Global demand is the main concern right now.

By Martin Tiller, Oil & Energy Insider:

I have, on many occasions in the past in these pages, touched on the relationship between oil and the U.S. Dollar. The basics of that relationship are obvious: oil is priced in dollars on the global market, so from a logical perspective a strong dollar must put pressure on oil prices and vice versa.

If the currency is worth more generally then anything priced in it is, relatively speaking, worth less…the price of that commodity goes down. This is not a tick for tick relationship, but over time and when broader trends emerge it generally holds true. That is reason enough for those who trade and invest in the energy sector to keep an eye on the dollar, but right now it may be even more important than ever.

In a world where the debt of several major economic powers is trading at negative yields (you actually have to pay to hold German and Japanese government debt, for example), the dollar offers at least some return for those looking for a safe haven for their capital. That makes it an even better “fear indicator” than usual, and movement in the dollar is therefore likely to have an exaggerated effect on oil, where global demand is more important than local conditions.

Yesterday’s somewhat exaggerated selloff in response to an inventory report that was bad, but not disastrous, shows that oil is extremely news sensitive at these levels and that those holding long positions aren’t exactly doing so with conviction.

It also showed that the attention of the market is switching to the demand side. Crude inventories were not the problem yesterday; if anything they indicated that production is being kept in check. What caused the drop was a small drop in refinery utilization and growing gasoline stocks, both of which indicate demand concerns.

If, then, demand is the main concern for oil traders right now and the dollar reflects possible concerns about global growth, and therefore demand for energy in general, it makes sense to analyze possible moves in the dollar.

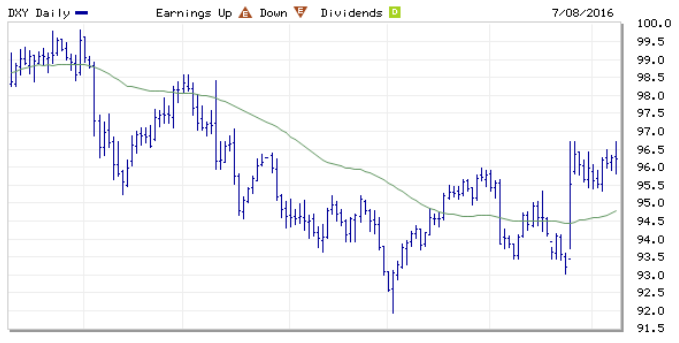

From a technical perspective the 6 month dollar index chart above certainly indicates some upward pressure. The clearly defined flag pattern that has formed post Brexit vote, with a sharp run-up forming the flagpole and then a period of volatility with a downward bias forming the flag, would generally be considered a bullish sign, and the run up over the last few days confirms that view.

Technical analysis, however, only goes so far. Without some fundamental impetus, any reaction to a chart pattern is destined to be short lived. In this case, though, the fundamental view also indicates that dollar strength is likely.

First, as mentioned above, it is one of the few safe places for capital to hide that offers a positive yield. In addition, though, this morning’s jobs report for June also indicated that the U.S. economy, at least as measured by that metric, is not in too bad a place. That is certainly true as compared to other major powers that are battling the prospect of deflation.

What we have, then, is a situation where the Fed has publicly admitted that they have concerns about global growth, but, based on domestic data, may be tempted to return to a path of rate increases earlier than most currently anticipate. The prospect of higher U.S. rates, and therefore dollar strength, even as the rest of the world is struggling is, quite possibly, the worst possible scenario for oil prices.

I should make it clear that I am not saying that oil is about to plunge again. Even if it is at a slower than optimal rate, demand for oil continues to grow. That and the fact that the huge cuts towards the end of last year and at the beginning of this by E&P companies are beginning to be felt, suggest that the $40-50 level for oil is about right. The point, though, is that the risk for oil from here is to the downside. That would indicate that holding off on energy stocks and trading oil with a bias to the downside would be smart things to do. Whatever you do, though, keep a close eye on the dollar. By Martin Tiller, Oil & Energy Insider

I take the huge demand for dollars and safe sovereign debt as a warning. Read… Do Oil Markets Signal A Global Downturn?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Consumption shrinks when customers lack the means to consume: when central banks ‘buy’ bonds (lend to banks w/ bonds as collateral) or otherwise engage in ‘extraordinary monetary policy’. The credit never flows to the customers; they cannot borrow enough for long enough to hope to retire more than the smallest loans. Rather, funds are extracted from customers: some are sped to drillers who use it to keep the repo man at arms’ length one more day …

More QE = more broke customers. More QE = negative interest rates and less aimless consumption. More QE = currency depreciation and holders/victims are a bit poorer overall, entire countries such as UK or China being pauperized stealthily.

Of course … the customers cannot meet their fuel bill by using the fuel, they waste the fuel for fun and borrow to do so. They reach for the plastic or their employers do the same, borrowing from their own customers’ banks, from the government or by way of foreign exchange.

