Now in San Francisco, New York, Boston, Chicago, Washington DC, and perhaps a city near you.

Averaged out across the US, asking rents for apartments still rose in November on a year-to-date basis, though more slowly than before, with the median asking rent for a one-bedroom up 1.8% and for a two-bedroom up 2.2%, according to Zumper’s National Rental Price Index. In July, rents had still been up over 4% year-to-date. Since then, they’ve started ticking down on a monthly basis. But averages can cover up more than they reveal.

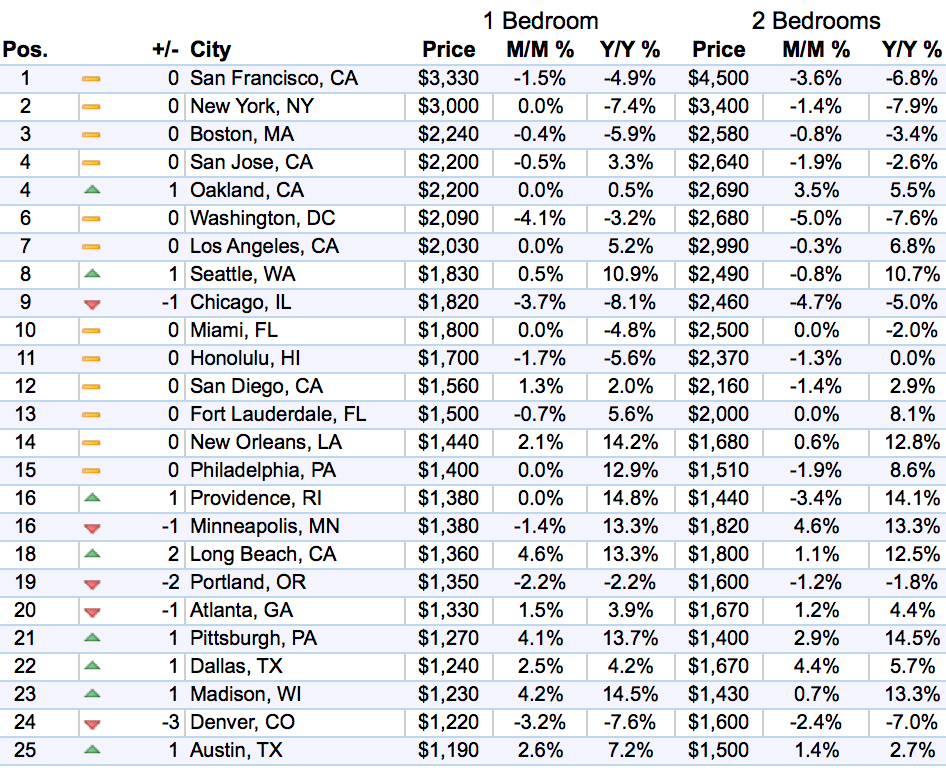

On a city-by-city basis, a different scenario emerges, with rents going totally crazy in some la-la lands, as if it were still the summer of 2015, and in other cities, including the three most expensive rental markets in the US, rents are coming down hard.

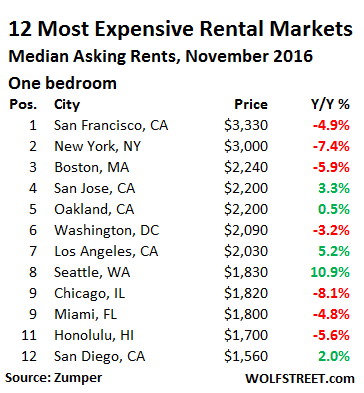

In San Francisco, the number one most ludicrously expensive rental market in the US, rents have now sagged for the fifth month in a row. Asking rent for a median one-bedroom fell to $3,330. That’s still a lot of moolah: $40,000 a year for a small, very average apartment. But that’s down 9.3% from the peak of the rental bubble in October 2015.

