Low oil prices are the wreckage from a war – a financial war.

By Larry Kummer, Editor of the Fabius Maximus website:

Oil sell-off after OPEC makes even ECB look good. Better to have announced something, even if less than hoped for, than nothing at all… — tweeted by Capital Economics.

We have not begun a new era of low oil prices, fruits of new tech and a beneficent Fate. Low oil prices are the wreckage from a war – a financial war.

The verdict is in. Experts proclaim OPEC’s policies a failure. Here’s T. Homer Bonitsis, associate professor of finance at the New Jersey Institute of Technology:

OPEC is non-relevant in terms of its ability to affect the price of oil. So any decision by OPEC will not have a long-term effect on the oil market. There are too many OPEC quota-chiseler countries and non-OPEC production countries that cast a shadow over the effectiveness of OPEC maneuvers. … If history is any guide, there is a secular downward trend on real oil prices.

… The Saudi strategy of attempting to knock out competitors by using predatory pricing is not a game changer long-term … Some producers may shut down temporarily, but will reopen when prices recover again. Indeed, some producers may go bankrupt — only to have their assets sold at bargain prices. The new investors in these assets have a lower fixed cost structure to produce oil; in essence, creating a lower-cost competitor! The policy is doomed to failure long-term.”

This is an economist’s perspective: now is forever, economics is everything. It’s why they are so frequently astonished by events.

US oil production peaked in 1973 at 9.5 million b/day, a record that, despite exciting predictions, seems likely to stand for a while longer. Then the Saudi and Gulf princes used OPEC to take control of the world oil market (i.e., manage production to boost prices). That control was shaken in the early 1980s as other oil producers refused to cut production, forcing the Saudis to do so to stabilize prices. In 1986 the Saudis struck back. They boosted production by 40%, using their low cost output to force others (especially the Soviet Union) to cut both prices and production. The USSR collapsed, with its lost oil income making a large contribution to its bust.

Now the US has challenged Saudi control.

In 2014 world output was 8% above that of 2008. Non-US production had risen 2%; US output had risen 64%. Action was necessary. The Saudis kept their taps open, watched oil prices crumble, and waited. It’s a game of chicken. With their cost of production (including both capital and operating costs) under $10/barrel, they know who will win.

Here’s Saudi Aramco CEO Ali I. Naim yesterday at the International Petroleum Technology Conference in Qatar, speaking softly:

“There is no additional unconventional oil coming to the market; actually there is a decline. … So the supply and demand imbalance in the market will adjust and stabilize, and the gap will be closing. And we will be seeing, hopefully, adjustment in the prices going forward starting in 2016.”

What is this? It’s financial war

It will not be pretty. The US oil rig count is down 66% from its October 2014 peak. The international rig count is down 22% from its July 2014 peak. The financial damage is already severe, as WOLF STREET reported last week:

The oil-and-gas sector accounted for 37% of the total distressed debt and sported the second-highest sector distress ratio of 50.4%. That is, half of the oil-and-gas junk debt trades at distressed levels! The biggest names are Chesapeake Energy with $7.4 billion in distressed debt and Linn Energy LLC with nearly $6 billion.

Economists assume the current difficulties of the oil industry are a blip. But with the world’s incremental sources of oil requiring $60 – $80 oil to justify production (including both capital and operating costs), low costs that bankrupt much of the oil industry will create ripples that last for a decade or more.

The expansion of US oil and natural gas production was fueled by cheap credit on easy terms. Now E&Ps’ cost of capital will rise for a generation as investors and lenders remember the coming bankruptcies.

The owners – the new owners – will have a lower cost basis on their E&P assets. They might enjoy short-term profits, but oil prices will not justify new investments. Hence expectations for a massive drop in oil and gas from fracking, as production from existing wells drops quickly and few new wells are drilled. Hence stories like this from Reuters: “U.S. oil output on brink of ‘dramatic’ decline.” Capital will flow out of the industry until oil prices double, or more, from current levels.

The casualties will cover the globe, hitting nations with high-cost oil or with underdeveloped fields needing investment.

Petrobras spent billions to become the next Saudi Arabia, developing its large but expensive to develop resources deep under the Atlantic. If oil were $150, they’re be rich; with $40 oil, they are broke. At $150 WTI, Venezuela’s vast oil reserves would have people saying “Rich as a Venezuelan”; $40 oil means they’re broke. With $150 oil, Russia would boom; $40 throws it into a tailspin.

