Those Sinking Banks

That the rest of the world didn’t follow Asia into another Friday stock-market abyss caused a worldwide sigh of relief. In many markets, short sellers got their heads handed to them, and no one felt sorry for them. But Asia descended into financial turmoil.

China’s markets were mercifully closed all week. But Hong Kong’s Hang Seng opened on Thursday with a 4% nosedive and ended the week down 5%. The Hang Seng China Enterprises Index, which tracks mainland Chinese companies traded in Hong Kong, plunged 4.9% on Thursday and another 2% on Friday. Down 50% from its peak, it’s back where it had been during the Financial Crisis.

Markets in Tokyo were closed on Thursday. But on Friday, the Nikkei plunged 4.8%, to 14,963, the lowest since October 2014. It’s back where it first had been in February 1986. It’s down 21% year-to-date. It’s down 28.6% from its recent high.

Thus it was inducted into a bear market, which we define loosely was a decline of 20% or worse from a more or less recent high.

It plunged 11% during the week, the worst weekly drop since October 2008. It plunged 17% during the past eight trading days, starting with February 2. That was the propitious day when the Bank of Japan’s negative-interest-rate magic curdled into a toxic mix.

On Friday, January 29, the BOJ had cut one of its deposit rates from positive 0.1% to negative 0.1%. Due to the three-tiered system, the rate cut won’t even impact anything for now as there are no deposits in that tier. It was a head fake.

The move was designed to bash the recalcitrant yen that was inching up against the dollar, and to inflate Japanese stocks that were teetering at the edge of a bear market. It worked for just two days! Then it all came unglued.

On Tuesday, February 2, stocks began to plunge, and the yen began to climb, eventually reaching 111 yen to the dollar, though it has since edged back to 112.6. Bank stocks got crushed. This has become the norm with NIRP: it hammers stocks, crushes bank stocks, and does unpredictable things to currencies.

But it inflates government bonds, and even the 10-year JGB yield fell into the pandemic negative-yield absurdity for the first time ever. Now the 10-year yield is back in the positive, a microscopic 0.08%.

After watching stock prices plunge for eight days, the frazzled BOJ dispatched its deputy governor Hiroshi Nakaso to New York to rationalize the BOJ’s action. Yesterday, he met with some investors and bankers and told them that the selloff in Japanese bank stocks was “overdone,” thus joining other voices around the globe that are desperately trying to talk up bank stocks.

Concerning the negative deposit rate, he said that it was “technically possible to go farther down in the negative.” But he added, perhaps ruing the day the BOJ went down this road, “My sense is that for now I would like to watch carefully how this new policy is going to work through the economy.”

It was part of the BOJ’s hearts-and-minds campaign. He and his colleagues were also talking with bankers in Japan, he said, “to seek their understanding that overcoming deflation is in everyone’s interest.”

So when Europe didn’t follow Japan on Friday, markets emitted an audible sigh of relief.

For once, the big banks didn’t get hammered. They’re trying to re-inflate confidence in them with methods that are eerily reminiscent of 2008. So Deutsche Bank came up with a new thingy: a plan to buy back its own bonds to show off its “strong liquidity position.” Its shares soared 12.5% to €15.40. Now they’re down only 51.6% from July 31, 2015.

Funny thing is, no one doubted that it had enough liquidity. Banks are awash in liquidity. What folks are worried about are potential losses buried on its balance sheet, more fines, penalties, and settlements for its misdeeds, and its derivative exposure, the second largest in the world.

They’re worried the bank doesn’t have enough regulatory capital to absorb these losses. It can only get this capital from earning a profit and issuing new shares or hybrid securities that count as capital, such as the infamous “CoCo” bonds which have collapsed.

But at least on Friday, Deutsche Bank’s joke worked. Folks needed some comic relief, on the principle that nothing goes to heck in a straight line.

And so, in Europe a terrible week became less terrible on Friday.

The London FTSE snuck out of bear market territory with a well-engineered one-hour surge at the very end. The 3% gain on Friday left the index down 19.9% from its recent high. Whew.

It still fell 2.4% for the week. Other major European markets weren’t so lucky. They’re hounded by NIRP.

Germany’s DAX rose 2.5% for day but ended the week down 3.4%. France’s CAC 40 rose 2.5% for the day but ended the week down 4.9%. Italy’s MIB rallied 4.7% on Friday but still dropped 4.3% for the week. Spain’s IBEX 35 rose 2.3% for the day and still plunged 6.8% for the week.

That’s how bad the prior four days had been. And they’re all stuck deeply in a bear market.

In the US, the rally was badly needed. On Thursday, the Dow hat closed at its lowest level since February 6, 2014, and the S&P 500 at its lowest level since April 11, 2014. The Nasdaq had closed within a hair of a bear market.

Something had to be done! And it worked: The Dow and the S&P 500 ended up about 2% on Friday, and the Nasdaq 1.7%. But it still left all three in the hole for the week.

