New vehicle sales down 53% since 2012.

We don’t hear much from the global automakers and their analysts about the multi-year sales fiasco in Russia, in part because they don’t like to bring up crummy data unless they have to. And they don’t have to. For them, Russia is just a tiny market, compared to China and the US: through October this year, new light vehicle sales in Russia amounted to about 8% of sales in the US.

Since 2010, auto sales in China, the US, and many other countries have boomed. And they grew in Russia too, but only until late 2012, when the market began to stall. They declined in 2013. Then, when the sanctions hit in 2014, the market sagged. When the oil bust hit in 2015, the market crashed. And to this day, it continues to head south. The numbers are stunning.

In October, new vehicle sales – measured by registrations and reported by the Association of European Businesses – fell 2.6% year-over-year to 126,568. Year-to-date sales fell 13% to 1,147,670 vehicles.

Compared to 2012, the last good year, October sales plunged 50%! And year-to-date sales plunged 53%.

When the Association of European Businesses, an industry lobby group, released the October figures, it begged the government to continue the subsidies:

This is not a bad result, confirming our earlier voiced expectation that the new car registration trend should improve towards year end. Seasonality is a factor, of course, but the main driver here are the government programs offering purchase incentives to end customers. These programs are running out, in any case in the well-established form as we know them. What awaits us in 2017 remains to be seen. But it is clear already that, without meaningful support from the government, any trend stabilization would be very short-lived.

The government seems to have gotten the message. The sales decline in 2016 could have been a lot worse if it hadn’t been for government subsidies, President Vladimir Putin told plant workers in Yaroslavl (central Russia), according to Reuters, which cited an Interfax report published today.

Auto sales would have crashed by another 30% to 40% this year without government subsidies, he said. The government spent about 65 billion rubles in 2016 to support the industry, Putin told the workers, and this support would continue next year.

Hit hard by the oil price crash, the economy has been shrinking for six quarters in a row, longer than during the Global Financial Crisis. The ruble has lost about half its value against the dollar since 2013, making imports of all kinds, including auto components and fully assembled cars, much more expensive for Russian consumers, already struggling with a big bout of inflation on day-to-day items.

Here are the year-over-year percentage changes for October sales, going back five years. Note the collapse in 2015:

- October 2016 -2.6%

- October 2015 -38.5%

- October 2014 -9.9%

- October 2013 -8.0%

- October 2012 5.0%

In October 2012, sales were still up from prior year. But by then already, long before the sanctions and the oil bust were even on the horizon, the industry was feeling a slowdown, enough so that the Association of European Businesses felt it necessary to warn:

For a while now, the market has been feeling a cool down in consumer appetite. By contrast, retail registrations are still performing above prior year level, supported by robust order banks generated in the first half of the year and a visible increase in market incentives in recent weeks. Current new order intake however is generally slower compared to the same period one year ago, and will impact sales performance in the coming months.

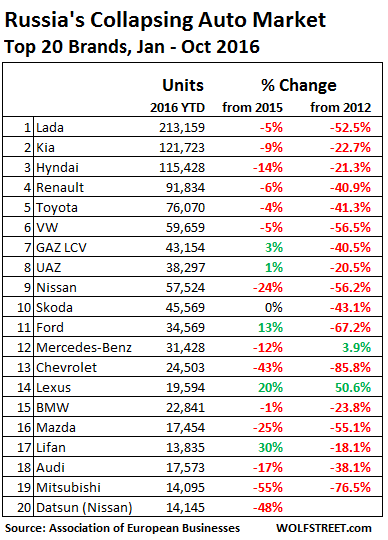

This kicked off the depression in the Russian auto market. Here are the top 20 survivors and their sales through October this year, compared to the same periods in 2015 and in 2012:

The car business is tough even in growing markets. It’s competitive and globalized. But Russia’s market has collapsed over the past four years, and even hanging on is tough. Since 2012, a number of brands have thrown in the towel and pulled out, including Opel (GM) which pulled out in 2015, and Volvo and Fiat-Chrysler which pulled out in 2016.

Russia’s top brand, Lada, owned by Russian automaker AvtoVAZ, has been able to nudge up its market share to 18.6% in 2016 from 18.4% in 2012. But its sales have suffered 52.5% since 2012. The Korean brands are muscling in on it, filling the void left behind by Chevrolet.

