Renters Squeezed by the Fed’s “Wealth Effect”

For inflation lovers, the headline numbers that the Bureau of Labor Statistics reported today was benign: The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2% in May, seasonally adjusted. Over the last 12 months, not seasonally adjusted, the index rose 1.0%.

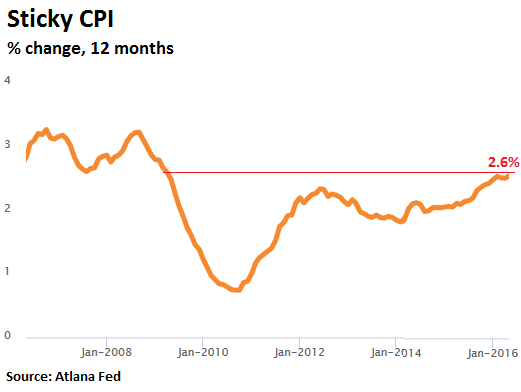

The Atlanta Fed’s “sticky-price” CPI – “a weighted basket of items that change price relatively slowly,” as it says – wasn’t quite that benign. It rose 2.6% for the 12-month period, the hottest increase since April 2009!

So prices are rising. Not that this is a surprise to anyone trying to make ends meet on a monthly basis. But now even the official numbers are beginning to limp behind reality.

The report by the BLS had a mix of rising and falling prices. Energy got more expensive. The price of oil has jumped since February, and so the price of gasoline rose 2.3% in May, seasonally adjusted, after having soared 8.1% in April. Without seasonal adjustment, it jumped 6.6% in May. Fuel oil jumped 6.2%, natural gas rose 1.7%, electricity edged down 0.2%. But the energy index is still below last year with gasoline down 16.9%. So yes, energy prices are rising, but they’re still down from a year ago.

That cannot be said of rents.

The Consumer Price Index contains two housing components: “Owners’ equivalent rent of primary residence” (OER) and “rent of primary residence” (Rent). They purport to measure the cost of “Shelter,” which is the “consumption item” that a home provides and is thus included in the CPI. The cost of the home itself and any improvements to the home are considered an “investment,” not consumption, and therefore not part of the CPI.

“Owners’ equivalent rent” accounts for 24.2% of total CPI. “Rent of primary residence” accounts for 7.7% of CPI. Combined they account for 31.9% of CPI. “Shelter,” which adds those two and some other items, accounts for 33.2%, by far the largest and most important component of the CPI.

The data are obtained by survey. For “owners’ equivalent rent,” homeowners are asked what they think they would have to pay if they were renting the home. A measure of implicit rent. Would homeowners think that rents of their types of homes are increasing? Nope. They’re not renting. They have no idea. They can easily fool themselves.

Based on the surveys, the BLS figured the “owners’ equivalent rent” rose 3.3% year over year. That measure accounts for 24.2% of CPI. It is always ludicrously low. It’s the simplest way of hiding the impact of soaring housing costs, and the simplest way of keeping CPI artificially low.

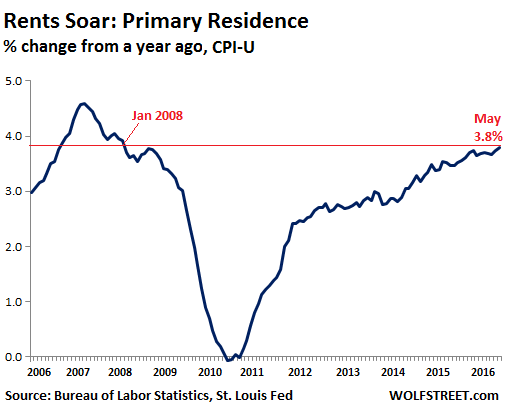

For the component “rent of primary residence,” renters are asked what they’re currently paying in rent. Even if they’ve lived in a rent-controlled apartment for 20 years and pay just a fraction of market rent, it becomes part of the statistics, and not the rent that a new renter pays. Market rent data is available everywhere. But no. So “rent of primary residence” – however understated it may be – rose 0.4% from April and 3.8% from a year ago, the biggest year-over-year increase since January 2008:

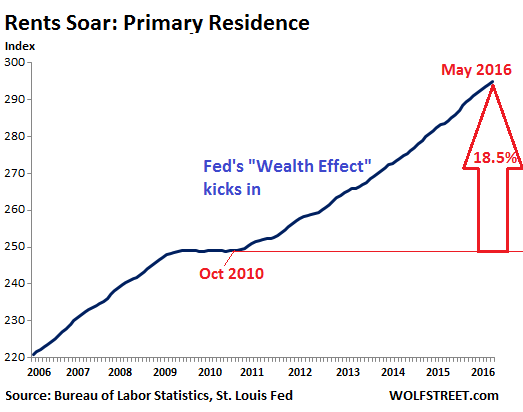

Over the longer term? In the five-and-a-half years since September 2010, the index for rent, understated as it is, has risen 18.5%:

Why are rents rising sharply when incomes, especially for the lower 80%, have languished? It’s not like renters have more money to blow on rent and thus are driving up rents. On the contrary.

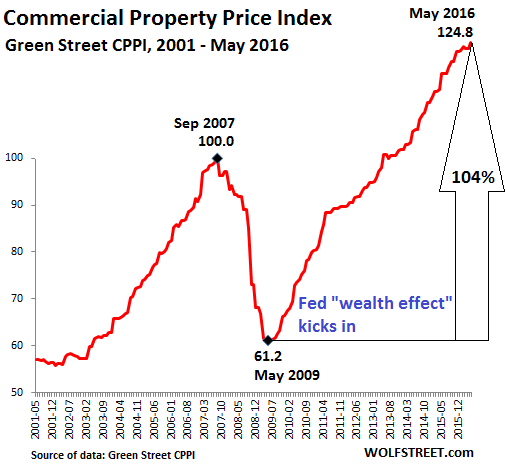

Since the Fed began its ZIRP and QE programs with the express goal of inflating asset prices, stocks and bonds have soared, home prices have soared, commercial real estate has soared, including apartments. Nearly all asset prices have soared. According to the Green Street Commercial Property Price Index (CPPI), commercial real estate prices have more than doubled since May 2009, when the Fed’s “wealth effect” started to kick in:

People don’t have to live in stocks and bonds, and those asset bubbles have little impact on the daily lives of regular folks. But they do live in homes.

But when apartment prices, along with the rest of commercial real estate, began to soar, landlords raised rents, on the essential logic of cap rates and return on investment. It has to work out for the investor, or else the whole over-leveraged house of cards comes tumbling down again, as it did in 2008.

Housing costs is where the Fed’s “wealth effect” is eating the lunch of regular folks. More than just their lunch. They’ve gotten hammered by the Fed’s policies. Just like savers, who’ve done the prudent thing all their lives, only to watch their income streams get confiscated.

Rents started rising in late 2010, according to the BLS. The commercial real estate boom had started 9 months earlier. The lag is natural. And rent inflation, as figured by the BLS, hasn’t been nearly as steep as commercial property price inflation, for two reasons: One, because the BLS systematically understates rent inflation. And two, because reality bites; renters can be squeezed only so far before there’s nothing left to squeeze.

For many renters, it’s a zero-sum affair: every dollar spent on rent is a dollar not spent on other items. In this way, rent inflation is a transfer of spending from healthcare, food, or electronic gadgets, to shelter. It’s not helpful for the overall economy. And it’s devastating for the people who have to struggle with it.

Sooner or later, with wages stagnant for many renters, market resistance starts kicking in. And this may now be happening in the first few cities, and a mega-landlord is preparing for a downturn. Read… It Starts: Apartment Glut in San Francisco & New York City

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Yellen is the worst Fed Chair in history. This woman has no idea what she is doing at all. The damage brought on by endless years of ZIRP will take years to unwind.

I think Greenspan was worse, because he could have stopped the derivatives, but didn’t have a clue how they worked. The reason Wall St. always praised him to high heaven was because they were totally getting over on him.