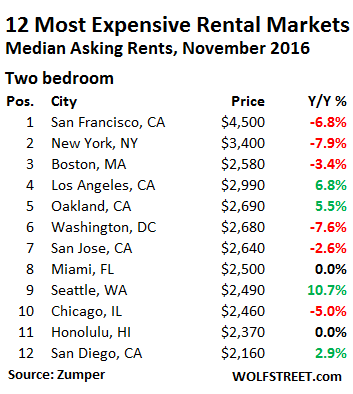

The median asking rent for a two-bedroom dropped to $4,500. So $54,000 a year. That’s down 6.8% from a year ago, and down 10% from the October 2015 peak, when landlords were asking $5,000 a month, or $60,000 a year, according to Zumper. Back then, rents had soared 11% from the prior year. Those kinds of double-digit rent increases were common. Hence the local term, “Housing Crisis,” when households with median incomes cannot afford to rent a median one-bedroom apartment.

The last time rents declined year-over-year was in April 2010 in the process of the housing bust bottoming out. Now it’s just the beginning, a turning point, not a blip.

Two-bedroom apartments can be small in San Francisco. And if you want a spot in the garage, you might have to fork over another $3,000 to $5,000 a year.

Back in landlord nirvana of October 2015, the median two-bedroom with garage might have set you back 65,000 a year. So were landlords nuts? Nope. They just thought they could get these rents. But people with the high incomes required to pay these rents don’t want to live in a median apartment. And demand withered just when supply began to surge.

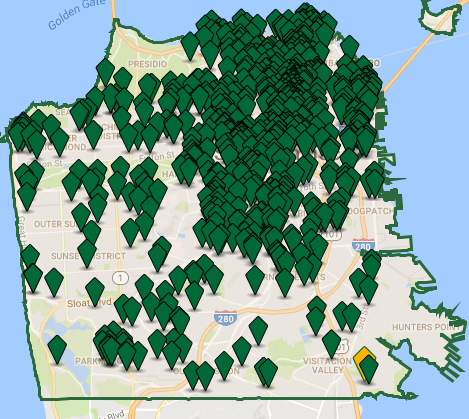

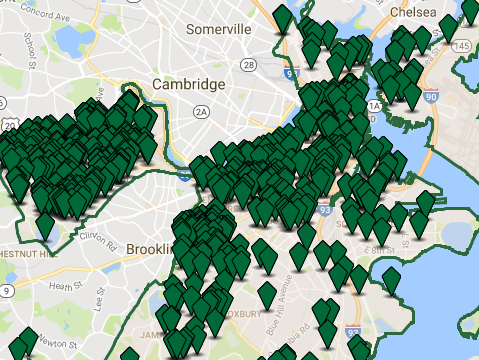

Thanks to a historic construction boom, enormous supply is flooding the market, not only of apartment buildings but also of condo towers, and investor-owned condos are appearing on the rental market. Nearly all of it is high-end. As rents come down at the high end, they’re pressuring the market from the top down. Apartments.com lists 2,278 apartments for rent:

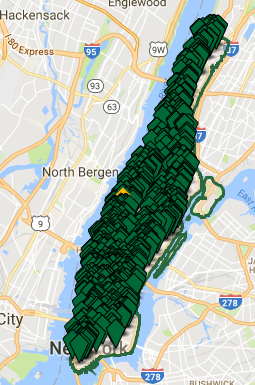

New York City, the number two most ludicrously expensive market in the US, is going through a similar scenario. Soaring rents have led to a construction boom which is now flooding the rental market with high-end supply, not only of apartments but also of investor-owned condos.

The median asking rent for a one-bedroom dropped 7.4% from a year ago to $3,000 and for a two-bedroom 7.9% to $3,400. Apartments.com lists 12,486 apartments for rent just in Manhattan:

Then there’s Boston. Even Boston Fed Governor Eric Rosengren has publicly fretted about the commercial real estate bubble, citing the crane forest in Boston as an example. That’s on the supply side. Apartments.com lists 11,384 apartments for rent in Boston:

On the demand side for rental apartments, things have slowed down, and the median asking rent for a one-bedroom apartment dropped 5.9% in November from a year ago, and for a two-bedroom 3.4%.

