But the Fed is steadfastly blind to bubbles & their consequences.

The Organization for Economic Co-operation and Development threw the Fed and the Bank of Japan – even as they had their meetings today – a curve ball.

We in the US woke up to a new central-bank term: “yield curve control.” This is what the BoJ promised its rapt audience of hedge fund managers. Another Kuroda surprise. His negative-interest-rate surprise in February was just aping the ECB. But now he has come up with something for which no one had even coined a word.

The BoJ will target 0% yield for the 10-year Japanese Government Bond, which had been negative for months. So it’s trying to push up the 10-year yield a smidgen. Shorter maturities would still sport a negative yield. This would steepen the yield curve. In effect, the BoJ will control the yield curve. By the end of next year, it might own 50% of all JGBs. Why even pretend there’s still a bond market? Maybe it’s just for entertainment.

And the Fed once again refused to raise interest rates by almost nothing from next to nothing, after flip-flopping about it for nearly three years.

But now even the OECD is fretting about these scorched-earth policies that have been dogging the global economy, which just keeps getting worse.

The OECD estimates in its Interim Economic Outlook that for member nations as a whole, GDP-per-capita will grow only 1% in 2016, “which is half the average in the two decades preceding the crisis.”

Per-capita is what counts. It’s what people experience. It’s their slice of the economic pie. Population growth papers over a lot of ills for economists: for example, in the US, 14 million jobs were created since the Financial Crisis, which has been touted endlessly. But the US population grew by 15 million people. Now there are fewer jobs “per capita” than there were at the depth of the Financial Crisis. That’s why per-capita matters.

So 1% GDP growth per capita in 2016 is terrible. And it’s likely happening because of these scorched-earth monetary policies. The OECD blames:

- “Weak investment”

- “Slower growth of total factor productivity”

- “Slowing of diffusion of innovations across firms”

- “And slowing innovation at the technological frontier.”

It adds: “These developments exacerbate the challenges to improving well-being of people in both advanced and emerging economies.” The problem for the OECD is this: people are consumers, and if consumers don’t do well, they can’t consume enough, and in consumption-based economies, that’s a cardinal sin.

Yet its outlook, bad as it is, is “subject to significant risks.” The economy might further deteriorate, it says, because: “Financial instability risks are rising, including from exceptionally low interest rates and their effects on financial assets and real estate prices.”

Bubbles in stocks and real estate! The Fed, however, as always, is steadfastly blind to bubbles.

Interest rates have advanced “more into exceptionally low and – in many cases – negative rates,” the report laments. It blames the markets. They see the slow-growth scenario and assume central banks will respond with even lower rates. So they buy those bonds and thus drive up prices and drive down yields further:

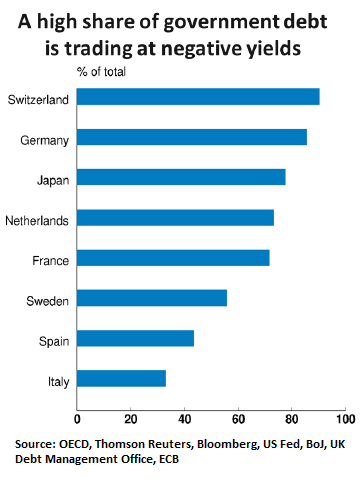

Bond valuations are particularly high in Europe and Japan, where the share of sovereign bonds trading at negative yields is estimated above 70% in several countries. Consequently, around USD 14 trillion of government bonds, more than 35% of OECD government debt, is currently trading at negative yields. This unprecedented situation creates a number of distortions and risks.

But a good chunk of corporate euro debt is also trading at negative yields but is not included in this list of the biggest NIRP countries:

The report goes on:

Low interest rates underpin widespread and substantial increases in asset prices, both internationally and across asset classes, which increases the likelihood and vulnerability of a sharp correction in asset prices.

A reassessment in financial markets of interest rates could result in substantial re-pricing of assets and heighten financial volatility even if interest rates were to remain below long-term averages.

This “substantial repricing of assets” is code for sharp declines in asset prices, such as during a crash, especially when used in conjunction with “volatility.” But the word “crash” never appears in the report.

Share prices have risen significantly in recent years in advanced economies, notably in the United States. By contrast, the growth of profits for non-financial companies has recently slowed to a modest pace, following a post-crisis recovery….

Notably in the US, in Q3, S&P 500 companies are expected to report the sixth quarter in a row of year-over-year earnings declines, the first time this happened in FactSet’s data going back to 2008. With earnings this terrible, what has propped up stock prices, according to the OECD?

- Falling long-term interest rates

- Cost reduction measures

- Share buybacks and dividend pay-outs, rather than as the result of additional productive investment.

There are residential and commercial real estate bubbles:

Over recent years, real house prices have been growing at a similar or higher pace than prior to the crisis in a number of countries, including Canada, the United Kingdom, and the United States. The rise in real estate prices has pushed up price-to-rent ratios to record highs in several advanced economies.

