But what’s different this time?

Revenues of the companies in the S&P 500 have been declining all year. Companies and analysts blamed the strong dollar. They blamed China. They blamed oil, Greece, Japan, and a million other things. In the first quarter, revenues dropped 2.9% from a year earlier. In the second quarter they dropped 3.4%. And in the third quarter, according to FactSet, they’re expected to decline by 3.4%.

The last time year-over-year revenues declined two quarters in a row was in 2009 during the Financial Crisis [read… Revenue Recession Spreads past Dollar, Energy]. Now there have been three quarters in a row of revenue declines.

It’s tough out there.

Given this revenue debacle, corporate earnings growth has been shrinking. By Q2, it turned negative (-0.7%), according to FactSet. And in Q3, earnings “growth” dropped deeper into the negative, now estimated at -5.9%, despite all the expert financial engineering, share buybacks, and accounting tricks that companies have been leveraging with great skill and singular dedication.

But if US-based corporations blame the strong dollar, then foreign-based corporations should benefit from the strong dollar. It’s a zero-sum game: if one loses the other gains. We’ve already seen profits soar at Japanese corporations during the early phases of the yen devaluation in 2013 and 2014.

But that bonanza is over. Companies in other countries have been struggling too, despite the strong dollar that should have been beneficial to their non-dollar financial reports. And some of the deterioration has been reflected in global share prices, which have gotten hammered, including in Japan.

The MSCI AC world index, which captures large and mid-cap stocks across 23 developed markets and 23 emerging markets, has now been dropping for two quarters in a row – worst performance in four years.

Turns out, for the companies around the globe that comprise the MSCI AC, earnings “growth,” as measured by 12-month trailing earnings, is in even worse shape than for those in the S&P 500: by Q2, it was -7%!

So this is a global thing.

It has not primarily been triggered by the strong dollar, but by a global slowdown in revenues caused by a global slowdown in demand.

The last two times that earnings of the S&P 500 companies reached this point – in Q1 of 2001 and in Q4 2007 – the US was already in a recession.

The National Bureau of Economic Research (NBER), which decides when a run-of-the-mill downturn becomes an official recession, hadn’t acknowledged the recessions at the time, but it did so later on. The same will be true during the next official recession. We’ll be told only after it’s too late.

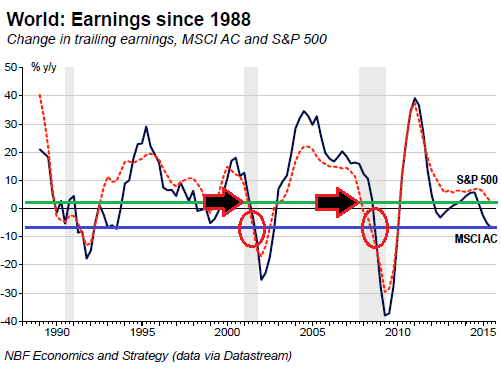

This chart by Economics and Strategy at Bank National Financial shows how earnings growth for the S&P 500 companies, as measured by 12-month trailing earnings, has sharply deteriorated, and by Q2 was barely above zero. This is slightly higher than the FactSet numbers for Q2 (-0.7%). For the companies in the MSCI AC index, earnings shrank by 7%. I added the green and blue parallel lines, the arrows, and the red circles to highlight what was going on when the prior two earnings debacles hit: the beginnings of the 2001 recession and the glorious Financial Crisis:

The last time earnings of the companies in the MSCI AC were shrinking like this without a recession was in 1993. And according to the measure used by Bank National Financial, the last time earnings of the S&P 500 companies were close to zero without a recession was in 1998. But if FactSet is correct in its estimate for Q3 earnings growth (-5.9%), all bets are off.

That just doesn’t happen without a US recession

The reason is simple: When corporate revenues and earnings tank, bad stuff starts happening. Companies curtail their investments further, and they cut expenses even more, all of which are a drag on the economy. And they whittle down their workforce, which drags down consumer demand even further.

This coincides with today’s high business inventories and inventory-sales-ratios. To bring inventories in line with lower demand, companies slash their orders, and this additional hit to demand ricochets up the supply chain.