The tables below show the 12 most expensive large rental markets in the US. A lot of red ink in what used to be a sea of rich green for the past six years. But note the rental la-la land in Seattle and in Los Angeles:

Zumper tracks asking rents in multi-unit apartment buildings. They’re usually owned by institutional investors and mega-landlords. Single-family houses for rent are not included in the data. That market, often the playground of mom-and-pop investors (though mega-landlords have also muscled into this space), is subject to different dynamics.

Some of the cities have rent-control laws that limit how much the rent can be raised in rent-controlled units. These rules can be complex. In San Francisco, for example, rent control only applies to multi-family buildings completed before June 1979 and correlates with CPI. This year through February 2017, the maximum rent increase is 1.6%. Buildings completed since June 1979 are not rent controlled. Condos are not rent-controlled either. And anyone moving into an apartment, rent-controlled or not, is going to pay market rent at least for the first year.

A special word about Chicago. The city is jacking up property taxes and other fees and taxes to deal with a multi-layered reeking morass of a pension crisis that is emanating from several municipal pension funds and that just keeps getting worse and is pushing the city and its school district toward bankruptcy [read…. US Pension Crisis: This is How Families Get Squeezed to Bail Out Pension Funds in Chicago].

These tax and fee increases will raise the costs for all homeowners – and for landlords. So landlords would want to pass on these additional costs to their tenants in form of higher rents, but rents are plunging, and landlords are getting squeezed from both sides. This will eventually filter into commercial real estate prices in a very unpleasant manner. A similar scenario is already, or will soon be, playing out in other cities across the country.