At some point oil prices will reflect actual return for use of the fuel not access to credit. This point is approaching at an accelerating pace … stealthily, nobody is noticing … nobody wants to notice! That is why oil prices are declining, credit is being stripped out of the economy which is a bubble.

POP!

You are right. That is probably why QE for the consumers will probably be next play in the new QE playbook

According to Zerohedge, the Fed have NEVER EVER not done what they claimed they were going to do, if they claim rates will probably rise, then you can be assured that is what will happen, the issue is not therefore the direction the Fed moves, it is WHEN do they move that is the million dollar question! I say they move rates higher in August, because this will crash the markets and allow time for the riots and looting, before being taken under control by the military. Namely Obama, (the election will be canceled) then war shall commence on Syria and Iran along with possibly Russia and China.

This is their elite day of “bonding of the Western Oligarchs”. Just connect the dots!

Though I’m sure Obama would just love to cancel the election and crown himself Emperor, I suspect that not even the lefties on the US Supreme Court would be willing to cancel the constitutional requirement that an election be held.

However, since we no longer have Rule of Law in the United States, I suppose the Supreme Court could easily rationalize away the Constitution using the Hillary Clinton approach: ‘What difference does it make?’

After all, as repugnant as an Emperor Obama would be, it certainly could not possibly be any worse than a President Hillary Clinton.

Oh boy, don’t pay too much attention to ZH, they’ll rot your brain.

“The Fed have NEVER EVER not done what they claimed they were going to do” until they don’t.

It’s a bad idea to forecast rational behavior by those who have lost their traditional power. E.g. the Fed, the US banking system and angry old white men (the later group includes me.) People with their backs against the wall act in unpredictable ways.

It’s quite easy to be in the prediction business because no one ever reconciles the accuracy of your predictions.

Do not trust soothsayers. Observe, analyze and think for yourself. If you can’t do that get out of the game. Go to cash while they still allow it.

I’d sum the situation like this: is the Fed responsible only for the US economy or also the world’s economy?

As I understand it there is nothing in the Fed’s mandate to do with other economies, but since I am assuming the mandate or remit was written before WWII it predates the US leadership of much of the world.

The US could arguably stand two or three more .25 percent hikes but if friendly powers can’t stand it – is this a consideration?

I don’t know- I’m just throwing it out there.

Also, with the euro entering what could be a weak period- how much stronger does the FED want the dollar to get?

The US has publicly put Germany and Japan on watch as a currency manipulators- a bit baffling where Germany is concerned- but how could you criticize a country for having a weaker currency if you took steps that strengthened your own by raising rates?

This whole thing has me baffled.

The easiest explanation has to do with global trade and its impact on our economy. If you want to know which countries the Fed cares about, look at the list of foreign banks in America. Their locations and size will tell you almost everything about who the Fed cares about and why.

Some of the foreign banks are huge and some are very small. Some are there to facilitate trade, others facilitate only the movement of money, some do both. Some have a network of branches, others are based in a small office in a large building somewhere in NY, Dallas, LA, or elsewhere. The list represents the financial interest of America around the world.

US$ down 80% against gold this century! Go get some Nick Kelly.

Read the original legislature that established the Federal Reserve. It is a private, corporation whose stock holders are the “member banks”, BUT nobody is allowed to know who are the stockholders nor can anybody audit the “agency”.

The FED exists to serve the owners.

Most people can not “handle the Truth” and don’t want to realize what this means.

The 19 trillion dollar question is: what will be the cost to finance the US national debt?

The current Treasury Yield Rates are:

1 year @ 0.48%

2 year @ 0.61%

5 year @ 0.95%

10 year @ 1.37%

20 year @ 1.69%

30 year @ 2.11%

As Mr. Tiller points out, at least the US pays you to hold government debt, but it is my understanding that much of the national debt is covered by selling short term low interest notes. In the insane new Central Bank world, a 5 year US note that’s just under 1% return does look good.

One percent of $19 trillion is $190 billion. Our current national budget is a drop under $4 T, and national revenue is just over $3.5 T. Long term, our debt keeps outpacing GDP, but we still have the cleanest dirty shirts.

For a reminder, at the beginning of January 2007, the 1 year note was at 5%.

I enjoy some of your columns and realize you need some ads to help fund it. However, accepting ads such as ‘Tesla Generator $49 – “Eliminate Your Power Bill”, diminishes your sites credibility. Any scam discovery site will tell you with simple laws of physics the claims are completely untrue and that the long-winded Doctor presenting the $49 build video (without any details), does not exist. As a national reporter for many years find that both journalism and advertising has sunk to new lows and would hope useful info sites such as yours would weed out highly dubious advertisers.

This particular company ranks with the well-known Nigerian scams and creates its own large number of false positive user comments. The simplest search determines the ad is dishonest, without any company names or addresses listed.

Will continue to enjoy your site, provided no more scam ads appear.

Yours truly, Casey Robert Baldwin

Casey, it seems you don’t know how online advertising works. The ads you see on WS are served by Google’s ad exchange Adsense. Everybody gets something different. You get ads, based on what YOU have on your machine in terms of cookies and browsing history and based on a million other factors personal to you that data brokers know about you and that are used to personalize ads. These ads are designed for YOU!