These are normal business cycles. Recessions happen. They’re essential in what is left of the free-market system. It’s the process of cleaning up after a party, shutting down what doesn’t work, taking losses, wiping out debt through bankruptcies, and building the base for the next growth period.

What’s different this time?

Interest rates are already at zero. The Fed’s balance sheet is weighed down by $4 trillion in QE assets. Companies have loaded up on debt, much of it high-risk junk bonds and leveraged loans, that many companies will not be able to service during leaner times. Governments at all levels, after years of deficit spending, are burdened with enormous amounts of debt, with for example, US gross national debt more than doubling since the onset of the Financial Crisis.

And when the recession materializes, all these chickens are going to come home to roost.

So now everyone is hoping for some kind of earnings miracle in 2016, however unlikely that may seem. As Bank National Financial put it – with a total lack of conviction:

The bottom-up consensus currently sees an earnings rebound of 7.4% for the constituents of the S&P 500 over the next 12 months and about 8% for the MSCI AC. But will it come?

We think earnings growth is possible in 2016, provided of course that a few things go right. First, the global economy needs to get out of its funk.”

But by the looks of it, the global economy is just now sinking deeper into “its funk.”

So the risks the Fed promised to banish from the globe suddenly return with a vengeance. Read… This Chart Truly Depicts a New, Terrible Trend in Jobs Mess

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The ordinary person has not benefited from all this money the fed has printed most of it went to bailing out the big corps with has pushed up asset prices while there wages has remained stagnant and major prices have been going up eg rates. Power. etc making people porrer less to spend. It’s a zero sum game. The money hasn’t trickled down

It was not intended to trickle down.

Agreed.

Evidently the elites figured there was enough capital and standard of living sloshing around, and the public was suitably confused and distracted, that they could respond to the ’08 crisis by filling their coffers.

7 years in:

– Elite coffers fuller.

– General public still confused & distracted… and a little poorer.

So far so good.

Wages have been in recession for some time, and workforce participation is at a 37 year low. And, although I have not seen anyone writing about this, folks older than 25 have been enrolling in community colleges just so that they can borrow money to live on. When that money runs out, so do these older students. Community college enrollment is going to drop the way subprime mortgage home ownership did. Main Street America is well into a deepening recession.

No, I think the abuse/misuse of student loans is pretty widely known by anyone that wanted to know. It has progressed to the point that many young people are starting to figure out the game (i.e. the degree isn’t worth the time/debt). If one has an older brother, say by six years, as a sibling you would get a front row seat into how it turns out.

Further, many do not realize how student loan debt works. I suggest the following:

Originally I saw this here (in 2010):

http://www.ritholtz.com/blog/2010/09/student-loan-debt-credit-card-debt/

Infographic:

http://www.ritholtz.com/blog/wp-content/uploads/2010/09/student-loan-scheme.jpg

There were two major changes that created the mess that student loans are today; one is loan guarantees and the other is non-discharability in bankruptcy.

As I have posted before, get the hell out of debt. All that is lacking is a law from Congress re-assigning the dischargability of debts, such as consumer, auto, or mortgage, to create an inescapable debt situations for most Americans.

Regards,

Cooter

In my post, I specified “students” who were over 25, not the traditional students you are writing about. My 46 year old neighbor was having trouble making his house payment after losing his job, and enrolled in the local community college. In doing so, he got student loans that enabled him to keep his house and his credit, until he found another job. Another friend of mine borrowed all the way through her masters degree, and, because she agreed to go to Puerto Rico and teach, her loans will be discharged after a few years. She is almost 50 years old with two out of three grown kids, and a divorce that left he cash strapped.

A community college a few counties north of my county has seen its enrollment drop dramatically as the student loan defaults mount. A 44 year old friend of mine, who went there to get his paralegal degree, talked to many older ‘students’ who had enrolled in order to borrow money. When he went back the next semester, many of his classmates had not returned.

“Business has been booming at community colleges across the country in recent years, as a slow economy has sent many displaced workers and high school graduates in search of affordable higher education to their campuses. However, that trend appears to be slowing – at least for some areas of the nation – this year, as many community colleges are seeing slower growth rates and even a reversal in enrollment numbers.”

California, Illinois and Michigan community colleges have seen the biggest drops in enrollment, but with a few exceptions, I predict this will become a national trend.