Commercial real estate prices have also increased rapidly in a number of markets, including exceeding the pre-crisis highs in the United States.

The not negligible issue of “sustainability” of banks:

If sustained over the next couple of years, negative and low interest rates will challenge financial institutions’ business models and sustainability. For the banking sector, flat yield curves undermine the profitability of the traditional model of borrowing short and lending long.

At the same time, negative deposit rates, low lending volumes, and banking overcapacity imply lower profits. These developments are reflected in the underperformance of bank shares relative to other sectors, which may in turn slow credit availability.

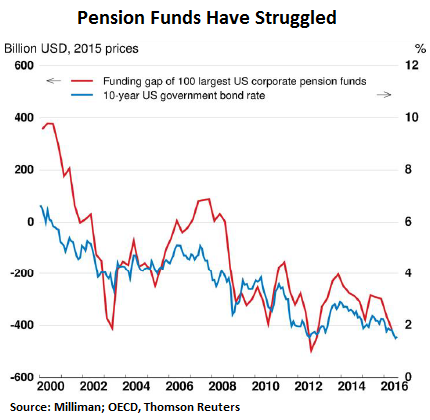

The issue of “solvency” of pension funds and insurance companies:

Prolonged low interest rates also pose major challenges for other financial institutions, notably asset managers and pension funds. A lower discount rate increases the present value of liabilities of defined-benefit pension funds and life insurance companies, which undermines their solvency.

Conversely, low interest rates reduce future returns on assets given the larger share of fixed income securities in total investment portfolios of pension funds and insurers. This could have significant implications for financial institutions, but also savers and retirement incomes and businesses that face higher contribution rates or higher obligations from company-sponsored pension funds.

Not to speak of the much bigger disaster playing out in state and local public pension funds in the US – and who will end up paying for them.

And the risk associated with central-bank interference in the markets:

With past and current purchases of government bonds, central banks have become major holders and buyers of sovereign debt and are intervening in a wide range of other markets, including for corporate bonds and equities. The uneven policy response across countries and over-reliance on monetary policy adds to global imbalances and creates spillovers that can have disruptive effects on other countries through capital flows and build-up of financial risks.

But the Fed and other central banks live in their own world and can neither see the bubbles that their “interventions” are inflating, nor anticipate what happens when these non-existing bubbles burst.

Despite these policies, in the real economy, the heavily touted “recovery” doesn’t exist for the “Invisible Americans.” Read… “Or We’ll Lose the Whole Middle Class”: Gallup CEO

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The CB’S desperately need a “New Drug” as the patient is no longer responding positively, to any of the current ones, due to developed immunity’s.

The negative behaviors of the patient, are giving the OECD serious nightmares, as they start to further develop.

d,

The patient (we in the US) is responding to the drug (idiotic monetary policy) just as they expected and intended. The results you, I, and 99.9% of us want are just not the same thing they want. The Fed is protecting the ‘financial markets’, aka bubbles and their reputations and a few very rich people and the politicians who work for them.

Yes, they are protecting their reputations. They MUST publicly deny the existence of bubbles because if they admitted even one that they caused, then they would have to explain too many uncomfortable things that would crack the incompetence door much wider.

Even admitting 1 bubble would require them to provide explanations to:

1) If their theories are so good, why do they excel at bubbles in financial markets and asset prices and ignore benefits to the real economy

2) Why do they continually apply these theories if they have unintended consequences of such magnitude?

3) Why do they apply these theories over and over again if they don’t work?

4) How did “Going Bigger For Longer If It Does Not Work Today” become the mantra to ignore failure by defining it’s failure only if you admit your mistake and stop what you’ve been doing. Or, anything that’s not success is never failure … it’s always success, just not as much of a success as they wanted.

Finally, they can’t raise rates and change policy. The Fed is in a prisoner’s dilemma with the ECB, BOJ, BOE, and most minor central banks. The only reason monetary policy can crush interest rates so well is that they all are doing it in a coordinated manner. If the Fed broke ranks and tried to normalize rates, they would ruin the schemes the other two employ … The ECB monetizing bad euro debt to keep the plate spinning a little longer and the Japanese doing god knows what. The Fed doesn’t want to be the one that explodes the sovereign debt bubble. How would they explain that?

It’s not complicated, but there is a lot of BS that surrounds the bad policy they implement.

The Fed and the rest of the ‘central bankers’ are ALL ex-goldman, if there is such as thing as ‘ex’.

I keep hearing they don’t know what they are doing, well they know exactly what they are doing and it is a plan from day one. They are not trapped, we are trapped. They are not prisoners, we are the prisoners. Look at what they have done to Europe, a practice run, and it is mighty quiet signaling a green light for the next stage. They are experts at distraction, experts at execution, the Teflon mob.

The smart ones are taking the profits now that these disruptive policies were planned to create. Just watch, when the music stops this time, the bottom will be found when 99.9% are destroyed, and the smart ones can own your lock, stock, barrel, and your soul for generations to come. The squid…’Specter’ has you right where they want you to be and they know you will not protect yourself. just one more day in the market …ok?