Greenspan was the Captain of the Titanic who noticed that it was sinking right before it slipped beneath the waves. He was last heard saying something about “irrational exuberance” as he jumped into his private launch and sped away from the carnage.

What will happen if the Fed discovers a bit more inflation then they’re prepared to accept? It seems they have made sure the investment banks got all they needed and saw no problem in that but traditionally the Fed was terrified about inflation and would raise rates at the hint of it. I know their whole plan these past 8 years was to grease the skids a bit but if they start raising rates when the whole world is not wouldn’t that bring a flood of hot money to the US? I’m probably just a pessimist but I don’t see how we are going to get out of this without a very serious recession that could turn into something much worse.

Don’t forget to add the deposit you never get back to the cost of the rent. The big corporate landlords don’t ever give back the deposit. I didn’t get mine back. Unfortunately, there is no consumer agency that deals with rent issues for renters. The states make you go to court which is expensive and you have to take time from work, so it is not possible for most renters.

I would like to take this opportunity to rant about Senator Warren’s Consumer Protection Bill. The biggest fraud since the financial collapse. This bill could have given people relief on credit card rates and renter’s protection. Instead the consumer agency is funded, not by congress, but by the fed, the banks. This is why the bill is a total fraud. Thanks for nothing Senator Warren.

Petunia,

Senator Warren’s Consumer Protection Bill? Do you mean the Consumer Financial Protection Bureau? Its creation was part of the Dodd-Frank financial reform act of 2009. Warren wasn’t even in congress when the law was passed.

That kind of mash-up is right out of the current Republican play book.

Wall Street and the banks opposed Dodd Frank but the C.F.P.B. was the biggest thorn in their side. So much so, they axed ‘s Warren’s nomination as its chief, after she spent months setting up the agency.The C.F.P.B.’s mission was simply to enforce rules protecting consumers already on the books, bringing laws from seven different agencies under a single authority.

Before creation of the C.F.P.B, most of the rules were overseen by bank regulators. Of course, none paid attention to consumer protection which would impact their bottom line.

The Consumer Protection and Choice Act, a bill by Wasserman Schultz that would delay the CFPB’s payday lending rules by two years, and nullify its rules in any state with a payday lending law is in play now. Several Florida democrats who have sold out their constituents are behind the bill.

Correction. Dodd-Frank was proposed in 2009, and passed in 2010. Elizabeth Warren was indeed elected to the U.S. Senate after passage of Dodd-Frank – in 2012.

Warren served as Chair of the Congressional Oversight Panel for the Troubled Asset Relief Program (TARP). That was the 700 billion dollar bailout of the banks. She was a distinguished Harvard law professor before being elected Senator from Massachusetts.

Elizabeth Warren was once a registered Republican. She changed affiliation after studying the reasons for consumer bankruptcy, unexpectedly finding the reasons to be divorce, job loss and medical bills, not fraud.

Although I don’t live in MA I followed the race because I wanted to see Scott Brown defeated, a total sell out. Warren ran on her support of the consumer bill/bureau and it was widely believed, out here in the real world, that the bill would be a help to the masses. I was sadly mistaken and uninformed as well. This bill was a fraud perpetuated on the public, to make them believe they would get relief, from the abuses taking place in banking.

Instead of forming an agency which would be overseen by congress, supposedly the people, the bureau is overseen and funded by the fed. There is no way that the fed, owned by the banks, would ever give relief to any complaining consumer. This is why the bill is a fraud and the people, like Warren, who supported it are frauds as well.

Come on, don’t twist facts trying to win an argument. Republicans are implacably opposed to any attempts to regulate banks and Wall Street. If elected, Trump is promising to revoke Dodd Frank.

Here from Forbes a relevant article about the Republican Congress’s attacks on the Consumer Financial Protection Bureau:

http://www.forbes.com/sites/jimhenry/2013/06/29/some-house-republicans-dig-in-against-the-consumer-financial-protection-bureau-and-auto-loan-measures/#7a2f348b34c3

Petunia,

The CFPB is neither overseen nor funded by the Federal Reserve. Your “facts” are right out of the Republican playbook that seeks in this case to undermine what little consumer protection is left for the American public.

