It’s a really bad day when the battered Shanghai stock index, down 1.3%, was the best performer of the major markets. The Nikkei plunged 3.8%. The largest European stock indices all lost between 2.4% and 3%. The German DAX, indicator of Europe’s miracle economy, is down 19% from its peak in April.

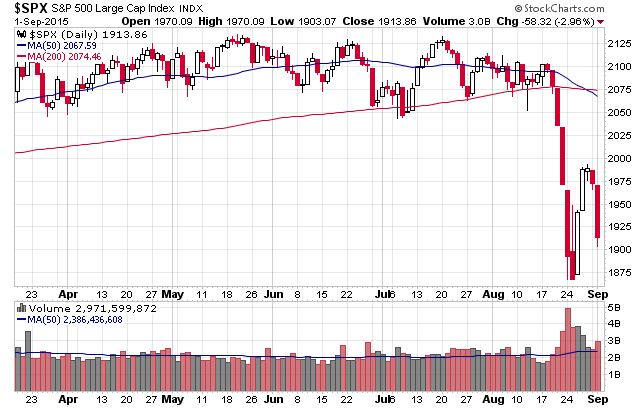

The S&P 500 dropped like a rock at the open and finished even lower, down nearly 3% for the day and down 10.2% from its high in May – back in an official “correction.”

Turmoil.

That’s the word that is now flying around. NPR tries to soothe the nerves of its listeners with comforting words about not selling during a rout. It’s in the papers. It’s everywhere.

The ugly fact is that since the Financial Crisis, the S&P 500 has rallied only during periods of QE and Operation Twist. But the Fed tapered QE out of existence last year and has been palavering about raising rates for months. And so, after years of powering higher despite a languishing economy, and making everyone smile and nod in a self-satisfied manner, stocks are being stocks again.

This chart by Doug Short of Advisor Perspectives shows the daily movements of the S&P 500 since early April. The trading range remained relatively narrow through the China swoon in June and July, though there were some downdrafts. But in mid-August, stocks came unglued, on soaring volume on big down-days (lower part of the chart):

And Americans are rattled.

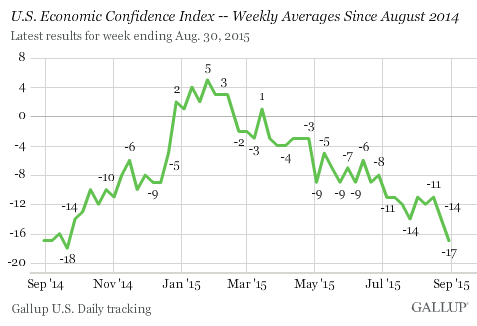

Confronted with this market that suddenly redeveloped a will of its own, not just in the US but particularly in China, Americans’ economic confidence is getting hammered, according to Gallup’s latest report.

They haven’t been exactly exuberant about the post-Financial Crisis economy to begin with. Gallup’s weekly survey of economic confidence reached its highest point in January of a still crummy +5 on a scale of -100 to +100. The index hit -65 during the Financial Crisis and took until the end of 2014 to get into positive territory.

But it didn’t last long. In February, economic confidence began to fall. At first, it looked like a blip typical for weekly indices. But the trend south continued month after month. And for last week, which Gallup released today, the index dropped another 3 points to -17, the worst level since September last year.

But it’s even worse.

In the three-day rolling average for Monday through Wednesday last week, confidence dropped to -21. Monday was the day the Dow plunged over 1,000 points at the open. The mood recovered later in the week as markets jumped.

“Americans’ confidence in the U.S. economy has been sensitive to international turbulence recently – such as in July, when Greece’s agreement on a debt deal remained uncertain,” Gallup said. And the latest debacle came “as international markets struggle amid volatility” – a euphemism for a historic crash – “in China’s stock market.”

Which begs the question: what is today’s rout doing to the confidence of Americans?

Which begs an even more troubling question: the S&P 500 is just 10% off its vertiginous record high, after rallying since 2011 straight. It can fall a lot further. And if it does, what is the economic confidence of Americans going to look like then? How will that impact their decisions to purchase cars and smartphones and whatnot? We can imagine the answer.

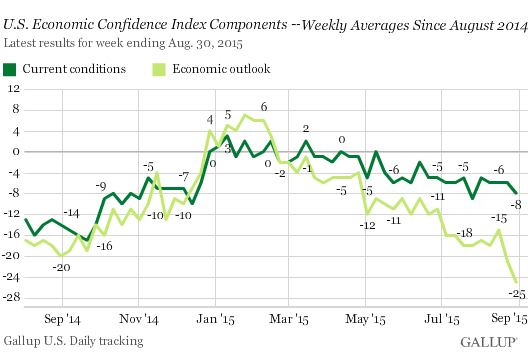

The index is a composite of two sub-indices: one tracks how Americans perceive current economic conditions; the other tracks how Americans see future economic conditions.

The current economic conditions index has been heading down in small uneven increments. Today’s reading dropped another two points to -8, down 13 points from January. But the index for future economic conditions has plummeted 31 points since January, 10 points in the past two weeks alone, to -25, the worst level since July last year. This is what this sharp deterioration looks like:

Just 23% of Americans rated the current economy as excellent or good; while 31% rated it as poor. In terms of economic outlook, 37% said the economy is “getting better,” but 60% said it is “getting worse.”