People are fools. People nurture a bad memory in favor of one more chance at the lottery with the last dime in their pockets.

The banks, insurance companies, pension funds etc. are all crying, well where are the 1,000s of lobbyists they have in D.C. (deceitful criminals). Frankly I don’t hear their cries, outrage, anger, so it this too a part of the plan?

To many years have passed with the outside cries that the sky is falling, yet here we are, same thing every day and the beat goes on.

If and when it comes apart, I will stand and watch and say nothing. I have said enough already.

A “prisoners dilemma” is a situation where a group of people are cornered. If they all stick to the same story, they all get away with it. If even one tells the truth they all lose.

The central banks are in a prisoners dilemma. If even one raises rates or openly admits the theories that support negative rates are idiotic, then, as Kuroda fears, it will all fall apart when they all stop believing. Or, as Kuroda said “It stops working when you fail to believe in it.” He wasn’t quoting Peter Pan, as he claimed. He was expressing the prisoners dilemma.

Economics is simple. People, on the other hand, are excellent liars who can take the simple and weave it into complicated distractions. Current economic theory is an excellent example. Excessively low interest rates for a prolonged period are destructive. This destructiveness is obvious and easy to see and understand. Yet, learned people insist low rate policies be implemented and embrace them. At that point, it’s a question of their motivation for lying. This is where the true explanations are. Not ‘economics’, even if a few true believers, such as Ben Bernanke, claim otherwise.

The sucker play is to talk and argue economics. It’s the distraction. The value play is to question the motivations for such blatant incompetence and untruthfulness. Follow the money.

In fact, let me put this differently.

‘Never Play Someone Else’s Game’

That’s the best advice I ever got. It has saved me, literally, a lot and more than once.

When you argue economics, you are playing their game. You can’t win. They define the rules and you will never know them all. You become their plaything and fool. ‘Experts’ will circle the wagons and wear you down. They will never admit to lies or incompetence. They will put you on the defensive continually.

For example, arguing negative rates and sovereign debt purchases with Draghi is a waste of time. No matter how obviously his theories contradict themselves, he will never admit it but force you to debate his inscrutability.

To win, you must avoid playing their game. You must concentrate on facts and logic while never responding to one of their distractions. It’s a good way to get thrown out of a press conference, but it’s the only way to get at the truth. At this level, it requires a lot of support from like minded truth seekers.

Given the organization and determination of those who support the status quo, successfully NOT playing their game is doubtful.

economy – at least the incarnation practiced in the west nowadays – is a religion, not a science. That’s why they can keep denying the facts, facts don’t matter for economists (and even if they do, there’s always the statisticians and MSM to give them a little help).

BTW, that almost every economic ‘expert’ denies how bad the current situation and policy in the West is (at least in public, or as long as they have an official job) is not much different from all the lies and cheats you see in e.g. current medical science, etc. People keep getting unhealthier in the West, prescription drugs kill more people than illegal drugs and profits for the medical/pharma complex rise into the sky.

Policies are made by the politicians to benefit a tiny minority and they couldn’t care less about the general population. It’s all ‘follow the money’, honest science and real facts went out of the window long ago.

spectre, to be exact.

the oecd chart of the gross share of debt yielding less than zero is, well, who exactly owns this crap?

we are trying to lead, but they never got in line. because they can’t.

i hate to say it, but flex/fiat currency is the flame to the fuel of global deflation gasoline.

but it is a fact, not a fiction that can be overcome.

Bernanke had called for fiscal stimulus, and as the Republican Congress would never go that way, the economy was was saved from depression by cheap money. The game went on for too long.

D-

I think the CB’s don’t need a new drug, the drug is working perfectly. However, society doesn’t understand what the CB’s are doing. The CB’s across the world are buying worthless paper from private investors, who have no other buyer except the CB’s, then placing it on public balance sheets. The consequences to the public will create a liquidity crises. Ask yourself this, How do the CB’s buy trillions of dollars in assets, essentially cornering each sector of the market they enter, without anyone getting the wiser? I think the hens are coming home to roost and I heard that in Dr. Yellens voice yesterday. I think our Fed just capitulated.

Thanks for sharing,

Kyle

http://kylewoodard.weebly.com/blog

Well, the OECD did just use a lot of foul language in church :) It will be interesting to see wether the talking heads in MSM will notice this because it is so contrary to the prevailing BS …

The BIS said much the same last year, and many previous years. I don’t think anyone in the MSM noticed and it certainly didn’t have ANY effect on policy around the world.

And of course it didn’t, because the policies are made by the same central bankers who constitute BIS and officially wrote those damning reports … it is a fig leaf, nothing more.

The central bankers policies and the point at which we find ourselves, reminds me of Tennyson’s “Charge of the Light Brigade”. Apparently we can only go forward despite the obvious damage our economies have already sustained. Success is doubtful, but onward we must go. And when this folly is finished and the carnage tallied, there won’t even be glory to wave flags over.