Elizabeth Warren is an unmistakable champion of the middle class. Her Massachusetts’s senatorial platform was based on its protection.

Years before the financial crisis and her successful senate run Warren’s own impeccable research at Harvard, where she was a distinguished law professor, burst the Republican propaganda balloon by uncovering the facts about predatory lending, bankruptcy, the real estate bubble, and unsustainable debt.

She knew the middle class was being eviscerated by big money interests through deregulation and lax enforcement of existing laws. She set about to share what she knew with the American public.

Elizabeth Warren’s unwavering search for the truth, her intellectual agility, forthrightness and integrity mark her as both a leader and an irresistible target.

I’m sincerely sorry to say you and Trump appear to have two important things in common. 1) Neither can pass a fact check. 2) Your credibility relies upon an audience that is either manipulable or part of the deceit.

Mary & Bloom,

I was a huge admirer of Warren. She puts on a really good hearing and then nothing comes of it. I could say the same about Sanders. At least the republicans don’t pretend to care about the working class. I believe you are both mistaken about the funding for the so called consumer bureau.

For Mary & Bloom:

https://www.washingtonpost.com/blogs/wonkblog/post/why-the-cfpbs-funding-is-guaranteed/2012

Petunia,

Mary and I are not wrong.

The WaPo link you provided does not work. You may be aware that WaPo is now owned by Jeff Bezos. Another once great newspaper, now part of a vast network of corporate-owned, Republican-controlled mass media.

One really must read widely and questioningly, but I think you already know that.

Alas, truth tellers like Sanders are demeaned and relegated primarily to narrow channels of communications while mouthpieces of power like Trump, Clinton, corporate CEOs, and other politicians persuade vast audiences through mass media channels. Warren is an exception, due to her rise to champion of the middle class.

Sadly, I am beginning to think you resemble a Chameleon much more than a Petunia.

You state, “I was a huge admirer of Warren. She puts on a really good hearing and then nothing comes of it. I could say the same about Sanders. At least the republicans don’t pretend to care about the working class.”

Really Petunia? Have you mistaken Senators Warren and Sanders for dictators with vast power? Many democrats may have sold out, but Warren and Sanders are not among them.

I’m not getting into the rest of this debate re Elizabeth Warren but to say that she’s not a sellout is going a bit too easy on her. There are some wonderful clips of her several years ago talking about what a hack Hillary Clinton is. That’s before much of the whoring herself out to big banks. And now, after refusing to endorse Sanders she endorses Hillary Clinton. That seems a bit like a sellout.

And when bills have come up to audit the Fed, the real center out of which all the fraud spins, she’s opposed them. That’s not consistent with really trying to get to the bottom of things.

Bloom,

If you google CFPB funding you will get the WP article among others. It is dated 2/15/2012. I picked the WP article because it is a liberal publication, so any liberal would accept it as a source.

Warren is just another Hillary, I am sorry to say.

“the middle class was being eviscerated by big money interests through deregulation and lax enforcement of existing laws”

Petunia,

. . . and who are you suggesting is doing better than Sanders and Warren in stopping the egregious behavior in ripping off the middle class and poor?

Do you think that if they were really trying hard they could do it all by themselves?

WaPo has been owned by Jeff Bezos since last year. It is now the farthest thing from a liberal publication. That said, I have researched the CFPB’s funding and you are correct, it does come from the Federal Reserve.

Warren does not have special power, neither as an an appointee, (remember, it was as Chair of TARP that she championed the CFPB), nor as Senator. Compromises must be made.

Whatever the source of the CFPB’s funding, that’s quite a leap of logic to equate Warren with “Hillary”.

In your rental lease, the spell out what the deposit is used for. How did you leave the apartment?

Some leases require you to clean the carpeting, all appliances, and perhaps even repair walls due to pictures you put up, and even paint.

