The long-term effects will echo for a decade or more.

By Larry Kummer, Editor of the Fabius Maximus website

Oil prices fell by over half from June 2014 to January 2015 (Brent: $110 to $50), then another one-third since (to $35). Natural gas and coal prices have also plunged, partially due to the same forces but also from substitution.

These are the results from a modest slowing of demand growth and — more importantly — the decision of the Saudi Princes to wage the first financial war against next-gen oil producers, those that tap oil sands, shale fields, and deep ocean deposits.

This is how Bloomberg put it:

Saudi Arabia won’t be satisfied with another temporary rebound in oil prices, such as the one that occurred last spring: Their U.S. competitors would just increase output again. They must inflict permanent damage by demonstrating to investors that with shale, they can’t bet on any kind of predictable return.

This will not end quickly; the list of casualties will be long. Goldman found $1 trillion in “stranded” or “zombie” investments in oil fields — a year ago at $70 oil. At $35 oil the total would be much larger.

The end will come with the bankruptcy or restructuring of many next-gen oil corporations, followed by a newly empowered (and perhaps expanded) OPEC cutting production to bring spare capacity back to average (3 or 4 million b/day) — providing a valuable production cushion for the world economy’s supply of this vital input. The long-term effects will echo for a decade or more: a higher cost of capital for and depressed risk-taking in the petroleum and coal industries.

The bond market has already begun to price in the coming bankruptcies of oil and natural gas Exploration and Production companies. But the geopolitical implications remain largely unexplored.

The global effects

As a first cut, the aggregate global gains and losses from lower energy prices sum to zero. The full effect depends on the balance between the small gains in the majority of regions that import energy — and the potentially catastrophic effect on those that produce it.

This short period of lower prices provides an opportunity for energy importers (including the US) to prepare for the higher prices to come. Foolish nations sell into low prices, such as America’s sales from strategic oil reserve at generational low prices (as Clinton did in 1997). Smart nations increase their energy efficiency and, even more importantly, cut energy subsidies (listed in the New York Times and Financial Times).

Malaysia led the way with reforms whose effects will continue long after oil prices recover. The IMF:

After raising electricity tariffs in early 2014, [the Malaysian government] took advantage of lower energy prices in the second half of 2014 to reduce and ultimately remove remaining gasoline and diesel subsidies. … [Subsidy reform should] help broaden the base of [the] federal revenue system and diversify it away from volatile oil and gas revenues. …The removal of subsidies freed up resources that can be redirected to better support poorer households through better targeted cash transfers.

As for the energy exporting nations, some are far better able to withstand low oil prices than others. But the effects have already begun to appear in their currencies and GDP.

Most exporters began this down cycle with lower debt levels than during the oil shocks of the late 1980s and 1990s. Those with rainy day funds (e.g., Alaska, Saudi Arabia, Norway) are running them down, making their futures look less secure. Those without them cut spending, often throwing their economies into recession. Many of these nations have weak political structures unable to take the resulting stress.

The weakest are already suffering.

Venezuela is breaking. Brazil is on the rocks, Russia grows weaker. Each month of lower prices adds to the casualty list, with effects that eventually will shake the world.

The IMF estimated the 2015 breakeven oil prices for these nations’ government budgets and current account balances. For example, here are numbers for some nations that continued low oil prices will put in the headlines (breakeven oil prices for budgets and current accounts).

- Algeria: $119, $86.

- Iran: $43, $107.

- Iraq: $75, $68.

- Libya: $103, $125.

- Saudi Arabia: $59, $87.

- Caucasus and Central Asia: $66, $76 (Azerbaijan, Kazakhstan, Turkmenistan)

These nations suffer conditions that the IMF often describes as needing “bold structural reform.” In fact they need higher oil prices — or a miracle.

