Creating a situation worse than 2008?

By Alex M., Founder of Macro Ops:

On Oct. 17th new SEC rules will come into play that’ll affect money market funds and liquidity across the financial sphere.

These rules are an attempt to prevent an 08’ style crisis by controlling money market liquidity, but in reality, they may actually cause another financial crisis. The regulations say that prime and municipal money market funds (the funds invested in riskier assets than T-bills) will have to float their net asset values (NAV). They’ll also be required to impose liquidity fees and redemption gates.

The problem with these new rules is the massive shift they’re causing in the money markets. Investors are moving en masse from riskier prime funds that will be forced to abide by these new rules, to safer government funds which are exempt.

So far $500 billion has already moved from prime to government funds, and it’s expected another $500 billion will follow suite in the next few months.

This massive change in the money market landscape is leading to issues in the lending markets. And issues in the lending markets are extra dangerous because they directly affect the financial system’s liquidity.

The prime markets are where a lot of large corporations and banks get their day-to-day financing from commercial paper. This is considered unsecured funding (meaning there’s no underlying asset backing it up) and is based on the credibility of the borrowing firm. These markets are a preferred route to access short-term capital for many institutions because it’s quick and avoids SEC involvement, which usually becomes expensive.

But now with the new rule change and all this money flowing out of the prime money market funds, this source of funding is drying up. More corporations will be forced to find other ways to support their daily expenses like payroll. But unfortunately, these other options are more expensive, and will likely lead to a slowdown in business activity and even unmet obligations. This could only be a negative for equity markets as corporate costs go up to account for the change.

And even worse off are foreign banks that depend on prime unsecured financing to meet their dollar obligations. A lot of these banks don’t have US customers depositing cash with them. This means they don’t have a ready supply of dollars available like US banks. In order to get the dollars they need, they access commercial paper through prime funds.

US dollars are the key to the liquidity of banks around the world because USD is a global reserve currency. It’s used in all types of transactions, even when neither party is based in the US. This makes access to dollars extremely important. But now with these new prime fund requirements, these banks are facing dollar liquidity problems.

We’re seeing the first of these problems develop in Japan’s banks. Reports have shown that out of the collective balance sheet of Japanese banks with branches in New York, almost 2/3rds of their funds raised on the liability side come straight from unsecured funding.

Now the lack of this unsecured funding is forcing banks to try and find alternative dollar sources. And their actions are causing distortions in the broader market.

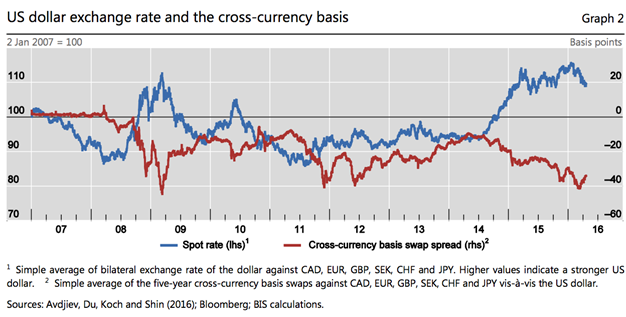

Recently we referred to the above chart as the most important in the world.

To summarize, what you’re seeing is a huge discrepancy between interest rates implicit in the FOREX swap rate and market interest rates (LIBOR). Normally these two are supposed to be consistent with each other. But right now they aren’t. A large reason why they’re different is because of the structural changes in the money market we just described.

So what does this mean?

First, there looks to be little appetite to lend dollars in the swap market. Swaps can sometimes be very illiquid, which means they can be high risk. No one wants to lend because they don’t want to gamble on not getting those dollars back. They’re anticipating and protecting for liquidity issues. And what’s funny is that by doing that, they’re in turn creating the liquidity issues they fear.

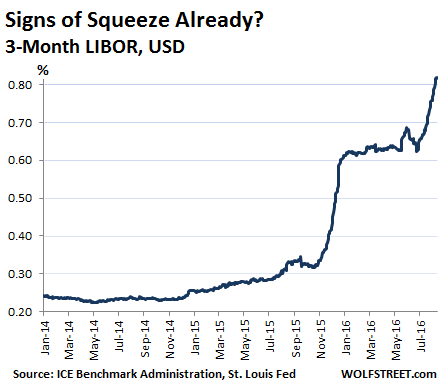

Second, the 3-Month London Interbank Offered Rate (LIBOR), based on USD, is continuing to rise, signaling tougher standards of lending between banks:

This again shows the lack of options available once banks lose their funding from prime markets.