(Yes, in my long life, I have also owned apartments, but thankfully I got out of that. Nothing is worse than being a landlord when you are not allowed to properly screen the tenants. Today’s tenants will trash the place and remove all appliances the night before they leave…….and the landlord can do nothing about it. There is really no money in renting units. The money is in the “tax” advantages and capital gains. Like in Health care, providing housing has nothing to do with housing. It is paper shuffling, accounting, tax credits, depreciation, capital gains).

um, house prices up, down payments up, it’s a seller’s market. don’t like it? live somewhere else.

get ready for more subsidies for affordable housing paid for by…..the sellers.

one way or the other, those with, pay for.

but what do i know, i’m just a dumb real estate guy.

The old time long term landlord who raised rents only rarely and didn’t buy and sell much is a rare breed these days. So many landlords now see rentals as a get rich quick scheme rather than a long term profession that pays off after decades of patience and hard work. It’s really a zero sum game now since the economy isn’t growing. I knew many people in real estate and contracting who were independent types who’d rather be right than rich, who never charged more than a fair price, even when the customer expected to pay more. It seems quaint but there’s a few people left like that.

There was a book by Nickerson called ‘How I turned $1000 into a million in RE in my spare time’ which I read as a kid in the ’60s. The point was to buy rental property, improve it, and raise the rent thereby increasing your equity instantly, based on the cap rate. Cash out and do it again or borrow against the equity and do it agan. Rinse and repeat. This has always been the formula for RE investors, large or small.

The mom and pop retirement-plan duplex or triplex, who lived in one unit, sought steady tenants for the other(s), and didn’t raise rents to the max may be the type of landlord you’re thinking of.

What ISN’T a get rich scheme these days??

Moved to Colorado Springs last year my rent is 1250. Looking at rent history last year it rented for 1150. Year before 1050. That pace is not sustainable for the folk.

Chris you are a real genius. Enjoy the next housing collapse. Don’t like it, move somewhere else.

Not mentioned in the article is health care costs and health insurance. Both are rising rapidly and taking a huge bite out of consumer wallets, leaving less discretionary income.

Yes, and here’s to student-loan and health-care inflation:

http://wolfstreet.com/2016/06/13/debt-slaves-student-loans-government-largest-asset-class-to-haunt-economy-for-years/

all very similar in Europe, at least in my country (Netherlands).

The free rental market is small here (most is heavily subsidized for ‘disadvantaged’ citizens so they can live far beyond their means) but the pattern is the same as in the US: huge increases in rent, in real (mandatory) healthcare insurance cost, in education and all kinds of other taxes while officially the CPI is around zero.

Homeowners don’t just enjoy soaring home prices (again) but also the lowest mortgage costs in four centuries and even those minor costs are 50% subsidized through income tax deduction. And unlike the US situation, homeowner taxes are tiny over here (that may change, but no sign of it yet) and transfer tax when selling is almost zero as well.

Free money for all homeowners, however you HAVE to play the game and buy a heavily overpriced home to start with. And punishing costs and taxes for savers and renters, so almost everyone has to give up and play the game while the elite unloads their way overpriced properties (but not yet, so I guess the market is going to get even more ridiculously overvalued than it already is).

I always wondered what would happen to the costs of rent if Governments ceased their Rental Assistance programs.

Such welfare payments are really Landlord Subsidy Schemes.

good point … I agree these are huge subsidies that drive up rents and ‘home values’.

In my country most of the rental housing is heavily subsidized. If you are on social security or otherwise ‘disadvantaged’ (like single moms, migrants etc.) you win the lottery and can chose any rental home you want, with the difference between the worst and best homes about 30 euro’s a month. So most of these people go for the very best homes, often 3-4 bedroom terrace homes in good conditions with everything you need a nice garden.