The commodity bear market is more than oil

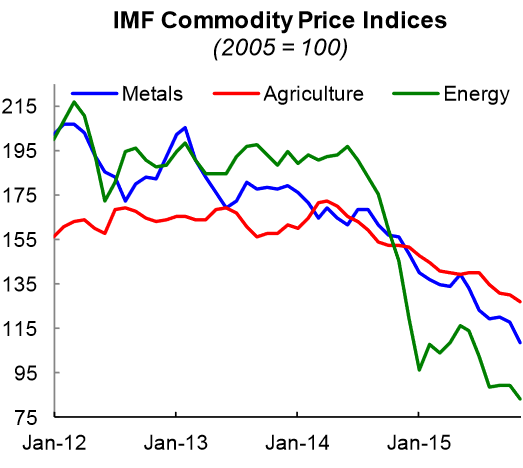

We’re in a global bear market in commodities, with some unpleasant side effects for the US: customers for US exports are getting hit. Coal is down 45% since 2003; food prices are down one-quarter (priced in US dollars). Copper and zinc prices are at six-year lows; nickel is at a twelve-year low.

This could easily ignite global debt deflation – a bad thing in our high-debt world.

Adding to the woes of commodity exporters, the Fed has begun hiking rates — boosting the US dollar, causing a variety of problems for these nations. And the world economy appears to be slowing, with the possibility for China to lead it into a recession. By Larry Kummer, Editor of the Fabius Maximus website.

Low oil prices are the wreckage from a war – a financial war. Read… Financial War over Oil Reshapes World, Will End with Much Higher Prices

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The USD just getting stronger. Will not end nicely. Appetite for conflict seems to be growing.

For individuals that don’t live a “commercial lifestyle” – i.e., those that work hard, educate themselves, save, and don’t waste their cash on the detritus of American culture – life has never been better.

100% correct.

Cheers.

Jim you sound somewhat arrogant because things are going well for you? Most people are a job loss or illness away from disaster.

There are good and bad things happening but most individuals, companies and countries have far too much debt and the day of reckoning will come. We all will be affected in some way.

No kidding. I’m living on easy street. Want to buy something? Pay cash. Living debt free; Life is beautiful. Another side effect of this energy revolution, renewables continue to advance, regardless of oil price. And if there is war? …well, it’s what America does best. ;)

Agreed!…..read a book instead of shopping at the mall…..make a healthy meal instead of charging more debt on fast-food……do some outdoor physical activities with your kids instead of racking up even MORE debt visiting Disney World!

…..etc….

For the U.S the dollar is a fiat currency, but for emerging markets unable to print dollars with $9 Trillion in debt, the dollar is almost like gold.

A U.S government bail-out of the oil companies can always be financed through the Feds printing press, but for oil companies in emerging markets it’s a different story.

You see, there are three major problems with the Saudi strategy.

The first is US fracking concerns are proving to be remarkably resilient. They are all bleeding, some are hurting badly, but they are not dropping dead by the score. Unless Saudi Arabia is into this for the long haul, their plan will fall. Sure, there can be a “tipping point” for fracking outfits, but it will be the interests they pay on their debt, not the price of oil.

Lenders are presently reassessing known oil reserves at, I think, around $50/bbl, down a third from last year $75/bbl. This will make further leveraging by fracking outfits considerably more expensive, and for CCC-rated interests are already 17%, a monstrosity in our present climate.

If the Saudi are really determined going all the way, bankrupting the bottom of junk-rated companies won’t do. They need at least a few big name casualties in the war, and hope there won’t be an oil patch bailout.

The second is Russia. Russia may be hurting as much as we want, but the fact stands it’s the only country in the world with enough output to challenge Saudi Arabia. And she has been pumping like mad, exactly like Gulf Oil Kingdoms.

There has been a lot of speculation about Russia’s decision to join the war. Jousting for market quotas in the Far East may be one, but I feel the Kremlin’s decision was dictated by carefully weighing numerous factors: reading the Russian mind has long been a challenge.

I feel the Saudi, for all their faults, have long come to accept Russia as something that won’t go away. There have been high level meetings between Saudi and Russian oil officials, with very little emerging. It’s possible, just possible, the two countries were just caught in the commodity slump (which is hitting Russia not just in the oil patch) and at that point decided to take the occasion for an alliance of convenience against “upstart producers”.

The third is Saudi Arabia herself. Under the surface of order imposed by the Mutaween and the Mukhabarat through sword, gaol and whip, the country is in deep turmoil at all levels.

The ruling family has grown to quite enormous proportions and, with ibn-Saud’s children out of the picture, succession could become messy. Simply nominating a heir apparent won’t be enough for many royal princes, who think their blood claims are just as good and who can muster support among the National Guard, the Army and the Mutaween themselves. They will have to either be appeased or eliminated. Both can cause resentment among the other hundreds of members of the royal family and the powerful clans related to them.

