The HK financial system is “very strong” and “can withstand an adjustment in the property market.”

The Hong Kong dollar is pegged to the US dollar. Hong Kong’s monetary policy is follows the Fed’s monetary policy. The Fed has embarked on a tightening cycle, raising rates four times so far. The Hong Kong Monetary Authority has followed each time. Last week, it raised its policy rate by 25 basis points to 1.5%. This will have consequences for the most expensive and ludicrously inflated housing bubble in the world.

“We have to warn our people about the dangerous situation of the property market at the moment,” Hong Kong Financial Secretary Paul Chan told Bloomberg TV.

“No one can tell how deep the adjustment will be or what is the appropriate level of adjustment because it is market force,” he said. “It is not up to the government to dictate, but I think it is important for people to recognize it is risky.”

But he doesn’t expect a repeat of what happened when Hong Kong’s prior housing bubble imploded during the Asian Financial Crisis.

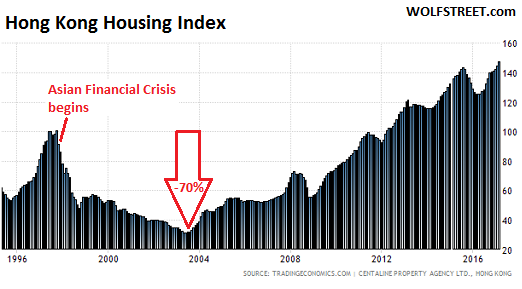

In the two years prior to the Asian Financial Crisis, property values had surged about 80%, with the Housing Index rocketing from 55 to 100. But in 1997, it imploded. Over the next 15 years, the index plunged 70% and bottomed out in 2003 at a record low of 31. Housing market “corrections” from bubble highs can take a very long time and can be very deep.

Now, Hong Kong has a housing bubble to beat all housing bubbles. The Housing Index has soared to 147.2 in March, up 1.8% from February, and up 17% year-over-year, having doubled over the past seven years (via Trading Economics, red marks added):

But current situation “is very different from 1997 when the last property bubble burst,” Chan said. This time, the “financial system of Hong Kong” is “very strong” and “can withstand an adjustment in the property market.”

Last time, it couldn’t. During the Asian Financial Crisis, the Hong Kong stock market crashed. The currency peg came under speculative attack. The government defended the peg by, among other things, raising interest rates to 23% (and briefly much higher), which caused stocks to crash further, which caused the government to buy stocks to prop them up….

But the property market was let go.

This time, Hong Kong’s financial system could withstand a crash better. That’s the theory. But the government didn’t prop up the property market last time, and now it is warning homeowners, potential home buyers, and speculators that the market has become a “dangerous situation” for them.

Hong Kong has been trying to tamp down on property speculation with various measures, such as tighter rules for mortgages, raising stamp duty rates on the sale of property, and other measures. But to no avail so far. Why?

“Fundamentally over the past five years, the exceptionally low interest rate, the ample liquidity in the market, the supply-demand imbalance situation, all add up,” Chan said. “By demand measures alone we cannot suppress the price. But I think it is fair to say by applying those measures, we do suppress external speculative investment demand.”

By “external,” he meant speculative demand from China, including Chinese developers that are outbidding Hong Kong developers for plots of land at record prices.

Though policy rates have come up, borrowing rates are still very low, and borrowing knows no limits, with more parallels to the Asian Financial Crisis. Bloomberg:

The value of outstanding mortgages jumped by more than a third in the five years through December and now amounts to 47% of gross domestic product, more than 10 percentage points higher than in early 1997 before a housing bubble burst.

Housing bubbles can go on for an amazingly long time, particularly when supported by loosey-goosey monetary policies and external demand that sees housing as just another global asset class in a diversified portfolio. But housing bubbles always burst. They run into the buzz-saw of the real economy, and the selling begins. And as past events show, housing busts too can go on for an amazingly long time and can go amazingly deep.

Oh my, how things have changed since late last year. Read… The Fed is on a Mission, Doesn’t Worry about Markets: New York Fed’s Dudley

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Would be pretty spectacular to be able to time a negative GDP in China (hasn’t happened since 1976). So much of our own growth is dependent on them. What would that do to property speculation in Toronto, Vancouver, Seattle, L.A. ?

When I was in Shanghai a couple of months ago, I met someone who has a “small” business doing basically what we do, except they’re in China and we are in the US. He laughed at all the rules we have to follow while I marveled at how insanely high his margins are, hence the small in quotes – if we made his margins… It seemed a bit crazy to me, but then again, I’ve stopped trying to understand how business is done in China.

