When will the Home Price Bubble blow up?

Home prices in China are “high and hard to accept,” said 53.7% of the respondents in a survey by the People’s Bank of China, published today in the People’s Daily, the official paper of the Communist Party. Only 42.9% found them “acceptable.” And only 23.1% predicted that they would rise next quarter, while 11.9% expected them to fall. But that isn’t stopping people from wanting to participate in this frenzy:

Nevertheless, the ratio of residents who were prepared to buy a house within the next three months increased 1.3% from the third quarter to reach 16.3%.

That’s a lot of people “prepared to buy a house,” even with prices “high and hard to accept.”

There are several remarkable things in this survey: the worried tone in terms of the soaring prices, the increased desire to buy because, or despite, of the soaring prices, and the fact that this survey came via the official party organ from the PBOC which has been publicly fretting about the housing bubble, the debt bubble that comes along with it, and what it might do when it deflates.

And what a bubble it is!

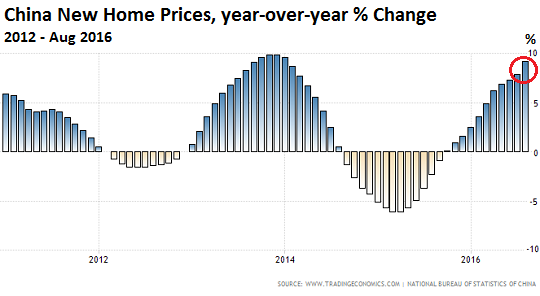

The average new home price in 70 Chinese cities soared 9.2% in August year-over-year, after having jumped 7.9% in July, the eleventh month in a row of year-over-year gains, according to the China Housing Index, reported by the National Bureau of Statistics. In Tier 1 cities, prices skyrocketed: in Beijing, by 23.5% and in Shanghai by 31.2%!

Prices increased in 64 of the 70 cities, up from 51 in July. They fell in only four cities and remained flat in two. This chart by tradingeconomics.com shows the year-over-year percentage change in new home prices, the boom and bust cycles, and the stage of the boom where prices are at the moment:

Housing construction is critical to the Chinese economy. When construction suddenly slows down, as it does when the housing bubble deflates, it has deep and broad effects. And this phenomenal home price bubble and the construction bubble that comes with it are funded by ballooning debt: outstanding bank loans to households, mostly mortgages, surged 21% in August year-over-year, according to Bloomberg’s math.

“The more immediate risk of a sudden and steep downturn in the economy comes from the threatened bursting of the property market bubble,” Pauline Loong, managing director at research firm Asia-analytica in Hong Kong, wrote in a report, cited by Bloomberg. “The real question for investors is when and what will pop the bubble?”

The central bank has been out there, trying to gently deflate the Chinese property price bubble before it pops violently. Ma Jun, chief economist of the PBOC’s research bureau, warned in an interview September 11 interview:

“Measures should be taken to put a brake on the excessive bubble expansion in the property sector, and we should curb excessive financing into the real estate sector.”

According to a note today by JPMorgan Chase analysts led by Zhu Haibin, paraphrased by Bloomberg: “One difficulty in reining in the home-buying frenzy is the larger leverage residents used through commercial banks with a growing appetite on mortgage loans.”

Other measures of credit soared too in August. Aggregate financing, the broadest measure of lending, hit 1.47 trillion yuan ($220 billion), far exceeding expectations. The voices of concern, according to Bloomberg, are accumulating:

“Monetary policy is obviously loose and liquidity is ample,” said Zhao Yang, chief China economist at Nomura Holdings Inc. in Hong Kong. “The loans almost all went to the property market due to surging prices in big cities.”

“Monetary policy is pushing on a string and we are reliant on state lending, spending for recovery,” said Michael Every, head of financial markets research at Rabobank in Hong Kong. “But that can’t last forever. It’s a clear sign that there is a liquidity trap.”