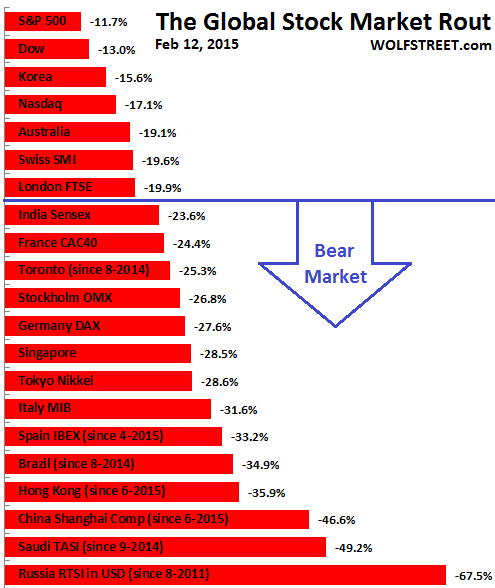

So our Bear Market Progress Report shows some, well, progress. A week ago, eight of the major markets we track were not in a bear market. This week, only seven are left. Three of them are within less than one percentage point of qualifying for a bear market. For the moment, the S&P 500 is the cleanest dirty shirt (-11.7%), followed by the Dow (-13.0%), the Korean KOSPI (-15.6%), and the Nasdaq (-17.1%). To find the Nikkei, which a week ago wasn’t even in a bear market, you have to dive much deeper:

Gold surged 7% during the week and 16% since the start of the year. A phenomenal climb for the beaten down metal. It paralleled the climb in US Treasuries with longer maturities. It pushed the 10-year yield down to 1.55% at one point. That combination speaks of fear. But on Friday, as fear subsided, gold and Treasuries fell.

And crude oil had its best trading day in seven years, with WTI up 10.7% on Friday as short sellers scrambled for dry land. But that huge bounce still left WTI at a gruesomely low $29.02 a barrel.

In the US alone, there are over $1.8 trillion of junk bonds outstanding. It’s the lifeblood of over-indebted corporate America. When the bonds at the bottom of the scale began to swoon over a year ago, with yields soaring and liquidity drying up, it was said to be “contained.” But now it’s not contained. Read… This is How Financial Chaos Begins

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The “lifeblood” of debt is flowing in the street gutters.

China was closed last week and Wall street will be closed Monday.

Come Tuesday morning, the “bloodletting” will continue.

All the main participants will be present.

With renewed vigor, as the search for safety ratchets up.

Why is New York closed monday?

Monday 2/15 is a Federal holiday – President’s Day.

The Nasdaq had closed

Within a hair of a bear

Dr. Seuss could not have said it better.

Uh, I think not……

A nasdaq may quack, as quack in a hat

‘but a hair on a bear needs a rack to be that

be it a short, nor long, to lay bare,

a bear to a short is a sweet heart attack

Touché!

I suppose it’s always better to laugh than to cry. And there will be lots to cry about soon enough.

The global market will go one step forward and two steps back until the Fed makes a move.

FED can’t make a move. Other than buying up sub-prime auto loans, delinquent credit card debt, 90-day past due home mortgages and other junk, there is nothing they can do. Negative 10% interest? go for it.

It’s great to see the US markets explode higher on Friday. I hope this trend continues in the short term. It just means higher out-of-the money puts will be cheaper and more money to be made when the downtrend resumes. And it will continue down to that magical support line of 181 on SPY. When it cracks then it’s timberrrrrr….look out below.

Considering what is transpiring in Syria with SA, UAE and Qutar now becoming physically fully involved along with all the present participants, full-on-war is only a whisker away.

The World Security Conference taking place now in Munich with almost 60 countries taking part, may be the last ditch chance of an accommodation.

Highly doubtful at this late stage.

When all else fails? The powers that should not be go to war.

Its good for business.

You are correct. “They” are doing all they can to keep the Dow over 16,000. Good luck. Short it.

“They” are doing all they can to keep oil above $30. Good luck. Short it.

We are at the beginning of a recession which only means the Dow and Oil are going down like my drunk girlfriend back at college…………..

They’re coming through our tunnel for the next egg. Cameron from the mainland and his mates from the states over here.

I am starting to wonder.

It’s been known for a while NIRP has the disagreeable tendency to erode bank’s main old fashioned source of profits: the spread between interest they have to pay to other banks (indicated by Euribor, Libor etc) or depositors long term and the interest that’s paid to them on short term loans.

The closer interest rates are to zero, the more reduced the spread. As rates are pushed into negative territory (such as less than six months Euribor has been in a while), yields get compressed to the point bank make profits on loans as thin as Amazon’s, but without the benefit of volume.

This has pushed banks into all sorts of risky assets, such as derivatives and junk bonds, and has accentuated their tendency to manipulate pricing through cartelization. This tendency has always existed but has jumped into overdrive ever since banks have desperately started looking for ways to make up for the lost profits resulting from spread compression.

What I wonder is how people can expect NIRP’s to help banks, especially at a time when regulatory capital requirements are increasing both due to new legislation kicking in and the need to cover for the increased risk banks will have take to make up for further lost profits from further spread compression.