Chevrolet was Russia’s second largest brand in 2012, now reduced to number 13. It has lost 85% of its sales. Ford, number 8 in 2012, has dropped to number 11, after having lost 67% of its sales. The sanctions do bite.

This four-year collapse of the auto market, and auto manufacturing in Russia along with it, shows just how tough the economy has become for Russian consumers, particularly since 2015, when the effects of the oil bust started spreading across the economy.

But even in the US, where auto sales set a new record in 2015, the auto boom is running out of fuel. Read… The Chilling Thing Hertz Just Said about the US Auto Boom

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Note that the decline began in 2013 before the crash in oil and before the sanctions resulting from the take over of the Crimea and their tightening after the fighting in east Ukraine.

This slowdown was mirrored in the whole economy: it was hitting the wall before outside shocks.

Under Putin the share of the economy controlled by the state has doubled from 35% to 70%.

So although he may not have yet reached his stated dream of re-creating the Soviet Union- he has recreated the dis-functional Soviet economy.

Inside Russia, little mention is made of the slowdown having anything to do with its management. It is partly blamed on oil prices and mostly blamed on the sanctions. This is vital to the government, i.e., Putin, because only if they feel they are under siege by the West can the Russian public tighten their belts as a patriotic duty.

Perhaps because they aren’t journalists or rival politicians who can easily be silenced, some very high profile Russians are openly critical of the regime. Former minister of finance Alexei Kudrin was fired for telling Putin that Russia could not afford a 500 billion (US$) arms build-up.

But he has been recently been partly ‘rehabilitated’ and appointed to an advisory panel. He and the current head of the Russian central bank have said ‘there is no alternative to painful fundamental reforms’.

This would seem to be about as close as you can come to saying Putinism must go, if not Putin.

There has been either zero or negative progress in the rule of law. There is no point in building up a business of any size without what the Russians call a ‘roof’ a connection to someone in government who is connected to Putin.

A group of Canadian hoteliers had an experience of this.

They entered into partnership with Russians to manage a Moscow hotel, which because it was run in typical Russian fashion was failing.

Over a period of a year or so they built it up to a success.

Then the Russian partners arrived with hired muscle and threw out the Canadians.

The latter soon found out that the fact that the partnership was all in carefully written contractual language meant nothing. There was no law to appeal to.

But here is where it gets interesting. Canada is a small country (35 million) but influential for its size. As it turned out , although the Russian partner had a ‘roof’ inside Russia- the Canadian team had a ‘roof’ inside Canada. Senior members of the Canadian team knew senior Canadian politicians.

I’m sure it was a major factor that the Canadian partners were in the right, but they were also connected.

The Canadian PM, Harper, took it up personally with Putin.

It ended up with Putin telling the Russians: settle with the Canadians or go to jail.

So a sort of happy ending but it isn’t supposed to work like this.

And for the average Russian it doesn’t.

The next shoe to drop is the exhaustion of the reserves built up in the $100 a barrel era, sometime in 2017.

You fail to acknowledge that Russia’s recession has been a geopolitical one and one that cannot be sustained be her many enemies. Russia’s financial reserves have risen since the late 2014/early 2015 plunge: http://www.tradingeconomics.com/russia/foreign-exchange-reserves Moreover, it was mistakenly reported that the drainage from these reserves went to support the ruble, it did not. Hundreds of billions of dollars were set aside for a military built-up and modernization to wage war against NATO’s proxies in Syria & Ukraine and also modernize the Russian Armed Forces in general: http://www.politico.eu/article/russia-cooks-its-defense-books-military-spending-2016-nato/ NATO shills and enthusiasts also forget to mention that Russia is far and away the least indebted major country in the world: http://www.bloomberg.com/news/articles/2016-06-29/russia-can-quadruple-its-domestic-debt-and-get-away-with-it On all counts of debt, Russia is at exceedingly low levels. Russia has managed to weather a perfect storm of supremely negative external conditions (partly created by NATO-GCC) and has also managed to counter-attack NATO on the battlefield (Illovaisk, Debalchevo, Syrian Campaign) and the geopolitical chessboard. The economy has even started to grow: http://theduran.com/growth-returns-russia-sticks-to-tough-economic-policies/

Most important of all, the oil price-war is gradually devastating all of Russia’s rivals in the global oil industry (just check the balance sheets of Western majors, shale corporations, the divestment in the North Sea, or KSA’s hemorrhaging of dollars) My point is that the low oil price cannot last for much longer, and Russia will be the number one beneficiary of this reversal.