This same person mentioned that he was thinking about buying a home in California, as Shanghai real estate is so insanely over priced right now, for the same amount of money he might as well buy a home in the US where he actually owns the land under the house.

This guy has to be one of millions, right? As long as it is easy for him to make money, and he has a way to convert it into USD, I think the property speculation will continue.

The Chinese take their stolen, dirty money and first buy the large residence (they like Irvine and parts of Orange County, San Fran) and then rental property because they have to launder the imported money into income. They can do this by proxy and not even be here.They first enter Vancouver, BC because Canada doesn’t require a Visa to enter.They then apply for an EB-5 Visa essentially buying their way into the U.S. for 500k. Now they have residence,anchor babies,school for the kids and work on citizenship.But watch out when the money train dries up and our Millenials have to rent from them because they own all the houses.

In SF I see Chinese buy-in up all the houses and they workers are chinese too. I don’t knock there hustle but they clearly have big money coming in and a work force to flip very house and rent or sell them. Across the street a Latino family sold their house to a chinese investment looking guy, they have been working on the house for over a year, word is they are making in into six bedrooms and will rent out every bed room. There is a history of chinese racism in this country but something has to stop this chinese money from coming here and buying up everything in there path, to the point know else can buy a home.

Also just remember how many of them, there are! Eating up all the property in the world, it’s the same scenario in Europe, Australia and New Zealand, to name a few places they are buying up, with the tiny populations of some countries they are colonising, they will easily out number the nationals (New Zealand is a good example). In China there is also presently easy credit, and a credit bubble of massive proportions developing.

” What would that do to property speculation in Toronto, Vancouver, Seattle, L.A. ? ”

… as well as NYC , Portland(ia) , Denver , San Francisco , all the overly gentrified luxury resort towns ( e.g. Vail , Aspen , Telluride , Jackson Hole etc. ) etc – et al – ad nauseam .

And what would happen to them you ask ? Suffice it to say ” all the kings horses and all the kings men ” .. aint gonna put that mess back together again .. assuming that is .. that it ever does happen .

Not too bad considering the 10s of trillions $$$ in wealth the Globalists transferred to China and HongKong from the West since 1997!

Ever wonder why Chinese can buy homes and condos and land in the West while most native born can’t afford them.

As long as the trillions in wealth from the West keep flowing into China there will be no crash anytime soon!

The globalists offshored our manufacturing base and living-wage jobs to China. Now they’ll be looking for even cheaper wage slaves in places like Burma and North Korea.

Yet the sheeple keep voting for more of the same.

Regarding, “Yet the sheeple keep voting for more of the same.”, we have terrible options to choose from. Look at the last elections. Either choice would give you more of the same but with a different spin!

Those trillions in wealth are now flowing back to the USA. Here on the West Coast, at least. the dirty stolen Chinese money has bought billions in property in cash and bought residency in the US through the EB-5 Visa program. The Chinese are buying luxury homes to live in and smaller properties to convert cash to rental income. Yes, your kids will probably either rent from the Chinese or from the Wall Street equity funds that have been buying properties since 2013. You can blame the Federal Reserve for most of this displacement. The Millenials may never own property in this country. Not until our Bastille Day.

Yes, by all means, we should welcome Chinese embezzlers and money launderers into our midst with open arms. Because propping up the housing bubble with dirty money is so much more important than giving our kids a future in their own country.

Well, Chinese millennials are in the same boat as our millennials. Look at that graph above, how do you expect anyone on a salaried income to buy property in that country. There is a simple reason why so many Chinese are jumping ship and investing in RE in the US, their economy is in big, big trouble. Forget what the government stats says, they are all bullshit. There is pervasive oversupply and inflation throughout the economy. Stocks are a sham, everyone wants to throw their money into RE; more money more building, more oversupply and on and on.

Do what Vancouver did, increase the property tax to 15% on foreign buyers and California’s housing bubble and rent bubble will deflate. Current property taxes in CA are a joke because of a state law that limits it to 1%, or 1.2% when you throw in all the city stuff. What a joke and then there is prop 13.