What is the cure for low oil prices?

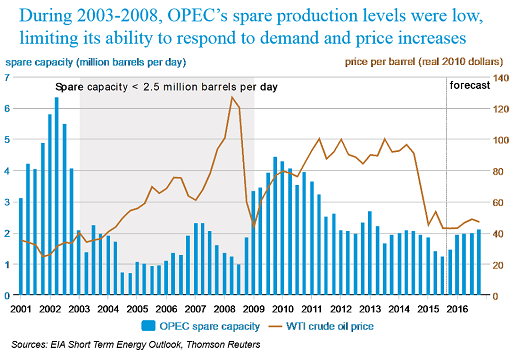

Answer: the Saudi Princes cutting output, with other major producers following their lead. Spare capacity is low with everybody pumping at max, under two million b/day (much of this “surge” capacity, short-term only). A production cut of 3% would bring that up to a more normal four million barrels/day. OPEC’s spare capacity (blue columns in this chart from EIA) was low during the global boom, driven by China, of 2003-2008. It’s low now with the taps running open:

When will this happen? It could happen fast; it would hit the oil market like a thunderbolt. Capitulation, such as happens at the end of siege and at troughs in stock market prices, takes place in the minds of the decision-makers and cannot be predicted. But it will come. The Saudi and Gulf princes have more money in the bank than anyone else, and they have a lower cost of production than anyone else. They will squeeze their competitors as long as necessary, until they capitulate.

The survivors will beg the Saudi Princes to regain control of the oil markets. Norway and Russia might join OPEC (de facto if not formally). Texas, Colorado, and Alaska might muse about wanting to join OPEC. The sight of the gallows focuses the mind on the need for cooperation. By Larry Kummer, Editor of the Fabius Maximus website.

Investors are already getting bloodied as the Great US Credit Bubble implodes at the bottom – and it’s not just energy. Read… “Distress” in US Corporate Debt Spikes to 2009 Level

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Uh, when was this article written? The Chavezista revolution in Venezuela just ended a few days ago. …then we have Iran sanctions ending in the new year. Obama foreign policy may well be seen as genius as cheap oil persists and drives a US recovery.

Mark, politics in Venezuela have no impact on the price of oil. It doesn’t matter who runs the show. They’re broke at $40.

“drives a US recovery”

my “head fake recovery” ended in Q2, 2014, you got any ideas when the economy is going to “actually” recover?

I think the scenario will be unbelievably complex. In the end, oil will go up, but at great cost to Saudi Arabia.

Sorry – I’m going to go with the ‘silly’ economist who thinks there are too many non-OPEC quota chiselers for OPEC to control prices.

There are also OPEC quota chiselers.

You have too many countries that have to sell at any price- like Venezuela.

There is already a huge black market in their oil. In the socialist paradise, you can fill up an SUV for the price of a candy bar. So oil is trucked out of the country- bribes paid as needed.

The other factor is the general collapse in price of ALL commodities- the one in iron ore from 190 to 40 makes oil seem not so bad.

If 1928 is any guide, this presages a general crash, which will take down demand.

Of course, no one knows, That’s the point, As much as I hate to repeat the words of that idiot Rumsfeld, we have known unknowns and unknown unknowns.

Can anybody tell me why Saudi Arabia is still considered an ally by the USA?

Because they are a reliable supplier and financier of terrorists when our clandestine agencies need cover for the false flag attack on 9-11 or want to destabilize a country like Libya or Syria. And they are a key player in the American program of economic warfare against Russia.

Good question, giving that the KSA has been financing terrorism on a global scale. Their Wahabism is as extreme as it gets… Q: Who do you think has been behind the IS?!?

It is very easy to predict the future when you have tunnel vision. Mr. Kummer’s hidden premise is that Saudi oil is a limitless resource that never depletes and enables them to “squeeze their competitors as long as necessary, until they capitulate.”

The fact that the over half the Saudi oil production comes from Gahwar, a super giant field that started production in 1951, is irrelevant if you believe that oil fields don’t deplete with age. As is the fact that production peaked in 2005 and is being kept up by injecting ever-increasing quantities of salt water under the oil reservoir to float the remaining oil toward the surface. Since Gahwar now produces 46% water, will the Saudi’s find some way to sell it as a by-product as Gahwar reaches senility, or will the reality of a finite resource triumph?

Thanks for your comment. Since the 1970s, the Saudis have been publishing unchanged resources. Actual data is the #1 state secret. But I recall ugly news of depleted oil fields in Mexico…

Q: how should traders or speculators respond?

We had low crude prices some 20 years ago. But the $ was worth more back then… I’m going long.

True, but understated as far as I know. Ghawar is now, at least, 75% depleted, and that´s optimistic. In 2011 it fell to 45% of Saudi output and in 2010 it got to 85 billion barrels produced since inception. I wonder if they´re pumping anything else than water there by now. I have come to thing that, maybe, they are covering the fact that the times of cutting down production at wil are long gone. Once you start with enhanced oil recovery on a massive scale you just can´t play with output, you risk losing completely the well. Any thoughts on this?

Oil is headed down to 20 Bucks like it was before. Everything works in cycles and I don’t see what all the hub bub is about. *sigh sometimes I think someone put me back in the 70’s and 80’s players and names have changed but the game remains the same.

The Saudis did not come this far only to give up. They did the math, and they’re going to take down US shale. The IMF says they are solvent until 2020 at $40 oil, and the other gulf nations are in even better shape. The same cannot be said for their American competition.

The math is quite simple – Saudi Arabia needs to sell oil at any price to fund its government that has had to make expensive promises to its citizenry in order to stay in charge.

SA is not in control – but wishes that all believe they are. It is the best way to stay in power.

And the world’s monetary system wants this too – Saudi USD$ are placed in US Treasurys – and not in real, tangible assets. This fraudulent system too is under pressure by low oil prices as these paper assets of another nation will be sold off to fund social policy (creating a demand for true price discovery or a short duration of musical chairs).

Where is the money? Show me the money!

My brother used to say, “real estate prices can only go up because God isn’t making any more land.” I said, “God isn’t making any more people with money! Without good credit = no bid for real estate … ” Also, no bid for oil.

Okay, bring on the inflation arguments!

They won’t work! Whether the nominal price is $20/barrel or $20k, the buying power of the purchaser is the the same or diminished. At the same time, changing the customers’ number adverselt affects the driller who must use the same $20k — or more — to extract his barrel of crude.

Our problem isn’t frackers or Saudi sheikhs, it’s on the consumption side … at the end of your driveway. Using petroleum does not produce any value for the user, it provides ‘utility’ … a bit of time-wasting entertainment and convenience. Using does not offer the user the means to retire the funds he has borrowed to buy the fuel. Without means, he must borrow but he can’t! He’s insolvent … so is the entire fossil fuel industry … so is its lenders and the speculators (markets) that bet on prices!

There are two ways to do anything: easy and hard. Easy way is to acknowledge our absence of return, observe this is structural. Next is to get rid of the cars, the industrial firms (that are all underwater from a macro standpoint), reform agriculture, jettison the hubristic empire and the political messes that go along with it … and learn how to live within a finite (shrinking) energy- and resource budget.

The hard way is to allow circumstances to do the exact same thing: ‘Conservation by Other Means™’ … already taking place in Syria, in Greece and Somalia, in Venezuela, Spain, Ukraine and Portugal, in Haiti and pile of other countries.

Coming to your town. Are you ready or are you still in denial?

The Saudi target is the dealers (PE) not the users (E&P) though of course if the PE evaporates the E&P stops also except for the conservative companies that operate within cash flow (a novel idea!).

US oil production misreported? Should be at 19 mbd https://www.iea.org/media/omrreports/tables/2015-11-13.pdf

The US production numbers cited in the article are correct. Here is the annual data (in barrels per day) from the US EIA:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS2&f=A

The number you cited from the International Energy Agency (IEA) table of 19 million barrels per day is for the “Americas” with an S at the end, which includes Mexico, Canada, and all of South America.

Nice post “Steve from Virginia”.

As more people call for “leaving it in the ground”, producers will feel compelled to pump. Any money the Saudis can get for their oil is essentially “free money”. They are just loading up the vault and fueling up their planes for the day when they will fly to their villas around the world because the middle east will be uninhabitable.

Where’s all the conservative excitement for Drill, Baby, Drill? They demanded US production increase dramatically and that rapid moneygrab has spooked other producers into reacting with a price war.