Basic rental homes with a small garden that were build in the fifties for 5000 gulden (nominally about $2500, not adjusted for inflation) are now rented out with some kitchen/bathroom upgrades for 1000-1500 euros per month for non-subsidized renters (just figure, in two months you pay more rent than the original construction cost), but people on social security pay 280 euros for exactly the same home. Sometimes these rental homes are sold on the market because the housing corporations have to downsize – they sell them for e.g. 250.000 euros (over 100x the construction cost in the fifties!) but current renters can get a ‘very attractive’ discount of e.g. 15% and of course no downpayment needed. They rent from the bank instead of from the housing corporation, often with extra government mortgage subsidies but – without realizing it – they are now officially on the hook for 250K.

These same homes can be build nowadays, despite heavily inflated construction costs (severely bloated sector thanks to 30 years of housing bubble …) for about 75K euros including land price. And those homes will have much lower energy use as well, So it’s easy to see that most of the ‘value’ of these rental homes and most of the rent is pure fantasy.

At the same time, without subsidies even those 75K homes would be barely affordable for the average citizen while still allowing the investor a decent return on investment (like 3-5%).

I’m convinced that without the enormous rental subsidies, in my country rents – especially for the less attractive (smaller) rental units – would decline by 50-75%. More people would be forced to live within their means which is a good thing IMHO. But obviously, all politicians and a large chunk of the population, both the ‘socialists’ and the ‘landlords’ and their representatives, will do everything to keep the current ripp-off system going.

The prices don’t tell you what the house is worth – they tell you what the money’s worth!

Hello from New Zealand

Here in New Zealand – along with many other nations that have adopted it – we have suffered the same private banking network credit fueled land price inflation beyond supporting real economy fundamentals due to the land portion of property being removed from the Consumer Price Index back in 1999.

A former Reserve Bank Governor of New Zealand is credited as being the founder of the Interest Rate Inflation Targeting regime that I contend has become an international banking fraud.

As evidenced at this link here;

Failure of Interest Rate Inflation Targeting and the part of former New Zealand Reserve Bank Governor Don Brash as flag bearer for the failed policy.

http://publiccreditorbust.blogspot.co.nz/2013/03/failure-of-interest-rate-inflation.html

but are land prices really a ‘consumer good’? Or does this include the land prices for all properties as included in the price for a home?

I don’t know if this helps. But the land cost in the US, by insurance companies, is considered to be 20% of the price. If you pay 100K for a house the insurable portion will only be 80K on the house.

When I was selling RE in the eighties, a fairly nice lot in Nanaimo, BC was 20-25K. To meet the building scheme you would have to spend about 60K.

Today the same lot would be about 150 and you would need to spend 120 K to build.

The cost to build has doubled the cost of the lot is up 6 times.

BTW: this is in a city with good services but with low land- inflation compared to Victoria, the capital on Vancouver Island, or of course the Canadian hot spot, Vancouver.

A tear down in Vancouver’s Point Grey area just sold quickly for 2.2 million. The house has negative value- the buyer will be spending about 20K? for demo and dump.

The retired guy selling it says it was a tear down when he bought it in 1985 for 150. The realtor said: you won’t want this one it’s a tear down.

But the guy went for location and it paid off.

BTW: the piece had photos of interior. Looked comfortable, if you can live without vaulted ceilings.

Rent, health insurance (&care), education are all rising. These costs go up every year. No way are wages keeping up.

But I still see restaurants full of customers. The women working retail jobs all have their nails done.

I don’t get it. Maybe people are busy maxing out the credit cards.

you fail to see that a large part of the population is HUGELY profiting from these policies. In some EU countries many homeowners are (again) making more money from rising home prices than from their day job, plus they enjoy mortgage costs that are WAY lower than the cost of renting.

Of course this is just virtual money that you can only ‘loan’ but many of these speculators now assume that they will never pay it back, or at best with ‘funny money’ thanks to runaway inflation. And they may be right.

So although a part of society is crushed, another part is still benefiting hugely and those are the people you seen spending their ill-gotten gains.

Speaking of nails. It is extremely common to see little girls, as young as 3 or 4, getting their nails done with mom these days. This trend has been going on for a few years now. Nail painting parties are also popular for these young girls. Some people seem to have money to burn.

Josap

It’s all funded by equity withdrawal on rising house prices.

15 years ago 2000 dollars was a mortgage on smaller house. Today that’s the rent for one bedroom apartment!

