“Everything feels distorted and unnatural”: Citigroup

On Monday, the S&P 500 index edged down 1.2 points. Over the last three trading days, the &P 500 has moved in a 12-point range, from 2175 to 2187. The index is now down a practically invisible 0.34% from its record close on August 15. Over the past 30 trading days, it had only five daily moves, up or down, of more than 0.5%, according to The Wall Street Journal, “equaling the lowest since October 1995.”

And trading volume has fallen asleep – much more so than during the normal summer lull. Even the algos appear to have been turned off for maintenance. Jared Woodard, a strategist at BofA Merrill Lynch, summarized it this way:

“Last week and the week before, you had to make sure your machine was actually on because it was flashing so infrequently.”

And no one is worried about anything.

The Chicago Board Options Exchange SPX Volatility Index (VIX) – the vaunted “fear index” – spent much of the past two weeks below 12, only a smidgen above the record low of July 2014.

In other words, nothing moves. But something has been moving: Earnings. The wrong way.

All-out financial engineering, record share buybacks, questionable accounting methods, such as those used by Valeant, and other tricks and devices [“The bezzle shrinks”: LendingClub, Theranos, Breitling Energy], have just one purpose: Drive up earnings, or at least “adjusted” ex-bad-items earnings per share that Wall Street likes to proffer, and that investors gobble up, eyes tightly closed, in a form of Consensual Hallucination.

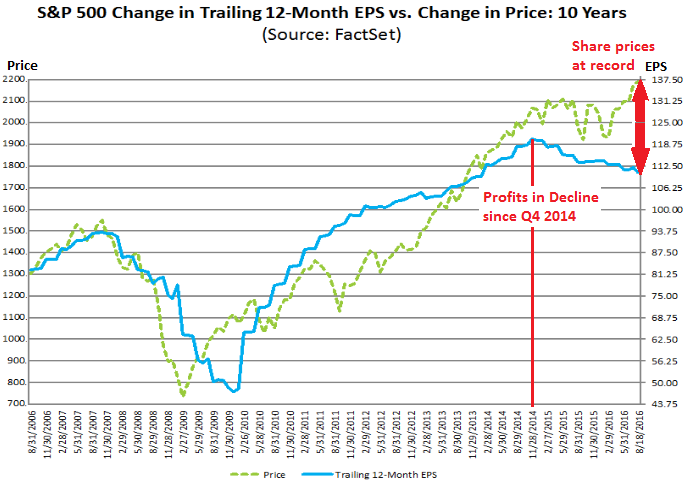

But even those expertly doctored “adjusted” earnings per share of the S&P 500 companies have declined (on a trailing 12 months basis), according to FactSet, since their peak in November 2014 – for nearly two years, even as stocks have chased after new highs (red marks and text added):

Note the open-jaws syndrome between falling doctored “adjusted” earnings per share and rising stock prices. These two normally correlate. But no longer. They’ve been going into opposite directions for two years.

And earnings aren’t about to turn around. According to FactSet, “adjusted” earnings per share for the S&P 500 declined 3.2% in the second quarter. For the third quarter, the consensus forecast – so the optimistic case – is a decline of another 2%.

Analysts adjust their forecasts down as the quarter progresses so that companies have a chance to exceed these lowered expectations. A month from now, analysts will likely forecast an even larger decline in earnings. And they’re already forecasting an earnings decline for the entire year.

John Lonski, Chief Economist at Moody’s Capital Markets Research, when he mused that “overvalued equities threaten credit outlook,” put it this way:

Of late, the market value of US common stock is setting new record highs, notwithstanding the likelihood of a second straight annual decline by 2016’s broadest measure of pretax operating profits. As derived from the Blue Chip consensus forecast of early August 2016, profits will not at least match 2014’s apex until 2018 on a calendar-year basis.

So the Blue Chip optimist soothsayers think that earnings might not go back to the level of two years ago until 2018. And even as they’re saying this, earnings are still heading south.

Yet stocks are hovering at all-time highs, on very thin volume, and no one sees any risks to speak of, and earnings – even those beautifully doctored and “adjusted” earnings – for sure don’t matter anymore.

What underlies this paradisiacal faux reality?

Lousy economic data in an economy ruined by free money and hobbled by asset price inflation out the wazoo, where companies no longer have to show profits or profit growth or revenue growth, or anything at all, other than share buybacks interspersed with some delicious mergers & acquisitions and a good dose of layoffs….

