Moral Hazard Spreads: TBTF States?

During the Financial Crisis, it was California that made the headlines with “out-of-money dates” and fancy-looking IOUs with which it paid its suppliers. The booms in the stock market and the startup scene – the state is desperately hooked on capital-gains tax revenues – but also housing, construction, etc. sent a flood of moolah into the state coffers. Now legislators are working overtime to spend this taxpayer money. Gov. Jerry Brown is brandishing recession talk to keep them in check. Everyone knows: the next recession and stock-market swoon will send California back to square one.

Now Puerto Rico is in the headlines. It’s not even a state. And it’s relatively small. But look at wild gyrations by the federal government and Congress to deal with it, to let the island and its bondholders somehow off the hook.

But Puerto Rico may just be the model. Big states are sliding deeper into financial troubles, particularly New Jersey, Connecticut, and Illinois.

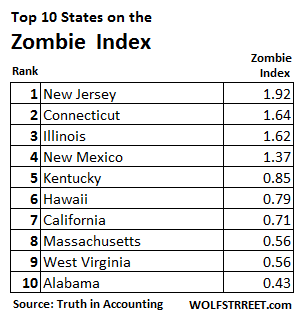

These three states hold the top positions in the “Zombie Index” that Bill Bergman, Director of Research at Truth in Accounting, developed two years ago. California has dropped to 7th place. Whew!!!

The Zombie Index for the 50 states is based on three main factors:

- Truth in Accounting’s “Taxpayer Burden” measure of state finances

- The timeliness of state financial reporting

- And the share of total debt effectively “hidden” off the balance sheet.

This “taxpayer burden” is not a reflection of actual state taxes paid, but of the state’s total liabilities per taxpayer – such as outstanding bonds and loans and off-balance-sheet liabilities such as for pensions.

In explaining the Zombie Index, Bergman writes in his article, “Zombie states deteriorating faster and further”:

The index is named after a term coined by Ed Kane, professor of finance at Boston College. Kane wrote two books warning us about the S&L crisis back in the 1980s and early 1990s, before we knew what hit us. Kane used the term “zombie bank” to identify insolvent firms that were allowed to stay open by regulators, frequently with the aid of false regulatory accounting principles that delayed the recognition of insolvency.

Many of these firms ended up “gambling for resurrection,” in Kane’s terms, and these incentives ended up trebling the cost of the S&L crisis when many gambles went sour.

In an article two years ago, when Bergman introduced the Zombie index, he wrote:

Kane’s careful history indicates that this risky behavior and the financial conditions of these zombie banks were hidden by less-than-truthful accounting practices. There are alarming parallels to the financial crises faced by many state and local governments today.

These questionable accounting practices have allowed hundreds of billions of dollars of pension debt to accumulate outside governments’ audited balance sheets.

This state of affairs is all the more ironic in light of the balanced-budget requirements that are widespread in state and local governments. Government leaders regularly proclaim their fidelity in living up to the spirit of these laws. But false accounting practices have allowed real expenses (and debt) to accumulate anyway.

Taxpayers and citizens have been left in the dark.

So here are the top ten winners on this honorable Zombie Index:

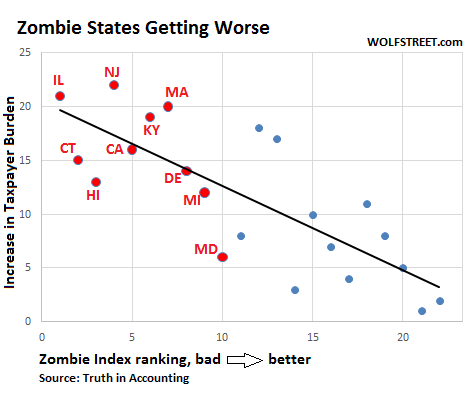

Based on the 2015 financial reports that are now available, Truth in Accounting did some digging and found two trends:

- Larger states tend to show greater deterioration in their “Taxpayer Burden” from 2014 to 2015, as well as from 2009 to 2015.

- And states ranking high on my Zombie Index have been getting worse, as well.