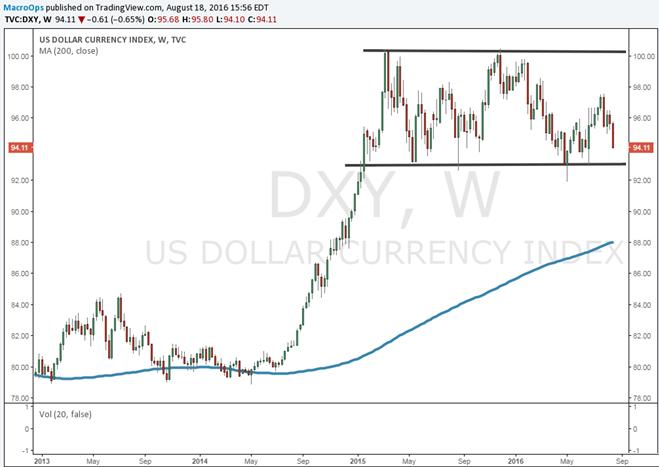

We all know how supply and demand works. So we know what happens when more institutions need dollars, as less institutions are able to supply them. The squeeze that’s coming from this reality has a good chance of causing a massive USD runup.

You should also remember that the world is also already collectively short $8-11 trillion US dollars from the USD carry trade. That’s another reason no one wants to lend any more dollars. But if the USD appreciates from the prime money market squeeze, it could cause the carry trade unwind too, forcing the dollar even higher and exacerbating supply problems.

Banks struggling to obtain dollars will cause massive liquidity problems in the system. Central banks understand this and are already working to try and ease the issue. The Bank of Japan for example has been expanding its swap lines and adding new facilities to help their banks access dollar funding.

The big question though is whether this will be enough. Or, will this new money market rule be the spark that ignites the USD carry trade unwind, freezing liquidity in the system, creating a situation worse than 08’.

Most investors have put the USD carry trade theme behind them in recent months, which tends to happen when you get price action in the dollar like we’ve been seeing since 2015…

But the USD carry trade situation is still alive. And it will happen. The question is when. We’re keeping our eye on the dollar for a signal. October looks like as good a time as any for the trend to kick-off with the NAV rule coming into play. By Alex M., Macro Ops.

So here is a leading Indicator of big trouble for the real economy, now fermenting in the banks. Read… Business Loan Delinquencies Rock Past Lehman Moment Level

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just to show you all how out of touch I am, when I read the headline to this post, as saw “SEC”, I thought: …… Hey, I didn’t know the South Eastern Conference had a mutual fund and why am I not invested in that!!?

The Red Tide, Gators, and Bulldogs are a sure investment bet !!!!

Before Night train chimes in, I will tell you it’s “Crimson Tide” not RED!

Event Horizon is obviously an Auburn fan

If I understand this correctly, it seems we should get a rise in USD dollar value in the short term. This appears already to be happening. The Central Bank swap contracts are then specifically agreed upon to avoid a change in the currency rates, and indirectly to bail out the bankers/wallstreeters that made the wrong bet. Yes?

The dollar ($DXY) has been making lower highs and lower lows. The longs are beginning to understand that the fundamentals are not bullish for the US dollar.

The dollars recent failure to regain it’s 200 day moving average and is now below it’s 50 day moving average, add credence to the dollar weakness. The short term trading range has essentially been flat since April 2014 and the dollar advance decline line rolled over in January of this year. Which is now below the level set in July 2015.

Long term (30 years) the USD has been in a down trend, starting in 1985 at 160.0 ($USD) and now in the low nineties. If the dollar falls below support at 92.0 there is nothing below but air and down there be dragons!

Oh, oh- October! If I was those guys I’d pick any other month to make a potentially disruptive change.

planned to coincide with the election?

Hmmm… depends on what you would like to accomplish.

This rule change has the potential to be massively disruptive, but that’s not necessarily a bad thing. At some point a little air has to be let out of the bubble. If American businesses are able to obtain other forms of short term funding, so what if Japan and China have to sell some treasuries to obtain dollars for their banks, if the American financial system is made a little safer? And no, China can’t collapse our economy by selling all our treasuries, but they can sure collapse theirs.

This article assumes that the dollar’s reserve currency status will continue indefinitely. Recent trends show that many countries are starting to engage in swaps with their own currencies. As dollars dry up there would be more of an incentive to swap for Yen, Euro, Yuen, etc. As long as you can redeem the currency you might get stuck with for goods, I don’t see that it will be a problem, just more work to trade out of the currency.

A very interesting article and one that again shows how governments making changes to rules (Vancouver real Estate anyone…) can screw up markets and have unintended consequences.

I wonder if the rules will be changed before the implementation date?

Also if Japanese banks are having trouble getting US$, then other banks in Europe where they are even in more trouble than their counterparts in Japan are, must also be in even bigger trouble.

So far this has not had much influence, if any, on the US$/Yen exchange rate either………..

Interesting times coming in the markets.

Steady as a rock, ASSUMIng the FED wants it that way as per their masters of the universe.

That is not the only drain on liquidity.

Starting September 1st, banks need to provide maargin for derivatives. The numbers go from some 300 billion proposed by the ISDA to 3.6 Trillion asked for by “regulators.”

I saw the link to the article at jesses crossroadscafe and have not seen anybody picking it up.

https://www.bloomberg.com/news/articles/2016-08-22/banks-sprint-to-meet-margin-rules-for-493-trillion-swaps-market`