Matt King, head of credit strategy at Citigroup, explains is this way to The Journal:

“Everything feels distorted and unnatural, you know the source of that is the central banks but equally there’s nothing to stop them carrying on.”

Some fearless central-bank non-believers, with one eye on the above chart, might call it “the mother of all shorts.” And many have gone done in flames.

For Wall Street and for investors listening to Wall Street, it has now been firmly established that central banks will always bail them out. No matter what. And no matter what the cost to the real economy. At first there was the “Greenspan put” (a put option is a form of protection against dropping prices). The Greenspan put led to the Financial Crisis, when stocks crashed in a dizzying manner.

This gave rise to the ferocious scorched-earth Bernanke put that included QE and zero-interest-rate policies. Since then, every time stocks or bonds more than squiggled, central banks – and not just the Fed – stepped in to rectify the situation with policies that have become ever crazier. This has taught investors a lesson:

Nothing matters anymore, nothing but central banks.

Now there’s the Yellen put. So far, she hasn’t disappointed. Occasionally, she mumbles something about valuations being “stretched” and warns about the “reach for yield,” but these words are just decoration around the edges of her put.

And now markets are more precarious than ever, with silly valuations and a historic debt overhang, the very result of all these central bank puts. Liquidity is thin. And markets tend to go haywire and apply maximum pain when investors, perhaps lulled to sleep by all these puts, least expect it. And here’s the thing: stocks crashed twice since 2000, despite the Fed’s puts. Why? Because reality suddenly got on top of them.

In terms of the real economy, here’s the other side of that coin. And the year isn’t even over yet. Read… The Biggest American Layoff Queens in 2016 “So Far”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Sounds like all we need is an excuse for the big correction to begin. Any ideas what it may be?

The short answer is a shooting war. There is no lack of candidates, the South China Sea, Ukraine, and the Persian Gulf are all part way there already. The Central Banks can paper over nearly anything else.

However, while I agree that the Central Banks are responsible for this mess, the real blame should go to the venal politicians who tolerated it. It is too easy to say that the Central Banks are independent. It isn’t really so. The governors are appointees. If they were not doing what the POLS wanted, they could be reined in pronto. But that would require politicians who were watching out for the country instead of themselves.

Yes, war is the correct answer, the one that can’t be papered over. But let’s not forget civil unrest as well. That’s the main focus of the Chinese central bank and soon it will be the focus of all the other central banks in the developed world as inequality and lack of social justice breakdown the political systems. The politicians are skating on very thin ice and they know it. The systems they have created are no longer working except for a select few.

Tuitions

The sprunjer never lies. As time progresses, it’s become clear to everyone whom the chosen winners are. Constantly pulling demand from the future via cheap money on behalf of special interests resolves to a complex exponential in the denominator of causal relationships.

Winners?

How can there possibly be any winners when the centrifuge that is the global economy … spins wildly out of control…. and explodes.

Super Nova (as in no-go).

This is nothing but a headache for investors and traders. If everyone agrees to only use non-gaap earnings or gaap earnings, that would be great. It is tough for me to reconcile gaap earnings going down and most investors not even caring. I don’t blame them for not caring either since the Spy doesn’t seem to care either…for now. If I knew no one cared about GAAP earnings, as a trader I could just ignore them and use the made up numbers that Wall Street and CNBC shout everyday. Does that make it right? No, but my job as an investor and trader is to make money. However, as an investor I would be using GAAP earnings since that is what matters over the long term.

I was calling for an earnings decline year over year in November of 2014 so I adjusted my portfolio to reflect the decline in earnings. Let’s just say that was a bad choice since the Spy is higher now than when earnings topped. At least my oil shorts worked. It is even more maddening since I actually called an earnings decline. Most times when earnings decline, the market declines. Not so this time.

It seems the only thing that matters for now is central bank QE across the world. Liquidity is the main driver of asset prices over the short term, and there is more liquidity sloshing around than ever before due to central banks. Central banks are causing a bubble in complacency and malinvestment that won’t end well, but this could go on for years.

Is it our job as investors to just accept higher valuations since the Greenspan era? We have been going on almost 30 years of higher valued stocks compared to history. So is the fed policy a permanent change that investors must adjust for or are we living on borrowed time? Many investments would not have been made if you were waiting for the markets to hit historical p/e’s. However, what I do know is that the higher the p/e goes, the lower future returns will be. Either way, we are looking at another lost decade in the market due to valuations.

I think you’re overlooking the structure of the SPY, what was it Buffett said about if he died and left any advice for dummies it would be long SPY?

