Every now and then we get a sign.

Money creation in China has gone bonkers. Authorities have opened the valves, and new credit is surging through money pipelines, including state-owned banks and the “shadow banking” system, and so loans in just the first two months this year soared by $1 trillion. Where did this money go?

We don’t know, but we’re getting indications that some of it is showing up right here in the US.

At the same time, “China is getting into the venture capital business in a big way. A really, really big way,” as Bloomberg put it: Government-backed venture funds raised about 1.5 trillion yuan ($231 billion) last year to bring the total to 2.2 trillion yuan. “That’s the biggest pot of money for startups in the world and almost five times the sum raised by other venture firms last year globally….”

While China is drowning in this sea of liquidity, its exports in February crashed 25% in dollar terms year over year. Part of it was due to the Chinese New Year effects. The rest was due to weakening global demand for Chinese goods: It was the 11th month of declines in 12 months.

Exports of goods are crashing, but hey, no problem, exports of money are booming. Capital flight takes on ever fancier dimensions: mansions in Southern California, tony condos in San Francisco, huge commercial and residential development projects, corporate acquisitions, and so on. Prices have surged for seven years and have reached ludicrous heights. So this is a good time to buy.

But this deal marks what everyone has been waiting for: a sign that the Chinese, in their desperate efforts to get these piles of money out of the country, have finally gone nuts.

They fell for WeWork – just when the “valuations” of startup companies are getting chopped in half as they raise new money, a time when this new money has in fact been harder to come by as investors suddenly ask uncomfortable questions about revenues, cash-burn, sustainability, or even survival [It Gets Ugly in the Startup Bust].

WeWork is essentially a real estate company. It leases large office spaces and then sublets smaller sections to whoever needs it – wayward workers of a large corporation, smaller companies, startups, or even individuals, and for whatever time periods – perhaps just a desk for a day.

And all these people get to work in the same cool communal space decked out with couches, snacks, and games. It started in 2010 in Manhattan and has grown to 80 of these coworking spaces in 23 cities mostly in the US with a few around the world. It’s not a bad idea, but it’s nothing fancy.

But WeWork timed the commercial real estate cycle just perfectly.

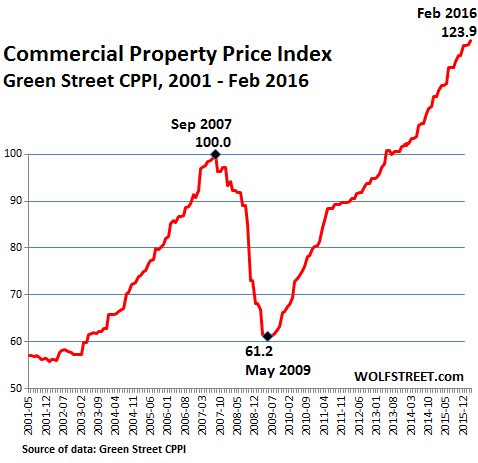

According to the Green Street Commercial Property Price Index, prices for office, retail, and apartment buildings jumped 10% in 2015, after having already jumped 10% in 2014. They’ve more than doubled from their cycle lows in May 2009. Even on an inflation-adjusted basis, prices have risen 12% above the peak of the prior bubble. But over the past few months, prices began stuttering, though they eked out another record in February:

These prices are in a symbiotic relationship with lease rates, which is WeWork’s business: it takes big ones and makes little ones out of them.

Now that the commercial real estate cycle is peaking, Chinese money got really excited about it in all kinds of ways, including WeWork.

Unnamed “WeWork executives” told the Wall Street Journal that the company was able to raise $430 million in a new round of funding led by Chinese investment companies Legend Holdings and Hony Capital Ltd. And the “valuation” these folks decided to attach to the company?

$16 billion.

That’s up 60% from $10 billion the day before, established during the last round of funding in June 2015. The new “valuation” puts the office sublet company in fourth position, along with Snapchat, on the US list of startups with the highest valuations, behind Uber, Airbnb, and Palantir. The company intends to burn some of this new moolah in Asia.

And it has set in motion a new hope in the deflating startup bubble in San Francisco, Silicon Valley, and other places in the US: that the desperate money fleeing China will somehow show up here and give startups more time to breathe and burn cash, while stamping them with totally silly “valuations.” This sort of thing happened before.

