Japan took fiscal and monetary policy to the outer limits. Now it’s in a recession.

By Larry Kummer, editor of the Fabius Maximus website:

Although the economic circumstances in the US and Japan differ, we’re following in Japan’s tracks – and Japan just entered a technical recession.

As Richard Koo predicted, during the Great Recession America repeated Japan’s mistakes during its “lost decade”. That’s the bad news. The good news is that America climbed into a slow recovery after the worst downturn since the 1930s. The worse news is that another recession lies ahead. Potentially a bad one, with both the world economy and many domestic sectors weak. The government will deploy powerful tools to fight this downturn. How well will they work?

Look to Japan for answers

Japan crashed in 1989 and never got up again — despite repeated massive rounds of stimulus, and during a period of rapid world real economic growth: 1990-2003 at 3.3%, 2004-07 at 5.3% (probably the fastest since the invention of agriculture). Deflation and a shrinking population cushioned the decline, but by 2005 they were getting desperate. Between 2006 and 2011 Japan had 6 prime ministers in 5 years; none of the last 4 able to remain in office a full year.

Shinzō Abe became prime minister on 26 December 2012. He quickly announced the bold program known as “Abenomics”, consisting of three “arrows” — each a bold policy action.

- More fiscal stimulus, increasing the government’s deficit by 2% of GDP (to 13%).

- More monetary stimulus: doubling the money supply in 2 years to create 2% inflation.

- Structural reform — broad, deep, and powerful.

Financial and investment gurus in Japan and American were euphoric at these precedent-breaking measures. The first arrow was easily and successfully fired. The second started well, with inflation rising almost to 2% in 2014 — but has collapsing back into deflation. The third arrow remains missing in action (Abe made weak proposals in June 2014).

“Keiki Kaifuku, Kono Michi Shika Nai” (“Economic Recovery, There Is No Road But This”). — LDP Campaign Slogan, December 2014.

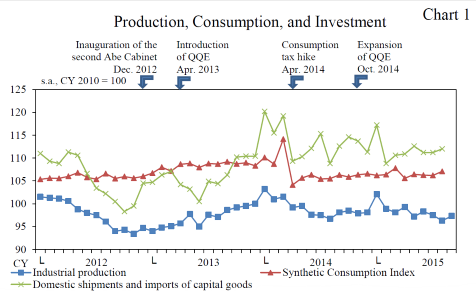

What were the results? A few graphs tell the tale, from a speech on Nov 11 by Yutaka Harada, Member of the Bank of Japan’s Policy Board:

Consumption, industrial production, trade in capital goods – these sketch a picture of Japan’s prosperity. Those lines look quite flat. Do you see any changes of trend at each of the key points he helpfully marked?

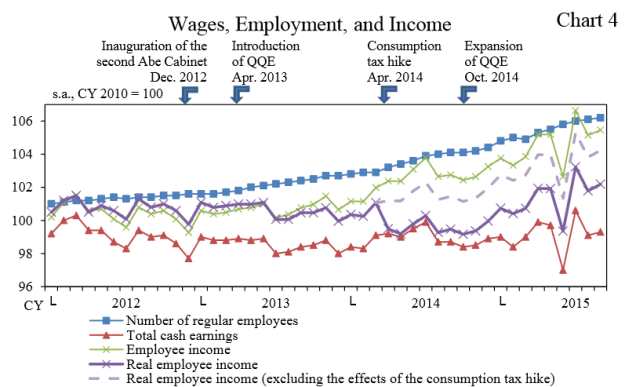

Here’s something more relevant to Japan’s workers:

The red line is total nominal cash earnings, what we pay our bills with. It looks flat (it has been flat since 1999). However, the number of employees has grown nicely, as have corporate profits (not shown).

As for the overall economy, GDP fell in Q2 and Q3 of 2014. And this year, it dropped 0.7% in Q2 and 0.8% in Q3 (SAAR), which makes it the fifth “technical recession” (at least two quarters in a row of declines) since 2008, and the second under Abenomics. There’s no shortage of depressing charts about Japan’s economy.

