PBOC: “Put a brake on the excessive bubble expansion.”

For Chinese households, owning residential property serves as a mix of risk-free savings account (on the premise, valid in the US as well, that “you can’t lose money in real estate”) and highly leveraged speculative betting game. Some people own vacant apartments like Americans own stocks. A report in 2014 showed that 75% of household wealth had been sunk into real estate. Whatever the percentage is today, it’s high, to where major declines in house prices have caused uproars.

Uproars are exactly what Chinese authorities fear more than anything. But they also fear bubbles, having seen how they implode – and cause uproars.

So they tweak the housing market with various policies, ranging from local measures to central-bank monetary policies, trying to contain the bubbles. And then, when these efforts begin to implode the bubbles and people get restless, authorities step in once again to keep the market from collapsing, which has the effect of re-inflating the bubbles. Hence the yo-yo effect of government policies.

And now the People’s Bank of China is fretting again.

“Measures should be taken to put a brake on the excessive bubble expansion in the property sector, and we should curb excessive financing into the real estate sector,” warned Ma Jun, chief economist of the PBOC’s research bureau, in an interview with China Business News cited by Bloomberg.

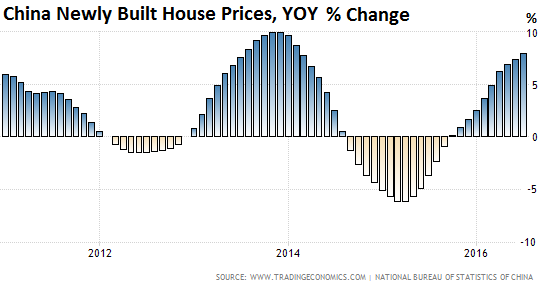

The China Housing Index, based on newly built house prices in 70 medium and large cities, as reported by the National Bureau of Statistics, jumped 7.9% in July from a year ago – the tenth month in a row of increases. But that’s the average increase. It doesn’t reflect the pain in some second and third-tier cities, where prices have dropped, sometimes sharply. And it doesn’t reflect the horrendous bubbles in first-tier cities like Beijing and Shanghai, where prices have soared respectively 20.7% and in 27.3% year-over-year.

This chart (source: tradingeconomics.com) of the China Newly Built House Price Index shows the yo-yo effect over the past five years, in monthly year-over-year percentage change:

Source: tradingeconomics.com

Trying to contain roaring house price bubbles in some of the biggest cities while bubbles are already deflating in other cities is a little tricky.

In June, Li Yang, committee member of the Chinese Academy of Social Sciences and chairman of the National Institution for Finance and Development, while speaking at the State Council Information Office’s “Briefing on China’s Debt Issue,” was confronted with this question:

For the past two years, multitudes of scholars and local officials have become aware of the bubbles ballooning in the housing market, and are now worried that with the risk of downward pressure on the economy, any slide in the real estate sector will possibly trigger a local debt crisis. How do you view this issue?

And Li Yang responded:

This is why I have reiterated that the problem cannot be solved until it has been considered in a comprehensive way. A partial attempt will not successfully solve the problem. But it will be different when we find the causes of the problem, then we can eventually find a solution.

The local governments and real estate developers are in the same boat when they sell land and houses to yield revenue and sustain employment as long as the housing prices do not fall. The logic is correct.

But the real estate bubbles, especially in the second and third-tier cities, have long been there. The decision made by the central government is to reduce the inventories of the housing market, a move understood as destocking in view of the real economy and as bursting bubbles in the financial perspective. It is an adjustment that we have to put up with.

“We need comprehensive solutions,” he added.

So now, the PBOC’s Ma Jun said in the interview on Sunday that “measures should be taken” to contain these bubbles by throttling “excessive financing” in the real estate sector. He said that a third of the leverage in the financial system added over the past ten years has come from the surge of mortgages based on the surge of housing prices.

So cities with the biggest bubbles are trying to tamp down on them with local measures, in face of a torrent of stimulus from the national government and the central bank – including slashing rates to record lows, devaluing the currency, and kicking off massive spending measures – geared toward propping up the dreadfully lackluster economy, kneecapped by slumping exports.