Regional and local governments have also been trying ineffectually to tamp down on the frenzy before it blows up wildly. Shanghai and Shenzhen imposed some home-buying limits in March. Other governments followed, according to Bloomberg:

Hangzhou, Zhejiang’s provincial capital, on Sunday halted home sales to some non-local residents, adding to similar bars introduced last month in nearby Suzhou and the southern port city Xiamen. More second-tier hubs, including Jiangsu’s provincial capital Nanjing and Hubei’s Wuhan increased down-payment requirements in bid to dent demand from speculators.

More governments are expected to announce curbs on home buying. But these measures are unlikely to work very well unless the central government and the PBOC tighten credit and mop up some liquidity. But that’s exactly what could bring this whole construct crashing down. So for now, the PBOC might instead refrain from loosening its monetary policy further and attempt to jawbone down home prices and mortgage lending, or at least keep them from inflating further, via interviews and surveys. This is tricky business in an economy that runs on monetary fumes.

House price declines have caused uproars in China, which is exactly what authorities fear more than anything. But they also fear bubbles, having seen how they implode – and cause uproars. Read… Another Big Central Bank Warns on Housing Bubble, Frets about Risks to Banks, Blows Whistle on Stimulus

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Chinese are incredible, they can switch from one bubble to another without having a crash. In Western markets the players would have lost so much money from one bubble, it takes a while to get another bubble going, but the Chinese switched from the equity bubble to a housing one seemingly with no pause. They have to be the richest people on earth. And when this one pops, I bet they’ll just go back to commodity/stocks again.

They’ll pop at the same time- deflation/ depression sinks all asset classes.

The Chinese bubbles ( really one big bubble) are the result of several things: not in order of importance they are: very few investment vehicles other than their stock market and their real estate. Only the 1% of 1% can buy in London etc.

Investing in foreign stocks, something discussed all the time in the US is impossible except for the aforementioned clique.

A frantic expansion of credit exceeding anything in history. Foreigners in China notice all the money is new- it is hot of the press.

Part of the above: the shadow banking system, which among other things lends down payment money- one of the securities a young girl friend can be asked to provide: nude pictures for blackmail.

Multi- generational pooling of cash and borrowing power.

A crack down on short sellers or even journalists who are bearish.

No social security, so investing is almost literally a life or slow death affair.

There is a resemblance to the US Fed’s extreme reluctance to allow a recession, because both are far out on the limb.

But China is further out on the artificial credit limb and is a much more unequal society.

About 8.5 million CCP members and their small families consume about 80 % of the health care budget- almost literally 1% of 1%.

A deep recession in the US does not equal regime change although it might equal party change.

There is no mechanism for China to change the CCP, other than revolution.

Thus the CCP will double down as long as it can- but if something can’t go on forever, it will end.

I can assure you millions get hurt.

Back in 2008 we didn’t see Hoovervilles in the West because they were located in China’s interior: the big exporters and their contractors laid off millions (no official figures exist and estimates go from as low as 4 millions to as high as 20 millions) but us Westerners, as our usual, believed the official figures.

Now the Communist Party has announced it’s laying off immense numbers in heavy industry. Official figures say so far in 2016 about one million steel and light alloy workers have been laid off by State-owned conglomerates such as HBIS and Baosteel, with a further 800,000 steel workers alone to be laid off by the end of 2017.

Precisely to give the impression that everything is smoothly transitioning to the chimaeric new “consumer economy”, Beijing has announced of these million workers 480,000 have already been hired as… taxi drivers! The rest are probably being trained as hairdressers as we speak.

According to a piece in Bloomberg a few months ago, apparently not sarcasm, the new jobs replacing lay offs in: steel, aluminum (a biggie, two trillion $ Chinese industry- flooded world wide supply) concrete, construction, etc. are: ‘baristas, barbers and (my favorite) baby sitting.’