Here’s a chart of 22 states for which Truth in Accounting analyzed the 2015 financial results. It compares their five-year average Zombie Index rankings (so not the most recent rankings as in the table above) to the change in their “Taxpayer Burden” from 2009 to 2015. It shows that the worst states on the Zombie Index (red markers, 5-year average rankings on the Zombie Index axis) are also those states whose “taxpayer burden” has increased more (left axis).

Bergman paralleled these trends to the current “regulatory issues in banking”:

Sadly, and perhaps alarmingly, these findings may point to a “too-big-to-fail” problem in state government finances, similar to a TBTF problem in banking. We may have a significant moral hazard problem operating, if larger states are assuming their failures may be cushioned by federal resources.

Especially if Uncle Sam has already been pursuing, in the words of the Financial Report of the U.S. Government, “unsustainable” fiscal policy.

Politicians can kick the can down the road for many years. It works for an amazingly long time. They can adjust accounting practices to where the biggest problems – such as obligations related to pensions and other retirement benefits – are neatly swept off the balance sheet and thus out of the public eye.

So politicians cycle through their offices, and they’re kicking the can happily down the road for someone else to kick down the road even further. But at some point, they’re going to run out of road. And then, like the S&Ls, they may end up “gambling for resurrection.”

They’re already doing it: For example, governments are issuing “Pension Obligation Bonds” – they’re borrowing money from Wall Street to fill the holes in the state’s obligations to the already underfunded pension systems, and they’re gambling that total investment returns are 7.5% for evermore, even after the most phenomenal stock, bond, and real estate booms in memory.

And then, much like the banks, they’re counting on a bailout from the Federal government or better yet the Fed. Because who can stomach seeing Illinois go bankrupt?

Now subprime mortgages are moving into the crosshairs of regulators, who’re fretting about “astronomical” default rates. Read… NY Fed Warns about Booming Subprime Mortgages, now Insured by the Government

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yet the western world’s Baby Boomers keep on retiring by the tens of thousands every month in the fond/certain expectation that their smart, brilliant, farsighted…you fill in the blank.. Financial Planner is able to, not only see 200 years into the financial and political future but will, in addition to being such a bright guy/gal positively guarantee that your golden years will be a 21st century Garden of Eden! (if only you follow what his/her laptop predicts)

All you have to do is…”Buy and hold”,.. “It’s time in the market not timing the market”..’Just hang in there’ …Again, you fill in the blanks.

Of course when Mrs and Mrs. Pensioner are ultimately up the effluent canal without a propellant device those self-same FP’s will shrug their shoulders and issue the best known phrase in the FP’s world: “Nobody could see it coming”

Be warned folks!

Everybody’s screwed but how did you expect me to live without the commissions?

The problem is not government debt per se. The real problem is that the $70 trillion in G10 debt is the collateral for $700 trillion in derivatives.

You can rest assured that a goodly portion of city, municipal, county, and state bond debt rests in some derivative. The tragedy is these derivatives make up a segment of pension funds portfolios.

So here we have a true conundrum.

Governments are issuing “Pension Obligation Bonds” that are rolled into derivatives, that pension funds buy in their search for yield. This has idiocy written large all over it! Debt being used to buy debt, so that it may pay debt, that was issued as debt to cover a prior obligation, for which the debtor was insolvent to begin with!

Isn’t government debt an asset nowadays, with NIRP? The more debt you have, the more you get paid by bondholders every year; a game which might continue until the whole system explodes.

Pension funds might get in trouble because of the same NIRP (although pensioners often deny there is a problem, they say the coffers are fuller than ever and there is no problem at all, their pensions should go up!). I guess the pension funds just need some clever G$ derivatives and everything will be fine, at least until someone blinks ;-)

Those government pensions won’t be paid. All the major pensions are wrapped into derivatives. I have no pity for the government retirees since they spent years not paying attention to the real producer’s costs. They over-expanded all the cities & built all those strip malls that will be empty.

No, it’s going to be a true squeeze, especially on Americans who have been entertaining themselves for decades. Plus, they can’t get enough tax money to cover all this….no way.

