They tried to spin it in the most favorable light, and even then it was ugly.

It’s early in the shopping season, and Americans might still come out and head to the mall in massive numbers and do their patriotic duty and buy things that ideally no one needs made in countries they don’t know with money they don’t have to prop up manufactures, middlemen, transportation companies, oil companies, the entire supply chain, and finally US retailers that have hired hundreds of thousands of part-timers just for this sacred period of the year.

The hope is that these consumers will get their act together to relieve the enormous pressures that have built up behind the scenes: ballooning inventories. But it doesn’t look like it.

After months of crummy retail sales across the nation, followed up by earnings warnings and lousy results from big retailers, the first numbers are in for the Thanksgiving Weekend. And they support ugly anecdotal evidence of less crowded malls and parking lots: Brick-and-mortar retailers are having a hard time.

The results of the National Retail Federation’s Thanksgiving Weekend Survey were painfully – some might say willfully – murky: It said nearly 102 million people shopped in stores over the Thanksgiving weekend, while over 103 million shopped online, including via mobile devices. Given the overlap, over 151 million people did at least some shopping over the weekend. That’s 47% of the entire US population of 319 million. This would be a good sign, at least the surge in online shopping would be. But average spending over the weekend was a measly $299.60 per person.

That’s where it gets murky. This year, NRF refuses to provide comparisons to prior years. The results are “not comparable to the 2014 results,” it says, since it changed the methodology of its questions. So it refuses to answer the single most important question that it had answered before: are retail sales up or down?

But Bloomberg compared the numbers that were “not comparable” and found that the average spent per person over the weekend had been $380.95 in 2014 and $407.02 in 2013. So this year’s sales would represent a 26% and 27% plunge!

We hope that the change in methodology is responsible for this plunge in per-person spending, that this is not indicative of actual retail sales. And if that hope doesn’t work out, we hope that the first sales estimates for the Thanksgiving weekend have no bearing on the rest of the shopping season. Because the alternative would be ugly.

The NRF also refuses to provide a total spending amount, though it was included in its prior surveys. Already in 2014, total spending had dropped 11% from a year earlier. And a drop this year from that already disappointing level would have been embarrassing.

Those numbers are based on what consumer said they did. In terms of tracking what’s actually going on at retailers, RetailNext and ShopperTrak provide some early estimates.

RetailNext estimated that sales at brick-and-mortar stores fell 1.5% from already disappointing sales last year, to $12.1 billion on Thursday and Friday, dragged down by lower customer traffic. ShopperTrak came up with the same figure, “an estimated decrease versus 2014,” without giving precise comparison figures. It also fingered “a decrease in shopper visits” on both days.

Both blamed the debacle at the mall on hot online sales. ShopperTrak also blamed early promotions in November that increasingly desperate retailers, stuffed to the rafters with inventories, had instigated.

One thing is certain: malls are getting a smaller slice of the pie as retail continues its revolution to the internet. Under these conditions that brick-and-mortal retailers find themselves in, managing your absence is even more crucial. Online sales over Thanksgiving and Black Friday soared 18% to $4.47 billion, according to Adobe Digital Index, which tracks 80% of the online transactions of the largest 100 retailers. In a sign of the times, people mostly went after doorbuster deals, which accounted for 40% of total online sales.

But was it enough to pull out overall retail sales? And will it be enough for the remaining shopping season? We won’t know for a while. But we do know they better be! Because there is a historic inventory glut in the US.

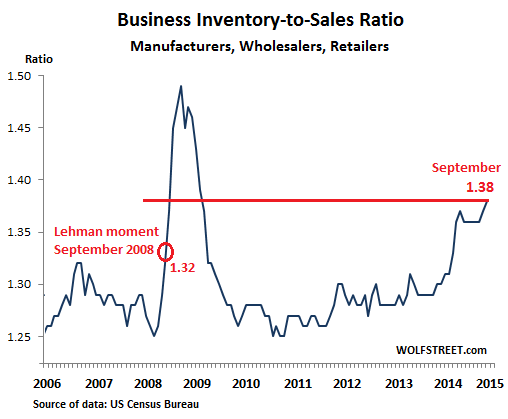

Inventories across manufacturing, wholesale, and retail have been piling up since late 2014, as over-optimistic sales projections led to aggressive ordering, the results of which have now come in contact with consumer reality. This pushed up the crucial inventory-to-sales ratio (reported by the Census Bureau) to Financial Crisis levels during the first half, when business inventories soared by a record $223 billion. And it has continued rising, forming this increasingly ugly chart of an inventory glut:

Throughout November, retailers have warned about disappointing sales and ballooning inventories going into the end of the year. At some point, they will have to unload these inventories, come heck or high water, and the only way to do this is to slash prices – which slashes sales, margins, and profits. Hence their reluctance to do so. But the inventory has got to go. The longer they wait, the worse the problems get.