I’d love to know the origin of this- written under the byline of some Bloomie sweet young thing who didn’t think ‘WTF- you’re punkin me’ when she was handed the raw ‘info’

Surely even the CCP, that keeps repeating the new mantra of growth- 6.7 …6.7 …6.7 (after realizing that the former new mantra- 6.9, sounded a little too much like the original version 7,,7..7 ) wouldn’t come up with such.

Is it possible that a saboteur in the Ministry of Truth planted this, or did it begin as a joke?

PS: China expert Ann Stevenson-Yang in her masterful presentation of Feb. 2015 (enter her name and look for her photo on Youtube)

describes an aluminum plant that wanted to close but had to stay open so the CCP owned, sorry, State Owned (you figure out the difference) bank wouldn’t have to declare a loss.

The big problem for Bloomberg is China already has a vibrant consumer economy, otherwise Apple wouldn’t be able to use iPhone preorder/sales data from China to save the day. Well, at least until channel stuffing is still legal (sort of) there.

The old economic milieu with its foundations of “scarcity” is indeed rapidly being replaced with new one with foundations of “satiety.”

Of course the new economic milieu of “satiety” currently exists only in a few select sectors in a few isolated areas, but it is rapidly displacing the old scarcity based economics as autonomous robotics/automation, artificial intelligence/ “big data” computerization, and the many other highly disruptive technological developments are deployed.

This is on top of a rapid shift to mega urbanization, which appears to be acting synergistically with the implementation of disruptive technology, to drive head-long socioeconomic/cultural change [evolution? degeneration?].

You have to separate the Chinese people from the CCP because these are two different entities (I kid you not!).

I am not sure that is really so different than here in the bat area…….

I think in some parts of the Bay Area, we’re already on the other side of the curve.

You may remember a large part of the inner urban main city Japanese property bubble, was Yakuza,money laundering/fraud driven. Especially close to the end of the bubble period.

How much of the chinese tier 1 city’s gains, can be attributed to the same sort of activity? They have a huge amount of money to wash/extract, before the implosion.

Must be the peninsula. Prices are crazy stupid.

The inscrutable Chinese truly are.

Home prices are at a 6 year high since January 2010.

Mortgage loans at 21% of all loans, yet total Chinese loan demand is down to 55.7 from it’s high set March 2010 at 87.0

We have just looked at the China Containerized Freight index, which is bottom bouncing, portending an economic slow down. As far as their exports are concerned.

Importation of all commodities are down, yet again pointing to an economic slow down.

Truly inscrutable.

An ancient Chinese curse: “May you live in interesting times”.

“Interesting” is fast becoming too calm a word!

The 3 “Ancient” Chinese curses were the work of a 1950s Science Fiction writer.

May you live in interesting times.

May you come to the attention of those in authority.

May you get what you deserve.

Interesting in the context that Chinese scholars wrote about interesting historical events – war, famine, pestilence, revolution.

Attention in the context of attention by police and similar organs.

Deserve in context that is not always positive.

China is taking seriously this whole “consumer economy” thing.

If mortgages are skyrocketing, loans to large corporations have staid stagnant at 51.5/51.4 for quite some time now.

However loans to “small manufacturers and businesses” have dropped 55.8 and those to “medium-sized enterprises” plummeted to an unheard of 52, the lowest since the PBOC started releasing loan demand data in 2004.

In short it seems, very much like their Western counterparts, Chinese leaders expect cars and houses to pull their chestnuts from the fire.

Two words of caution however.

First, we all know Heisenberg’s Indetermination Principle will strike again and these data will soon be made useless by outright manipulation. Let’s see how long it take for that index to rebound all the way back to 60 if not 65.

Second, for us foreigners it’s impossible to know what is going on in the shadow banking system. While I suspect the PBOC has at least some idea, those data are not going to be freely shared in raw form.

Indeed very much like the West and no surprise given where much of their leaders have studied; but still very disappointing.

