In San Francisco, a boom is always associated with its essential counterpart, the bust. They’re as typical to the city as sun and fog. And currently, the city is in one heck of a housing boom, but the national indices don’t quite do justice to how over-the-top mind-blowing crazy the situation has gotten.

For example, the S&P/Case-Shiller Home price index covers not just the city or county of San Francisco (identical) but includes four other Bay Area counties: Alameda, Contra Costa, Marin, and San Mateo. There are more counties in the Bay Area, but they’re not included in the index. Two of the cities in these counties – Richmond and Oakland – have made the lists of the nation’s most dangerous cities, justified or not, and home prices in these cities and other cities too are much, much lower.

So in terms of home prices, the five-county Case-Shiller index for “San Francisco,” though showing a significant gain, waters down the craziness happening before our very eyes in the real San Francisco.

For the most current granular neighborhood-by-neighborhood data for San Francisco itself, we go to Paragon Real Estate Group’s May 2015 report, and what we find are vertigo-inducing price increases that have now beautifully spiked.

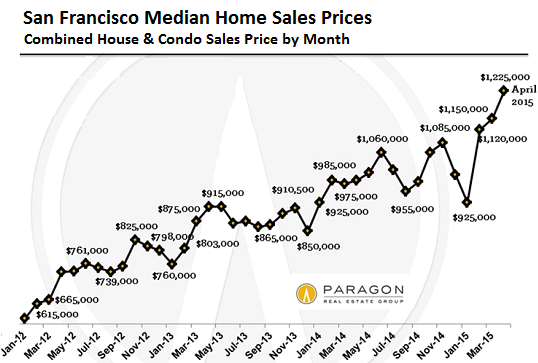

During the prior nationwide housing bubble that blew up with such fanfare, helped take down the world financial system, and caused central banks and governments to instigate the largest bail-out schemes the world has ever seen – from banks to entire countries – well, during that bubble, while it was still going on, homes in San Francisco reached what afterward were called totally crazy valuations, with the median price topping out in November 2007 at a completely mind-boggling $895,000.

People were shaking their heads at the time. But after the boom came the inevitable bust. By January 2012, the median home price had plunged 31% to $615,000.

By then, the tsunami of money that the Fed had unleashed was already washing over San Francisco from multiple directions: a stock-market and startup boom that the city is so dependent on, a tourist boom from around the world, waves of foreign buyers too, and a veritable flood of nearly free funding. Everything came perfectly together. Over the course of three years and four months, the median home price about doubled to $1,225,000.

January is typically the low point in the seasonal fluctuations of the median price. Paragon notes that sales prices in one month reflect deals negotiated in the prior month or two. So from January to April last year, home prices surged 15%. The four-month surge in 2013 hit 20%. But look at that gorgeous 32% spike so far this year! That’s what a real boom looks like:

The median home price is now 37% above the prior-bubble completely mind-boggling median price that afterwards everyone admitted had been based on totally crazy valuations.

This has a real impact on rents, with average asking rent in the first quarter hitting $3,458 a month, or $41,500 per year.

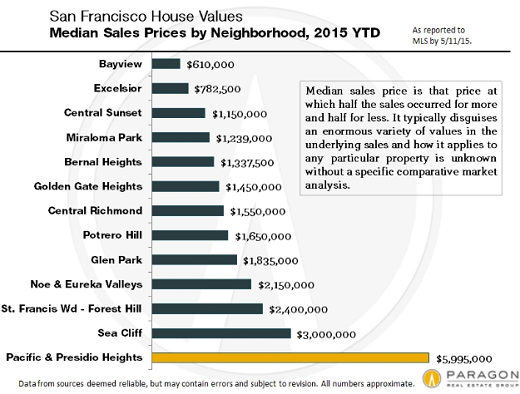

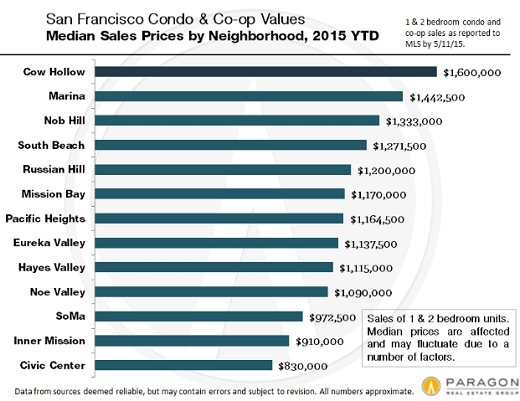

On a neighborhood-by-neighborhood basis, the differences in median home prices are enormous. Below are two charts from Paragon. The first chart shows median prices of houses; the second chart shows median prices of condos and co-ops. In some neighborhoods, houses dominate. In others, condos and co-ops dominate. So not all neighborhoods made it into both charts.