Errr .. hate to be contentious but it is not a matter of the ‘ so called ‘ globalists … transferring the wealth … but rather the reality of our 2008 economic crisis created in part by the poorly handled economic aftermath of 9/11 , two never ending wars and multiple military ‘ engagements’ as well as non-discerning consumers etc in combination with ill conceived tax breaks that left much of America bankrupt .. with us .. yes us .. SELLING .. not transferring much of the US to China by the square foot as well as by the manufacture and businesses in order to remain afloat .. Then add in greed addled investors placing short term gains over long term sustainability out sourcing in order to save money etc etc etc etc etc ad infinitum .. and there you have it .

So once again yet another overly simplistic conspiracy addled theory having little or nothing to do with the extremely complex realities facing this little blue ball in the sky we’re ALL living on

I have noticed that whenever you disagree with someone, you resort to the conspiracy theory bullshit.

While I do not agree either with the original post you answered to, I do not see any conspiracy theory there.

It could be possible that not everyone who does not hold the same opinions as you do is a paranoid. You could also be wrong sometimes. You know..

It really depends on whether much of the run up is funded by cash or debt.

Check the mortgage as % of GDP number from Bloomberg in the article (mortgage balances = 47% of GDP, 10 points higher than before the Asian Financial Crisis). So that’s a lot of debt.

– I see Hong Kong as a gauge for what happens in China.

– But real estate in HK is financed by short term rates and those have gone up higher. Not a good development.

For the ( historic ) record . I would not go so far as to say that Hong Kong is in any way shape or form a gauge for whats going on in China in light of Hong Kong being a bit of a Heinz 57 topsy turvy fantasy land verging on Monegasque pretentions with delusions of becoming the Switzerland of the Far East since the days of being a part of the British Empire .

Suffice it to say despite being back under China’s rule .. Hong Kong is a place and a rule unto itself .

TJM

No way did I understand all of it, but your second sentence was fantastic. Especially the “…verging on Monegasque pretentions with delusions…” riff.

oops – looks like it was the 1st sentence.

Every time CB print money they are printing debt. The abuse of money printing is theft against savers. The FED are worried it’s gotten out of control and the consequences.it would have been ok if it had spurred enough growth but it hasn’t and now has become dangerous .if (when ) it goes wrong the finger pointing will be at them and there unbridled power.

It could be time for all of the property bubbles around the world to burst and go back down to their fundamental values. Which I’m sure would make many who missed their window of opportunity to get in to the

housing market before homes became extremely overvalued very happy.

I wish all of the central banks would have been more clear and stated they were ready to finally raise rates, instead of threatening rate increases for years but leaving them near zero to then all of a sudden start raising rates on highly leverage individuals who have debt with adjustable rates.

Also, Bremer Landesbank decided it will cancel all interest payments on its most subordinated debt, in one of the first moves of its kind in Europe’s market for risky bank bonds. The next interest payment is June 29, 2016.

https://www.ft.com/content/17608487-5e70-341e-b8b3-a70a59792f24

Simplyput7

So what exactly are these property “fundamental values” of which you speak?

I lived in the SF bay area from 1973-1997 and the property market (CA in general, SF in particular) was flat-out crazy for about 100% of that time. Dirty Chinese money may currently be aggravating the problem, but it sure didn’t cause it.

Not blaming any foreigners for any particular asset bubble. People who are extremely leveraged are going to be facing a rising interest rate environment and do not have the income to support their large debts at when rates increase by even a small percentage.

This appears to be a global problem.

“Which I’m sure would make many who missed their window of opportunity to get in to the housing market before homes became extremely overvalued very happy. ”

Tell me what is the ‘fundamental value’ of housing or any other asset?

So you would destroy trillions of NET worth in the housing market so a small group of people who didn’t buy a housing unit could buy one?

Here in Oz about 70% of people own their own houses with about half of those paying off a mortgage. Wipe out the market so the others 30% can get a chance?

Maybe they should save, move, and make other choices.

And while the others get a ‘chance’ take the banks, builders, plumbers, and everybody else down involved in housing as well in order to make it happen.

You know, there are a lot things that I really like to own, consume, and derive pleasure from, but am not able to do so as a result of choices I’ve made and other circumstances beyond my control.

Maybe we should apply your thinking to all those markets and hope that they return to ‘fundamental value’…….

Let me know where we should start – hopefully with something that you own or area you work in as they must be ‘fundamentally overvalued’ and worthless from my perspective!!!

I concur with you, this is what happens when central bank becomes politicized and makes decisions to favor on class or the other in the society. The issue is not to favor homeowners or savers, it is to let free markets works. Socialism has been tried and it did not work, on th other hand free markets hav lifted billions out of poverty and generated tremendous economic prosperity. Why people think that a bureaucrat knows the price of money better than the free markets is beyond my understanding.