College education loans have been serving as a stopgap debt financing measure for people without jobs who can’t borrow anywhere else. My point is that the financialzation of the economy has created a large class of debt slaves that must borrow money where ever they can. The exponential rise in college tuition, along with health care costs, are forcing Americans into even more desperate debtor situations.

I parsed that more as twenty-somethings as I had heard many stories of younger folks gaming the loan system for income. I haven’t seen much reported on the middle age folks doing the same thing due to extended job loss, but it follows logically.

Either way, they can’t discharge student loans in bankruptcy (the bar is extremely high), so it isn’t clear how your friend in PR got her debts discharged (assuming she did it after the late 90s when the changes were made).

Regards,

Cooter

Just a few years ago 5% interest was the fair return for a risk free investment in US sovereign debt. Those days are long gone. Yet many were not willing accept such reality fact. Instead they and accepted the risks inherent in leveraged debt just to continue their stream of interest income and prior level of spending. They appear to have been blinded by their complacency to the reality of risk to their capital.

The reduction in liquidity has placed a significant strain on this investment. Many of the complacent were unable to foresee that any portion of their capital was at risk believing that it was only a shade less risk free than US sovereign debt, particularly if they invested in funds that leveraged only federally guaranteed obligations like mortgage backed securities. So they are now experiencing the effect of less liquidity on leveraged investments that rely heavily on the available of plentiful liquidity.

Now apparently a lot of those who were applying this interest income to maintain a prior level of spending have lost enough of their principal to decrease that spending level. This is likely a vicious cycle as it influences others to also conserve rather than spend. In a service economy addicted and highly dependent on excessive consumer spending this has a significant impact.

No help for US consumers facing record levels of debt, China headed for a hard landing, Europe facing the consequences of austerity policies. How could a recession caused by weak demand come as any surprise?

In fact, this was predictable from the day the Fed decided to bail out big corporations and ignore the plight of US consumers.

hey Wolf,

That FactSet report doesn’t sound as pessimistic as one would expect if we are in a recession/depression. There are positive quotes from Accenture and NIKE scattered throughout the report.

I dunno, the “tone” of the report was just very “business as usual”. The ‘tone’ on ZeroHedge for example is always that the sky is falling, so I’m wondering who to believe here.

FactSet mostly reports on the forward-looking metrics (analysts’ expectations and how they change). And these expectations are always optimistic. But between the lines, well actually explicitly, the report is a warning about the current reality; it mentions crisis year 2009 six times!

It compares both, earnings and revenue declines, to 2009. So the report uses fairly upbeat language, but it also points out how terrible the data (reported revenues and earnings) really are.

thanks for the explanation, Wolf. That makes sense: the rosy numbers were future forecasts.

Perhaps we are finally entering the second unavoidable leg of the double dip that has been repeatedly staved off since08. As the CB’S have run out of ways to stave it off.

logic says it must now be longer than it would have been in 08/09.

If the Global economy gets any funkier it will be able to go on the road for a World Tour with Lenny Kravitz.

I’m still waiting for Helicoper money!

When the dam finally bursts the central banks will be powerless to do anything – because they have used up every tool in the box trying to stop the dam from bursting.

The formula will look something like this:

WW1 x WW2 x All Major Economic Depressions (squared) + (Fukushima x Chernobyl) x ‘The Road’ x 8765432.9876311

I will save you working it out — the answer is End of Days

You give them too much credit. They can only screw everything up this bad to two decimals of precision.

Regards,

Cooter

“so it isn’t clear how your friend in PR got her debts discharged (assuming she did it after the late 90s when the changes were made).”

The government is discharging/forgiving her debt, much in the same way my sister-in-law is getting her medical school loans forgiven by working in a low income area. There are a lot of tax breaks in PR, and it follows that in order to get qualified teachers to relocate to that crime ridden, broke island, where far more people are leaving than coming, some serious incentives would have to be offered. That said, she says she is enjoying it there.

Nice work, Wolf. The first arrow you added to the chart obscures what happened to S&P 500 earnings in 1998. But it looks like they bottomed out just below zero?

Indeed, in 1998 S&P 500 earnings dipped just one tiny bit below zero, and the MSCI AC to about -5%.

Here is the chart without my arrows: