The goods-based economy swoons.

The transportation sector just keeps getting worse. Even after today’s uptick, the Dow Jones Transportation Average is back where it was in April 2014, and down 18% from its peak a year ago. Within this transportation sector is freight, a gauge of the goods-based economy, which is having a rough time.

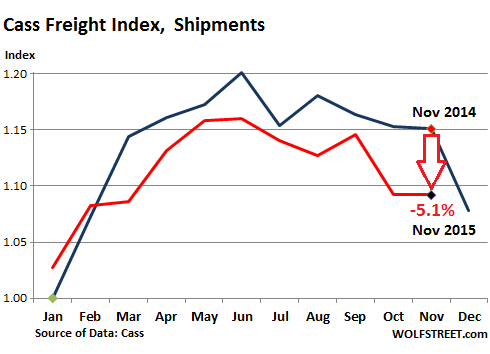

In November, the number of freight shipments in North America plunged 5.1% from a year ago, according to the Cass Freight Index. It hit the worst level for any November since 2011.

The index is based on $28 billion in freight transactions processed by Cass on behalf of its client base of “hundreds of large shippers,” Cass explains. It covers shipments, regardless of the mode of transportation, including shipments by truck and rail. It does not cover bulk commodities. Shippers include companies in consumer packaged goods, food, automotive, chemical, OEM, heavy equipment, and retail.

This index of shipment volume has been lower year-over-year every month, with the exception of January and February, which makes for an increasingly awful looking year:

Reasons for these lousy shipment volumes are spread throughout the economy, including a litany of big retailers that have come forward with crummy results and disappointing projections.

Yesterday it was Dallas-based Neiman Marcus, which caters to luxury shoppers. It reported its first quarterly sales decline since 2009, down 1.8% from a year ago, with same-store sales down 5.6%. It booked a loss and laid off 500 people. As so many times, there’s a private-equity angle to it: Subject of an LBO in 2005, it’s now owned by Ares Capital and the Canadian Pension Plan Investment Board. They were hoping to make a bundle via an IPO. But now the IPO has been put on hold.

CEO Karen Katz blamed the oil and gas fiasco. Its customers in Texas run and own companies in the depressed energy sector, or they receive royalty checks. Alas… “Business conditions were quite challenging,” Katz said. She also blamed the “strong dollar” that prevented foreign tourists from splurging at its stores in the gateway cities Honolulu, San Francisco, Las Vegas, New York, Washington, and Miami.

This follows the disastrous results at Men’s Wearhouse, which blamed its misbegotten foray into M&A. At the company it acquired, Jos. A Banks, same-store sales plunged 14.6%.

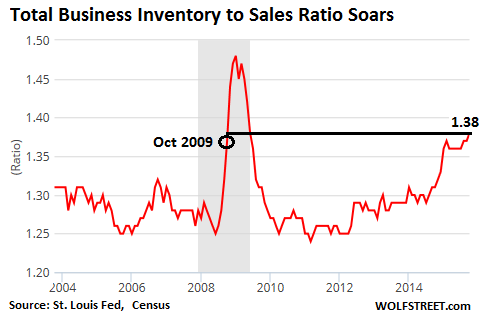

Retailers are lamenting their high inventories. But not just retailers. Total business inventories across the country have piled up to suffocating levels. Given lackluster sales, the crucial inventory-to-sales ratio, which measures inventory turnover, has reached 1.38, worse than it had been in October 2009 during the Financial Crisis:

And Cass issued a warning about this inventory glut:

The Federal Reserve has held back from raising interest rates, but is expected to announce higher rates in December. This will negatively affect those companies holding record high inventories, as carrying costs will begin to rise more rapidly.

So companies are trying to whittle down their inventories, and since it’s not happening via booming sales, they’re cutting orders. Shipment volume follows. And the Cass index for shipments, including rail and trucking, has been taking a drubbing in November – particularly among railroads. Cass:

The Association of American Railroads reported a drop of 7.4% and 6.0% in carloads carried and intermodal [containers], respectively.

The drop in intermodal reflects the high inventory levels faced by retailers and wholesalers and is more reflective of the goods included in the Cass Freight Shipments Index.

Much of the carload loss is due to drops in bulk commodities such as coal, petroleum products and metallic ores—products not as well represented in the Cass data.

Cass summarized the situation in the economy as it impacts transportation this way:

Imports have slowed down considerably as retailers and wholesalers have ample supply for the holiday season. The November Institute for Supply Management’s Purchasing Manager’s Index (PMI) declined almost 3%, while production was down 7%, new orders off 7.6%, and order backlog increasing 1.2%. For the first time since August 2012, the PMI Production Index has dropped to a level indicating that it is contracting.

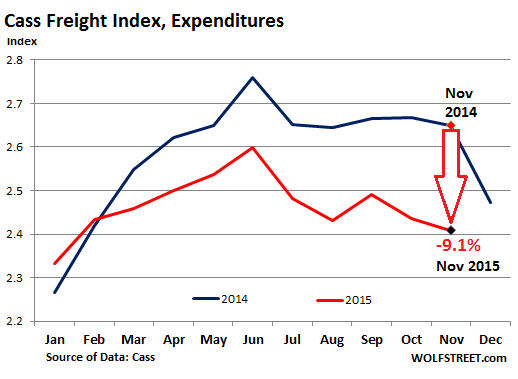

And so the index for freight expenditures, which tracks the money spent on shipping products, plunged 9.1% in November from a year ago, on a combination of lower volumes and lower shipping rates. Except for January and February, the index has been lower year-over-year every month.

And December is going to be even worse: “Expect freight to erode in December following established seasonal trends,” Cass said to soothe our frayed nerves.

Retailers of all kinds in once booming Texas, not just luxury-focused Neiman Marcus, are getting hit as Oil Bust Contagion spreads into the broader economy. Read… Retail Sales in Texas Plunge

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As anecdotal evidence of the retail inventory build, on a recent trip to the local area WalMart super store (serving approx. +400,000 pop.) the store is over flowing with stock.

The shelves, racks, stands and cases are full, with shipping boxes piled up yet to be opened. When commenting on the piles of boxes, I was told “there’s no room in the back”. By the way, it was weekday at about 10:00 AM and the large parking lot was about 2/3 empty.

Great boots-on-the-ground observation. Thanks for sharing it.

I wonder if the quality of Chinese made goods is going up and thus the replacement interval is longer. Many may not feel the need to replace their Walmart stuff as often.

So… it turns out the inventory buildup we saw earlier this higher (as highlighted by graph #2) was not the result of wholesalers and retailers taking advantage of the deflationary wind blowing from China to stock up on the cheap in view of the shopping season, but something far more complex at best and far more ominous at worst.

Even more interesting is the CFI appears to have broken down in February, just when those Made in China goods were supposed to start arriving (and hence requiring lorries and freight trains to be shipped) and took an unexpected plunge in August. Then it did what oil has been attempting doing for over a year: a rally, which was about as long lasting as those on oil markets.

Now: outside of food (which would warrant a separate treatment) and utilities (pity us!), the deflationary wind blowing from China has really started to pick up momentum. It may not turn into a full force gale but it will make itself felt on corporate profits, not in this year but in 2016.

Some indicators I’ve seen of this year are telling:

1) For the first time ever, fashion house Louis Vuitton has authorized its stores to offer discounts.

2) Japanese industrial tools giant Hitachi Koki has been running back-to-back “promotional offers” all year long on pretty much every single tool they offer, with individual very large dealers authorized to offer further discounts.

3) German power equipment manufacturer Stihl has been dropping prices on its top of the line forestry equipment and running back-to-back promotions on low end of spectrum ones.

4) Many previously unobtainable Swiss watches are now available for immediate delivery: a “40% drop in orders from Asia” is being blamed.

5) The local big box store started a promotional sale on toys and Christmas decorations this past Sunday, when prices are usually hiked.

A magnificent glut in supply, built around the certainty of eternal 2005-2006 sales growth is surely to blame, but it doesn’t tell all the story. This is a classic example of Hemingway’s “going broke slowly, then suddenly”: inventories started to build up, slowly and almost unnoticeably, in 2012 and accelerated dramatically in 2015, when the continuous increase in supply coincided with what can only be described as consumers finally becoming maxed out.

Right now they are only buying cars on credit, and given the absolutely crazy numbers media breathlessly report I suspect we are dealing with another case of “Chinese Growth”. I am not saying somebody is cheating, but a bit of (most likely legal) creative accounting is probably involved.

How long this conjunction will last? Extremely hard to tell since it would require not one but two things: soaring real wages (closely tied with another massive round of household deleveraging) and reduced supply. The chances of both happening are slim to say the least. 2008 was a great occasion to reduce supply but very few bit.

