One of the craziest financial creations on earth, available only near the peak of enormous credit bubbles when nothing can ever go wrong, became available this spring: 100-year bonds issued by governments or companies in emerging countries, in currencies they don’t control.

Yield hungry investors in developed markets who purposefully had been driven to near-insanity and drunken benightedness by the zero-interest-rate policies of central banks around the globe jumped on them. For them, it was the way to nirvana.

At the peak of Draghi’s QE hype in April, Mexico, which has a long history of debt crises, was able to sell €1.5 billion of 100-year bonds denominated in euros because yields were even lower in the Eurozone and bond fund managers there even more desperate and insane; at a ludicrously low yield to maturity of 4.2%.

Even more inexplicable was just how Petrobras, Brazil state-controlled oil company, was able to bamboozle investors on June 2 into buying its 100-year dollar-denominated bonds.

At the time, the company had just ended a five-month delay in releasing its financial statements. It’s tangled up in a horrendous corruption scandal that has reached the highest echelons of political power. It’s backed by the Brazilian government whose credit rating, as everyone had been expecting for months, was cut to junk last week by Standard and Poor’s. To top it off, Brazil has been facing a deep recession and a plunging currency, which makes paying off dollar-denominated debt prohibitively expensive.

And it renders that debt toxic.

Petrobras, whose credit rating was cut to junk the day after Brazil’s – though Moody’s had cut it to junk seven months ago – faces other, even bigger problems: over $130 billion in debt, the most of any oil company, and the terrific collapse in oil prices.

OK, in the second quarter, oil rallied sharply, and some bond-fund folks might have thought that the oil bust was over though the entire world was still practically swimming in oil. And amidst this buoyant mood about Petrobras’ prospects, the company was able to sell $2.5 billion of 100-year dollar-denominated 6.85% bonds to fund managers in the US and elsewhere who were blinded by their own optimism and driven to insanity by years of zero-interest-rate policies.

Now, three months later, these “century bonds” have gone to heck.

The three largest holders of these bonds are Pacific Investment Management, Fidelity, and Capital Group, according to Bloomberg. After Petrobras’ credit rating was cut last week, the bonds traded at 69.5 cents on the dollar.

That’s a big loss for these geniuses, or rather for their clients, in just three months.

To be able to sell these misbegotten century bonds, Petrobras had announced in June that it would try to unload $15 billion in assets by the end of 2016. But that plan isn’t working out very well in this environment where prices for these assets have plunged. So now it’s scuttling that plan and instead is focusing on cutting $12 billion in expenses by 2019….

This is the sort of peak insanity that can only occur near the peak of multi-year, central-bank-instigated credit bubbles. But this is just one example in a global nightmare now playing out.

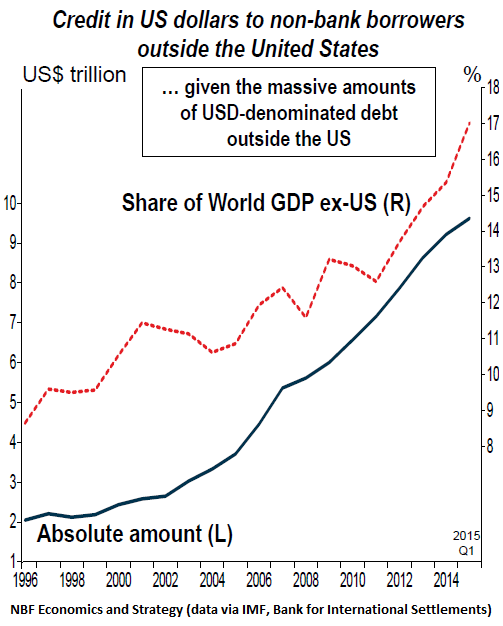

In total, $9.6 trillion of this sort of US-dollar-denominated debt issued by non-bank borrowers outside the US were outstanding by the end of the first quarter, according to the Quarterly Review released Sunday by the Bank for International Settlements – after more than quadrupling over the past 20 years.

In relative terms, this dollar-denominated debt reached a record 17% of global GDP (excluding the US), a ratio that has doubled over the past 20 years!