Maybe somebody will write a long epic poem about us someday. Something like “The Charge of the Moron Brigade — Right Off the Cliff”.

Will Pete Seeger’s “waist Deep in the Big Muddy” do?

“Waist Deep in the Big Muddy and the Big Fool says to Press On”.

Pete Seeger’s “Waist Deep in the Bug Muddy” works just fine. I think anything about following foolish leaders applies.

i’m more optimistic. i have to be.

Extend and pretend has been and still is the name of the game. Toward what end? While many or perhaps most believe that the FED and central banks are blind to the bubbles and financial devastation they are creating, I prefer to think that they know exactly what they are doing. If one were to suspect that the world’s financial powers are enacting every single policy available no matter how seemingly absurd and self-destructive, just to hang on for a little while longer, and that they are doing so in a coordinated effort, that would probably be the logical observation from just reviewing available data.

Agree. IMHO this whole OECD report is on a similar level as many BIS reports from the last 5-10 years: there is a lot of truth in them (especially if you read between the lines) but it is only mean to cover their a**, and not a recommendation to change. After all, the same OECD en BIS economists and bankers who write about how disastrous the current policy is are those responsible for it in the first place.

It is all perception management. This week again my government is cheering the fact that Dutch home prices are rising at over 6% yoy (20-25% in the big cities, while inflation is supposedly zero) which is the biggest rise in 13 years. Mind you, this is a rise on top of an epic bubble that had home prices rise by 1500% or so within 15 years.

You can bet that many of the sheeple are cheering along, after all most of the Dutch public is a ‘home-owner’ with a maximum mortgage. They are doing great at long as the Ponzi lasts. They will keep the current policy makers in power and anyone who tries to prick this bubble (e.g. by removing some of the countless subsidies, guarantees and other bad incentives that stimulate the housing bubble) will be quickly removed from office.

Some of our best-known e-con-omists and politicians who specialize in the housing market are big housing speculators themselves. What do you expect them to say in public, and do behind the scenes … I don’t doubt it is similar everywhere in the West. Real estate has been the easy way to get rich quick for the well-connected for many years, they will do everything they can to keep things this way.

it’d be interesting to look at the loan books in holland.

i suppose the gross data is out there, probably in that incomprehensible dutch.

There was an excellent analysis of the Dutch housing bubble from BIS (again) about ten years ago, with severe warnings and good recommendations. It was spot on and probably the best analysis of the situation I have seen. Of course it was totally ignored, and BIS later retracted the paper, or at least made it very difficult to find on their website (probably some of the Dutch elite got nervous …). There was a hiccup in 2008 but the bubble has only gotten bigger, shrinking the debt is no option because the whole Ponzi would collapse.

The Dutch housing market can claim many extremes, like the highest valuation-to-income ratio in 400 years, the most lax mortgage conditions worldwide (almost the entire market is subprime by US standards), extreme differences between the costs of renting and owning, the highest public and total debt levels in the world and probably the biggest house price increases of any country (possibly excluding some densely populated city states) over the last 25-30 years.

Like most Ponzi’s it works until it doesn’t. Difficult to predict when this epic bubble pops (probably when interest rates stop declining) but it might be even more devastating then the 17th century tulip bubble (and as they say: they Dutch still trade tulips and some years ago many people who should have known better lost loads of money by speculating in a tulip bulb fund …).

As the Dutch invented the infamous Tulip Mania many centuries back, one can conclude history doesn’t necessarily repeat but certainly does rhyme

the Dutch sure have a habit of engaging in financial manias …

The press conference yesterday by the FED revealed it all: There is only FEAR. Data does not matter anymore – it is all about fear that the FOMC could be blamed for triggering the next recession. Driven by this fear – of course they will trigger the next recession and they know that they have nothing really left in their tools to counter act. So we will continue to life in a kind of communist regime, created by the biggest Western Central banks with productivity declining further, financial assets in a bubble and average people loosing out. The FED has bought a little time again…. but the end game is faster approaching than think ( if they are thinking about it, or if it matters to them)

The FED doesn’t mind a juicy recession at all because the FED can only gain from a recession: it gains real assets at the loss of some funny money that has no value to them (because they just invent it). Recessions are GOOD for central banks, there is a HUGE motive to engineer them.

What it does mind however is a lynch mob and being blamed for stuff that could have consequences – so yes I agree 100% that the FED will work hard to make sure it’s not to blame.

Just like the banking sector managed not only to avoid punishment but actual got gifted huge additional chunks of our wealth when the credit crisis struck – a gift enabled by Bill Clinton and his scrapping of the Glass Steagall at the request of the bankers.

So there _will_ be a recession (we’re in one now really), perhaps also a crash soon, and the net result will be to deflect blame from the cause – central bankers – and another mammoth transfer of wealth from us to them, followed by more hand wringing confusion about the wealth gap between the elite and the rest of us, despite the media being just as able to view the heist in progress as the rest of us.

There is a 90% probability that in the last year or the first year of any U.S. Presidency there will be a recession.