The moment when the “dumb money” arrives is also a sign of just how desperate the Chinese have become trying to siphon their liquidity out of China, apparently under the motto: the more, the better, no questions asked.

But even Chinese money might not be able to keep things from unwinding in San Francisco. Read… This Will Crush the Insane San Francisco & Silicon Valley Housing Bubble

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Dear Commenters:

The lower-case letter “I” is not showing in the comments for some reason – going back to the beginning of time.

I’m not sure what caused it. The I’s are still there; I can see them on my side. They just don’t show up.

Once we get this worked out, they should all show up again, back to the beginning of time, I hope.

If you have any Ideas what might cause this, please let me know.

Other sites using the comment software from WordPress (which this site is based on) are having the same problem with the lower-case “I.” So please bear with me.

I did a test post and it looks like the “presentation layer” is stripping the “eyes” out as it were.

This type of processing is not uncommon as folks might want to use tags or markers to bold text, link youtubes, and do other stuff. So, a “parser” goes through the whole thing, looking for patterns it knows about, and then does substitutions according to how it is programmed.

Along the same lines, you have profanity filters. Same idea, different goal.

Your parser only cares about “eyes” and seems to skip everything else.

They probably have some kid that got all excited with regular expressions, wrote some horrible thing that no one can decipher (including him after sleeping), and they haven’t managed to go back to the last version of it yet. In fact, just today at work I had some logic blow up because someone had an unusual (but legal) email address and totally choked my billing software when they tried to enter the customers email address. As soon as I have time to work on it, I will extract the regular expression, toss it in the bit bucket, and replace it with something readable and sensible and let the customer be smart enough to provide a working email address.

Bit of advice; don’t upgrade every chance you get. If it is a security thing, go for it at first shot, but otherwise wait a few days, a week, or approximate and you won’t feel these kinds of problems as other people will eat it and the fix will be in before you patch.

Technology is a tool. Tools solve problems. If you don’t have a problem to solve, you don’t need a new version of the tool. So, a week delay isn’t going to hurt one bit. That said, things tend to improve over time, so upgrades are generally good, but the increments are usually very small and unnoticeable and so not urgent.

But now we are back to commoditization of info tech and old KWaves …

Regards,

Cooter

Thanks, Cooter, for the explanations and suggestions. This sort of stuff drives me nuts. So I totally appreciate your support and comment!

They just issued a new update with a fix. So the i’s are back!!!

I really started missing them.

“Bit of advice; don’t upgrade every chance you get. If it is a security thing, go for it at first shot, but otherwise wait a few days, a week, or approximate and you won’t feel these kinds of problems as other people will eat it and the fix will be in before you patch.”

Once I get something running how I want it.

I dont update unless I absolutely have to.

Which was a driver in my divorce from Micro$oft.

I need to us a Micro$oft system, to run 1 Sw package.

I am experimenting with 10, does anybody know how to completely turn off Auto update in 10. So they do not attempt to download then demand to be allowed to update?

Admittedly I haven’t tried to hard to resolve that issue yet.

I refused to upgrade to 10 for now. I am quite happy with 7, they are still doing security support for it, I have all the apps/tools I need, so no reason to upgrade.

OS’s are what is known as “feature complete” and for the most part any new changes that are made are attempts to position for future revenue streams.

Just imagine how much money MS would NOT make if you could still run Office 98 or Office 2000 which, quite frankly, does everything most people need to do. Newer versions of Excel have some nice bits (e.g. PivotTables) but most office work is just plain vanilla.

The cloud is subscription based for a reason …

Regards,

Cooter

Fault may be in another place.

my system has never had the problem, displaying the character, no matter the browser used.

I think you might have missed the fun. It lasted only a few hours.

But I’m glad you weren’t impacted. It’s really not fun to read stuff without i’s. That seems to be a particularly important letter in the English language.

Just think … all those DOLLARS (not RMB) flowing (back) into the US would have remained here if our JOBS had not been exported to China in the first place.

China’s admission to the WTO + dollar carry have sped what should have been domestic investment overseas, making all Americans poorer (except for the bankers).

What the rest of us get out of the deal is a ‘I ♥️ TRUMP’ tee-shirt.

Good grief!

Do bad the sheep don’t understand what all that means!

