It’s hard to measure the growth rate of a vast, complex economy with just one number, accurately, and on a timely basis.

The Chinese found an ingenious solution. They decree the growth rate and announce it in advance, and that’s about what the number says when it comes out. It’s faster than any other major country can produce its GDP numbers. It avoids nasty surprises and doesn’t need messy revisions. Whether or not establishing statistical data by decree is an accurate reflection of reality is a hotly disputed topic.

But then, the accuracy of any statistical data is a hotly disputed topic.

In the US, it’s a slog to get to the final answer. Quarterly changes in GDP, as measured by the Bureau of Economic Analysis, come in a series of estimates. The first estimate gets all the press, but subsequent revisions in the second and third estimates can be significant. Further revisions follow over the years. By the time the BEA has a fairly good handle on what actually happened back in the day, no one cares anymore.

So the Atlanta Fed started a new approach in 2011. The forecasting model is supposed to reflect a more immediate picture of the economy. Taking into account economic data when it is released, the model adjusts its GDP forecast accordingly and closer to real time. It has plenty of quirks. It’s jumpy as it reacts to incoming monthly data that is itself highly volatile and subject to revision. But it’s a good indication of where the economy has been going over the past few months.

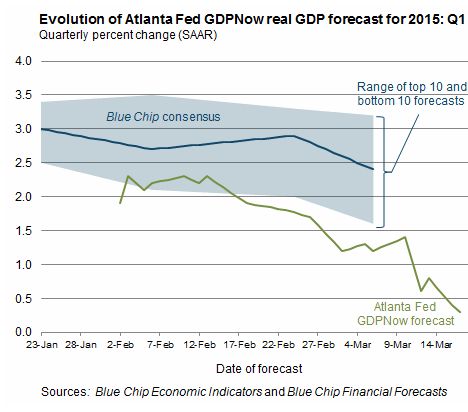

And according to this “nowcast,” as the Atlanta Fed calls it, the economy is going to heck.

The economic reports that filtered into the model over the past few months ranged from mediocre to very lousy, with the exception of the jobs reports, which were considered “robust.” The most recent set of reports, released over the last few days, dragged the GDPNow forecast to an annualized growth rate of a near-zero 0.3%. A couple more crummy reports, and this may turn negative.

The blue area in the chart below is the range of the so-called Blue Chip consensus forecasts. Now even the most pessimistic among these forecasters are way too enthusiastic, though they’re also dialing down their exuberance:

The biggest culprit?

Turns out, the oil bust is being felt despite assurances last fall from our preeminent economic gurus, who’d postulated that the oil bust – the lower price of gasoline – would act like a stimulative tax cut. Which I have been debunking ever since they first brought it up. It was one of the simplest things to debunk. It was just basic math.

So today, the Atlanta Fed specifically mentioned drilling activity in the oil patch, as measured by the collapse in the count of drilling rigs [a historic cliff dive; read… The US Oil Bust Just Got Worse].

This collapse in drilling activity knocked the category, “investment in structures” down from an already terrible negative growth rate of -13.3% to an even worse -19.6%. These non-residential investments in structures are important factors in GDP. And one of the most prolifically investing sectors in recent years, oil drillers, has been slashing these investments. Drillers are trying to make their cash flow less negative so that they don’t run out of money before the bust is over. They want to survive.

Investments in residential structures also deteriorated from a growth of +0.1% to a decline of -3.2%. And goods exports skidded further.

So this is what the eternal promise of “escape velocity” looks like when it collides with reality in real time. Wall Street keeps holding up the promise that “escape velocity” would soon be reached in order to rationalize irrational stock prices. It has worked wonderfully for six years. Stocks have soared, while “escape velocity” has remained a false promise. But now we have in fact “escape velocity,” only this one, at least for the moment, is headed in the wrong direction: it’s headed south.