Go take a look at the The Advocate dot com, the Baton Rouge daily newspaper. You may see some trading ideas right on the front page. Home Depot, Loews, Costco, Kohls, these are some of the local companies that may benefit.

The markets are dead. They have died. Expired.

Honest price discovery does not exist. It no longer lives.

This is the FUNDAMENTAL reason for markets in the first place.

Without it – how does one value anything? Valuation is dead.

The central banks walked it down a dark lane and strangled it.

Just one more very large fundamental that is negative.

And the sheeple continue to munch the grass… oblivious to wicked beast that has just about smashed its way into the paddock….

The end game will be apocalyptic… there can be little doubt of that

It is enough to make on sick to the stomach to think about it….

DEAD MARKETS

A customer (Mr. Praline) enters a stock brokers office

Mr. Praline: ‘Ello, I wish to register a complaint.

(The owner does not respond.)

Mr. Praline: ‘Ello, Miss?

Owner: What do you mean “miss”?

Mr. Praline: (pause)I’m sorry, I have a cold. I wish to make a complaint!

Owner: We’re closin’ for lunch.

Mr. Praline: Never mind that, my lad. I wish to complain about this stock what I purchased not half an hour ago from this very boutique.

Owner: Oh yes, the, uh, the American Blue Chip…What’s,uh…What’s wrong with it?

Mr. Praline: I’ll tell you what’s wrong with it, my lad. ‘E’s dead, that’s what’s wrong with it!

Owner: No, no, ‘e’s uh,…he’s resting.

Mr. Praline: Look, matey, I know a dead market when I see one, and I’m looking at one right now.

Owner: No no he’s not dead, he’s, he’s restin’! Remarkable stocks, the American Blue Chips, idn’it, ay? Beautiful plumage!

Mr. Praline: The plumage don’t enter into it. It’s stone dead.

Owner: Nononono, no, no! ‘E’s resting!

Mr. Praline: All right then, if he’s restin’, I’ll wake him up! (shouting at the cage) ‘Ello, Mister Market! I’ve got a lovely fresh IPO for you if you show…

(owner hits the cage)

Owner: There, he moved!

Mr. Praline: No, he didn’t, that was you hitting the cage!

Owner: I never!!

Mr. Praline: Yes, you did!

Owner: I never, never did anything…

Mr. Praline: (yelling and hitting the cage repeatedly) ‘ELLO MARKET!!!!! Testing! Testing! Testing! Testing! This is your nine o’clock alarm call!

I’ve found this advice is true until it isn’t – “Never short a boring market”

This is brilliant!

Pinin for the fjords.

Central banks will not stop …. The banksters cannot admit they were wrong and reverse course. There is no way back to a sane financial system because the real economy has been crushed and debt load is way too high.

So things could get a lot more crazy then they already are.

I too worry about charts such as these, and the underlying reality they represent. But a decline / revaluation can take many forms. With our formerly open and free markets turning into a sad and unproductive morass of monopolies, it wouldn’t surprise me if instead of a crash we’re in for years and years of malaise.

Bonds are already yielding next to nothing. Stocks may follow soon as dividends need to be cut to pay down debt, with growth not to be found as the giant mercks, wal marts or BPs do nothing but tread water and stifle competition (and internal innovation).

So perhaps stocks as a whole will enter a multi decade period of going nowhere, with the winners determined more by government spending than organic demand. I would bet that in 3 years the spy will not have made lasting gains, inflation adjusted of course. But with central banks having the last word, how can things crash? They won’t be fooled thrice. All thatll happen is the number of companies keeps shrinking. We’re at generational lows of entrepreneurship..

Thanks to central banks, the big multinationals are buying up all other companies and eliminating the competition (if the huge difference in access to cheap debt hadn’t already accomplished that).

When the banksters are done, they and the chosen few big companies (no doubt those of the western elite) will own the whole market (not just the stock market) and they can jack up prices into the sky, just like Big Pharma is already doing.

The best way to get back, and get even, with Big Pharm is to get healthy.

Clean up your diet. Eat NO Grains and NO Dairy. Read. Read every book you can about food, etc. There are some really great ones out there.

‘

Start with “WHEAT BELLY” by Dr. Davis and “GRAIN BRAIN” by Dr. Perlmutter (who is down the street from me).

Get healthy. Stay healthy and avoid the Hospitals and Medications which will only kill you faster.

On the bright side, think of how it would be a huge relief for the global climate (change) if growth of society were to totally collapse.