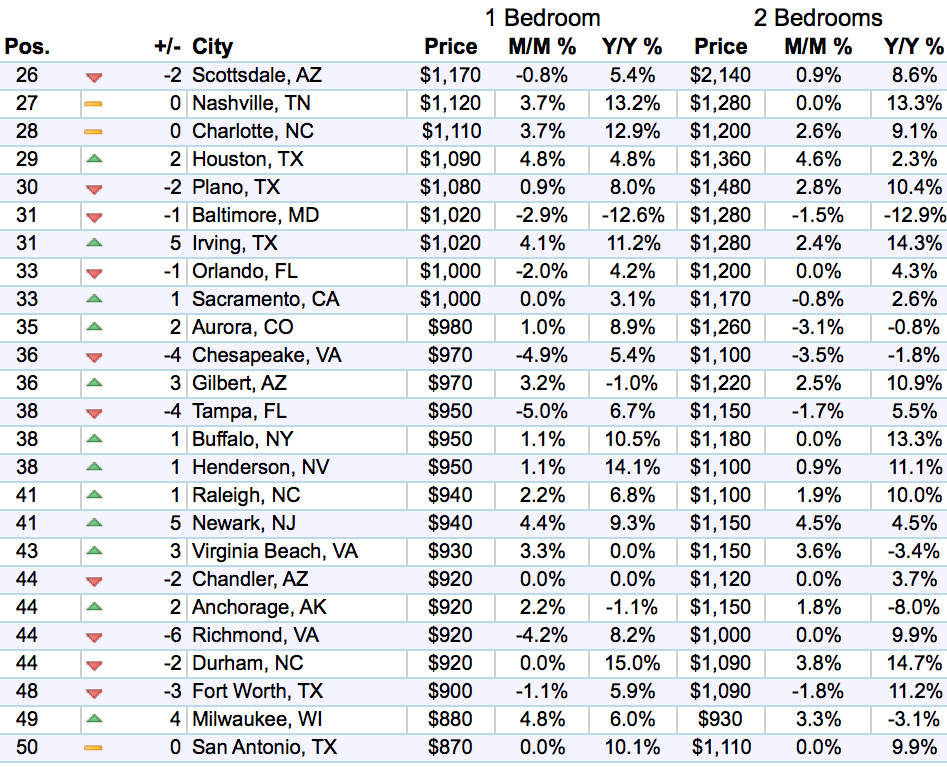

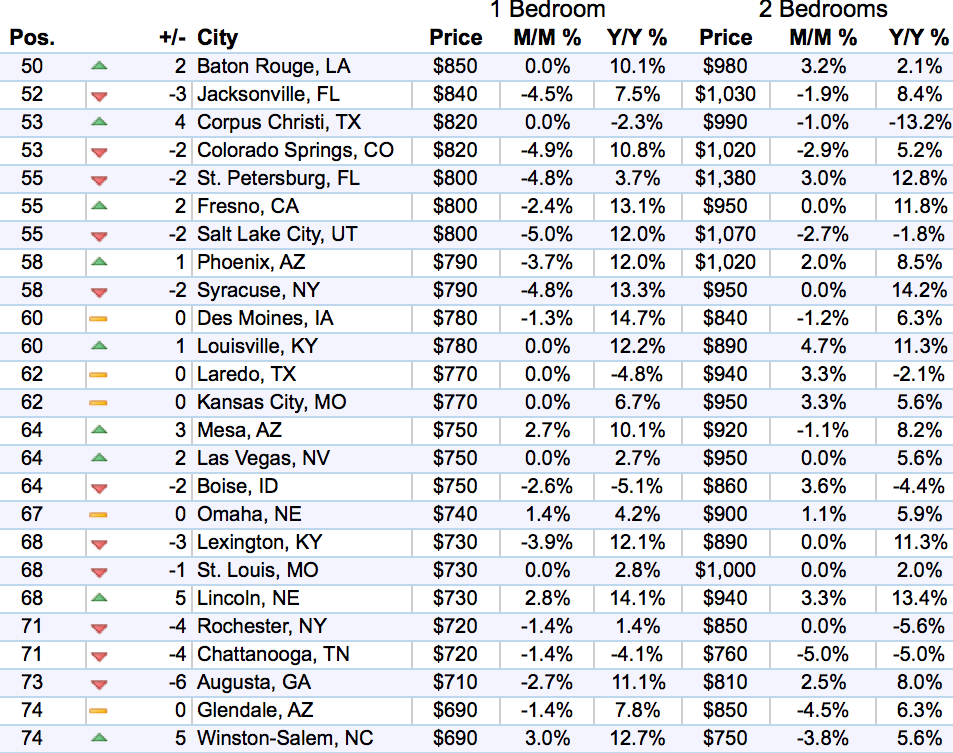

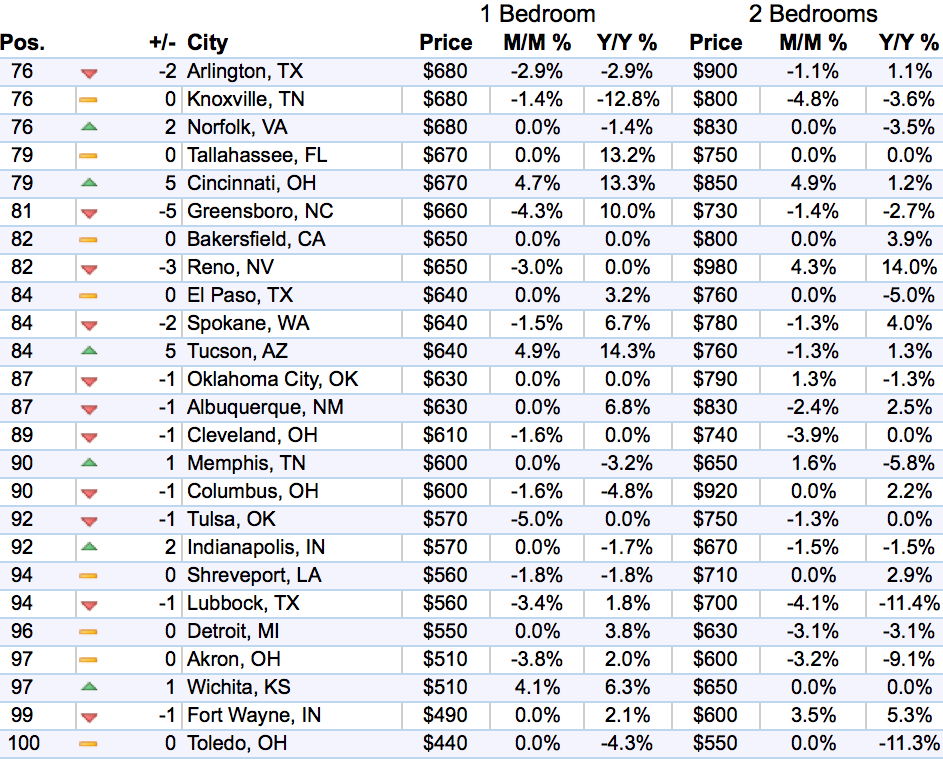

Below are the top 100 rental markets in November, in order of the amount of rent for one-bedroom apartments. In some of them, rents are still soaring in the double digits. In others, like Baltimore, rents are crashing in the double digits. Check out rental trends in your city (tables by Zumper, click to enlarge):

It’s the banks they’re worried about. Read… Who’ll Get Hit by Fallout from the $11-Trillion Commercial Property Bubble in the US?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Those rents are out of control People who pay them must enjoy being on the hampster wheel Not me thanks Im paying under 200 USD a month for a one bedroom on the Turkish Riviera and have plenty of cash left for the good things in life Been there Done that

That is great but most of the young professional class has to go where the jobs are in order to pay off those student loans, and those jobs ironically are located in the places with the rents are the highest. So most young professionals get squeezed on two sides. The educated and property owning boomers really got a sweet deal out of this generation of wage slaves. I pay for their jobs at universities, I pay over inflated rent on their real estate, and I pay for their social security and medicare. Furthermore, I have to pay for a crappy healthcare insurance plan that I don’t need because US gov believes that those that are young and are able to pay should be subsidizing the older and broker non retired boomers.

Maybe, one day I too will be able to escape wage slavery and relocate to an affordable locale but for now I need a high paying job in a high rent city in order to pay off my loans and while at it to support this ridiculous economic system.

it’s interesting how the widely expected ‘working from home’ thanks to computers and internet didn’t arrive. I remember how in my country in the nineties many professionals in IT, advertising etc. moved to France (at the time you could buy a French castle for the price of a basic Dutch town house …) or to remote/rural areas of the country because the internet / IT revolution would make that so easy. Soon enough the idea proved less practicable ;-)