Alabama is not a state with a high tax burden. We are a state full of deadbeats who are used to getting far more from the Federal government than we send in. Our income tax is too low, as are our property taxes. Just an increase in the tax on timber land won’t be considered. Even one that would bring us up to the rate of surrounding states. The vast majority of these land holdings are owned by large timber and paper companies.

No, Alabama doesn’t lack the ability to put our financial house in order; we simply lack the will. Like I say, it is a state with too many deadbeats who think necessary government services should be free. When our previous governor, Bob Riley, took office, he proposed a reasonable, responsible tax reform package in the form of a referendum. He was nearly tarred and feathered. He didn’t bring it up again and the current, soon to be impeached, governor wouldn’t go near a tax increase if his life depended on it.

Nobody talks about Bobby Jindel leaving Louisiana with a billion dollar hole in its budget. He kept rolling over the health care deficit until he left office and didn’t mention it publicly. The cause was the lack of will to raise taxes, because we all know these bills pay themselves eventually. Now Louisiana has raised about every tax it can think of and has cut all kinds of services. Another example of how trickle down was a scam.

Petunia: Trickle down economics may go down as the greatest con in history. I must be too far down the ladder, because I have been waiting on a little trickle since 1980.

All the bills could pay themselves eventually while the credit cycle of the US dollar as reserve currency worked. It’s not working now and these bills are coming home, along with the inflation. People will get an education very rapidly, but the blame game won’t solve anything.

PS speaking of trickle down, Bill Richardson ravaged New Mexico when he was governor. He raided the general fund and education fund for the Rail Runner, a boondoggle since he owned land near the stations.

As for Alabama, a 5% income tax and almost 10% sales tax rate are not what I’d call “too low”.

Sure the property taxes are reasonable but all states usually emphasize two out of three types of taxes (sales, property or income).

Would I prefer no income tax and higher property taxes? Maybe.

The problem is that the state’s budget is divided by statute. Courts, Medicaid and jails are chronically underfunded in the “general fund” while anything education based usually has a surplus.

And you can’t move money from one side to the other.

This goes back to the old days when the teacher’s union ran the state.

Now while all that is mostly negative, our state does require a statewide vote to raise property taxes (which means it never happens). I’m sure people in other states wouldn’t mind having something like that.

The US is often cited as the ‘model’ for the EU in that we have a true banking union, pooled revenues, a common Treasury bond etc. However, just beneath this placid surface we have the same tensions that exist in Europe. Iowa taxpayers are not going to assume the pension obligations of Illinois nor is Arizona going to help California pay off its HSR bonds.

E Pluribus Unum works great when all 50 states are fiscally responsible but will break down fast when the profligate become beggars.

yes, similar tensions except that the cultural and economic differences between the EU states are MUCH bigger.

I’m not so sure about that. Language is an issue for sure. But I don’t think or I can’t right off the top of my head think of anything in Europe the same as the racial problem in the US ( outside of the Balkans, Croatia, Serbia etc. which has always been a cauldron of ethnic hatreds)

There is also no one in Europe who thinks you should be able to carry guns in public, own machine guns etc.

There is a saying in Britain about British diplomats: if you want to convince a Brit he’s a European, send him to the US.

I think secession by a state although not likely, is not impossible.

The polarizing reaction to Donald Trump is one symptom.

At the end of the day, the test of a union IS how willing a member is to aid another member. The EU is bailing out weaker members. If the US will let poor states go broke, renege on pensions etc. who has the stronger union?

The problem is the EU is not ‘bailing out’ weaker members. You are doing what so many liberals do and that is confuse reality with what you wish would happen. Take Greece, e.g.. It is receiving loans from the European Stability Fund and to get that money it must adhere to fiscal targets set by the EU Commission, in other words Germany. This entails pension cuts, cuts in public services and meeting a repayment timetable.

There is no debt forgiveness because to fund Greece the other members are on the hook for the bonds that raised the money to make the loans. Hollande and Merkel cannot go to their taxpayers and tell them they are going to have to pay off those bonds so that Greeks don’t have to.

The EU is bailing out private-sector bondholders, not member states. It’s ALWAYS about the bondholders.

The “bailout” of Greece was all about bailing out its (non-Greek) private-sector bondholders – initially mostly banks, along with all kinds of funds, then hedge funds. Over the years, a big part of Greek bonds have been shuffled to the ECB, bailout funds, and other public entities, and therefore, sooner or later, to taxpayers in other countries. The private-sector bondholders were successfully bailed out. This was a wealth transfer from taxpayers to private-sector bondholders.

Greece should have been allowed to default right up front in 2008/9 and let these private-sector bondholders take the haircuts (a small portion was treated that way in 2012, when all should have been treated that way in 2008/9). Greece’s debt would have been a fraction of its current debt, and it might have been back on its feet by now.

And bondholders would have learned to not lend Greece money unless they get a huge risk premium!!!

But now, any debt deal with Greece will hit taxpayers in other countries.

on a scale of 1 to 10 — a 10!!!!!

RE: “There is no debt forgiveness because to fund Greece the other members are on the hook for the bonds that raised the money to make the loans. Hollande and Merkel cannot go to their taxpayers and tell them they are going to have to pay off those bonds so that Greeks don’t have to.”

——————–

Terrible comment on the human race that our “leaders” have no trouble raising trillions to wage war, but are unable to raise a few billion to wage peace…

It is common knowledge that Greece has yet to make the changes necessary to live within its means- that is why this thing drags on.

The bloated public sector has no equal in Europe, which has a lot of them.

Micheal Lewis’s book Boomerang goes into it in some depth. At the time of writing 2012, it had four times as many teachers per pupil as Finland which has the best results in the EU, while Greece has the worst. Want to bet how drastically that has changed? I don’t know but I’d bet it hasn’t changed much.

No one has ever gone to jail for tax evasion. No receipt is ever given- including the swank hotel where Lewis interviews. One of his interviews is with a tax collector who does not want to be identified who describes bribes paid to make cases go away.

When the IMF arrived back in 2008, it found government financial records more in keeping with a eccentric who keeps bills in a shoe box. It didn’t know how many employees it had.

After weeks of getting to the last obligation, the IMF team asked ‘is that it’

‘Well just one more: we just hired three hundred people to digitize photos of Greek ruins and none of them have any experience’

Greece has defaulted numerous times. It was a founding member of a sort of precursor to the EU, the Latin Union.

At the time ( around 1890 ) people asked ‘why include Greece, it has large amounts of unredeemable scrip’

It was eventually expelled for minting debased silver coins.

There seems to be a perception that it is jack-booted Germany leaning on Greece. Actually there are small poorer countries that want to lean harder. e.g. Latvia that wonders why it should contribute to pensions that are double its own.

By the way I am part Greek. Maybe that’s I can empathize with

what Lewis thinks is a national characteristic: a Greek thinks of himself as one to whom rules do not apply.

Nick Kelly:

Machine guns are illegal in the entire USofA. Also, very few states let you “open carry”, but I remember as a kid, in Miami of all places, where we all would take our .22 rifles and go out into the woods/everglades and shoot away.

Back when I was a kid, you could buy a gun through the mail. Anybody could as long as you vouched you were an adult. And, any adult could walk into the numerous guns shops in Miami, pick out what you want, pay cash, walk out and be free.

For some reason, back then when we had freedom, we had LESS gun crimes. So, now that guns are difficult to get all across America, we have MORE gun crimes. Why?

Actually no. Nationwide, homicides committed with firearms – like most violent crimes and other crimes – have been declining for many years (though there might have been a first uptick in 2015).

“I think secession by a state although not likely, is not impossible.”

THE FASCIST FED’S WOULD NOT ALLOW IT IN 1861.

I dont see that changing today, with the huge federal government, that currently exists, on the taxpayer’s tab.

funny, but as i recall, yugoslavia existed with no ethnic distress.

it was only after tito’s death that the nato states began to manipulate/stimulate/purchase ethnic hatreds so as to scatter yugoslavia to the winds of armed conflict.

isn’t that what really happened? bill clinton, madeline albright playing their game of global domination.