We got some serious problems!

15 years ago $500 was a decent apartment rental in Ohio. Now its a new car payment.

But there’s no inflation.

There is no doubt that the ‘free money’ from the Fed is, once again, at the heart of the problem.

However, so is the tax code. There was a time that rentals were somewhat scarce. To encourage rental ownership, big tax breaks were devised to create a rental market for boomers, vets, and those who could not qualify for a loan. Every dime could be written off, and loss subtracted from ordinary income. The IRS forms were so simple. Come sell time, only a portion needed to be reclaimed as gains. Live in the property for “three years” (now there is a loop hole) and no gains but the residence sell rules applied. Trade it up, and no gain applies. Cash deposits were easily kept. Sweet.

Now where do renters get such a golden deal?

Over 60% of homes are owner occupied. So the wealth effect is felt by the majority. I’ve noticed reverse mortgages and equity withdrawals are now on the rise, and thus providing a way to monetize this wealth effect.

Mortgages are now getting easier to get and have lower down payments. All this indicates that the current rise in RE prices is getting long in the tooth. I’ve also noticed that rents in fly over country are topping out as well. So I’m selling half my rental homes.

The cost of owning or renting a residence can not be solely linked to the “wealth effect”.

I have lived more than 40 years in NJ in a small city 22 miles from Manhattan. This town is highly desired because of its excellent rail commute, schools and general location. Same primary residence. Own apartments for more than 30 years. I rent about 8% under the asking rents for similar apartment. Reason: I have no vacancies and no damaged apartments.

I just ran the numbers. The effective rent for my home is the same for my apartments: Both equal $27 per sq ft per year.

Also, the out-of-pocket cost components total the same – 30% of total effective rent (my house) or actual rent ( an apartment). Out-of-pocket costs mean the sum of: real estate and sewer taxes; insurance; property maintenance; and incidental repairs.

I have no debt. I did not include major capital costs which come about once every 30 years – roof; boiler; central air; household appliances.

As for actual apartment rent: $1,800 per month for 800 sq ft or $21,600 per year.

My house: I estimated the annual effective rent to be 4% of fair market value.

All real estate is semi-liquid: in good times, your place will sell quickly for top Dollar. In bad times, you need to reduce the price 20% to 25% off of the highs to sell the place.

What’s the point. The point is that the “wealth effect” has nothing to do with the cost to carry the property.

If fair market value drops by 50%, your taxes and other costs will not drop. Instead of being 30% of total rent, they will be 50%+. If you have debt, you will be squeezed and need the highest gross rent possible to leave something over after paying the mortgage.

Here, in 2009, single family home prices dropped 25% off of their 2007 highs. Rents for those properties dropped too, but not that much. Apartment building prices also slumped by 20%. But, rents – they didn’t drop much – say 10%.

I watched a guy die a slow financial death. He paid top Dollar for a very nice house in 2007 and lost his job on Wall Street in 2009. Got another job in another city but refused to sell his house and take a 20%+ loss. Rented the place for 4 years and finally threw in the towel and sold it in 2013 for a 15% capital loss. But, the carrying-costs + mortgage ate him alive. Plus the aggravation and worry of having a rental property far away from home.

Why would anyone think the Fed gives a rat’s ass about ordinary people? It’s a bankers’ club, designed to advance the interests of bankers.

“The proposal of any new law or regulation of commerce which comes from this order [dealers], ought always to be listened to with great precaution, and ought never to be adopted till after having been long and carefully examined, not only with the most scrupulous, but with the most suspicious attention. It comes from an order of men, whose interest is never exactly the same with that of the public, who have generally an interest to deceive and even to oppress the public, and who accordingly have, upon many occasions, both deceived and oppressed it”.

– Adam Smith, “The Wealth of Nations”

Sounds like Adam Smith was a tin-foil conspiracy nut-case, huh?

Well, was he right or not?

If he was right, then the concept of “conspiracy” is…..true….as many of us have been saying for decades.