Give it a few years and even disposable income in China will be similar to that of many EU countries (they are already ahead of some former Eastern Block countries …). Also, my impression is that the amount of government lies and propaganda and the absence of free speak in the newsmedia, science etc. is now worse in much of Europe (especially the more ‘developed’ North/West part that is aligned with the US) than in China.

BTW, we don’t know what is going on in the Chinese financial system but how much do we know about what is going on under the hood of DB, JPM, G$ and similar entities? Most of them were practically bankrupt in 2008 but government makes sure the zombies thrive – also very similar to China.

Reality check: you are posting on a public forum under a ‘handle’ not your name, but it would take the government minutes to find out who you are.

In Mainland China, if you said the government statistics were lies, especially if you were a journalist, you would be arrested.

There was world wide video coverage of the young financial journalist in court, looking all forlorn, held up by two uniformed thugs. His ‘crime’ suggesting the government inspired stock rally was short lived.

But in Europe even ‘the more ‘developed’ North/West part that is aligned with the US’, you can say anything you like. People there and in the even more US aligned, the US, say the government stats are lies all the time.

The above piece you are commenting on uses Italian government stats to show Italian growth is lousy.

The Chinese stats say growth is great at 6.7 %.

Which one is more likely to be ‘lies and propaganda’?

@nick kelly:

discussions on open internet forums are not the norm. Indeed China is pretty scared about people stirring up trouble there, while our Western leaders know that people on internet forums bark but don’t bite. They could not care less.

I’m convinced that much of the general discussion in China and even what is written in the printed media is more honest nowadays than the BS we are presented in the west. I also know from experience what happens in the west with scientists who openly critize the government and refuse to stick with the government PR BS.

BTW, several high academics and even party officials in China have stated recently that some of the statistics are bogus or e.g. that the government should change policy on some important issues; I don’t think any of them was arrested. It really depends on how it is said, I don’t think China is afraid of valid criticism (unlike the US and its vassal states) as long as it is presented the right way.

My government just today stated that growth is solid but a bit less than they hoped, that everybody is going to be better off financially next year – but almost nobody in the street believes them. Wonder why?

‘BTW, several high academics and even party officials in China have stated recently that some of the statistics are bogus..’

Source or examples please.

Here’s an example:

http://www.nytimes.com/2016/01/27/business/international/china-economy-data-statistics-inquiry.html

@ nick Kelly:

I don’t know your location, but for example earlier this year there was a documentary on German Arte channel (the cultural channel, always very much in favor of the EU and usually pretty critical of China) that presented some of the highest level Chinese officials and academics talking about this issue, including e.g. the people who are responsible for city planning in Shanghai (and who need very reliable data to make the best plans for building and transport), several economists and statisticians from Beijing University and some high ranking party officials who make the recommendations for where the party and China are going. They made it perfectly clear that all these issues are openly discussed in China (just not on internet forums …), and that opinions sometimes differ strongly.

It all made a far more honest impression on me than the way our Western politicians and planners do things, all based on a web of lies. And it was obvious that many of the new managers in high positions are very bright (and very young!) people instead of failed politicians and bureaucrats who are rewarded for party favors with a top job like it is still done over here.

“The international credibility of China’s G.D.P. figures is anyway very low, so this probably is not a severe blow,” said Diana Choyleva, the chief economist and head of research at Lombard Street Research…”

Even the CCP realized their BS could no longer fly. A touch on the rudder was needed. We’ve gone from a claim of 7% growth to 6.9 to 6.7. Next? How about 5.5?

The lashing out at the stats guy comes from higher up- probably XI himself, and follows the time honored tradition of passing the buck down when it hits the fan.

Of course there is no peril to the critic in this case- the fact that the CCP might have been upset by real numbers last month doesn’t prevent it from changing its mind. Reality is what the CCP says it is.