Maybe this will change again when people finally realize that many of the high-paying city jobs in finance etc. are not exactly good for society.

Those people paid for schools parks and endowed universities. You got no idea what your life actually costs cuz everyone subsidizes someone else. The US borrows 20 T more than it takes in– by def everything is subsidized.

You stopped looking for someone to blame when you got to ,dare I say, the boomers. If you bothered to use that education that we educated boomers too paid for without crying about, you would see that after working 40+ years while the dollar was being raped by Wallstreeters, politicians, and bankers we are left with savings worth about 5 percent of what we put in and near negative interest rates on what’s left.

So grow up little one and cry me a river. Oh by the way Obama has heard your wails- with what little us boomers have left, we’re going to help you pay off your student loans. Say “Thank You” and stop blaming us for your choices.

You omitted the cool factor. Most of the young professional class would rather eat dog doo-doo than live in an uncool place. That’s why they’re flocking to such places as Seattle and Portland. I live near Portland and the hipsterism here is wall-to-wall. I see lots of license plates from the South, which is a long way away, FYI. Never used to see that many plates from places like Alabama, Tennessee, South Carolina, etc. As well as the liberal mainstays like Vermont, Massachusetts, New York, etc. Portland’s become a node on the liberal archipelago and an entry point for many wannabees who are looking to escape their roots in flyover country and change citizenship. Wages are only part of the story.

Say Hi to Erdogan before he finds a way to show you are a traitor LOL

Frederick, where do you live on the Turkish Riviera? Do you buy and sell in dollars in Turkey?