Last year I said that I honestly didn’t think people could come up with many more things to whine about. They had whined and bitched about the communists being what was wrong with the world. Then on learning these communists in Red China could make stuff cheaper, the Red was deleted as if God himself had erased it. And now that China was just plain old China, these communists couldn’t make the junk fast enough to keep Walmart shelves full.

Then of course these bargain hunters whined about money leaving the US and going to China. “Hello! Answer the phone moron.” Now they’re whining about the money returning. It simply must be awful for those of you who had intended to buy one of these three million dollar mansions to learn that some guy from China had run the price up to four million. Ouch! That had to really hurt. I’m reasonably certain these free spending Canadians feel as if they’re having an out-of-body experience.

Now of course, we have Mr. Trump to whine about. That’s on cue since Trump is unarguably the true face of America. He has a big mouth, he’s arrogant, he assumes everyone else is beneath his station, he’s a liar and a back stabber. If he has one virtue, it’s the fact he isn’t trying to ride a dead Jew’s coattail into office like all the other candidates. They don’t come any sneaker and crooked than this Cruz, and the lady too ugly for a dress, named Clinton. Rebio can’t keep up with Trump, Cruz or Clinton simply because he’s dumber than dirt.

Yet, out of all these millions of whiners and bitchers on social media, the ones willing to go to jail, not to mention getting shot, to save this country from these crooks are scarcest than hen’s teeth. The crooks know that and so they do as they please. Do you know who taught these bankers, politicians and preachers to lie through their teeth? It was their parents. Even before a child can dress him or herself their mother, the one person they should be able to trust above all others, lied to them about a fat guy in a red suit who can circle the earth in one night in a sled pulled by reindeer that’s full of toys for the good little boys and girls. Christians celebrate the birth of their Savior with a lie about Santa and His resurrection with a lie about an egg hiding rabbit. Hell, it’s virtually impossible for one to be truthful when their entire existence is founded on nothing but lies. Well, we had to do something about calling mothers liars so we came up with ‘Little White Lie’. Let’s face it. Little black lie sounds worse that plain old lie.

Hmmmm, now I know that all greed and malfeasance is because of Santa and the Tooth Fairy…maybe a Sky Daddy tossed in there somewhere, too.

Human Nature seems pretty constant as far as I can see. Unfortunately, as the pie shrinks the worst of it comes out to play hell and games.

Don’t worry, though. Modern kids will think Christmas is just a WalMart sales gimmick, and church is for lame rock bands. Thanksgiving is for football and sales events. Up and comers will pine for those ‘Sandals Resort’ experiences and the realistic will proclaim, “Greed is good”, or Rumsfeld’s, “there are no “knowns.” There are things we know that we know. There are known unknowns. That is to say there are things that we now know we don’t know. But there are also unknown unknowns. There are things we do not know we don’t know.” Then, go and drone some wedding party. Hah!!

My 5 year old granddaughter is pretty magical. I’d hate to destroy it with ‘reality’.

Santa, the Tooth Fairy and Sky Daddy are like an unopened bottle of gin. It harms no one until so fool opens it. I think these modern kids will be just fine with the truth. To each his own, I much prefer my grandchildren understand that reality is knowing right from wrong and that lies are bad no matter who tells them. A hot stove will burn you…that’s reality.

i had this discussion with the wife about the guy in the red suit and i told here if our kids ask if Santa is real i’m going to say no.

they did and i did, and whenever they asked tough questions i first told them “this is a tough question and i’m going to tell you the truth in the hopes that when i ask you tough questions you do the same”

and as far as i know they have.

Great artIcle, so In short ChIna prInts lots of money, sad money get’s sIphoned out of the country, saId money washes up on US shores where every lame startup Idea In sIlIcon valley gets 10, 20, 50, 100 ml In fundIng. ThIs s madness!

Testing.

i. ii. iii. \i. \ii.

Regards,

Cooter

Looks like some of that money is finding its way into the Australian iron ore sector.

http://www.smh.com.au/business/mining-and-resources/fortescue-metals-group-defends-share-spike-20160308-gne413.html

But that’s the name of the game right now. I own a silly domain name I got as a gag once, and please don’t think I’m making it up: someone tracked me down and offered $2,000 for it.

It was so ridiculous I decided to play hardball just to see where this would go. This person negotiated with me for weeks over email, claiming their business partner had to be included and sign off on the cost.