I do not equate this with the claim of a freer more honest media. The test of such is when those not in power criticize the powerful.

true kings of capitalism thank god they dont have 15 percent taxes like the moron christy clarke

Still almost all residential real-estate purchases are for cash, or 30% down.

Cash borrowed via the shadow banking system?

Wolf,

we need to get to the bottom of this cause posters like David keep harping on this 30% down issue as if that’s why China will NEVER have a property crash.

And it’s been 5+ years since China Ghost cities was all the rage so an update there would be interesting as well.

I remember reading a long article about this 2-3 years ago that stated that in many areas in China (but possibly not in the hotspots) it wasn’t even 30% down but more like 60% down or paid all in cash right away. It’s a huge difference with countries like Netherlands where almost nobody with a mortgage has serious skin in the game; these ‘homeowners’ will stop paying as soon as there is a serious price decline. I don’t see that happening in China (except maybe for the speculative hotspots).

It makes a bit of difference of course that many Chinese ‘homes’ are purchased as empty shells, so part of the cost is still coming at some time in the future.

As for the ghost cities, maybe China can offer to house all the EU migrants? Countries like Netherlands and Germany are now spending up to 50.000 euros per migrant per year on housing alone (of course some of the elite are making huge profits from this …), I guess for that cost China could offer them a small home not for one year but for life, and including a free airline ticket ;-) Of course this will never happen with the current politicians in charge, because it would endanger the ‘business model’ of some of the elite and the Dutch housing bubble.

This bubbling mal-investment binge must be hurting the 90+% badly – I read renegade Chinese journalists who emphasize that the ugly civil oppression this financial havoc has instigated across the provinces will lead to revolution sooner or later – you can’t stop a few billion pissed off Mr. Chans, no matter how far you run and how many police/military you put on the street. I wonder if an open Chinese revolution would not inspire other unstable populations now under the thumb of central banks who protect their own at the expense of the larger society? The elements, as they say in Hollywood, are all there, and have a sense of inevitability about them. Few are unaware of how close we are to an irresistible spiral down into economic apocalypse, but few understand the true forces at work .

Striking out in all directions, aimless, inchoate, angry has just begun: somebody owes me and it might as well be you. Keep drinking.

The international housing bubble has long since passed my grasp of macro economics and now, my mind sprung like an overwound watch spring, I just sit back and watch it as spectacle waiting for the story’s crescendo climax.

If it dosent implode in a big way globally. We are in for a big period of Social unrest, as the ordinary can no longer afford to buy, or even keep their inherited property’s, at the municipal taxation, set by the unrealistic property values.

The left thinks its great, when inheritance tax takes from the rich. Now municipal tax is taking property’s from the poor, putting them on the street, yet the left still thinks all is well in the municipal extortion system’s.

it doesn’t have to work like that, in Netherlands it is the other way round: property taxes and tax on gains from selling your home are close to zero, and people with lots of money can pass 100.000 euros per child per year tax-free (no inherit taxes), on the condition that it is used to buy a Dutch home.

Also, the ‘poor’ (those on social security) don’t have any problems with the Dutch housing bubble, in fact they get better homes every few years without paying anything extra – because the housing corporations keep improving the homes so they can jack up the rent (and collect even more subsidies from the government).

Both the left AND much of the right thinks this is great because they keep getting ‘richer’, thanks to the leverage frequently with yearly gains from the home piggy bank that are bigger than from a real job. The real middle class, people with significant savings and renters in the free market are thrown under the bus to make this happen but they are a small minority among the voters, so who cares …

It is all great as long as the Ponzi keeps going, and because the Dutch housing Ponzi has been going on for 30 years now almost everyone expects it to go on indefinitely. And even if the bubble pops, most people with a mortgage fully expect the banks or the government to come to the rescue.

The dutch situation is rather unique and is also long term untenable.

What I wrote does not apply there.\

The system in Holland will be imploded, by overloading, by immigrants, mostly from the greater ME.

