if it had been invented. Instead they held on to it, and took thought on how to be truly wise with it. It’s still stirring after all these years.

I say, it’s never too late to have a happy childhood. Everybody should have at least a couple.

“I say, it’s never too late to have a happy childhood. Everybody should have at least a couple.”

oh my god that is SO TRUE. SO TRUE. TOO true. i was just saying to my James, “thanks for being my best friend, my father, my brother, my former lover, and giving me a whole new childhood that has healed me and made me strong and happy.”

i had NO idea. therapy, shmerapy. my mom swore by that stuff but even as a kid i wondered why the therapist would ever let you go when they’ve got a stream of your money?

and then i got older and realized therapy is just to keep you in the game and behaving to fit in where school failed. and the diagnostic codes so the insurance will reimburse the therapist were just another way of making money off the whole shebang.

My thoughts exactly Once you have everything you need and want why do you need to get more? Its just a psychological sickness in my opinion and leads to unhappiness and addictions no doubt

I’m not too worried about the fate of the TRUMP Tower. Lot’s of big buck folks out there, foreign and domestic, who will want to curry favor. I expect those places on the market will be snapped up straightaway. Then the other tenets not on the market will start getting solicitations. Put Putin down for a couple.

Kim Jung Un should purchase a penthouse

President Kim has already purchased property in North America: http://www.bcsportbikes.com/forum/showthread.php/146566-Build-to-Fail-Fail-to-Build-What-is-this-I-don-t-even

This is the original and VERY long thread which gave raise to the Internet meme.

For the record the Shed is still standing.

If I had the wings of an eagle,

If I had the a$$ of a crow,

I’d fly over Donald Trump’s tower,

And $h*t on the bastard below.

(with apologies to soccer hooligans on both sides of the pond)

LOL. My sentiments exactly.

Be interesting to look at those units on the market at Trump Tower a few months from now. I notice all the listings were from before the election when, no doubt, a lot of people were apprehensive over the Trump ‘brand’.

Like football tickets when the team is 0-8 you can’t give them away but when the team is 8-0 you can set your price, Trump Tower may have a similar dynamic now. Boeing, Lockheed and other big companies with lots of business with the US government might want to keep a New York apartment at the Trump Tower. No telling who you might meet in the elevator.

I read somewhere that the Secret Service was already renting apts in the building to shelter the agents working there. Some owners moved out because the rents they are getting are very good.

He could afford to put homeless veterans in something. Veterans are some of the greatest people. WARNING, this will make you cry.

http://www.argusleader.com/story/news/nation-now/2016/12/11/cried-all-way-home-santa-claus-grants-final-wish-dying-child/95315536/

oh man, things just keep getting more surreal like a Vonnegut novel. THIS is why i dislike most fiction movies. they seem trite compared to real life these days.