This chart by National Bank Financial, a division of National Bank of Canada, shows the absurd growth of dollar denominated debt by issuers that use another currency, in dollars (blue line, left scale) and as percent of global GDP exclusive of the US (red line, right scale):

If growth of this dollar-denominated debt continued at the same rate in the second quarter, including the 100-year bond folly, this number has likely reached $10 trillion by now.

So what’s the problem, in a world where debt apparently doesn’t matter? Krishen Rangasamy, a senior economist at National Bank Financial, put it this way:

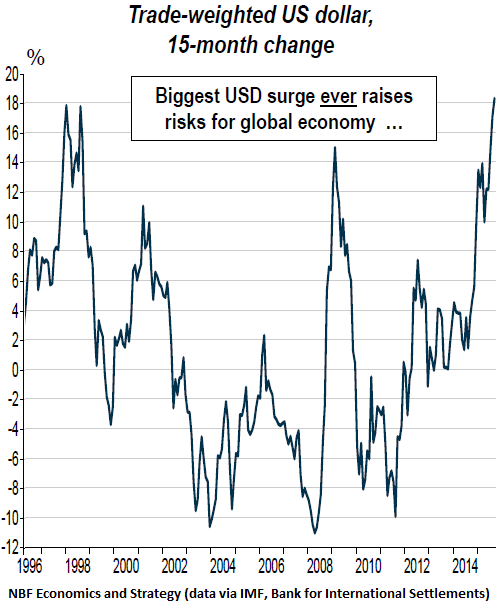

Thanks to diverging monetary policies between the Fed and other major central banks, the trade-weighted USD has now gained more than 18% since June of last year, the fastest 15-month appreciation ever. That cannot be good for USD borrowers outside America.

This chart shows the percentage change of the trade-weighted dollar. Keep in mind that some emerging-market currencies have gotten slammed much harder than others:

A strong dollar relative to emerging-market currencies makes it very expensive or impossible for the issuers in the emerging markets to service their dollar debt. And thus, as Rangasamy concludes, the world today is “more exposed than ever” to the strengthening dollar, just when the mountain of dollar-denominated debt turns out to be larded with explosives.

This is one of the many outcrops of the ingenious monetary policies exercised by our central banks. It’s piled on top of the enormous asset-price inflation that has occurred over the past six years. It’s a risk too ugly to behold, as bond investors in the US are beginning to find out.

Global recession watch: the cleanest dirty shirt gets dirtier. Read… Freight Goes to Heck, Now Even in the US

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

As Mark Twain said, history does not repeat itself but it rhymes with itself a whole lot of times.

I remember the 1997 Asian Crisis, which had been brought about by Pacific Rimmers (plus India) feasting on cheap credit from the Bank of Japan. Dollar and especially yen denominated debt looked like a win-win for everybody: countries with weak banking systems such as South Korea and Indonesia had access to far cheaper credit than they had available before and investors in Japan, Hong Kong, London etc got truly high yielding bonds. I remember around 1995 it was not uncommon for investment grade paper from the Pacific Rim to yield 7-8%.

Thailand was the poster child for all of this, especially given it had long been a manufacturing hub for Japanese companies and hence banks such as Sumitomo and Sakura were already well established on the ground. Thailand was also the epicenter of the crisis, when it was forced to float the baht after “discovering” its foreign currency reserves were nowhere near as large as reported.

This time, it’s slightly different. Far from being confined to a single continent, dollar and euro-denominated bonds have been issued by governments and corporations all over the globe with abandon. From Brazil to Ukraine, from Petrobras to Fosun International, it has been a mad scramble to take advantage of financial repression in the US and Europe. So far it has been a win-win for all parts involved.

A Chinese company issuing euro-denominated bonds can save more than 2% on interest payments even with the PBOC in full panic mode. With the yuan tightly pegged to the dollar, it also means repayment costs in domestic currency terms have gone down considerably in the last year and a half.

An European investor gets investment grade bonds yielding around 4%, a mirage in these hard times we live in when Italian sovereign bonds yield half as much as German bonds yielded in 2006.

We are daily reassured emerging countries such as Brazil or Indonesia have learned their lessons and now have vast foreign currency reserves with which to defend their own currencies and hence avoid a repetition of the Thai disaster.