Just as no productive immigrants are imploding the NHS and the Pension system in England.

The seemingly limitless ability the Chinese have to run up real estate in many world class cities/areas and still inflate their own truly amazes me. I was telling my husband the other day that I feel that whereas the majority of Americans have an internal gauge that makes them take to the sidelines when real estate reaches a certain price level, the Chinese don’t have that. High pricing results in the opposite frenzy effect. I think they view real estate completely different from the people in the U.S. I have no idea but its really interesting. Am I seeing this incorrectly?

yes, incorrect. I don’t think there is any difference between this kind of idiocy in China or the US, and not only for the masses but also for many of the execs of large RE companies who apparently believe their own BS.

Anecdotally, from friends who have traveled in China (and enjoy the country very much), the Pacific Northwest and West Coast are still seen an a hell of a ‘deal’; relatively few toxins, still some greenery, and not too much snow.

In addition, if they buy property in Seattle, Portland, etc, their kids can go to public (or private) schools. A US high school diploma, plus US residency, gets them farther up the line in terms of (US) college admissions.

IOW, buying a house gets your kids a better shot at entry into a first-class US university.

And that’s just for starters — the medical care in US is also viewed as a prime benefit of residence.

Housing markets across the world have laid waste to the efficient market hypothesis.

When the bubble inflates a collective insanity takes hold.

Markets are irrational and have been since Tulip Mania in 1600’s Holland.

Do not look for rational explanations, the prospect of easy money turns human beings into gibbering idiots.

Stocks, house prices, [yet another asset type] are going up in value.

I have heard of someone who has made lots of money, I want in.

I am making money, I need to borrow money to carry on investing and make more money.

Gibber, gibber, gibber ………………………………

The bubbles burst; I am going to be ruined.

No more gibbering, till next time.

Tulip bulbs ….. gibber

South sea company …. gibber

UK Railways (1800s) …. gibber

The new internet (pre 1999) …. gibber

Sub-prime ….. gibber

Property …. gibber

Apple …. gibber

Social media …. gibber

Emerging markets … gibber

Easy money ….. gibber, gibber, gibber

Much more appealing than working for a living.

Imagine working in an Apple factory with suicide nets.

You are going to ride any bubble going to get out of there.

No wonder China is so bubblicious and price discovery doesn’t even get a look in.

in fact it has gotten a lot worse because in many cases government are now trying to ‘protect’ both the big and the little speculators from market crashes by making others (who did not participate in the madness) pay for the mistakes.

e.g. the Dutch have a ‘National Mortgage Guarantee’ that guarantees, with government backing, that you can NEVER loose money when you have to sell a home due to job loss, divorce, health issues or some other factors. Of course, everyone who is under water and wants to move suddenly feels the urge to ‘divorce’ or stir up trouble at work. You can have all the upside from the bubble (gains from housing are tax-free in Netherlands) while passing all the downside to others – great isn’t it, what government can do for us? The only limitation here is that the mortgage cannot exceed 275K euro which is about the median home price (but of course, one can piggy-back mortgages which is officially illegal but silently allowed).

After the Dutch tulip bubble many people, including some from the elite, lost everything. The biggest problem was that is was impossible to settle most of the debts, because much of it was not clearly registered (most tulip bulb speculation occurred in the local taverns). This had devastating results for the economy. After two years two high government officials were lynched as a result of the ongoing debate about how to settle the debts.

People never learn. I think this time we need to keep all politicians, bankers and small speculators personally responsible or it will be off to the races soon after the next crash…

We love our housing bubbles in the UK.

I bought into the UK housing market at almost the peak of our late 1980s boom.

The (almost) biggest fool who finally gave up on common sense prevailing.

The bust lasted years but there was no sensible phase before the next boom started.

University educated friends who had been caught in the same bubble as me had forgotten all about it in just over 10 years and were convinced that this boom would never end.

A University education (and a good UK university at that) still does not guarantee one iota of common sense.