And there are deeper problems: a sudden Lehman-Moment-like spike, but worse than in October 2008. Read… Last Time This Ratio Spiked, Stocks Crashed

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great title! I can always use a good laugh.

Hard to see how the Fed can raise rates now. They would like to so they have the ability to cut them again as “stimulus” but they’re a bit late.

I wonder sometimes if rates were higher all along if the economy wouldn’t be better. Retirees wouldn’t have come out of retirement to compete with younger workers and the retirees would have more money to spend. Most small business startups are funded from savings. What if consumers actually had savings for the past 6 years?

If they had just let Bear Stearns fail none of this would have happened.

Pass the popcorn, Wolf! This show is starting to get interesting. Isn’t the opposite of escape velocity terminal velocity? Kirk to engineering – Mr. Scott, our orbit is starting to decay…

Terminal velocity is when a falling object stops accelerating due to the fact that [buoyancy + drag] = force of gravity. At that point the object has reached maximum speed.

It sounded good though. Very dramatic.

I think the Fed is going to “raise” interest rates come hell or high water. It will be minimal of course.

We know they are boxed in; they know they are boxed in. But they will make a feeble attempt to move out of the box. A symbolic gesture; confidence booster, if you will.

It will fail spectacularly. The economy is slowing by the week as the QE hangover takes hold. The mini-boomlet in housing and tight oil all came as a result of QE free money. Now that they’ve pulled the spirits, the economy is falling back to its’ natural condition…..DEPRESSION.

It’s going to be an interesting ride for the next 6 months. Buckle up!

Very zerohedge.

Speaking of velocity. Whatever happened to the velocity of money in the USA? Wouldn’t any real recovery REQUIRE an uptick from the current record lows?

Aside from that I think we are heading for a Talebesque or Lehmanesque (for the non-black swan crowd) moment of undefined dimensions.

We all know it’s coming. Will it be Russia? Greece? ISI? The FED? Also, America has so pissed off the world that anything is possible. Its credibility is fear, its power a bomb in your back-yard. Not really good for global PR. The global gyroscope is askew and we’re all on the verge of spinning off into space. (more so anyway)

America has become all stick and no carrot, my Euro friends complain. That’s no way to captain space-ship earth and it could mean we’re all just resting on a piece of dead rock in interstellar space.

i’ve had some difference of opinion with the Atlanta Fed on their adjustments as they delivered them over the past month….figuring GDP is more complex than they allow for; there are good reasons other forecasters are higher…

you should be able to make use of this yourself, wolf: http://www.bea.gov/methodologies/index.htm

Thanks. The Atlanta Fed has been studying the accuracy of the model on an ongoing basis and found this (more detail and a chart of the mean error over time in the FAQ section): “Overall, these accuracy metrics do not give compelling evidence that the model is more accurate than professional forecasters. The model does appear to fare well compared to other conventional statistical models.”

We’ve also seen that these professional forecasters are routinely adjusting downward their forecasts as the release date of GDP gets closer. They will do so again for Q1. The day before the release date, professional forecasters and the GDPNOw model are likely going to be pretty close. And GDP for Q1 isn’t going to look very good.

Ah, Michael my satire is sometimes too quixotic. It’s not the fall that kills you, it’s the sudden stop at the bottom. B-)

Although the US isn’t looking that great economically, would you say that other major economies’ (like China, Japan, Germany, etc…) numbers look worse?

I don’t think this one is a head-fake.

The Fed will raise rates this year – just in time for the new old recession. -thus continuing their fine tradition of not only CAUSING the problems they say they want to solve but of making them WORSE.

Escape velocity? No. More like a Recession Lagrange Point.

Couple suggestions here that the Fed will raise rates. Why? If there’s any prolong dip in the stock market (the only thing with any momentum now) because of, or even just contemporary to, a rate hike, Yellen and Co. will probably be threatened with charges of treason.

The fact that the Atlanta Fed considers the jobs report as “robust” might be the funniest thing in this post.