Heck, even Al Gore might pick up a gallon of gasoline on the cheap for $100 before it’s all over with.

Here’s to seeing you guys on the other side.

Sadly, you may be closer to predicting the near future than you think.

The world, especially America, is running out of water to grow crops. The Midwest, from Texas to South Dakota, is turning into a damp sponge, California is already there. The only place (worldwide) that is actually benefiting with increased rain fall and warmer temps and will for years to come is…drum roll…Russia.

Now for all you nay Sayers, I suggest that to tag alone with the wife when she goes to the store and see first hand prices going up and content going down. How about Romaine up 30% in 60 days for starters, then move on to corn, and then….there is the new pound that was 12 ounces and is now 9.5.

So, Chicken, see you on the other side of the road.

well … in the Netherlands we sure are getting more rain too. I think it is expected to increase something like 30% (yearly average) within a decade and it is easy to notice the change, especially in summer.

The main problem is climate CHANGE, not so much the direction. All this will wreak havoc with modern agriculture and many other parts of life (more rain can be a problem too, if crops, sewerage, dikes etc. cannot adapt quickly enough). Especially in Europe the cost to agriculture might be small compared to the cost of the extra migration this is going to cause, as long as our politicians don’t wisen up and keep handing out free money and free homes for life to economic refugees.

They are not economic refugees. It is far worse than you can imagine.

In Korea rice paddies are fertilized using the sewage, they seem to grow well.

Some believe that the Fed and friends can contain the damage from any crisis, save perhaps WW3. I certainly understand that point of view, as that is what the CBs have been selling.

My view is that the more complex the engineering, financial or otherwise, the more things there are to go wrong. I imagine there is a black swan flying, or a perfect storm brewing over the horizon. Of course, if I knew what that was…….. But, I don’t. So I remain just another observer on the sideline wondering how long this thing can levitate.

Central bank purchases of bonds has driven interest rates to below zero in Japan and Euroland and to all time lows in the US

The BOJ has basically destroyed the government bond market in Japan while the ECB is close to doing the same in Euroland .

Central Bank purchases has driven interest rates of otherwise insolvent countries to all time lows

Central banks have been purchasing corporate bonds in Euroland and ETF”s in Japan

Goldman Sachs has estimated that the BOJ could become the # 1 shareholder in shareholder in 40 of the Nikkei’s 225 by the end of 2017.

And this is all with money created out of thin air with a computer keystroke.

GAAP earnings do not matter,balance sheets do not matter,future growth does not matter and the lowest level of cash /debt in history does not matter.

THERE IS ONLY ONE FUNDAMENTAL AND THAT IS CENTRAL BANK ASSET PURCHASES.

Until confidence in the CENTRAL Banks are shattered,expect more distortions and more of the same

Yes, and yes and yes, r cohn, except for your last sentence. The confidence in central banks (by the financial engineers) will not waiver. That will be their only life raft in the tsunami. Let’s cut to the chase:

We have a new form of fascism now in which gov’ts with their arm of central banks do not run essential companies, they control economies and because this is done behind the curtain the larger voting population has no real idea of the power of the banks. In fact, financial corporations smart enough to take advantage of the bank policies are the new goats. There will be no public outcry to curtail the central banks when real trouble begins, hear instead the shriek to end corporate greed, now tuning up. The shower of helicopter money to follow will mark the moment of fundamental change in the social contract. In fact, the seamless transition to the United Support of America will shutter most small businesses. Why bother. In effect everyone becomes a farmer subsidized not to grow a crop. As to who will actually grow a crop, and produce the essential commodities – now there we have the crony capitalism model, already growing by leaps and bounds as the government begins to exert more control of GDP. Jobs will be scarce but pay hugely. The perfect president of such a society, Hillary Clinton, has already arisen to run it. Independent boutique companies producing bling and hypercars will do fine. The rest of us will be supine, doltish, pot addled on a holiday awaiting our robot allocation to do the housework. What possibly can go wrong.

Humpty Dumpty

You are nothing but a dystopian pessimist,but unfortunately you are probably correct

QE 4 on!

Festivus for the rest of us!

Not two days ago, I asked the question: ‘are the central banks nationalizing companies by and with the massive purchases of stocks’. I noted the BOJ and SNB as examples, heaven knows our own Fed must be doing something we can’t see beside futures buys.

Low and behold, on this day, Zero comes out with the same point of view: “CLSA: “The Bank Of Japan Has Nationalized The Japanese Stock Market”.