From a Chinese citizens viewpoint, the graph implies that housing is a great investment. True, it is quite cyclical but it looks like two steps forward, one step back. For those investing for retirement or generational wealth accumulation this cycle is a trivial factor. As long as the central government can restrict long term stability investments ( gold? ) the muppets have no choice. Just a few decades ago land was the investment of choice. Mao proved otherwise. Consumer goods are not an investment. I wonder how investments in off shore blue Chip stocks are trending.

The PRC asset bubbles appear to be a phenomenon better explained by Behavioral Economics/Psychology than by convention economic theories. The recent and immediate personal observation of the [apparently] inevitable and continual rise in the cost [not value] of the foundational bubble asset becomes the dominant impression for many people (heart), rather than cold, hard, facts about the actual value of the asset and the dreadful history of asset bubbles (head).

The U. S. has twice had a similar situation, the latest based on residential mortgage backed collateralized debt obligations [RMB CDOs] which exploded in 2008, resulting in the “Great Recession, and an earlier frenzy in the early 1920s called the Florida Land Boom which exploded in 1925.

http://floridahistory.org/landboom.htm

The real takeaway seems to be that even with the monolithic Chinese Communist party, backed by the power of the state, asset bubbles still occur. Although not widely reported, a similar housing bubble seems to have inflated in mega-urban India.

Are asset bubbles an intrinsic “feature” of the new global economy? How can asset bubble inflation be minimized? Do we need anti asset bubble programs and education analogous to the (somewhat successful) anti smoking and anti drug campaigns?

If you understand the theory you can see them inflating.

Irving Fisher looked at the debt inflated asset bubble after the 1929 crash when ideas that markets reached stable equilibriums were beyond a joke.

Fisher developed a theory of economic crises called debt-deflation, which attributed the crises to the bursting of a credit bubble.

Hyman Minsky came up with “financial instability hypothesis” in 1974 and Steve Keen carries on with this work today.

Steve Keen saw the private debt bubble inflating in 2005. He had the right theory and it wasn’t a “black swan” to him.

In 2007 Ben Bernanke could see no problems ahead and his models didn’t include money and debt. He had the wrong theory.

With housing it is fairly obvious everyone loses their minds over the capital gains involved, so don’t leave it to the market, regulate it.

Better credit controls and lending restrictions can resolve most of this.

In the 70’s we had deposit regulations, and lending criteria regulations, on most credit purchases , along with restrictions on foreign investment in land, and no credit fueld bubbles.

The US and IMF and WTO did not like that, now we dont have any of those restrictions, and 1 of the larger housing affordability and housing bubbles, on the planet.

Our homeless and housing affordability issue are massive, and growing. But the US IMF and WTO are happy.

Fully employed family’s, are living in vans on the street, as they can not find any accommodation in their price range.

Clearly the well-being of the US IMF and WTO, is more important than the welbeing of our citicens. Many of whom are currently being made homeless by chinese property speculators.

Either property values go down, or wages go up, a lot ,to prevent serious anti chinese/anti immigrant social unrest.

China is using much of the same e-CON-omy nonsense that asset bubbles in the West are based on. No surprise that China is bubbling over now that they have drank the Cool-Aid from the west for 25 years or so.

It’s interesting that so many Chinese expect the bubble to stop growing soon and still want to buy (hurry, you can still get in just before the top?).

In the Netherlands – where the bubble is nearly 30 years old and price to income ratio is the highest in 400 years – a huge majority (70-80%) expect significant price gains again next year, of course helped by the usual bankster, economist and government propaganda. That explains why many still want to buy (if they get the loan …) despite considering home prices very high – buy now or be priced out forever. The Chinese reasoning seems a bit opposite…

There is a similarity though with the Chinese situation, and that is ‘TINA’. In the Netherlands buying a home with maximum mortgage reaps huge profits because all costs can be deducted from income tax, bringing the effective mortgage rate to around 0.5%. Unlike many other countries, transfer and property taxes are next to nothing (and upkeep is something that the next owner is expected to pay for …) while savings are heavily taxed, effectively more than 100% nowadays. And rents in the free market in Netherlands are punishing. Plus the Dutch mortgage guarantee system means that one can play the market with huge leverage while shifting all the downside risk to the taxpayers – something that is entirely absent in China unless you suppose that all these Chinese loans will be forgiven in future.