The PBOC is conflicted, as we would say, between the lethargic condition of the overall economy despite the torrent of stimulus, and the risks that the asset bubbles – which the stimulus policies have caused – are posing to the financial system when the associated mortgage loans implode. So the PBOC appears to have lost its appetite for additional monetary stimulus.

The subsequent price declines due to lack of government intervention would be in Li Yang’s words equivalent to “bursting bubbles”; and that would be, as he said, “an adjustment we have to put up with.”

Until the uproar re-starts. And then it’ll be time to once again yank desperately on the string of its bubble-policy yo-yo, trying to get it to wobble up one more time.

But mandating top-down economic growth is not enough. Read… What Rail Freight Volume just Said about China

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Everyone loves a housing bubble.

You make money doing nothing.

The true appeal of capitalism.

You put your money in, someone else does the work and you take out more money than you put in.

It’s what it’s all about.

That is not “Capitalism”. You don’t understand. What you describe is Fascism, or better, Feudalism.

What you describe ONLY can exist with a Central, Private, Banking based on paper notes as currency.

This can NEVER, EVER happen if GOLD was our medium of exchange.

You really don’t like it? The ONLY way to stop it is to use GOLD as money.

“This can NEVER, EVER happen if GOLD was our medium of exchange.”

Which is precisely why gold isn’t.

funny thing is that here in Europe the ‘socialists’ (like Labor, former communist parties and the Greens) love those RE bubbles even more than the traditional RE speculators from the conservative/liberal angle.

Obviously they see it as their chance in a lifetime to become a real capitalist, because being a socialist is just for the outside world … The masses perfectly understand how ‘privatize the gains, socialize the losses’ works, and the housing market is a great way to play especially in countries like Netherlands with its endless subsidies, tax incentives and free put options from housing speculators.

Just last week all Dutch political parties were polled about housing policy and if there was an RE bubble: nobody sees a bubble, and only one party thought the current incentives for borrowing for RE are a bit too easy and should be gradually diminished. Indeed, everybody likes it. Except renters, savers and the middle class but they are an insignificant minority nowadays.

Nothing to worry about. The plunge protection team was at work on Monday, and stocks are back to their bubbly levels. How long can the CBs run the stock market, the bond market and the property market is the trillion dollar question.

As long as they can issue “credit” by typing on their key-boards, they can keep this going on.

I was active on the Shanghai stock market until about one week before the big 2015 crash. As it was a purely speculative endeavour, I was happy to walk away with a large profit, but I have kept a weather eye on the whole thing ever since.

The big problem with the PBOC’s plunge protection team is that is artificially reproducing the “narrowing” phenomenon we are seeing in the West, meaning indexes are driven up by a handful of stocks. Before the crash it was a true bubble market where pretty much everybody was a winner: if you somehow had access to the Shenzhen Small Caps (something not exactly easy for foreign retail investors) you could literally double your money in two weeks, even after taxes and fees had been deducted. If you could access IPO’s… the profits were literally insane, never seen anything like it.

I did my homeworks and went for large brick and mortar companies, some of them State-owned, but you could literally pick a stock at random and at the height of the bubble you were guaranteed a profit, regardless of what the company manufactured or sold.

Right now? Not so much. Selected stocks are doing well but the rest not so much. I am pretty sure PBOC and Big Four officials are making sure their relatives, bosses etc are tipped in advance of what will be bought, but the rest of us is not so lucky. Following the plug protection team around can result in acceptable profits, but the big gains are gone: if before it was like feasting at a banquet, right now it feels like being a jackal following a pride of lions around. You can still eat, but you’d better wait your turn.

mc – well written…

you know the lions eat the jackals:) be careful !

I think the millennials are on to something. I keep reading they are shunning debt, and if this is true, I wonder who’s going buy them McMansions in the burbs.

who’s going to buy them McMansions in the burbs, you ask ??

Why …. with all them H!b east Indians, and expat Chinese ……. to replace the eventually broke, jobless, homeless, and starving formally known as American citizens ….. especially after those lusciously shiny, new trade abominations …. er…. I mean trade agreements kick in …..