But those reserves are draining fast and due to the commodity slump are not being rebuilt. Financial markets right now are far larger than they were in 1997: it takes a whole lot of money to defend a currency, one way or the other, as the World’s Largest Hedge Fund (also known as the Banque Nationale Suisse) learned earlier this year.

Much more critical, the world is fleeing to the safety of dollar-denominated assets. The pressure on the US dollar is upwards and will probably get even stronger over the next six months, regardless of what the fed will do. For countries such as Brazil and Malaysia, defending their own currencies, and hence the solvency of their own credit systems, will become harder and harder… and this is if things stay the same, if those countries can resist the temptation to pull a Kuroda or play the old and tired Keynesian card.

Honestly I don’t believe we’ll be so lucky as to have another 1997 Asian Crisis. I say “lucky” because, as painful as it was, it was over soon and countries such as South Korea could start rebuilding.

This thing has the potential to drag itself for years if not a decade. We’ve already seen this in Europe: outside of the German export machine, the whole Continent has been dead in the water since 2009.

Shell has predicted the slump in oil prices may last well into 2020. That’s an awfully long time and Shell seems to believe in it, as they are quickly dismantling and auctioning off their European operations to save money.

But oil is just a single commodity which is far more reactive than all the others put together except perhaps copper. Iron ore, coal, cotton, palm oil, bauxite, natural gas… unless China doubles down, again, on building empty cities in the middle of nowhere the slump in some commodities may last for a decade. Think about it.

This is extremely bad news for countries such as Brazil. It means their precious foreign currency reserves will have to last for an awfully long time with no top ups.

’97 financial crisis the Asian governments literally giving away the sovereignty to IMF was a wake up call. Granted many countries and especially Korea having gone thru debt workouts came out OK but the economy was ravaged for few years.

I think another crisis like ’97 won’t be regional but rather global and much bigger scale with China’s hidden mountain of bad debt (for now swept away) by SOE (state owned enterprises) and provincial & local governments on spending binge with astronomical mother of all debt. And if China is the next sick man of Asia (coming on the track of Japan since stock and housing crashed in ’89 – history does repeat) gets sick then peripheral Asian countries will get sick. Add to this PIIGS in EU-land, Latin America, Aussies, etc. Yep lot more sinister than ’97 crisis confined to Asia.

I read on ZH about how CBs can only control their own monetary policies and limited and costly endeavor when if comes to currency/FOREX – “Add all this up and it seems increasingly likely the next Global Financial Meltdown will arise in the FX/currency markets. The core paradox – that central banks can’t control both domestic and global FX markets with the same set of policies – cannot be resolved by printing $1 trillion, or even $5 trillion.”

I sense the global CB cabal is about to unwind exposing the follies of money printing and lost confidence in the FIAT currencies.

Exellent article Wolf! I had read something about this earlier elsewhere but your article explains in much better detail. Thank you.

good article wolf. do you agree that it is is a counterpoint to the zerohedge idea that we are watching the “death of the dollar”?

The dollar isn’t going to die. Over the long term (decades), it will do what it has always done since the Fed started managing it 100 years ago: it will lose value. But it will be around for a lot longer than I will be around :-]

Wolf,

maybe you could do a missive in that regard so we can silence (but probably not) the “yuan is the next global reserve currency” blowhards….as if that is going to happen any second now. Just a thought.

Thanks for the suggestion. Done!

Gregor MacDonald believes that the US, over the next five years, will go from a net energy importer to a net energy exporter, and, therefore, the USD will remain strong over that five year period.

After reading the this post, and the post that preceded it, two things come to mind. One is the Mexican Peso crisis, in which some Mexicans took out home mortgages in US dollars. When the peso tanked, those folks got foreclosed. It was a great time for US citizens to pick up Mexican real estate assets. Even though the peso has weakened again, this time there should be far fewer bargains in the Mexican foreclosure real estate market. However, Americans vacationing in Mexico have got to be enjoying the powerful USD.

The other thing this post brought to mind was that period when the Japanese used 100 year mortgages to buy US trophy properties, at super bubble prices. This happened about five years after the Plaza Accord, when the yen got super strong. Those 100 year mortgages did not turn out well for Japanese buyers or the Japanese banks. The Plaza Accord did not turn out well for Japan, itself.

On another note, hadn’t realized that PIMCO was holding rotting Century Bonds. Well, PIMCO investors can’t blame Bill Gross for this blunder.

