“Many of our major trading partners are experiencing stalled or slowing economies, and the strength of the US Dollar versus other currencies is making US goods more expensive in the export market.” That’s how the Cass/INTTRA Ocean Freight Index report explained the phenomenon.

What happened is this: The volume of US exports shipped by container carrier in July plunged 5.8% from an already dismal level in June, and by 29% from July a year ago. The index is barely above fiasco-month March, which had been the lowest in the history of the index going back to the Financial Crisis.

The index tracks export activity in terms of the numbers of containers shipped from the US. It doesn’t include commodities such as petroleum products that are shipped by specialized carriers. It doesn’t include exports shipped by rail, truck, or pipeline to Mexico and Canada. And it doesn’t include air freight, a tiny percentage of total freight. But it’s a measure of export activity of manufactured and agricultural products shipped by container carrier.

Overall exports have been weak. But the surge in exports of petroleum products and some agricultural products have obscured the collapse in exports of manufactured goods. For now, the currency war waged by all the other major economies catches much of the blame:

The strength of the U.S. dollar against other currencies accounts for a significant part of the drop because of the relative price advantage our competitors have. There is concern that U.S. sellers—especially suppliers of agriculture products and food products such as meats—may have lost customers for good.

That’s the goal of a currency war. But wait… the dollar began to strengthen last year, while containerized exports have been dropping since 2012, when it was the Fed that waged a currency war against other economies, and when it was the dollar that was losing its value. So there are other reasons, long-term structural reasons unrelated to the dollar.

And some of them, the report pointed out:

The global economy is also stumbling, with many countries experiencing contracting or stagnating economies. Export shipments fell to almost two-thirds of our top trading partners. Many of the rest experienced little or no change in their levels.

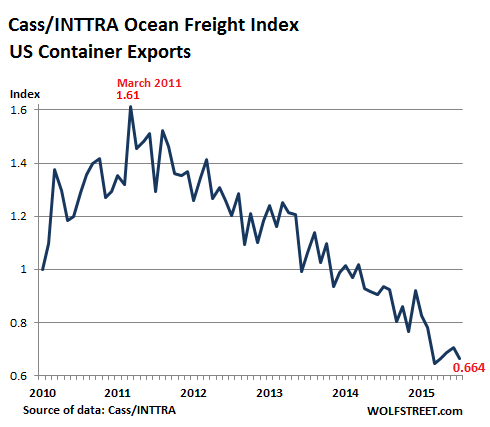

The index, at 0.664 in July, is 33.6% below the level of January 2010, when it was set at 1.00. It’s less than half of what it was in much of 2010, 2011, and 2012. This is what that multi-year collapse, as documented by Cass/INTTRA Ocean Freight Index, looks like:

Global trade had essentially come to a halt during the Financial Crisis. But by 2010, container export activity began to surge from very low levels and became part of the V-shaped “recovery.” It peaked in March 2011 of 1.61. But starting in 2012, month after month, interspersed with signs of false hope, it was beginning to fall apart. And now it has run into a global economy that is wheezing!

It’s going to get worse. The index hasn’t yet picked up on China’s devaluation of the yuan, currently at over 3% in two days. More devaluations are likely. The effect is already cascading around developing-market currencies, which are swooning. So the report: “The export market for containerized goods is not showing signs of a turnaround in the near future.”

As US exports become less competitive overseas, imports to the US get cheaper. And they’re already washing ashore tsunami like.

The import container index in July jumped 21.5% from June to the second highest level in the history of the index. It’s up 10.3% from July last year – already a record year for container imports. Much of that increase is due to rising imports from China as the back-to-school and fall merchandise arrived in the US.

But even in this scenario, problems are cropping up, according to the report: “Slow ordering patterns showing up in China’s measure of new orders indicate that US retailers are being a little cautious with their ordering.”

And they should be. Just today, the Census Bureau reported that the already sky-high business inventories – from manufacturers to retailers – rose again. Hampered by lackluster sales, the seasonally adjusted inventory-to-sales ratio reached 1.37, same as in February, the worst level since July 2009, during the Financial Crisis.

At some point, if sales don’t miraculously pick up by a whole lot, businesses are going to cut back ordering and channel-stuffing. This will curtail imports, which will hit China and other countries. And the US is supposed to be the engine that pull’s the global economy out of the quagmire.

There are consequences for the US bond market that has so vigorously and blindly funded all comers. Companies gorged on debt, even junk-rated companies. But now things are coming unglued at the riskiest end. Read… Wall Street Sees Junk Bond Collapse, Prepares to Profit from it

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’ve noticed something that I consider to be creepy in Tulsa, and that is that there is very little traffic. In the morning when I go to work I rarely have to wait to leave my apartment driveway. Tonight coming home from work on Memorial Dr at 5:30 there was literately no traffic. Pretty much everyone I know thinks everything is normal but it’s not normal that people aren’t coming and going to work.