Stock market upheaval has “pushed Americans’ economic confidence further into negative territory,” Gallup said. But it pointed out that the unraveling of its weekly index in the second half of August is not yet reflected in other consumer confidence measures that cover an entire month and that have been mixed, with some, like its own monthly survey, heading down a smidgen, while the Conference Board Consumer Confidence Index actually rose.

In its prior report, Gallup figured that market turmoil hadn’t yet “greatly shaken” Americans’ overall economic confidence, based on the only slowly degrading current conditions index. But it had already slammed into Americans’ economic outlook: “To the extent stock markets continue to suffer, particularly if this affects broader aspects of the economy, Americans’ confidence could be shaken further in the coming week.”

Which is exactly what happened. And given today’s swoon in the markets, confidence is likely to take another hit.

It’s tough when you design an economic recovery solely on the principle of inflating asset prices to bail out the biggest risk takers and make some folks rich, and then, after years of ballooning asset prices, they begin to deflate, and now there are real consequences.

And this sort of stock market manipulation hit a sour note in Japan. Read… Bank of Japan Drops Ball, Government Pension Fund Stops Buying Stocks, Nikkei Plunges, J-REITs Eviscerated

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It will be interesting to see if the major indices can bounce off of last low from week ago Mon/Tues lows or double bottom formation. My take is that there will be lower highs on general down trend thru Sept and Oct with dead cat bounce followed by each low. Janet may be forced by the banksters to unleash QE IV in Nov so the indices end above 2015 low along with X-mas rally only for the market to gap down in Jan 2016.

Been a while since I shorted and today took the big step 1 hour after opening to establish market order short positions in AMZN, TSLA and ANGI. Place stop loss orders at 10% below in case it turn out to be bad bet.

I would be careful shorting any company with huge govt contracts. They are guaranteed a profit, have the opportunity to expand their contract and to gain other contracts as well.

Buckle up people buckle up!

npr’s business reporter. marilyn geewax[sic]

what a shill.

that is why it is known among the cognoscenti as national propaganda radio

So much for “buy the dip”.

The markets are totally irrelevant to the new “average” American who doesn’t own a house, have a 401K, or a bank account. The market is just entertainment for us. Our children have no confidence in it as well. As someone who is both the new average American and has worked on Wall St. I see the disconnect between the markets and the economy more clearly than ever.

I read today on Drudge that Marco Rubio, the Florida senator and presidential candidate, thinks America is doing great. I have news for him as a fellow Floridian. Last week a complete stranger knocked on my door and asked for the fruit on the fruit tree on the property I rent. I had already been asked for the fruit by a neighbor. My neighbor actually picked an entire box and seem very happy to have it. This is the new America.

Charles Hugh Smith seems to have a good take on it…

Is the Stock Market Now “Too Big to Fail”?

“Who knows what will trigger Fed intervention; that information is asymmetric, i.e. only known to Fed insiders.”

http://charleshughsmith.blogspot.com/2015/09/is-stock-market-now-too-big-to-fail.html

Geez, have to be brave to short. Today futures are up based on Japan renewing intervention. I read where Gartman says to get into cash or short term corp bonds. Bonds? Call me cynical but I think this market isn’t based on anything, let alone raising money for actual development/investment.

I have really been fascinated watching the ups and downs this summer, mainly as entertainment. For the last two years my riskiest venture has been ‘rate climber’ GICs which maybe keep up with inflation. This afternoon I’m going fishing.

What’s in your wallet? (Goes the commercial). Risk or cash? Risk would be fine if there were actually fundamentals at work that Joe Blow could understand. Instead, everything is based on manipulation by psychopaths. Like I said, good time to go fishing.

regards

Post Correction:

It was Bill Gross who said go cash. Gartman says to short. Hah .

I believe the question still remains: Is this The Big One or is it only a much needed correction?

On the subject of entertainment, am I the only one wondering why it (the ‘market’) chose this particular time to correct? What I mean is all the reasons cited for the downturn have been at work for months; it just as easily could have happened a year ago. So: Why now?

Why now?

Even to algos, reality eventually sets in

The “why now” question has a lot to do with Wall St. traditions. The summer is usually quite because this is when the guys spend time with their families after not being home during the school year. It is also the time they spend the bonus money. September is when they get back to business and need to clean up all the crap before the year ends. September traditionally is the worst month. Followed by October when the guys who weren’t that sure dump the rest of the garbage.

Why now?

Well emerging markets are in bear market territory thanks to commodities bear market (and inputs to upstream goods with its own declining demand), Chinese comrades over-reacted and their PPT (plunge protection team) is running out of ammo all the while the ordinary citizens are holding bags and ghost cities are still vacant and looks like China is headed to the dreaded hard landing, dear leader Janet in deer facing headlight mode, and the global CB cabals’ Keynesian wetdreams are exposed and not working out.

I can’t remember where I saw it, but if you break down consumer confidence by region, it’s actually doing ok on the coast but poorly in the middle. Go figure.

Also, some great quotes from Bill Gross this morning:

He quoted Will Rogers amid the Great Depression, who said he was more concerned about the return of his money rather than the return on it.

“In the long run though, the return of your money will likely not pay for college, health care or retirement liabilities,” Gross wrote. “Finance-based capitalism with its zero-bound interest rates has now produced global imbalances that impair productive growth and with it the chances for ‘old normal’ prosperity.”

Dannie, the answer to your conundrum is that by and large, people in the Midwest still work for a living. Cheers!

Sabbie, the answer to your conundrum is that by and large people in the Midwest still work for a living. Cheers!

Darn spell check