We are in a recession. Some are still dreaming and claiming otherwise.

eight years of trend is often followed by disruption of trend.

This year will make it 100 % three times in a row.

Perhaps they fear the pitchforks …..

The fact that while 14 million jobs were created in the US but the population grew by 15 million may indicate job creation substantially worse than even that number.

This is due to the rapidly shifting demographic- the steadily increasing wave of baby boom retirement. Every time someone leaves the labor force by retiring, a new hire would have to take place just to keep a net change of zero.

As of 2014 (so this will be larger now) 4 million US workers had left the labor force through retirement (Obtained via ‘Market Realist’)

Supposing for simplicity’s sake that of the 14 million ‘new’ hires, 4 million were to replace retirees, there were net only 10 million jobs created.

Or to put it another way- the wave of baby boom retirement should be

reflected in a growing jobs bonanza for recent grads. They should be experiencing the same wave of hiring the boomers did, if the growth of the economy had just matched the growth in population.

The generation before the recent grads, (Gen.X?) had long complained that the boomers had clogged the better jobs market, using their seniority to fend off new comers.

That should be rapidly ending now, creating a much better prospect for recent grads.

But apparently this is not the case.

Correction: as of 2014, 4 million US workers had left the labor force through retirement SINCE 2008.

“The Fed ks blind to bubbles.”

There’s a reason for that. To admit to them would result in the exploration into the fact that they are the cause for them.

They have a lot of baggage that needs to be sold to someone, and a portfolio of bridges.

Meanwhile rioting seems to be on the rise, wonder if the root cause happens to be lack of opportunity resulting in a declining society?

Cardboard box prices might rally along with the unicorns this time around, leave no stone unturned.

CDR,

Great analysis and true.

We have broken all the tethers to stability and now can’t deal with the instability. We have a broken system of companies which know how to raise their stock price but not their earnings. A broken political system of politicians that can get elected but don’t know how to govern. A citizenry that expects the people who broke the system to fix it. None of these things will lead to good outcomes. I never thought I would live to see any of these things, but here we are.

Central banks are like dark matter engines. Mathematically impossible from a rocket scientists point of view, the economy stays as is without moving while central banks move the universe around it.

“Population growth papers over a lot of ills for economists: for example, in the US, 14 million jobs were created since the Financial Crisis, which has been touted endlessly. But the US population grew by 15 million people.”

=========

Population growth does not just “paper over a lot of ills”. It is an absolute necessity in / for the “design” of whatever you want to call the present economic system in which a small percentage of the population owns the vast majority of “money” and capital equipment.

If you don’t believe me, use you imagination and ask yourself the following. What would the US’s economic situation be today if since the so-called

“financial crisis” its population had decreased by 15 million people instead of increased by 15 million.

For example, if seven years ago “investors” had actually known that over the next few years the population would decrease by 15 million, in just exactly what would they have “invested” their “money” — real estate? I doubt it.

http://jpninfo.com/22498

So “where” would they have put their money to eek out some “profit” in the future?

In short, the present economic system cannot “stand up” in a world with a stable population, let alone a shrinking one. And THIS is the reason why we see governments and central banks (that are controlled by that same tiny percentage) are doing what they’re doing. It’s the one and only way to allow that tiny percentage to “make a profit” and sustain the present fatally flawed design.

Just is it always did in the past, our economic system requires a wildly-growing population, but the earth cannot sustain a wildly growing human population. It may not be able to sustain the present one.

Therefore, the very old (far, far older than the “science” of “economics”) human social “arrangement” in which a tiny percentage of the population “just happens” to own the vast majority of wealth (and that tiny percentage expects a future “return” on any investment of their wealth) must be changed.

It must be changed because the materials of war, the corporations of war (that employ millions of voters), and war itself may be the one and only “investment opportunity” available to that tiny percentage in a world that has a stable or shrinking population.

Yes on an expanding population, it logically is necessary assuming you intend on the same path. The strategy must change if/when population ceases to expand as a result of environmental consequences.

RE can easily keep rising in price despite a stable or even declining population. Just look at all the tricks the Dutch are using:

– demolish complete neighborhoods of rental housing because the houses are ‘outdated’ despite being perfectly find for the people who live there (private homes in the area are purchased by the government for top money and demolished as well).

– importing loads of foreign migrants who are all entitled to their own free home and first on the waiting list for rental homes (so the locals have to wait over 10 years for a rental home, and try to buy despite sky-high prices).

– make sure that it is attractive for speculators to buy homes because of zero property/transfer taxes, steadily rising valuations, negative rates and punishing taxes for savings accounts etc. Before you know it 10-20% of the inner cities are empty homes, used to park speculator money.

– make it impossible for citizens to buy private land for building so they have to buy from local government, which means paying at least 100.000

euro or so for a tiny plot of land.

Yes, home prices in the big Dutch cities that still have population growth are rising at the highest rate but even in depopulating areas prices have been rising on average for over 30 years. Never bet against politicians and bankers, they make the rules and you have no chance playing their game; they always have more brutal and dishonest policies up their sleeve.