Wrong.

The system which has allowed millions of people out of poverty is by no means free market.

On the contrary, it is a mix of state and private industrial capitalism (korea, china..). On the other hand free market has been decimating the middle class in the west for far too long.

No country in history has ever prospered with free market policies. They are ok for propaganda and economy departments in universities, but that’s it.

You are defending a rigged system: casino free marker capitalism, but it is not the system which has lifted people from poverty.

Too bad that people do not seem to realize that there are many forms capitalism.

IMO There is no net worth in the housing market. We have built too many houses and the bubble is going to burst whether we like it or not. They will return to their fundamental value which is much lower than today’s values. I think we are going to face a worldwide depression in the near future and we will realize it’s the end of a petroleum based society. This effectively means we are going back to the middle ages.

The meaning of fundamental values would vary from country to country. I’m from Canada our banks recommend that your gross debt service ratio should be no more than 32% of your gross annual income, that is principal, interest, property taxes and heating costs plus fees for condominium maintenance (if any). Many people in Canada live beyond this ratio, some have ratios of over 50% of their after-tax take home pay.

The “equity” people are building in my country is fake, not only would it disappear as interest rates rise (which there is talk it could be as early as July in Canada) it would also disappear if people change their mind about property as an investment, as they have over the last 6 weeks.

Homes that sold for $2.5 million Canadian 2 months ago, now listing for under $1.7 million and have had no offers in over a month. Very few homes have sold for over $2 million in the past few weeks, there’s over 1800 for sale in the Toronto area right now. Most of our homes used to sell in less than a week. But our house prices are not based on our fundamentals which for us, is costing no more than 3 or 4 times the family’s gross income, that’s only $75,000 Canadian in Toronto. The prices were inflated by local speculators who convinced themselves that there was no more homes being built and prices always go up and never down.

Well that’s not true in Canada where 70% of people own a home and that’s not true in Hong Kong either. Prices can go down and have gone down in the past in both countries, people can lose a fortune, even if the majority of people own homes – that doesn’t matter if no one can pay off their loans, or if the new people coming in looking to buy a home can’t afford to buy homes at current prices. I don’t know of any housing bubbles where the government for the country bailed out the homeowners and left the companies who gave them the loans to fall. It’s usually the other way around.

I don’t think the government in Hong Kong or Canada is coming to rescue homeowners who speculated in the housing market. They haven’t in the past, why or how would they do it now?

https://www.youtube.com/watch?v=nGHmk4UeK_w

“So you would destroy trillions of NET worth in the housing market so a small group of people who didn’t buy a housing unit could buy one?”

You mean paper wealth. This is not real wealth so it will eventually evaporate anyways. The longer it takes, the deeper the economy is going to sink.

So yeah, for the sake of a healthy and functional economy real estate prices must go down (down, down down).

Nothing shocks me any more.

I have read so many WTF articles that I wonder if I have become immune their effect. Everything has gone up hugely from where I thought the insanity has to end soon. That was years ago.

My working assumption now is that things can double from here.

I couldn’t keep my sanity if I was invested in it, so I am merely a puzzled observer.

“Everything has gone up hugely from where I thought the insanity has to end soon. That was years ago…

I couldn’t keep my sanity if I was invested in it, so I am merely a puzzled observer.”

Si – I feel the same. I thought years ago that this was going to crash any day now, yet it goes on and on. Average home price in the bay area is going to hit 1 billion before anything surprises me again.

Just remember the crash happens when people least expect it.. if everyone is expecting for a crash.. it’d never happen at that time

This show would stop spectacularly but no one knows when and how… the reasons are always different every time..

Most educated people knew the 2000 bubble was going to pop. They just didn’t know the timing of it.

Si you are not alone in that thought. “The distance between insanity and and genius is measured only by success”. Bruce Feirstein

As someone refusing to buy overpriced crap shacks 3 years ago in the SF bay area and having witnessed them rise 30-40% since then; I have begrudgingly come to accept that I have been wrong.

Alos, the stock market has no fundamentals either but the party doesn’t appear to end . A 1% decline is followed by a new peak.

Maybe we the minority lurking here are::

1. All insane. OR

2. Will be proven right

IF so When?

3. Or theoretically correct and will remain factually wrong because NIRP / NIRP has changed the economy such that the long held models don’t apply.

I have been saving over 40% of carry home income and the house prices keep going to the moon – maddening as hell. I wish I had not read the theory of 20% down and should have gone the 5% down and would have been 200-300k richer.