But most important of all, Russian Intelligence Services have achieved what is probably their greatest ever success (or at least since the Battle of Moscow, 1941) the election of Donald Trump to the US Presidency. This was probably the only truth that Hillary’s campaign ever said. The Kremlin was behind Trump 100% and has helped to get him elected (via leaks and some indirect propaganda outlets) While the neo-cons in the US, and allies in Europe and the Middle East will try their utmost in stopping Trump from pulling off a rapprochement with Russia, he seems determined to pull it off, and for very good reason. Both the American strategic position in the world can be improved (apropos the EU & China and Iran) as well as US financial interests can be served ( http://www.bloomberg.com/news/articles/2015-03-03/exxon-s-russia-exposure-surges-as-long-view-outweighs-sanctions) if there is cooperation with Russia.

And be careful, I am not saying that Russia hasn’t been badly affected by all this, because obviously, it has. What I am saying is that Russia is the one country on the planet that can sustain pain (financial or otherwise) like no other. And even so, despite the monumental collapse in the price of oil, sanctions and other forms of economic sabotage on the part of NATO, Russia’s economy has seen no spike in unemployment, no food shortages and no social or labor turmoil.

Russia has already won.

Given that the average Russian spends about half his income of about 400 per month on food and the pensioners are approaching subsistence as inflation reduces their meager income- it is amazing that Putin feels he can subsidize new car sales/production.

Firing people for not making enough money is what we do in the west.

“This slowdown was mirrored in the whole economy: it was hitting the wall before outside shocks.”

European economies stumbled well before 2013, crushing a lot of Russian exports. That was an outside shock. Global growth prospects were being revised downwards. Severe drought at this crucial time also dried up their agricultural output.

You are to the point. But many miss the point. OK, the automarket has been hit hard, because it is driven by credit. Much bigger US market sagged what 30-40% during the Great Recession and the deleveraging that ensued? The other sectors hit hard (and that are also credit-driven and boomed on that) are retail and construction. These accounted for a largest contribution into the GDP contraction. Industry declined for while (including the auto industry), but has been flat with agriculature growing robustly. Russia just hit post-Soviet in oil output and harvest, all-time daily record in gas exports to Europe. Its inward tourism sector is booming thanks mostly to Chinese and deleveraging process is almost completed. It has, for the first time, become a net exporter of food products, increasing exports to China, for example, fivefold. This includes such traditional import categories as sugar and beef.

But overall, you can hardly expect a boom where the value of your exports drop over 50% in value, if not in physical volume.

As a question. Russians dont typically use credit. I wonder what % of the US’s auto industry is purely credit? If you took that vehicle out how would the numbers look?

That is not exactly so. When auto market peaked, the sales on credit grew to over 60%, now they are down to much less than 40%. The rates are high and banks are unwilling to lend with some foregoing auto loans entirely as “risky”.

Interestingly, the truck market has already rebounded, but not the passanger car market. Maybe it is because it still need to go some way before pricing is normalized. The issue is that as ruble was devalued, passanger car prices were rediculous. Ford and VW cross-overs like Tiguan and Kuga were priced at less than $15000. At some point Lada Granta was the cheapest car available anywhere in the world, cheaper than in India and some Russian-made mid class sedans went for as little as $8000. The prices for Russian-made cars are still low compared to thw Western markets. Tiguan special offer price is still under $20.000.

I wasn’t really thinking about prices. My thoughts were more along the lines of what % of the US’s Auto-Market is being maintained on an IV of leverage. And, if you stripped that leverage out, what would sales really look like? Thinking back to an article posted here on wolfstreet (included at the bottom)

It would suggest to me, that while auto-sales have managed to stay strong in the US, looking at only the car sales data might be misleading. In consideration of that article, the sales data might be more indicative of just how loose credit has had to become in order to prevent the same kind of pain being felt else where. This seems especially true, when considering the increase in overall Car-Loans 1T+ and the new normal for the length of loan terms 76-84 months.