In the chart below, the median house prices range from $610,000 in Bayview, one of the more troubled neighborhoods, to nearly $6 million in Pacific Heights. It is in this exclusive, gorgeous, and groomed neighborhood, endowed with breathtaking views of the Bay, where you find the humble abode of the champion of the poor, former Speaker of the House Nancy Pelosi.

The chart below shows median prices of condos and co-ops. Prices too vary from one end to the other, but not by as much as prices in the prior chart:

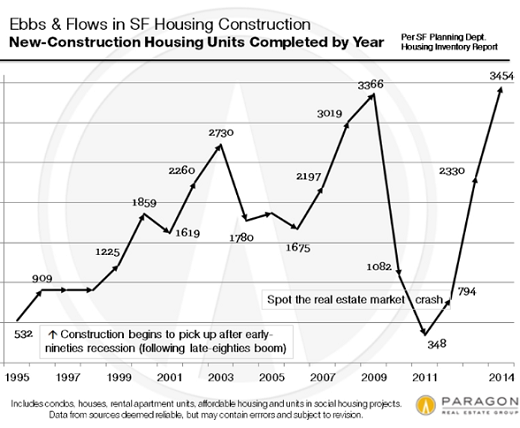

The extraordinary moolah that developers make at these prices has kicked off a construction boom – to be followed, as always, by the inevitable bust.

“The new-home development situation in San Francisco is fascinating – and a fierce political issue,” Paragon explains. Probably one of the biggest understatements of the year. And this is what the construction boom-and-bust cycle looks like through 2014:

This year promises to be even more ebullient. Cranes are sprouting in some neighborhoods like mushrooms. Lots that have been vacant for years or decades suddenly see construction work. This place is hopping. According to Paragon’s Housing Construction report: “99% of all new construction being built for sale consists of new and usually high-end condos.”

New home development often goes through gigantic boom and bust cycles. What complicates the issue for SF developers is that from start to finish, from creating plans for city review to completing construction, the process can easily take 4 to 6 years. Right now, both residential and commercial developers are making enormous bets on a long, sustained, up cycle in the SF economy and real estate market.

They’re certainly not betting on the next bust.

Most of it is happening in the eastern quarter of the city (Paragon map) near the Market Street corridor, the Van Ness Street corridor just north of Market, and in the large area southeast of Market where sleek condo towers are replacing former commercial and industrial sites. Zoning in these areas “allows for large – sometimes very large – projects,” Paragon points out. Which you can’t do easily or at all in other areas of San Francisco. And people are already complaining that it doesn’t even look like San Francisco anymore.

So in this environment, how many years does it take to save up for a down payment in San Francisco and other US cities if you earn the local median income? Are you sitting down? Read… How Soaring Housing Costs Impoverish a Whole Generation and Maul the Real Economy

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I live in east of SFand the prices in my development built during halcyon bubble days of 2007 now exceed the 2007 prices like most of SF bay area. Just nuts…

We learn history so as to ignore it and repeat at our own peril with it’s different this time mantra..,.

Yes my observation supports yours Vespa. Prices in Fremont (Alameda) are well beyond the point of reason. I am seeing recently a large increase in listings with reduction in asking prices from last month with longer on market time. Just waiting for the inflection point on this mania.

Hi Michael,

I live in Contra Costa county and saw a lot of homes come up for sale once the asking price was about same price as in 2007 when the development began to sell homes or break-even prices. Homes that came on the market 3 months ago got snapped up within 2 weeks but the home that came on the market recently are kind of stagnating. It is as though those who really wanted to buy bought in spring time and soaked up the supply which resulted more supply but perhaps demand is slacking or as you put it inflection point.

Dotcom bust 2.0 is one ripe catalyst. Or there may be no discernable inflection point, but rather a series of incremental chain reactions that slowly melt through the existing economic containment vessel.

You’ll know you’ve arrived when there are more homeless than homeowners, and they’re all defecating in your driveway.

SF city area prices are simply jaw dropping with median $615k house from Jan 2012 selling for median $1,225k per chart Wolf provided. Hear that even the once shady neighborhoods are turning/gentrifying into yuppyville of sort.

Chalk it to the steady stream of GOOG/AAPL/YHOO/etc. commuter buses on 101 with young tech workers with lucrative stock options buying up the town in bidding frenzies.

That said just looking at the past housing bubble is an indication that prices can defy gravity for so long till the greater fool theory takes over.

San Fran housing prices are simply a barometer for inflated money system of the past 30+ years. People flock to SF because it is one cool town. And, people with money and good taste desire to live there. Up go the prices. No different than other great areas to live in the US; but probably the poster child.