Despite being fundamentally wrong, the crowd has been correct.

All that Chinese money has to go somewhere, if not into constructive endeavors then into real estate (or some other physical asset that can be bid up in price). This is what happens every time there’s too much money in the hands of those who don’t know how to make constructive use of it.

Besides, what goes up must eventually come down, quite often with a loud thump.

“Housing market “corrections” from bubble highs can take a very long time and can be very deep”

Follow the US then with it’s RE method, bailout banks and allow said banks to hold property off the market while giving free money to hedge funds to buy up said RE at pennies on the dollar and presto, a new bubble follows.

If there was one thing crazier than the HK real-estate market, it would be the crytocurrency madness:

https://motherboard.vice.com/en_us/article/a-messaging-app-for-ethereum-just-raised-millions-with-barely-an-alpha

Cats and dogs are raising mad money through “Initial Coin Offering” (ICO).

In this particular case, a messaging platform raised $44M, more than Google received during its early stage second round fundind. And its safe to assume that this messaging app currently has, for all practical purposes, no users. So the “old” high-tech industry raises money without demonstrating profit; the “new” high-tech industry raises money without even demonstrating users traffic. Crazy got crazier.

From the article:

“one use case states that a small amount of SNT will be needed in order to register usernames on the network, while another suggests that high status members can charge a fee to users outside of their contact network who wish to contact them.”

The whitepaper explains that message push notifications is decentralized. So to create an incentive for someone to agree to provide the notification service (store your message while the user is offline), the user would directly or indirectly pay (with cryptocurrency tokens of course) such service provider.

Sounds to me like major hurdles for users who are now totally accustomed to getting service for free, while not minding seeing ads in exchange.

The creators of this app argue that by paying, the users become a stakeholder of the app/service and therefore have a say in the direction of development of the product. Who are we kidding? This is to completely missing the consumer mentality. They usually don’t care enough, and even if they care enough, most are not qualified to form an educated opinion about the direction and the development of a product or service.

A burst of the cryptocurrency bubble may very well ignite a chain reaction that would pop the assets bubble and ultimately, the global economy.

Very appropriate, as it’s Asia which is driving cryptocurrencies to the Moon.

The dynamics are very similar to the 2014-2015 Chinese stock market bubble, in the specific those of the Shenzhen Small Caps, where daily double digit gains were the norm.

The main difference is the bubble is not limited to China: Japan is piling on, judgement clouded by years of financial repression, and India is jumping on the bandwagon with enthusiasm. So much for Modi’s “anti-corruption” crusade which as usual only fooled gullible Westerners.

The first difference between the two bubbles is that, as loose as standards were in Shenzhen, you needed to have an actual company to go public. Cryptocurrencies can be created literally out of thin air. Yes, units of the individual currency are limited, but there’s nothing against a proliferation of cryptocurrencies: the more money Asia pours into Bitcoin and Ethereum, the more cryptocurrencies and related “services” will pop up.

The second difference is cryptocurrencies have no taxpayer-backed safety net. Even the almighty People’s Bank of China struggled, and badly so, to turn the stock market freefall into a mere rout, despite countless billions expended and a few “malicious sellers” sent to the laogai.

The moment one of these cryptocurrencies collapses, central banks and governments won’t come to the rescue. If they did they’d lose the last shred of credibility they have left: for all their posturing, muscle flexing and braggadoccio they’d be seen as easily swayed by a bunch of greedy peasants beating on their pans in the streets.

Many ICOs can be reduced to simply a spreadsheet containing the number of tokens investor XYZ purchased during the ICO. There is zero line of code! In other words, there is no token and no code that ties the tokens to the Ethereum network; it’s merely a promise that whenever (if ever) the app becomes a reality, investor XYZ will be granted that amount of tokens, to be used in the app. Madness.

Blockchain technology is awesome but the current frenzy does not reflect reality. Many players in the sphere are putting the cart before the horse. It will inevitably crash, leaving only the few projects with a real value proposition standing.

As for governments not coming to the rescue, they likely would not, at least not directly. But if it impacts the assets bubble and the real economy, the government will have no choice but to step in and do something. The bigger the cryptocurrency bubble gets, the more likely its inevitable burst will impact the whole economy. I mean I begin to hear my no-techie acquaintances and friends talking about that amazing investment called Bitcoin and Ethereum! Furtunately, it’s still fairly mysterious and inaccessible here in the West, unlike in Asia.