Secondly:

The ease with which any digital data can NOW be manipulated, think of Photoshop, it can’t be far behind before no trades appear as real trades? We already have digital ‘money’ buying ‘digital’ bets, why not get rid of the process and just make it up at will with total illusion.

Can this explain why the markets seem zombie like and unnatural. Up markets on no volume. Two shares move the market 10 points.

So the last question before the lights go out is?

The CB cabal appears to be all out to outdo themselves. Ever more riskier experiments…

QE – check and didn’t work (maybe 1st couple of QE in US did work a little)

ZIRP – check and didn’t quite work but destroyed pensions and savers

NIRP – check and didn’t work as look at Japan, EU and Switzerland

Next up for the CB out of ammos as led by mother of all idiotic/desperate CB leader BoJ – Nationalize the stock and bond market.

New QE – BoJ is printing digital currencies like SNB to buy ETFs where it will become top shareholder of 55 largest Japanese companies. SNB reported to have war chest of $60 bil in US equities (and growing) again all using money created out of thin air. Add to this ECB’s purchase of corporate bonds.

When US market stumbles a bit Janet will be under pressure to follow BoJ’s path to create USD with few key strokes to bid up the stocks and bonds. Heck maybe even buy houses while at it to support asset bubbles of all kinds.

Welcome to the “Matrix”

Sadly, human beings are far better at repeating history than learning from it. Down the ages banks have looted by foul rather than fair means, it’s simply got easier for them thanks to technology. The Second Boar war (and deaths of many Boar farmers, their wives and children), was thanks to the Rothschild mobsters who persuaded the British government of the time to send an army of 46,000 troops to South Africa. This was all because a vast tract of gold and diamonds had just been discovered in the Transvaal and the Rothschilds wanted a cut.

By demonising gold and silver and paying one generation after another of senior politicians to loosen banking regulations, the Great White sharks of US, UK and EU Banksterville have been systematically looting once strong economies. They spewed out debt in the form of easy credit to all and anyone. Since that party came to an end (2008), and Main St. got handed the bill, their new system is even better as in their CB chums just invent money so big Banksterville and Big Corp. can keep gaming the system. Heck, what do they care that their policies are ruining our economies and sending more and more of us towards poverty.

Everything changes in time and nothing changes. The West was ruled by an aristocratic and religious elite for centuries. Now we are ruled by a banking-big corp.-political triangle of elites (serving one another’s interests, covering one another’s backs, perpetuating their status quo rule over the masses).

The Aristocratic Elite you talk about never stopped ruling. The Dutch and British Kings/Queens combined with the merchants of their time to create their respective “National Banks”in the 1600’s. The Royal families of Holland (Bilderbergers) and those of the British Royal Family are stock holders in their respective Central Banks.

As private Banking Families grew (Rothschild, Warburg, Fugger, Oppenheim, Baring), they all intermarried. They are the 0.01%. They are the ones pushing for the One World Government, to be run by their private families. (Morgan and Rockefeller were late comers and the Morgan bank worked for the Rothschilds. Rockefeller was a unique exception who made so much money, and gained so much power through the “new” oil business that they had to invite him in).

(Carnegie was not trusted and was too independent. The Astors had no real power and by 1900 had fragmented. The Vanderbilts were never taken serious and by 1900 did not have enough money to make any difference.)

It is a brilliant, clever, smart and beautiful plan. I just wish I could be in on it.

Nothing has really changed since around 1600.

The more they trash gold and silver the more I like them and the more I keep adding to my stack and wait Reality believe it or not always rules the day Be patient everyone

Let’s not forget one important fact: we live on a planet in a far off corner of the universe that is heating up changes that endanger our very survival. Climate Change is real but the stock market is a ponzi scheme for the 1%. Growth is not an option If we want to watch our children live happily in an ecosystem that has not collapsed. Reality can be a bitch.

Global warming/climate change is the biggest scam of all.

It’s a rock-solid constant the zombie sheeple will never learn their lesson. The honest reason is it’s impossible to fully comprehend the concept and extent of bureaucratic hubris and how it’s used for the purpose of confiscating wealth.

You need help…seriously

If you believe AGW is a threat — what do you suggest we do to stop it?

As a climate change denier the smart thing you seem to have done is move out of Florida, it will be a huge swamp again soon as will most of the gulf coast.

Lets see Americans like you deny man caused climate change as New Orleans goes under and stays under no matter what the USMC engineers try.

Do you have any thoughts on how we would stop or even slow AGW?