Retailers had hoped that the lowest gas prices in eight years and historically low interest rates would induce folks to go on historic shopping sprees for clothes, electronics, toys, and doodads, but they haven’t. They borrowed money to buy cars and big-ticket items for the home. They’re struggling with the costs of education, healthcare, and housing. And they’re taking advantage of online deals. But they’re not propping up malls with their credit cards. And they’re not burning through the ballooning pile of inventories.

And that’s why the industry is now praying for a miracle. Those inventories, whose buildup inflated GDP, have to be unwound. And this is going to be costly. But miracles are increasingly rare in retail. Read… Consumers Lose Grapple with Reality, “Decline in Economic Aspirations” Sets in

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is why we need NIRP! This will force the sheeple to spend every last dime – possibly even take out some NINJA home equity loans to really make things exciting!!!

There is shift in people minds (and pockets). People tend to look for quality not quantity and more and more make purchase on-line.

I purchased top of the line laptop from comfort of my own home and saved $500 instead waiting in line for hours (In Canada is already cold) and risk to fight with some loser who is there “just for deals”.

Shopping malls will become ghost malls in coming decade.

Curious…do so many REALLY shop online? WTF do they buy? The same DvDs, games, electronics, CDs and tech stuff are available online as are sold in the bric-and-mortar stores…there’s zero in the way of unique items or daily necessities.

I suspect that the economy is now SO utterly dependent on the spending of fewer and fewer people – the few employed or big-borrowing teens, 20s and 30-somethings – that these products are now essentials in terms of profit-making…

After all, they don’t get rich selling groceries to the rest of us…

Clothes.

You got it all wrong. I am lower middle class retired now under 65, and most my frinds stilln working because they never learned to gear down their lif stype and are suffering. Plus Ihad a job that still had sime pension and couldn’t be shipped off shore(was RN, and hard to wipe butts from Mumbai. I own my house, have old cars, have old rv. Kids gone. But health care premium which I can’t get as good of coverage from Obummer care(the real main drag plus lack of real good jobs, and obscene housing costs) . Most of my friends who took equity out and still have a house are scared to death, and will work till they drop!!! I pay 1300 a month, and I am lucky cause only 2000 out of pocket max, with severly disabled wife. But still I quit buying crap, and only buy great deals online, first checking retail, and do serious comparisons, and only buying what I need, and lots of quality when I can, so I don’t have to buy again . Big thing people will need if we don’t change our fascist corptocracy soon is pitchforks for CEO’s, THE real RICH AND POLITICIANS!!! HA HA, NOT REALLY THAT FUNNY IS IT.

I buy lots of stuff from a recent purchase of a scooter lift for the back of my RV to the fused link I needed to install it.. I buy shoes, oil filters, hydraulic hoses, all sorts of electronic stuff, cameras, office supplies for my office and so much more.. Why drive all over town looking for something when you can just search the Web and find it and most of the time have it delivered free.. I have friends who even buy toilet paper on line.. It is to easy and most of the time way cheaper than driving all over.

Dear confused Retailers,

I regret to inform you but we, the American working-class schlubb, are all tapped out financially. then there’s the delema of BLM holiday beatings & disruption & terrorist bombings that we MIGHT encounter @ the mall! … dunno, jus’sayin’ … but it’s startin’ to feel like we gotta ‘brain problem situation’ on our hands.

signed,

what part of belly up don’t you get?

I don’t get the “delema” part.

Haven’t heard of a single “BLM holiday beatings” anywhere in the US.

US Police have killed over 1,000 Americans this year, though, white, brown and everything in the middle. Now THEM you’d need to be wary of at any malls!

Another thing is that when the retailers do at last push out their inventories at almost any given price. Afterwards the consumers probably have their “inventories” filled with whatever they needed or just plainly wanted to have, as well they have their credit cards maxed out. What then?

Likely nothing much for retailers before next holiday season which is many months away…

That is actually pretty scary.