Wolf, do you have any insight into what’s going on in Seattle? There’s a crane forest here, so I’d think there’s about to be a flood of new rentals on the market soon. Why would rent keep going up 10+% YoY? House prices don’t seem to be slowing down much either.

Every market is different. I suspect that rents in Seattle will smack into this new supply eventually, but a surge in tech employment might delay that to some extent.

These things can go on for a lot longer than reasonable people think possible. Which was the case in SF. But eventually, some form of reality begins exert pressures on housing.

The party/music always goes on longer than you expect. Always. Rule #1 of frothy markets.

Its what makes shorting such a dangerous game, even if you know the fundamentals cannot support a given price, the “animal spirits” will.

This is a Chinese capital flight city coupled with Amazon and Microsoft stock grants. I personally can’t wait to move out of here when my daughter graduates this year.

Also some of the foreign buyers have been pushed out of Vancouver so are buying just down the coast.

A friend of mine who rents in Seattle says that rents at the high end have actually fallen a bit. She could afford to buy, but she keeps delaying it figuring that the boom is going to play out and a lot of landlords are going to all sell at once. She’s been right before which is why she can afford to buy if she cared to.

reading about rents in these top-10 cities I feel better about the still unaffordable rents in my small country ;-)

Here too the median family cannot afford renting a medium home, and why rent anyway if buying is several times cheaper on a monthly basis? They could buy a small apartment in a less nice area for 100K euro, 2-3 years rent for a small apartment in SF ;-)

Of course income and amount of rentals to chose from is also very different over here (probably 50 rentals to chose from in my city of 50.000 …). RE is very local, I’m often amazed at the huge differences in RE pricing between different areas, both in my own country (which is just 200×300 km in size) and in the US, judging from some of the ‘home improvement’ shows I see on TV. Some US states seem FAR cheaper than my own country, and some cities are several times more expensive. Seems housing bubbles have their own dynamics that exaggerate the local differences between cheap and expensive areas.

What is the expectation for rents if the current rate increase continues and starts to damage the housing (owner) market? Would homeowners who have to sell put new pressure on the rental market? Or do they move to cheaper areas, effectively spreading some of the bubble?

Meanwhile Wolf Street just posted an article about how 6 million Americans are delinquent 90 days on their car loans This is unsustainable longer term in my opinion

the US is a tough country; if you are up to 1 year behind in paying the mortgage in Netherlands you aren’t even registered as delinquent ;-(

I guess I don’t want to know what the numbers arevfor cars loans in Netherlands.

US is a funky place, took me years to get a hang of things. But spending half of my life here are my conclusions: corporations privatize profits, but socialize the loses among the wage slaves. Free market capitalism for the young, European style socialism for the old. Corporations are persons but they have no moral obligation to pay any taxes. Law and order for the blacks and other minorities, while upper class white collar crimes are not prosecuted. Punish lower class people who use street drugs, while provide limitless psychoactive pharmaceuticals for the upper class with nice health insurance. Good liberals talk big on diversity and inclusion while living in gated communities and send their litter to private schools. The conservatives are all about “free market” in theory but corporate welfare state in practice. Crony capitalism is the status quo.

I think you finally got it figured out :-]

Amazing summary, good job! I’m not sure about Europe necessarily but the EU seems to have a rotten-hearted unelected system that doesn’t seem to be working in favor of the people.

I can understand why it’s so important to environmentalists that elites be kept in total control else damaging aspects of population growth could destroy the environment.

Whoa…Chillbro… that was PURE PERFECTION./chilling.

What happened in Seattle that prices are up 10%. Those who cannot afford Vancouver move there?

Lots of reasons. Seattle’s still quite space constrained as the city is a narrow strip of land wedged between the ocean and a lake, and traffic is such a nightmare living in a place like Tacoma (25ish miles away) is a 90 minute commute each way at rush hour. Amazon continues to hire thousands of 22 year old grads for $100k+, they all want to live in the city. Oh, and I can’t leave out the NY/Bay Area transplants moving up here in droves. They think RE is seriously cheap.

Amazon keeps hiring 22 y/o $100,000 – I guess Amazon must have some huge unresolved problems?