I have no clue what you’re seeing.

There are many of these ad exchanges. They’re fully automated. Algorithms make all the decisions. No humans required. All media companies use ad exchanges, from the New York Times to WS, though big media companies also run their own ads.

So if you really want to know how modern advertising works (I mean modern as in the last 20 years), do a little research. It’s VERY interesting. It has been a revolution.

And this modern advertising is where 90% or so of Google’s revenues come from. That’s how Google makes its money. It’s a middleman….

“I have no clue what your seeing.”

should be

‘I have no clue what YOU’RE seeing.’

otherwise, great stuff Mr. Richter. I spend a fair amount of time at your site and have learned some things from you and your columnists, especially Dr. Gorback. More from him, please.

BTW, I DO click on advertisement links here as I know this is in part how you derive an income for providing a free education to interested readers.

Keep up the good work!

Thanks for the proof-reading … I should never write anything before I have coffee. And MANY thanks for your support.

If you get tired of being recorded and analysed by GOOGLE try DUCK GO GO. It works perfectly well and does not track its users.

Absolutely correct. You are the source of your adds. Maybe, clear all your Google cookies or all cookies and storage will help.

Good concise explanation of how online ads work.

I would add that it’s been uncovered recently that sometimes, even the visitor of the site has no clue what he is “seeing” because some ads are “invisible” — they are “served” by the exchange but not actually displayed on screen. The mechanics of this multi-billion dollar industry are very opaque and complex. Ad space buyers have no choice but to show blind faith in the system. They don’t bother to audit or verify because 1) they have no expertise to do so, 2) it costs money, 3) online ads don’t represent additional expense because they use ad money from another medium and 4) afraid of being left out.

One of many things I enjoy about Wolf Street are the particularly wackadoodle ad choices being directed at me via this site. On most sites I visit, ads are boringly predictable. Did I buy something yesterday from Amazon? The ads are hoping I’ll buy the same item again today.

But whatever febrile algorithm links Adsense to Wolf Street to me, the ads are entirely different. Right now it’s pretty much all Ron Paul either encouraging or discouraging an investment in gold. Hard to tell which.

The gov and the economy cannot stand an increase in interest rates. The DXY on the rise also indicates trouble. Rate cuts are the answer that the Fed will turn towards. Election year pressure as well.

Most people don’t worry about the price of energy for investing. They just want to know if they can continue to afford to fill their tank and will they have a job to drive to?

Stronger US dollar is not a good thing. Sure, Walmart plastic will be cheaper at the expense (excuse the double entendre) of more manufacturing jobs. So what?

I would have thought that images of the Earth from Space would have indicated we basically live in an spherical aquarium. You won’t do well if the rising tide only floats one fleet. We’re all in this together and one affects all. I guess the writer missed that part, or is his hand and mind stuck in the cookie jar?

I would think of greater concern is watching the US begin to tear itself apart this past week….just in time to lead into the political conventions. Of course building materials might be more affordable. Or, rebuilding materials.

Crude inventories reflect the demand /supply imbalance of crude oil.And the important number is WORLDWIDE inventories ,not just US or European inventories .Worldwide inventories are opaque largely because China is rapidly building storage capacity that is not reported

But crude oil is only the feedstock; we consume refined products.Because gasoline represents about %50 of the refined products,gasoline supply /demand is the first place to start in determining whether demand is running ahead or behind supply.Currently gasoline inventories are much higher than expected at this time of year .Added to this is the large amount of gasoline that China is exporting.This brings up three additional questions related questions

Why is China exporting gasoline?

Has Chinese demand been running less than projected?

Did the Chinese demand for crude oil during the winter and fall represent “true demand” (demand for actual CONSUMPTION of oil)or did it represent storage demand

If the Chinese demand earlier this year was storage demand ,then there is a good chance that this oil will come back on the market as refined products.

Crack spreads have been deteriorating especially along the East Coast and are at 5 year lows for this time of year.If gasoline inventories continue their current trend,there are two ways to rectify this.Refinery shutdowns and /or a lower price for their feedstock ,crude oil.

Combine this with a stronger dollar and things could very dicey this fall for those who are bullish on oil and oil stocks.

r cohn, the space key is in the bottom of the keyboard, please

“the Fed has publicly admitted that they have concerns about global growth”

LOL, maybe having an economy where most haven’t had a raise in pay in decades wasn’t such a great plan.

Artificial Intelligence: “The ads are hoping I’ll buy the same item again today. ”

“maybe having an economy where most haven’t had a raise in pay in decades wasn’t such a great plan.”

Globalization was the plan enacted and it was a great success of one-way trade. “Americans don’t want those dirty jobs” It’s hard for the 35 year old American to compete wage-wise with the 12 year old Chinese working 18 hour shifts.

US foreign policy seems to be geared towards keeping other currencies weaker so that the Fed can keep printing money. So far, so good, As the guy who fell out of the 100th floor said at floor 50.