100 year bonds? For a minute I thought this was April Fools day. I had not heard of these.

My mom is almost 100. In her approx lifetime: (Funny, no 100 year bond offerings or fools dumb enough to buy them on this list). With all the uncertainty and gamed markets I went cash 5 years ago…and land purchases 8 years ago. I didn’t win the roulette spin but I didn’t lose anything, either.

Steady as she goes, matey.

Interesting list. The list excludes inventions and technological change other than war facts, nukes, etc.

World War I-1914-1918

Russian Revolution-1917

Versailles Treaty signed-1919

American women win the right to vote-1920

Benito Mussolini comes to power in Italy-1922

Teapot Dome scandal-1923

Scopes Monkey Trial-1925

Britain has a general strike-1926

Charles Lindbergh makes first flight across Atlantic-1927

Stock market crashes-1929

Japan invades Manchuria-1931

Franklin Roosevelt elected president-1932

Adolf Hitler comes to power in Germany-1933

President Roosevelt launches the New Deal-1933

Social Security is enacted-1935

Italy invades Ethiopia-1935

President Roosevelt is unsuccessful in his efforts to pack the Supreme Court-1937

Japan invades China-1937

Germany annexes Austria-1938

Germany invades Poland; World War II begins-1939

Germany conquers Western Europe-1940

Battle of Britain-1940

Franklin Roosevelt becomes only American president to win a third term-1940

Germany invades Soviet Union-1941

Japan bombs Pearl Harbor; US enters World War II-1941

D-Day-1944

Germany surrenders to Allies-1945

British Prime Minister Winston Churchill is defeated in a general election-1945

US drops atomic bombs on Japan-1945

Japan surrenders; World War II ends-1945

India gains independence from Britain-1947

Marshall Plan to help Western Europe recover from World War II is enacted-1948

Berlin Airlift-1948-1949

US President Harry Truman unexpectedly wins reelection-1948

Queen Elizabeth II assumes throne in Britain-1952

Korean War-1950-1953

Supreme Court hands down decision in Brown v. Board of Education, mandating integration of public schools in US-1954

Soviet Union launches Sputnik-1957

President Eisenhower sends federal troops to Little Rock, Arkansas to enforce integration-1957

Bay of Pigs invasion-1961

Berlin Wall is erected-1961

Cuban Missile Crisis-1962

Nuclear Test Ban Treaty signed-1963

President Kennedy assassinated-1963

Civil Rights Act signed into law-1964

US ramps up involvement in Vietnam, leading to the Vietnam War-1964

Riots in Watts, Los Angeles-1965

Sterling devaluation crisis in Britain-1967

Six Day War in the Middle East-1967

Riots in Newark and Detroit-1967

Dr. Martin Luther King Jr. is assassinated-1968

Police attack demonstrators outside Democratic convention in Chicago-1968

Astronaut Neil Armstrong lands on the moon-1969

The Boeing 747 enters passenger service-1970

Kent State massacre-1970

Watergate scandal-1972-1974

Yom Kippur War-1973

Arab Oil Embargo against the West-1973

Strikes and an oil shortage lead to a three-day workweek in Britain-1973

Richard Nixon first US president to resign that office-1974

Britain has to go to IMF for emergency loans-1976

Camp David Accords agreed between US, Israel and Egypt-1978

Margaret Thatcher elected Britain’s first woman prime minister-1979

Iran Hostage Crisis-1979-1981

Ronald Reagan elected president-1980

Assassination attempt against President Reagan-1981

Air Traffic control workers fired by President Reagan after going on strike-1981

Riots in Brixton, Southall, Toxteth and other inner cities in Britain-1981

France unveils TGV-1981

Falklands War-1982

President Reagan unveils SDI, aka Star Wars-1983

USSR shoots down KAL 007-1983

Cruise and Pershing missiles deployed to Western Europe-1983

Brighton Bomb-1984

Miners Strike in Britain-1984-1985

Mikhail Gorbachev becomes General Secretary of Soviet Union-1985

Iran Contra scandal-1986-1987

Pan Am flight 103 explodes over Lockerbie, Scotland-1988

Berlin Wall comes down-1989

Democracy comes to Eastern Europe-1989

Germany is reunified-1990

Iraq invades Kuwait-1990

Margaret Thatcher forced to resign as Britain’s prime minister-1990

Gulf War-1991

Soviet Union is dissolved-1991

Republicans, led by Newt Gingrich, win control of Congress-1994

Oklahoma City bombing-1995

Princess Diana killed in a car crash-1997

Asian Economic crisis-1997

Monica Lewinsky scandal-1998-1999

Kosovo air campaign-1999

George W. Bush declared winner by Supreme Court after a bitterly disputed election-2000