If my experience is any guide, at least half of the new hires are low paying jobs like Q&A. I am also assuming these are in software development and not distribution centres.

Any idea on why Seattle experienced that double digit jump?

Boeing is in the middle of the nastier version of a stock buyback, meaning big layoffs, which is squarely focused on Seattle. So far Boeing has announced 4000 layoffs, and there isn’t a set number yet. The Seattle Times has quoted an 8000 figure up to March 2017, which is hardly encouraging, as Boeing employs about 75,000 in the whole State.

Perhaps Starbucks is hiring this time of the year…

Gridlock traffic based on semi-unique geography is part of the problem…with the other part being that alot of the construction in Seattle over the past seveal years was commercial rather than resi/condo. The financial crisis and disappearance of WaMu combined with complettion of several new projects crushed commercial rates in Seattle resulting in a lot of new businesses taking advantage of low(er) rates and moving into the downtown core. With more jobs in the central core (and all the foreign money from Asia) resi rental rates have been increasing because the traffic to get into downtown is a pain. While maybe not as painful as commutes in LA/SF….workers in Seattle will typically pay a lot more to avoid the long commute lifestyle prevalent in CA.

I think Wolf is correct that this increase will hit a wall just as other areas are feeling now….it just will come slightly later.

I’ve checked this a couple of times and I think I’ve got it right:

Both San Fran and NY have dropped but the new rents are 400 a month higher for a two bed in NY but almost 1200 higher in San Fran.

Since this approx 300% difference between a 1 bd and a 2 is so much more than the less than 50% in the overall rent between the two cities- I am puzzled as to why that would be.

On the face of it- the landlord in NY is making a lot more affordable for people to split rent- suggesting even a weaker market in NY.

My guess is it’s just a temporary imbalance in housing stock. LA also has relatively higher 2bed apt rates. My guess is that in SF and LA once you’re ready to move up from a 1 bed apt, you typically used to buy a house, whereas in NY people would keep renting and just move up the luxury and size scale. So there’s probably a relative dearth of 2 and 3 bed apartments.

Housing patterns have changed so quickly in SF due to not just the prices but the change in demographics from both the inflows and the outflows that I bet the apartment market is still lagging.

Some of this is likely a function of the age of the housing stock in both markets. That 2BR in NYC is often older and built at a time when it would have been used by a family. So you’ll have a size discrepancy between the two rooms. In SF, increasingly these will be newer units where they were designed for roommates and both BR are the same size.

A drill down into the crosstabs probably would explain most of the variances.

Gee, amazing……………

Supply increases and prices fall!!

Prices increase and demand falls.

Economics 101!

Sometimes markets actually works.

Well here in ‘bubble land Melbourne’, where prices have been going to crash for the past twenty years, you can rent a studio apartment from around A$250 a week, a one bedroom apartment in the CBD for the amazing price of A$400 a week…………

Top of the range three bedrooms will run around A$1200 a week to A$1300 a week.

Good data, but absurd that Oakland/Western Wayne Counties of Michigan aren’t separate from Detroit. Two completely different marketplaces and both far bigger than some of the communities represented on the top 100 list.

From personal experience in tenant activism among friends and living in the Mission District for 30 years, this is good news, in only that this bubble is going to pop hard. But we need at least a 30% drop to get working class and middle class people to move back in….Fat chance….cuz even in a depression…that cut in rent, will be too expensive for a population completely broke….

I’m getting ellis acted….and just on my block I’ve seen 5 three floor Victorians cleared of families….that’s 15 or more a house….replaced by 2.5 people.