My assumption was that if I claim that similar useless idle domain names are being sold for $50,000 nowadays, this clown would wise up and disappear.

Alas, no such luck. The negotiation is still going, currently my domain valuation is hovering in the $5,000 range. I’m utterly flabbergasted. This isn’t something cool and brandable like zoomooz.com or say, ghastly.net, mind you. It’s more like flipzflopz.com or Mydrivingrange.org… You know, silly stuff.

I’m wrecking my brain on how to safely capitalize on this insanity.

Selling a domain name is not without risks, for either side. It’s best to use an escrow service specialized in this (they charge for it). This way, you’re reasonably sure you get your money, and the other party is reasonably sure it gets the domain name.

If not, you need to get paid first before you transfer the domain name. But the other party may refuse (I would!).

Good luck with it.

Dumb money is hot-to-trot-money!

Case in point;

West Vancouver, Point Grey. Large lot with 92 year old 2 1/2 story Victorian style mansion in very poor shape.

Asking price $1,710,000.00 CAD

Within hours of the listing appearing, a bidding war broke out among the interested buyers. Half off-shore telephone bids through an agent!

Final selling price? $2,935,000.00 Over $1.2 million above asking!

Hot money, desperate to find a safe place to hide indeed!

Funny thing is that when I was in Vancouver as a political refugee during the Vietnam war I lived 3 blocks from that house — 3 blocks closer to the waterfront. Similar style house, only in great shape. Rent: $65 CAD per month.

that is f’ing insanity!!! that screams money laundering.

but what is the end game for all this? how is the native population going to survive on $12 an hour jobs and $2 million dollar houses?

Now you are getting there.

The chinese are going to buy up your bank, with worthless pieces of chinese paper, throw you out of your house, and make you work for 12C not 12 $ an hour, until you starve to death.

And western governments are standing buy, letting it happen.

Force CNY into IMF reserve basket.

Clandestinly print, thousands of trillions of CNY, use it to buy hard western assets.

Crash CNY, that everybody but china, is holding.

Chines invented paper money, and had the first Fiat, printing induced, hyperinflation events.

As far as Mainland china is concerned, the rest of the world is inferior to, and should be subservient to, them.

It is there, purely for, their(chinas) benefit. To consume, how, when, and as, china sees fit.

The Chinese seem to be getting really desperate lately.

The ongoing Communist Party Congress has floated the idea of turning non-performing loans into equities, which will then be held by those same banks.

As I said, an idea, but the People’s Bank of China has already been instructed to prepare drafts of the needed legislation for the Party to examine and do some back of the envelope calculation to see how much money we are talking about here.

Even without taking into account the shadow banking system, nobody has a clue how many NPL’s are held by Chinese banks.

Estimates vary between 8 and 20% of their bank assets: given the size of the Four Big Ones alone even the lowest estimate alone should give anyone pause.

China is drowning in liquidity… at the worst possible moment.

The housing market may have “stabilized” in third and fourth tier cities but it’s still white hot in second tier ones and has gone into overdrive in first tier cities, meaning Beijing, Shanghai, Guangzhou and Shenzhen.

That liquidity sloshing through the system is desperately trying to find an outlet as, differently from the West, the PBOC seems alien to the concept of excess reserves parked in its digital vaults, what has so far saved the West from feeling the full wrath of the tsunami of liquidity unleashed in 2008.

Food prices are already spiking, an extremely touchy subject in China after the disasters of the Great Leap Forward. This is not due to wholesale prices increasing: those have actually decreased 3-5% year on year. I am talking about retail, the food ordinary people buy.

This will be a good occasion to see how much the Party is still in control: the reply to the stock market crash in June 2015 was tepid by Chinese standards. I was actually surprised so few “speculators” were arrested and sentenced.

As food prices increase, the calls for the Party to restore order will multiply: if the Party does not do what is expected from it (arrest hundreds of “speculators” and send quite a few of them to the firing squad after an old fashioned show trial), it means they are losing control of the monster they created and have no idea what to do next.

If you think the problems created by central banksters are bad, just wait until you see their solutions.

All too clearly, the problem with ‘supply-side economics’ is that it ultimately destroys demand on which it depends. Their ‘solution’, of course, is to create even more supply, further destroying demand. That demand should be supported never occurs to them.

Collapse is coming. It is only a matter of time now. It’s going to be ugly, and then it’s going to be weird ugly.