I seem to recall a heeded warning by some old guy by the name of ….. uhh ….. Jefferson !

Yep, and the majority of blind believers in fairy dust gets duped again. What a surprise.

Silicon Valley h1ds live 10 people per 2db 2bth apt. They don’t have the money. Beside they are too busy remitting money back to hyper inflation and low growth India.

India has the highest rate of growth currently of any of the BRIC’s and local energy consumption has been soaring in the last few years, I believe it is now the third largest user of energy in the world. The rising prosperity is unmistakeable from my trips there. Price stability is actually quite good in India and the cost of living is highly reasonable apart from the high cost of housing.

“If the American people ever allow private banks to control the issue of their money, the banks and corporations that will grow up around them, will deprive the people of their property until their children will wake up homeless.” -Thomas Jefferson

Like for most RE related problems, the Netherlands has invented a solution for that: for many years they have allowed parents to gift 25K euro per child in one year totally tax-free, on the condition that the money is used for buying a home. Recently this has even been increased to 50K and now 100K and even grandchildren etc. are now included. This is a great way for rich parents (with often loads of money in the home piggy bank) to transfer their wealth totally tax-free (standard inheritance tax is 10-25% over here), so this has been quite popular among the wealthy.

Suddenly 20-somethings fresh form college are buying 500-1000K homes and some of them don’t even need a mortgage. I know several of these youngster who are planning to retire at 25 or so and live from the income from their homes by renting them out (RE tax is almost nothing in Netherlands, so their cost is close to nothing and though rental income is low, it is much higher than interest on a savings account if you don’t have any real costs …

Please forgive my ignorance. I thought you couldn’t actually own property in China. Aren’t people just leasing it from the local communes?

Or is that really dated info?

What exactly are people owning? What are they making a profit on????

Good question! You cannot own LAND. The government owns the land. You can only lease the land. But you can own a house or an apartment that sits on top of leased land.

Incidentally, this is becoming quite an issue now as a lot of these leases are expiring. For homeowners on expired leases, there is not yet a clear way forward, and they can’t sell their properties as long as the fate of these leases remains uncertain. But this too will be worked out or else there’d be another revolution.

The land is owned by the government/people just as in a condo/apartment/co-op/gated community/PAD/PUD everybody owns ALL the land under the units. Each unit owner owns a piece of the whole, but not specific to his unit. He has the sole right to occupancy and usage of his unit. In China now the 60 and 70 year leases are rolling over, so nobody is worried. If the landlease did not roll over, as in the hundreds of millions of urban renewal projects, the owner gets a certificate worth the value of his property toward a new home of his choosing. He and his family get relocation assistance and a place to live while new homes are being built. He can also sell this paper. It all works out. Most people are pleased with the system. Americans cannot understand anything different from what they have.

Chinese don’t have property tax. Americans rail about the China not owning the land under their homes, when the government owns the land they live on. Don’t believe me? Don’t pay your property tax. Men with guns from the government will remove you from the land. They will then sell “your” land to another citizen.

You have a twisted understanding of “ownership” in the Western sense. Have you been in China too long?

you are correct.

my chinese friends have long term leases & no property taxes….

in the usa i “own” my home & must pay property taxes forever. these taxes generally do not go down and are indexed to help the government, not me….. so i really own a reverse annuity to support government whatever they decide, unless i choose to move to another jurisdiction & do the same thing all over again…

increasing property prices just make the (reverse annuity) tax payments more……

i remember a time when people could buy properties from local governments for $0 + just paying the back taxes owed…. this could be coming again…. especially when you consider if energy & other costs rise as well, without labor being able to earn more because of technology….

i still believe in a better future, but it looks like a painful road ahead !!

“when the associated mortgage loans implode”

well here’s where your logic is wrong or so we are always told, the China bulls ALWAYS pull out the “but people in China don’t buy RE with a mortgage or if they do they put 25% of more down”

I’ve read this repeatedly and is always the reason why China will NEVER have an RE implosion like the USA.

maybe you could look into the amount of leverage in the China RE market so we can find out what’s really going on?