More critically, the country, very much like many Muslim ones, is primed for social unrest that will make the Arab Spring look like a stroll through the park.

The world has gone back to sleep after that short spell, thinking the problem has been eliminated. All eyes are on bloodthirsty extremists in Syria and Iraq.

But the underlying problems which caused the Arab Spring are not just still there: they’ve become worse.

The Morsi Junta in Egypt is not behaving more truculently than Mubarak just because the former Mukhabarat chief is a bloodthirsty fanatic. They are facing a much more heated political and social environment than Mubarak ever faced.

The faqih in Iran are scrambling their brains on how to maintain their hold on power. Ali Khamenei is a shrewd and ruthless politician, but he is not Khomeini. Being a highly intelligent man, he knows a young country ruled over by old men is a powder keg waiting to blow but he’s also absolutely committed to the velayat-e faqih, the principle laid down by Khomeini and his closest allies, according to whom Islamic jureconsults (faqih) have not just a right but an obligation to hold Iran in a regency (velayat) while awaiting the return of the Twelth Imam.

In short an eventual Saudi victory in the Oil Wars (which have shaped up to be quite different from what we expected) may prove a short-lived an Pyrrhic affair.

Well, I’m an expat living in Egypt. The Morsi regime may be abrasive and reactionary, but they are focused on the goal of stability at all cost. To this end, world bank and IMF loans have been released in recent months, massive natural gas reserves are being exploited by international oil companies, the domestic consumer market continues to expand..and inflation is tempered. Unemployment is still high, and the threat of terrorism has scared off international tourists. Yet, massive infrastructure spending is proceeding.

Similarly, the threat of massive unrest (or revolution) in Saudi is grossly exaggerated. The common people in these countries may be disgruntled, but they see the chaos in Libya and Syria, and want nothing to do with it. Saner heads may prevail yet. If it’s a glass half full/half empty proposition, I’d go with half full…or at the very least, one step forward, two steps back.

News, blogs, and so on always try to craft narratives around various subjects. Perhaps useful, perhaps not. I recall being introduced to this idea in Jessie Livermore’s autobiography as it was one of many tools used to manipulate markets/stocks. The truth is that sometimes price/data doesn’t have a simple, easy to write narrative as to “why”.

Oil is a global commodity of utmost importance. There billions of dollars out there looking for every arbitrage opportunity imaginable. This story is unimaginably complex.

Oil prices go in cycles because high prices encourage exploration and production and low prices take high cost producers from the market.

The narrative you presented falls completely apart when one realizes that perhaps if SA cut 1M barrels a day that price might not move (10% of their output). 2M barrels a day might put a floor under price a bit, but they are down 20% of their production.

The oil story is all about demand falling out underneath the expansion in supply that was long encouraged by high prices.

Demand is absolutely a key ingredient and few, few people take any note of it and carry on about all the curious political ins/outs of how much any individual country might produce and why. And supply cuts. And cartels. And so on.

Don’t take it personal, I don’t mean it that way. Literally every website and blow I follow has the same “supply side” focus. I am hungry for demand side analysis of the situation. Maybe I am wrong!

So, to wrap up, let us consider a question.

What happens if the global economy implodes and oil demand starts trending down for a number of years. The BP Statistical Review of World Energy 2015 showed oil production for the whole world in 2014 was UP 2.3% vs 2013 (88,673 M barrels per day). For the same time period, consumption was UP 0.8% (92,086 M barrels per day).

https://www.bp.com/content/dam/bp/pdf/energy-economics/statistical-review-2015/bp-statistical-review-of-world-energy-2015-full-report.pdf

(data from pages 10, 11, 12)

If you look closer, you will very quickly discover that much of that growth can from ASIA. Almost all major geographic segments are flat. European demand actually declined since 1989. Also of note, look at the huge ramp in US production – that is the fracking boom – enabled by cheap credit (i.e. malinvestment).

Has anyone looked at the oil picture if Asia hits the skids and starts back tracking their massive appetite for oil?

Wouldn’t all agree China is staring at a massively deflationary mess?