“– importing loads of foreign migrants who are all entitled to their own free home and first on the waiting list for rental homes.”

===========

This is the standard practice. Here’s how Canada plays the immigration strategy:

http://www.theglobeandmail.com/news/politics/ottawa-seeks-to-bring-more-than-300000-newcomers-this-year/article29069851/

The question is: why is this necessary? The answer is what I wrote above — to sustain a fatally flawed system.

FWIW – “There’s something happening here, what it is ain’t exactly clear. There’s a man with a gun over there telling me, I got to beware.”

“Just is it always did in the past, our economic system requires a wildly-growing population, but the earth cannot sustain a wildly growing human population. It may not be able to sustain the present one. ”

That is THE bottom line, they dont want to talk about.

As the ramifications are huge, and all negative.

For a consumerism based capitalist system, run for the Oligarchy owned, Globalized Vampire Corporates. Which is what we currently have..

I bet the solution of the elites for this issue is simple: consume (much) less per citizen, but pay a lot more. Said otherwise, runaway inflation and a lower standard of living for the 99%. Of course not for the elites, who are the real cause of worldwide ecological destruction due to their huge environmental footprint.

I think there are better solutions, e.g. switching from material consumerism to virtual consumerism that doesn’t tax the environment. A lot of the technology is already there and we could make that transition within one generation. But it will be difficult to tell the current people of the world (especially those in the US) that they don’t have a god-given right to own a big home, a big polluting car, countless gadgets, have several foreign vacations a year etc. etc.

People have been brainwashed, even the legions of migrants that flood into Europe have these same materialistic aspirations; maybe in ten years time they will understand how wrong they were in coming to Europe and expecting paradise just by being given everything for free (here too, it’s their god-given right: many of them complain about everything they get for free, it never is good enough even though most of the stuff is brand new).

Yes sustainability, sustainable capitalism and sustainable population levels.

Major City’s are a big part of the problem. They have way outgrown their original purpose, as a place to meet, to trade, and house the national administration. All most of them do today, is hold a huge consumer mass, and leech the rest of the environment.

Without Consumerism based Capitalism, that consumer mass has no purpose, and is not needed.

As the Population level drops, so will the volume of the % at the top.

There will always be a % of alcoholics, drug addicts, grossly immoral women, lazy no hoper’s, bully’s, thieves, successful, and super wealthy.

What has happened today, is not that the super wealthy are to many, or have to much, but that the unproductive Consuming population mass is simply to large.

To coin Plagiarizer Mao. “Useless mouths” is what we have, a mass in the west being fueled by the, untenable, uncontrolled population explosion, in the indian subcontinent Africa and South America. America in Particular is still importing to many unskilled mouths, to feed its untenable consumerism and ever expanding population based capitalist model.

England has said STOP as it social services and society are imploding under the strain of mass un/low skilled immigrant, going there to milk its social services.

Europe will do the same eventually, or become Sharia Law Europe (which is the plan in Tehran).

America was modeled on London both were founded on Immigrants both are now being swamped by the wrong sort of immigrants.

I support immigration to meet skill shortage labour shortage demand, but not the Mass unskilled migration the west is being subjected to by a taker group that intends to contribute nothing to the society’s that they are invading and colonizing.

Some of the people organizing this migrant invasion are doing so with the intention of controlling the society’s they are using the migrants to invade.

The white western birth rate is dropping, what the west does not need is immigration to fill the population loss, the birth rate on the rest of the planet needs to drop, and excess population needs to stay in its birth nation to emphasize that.

The Globalised Vampire Corporates allied with china, need more western population to milk.

The Globalised Vampire Corporates, Currently allied with china, are not compatible, with a smaller sustainable population, living in a globally sustainable manner.

The world needs to decide, if we are to have a sustainable smaller population for a long time, or richer Globalised Vampire Corporates, for a short time.

Humans better hurry up and change, if they wish to stay around, as the planet will not tolerate their current population level and behaviors for much longer.

BREAKING NEWS

The US Fed, the BOJ and the ECB warn OECD of severe recession leading to deflation/ depression if interest rates rise.

Take your pick- one’s a rock the other a hard place, ones the devil the other the deep blue sea.

The reluctance of governments to force borrowers to pay higher rates is partly due to their fear of a recession, but also because they are the biggest borrowers.

Governments have to either inflate their way out of their debt, default on their payments, possibly including pensions, raise taxes overall, or seize wealth by raising taxes on the wealthy.

In the case of the US, I believe alone in the G20 without a VAT ( Federal Sales Tax- in Canada the GST) would seem to loom large.

BTW: the rich may hate the GST more than anyone- for some it’s the first time they’ve paid tax.

deflation, cheaper everything, money getting some of its value back after getting almost worthless within the last 100 years? bring it on …

Would be the best thing to happen IMHO, and teach much of the sheeple a valuable lesson about living within your means instead of living at the (future) expense of others. But I think it has zero chance, the bankers and politicians would rather blow up the planet in a nuclear war instead.

As to VAT, do you really think the elites care? I have a pretty good idea of how they spend their money, and almost all of it is on stuff that is VAT-free, because of special laws (we have to keep the 0.1% happy) or because their big purchases are done – at least on paper – outside the country in a tax paradise, or through some shell company that can claw back the VAT from the government. The elite doesn’t pay taxes, maybe VAT for food and some other stuff that is less than 1% of their expenses …

And raising taxes on the wealthy, you are joking I guess? Just look at Greece, the wealthy in Greece could easily pay for the whole government deficit with only their black money stuffed in Swiss bank accounts. But from the list of over 2000 big tax cheaters that was handed to Greece many years ago, only 2 have really been prosecuted and fined. I bet those two were people that the government didn’t like for some reason. In the mean time, a lot of people were removed from the list thanks to family ties to Greek politicians or other elite. That’s the way ‘taxes for the rich’ are don in the West (of course not just Greece, they are just a bit less clever in hiding what they do).

Re VAT: In Canada it is almost impossible to avoid VAT (GST)

An elderly couple wanted to donate park land to the province- the Feds had their hands out for 7% of appraisal. This one was eventually sorted out.

Renowned painter Toni Onley would get up in the morning, take 10 dollars worth of paint 10 worth of canvas- and at the end of a good day have a five thousand dollar plus painting,

Revenue Canada : ‘Please pay 7 % (it was 7 for years)’

As of when?: ‘as of the end of the day you completed the painting.’

But it hasn’t been sold!

The GST is not just a sales tax it’s a Value Added Tax, often collected at point of sale ( when wholesale becomes retail, value is added) but not necessarily.

This one again was worked out with some kind of compromise.

In Canada there are exemptions- food, kids clothing, bikes, etc.

Motherhood stuff. Funerals were but no longer.

In New Zealand a co-inventor of the VAT, there are no exceptions.

The province of BC ordered a ferry from Germany- GST was demanded, don’t know how it ended.

‘And raising taxes on the wealthy, you are joking I guess?’

Try reading the comment before waxing sarcastic. I’m listing the logical alternatives not likely ones. And believe me, the wealthy have been pillaged many times in history- if you were a Jew who managed to get out of Europe pre-1940 you left everything behind AND you paid heavily for permission to leave.

And you might want to try reading up on the more recent UK super tax era, where the marginal rate (only reached by wealthy) went to 90%.

This caused the Rolling Stones among others to leave the UK.

Greece is a basket case all of its own in the developed world, well ok sharing a cell with Venezuela although they are charged with different crimes. Greece may not be governable and may be heading for its second civil war since WWII.

Neither is a useful example except maybe of what not to do.

A tax rate of 90% is never paid by the elite, they simply shift their income to other countries. That is one of the basic problems that no country in the West really wants to avoid (because all the people who make the rules profit from it). Do you know what country the Rolling Stones moved to, on paper?

My country had a tax rate of 70% in the nineties that kicked in above something like 75K guilders (35K euro) per year. But I guess I was one of the very few really paying it, most people with higher incomes used this to deduct mortgage cost (of course from a huge mortgage that financed a lot more than just the home) with the effect that they paid nothing. Quite some pop stars and other wealthy people officially settled in Netherlands or route their income through a shell company in Netherlands. It’s a tax paradise, on the condition that you are very wealthy or buy a severely overpriced Dutch home.

As for the tax and VAT rate exceptions, maybe Netherlands is different because as a small country they are more likely to play with the rules in order to lure rich people and big multinational companies (which works, but doesn’t benefit the tax payers in any way).

While we pay 21% VAT on daily products like most food and all kinds of mandatory services, super yachts (costing 100 million euros or so) are purchased totally VAT free using a trick that is silently approved by our tax office. We don’t want to make life difficult for the Dutch super-yacht builders, do we? Expensive art and antiquities, luxury estates etc same story.

I don’t think Greece is much different from Portugal, Spain or even France. They are just some years ahead on the path that is inevitable.

I’m pretty sure the sheeple had believed what they were told to believe.

“Now set to work, and if by tomorrow morning early you have not spun this straw into gold during the night, you must die.”

Nice Article Wolf. I just wish the mainstream media would start reporting the reality about the economy rather than rainbows and unicorns.

I managed to catch Mr. Richter’s apparent reappearance on Max and Stacy’s show this morning.

It’s nice to be able to put a face and voice to the wolfstreet blogger. I have been watching The Keiser Report for about five years or so, yet I don’t recall your last appearance.

2012? 2013? It’s been a while…. The TESTOSTERONE PIT days.

‘OECD Warns Fed, BOJ, ECB of Asset Bubbles, “Risks to Financial Stability”‘

That’s a feature, not a bug. Bubble and bust cycles are one of the principle means by which TPTB accumulates and consolidates the world’s wealth. The last was a doozy. The next will be humonguous. One or two after that and they’ll be done.

Why, when the situation is so clear and alarming, does it remain so stubbornly intractable to change? It’s because those who have power in the world want it to be this way.