It goes without saying that this can’t possibly end well. Indeed, its like stacking barrels of gasoline around a giant ticking time bomb. When this thing finally blows it’s going to make “The Great Recession” look like a quilting bee.

Something about these Ubers, Airbnb, Wework etc companies just doesn’t smell right. May I suggest Wefly, a virtual airline that simply buys up all available airline seats from say, New York to Los Angeles and then resells them to the public. Essentially it would charter every scheduled flight at wholesale rates and retail them to public. Worth billions I tell you and I only want $100 million for the idea!

Will you take CNY?

Regards,

Cooter

Speaking of Chinese Monies. The mayor of Chicago just yesterday announced a massive new expenditure to update it’s mass transit. Brand new train cars for the cities elevated tracks and subways. The new cars will be manufactured at a plant in Chicago that has not been built yet. The company winning the contract with the city? You guessed it. Chinese.

I’d like to see the contract and decide for myself if this is part of some grand leasing program devised by venture capital.

If you’ve ever ridden the BART from the SF airport to downtown you’d understand why Chicago had to look to China where there is at least a chance that they can build mass transit properly. Or the Canadians (Vancouver Sky Train).

Knowing how Chicago politics work I had to read “grand leasing program” three times before it stopped coming up “grand greasing program.”

Don’t you think there is something suspicious about the so-called ‘Chinese capital flight”? We have always been told communist China has a tiny, tiny elite, a very small middle-class, and over a billion poor working-class. The last two groups likely buy silver or gold to retain what little capital they are able to save over their lifetimes. They are not going to be speculating in foreign countries with their very modest savings.

Who is really buying up western assets and why????

Jill, the population of China is something like 1.3 Billion people. Some stats claim that the “middle class” is 300million. Just the upper 1% of that is still 3million people.

An estimate of three million investing outside China still seems small and how are they acquiring MILLIONS IN CASH, some at a young age?

This news item from four years ago first got me thinking about this issue and the likely falsehood of the stories we are being told: http://www.theglobeandmail.com/report-on-business/seed-capital-how-immigrants-are-reshaping-saskatchewans-farmland/article4610589/

The article describes a young Chinese engineer who emigrated to the province of Saskatchewan, Canada and was able to purchase a large farm for 1.5 million cash. Other foreign investors (supposedly rich Asians) have been scooping up the best prairie agriculture land for years now. Someone is buying these valuable assets but I’m not convinced it’s hoards of Chinese trying to protect their capital.

You think that’s crazy?

During 2015 Chinese speculators drove domain name prices sky high. Prices could double in a single week! Within a few months, 4-letter .COMs that had been selling at $15-$100 for a decade or more in the wholesale market got up to around $3000 apiece. 6-digit numerical .COMs that had never been registered at all until 2015 began selling for hundreds or thousands of dollars each. The more valuable categories, which retail in the high 6 or 7 figures, were gobbled up at a record pace.

Since December, prices in those areas have been declining steadily as part of a predictable boom/bust cycle. So Chinese speculators are now turning to new domain endings, hoping to recreate last year’s crazy rates of appreciation by starting little bubbles in dozens of less familiar extensions – .TOP, .WANG, .WIN, .XYZ, .SITE, .BIZ, .WS, .RED, even .PET. They’re now buying up pretty much all 4-letter and 6-digit combos in those (and other ) domain endings. As many as 140,000 new registrations per day sometimes in a single suffix.

And the joke is, they’re buying these domains at special discount rates of $0.49 or $0.88 apiece. Next year, when the domains are due for renewal, they’ll cost roughly 20 times that much. So everybody is hoping to flip for a profit in the next few months, tossing away the hot potatoes before the music stops.

Yet in my industry – the domain name industry – many people continue to predict future growth, as if this situation were somehow sustainable. As you’d expect, they’re usually sellers attempting to recruit more bidders and buyers. They talk about a new era in which domains are traded as “currency” in a Forex-like market. Each day more and more domain “money” is printed without limit, and they expect that all these new “bills” will increase in purchasing power!

A lot of money has flowed from China to the West. And most short domains have gone to China – not to be used, just to be hoarded and traded.

China is printing up trillions and is going out and buying up the world (at $500K over asking) with this worthless paper but some still think the USD is toilet paper.

the world doesn’t make sense to me any more