Wouldn’t all agree that China MASSIVELY invested in overcapacity of every kind, consuming ever increasing amounts of oil, building cities no one lives in, roads no one drives on, manufacturing capacity no one needs … all with record credit growth and speculation?

Surely there couldn’t be a DEMAND shock in that toxic mix, just waiting to paint the tape.

Don’t forget, the data I posted was for 2014 and compiled in 2015. How were things looking in 2014 versus present?

So, coming full circle, these narratives about one producer (even if they are large) leading a bull around by the horns is, well, bulls**t. If Russia and SA had meetings, it was to agree to cut production together to shore up prices. I think we are seeing the result of that conversation.

And I disagree with the direction of SA. They are in trouble. But I am less well versed to express my opinion and a bit long winded already. Perhaps another time. :-)

Regards,

Cooter

It seems you are one of the very few who gets it.

Demand, nothing else matters in the long run, except death.

And that is the one thing that every lying gargoyle called an economist, statistician politician and every MSM crackpot swivel eyed nutjub screeching in hysterics on CNBC and Bloomberg will never ever acknowledge.

If you dissect the sheer aggregate improbabilities inherent in official statistics and chart the desperate growth of the divergence from the real world, then I can only come to a conclusion that no only is the world economy in deep recession, it has been that way since mid 20113 from which point it started accelerating with the usual suspects leading the chase, Japan, Insanity and dementia in the old age colony coming home to roost, from Europe, endemic corruption fraud and the most ridiculous ponzi scam ever invented to whit the euro coupon or voucher instead of real currencies, and the US where the sheer graft, stupidity, waste and an utterly incompetent Whitehouse governed by nothing short of collusion’s, corruptions, theft fraud and pea brained insanity from the fraudulent president down, is now having its effects in the most mismanaged and corrupt DM’s and third world economies, ie Brazil Argentina SA and the rest.

The bad news for me is that nothing whatsoever can now stop the rot. It is too deep, too entrenched and there is not a single actor on the stage anywhere who can deliver anything even remotely intelligible.

One thing I learned in life is that if you need to steer a ship you need a captain up to the job.

All i see are third rate deckhands with one leg and eye patches with hands out from a lifetime of begging and with IQ’s that would make an Ethiopian mother weep if was her son. And have it put down.

Do you see any captains on the horizon ?

I’m with Cooter and Gil on this. The oil equation is all about the demand coefficient, which simply isn’t there. And it’s beginning to look like the largest demand — from China’s seemingly endless growth spurt — was part and parcel of the same deluded hyperbole which has been driving the U.S. stock market. Whatever you do don’t look down.

Ooops, you looked.

While the geopolitical factors (which MC highlighted) playing out in the ME cannot be ignored, there seems to be enough elasticity and diversity within the global oil supply to reasonably mitigate any sudden shocks due to either a demand spike or supply curtailment. This isn’t 1973; OPEC does not have anywhere near the juice it once had. Yes, pun intended.

All of these fools predicting an oil rally and return to triple-digit prices — hell, even $60/bbl — are either delusional or duplicitous.

And no, I do not see an captains on the horizon. Not from either team. Just more variants of the same.

As for Team Obama, we ever elected a President. We elected a symbol. Should we be surprised then after seven years of symbolism instead of leadership?

It’s always tee time somewhere.

Let’s not succumb to the blame game, set up a scapegoat, knock off its head and declare mission accomplished. That is simply a refusal to accept personal responsibility for our own part in this greed fueled mess. What we need is leadership from an informed and ethical citizenry.. Not more sociopathic bankster puppets.

Re: resilient- this whole thing is one year and one month old. It was November 2104, almost year end when Saudi announced it wasn’t cutting production. Even a train wreck takes time.

Lines of credit, based on value of reserves are done annually. Hedges for the most part are done annually.

2015 was the year the above ran out. 2016 is when we see the result.

Not only is it common knowledge that virtually the entire industry is teetering on bankruptcy, it’s published in real time data. You can buy frackers bonds anywhere from 20 -60 cents on the dollar.

In normal times a small fish or a weak large fish is gobbled up for its assets- this time there aren’t any. The stuff in the ground is not economic to extract at these prices. These assets on which 500 billion has been lent, are stranded, probably for a decade.