The real issue is how many buying in at this price don’t care whether there is a bubble or not. Are they planning on living there for the long haul. I suspect that what is going on in this boomlet of the past several years is just that. Boomers seeking their last refuge. I know for a fact this is occurring in other cities (not quite as flashy as SF). People are using bridge loans (5/1 ARMS) to buy untii they retire and sell current house.

They to don’t care if it’s a bubble as long as they can afford the price and it’s where they want to retire.

All this said, we have one sick housing market overall. Young folks can’t afford entry. Prices will drop. Just a matter of how much and when depending on location, location, location.

It’s good to be part of the nobility. It’s also good to be living near the nobility.

As long as the Chinese are buying up everything in the USSA it’s all safe.

Until they stop buying of course.

We’re renters and were forced out of the city after 24 years. (Clay Leavenworth). Our 1 bedroom with one parking place topped 3,600 a month, new owners, I could read the writing on the great wall.

We searched along the bus lines from Marin and found a better place, with four car parking, plus on street, a back yard and much better weather, in San Rafael, east of the Civic Center off North San Pedro Road. There are plenty of reasonable (compared to the city) rentals here, especially in the “marginal” areas of San Rafael along Lincoln. As a bonus, the local school is close and guaranteed to us, no lottery nonsense, and our daughter can walk.

There’s a lot to do near downtown San Rafael, which surprised us.

Plus the wonderful Farmers’ Market!!!

I have just started a new job in the city after an absence of several years. I am renting a room in the Outer Sunset, a small one with its own small bathroom for 1050 a month. I remember renting something similar for 700 back in 2009. Food prices have also gone absolutely postal in my opinion, pretty much tracking housing prices.

And for people saying this is a cool city? Please, this place is a dump. Having lived here before, I realize that homelessness has always been an issue, but last week was my first time seeing a homeless person taking a dump in an area around Montgomery Bart/Muni station. Heck, it’s my first time seeing a homeless person doing that ever.

Speaking about Bart/Muni; the last two weeks alone I have seen the all too familiar emails from coworkers saying how they are trapped in the BART system and as a Muni rider, I don’t think it’s gotten worse, but then again N Judah has always been pretty sh**ty.

I hope to get out of here in one and a half years. It’s going to be a long wait.

The entire SF Bay Area housing market has gone nuts. In Sunnyvale, the heart of Silicon Valley, new mobile homes are on the market for $300-400K. Then add a monthly space rent of $1,000 or more on top of that, which increases yearly. What’s funny there are few available. When the tipping point has been reached and home prices retreat most of these mobile home will be stuck with negative equity.

You all are throwing around numbers that scare me and I’m fearless! My first apartment was $75 a month utilities paid, in Omaha. It’s all relative I guess. We paid cash for our current home ($35,000) and have plowed that much into it. We’re just far enough from Omaha that it’s an uncomfortable commute if you had to drive it every day. Assuming we can continue to pay the taxes I plan to be carried out feet first and the kids can fight over the scraps.

People flock to SF because it is one of the few booming towns in the USA. There is tons of opportunity here. But the price of housing takes that all away. Young people are sharing not only apartments but rooms.

If SF prices are insane then prices down under in Sydney and Melbourne have long been in the asylum. Recent interest rates cuts are now just putting the icing on the cake.

A fairly average little house in Fitzroy Melbourne just sold for a million over reserve at over $3 million. http://www.news.com.au/finance/real-estate/a-fitzroy-north-property-sells-for-more-than-1-million-beyond-reserve/story-fncq3era-1227359084804

Meanwhile the Oz economy is in decline as resource related spending falls off a cliff. Just like SF, something will have to give.

Auckland, New Zealand is well on its way to join the club of Sydney, Melbourne and SF. Average home price in Auckland just topped a cool 1 Million NZD. The Reserve bank of NZ is trying to engineer a soft landing….I sense a crash landing is on the horizon as soon as the Chinese stop buying everything they cant get their hands on. Cutting off the capital flight from China is what needs to happen, no work visa, or residency, no mortgage!!! That is my 2 cents.

Yes, we all know that in certain areas of Melbourne that real estate prices are going crazy. It is basic demand and supply: the demand for houses by a large number of buyers – mainly foreign is outstripping supply.

And who cares that resource related spending is falling off a cliff as it has nothing to do with the price of houses in Melbourne or Sydney or the the outer suburbs.

Melbourne never really had much benefit from the mining boom and only suffered the negatives.

It would be great to see the price of the houses in my little area of outer eastern Melbourne to go up 5% a year………………….or even hit the median price!!

ANd by the way banks here are starting to apply the brakes a little bit, but again if you are a foreign buyer paying cash it means nothing:

http://www.smh.com.au/business/banking-and-finance/banks-put-brakes-on-investor-lending-20150521-gh6imi.html