Tito held the anarchy of Yugoslavia, a state that should never have existed, together, with a gun. Backed by a BIG Russian gun.

As he, and the USSR faded so the Muslim based Aggressive Acrimony, and animosity, that had been simmering since the events in WW I and the muslim SS action’s in WW II Exploded.

Blaming the US for the Balkan Genocide and surrounding events, is like blaming the US for all muslim wars, a cop out.

Go demonize the US somewhere else.

“Iowa taxpayers are not going to assume the pension obligations of Illinois nor is Arizona going to help California pay off its HSR bonds”. Iowa taxpayers and Arizona tax payers themselves might not, but the federal politicians looking for votes might very well do it from the federal perch. Oh wait ….. that includes Iowa and Arizona tax payers, doesn’t it?

Interest rates are the lowest in history in Europe and Japan and close to the lowest in the US .This despite the fact that the amount of debt is the largest in history with large deficits inevitable in the future.The market seems to have concluded that deficits are irrelevant,so what is to prevent the US from guaranteeing and then assuming the debts of the states and then the Federal reserve buying up this debt.

The only thing that keeps the Fed from doing this is the cultural inability, in America, to tell the truth and call things what they really are. They called the bailout of the banking system QE and they are calling the liquidation of those assets NIRP. What you are proposing is already being done behind the curtain. Guess who’s first in line, the same lucky few.

Federal deficits are irrelevant, and most major financial institutions know that. State deficits are a whole different issue.

Alexander Hamilton wanted to create a powerful central government with a powerful central banking system and single currency. So he pushed for a constitution that did just that. The way he got the States to agree was for new federal government to assume, and pay, all of the revolutionary war debt accumulated by the States. He used deficit spending to achieve that goal.

Hamilton was working for the European bankers.

The states that had paid down their debt responsibly weren’t too happy to pay for the irresponsible states who hadn’t. Then there were all the IOUs (scrip) that were handed out to troops and vendors by the Feds, which were bought up by speculators in the know, cheap, to be redeemed at face value by the Federal government.

Then the Feds implemented the Whiskey Tax, and when the peasants revolted, sent in the Army to crush the revolt … it didn’t take long for the Federalists to get rolling, Constitution or no constitution.

The more I read about the Revolution, the more it seems it was started by a bunch of aristocrats who owed money to Britain and didn’t want to pay it back.

“The more I read about the Revolution, the more it seems it was started by a bunch of aristocrats who owed money to Britain and didn’t want to pay it back.”

Oldest story of mankind: Poor man fighting the rich man’s war.

I haven’t looked in a while, but are there any states left that issue AAA rated tax free municipal bonds? If so, does anyone really believe the rating?

Even the govt is now saying that without some kind of SS reform the beneficiaries will have to take a 25% cut in about 10 years or so. The CEO of AARP said this on CSPAN just a few days ago as well.

We won’t run out road, it will just become a goat path. I’m guessing that ‘means testing’ will be introduced as the solution to SS and Medicare.

get ready for that gravel burn when you slip and fall…

…..we’re all gonna be eating dust and pounding sand before this is all said and done,,,

modern society is f#cked big time!

….while ‘High Society’ carries on from their ‘lifeboats’…..

I find in ironic that #1 (New Jersey) is led by an obese chunk who prides himself on bashing Unions and likes to play tough with transit gridlock when someone disagrees with him. Plus, he is now a rabid Trump supporter after taking the better part of a year off to try and save the Country in his own Presidential bid.. Now watch, if his State ratings improve he will say it is the result of his leadership acumen, but if the current low standing continues it is the fault of those greedy Unions.

No wonder some of those States on the list are charter members of the walking dead.

Look for more storms, higher tides, and faltering revenues.

“Leaders? Leaders? Leadership, anyone? Simone, have you seen Ferris Bueller? Maybe he can help”.

That reminds me: a few years we had a visitor here (British Columbia) who owned her house in (Something) Orange, New Jersey.