This isn’t China, where a steel mill will run at a loss forever. Legacy stripper oil wells can chug along with a few owners doing the work. Fracking is an ongoing process requiring equipment, skilled employees with all their costs, and regulations.

The frackers have been lent 500 billion. No doubt some bankers have extended or increased loans hoping for a floor at 60- 50-40- 35??

There are going to be quite a few banking careers ending in 2016 maybe even a few banks. ( As happened in the 80’s crash)

And we haven’t even got to natural gas, which makes the oil story seem almost rosy.

Good analysis. In fact it may very well be that the largest victim of the oil wars will be the Saudies themselves.

Oil prices has crashed yes, but the common man aren’t feeling any benefits besides laughably small savings in filing up the gas tank and other necessities is still expensive as ever.

Yet when oil prices spikes the entire oil industry has no qualms passing the full impact of sticker shock to the same people every single time.

All I can say is: Justice is at its finest when it’s poetic.

Forget oil. How about natural gas?

The benchmark for Europe is down 42% year on year but the local (de-facto) monopolist utility company just jacked up heating gas prices, and considerably so.

The answer? They are attempting goosing profits that tiny bit because one of their major shareholder (a municipality) “needs” to sell part of its stake in it to finance… drumroll… a stadium!

The commodity slump coupled with the deflationary wind blowing from China has been a Godsend for corporations large and small: avoiding to pass on savings to customers will save corporate profits. Or at least it will until those unsold stocks building up will need to be cleared.

Why yes it is. I’m not sure why we should care whether the cost of oil will continue to decrease? When the prices were sky high, and a time or two I had to call in sick because I simply didn’t have the cash for gas, to go make money??? Did American oil producers care about regular Americans like me? No they didn’t. Let Them Fail, so they can feel what it’s like for the rest of us. Then and if they rebuild, they can dial that greed back and act civilized, like the rest of us. Until then, I have no cause for concern…

Jonathan,

Well said…..Not to mention most of the spikes are based on speculation rather than actual supply and demand.

The US will get hammered in 2016. Too much debt. You can’t spend your way out of debt. The dollar is very strong so less people will vist the US and by american products. Many more jobs will be lost and more unemployment benefits will be paid out. The War to Create More Terror will continue to suck cash out of the US. I could go on but I won’t.

The forecast calls for pain.

Merry Christmas for Australia.

Our NG prices will be going up by 7.5% o 1 February 2016.

Welcome to Australia: land of the continual consumer ripoff.

I believe that the Fed’s ZIRP policy kick-started the fracking revolution a generation too soon. Planet Earth does not have an infinite supply of oil and nat gas to extract, although it seems as such right now. The seven plus billion humans alive, on average, use about two litres of oil each and every day, but how long can this continue?

Oh well, I’m off to the gas station to fuel up my V-8 sports coupe at $2.00 a gallon for high-test juice! Maybe a Tesla is in the cards for me someday, but thanks to the Saudis, a full tank costs half as much as it did a couple years ago. Enjoy it while you can!

I’m not sure it is a “glut” problem as much as it is a demand problem.

I believe per capita demand is down yoy.

Demand will not be restored to previous per capita figures because the worldwide debt problem has overwhelmed economies. A deflationary spiral is what you get.

I forsee a drop in prices to the point where the crude remains in the ground. There will be little demand and no drilling because of low prices. The Red Queen will disappear over the horizon.

In other words TEOTWAWKI…

Please stop this mantra of the Saudis are trying to put shale out of business – because that is pure BS!

They are pumping like mad – as is everyone else – because demand is not there — so we have a glut…

And these producers have operational costs – debt — and in the case of the Saudis they have to fork out hundreds of billions of dollars to keep their citizens from tearing their heads off.

Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

So very obviously if you have fixed costs — and the price of oil falls by more than half — what do you do?

Duh – you pump like hell — you haul as much oil out of the ground as possible

Get your story straight.

read: The Prize: The Epic Quest for Oil, Money & Power

or if you prefer:

watch:

http://www.amazon.com/The-Prize-Quest-Money-Power/dp/B00CMDPTA4/ref=pd_bxgy_14_img_3?ie=UTF8&refRID=145SH1JHND0MP5BTJMM9