… plus much of the sheeple also think they want it this way.

“The Fed Really is Monetizing Government Debt” as Jeff Deist wrote in ZeroHedge on 21 September.

The Fed went from a $0.8 T (trillion) balance sheet at the end of 2008, to a $4.5 T sheet today. Initially, the public was assured that the FOMC would return the Fed’s balance sheet to “normal, pre-crisis levels over time.” But that has not happened.

As Mr. Deist reports, the Fed’s increase in Treasury debt holdings, if permanent (which in reality, it is), corresponds to new money that will remain in the economy as either cash in circulation or bank reserves. As the interest earned on the securities is remitted to the Treasury, the federal government essentially can borrow and spend this new money for free. Thus, under this scenario, money creation becomes a permanent source of financing for government spending.

“The Fed’s willingness to buy Treasury debt represented a kind of blank check for Congress: don’t worry about the debt, spend what you need to …” Deist accurately states.

So now we have zero interest rates and an annual budget deficit that’s relentlessly increasing the national debt. The roughly $3.7 T balance sheet increase is sitting on Wall Street as reserves, and the GDP is stagnant as there’s little cash for the masses to spend to kick-start our economy.

To me, this looks pretty F-ed up. David Stockman puts the blame for this on Alan Greenspan starting in 1987, and that’s really the beginning of the wealth inequality shift that we see.

Government self-funding by printing money is the old way of doing things, I’m not so sure by itself that’s any problem for Jos Sixpack.

Can you provide some reason it’s F-ed up for the average Joe living paycheck to paycheck?

I’m sure if he’s told this is bad he’d believe it b/c he’s already proven he believes every lie financial wizards and economists tell him and still he can’t comprehend why his adjusted income has been stagnant for decades. That’s right, JS is no financial wizard, unfortunately.

I can’t really provide reason for ‘average Joe’, but what the Fed did after the 2008 crash was F-ed up. The Fed gave secret zero interest loans to the tune of $13 T to banks that were insolvent. These banks, Citicorp being the poster child, deserved to have the free market forces do their job; get rid of those that are bankrupt.

Instead, these banks continue today, and they commit felonies against ‘average Joe’ (Wells Fargo, JPMorgan et al) with only fines being levied, and no criminal charges for those in control (Jamie Dimon).

In my opinion, it is F-ed up that the Fed printed trillions of dollars and basically gave this capital at zero interest to Wall Street for them to sit on as ‘reserve’.

Since Greenspan took over the Fed, the average Joe’s income is flat, but the top 1% is up 300%, and the Forbes 400 have been up 1,000%.

incomes may be flat (not for government workers though here in Europe, most of them are significantly ahead compared to 2008) but at the same time, in my country the average home-owner had their mortgage cost decline by 50-90% and for those with a maximum mortgage (a large chunk of the population) the valuation increase of their home is often more than their official income – and all that with almost zero taxes.

Many people are profiting hugely from the crisis, and not just the ‘elite’. The problem is that all this easy money comes from the pockets of others (often savers and renters) so there is no benefit to the economy. And in the long run, the bigger problem is that the debt keeps growing with the result that there is no way back, and all the bad incentives that will destroy the economy for many years to come (like rewarding financially stupid behavior and punishing financially responsible behavior)

Hey Wolf, saw you on Max tonight!!

Total credit to Wolf, I am not a cult follower at all. I follow many websites but you,re website is varied and interesting.

I always cross check my information flow and your website offers many interesting pieces.

Keep up the good work, I respect your input.

I read on Bloomberg that US banks today have much less leverage than during the financial crisis. Now, ignoring derivatives (which seem to have vanished as a concern for some unknown reason), I don’t see a crash coming unless the system is leveraged up.

Right now the markets are rising because they are pricing in a Hillary victory. Hence you should expect the markets to crash after the election because either ( a) Hillary won, so the ‘sell on the news’ dynamic is in, or Trump wins, in which case the markets sell off because, errr… Trump has won!) This will all be short term so long as interest rates are zero.

I read somewhere that home equity for US home owners rose by 10% over the last year. That’s quite a few new lines of credit!

This bubble is only just starting.

“Now, ignoring derivatives (which seem to have vanished as a concern for some unknown reason),”

Derivatives only vanish as a doomsday concern when the Derivative scaremongers are elsewhere perhaps screaming about the Central Banking Caba,l or Goldman Sax, secretly taking over the world.

They will return to screaming about derivatives in due course.

Derivatives are always part of the calculation for the slightly less hysterically adjusted.

“I don’t see a crash coming unless the system is leveraged up.”

The US system isn’t as leveraged up, as it was. IMHO, it is still, way over leveraged as a whole, especially when considering NPL’S, which in the US also need’s to be extended to cover NP Bond’s and Subprime Auto.

Europe and china ??????????, and they are interconnected with the US. look at the MXN $US Trump trade trade, for a close to home economic international connection.

In trading/investing, complacency will get you into more trouble, than Personal Bias, EVERY time.