Excuses abound, as they always do for bad news. But time is running out for Abe’s government. Its public approval ratings peaked in the sunny days of April 2013 at 74 Yes and 17 No. On November 10, before the GDP report, it was 51% Yes and 38% No. Weak support suggests that the window for bold policy action has closed.

Japan took fiscal and monetary policy to the outer limits, except for the ultimate step of pushing nominal interest rates below zero. The result: little or no beneficial effects, but there were bad results, such as wrecking the government’s solvency and slashing investors’ real incomes.

Public opposition prevented Abe from oft-recommended step of economist-designed, government-forced restructuring of the economy. This is why they are in a second recession under his rule, not a depression.

I expect us to follow Japan’s example in the next recession, as we did in the previous one. As before, I doubt we will have better results. By Larry Kummer, Editor of the Fabius Maximus website.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What will the oligarchy that runs the U.S. do as the recession worsens? It will avail itself of the opportunity to enhance its wealth by mugging the subject population again. Scripted like a mob shakedown, Guido, the federal government, busts up the victim and pins him down and Alphonse, the bankster cartel, rifles through his pockets while carefully explaining that “you want to do the right thing, don’t you?” Metaphorically speaking, of course, and no offense intended toward Sicilians.

Abenomics wasn’t a failure. Quite the contrary, it’s been a huge success. The rich got a lot richer, didn’t they? The herds aren’t stampeding, are they? Well, there ya go.

I am frequently concerned that my posts may not be sufficiently alarmist:

“… the powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole …

“This group is responsible for the death and suffering of over 180 million men, women and children. They were responsible for World War I, World War II, the Korean War, and Vietnam, etc. They have created periods of inflation and deflation in order to confiscate and consolidate the wealth of the world. They were responsible for the enslavement of over two billion people in all communist nations – Russia, China, Eastern Europe, etc., inasmuch as they were directly responsible for the creation of communism in these nations. They built up and sustain these evil totalitarian systems for private gain. They brought Hitler, Mussolini, Stalin and Roosevelt to power and guided their governments from behind the scenes to achieve a state of plunder unparalleled in world history.”

Carroll Quigley, Tragedy and Hope: A History of the World in Our Time. Macmillan:New York (1966)

http://archive.org/stream/TragedyAndHope/TH_djvu.txt

Members of the global bankster class have explicitly stated their intention to enslave the planet on numerous occasions over the last couple of hundred years. Having recovered from the temporary reversal imposed on them by FDR, they are now in a position to accomplish it. That, at least, is not a secret. Every major politician in the world is perfectly aware of it. Even top-tier corporatists are terrified of them. You are, in fact, destined for a wretched dystopia that will make the darkest Kafkaesque nightmare look like a spring day at the park.

Actually, the idea that international capital controlled by a secret cabal was a founding principle of the National Socialist German Workers Party.

Actually, the idea that international capital controlled by a secret cabal was a founding principle of the National Socialist German Workers Party.

Yes, but they stopped complaining when they got funding.

I think the article is implying that fiscal stimulus doesn’t work. You would get the impression from this that government’s are unable to impact the economy positively, and we’re left to our own devices and the ‘invisible hand’ to better our lot.

In my opinion, the method of wealth redistribution/stimulus is as important as the fact of it originating from the government. If you just think for a moment about how Abenomics and QE in the West was clearly a form of state-subsidy for 1) bankers and 2) the mega-wealthy whom the bankers are always courting, it becomes clear that the effects of these ‘stimuli’ would never expand through to the wider economy.