Recently a Rosfnet official quipped “Perhaps the world won’t need as much oil as we think it will”. Is this the end of cheap money-fueled extreme consumerism? One can only hope, but only time will tell.

ya know, dow theory and oil gyrating has always led to something going wrong sooner or later.

dang, sell in may and go away was right.

I’m foregoing shopping as much as possible……..making gifts; a framed earring & bauble holder for Mrs Polecat……and a stoneware japanese style tea set for my daughter……no cheap plastic throw-a-ways for this household!

The best gifts are consumables, such as wine, coffee, chocolates. If you don’t consume them, you can redistribute to friends and co-workers.

The best gifts to receive are those you would not typically spend money on: those overpriced peppermint piglets at Peet’s Coffee that come in a tin.

It’s the thought that counts!

We’re buying high quality epicurean organic food as gifts this year.

No sales tax in California.

Paying cash for everything.

Don’t forget thrift stores, I bought two magnificent Bean wool shirts yesterday for $3 each.

I am a car salesman and have been for over 20 years. I have NEVER seen our inventories at this level and more keeps coming. Sales are down as manufacturers count sales as soon as they hit our lot. Eventually we, as many other dealers, will tell them “no more” and then TSHTF.

Stuffing the pipeline, eh? Or is it just that the storage facilities are also overflowing with vehicles and dealers’ yards is the last, best place to dump the product?

I and my friends have all the stuff we can possibly use. Tesla, $30k trike, on and on. Everyone is pretty much sated. Travel? Pretty much been there, done that.

Now, going for hikes, getting together for book club, wine club, choir [!], Netflix & chill [with our wives]!

So, we have lots of money and income, but we are into other things and just aren’t spending like we used to.

I have no idea how widespread that is.

You do it by choice, the rest of us do it out of necessity. Demand is definitely down.

I don’t think its particularly widespread – the idea of not spending. In our corporate case it’s not even considered as spending, if just carries on almost like Freddie. We had the board (and bored) discussion of the jet-sharing, and we just kept it. Why not? It’s not the cost that matters after a certain point. But then again we didn’t go bigger, faster, fancier. And really, if I want to go to London I almost prefer to sit uptop in the BA747 with a sleeper bed and drinks etc. So net net, I almost agree. Why spend more for what? We are way past extravagant already.

Basically, we have so much money and assets, and we make so much money, that our marginal propensity to spend is pretty low. But most of us keep on working because [to a great extent] that is what we have been doing since our early teens, and it suits us just fine. We like our employees and our customers. And because the government is seen as being dominated by socialists, metrosexuals and atheists, so there is some uncertainty about the future.

Dominated by “atheists”? Atheists are the least likely to be elected of all types of candidates, and make up a tiny percentage of the population.

When it comes to observing trends close to oneself and one’s environs, they probably are not replicated anywhere else. Small sample sizes always delude.

This family has had “enough” of cheaply made foreign goods. Now, less ‘junk’ enters this house. No more throw-away electronics. We tend to hold onto, and buy those more expensive American, or German made things. Yes, vintage, but then I know how to repair them, restore them to new.

You can’t eliminate it all of course, but you can choke it down. Maybe, more thinking like this is why the big box junk stores are choking on inventory – who knows?

Same here ……couple months ago paid $5.00 for an old (1950’s) portable floor heater from a recycle/reuse business. Put maybe $35.00 into refurbishing the heater (paint n fasteners) ……and it’s good as new. I should also note that if need be, I can replace the heating elements if and when they fail…such a basic appliance. I predict that in the not too distant future, quality will replace quantity as the business ethos, as people will not have the luxury of buying badly made throwaway shit!

The other day I flipped out. Went to buy a self inking return address thingie that you push down and it stamps the address and seats the fonts on the ink pad.

Couldn’t find one for sale. Got exasperated. Took the old one that was broken and I repaired it with a little Barge shoe cement. Works fine. Then I pulled out every broken thing we had and I fixed them. Two hours labor, probably saved 50 bucks but most importantly, the satisfaction of doing something with my hands and saying “F* you to the system.

There are Youtube tutorials on repairing almost anything.

I work for the largest LOL carrier in US at a major terminal and have been watching the trailer count and loading fall,beyond the normal seasonal norms. Have warned coworkers of coming layoffs but they believe the unions will protect them. I have also been repairing,reusing and buying used quality items instead of just buying cheap.