Prototype – Not saying that this accounts for all of the drop in traffic, but don’t forget that while summer is the driving season and more people take to the Interstates, local traffic in general slows down quite a bit because school is out.

I don’t know when school starts again in OK but when it does, you’ll probably see a noticeable pickup, especially in the AM.

Proto,

I live in central CT. Tons of highschool and college aged kids around here. Normally while dog walking at night, it should be busy around here, kids driving back and forth, parties, pizza delivery etc.. Almost nothing is moving after the sun goes down in the neighborhood. Maybe 6 cars pass me on a 4mile walk.

Houses are dark and quiet too.

Never mind the bump up in for sale signs or boarded up houses in the area.

I think this is the calm before the next storm.

The traffic here in the bay area is horrific. I

believe this is ground zero for the FED’s free money. It took some time for the housing bubble to reach us, but this one will not prove to be anymore robust than the last.

I’ve never seen as many tourists in SF as now. Traffic jams on weekends!

Wolf just got back from SF hardly any tourist! Beautiful day! Exploratorium 3/4 full, parking no problem.

My favorite restaurant the Fransiscan 6pm Tuesday night half empty! First time in a decade no traffic on the famous Lombart street! ? No clue and it was strange like a disease broke out or something.

That’s it exactly like a disease broke out! And it’s not a 24 hour bug.

You’re observations are dead on, Girlfriend. I’ve been reporting on the downturn of traffic all over the country, even on traditional driving holidays like Labor Day and Memorial Day. There are hotspots of course Washington DC is worse than ever, which makes sense. Chicagoland and NYC used to be trucking nightmares with the sheer volume of shipping. Not so much now. Your instinct is dead on. Regards, Julian

They’re all coming to Texas! Please stop. We are losing the curious Texan drivers and being overgrown with Cali drivers. When you signal to move into next lane, a Texan will let you in. The other drivers will speed up to keep you from getting in. That’s why in Cali, you never signal, you just push over or never get into next lane to exit.

And the traffic has increased much here. Houses are being bid up to above asking. Thanks foreigners (non-texans). Hey, oil has tanked. Stop coming. The opportunities are not like before.

All the drivers are up in BC on vacation. I can hardly wait for Labour Day to come and go and the tourist traffic subsides.

No Snowbirds, too hot to be out. Traffic here is very light, even during rush hour.

Traffic in the northern Virginia suburbs of DC has been nonexistent once rush hour is over. I noticed the situation in late May while school was still in session and it still persists today.

The lack of traffic has always been my personal recession indicator. The traffic disappeared here just before the stock market collapses in 2001 and 2007.

House sales have also stalled. I’m a realtor and my email is filled each morning with price reduced flyers. It seems to me that the S&P is the outlier and that is likely to be resolved in the next few weeks.

Lots of traffic in l A and San Diego. The worst in 20 years. Took 6 hours from Northridge to San Clemente..110 miles..

Real estate is still very hot..

Traffic in Seattle is incredible almost any time of day now. It’s like LA around here!

Could be that part of this drop is due to the well-publicized labor troubles at west coast ports that ended just recently. One or two of the container majors actually pulled out of the US market (Hanjin?).

The West Coast port fiasco, in terms of exports, was largely resolved some time ago. That doesn’t mean that there won’t be future problems. A lot of shippers have decided to hedge their bets and have transferred part of their activities to other ports in the US. So you’re right, West Coast ports have suffered long-term damage from the strike.

But the export data cover all US ports, so the West Coast port issues – whatever they may still be, if any – would not impact the overall data at all.

I drove through Knoxville, TN last weed during the evening rush hour in down pour of rain. Traffic was moving well on I-40/I-75. It seems strange to me that the traffic was light for rush hour. When I got to Rockwood, TN just west of K-ville for a few days work, there was no traffic day or night. The town was dead, whole strip malls vacant, many businesses shuttered, downtown was dead. Back home in KY where I live, traffic is dead. Even school traffic in the morning is dead now. I suspect more and more kids are ridding the school bus because their parents are too broke to buy gas.

Rockwood, TN has always been dead after dark.

Here in Denver there is atrocious traffic… obviously everyone is moving here. Much more crowded and all the mountain areas are packed with people on the weekends.

Drove to DC and back this Saturday morning thru Sunday afternoon home……

I 95 was its beastly self with summer vacation (I think) travelers out in force. Back in Pinehurst…..ahhhhh