Fiscal stimulus / wealth redistribution along the lines of a Basic Income, (see https://www.reddit.com/r/BasicIncome ), or along the lines of Steve Keen’s Modern Debt Jubilee (see https://www.youtube.com/watch?v=X3yb2YiSycU ) , are the only realistic guidelines of how you simultaneously solve the three problems with which we are cornered:

1) private debt crisis, 2) massive wealth inequality, 3) speculative asset bubbles blown by the rich. ALL of these three things, either stem from or contribute to the main economic problem of our times, which quoting Warren Mosler, is “a big fat lack of demand”. The economy is a circulatory system, and the lower limbs are under very severe tourniquets.

Governments stepping in to save economies from the natural crisis dynamics of capitalism is pretty much the economic history of the 20th century in a nutshell. Hence the New Deal, and World War II, which was really primarily an economic public works project to end the Great Depression in Europe. Hitler ‘saved’ Germany from 25% unemployment and eating shoe-leather, that’s why he was considered a “God”, and had a cult; not because of the racial ideology or the pomp and circumstance of their regime. He solved a crisis in capitalism.

We’re in another such crisis, and this broad-brush dismissal of the ability of governments to intervene based on the example of Japan, strikes me as not having considered all possible methods that are open to us. So far it looks like we’ve only tried “welfare for wall street”.

The timeline for the collapsing global economy.

Japanese banks had been on a maniacal lending spree into real estate and the bubble popped in 1989. Rather than own up to losses and admit their bankers were fools, they covered up the problems with loose monetary policy.

Japan then had the rest of the world to trade with that was still doing well but it never really recovered.

US banks went on a maniacal lending spree into real estate and the bubble popped in 2008. Rather than own up to losses and admit their bankers were fools, they covered up the problems with loose monetary policy.

US banks used complex financial instruments to spread this problem throughout the West.

Rather than own up to losses and admit their bankers were fools, the UK and Euro-zone covered up the problems with loose monetary policy.

Japan, the UK, the US and the Euro-zone had the BRICS nations to trade with that were still doing well but they never really recovered.

The BRICS nations are now heading for recession.

Doesn’t look good does it.

Since 90’s turbulence in Finland I have had this weird idea that a sovereign or some smaller “independent” fiscal entity mainly needs to take care only on two comparably small things to keep it’s economy running. Or maybe running is bad choice of words, but anyway moving, not crawling or laying low. And every since then I always end up to the same conclusion when there’s hard times, although I’m not that smart I could recommend any viable means to meets ends with my “conclusions”.

First conclusion is that any sovereign should focus it’s care to the smallest common denominator of it’s GDP which is usually one consumer, the famous Joe next door aka anyone.

And the second conclusion is that any sovereign should take care of the nation’s financial transaction infrastructure, but only to the limit of the transaction infrastructure.

After that sovereign should have enough consuming, decent tax incomes and financial infrastructure to accomplish at least financial transactions of basic needs of the consumers and enterprises.

Other problems will be solved more easily if foundations are ok.

But as usual, I may be way wrong here :)

I find the second chart to be quite interesting as it shows the number of ‘regular employees’ increasing.

This is at a time where the population of Japan is falling and the number of workers leaving the forcework is actually increasing.

It is also at odds with a number of articles that has indicated that the number of casual and non-regular jobs is increasing.

I wonder how ‘regular employees’ is defined for the chart………

Just found this article on the Japan Times web site:

“But it’s women who could make the biggest difference, especially in fields that require manual labor, like construction. The problem is mainly structural, despite the government’s claim that it is giving more women opportunities.

Ever since equality in the workplace was guaranteed by law in 1985, women have been channeled into nonregular employment though revisions in the labor laws that satisfy corporate demand for cheaper workers. Right now, 70 percent of all nonregular employees in Japan are women.

On the one hand, many of these women are homemakers who only work part time and purposely limit their hours so that they don’t make more than ¥1.03 million a year. If they make above that amount, they no longer qualify as dependent exemptions for income tax purposes and will also lose their type 3 status, meaning they will have to start contributing to social security plans.”

SEE:

http://www.japantimes.co.jp/news/2015/11/21/business/without-tackling-japans-labor-mismatch-abes-gdp-target-just-pipe-dream/#.VlGadiG4bIU