The law of ‘supply and demand’ works much on high end shit, but not affordable housing. We’ve lost over 20,000 units in the past ten years thanks to this hot money from all over the world, not just the tech people moving in. And those affordable units are not replaced, since even if all this TIC or condo shit goes empty, most of those types of owners will not become landlords to families. Add to that, the ‘liberal’ Brown and Obama have gutted HUD funding even more. Drowning down here….neighborhood is being gutted. Tons of kids being pulled out of communities and their schools…tons of people having to leave their jobs…….This was not funny these 8 years of Obama, and Trump will be worse.

http://www.kgw.com/money/economy/growth/portland-has-become-even-less-affordable-according-to-state-of-housing-report/361080425

portland oregon is in good shape, but still considered expensive

HEY WOLF, WHICH COLLEGE DID YOU GO

I was a landlord on the UWS of Manhattan in the aughts. I thought the rents I got were ludicrous then (excepting the dip immediately after 9/11.) Little did I know. Made out quite well though when I sold the building.

Time is now to sell.

If you’re talking about housing, the time was probably several months ago…

I’m in Puerto Vallarta Mexico where I pay $250 cad a month for a studio includes everything.$150 for food a month and my gym pas was $18 a month

But can you find a six figure job there?

Es muey buerno Sr! :)

My bet is that history will remember these times as the roaring good times. It would be appropriate to invent a moniker for it. It should rhyme with FED as the supreme creator of prosperity.

The Fed’s Final Frolic BFA ?

(“BFA” = Before Financial Armageddon)

The rents shown for Pittsburgh must be for the city center.

Pittsburgh is a bit odd as there is the “City of Pittsburgh”, the urban core with a population of about 300,000, and a “Combined Statistical Area” population of about 2.66 million. The outer fringes of the CSA are rural – farms and woods.

https://en.wikipedia.org/wiki/Pittsburgh

Most of the workers in Pittsburgh don’t pay anything close to $1270 for a one-room apartment. That’s a mortgage payment on a large house. Pittsburgh has a very old-skewing population, some of them move south for retirement, and there are lots of big, older houses that you can buy for a mortgage payment of $1270 a month.

The coasts tend to have high rents because half of the adjoining area is off limits – you can’t build a house on the ocean. ‘Flyover country’ has lots of cheap space just outside of the urban cores.

I’ve been keeping an eye on the apartments under $1600 in SF Bay area since July (2016); basicallly the following link:

http://sfbay.craigslist.org/search/apa?search_distance=30&postal=94061&max_price=1600

Back in July , the number of apartments which qualified by those search parameters was around 620. Just before Thanksgiving the number hit 1100. Basically in 5 month the number of apartments asking for under $1600 has increased to 180% of what was available. If this trend continues, I expect the increase would be 300% of the original number.

Thanks for sharing this data!

I like the general approach to the analysis you preform, but when putting up the number of apartments available in certain LA-LA lands you definitely have to include certain surrounding “towns” that are actually part of the same LA-LA urban zone. I don’t know which those would be for San Fran or NY, but for Boston I would say: People would much rather try to live in Cambridge (not included in your apartment search) to live as close in as possible to the hip, happening, high employment (and high-tech employment) areas of Boston then in many of the parts of Boston included in your search like: Roxbury, which last I knew was the region of Boston furthest into the metro that still has empty lots (that no one wants to fill for any price) and some of the highest violent crime around in the metro area, or places like Readvile and West Roxybury that while being nice Neigborhoods and are technically part of Boston (and your search) are almost 1/4th of the way to Road Island from down town Boston and thus most Bostonian consider them part of some distant planet and not the normal “Boston area.” I’ll bet you for the Boston area, Cambridge is a *HUGE* contributor to the LA-LA land bubble effect too, because that is where the vast majority of the highly paid biotech industry people try to live (it is a little like Boston’s Silicon Valley) so you really want to include Cambridge in your analysis of Boston for that reason as well.

To a lesser extent this is also true of neighborhoods like Somervile and Brookline, which aren’t quite Boston (and not included in your search) but are more “Boston” by Bostonian living standards then the above mentioned places included in your search. Like Cambridge, these places also are more likely to have a bigger contribution to the “LA-LA” land of Boston housing and rents then many of the places included in your search. I.e. in short, when doing your apartment-rent and housing-bubble analysis you need to look at “LA-LA land Boston” and not specifically “Boston Proper” for your analysis.

Again I bet this may be true of certain neighborhoods in NY and SF as well, I just wouldn’t know which ones.