Judging from the numbers above the Chinese bubble isn’t very special compared to the Dutch one. Dutch mortgage debt increased by about 1500% while the bubble was growing, and yoy price increases of over 10% were the norm for many years (during most of the nineties and until about 2002; after that the yoy change was usually in the 2-5% range with a few significant down years).

It is difficult to know what is really going on with lending in China, but while in Netherlands 103% mortgages are the norm (down payments or paying down the mortgage for that matter are sooo old-fashioned …) most Chinese buyers still save for years so they can make the first down payment for their home, or borrow from their parents. They have a lot of skin in the game. Judging from that fact there is also still much room for the Chinese bubble to keep expanding…

“…skin in the game”.

China’s Ace in the Hole

The Chinese required deposit reserve is still quite high at about 11%

China can maintain their money market rates, most likely by cutting the reserve requirement ratio.

China has a ton of room to drop rates. The other three big central banks not so much, since they are at zero or below.

Agree, I think this bubble can keep growing for years if they want that – at least in most of the country. They are nowhere near the financial madness of e.g. the Dutch housing market.

One thing about China, when this bubble does pop, a whole lot of Chinese RE developers will lose their heads….literally!

These buyers into this bubble are going to get a good fleecing and education thats for sure The sheeple never learn

This is not bouble. This is CCP asking people for money. If CCP needs money for corporations, they engineer the stock market bouble. If they need money for construction workers, they engineer housing bouble.

Basically asking sheeple for money by inflation. Internally, China’s money printing inflation is huge but the exchange rate to foreign currency is buffered by the 3 trillion$ reserve. When people sees the internal inflation and wants to get money out, CCP put capital controls.

The point is, the entire China is not market based to begin with, therefore their bubble behavior is different from west.

How it will end? It will also end differently. In west, bubble ends in depression. In China, government asking people money ends in blood. How far is China to the bloody moment? Far far away because everybody in China knows if you go against government, you are risking your life. So as long as people can eat food, that day will not happen.

This is why people in China understands it is a “bubble”/”government asking for money”, but they have to pay any way. It is like tax.

I don’t know much about the Chinese housing market. However, I did attend school in NYC with a large population of Chinese girls. The Chinese are incredibly superstitious and family oriented. I understand that Chinese burial practices encourage the dead to be returned to their ancestral home, where they can be looked after by other dead relatives. It is a big deal to the living to fulfill these obligations, or their dead relatives will exercise ill will towards them, forever.

What may look crazy to us, may be based on a cultural practice, that has nothing to do with money or investment. Families may just be investing in their ancestral areas in order to fulfill cultural and religious obligations. Much the same way westerners build family mausoleums. Those ghost cities, may indeed be, ghost cities.

Much of it is cultural indeed, but I think this also varies strongly within the Western world.

e.g. in Netherlands they say that people from Belgium (neighbor country with very similar culture) are borne ‘with a stone in their stomach’ which means that as soon as possible they will start saving for e.g. a piece of land and gradually build their own home as money allows – often without using mortgages etc. It’s about building a nest, while in Netherlands (a country with a long history of financial speculation) buying a home is more about getting rich quick, getting on the housing ladder from the financial side. About ten years ago there was an interesting survey from the Dutch banks that asked their customers why they were buying a (new) home, and if you read between the lines the possibility of speculative gains was reason number one. The answers would have been totally different in Belgium (maybe less so today, don’t know …).