Regarding low interest rates, that is really for the big boys on Wall Street. A consumer might get a deal financing an auto, but looking at interest rates on credit cards (and student loans- mine at 6.5%), the money is not there. from an anecdotal example, my credit card interest rates are starting to near somewhere near 20%, and I have excellent credit. Never missed a payment and never carry a balance. All that free money is still floating around Wall Street, with Main Street paying the price.

At my local Walmart we stopped by at 7:08pm after having diner, where Walmart was having their Black Friday sale start at 6pm with a guaranteed 1 hour of stock, the parking lot was quite full, but there was a mass exodus in progress. We were there for about an hour poking around and looking at the $3.86 DVD’s. When we left about 8pm the place was starting to look like a ghost town and the lot was mostly empty. So much for Black Friday ! LOL If this is any kind of a ‘thin reed indicator’, this shopping season is going to be the worst in 41 years !

I took a look at the massive discounts offered by some brick/online retailers on Friday.

I saw lots of stuff that was buy one/get one free (i.e., half price), with additional 25% discounts for a $150 total purchase, plus a 10% online rebate from Ebates. I think that works out to 33.75 cents on the retail dollar.

And you know what? I just shrugged and ate turkey leftovers.

I’m probably better off than most folks because I’m not in debt and still have a few bucks in the bank. But even though I can afford to buy stuff, I didn’t buy anything because I just don’t need any more stuff.

I suspect that retail guru Howard Davidowitz said it best a little while back. “Retail customers just don’t have any ******* money.”

felt the same way.. .looked at a lot of stuff but didn’t find anything that I thought was a great buy that I even had a slight interest in… I almost bought a new GPS on Amazon but it was a lightening deal and by the time I went back, the price had changed back up so I just decided I didn’t need it anyway..

My wife and I decided we needed to get rid of stuff rather than buy any more anyway.. Now buying only what we really need as in replacement. Besides, after the big crash, everything will be really cheap for those who still have any cash..

HOWARD IS SPOT ON HE SAID SOME YEARS AGO 1/2 OF ALL RETAIL GOING AWAY WAY TO MUCH RETAIL SPACE.JUST LOVE HIS INTERVIEWS SOUNDS LIKE HE’S DOING A SPORTING EVENT.

Personally, I think the Xmas shopping is up this year from the previous two years. The average spending is in line with what I have spent so far, even though I was shopping for things I needed not Xmas gifts. I see many more decorated houses in my neighborhood, which is up from the last five years. People seem more up beat, maybe they are tired of worrying, I know I am. Expenses are up for everybody while income is dropping, there is a lot of downsizing going on.

Someone asked, who shops online?

Well, I needed an electronic tuner for banjo and guitar. I could have driven to town and bought one, but instead used the gas money saved towards a better quality and lower priced unit. While I do have to wait approx. 10 days to receive it, (as it is not an impulse buy or something necessary like food), 10 days is just fine. It will be delivered to my house by a friend who has the Canada Post contract for rural delivery. Why would I go to town?

Furthermore, by browsing online I was able to read many consumer eports on the product, and compare and contrast the model to others in a similar price range. The nosy sales clerk was none other than my dog wanting me to hurry up so we could go out and play. I saved $15.00 in gas, did not have to worry about parking, and spent the day doing something fun and productive.

I did watch a Black Friday fist fight while online. That was about as close to the shopping experience that I wanted to be.

regards

This is purely anecdotal, but I haven’t owned a TV in twenty years (give or take). I like to read; mostly internet but I do have a reading pile of books which I add to when I come across something I think is accurate and insightful (all non-fiction). Anyway, one of the reasons I quit watching TV (other than it was all crap anymore) was commercials sometimes just offend me. I feel I can read the demographics they target, the qualities of the target they try to manipulate, etc and sometimes they do stuff that just pisses me off (and puts me in a negative mood).

One of the best examples is a cereal commercial (frosted flakes?) where this kid is all by his lonesome at home, feeds himself some frosted flakes, and then his “dad” shows up and they hang out and have a great time and then eat some more cereal. Maybe I am just cynical, but I just couldn’t help but feel angry there is some poor kid out there, without a dad, who wants his dad (who is probably a total deadbeat), so he eats crap cereal that leads to obesity and diabetes because he is lonely, neglected, and being manipulated by the douche bags at General Mills.