Human advanced and accelerated GW can be resolved along with a lot of other problems, by long term population management. China proved it can be done, and work’s, along with the issues to avoid.

The Indian subcontinent, Africa, and South America, are regions of huge untenable population expansion, they do not have the wright to resolve their population explosion, by exporting it. Which is what they are currently doing.

Population Managment. Something the oil industry and the corporate consumer capitalist system (which you aggressively promote) is not interested in, as they believe they will die before the planet wreaks its vengeance on humanity.

The pace of the melt in Greenland, Iceland, and Antarctica, three places with huge above sea-level ice sheets, says otherwise.

Deny Human Increased and accelerated global warming, all you wish. Sea levels are Rising, Sea surface temperatures are rising in the lower and higher, formerly cold latitude’s. Land based ice sheets are melting/shrinking at alarming rates, all grossly accelerated to a higher level by human activity’s, CO2 levels are higher than they have been since the dinosaurs went extinct.

The world population has tripled since 1945 and is still increasing, this is all simply untenable, for humanity, and the planets survival in its current form.

The Patient does not like the medication, and is refusing to use it. Which will result in the patients early death. Common problem of Patients in denial.

.

Why bother with major wars when the current method is working so well?

For 2 years+ I have thought that the transition will be triggered after the election. Definitely so if “The Donald” is elected.

It is just makes too much political sense not to blame the predecessor, push the economy into recession (which of course they will think they can “manage”), and then work to schedule the recovery to coincide with their reelection.

Power begets power and Big Money gets to buy assets at pennies on the dollar. Rinse and repeat.

With the revolving door between politics and WallStreet (and its subsidiaries around the globe) we will see more and more direct government control of businesses.

Other countries will have to follow to compete with Japan, Inc., ECB direct purchases of stock and worst of all, China’s direct espionage, unlimited funds for purchasing productive assets around the world, and need for expansion to pacify their citizens’ desire for the “China Dream” and their looming demographic time bomb.

There are two aspects to China’s demographic time bomb.The first is that China is rapidly ageing.and will experience 3 million fewer workers each year during the next decade.The second is the less obvious one;there will be 40 million more males than females under the age of 20 by the year 2020.

Correct with male-female ratio of 1.46 to 1 and in some provinces more like 1.6 per Bloomberg. Add to this a generation of only child resulting in spoiled rotten, lazy and narcissistic men and women thanks to the 1-child policy (eased recently after 30+ yrs). Only the wealthy men can find wives or GFs and many women turn to lucrative prostitution. Any spark may result in mass protest by men in the lower tier society frustrated as hell.

History shows that the countries with excess men often started wars to trim the population of men and bring home the war booties of land, precious metals and of course women. No wonder China is rattling sabres in South China Sea.

Uhhh ….don’t forget China just threw support for the Syrian government in their defense from ISIS, Alqeda, or whatever the jehadi group du-jour-of-the-day is that the west is helping to support!

Sooo… that might whittle down a few extra chinese …uh…’recruits’ ……..

“With the revolving door between politics and WallStreet (and its subsidiaries around the globe) we will see more and more direct government control of businesses. ”

Always defending the old dying ineffective model of free market capitalism. At some point once majority ownership is attained we hire WS to cull the dirty ineffective components. We must act quick;y b/c capitalism has not been an effective environmental steward.

China can always buy Canada

If they don’t mind paying the foreign property buyer tax :)

If you live in Vancouver, you might be under the impression that China has already bought Canada. And you could be right.

Is fish head stew served in public school lunches? They claim it’s quite good.

Grilled salmon head and grilled hamachi head are TOTALLY delicious. It’s easier to eat with chopsticks because you have to dig out the soft parts (cheek muscles, etc.). Usually cut in half first and then grilled. It’s a delicacy.

What’s there to say about today’s new home sales figures, seems pretty decent on the surface.

Actually fish head curry popular in Malaysia (and Indonesia?). It is tasty and special treat I used to look forward when I used to go to Penang on business.

Ask yourself how home sales can be good with Millenials living in their parents basements and immigrants living 20 to a house Sure makes me wonder

The CBs have no way out, so it is easier to keep doing what they have been doing. It is the path of least resistance.

of course the debt burden will get bigger and bigger and still bigger (Japan is exhibit 1 in how crazy things can get).

That said Japan may be the trigger. They are getting progressively more and more desperate, and it is possible they will be the first to lose control and if they do look out below, and next door as China will be domino number 2. After that it is over for the CBs.