The Federal Reserve Company is a conspiracy. Just read about it. Some of the original founders admitted to it years later.

This is why Smith and Wesson and Sturm Ruger are enjoying record high sales. You don’t have to be a CFA to realize if you are middle aged and need to save for your own retirement or are lucky enough to supposedly have a pension your are doomed.

Yellen has pinned interest rates to the floor and sent housing through the roof. Pension and Insurance companies can’t earn secure ROI so they must speculate in Third World securities or overvalued stocks. Same problem for the individual.

Perhaps intentionally, Yellen has not only reduced government’s borrowing costs but also its contingent liabilities as people, facing retirement with little savings or a busted pension fund , will have no choice but to blow their brains out.

I agree and anticipate a substantial increase in the suicide rate in years to come. In fact, if the planet is still around, I believe in 25 years it will be quite easy to arrange your own state-sponsored suicide, and it will have a nice euphemism like “Personal Euthanasia Planning”. There will be new firms created to assist you in your own state-sponsored suicide in your 80’s or 90’s when you are unable to support yourself, your indigent family members cannot support you, and since you are not “contributing” to society, the state will be quite happy to be rid of you.

Even if you are in your 50’s or 60’s but you did not save enough or got wiped out financially through no fault of your own, there will be a special exemption for “early euthanasia”. It will offered as a “compassionate” solution for those unfortunates who used to be members of the middle class.

I HOPE you’re kidding…

If it ever came to that, I think most people would do something a bit more creative than suicide……

We have rented here in Seattle through now THREE full-on bubbles. We are getting ready to crash again. Way too much inventory that’s over-priced now even compared to 1999-2000 or 2007-9.

Everyone has a MILLION dollar property.

My extended family got sucked into that fantasy. We had a beautiful view property in North Seattle that they couldn’t wait to sell out from under our family’s aging patriarch, so all the kids, who were already well-off, pick up another million a piece.

Didn’t happen after the 2008-9 collapse.

But everyone with a tiny house and a decent view in this town has a real estate agent who will tack a Million dollar price tag on it.

Lotto winning thinking pollutes the whole process here.

Amen to that. I live in Seattle too. We are going to have to move to Bremerton to afford something. I rented out here to get my kid through HS and that ends next year.

I have definitely noticed an increase in rents in the Bay Area since 2010, which is when I moved from Fresno back to Oakland. In Fresno I rented a 2 BR/2 BA house for $1100 and then I rented a 1 BR/1 BA apartment in Oakland (in a very nice walkable and hip neighborhood) for $1475. Fresno is not a great place to live (awful weather, terrible air quality with high rates of asthma, no culture, etc) but the housing is cheap. I check the rents/home prices there recently and they have come up a bit since 2010 but not are not back to their peak in 2007.

Meanwhile, Oakland’s rental prices have skyrocketed. My 1 BR/1 BA apartment was renting for $2800 last summer (now it rents for $2500). It’s a nice building in a great area. But it’s very hard to find a 1 BR apartment for less $2000, a 2 BR apt for less than $3000 and many homes in a decent area rent for at least $4000. At that point, you’re approaching the cost of a mortgage for those homes, so why not buy?

Because the homes are selling for $800,000 to $1.2 million in a decent area – not a great area, just decent where there is still crime. You can pay less to live in much less safe areas but not that much less. It’s not easy to come up with a 20% down payment on homes at that price unless you have a very high salary or have wealthy relatives. Also, about 25% of homes in the Bay Area are all cash sales and will sell with no contingencies or inspections. The amount of money coming out of Silicon Valley has made a lot of people very wealthy and they are almost completely price insensitive to the cost of housing, especially if it is near the subway or the tech buses.

Despite this, my hourly pay has hardly budged in the last 4 years because the official COLA has risen very little. (I’m a professional in health care and make about $120k a year). Fortunately, I can still save money because Oakland is rent stabilized (can only raise rents about 2-3% a year but new leases can go for market rate). However, it makes one feel a bit trapped to where they rent. And if you are paying market rent, I don’t know how you are able to save much money.

Housing prices have a long way to fall.