9/11-2001

US invades Iraq-2003

Hurricane Katrina devastates New Orleans and Gulf Coast-2005

Al Quaeda bombings in London-2005

US financial crisis-2008

Barack Obama first African American elected US president-2008

Osama Bin Laden is murdered by US special forces-2011

Margaret Thatcher dies-2013

Due to my disbelief about 100 year bonds I looked them up and was amazed to also see 1,000 year options including CP.

How do you spell Hubris? Amazing stuff.

Some analysts see the demand for this type of long-term bond as an indicator of consumer sentiment for a specific company. After alls, who would buy a 100-year bond from a company they didn’t believe would last? For example, if there was especially high demand for Disney’s 100-year bond, this could mean that many people believe that the company will still be around to pay out the bond in a century.

1,000-year bonds also exist. A few issuers (such as the Canadian Pacific Corporation) have issued such bonds in the past. There have also been instances of bonds issued with no maturity date, meaning that they continue paying coupon payments forever. In the past, the British government has issued bonds called consols, which make coupon payments indefinitely. These types of financial instruments are commonly referred to as perpetuities.

Read more: Why do companies issue 100-year bonds? http://www.investopedia.com/ask/answers/06/100yearbond.asp#ixzz3lpBRmdKo

Follow us: Investopedia on Facebook

“In the past, the British government has issued bonds called consols, which make coupon payments indefinitely. These types of financial instruments are commonly referred to as perpetuities.” It is worth recalling that these consols were based on the pound when England was on the gold standard, and so it was not incredible that they paid “only” 1%*- but what kind of idiot puts his faith in a 100 year bond at 1% backed by paper money?

*And when they went off the gold standard in 1931, pure whipped cream turned into dog sh*t. Louis Sullivan in his excellent Prelude to Panic (hard to find) said this was the proximate cause for the Great Depression in America: when it became obvious that we were next, savers began demanding bullion for their dollars (i.e. gold certificates, or literally receipts for gold)- except thanks to fractional reserve banking, they had only $40 in gold for every $100 issued, and the banks failed one by one.

I got suckered last Xmas into attending a timeshare pitch in Branson. It was billed by the sales lady at Bass Pro Shop as an introductory vacation deal to encourage customers to consider the company’s resorts. No mention was made by her to marketing timeshares. I first realized I had been bamboozled when I got my bank statement and saw the transaction billed as Timeshares. I tried to cancel but the service rep told me there would be a steep penalty if I did so. It was a good deal if a person was really interested in the product. But I felt like I was benefiting on false pretenses. I talked to several people at the hotel and a pattern emerged. Older people such as myself were sold the vacation promo story, but the younger people knew it was a timeshare pitch but didn’t care because they got a free room and were able to vacation on Bass Pro’s dime. I told the sales rep that I was sorry he had to waste his time, but I had no interest in buying a timeshare or going into debt for any reason. He soldiered on but the wife told him the buyer would only be getting a promise to rent a unit on a discount, and I followed up with the notion that said the discount was only good as long as Bass Pro stayed in business. This rattled him. He could not wrap his mind around a big outfit going bust. We didn’t buy and enjoyed the rest of our long weekend. Selling blue sky and snake oil is back in fashion.

“Thanks to diverging monetary policies between the Fed and other major central banks, the trade-weighted USD has now gained more than 18% since June of last year […]”

So, even though the Fed has been following an easy money policy, the dollar has been rising anyway because other central banks have been following easier-money policies. This kind of begs the question as to what the Fed is supposed to do now. They can raise rates to a more “normal” level (i.e. above zero), and accept the grotesquely overvalued buck (and resulting grotesque trade deficits). Or they can do what they did, so as to have a somewhat less overvalued dollar, and somewhat smaller trade deficit. It would seem that “normal” is not an option.