So, with that highly unqualified know how, I happened to be catching some TV over the weekend while out having a few beers at a local joint and enjoying my time off (and watching the Alaska wildlife – the bar has a great view of the ocean and the seals were very actively feeding near the shore) and I was struck at how many commercials solicited people to BUY THINGS FOR THEMSELVES. The the “(s)he went to Jareds” stuck out, but there were many others I don’t specifically recall that are overtly telling people to shop for themselves (as opposed to buying things for other people).

Maybe that is a good thing, because if families that care about someone other than themselves aren’t the target anymore, maybe all this loser consumerism is finally on its last leg. Let the last of the “consumers” drown in debt if this proves to be the case.

Regards,

Cooter

Cooter, I’ll tell you one thing I’ve learned in my years.

If you absolutely must buy something, buy top quality.

Never pay today’s retail prices for new stuff.

Buy second-hand if you can…better quality, MUCH better prices.

‘Outmoded’ tech, etc., (non-fiction books, records, VHS, tapes, cutlery & dishes, hand tools…) is disdained by modern consumers and goes for next-to-nothing.

And there IS price inflation out there…A LOT of it.

I think they are hoping to expand the market by pushing kids sugar cereals on to adults. sad

A few chains were manufacturing “computer” problems to explain the crappy sales. I guess an 11% drop in sales is incompatible with the “improving economy” bullshit they are still trying to sell.

Rising health insurance premiums are eating away at discresionary spending. Pretty obvious.

@Mericans, you can do it!!! With the high savings rate of just a month or two ago, you have the chance, the final chance to bring that rate down to negative!!!

You can’t spend yourself rich.

Discretionary income is no longer being used for “life style”.

It’s now being used for survival. Just the basics.

Food. Shelter. Clothing. Medical. Transportation. Debt.

The average consumer is busy just getting by and anything left over is going to deleveraging and paying down debt. If they are really lucky, they have a few bucks left over to stuff in the mattress. That’s all.

Yup!

Healthcare costs are the real killer – specifically health insurance.

I’m under 65, and I have to pay nearly $550 a month for my worthless Obummercare insurance policy. I don’t qualify for any subsidies.

So that’s $6,600 of annual spending cuts from my discretionary budget until I turn 65 and go on Medicare.

So if the politicians are wondering why I’ve stopped most discretionary spending, there’s the biggest reason.

Agree 100% with VegasBob.

Although I wish I had his problem…I’m 45, in excellent shape, don’t smoke or drink, 5x/week at the gym…and my renewal for my health insurance went from $400/mo to $800/mo. FOR A HEALTHY, NON-SMOKING 45-YEAR OLD MALE WHO WILL NEVER BIRTH A CHILD.

So that’s where all of my “gas savings” are going.

Our insurance premiums rose 1.8% this year, the LOWEST annual rate increase EVER! There was a period pre-Obamacare when our rates more than doubled in a 2-year span (with an insurer we have since fled).

You’re correct in bashing the US healthcare system in general – it’s a ravenous beast that spiraled out of control decades ago. Obamacare simply tried to rein it in – but not very successfully for some people, though for us it has worked so far.

The problem is that there is no real competition in US healthcare, that’s why we’re all getting ripped off.

Wolf,

One irony of Obamacare is that many of the bronze policies (e.g., the one that costs me $6,600 a year) have deductibles as high as $6,600 a year.

So not only do I have to pay $6,600 in premiums, I also have to pay 100% of my medical costs up to the deductible.

Many people who struggle to pay for their bronze coverage frequently cannot come up with the dough to pay their medical costs up to the deductible.

While all Obamacare policies provide for an annual wellness checkup, at $6,600 per year in premiums, that “free” checkup turns out to be one hell of an expensive office visit.

Obamacare’s only value to me is as a grossly overpriced insurance policy to protect me against being bankrupted by medical costs.

I actually agree with most of this comment. My premiums were also up only slightly.

Free markets. I wish I knew ye better….

Good job Wolf.

This is a pet peeve of mine, being as I live in the HIGHEST cost health care segment in the US (i.e. Alaska). The wife and I went for physicals (with private insurance from a good employer) in 2013 and our out of pocket was ONE THOUSAND DOLLARS each.

A simple physical with basic run of the mill bloodwork. We are both 40-ish and in great shape.

I have not been back to a doctor since. I will spare you the obscene train of expletives and native Texan colloquialisms.

The problem with healthcare, if no one is willing to articulate, is that it is a straight up fraud. If I go into a steak house, they know what a meal costs. If I buy a car, the dealer knows what a vehicle costs. If I load up a complicated combination of produce and products at the store they can figure out what it costs. None of them are going out of business. Yet if I walk into a doctors office, NO ONE knows what anything costs.

B*LLS**T.

There is absolutely no cost control because the government/district attorneys aren’t willing to prosecute FRAUD and ABUSE in medicine. For some reason this industry gets a blank check to steak til their heart is content.

Karl Denniger over at the MarketTicker does the best coverage on this subject, although he can be a bit hyperbolic, he isn’t a fool and has his facts straight. I agree with him more on this subject than anyone else I have read so far and continues to break new content on the subject over time. If you are pissed about health care, google that.

Regards,

Cooter

The answer is single payer healthcare.

I speak from my experience of the french healthcare system. For several years I lived on and off in France. Loved some things about the country and hated others, but the revelation was a healthcare delivery system that WORKS.

Not speaking the language well, alone and a stranger, I ended up with medical problems in Paris. I was seen by a GP within a couple of hours and by the end of the day had seen a very competent specialist. Money was never mentioned. I got two low cost prescriptions, again within an hour, and was on the road to recovery.

In France healthcare is just there for whoever needs it, like the police force (but better). Even in Britain where the Tories are dedicated to defunding National Health, foreign travellers get urgent medical care at low cost.

But we insist on believing that somehow private enterprise and the profit motive will get us decent medical care. Our healthcare system works on one level–it’s the only part of the US economy that is still reliably profitable. But otherwise it’s a very expensive joke.

Why not drop the coverage and pay the penalties? The reality is that even under medicare, if you get sick they will take everything. Save your money and if you get sick, let them sue you. You will probably be able to settle for a fraction of the bill. In any case the system is designed to take everything you own so give it to them later, rather than sooner.

The best solution is to seek care outside the US and pay cash (and save a bundle) and have a vacation while one is at it.

Regards,

Cooter

Here in Canada, the whole Black Friday thing is just a joke anyways.

It’s a supposed one day sale lasting for 3 days at some retailers, but mostly a week at others.

There are no special deals….just the usual 10 percent of random crap that retailers always offer.

So..whatever. It pisses me off so I deliberately don’t buy during Black Friday.

Its an american thing anyways….it should stay american.

One of my hobbies is playing video games, and I scratch my head and wonder how these companies make any money. I buy most of my games through the monopoly download platform Steam, and twice a year they have a big sale where you can get excellent quality games up to 90% off. I end up buying about 20 of these games for under $5, and I now have a library of 400 PC games. I will likely never finish more than 30 of them, and yet they’re so cheap, I just buy them anyways. This also prevents me from buying $60 games on release where game companies make their real profit. There may very well be another video game crash coming up soon.

On online shopping, I buy 95% of my stuff on Amazon. I only buy items that have a 4.5 star rating. I receive tons of spam from the online merchants and producers to give them a good rating now because they are so desperate to get that 4.5 star rating. This year I bought nothing, since my family has decided not to give gifts to each other anymore. Yeah, we’re a cheap, sad family.

The brainwashing to consume is failing.

I’m in the 25-35 demographic. 95% of my known peers do not have cable TV. We do not watch commercials. We are comfortable being mutually selfish. Not a one of us expects personal gifts from each other over the holidays. Birthdays involve greetings and maybe a party/meal out. No gifts.

When we go out most of the time everyone covers their own bill and absolutely nobody judges anyone else’s spending choices. One person gets a beer. One person gets a water. One person orders a 75 dollar feast. Everyone is comfortable with their choice and we have a good time.

My daughter got a new tablet for yule already. I wanted her to have it as it makes her internet based schooling more mobile. We will probably also get her a new desk/bed combo. I got my wife the same tablet to help with our work… Both modern high power 10in tablets with Bluetooth cost $70 each. I do not expect a gift from anyone. If I want something I buy it. And I don’t buy myself much.

My generation spends 70%+ of our money on bills and debt service. We watched our parents work themselves to exhaustion to buy all the modern conveniences and keep up with the Joneses. We have learned that everything we buy owns us but anything we experience we own. Our grandparents knew how to save. They knew how to live well frugally. Our parents may not have understood that, but we are taking the lesson to heart.

The consumer monster of the American economy will never die, but the coming two generations of earners realise we will be working a lot harder for less pay, no job security and no retirement. Our money is far too precious to buy consumer crap the recipient may not want.

My old school family is even following suite. Adults are bringing 1 anonymous gift and we are playing the dirty Santa gift exchange game. My peers are having a party where we are doing the same thing. $25 limit both times.

Thus… My families gift expenditures for yule? $170 plus the bed. Mostly stuff we really wanted to get and would have without the holiday as an excuse. My families holiday budget for gas, party food, restaurants, movies and entertainment? $330 minus the bed.

We are trying to find a dang good deal on that bed…

Retail won’t die but it will shrink. That’s probably healthy.

SCOTT GOOD FOR YOU A PENNY SAVED IS A PENNY EARNED.

On Macy´s open at Houston Galleria was only about 8 people, against full people crashing to enter 4 years ago

I’m thinking my big purchase this year is going to be a family membership at the gun club. The star on the top of the stocking up on essentials tree.

Mostly down to essentials but did the online Black Friday sale to purchase 2 2Stage Trigger’s for a couple of AR’s. They were on the priority list but only purchased because they were 25% off with free 10 day shipping.

Since I cut the cable a couple of months ago in three months they are paid for vs watching crappy tv shows and commercials.

Have 2 son’s 26 and 28 and neither even own a TV or have cable. Anything the watch is streamed or on disc. They also are savvy spenders and budget based on needs not wants.

Overall, Americans who earn and produce are walking away from overconsumption and incurring more debt. I will have the homestead paid off in 2016 and will never buy another item on credit. Cash only from here on out.

Yo, oligarchs and plutocrats:

We broke. How about a raise? No? Then enjoy the spiral down, schmucks.

Sincerely,

American working class

Sounds like the Dow should go up 2000 or more points based on this “good” news. I used to underestimate the increase but now I should have it right this time.

When you estimate the effects of National Socialism and the war against white people you need to forget everything you learned about capitalism.

This generational retreat from spending at Xmas I understand on an intellectual level, resent on A parental/grandparent level, and worry about on the philosophical level. The object of all totalitarians is to isolate the individual from family/friends. Judging from Scott’s cynical ego-centric worldview I’d say we’re pretty much screwed. I have had this Xmas argument with my youngest daughter for years. Since they’ve moved to Oregon we’ve moved to gift cards. The gift is cheerfully spent and I get a Happy Holidays text or gifts that arrive late that have no thought behind them. You youngsters need to remember that before long you will be old. And the shoe will be on the other foot. Laugh it up, fuzzball

In expressing my generations lack of gifting, I think I may have miscommunicated.

We strongly value experiences, relationships, shared experiences. It is just that gifts and material wealth don’t heavily affect our relationships (other than influence what experiences we can afford). I have friends who are millionares and friends who can only afford to eat Ramen. One person isn’t better than another because of their financial state, they simply have different opportunities and priorities.

My friends and family ensure that our everyone is given opportunities and a hand when needed, but we don’t play into mooching. If someone is capable and doesn’t act they pay the consequences. If they need help they get it.

While we all do our best to be fully independent, we know that if we absolutely need help we will receive it. There is a pride in being strong and taking as little as we can from our friends/family. Not because we aren’t grateful, but because we value the help/support so much that we don’t want to insult it by taking it for granted.

Even those of us eating ramen are usually so blessed that we have everything we truly need and the ability to have anything we care enough to work for. The stuff we don’t have is usually so expensive it wouldn’t be a reasonable gift.

Out of work people do not have money to spend. Robots make a lot of inventory, but they do not buy.

A critical point for the future! We are steadily moving away from an economic model where workers on farms and factories earn the money to buy the output of same. Increasingly we will move to a model where we have to have some sort of distribution system for basic necessities and free enterprise classic capitalism for luxuries. Call it techno-socialism if you will but something like that will be absolutely necessary if we want to keep our society and its economy alive and healthy. You-Know-Who pointed out a century and half ago in “Das Kapital” that a factory owner cannot exploit machinery the way he could workers. If you try overworking machines or shortchanging maintenance, you end up with a bunch of expensive to replace ruined machines. However, a factory manager can usually manage to find some heartless way to squeeze a little more out of the workers by making them work more for less, especially if there is no free labor market but it is controlled behind the scenes by the tycoons,the way it was back in the gilded Age and the way it is now. The result is increased production but reduced demand and eventually overflowing inventories and economic crisis.