We were amazed at how high her property taxes were, and we lived in a full service city and weren’t overjoyed about our own taxes. But her’s were not just double, they were 8K ,about four times our taxes of about 2K ( not including our water, sewer etc. but those were only about 50 a month.)

newsflash – $8K in property taxes is average or low the tri-state NY. It’s also average or low elsewhere in the northeast like where I live near Boston.

i was going to say, ah, never mind.

The laws related to protecting pensioners were just changed a few years ago. The next twenty years will be ugly for pensioners in the U.S. Too many millennials living at home? Eventually, the media will be reporting on record number of elderly parents living with their adult children.

This was already common on my street in south Florida. Three and even four generations in a three or four bedroom house. They needed to pool the income to maintain a middle class lifestyle.

Wealth comes from Individual Free Enterprise Capitalism or Individual Free Enterprise Agriculture.

Unfortunately, these States you list are all against the individual and against Free Enterprise. They wish to regulate and suffocate businesses and, if they make any money, to tax them to death.

It is only going to get worse and these Pension plans are already bankrupt. Good luck in 5 to 10 years when there will be NO MONEY in any account to pay out.

When I make a motion in a meeting* to give a sign of approbation to the Entrepreneurs who provide jobs (my Dad is one), the atmosphere has gradually edged up from “Icy” 20 years ago to “Quite Cool” today…people still regard jobs as their Right.

*(prayed in church)

EH: Nothing you wrote is true of Alabama. We are a Grover Norquist controlled deeply red state. Government is demonized and free market capitalism is a religion. Regulations are exactly as prescribed by EPA and nothing more. The state is governed by Alabama Power Company and ALFA. ALFA once represented small farmers, but now represent large industrial agriculture and timber.

You really don’t know much about the Yellow Hammer State.

Great article, Wolf.

Quite obviously, because the present economic system being used in the US is woefully inadequate and is vitally dependent upon both a wildly-expanding population and never-ending war, what is needed is a NEW economic system / model that uses technology to pair what societies locally need with the abundant robot and human resources that are readily-available to satisfy that need.

What seems to be missing in this discussion is the evasion of the state constitutional prohibition of deficits in most state Constitutions.

“All the states except Vermont have a legal requirement of a balanced budget. Some are constitutional, some are statutory, and some have been derived by judicial decision from constitutional provisions about state indebtedness that do not, on their face, call for a balanced budget….”

http://www.ncsl.org/research/fiscal-policy/state-balanced-budget-requirements.aspx

IMNSHO the major problem is the lack of criminal and civil sanctions against the politicians and administrators, which evade these requirements and prohibitions.

Wolf I have been reading you site for several months and really appreciate the articles and thoughtful comments.

For anyone not aware of current Illinois details. Besides the state being 6-9 months behind on paying bills, we have been without a state budget since the end of last June.

IDOT said this week that if no budget is passed by the end of next week they will shut down all contracts. This will put 25,000 construction workers out of a job, create transpotation issues on current construction sites, and stop all engineering design on current and future projects by outside consultants.

Very “Bullish” for tire and alignment shops İ would imagine İnsta

And I would imagine nobody would notice any difference…..ha

seems to me that illinois is run by, was run by, ah, never mind.

I suspect that IDOT is much like CALTRANS which means that risk is present regardless if they are working or not.

I have just paid a visit to the TIA website, and darned if I could find something as simple as 50 state “Zombie Index” for the latest year. Did I miss something–has anyone else tried the same thing?

I have the data on a spreadsheet, sent to me by Bill personally. I don’t know why they don’t publish this in a more accessible form. But hey, that’s my job.

I hunted around…might try this map

http://www.statedatalab.org/

Holy Sh&t!!

Brexit defeated by 2 %! Stay vote 52%.

Three more percent and Ladbrooks betting shops might have been in trouble. They were giving 3 to 1 stay, with lots of action.

Sorry my lady friend got the numbers right but wrong direction.

So far markets are a blood bath but presumably and hopefully it’s an overreaction.

I still think they’re crazy but time will tell.