A central bank warning of a bubble, now that’s funny!

Pretending they aren’t creating them for their own purposes, which would be as a surrogate for the real economy, which died in 2008

In China, I am guessing what matters is not the bubble imploding as long as it happens somewhere else first for example in the US. Afterwards, they can always point to the global economy (and not deliberate bubble blowing) as the cause of the implosion.

This is why the Chinese economy will crater AFTER the US recession and not before. In the meanwhile, they’ll do whatever it takes to maintain the “status quo”.

You have to consider, differently from what we are told by self proclaimed “China experts”, the Communist Party, of which the PBOC is merely an arm, is not a monolithic block. There are dozens factions, each with its own agenda, and analysts have long attempting divining their power, influence or even agenda by reading seemingly insignificant signs such as the seating arrangements during the ceremonies to commemorate Mao Zedong’s passing 40 years ago or which websites are allowed through the Great Firewall of China.

It’s well known a number of these factions have long supported the so called “Sustainable Path”, which is self-explanatory. These factions have apparently lost a lot of power recently, as President Xi has stopped paying lip service to the “slower growth model” and pretty much embraced the “Growth at Any Cost” factions through his actions more than through his words.

In short it appears China, very much like the rest of the world, has decided to opt for instant GDP growth while attempting deffering the inevitable malinvestment liquidation a little bit more: yes, thousands of steel and coal workers are fired in China every week but this is nothing compared to what should be allowed to happen.

Just to give an example, back in 2012, when China had decided to put the pedal to the metal to “stimulate” her already grotesquely bloated heavy industry, most steel mills were running at 70% capacity or even less. A steel mill loses money, and lots of it, when capacity goes under 80%.

Now demand for rebar, cold rolled steel etc has dropped considerably in spite of formidable stimulus. Analysts are scrambling their brains to discover what China’s “sustainable” long term steel demand is. Numbers are all over the place but even the most optimistic projections, those considering China can keep demand as artificailly inflated as it is right now, say they should cut a further 40% capacity. Which considering the size of the Chinese steel industry is beyond insane.

So much for GLOBALISM. You sneeze, they sneeze.

Before all this push for ONE WORLD, a local financial event stayed very much local or region contained, no so now. Look out Canada, Australia, New Zealand, Vietnam, Panama, the USA and more as the snow ball gains the speed that ‘no one ever sees’. To loose ‘value or equity’ is never played the lip service of how serious it really is. Just ask Americans who lost in the last ‘event’ and never regained that ‘wealth’ again. And the World, however, didn’t wait, but instead moved on……may be not so this time.

China will be fine in the medium run (In the long run, all civilizations collapse). They’ve used their bubble to the utmost unlike the US by developing modern, brand new factories, a highly trained and very hard working labour force, they have the latest road and port infrastructure, the world’s largest high speed rail network, a rapidly modernising military that will rival the US within a decade etc. It’s in a very different civilizational cycle from the US and W. Europe currently. The Chinese have also built up a lot of good will amongst resource rich developing countries through infrastructure projects.

the U.S. Republic is, and will continue to fail ……

I would bet my finest wooden nickle on the States eventual dis-incorporation into separate autonomous states, and or city-states(L.A., Chicago, Washington D.C., for example) in, say 10 to 30 years out ……!!

Things are becoming too chaotic to think otherwise …

Agree, China has used the bubble to forge ahead and has good plans to clean up their environment, use significant sustainable energy etc. while the West has used their bubble to foster inequality, destroy the middle class and and waste enormous efforts on paper shuffling and building McMansions for the rich and the would-be-rich (not really something productive …).

My country has a 30-year housing bubble and home owners are sitting on tremendous profits, especially if they purchased over 15 years ago. But infrastructure and many government services are way inferior to 30-40 years ago (e.g. public transport, educational system), instead of better as one would expect due to ‘progress’. And the worst problem is probably the endless entitlement problem in the West, especially among the Boomers. The financial/housing bubble is a major factor in all this, without it the West would have been in much better shape.