As the last few months have shown, financial markets can go down even at times of central bank activism and in absence of “Lehman moments”. The losses people are eating right now even on “can only go up” investments such as AAPL may not be the stuff that can cause a major crisis, but are pretty heavy to digest. These losses will continue even after the inevitable stock market rally that will follow a Fed or PBOC announcement: fundamentals will continue hammering junk bonds and don’t bet on a lasting oil rally, at least not yet. Oil under $30/bbl will not last long, but can last an awful long time under $50, a level that was taken as “impossible” just two years ago and for which financial markets (and many producers) are not accustomed dealing with anymore.

Gutta cavat lapidem, as Latin-speakers used to say.

The FED will not stop this crash. Anyone betting they will is going to lose their shirt.

How do I know?

They didn’t stop any crash in history, that’s how I know. And no, this time is not different.

i just don’t understand how the government kicks the banks in the teeth and then expects them to smile, and gets upset when they don’t.

all the banks can do to place large amounts of funds is buy big packages of originated paper and hope the stuff floats.

didn’t that, ah, never mind.

The reason is, the robbery is an inside job. Insiders may even pretend to buy common stock but look deeper at the detail of the sweetheart deals they negotiate for themselves and magnitude of their own personal capital at risk which might be at token levels.

Big picture perspective, the criminal enterprise is thriving.

According to this article the global crude oil production peaked in 2005. The trillions of dollars invested in crude production since then has just managed to keep the production from falling. The increase in production of C+C has been an increase in condensate.

The storage tanks that are filled today and caused the oil price to crash are not filled with crude but with condensate since refineries make a lower profit on condensate compared to crude.

http://oilpro.com/post/22276/estimates-post-2005-us-opec-global-condensate-production-vs-actua

Thanks for the link, that was a very interesting read. If true, then we have much less heavier grades of fossil fuel than crude storage indicates. Counterbalancing that are increases in gas to fuel conversion efficiency and the build-up of had turbines etc. Condensate (propane etc) still are hydrocarbons.

A related point: i wish people would finally stop calling it ‘ natural’ gas. It’s fossil gas. In the article they even call fuel from gas condensate ‘ natural’ gasoline. Ridiculous!

Coal is tree fossil too, we should be switching back considering all our wealth has been stolen and we can no longer afford to heat our homes or drive our kids to the soccer match given out low pay and $10/bbl war-mongering tax?

The term ‘natural gas’ is indeed an anachronism, as you may well know. During the early decades of gas light, fuel gas was manufactured in municipal gas works, and pumped into the street piping networks. Producer gas was made by driving steam through a bed of burning coal – the product was a mixture of Carbon Monoxide and Hydrogen. It wasnt until the 1940s that pipelines connected natural gas from oil fields to the urban networks. Natural gas had a number of significant competitive advantages over producer gas, the main one being it is non-toxic, and the gas producing plants went away quickly.

There are new types and uses for ‘syn-gas’ however, so we arent really done with the distinction yet.

Zero Hedge posted a article related to oil on Friday. I never knew that tens of thousands of fake orders go through in HFT in a single day artificially propping up oil then wind up being cancelled a few day later by Wall Street firms as they realize it is almost all bogus. We can thank Congress for deregulating HFT in a emergency spending bill about 11 years ago to keep the Gov from shutting down in 11,000 pages of spending.

They very fact the central bankers have to resort to NIRP is basically them throwing in the towel by their own admission. It’s a worse “solution” than the already bad QE/NIRP problem which they created in the first place.

This insanity is on the levels of “destroying the village to save it”.

But hey those central bankers knows what they are doing with their little all knowing holier-than-thou central planning of the free market economy right?

…” the beaten down metal”…

…and the mogul Mark Cuban…””I think people are so confused about this market. Nobody really understands what’s happening, including me. So, things that I thought made sense didn’t make sense and weren’t working. … When traders don’t know what to do, they go where everybody is. And I thought that would be gold,” he said in the CNBC interview.

http://www.kitco.com/news/2016-02-11/Everyone-Loves-Gold-Including-Shark-Mark-Cuban.html

Another covert! A Shark no less. A thinking man.

Cheers.

The market is still not expecting a big crash just based on the VIX.

The Chinese government managed to find some good news. Retail sales were up 11.2% over the Lunar New Year holidays. Amazing that they could compile this data when most government offices were closed and it only confirms how quickly China is conforming to Xi Jinping’s plan to convert the Chinese economy from investment to consumer led spending.

Of course if Chinese consumers fear a major devaluation they might be eager to exchange their yuan for physical goods ( or precious metals)

Do you doubt the power of the Chinese statistics bureau?

If they could conjure 7% growth out of stagnation, double digit growth in retail sales is nothing for them.

Nope, totally nothing to do with this little concept called seasonality.

In other news at 11, water is wet.

Chinese are leaving cities and returning to the countryside due to lack of opportunity, as per the always accurate and trustworthy reporters in western media. Assuming the obvious demise of global shipping drags with it airfreight into the round file as well, these stories might actually be truthful for once.