I think Western economies are very different from Russia and else where in that cash is still king, very little in terms of personal credit is used, even when buying a home. It might be argued that their respective auto-industries have contracted to a point that might be manageable. I would think that any change in credit costs or a significant slowdown in the economy may have even sharper consequences here in North America.

http://wolfstreet.com/2016/10/03/subprime-auto-loan-backed-securities-turn-toxic-delinquencies-losses-soar/

Here’s a chart of consumer credit in Russia via

http://www.tradingeconomics.com/russia/consumer-credit

You can see that consumer credit surged until the economic problems hit in 2015 (oil bust). It about multiplied by a factor of 5 between 2008 and 2015.

This is in rubles, and there has been a lot of inflation in Russia during these years, including recently. So on an inflation-adjusted basis, the curve would look a lot less steep. And I would guess, since 2015, on an inflation adjusted basis, the decline would be sharper (click to enlarge):

Thanks Wolf.

Do you have any data that compares debt to income?

That might be a good comparison between the US and Russia.

Note the 2 brands in the green. Self explanatory and to be expected, in an oligarchy..

Russia will be very interesting the day Putin decides it is time for him to retire, then there will be interesting times indeed when the elite starts to play music chairs and real wealth and power will be redistributed.

Reform of the Russian economy will not happen, simply because it is against the interest of the current powers that be in Russia, they reap a nice profit, damn the consequences.

Will be interesting to see wether the back of Russia or the USA is first broken due to military buildup and crumbling infrastructure and economy ….

The Russians can still go to space with the Soyuz aircraft. Can the US go into space with any aircraft at present? The last time the US had the capacity to get personnel into orbit was 2011.

True. The amazing success of advanced Russian technology and science in military aero-space is an indication of what it could do if was a normal economy. Instead it doesn’t have a single consumer manufacture that can be sold outside Russia.

Supplying customers with launch vehicles will not save the Russian economy. I believe even its airliners were being replaced with Airbus units up until sanctions hit.

One success- the Kamov helicopter. It’s a single rotor that can do the work of a twin. It got an exemption to enter Canada even though it doesn’t have dual hydraulics or something. A tough competitor whose appearance was not universally welcomed.

I was watching a dinosaur fossil show and after encasing the T-Rex head in plaster the gang wanted an 6,000 lb lift to the nearest road.

When a single rotor showed up it didn’t look able but it was a Kamov.

It is rumored, when necessary, to set down in brush or saplings and create its own landing pad, like a lawn mower

On the low- tech end is another Russian work horse.

Would you believe the single most produced aircraft since WII is a biplane? And its a giant- the size of a DC 3.

It’s an Illuyshin (sp) single engine.

It probably cruises about 100 mph but it can take off and land in short distances on irregular fields.

It is rumored, when necessary, to set down in brush or saplings and create its own landing pad, like a lawn mower

Just like the original hue, dosent do the blades much good though.

Selling consumer products requires different prerequisites such as absence of import duties and cheap logistics. Russian currency was hugely overvalued and its products were too expensive to export. So most of its exports used to be either commodities or semi-finished products. Where you have so much manufacturingovercapacity everywhere, one would hardly be expecting significant and, more importantly, sustainable, surge in manufacturing exports. And although Russian exports are dominated by oil and gas, its non-oil exports (half of total in value at $40 barrel oil price) are quite diverse – to name a few significant ones: nuclear reactors and fuel, turbines, transformers and generators for power stations, titanium/aluminum aircraft parts, auto tires, saphire glass for smart phones/ watches, solar panel pastes (25% of the global market), space and aircraft engines, helicopters and passanger planes (mostly SSJ100), lasers, cars and trucks, rail cars and locotomotives, rails tracks and pipes, software/outsoured programming services, space launch services, electric cables and motors, electronic components, optics, yachts, mining equipment, pulp and paper, different wood products, such high-quality plywood, different construction materials, pharmaceutical products. Sometimes it is quite suprising when you come across an unsual category. One example is fitness club equipment, but that is of course in additin to Russia’s traditional mainstay exports – oil and gas, metals, petrochemicals, fertilizers, grain and all kinds of arms.

One sector where the Russians are far ahead of the USA is education, Russain education, especially mathematics and physics are top notch. The USA does have excellent universities, but those schools are available for the select few only, while education for the masses in the USA is less stellar, even substandard when compared to other countries while the Russians have decent education for the masses. With the talent dispalyed By Russian scientist, what would Russia be able to accomplish if their economy wasn’t so restricted, but instead reformed and developed ?

Russia has always had great mathematics and physics. They also had biphasic defibrillators long before the west. In the late 1970s, (’79 I believe) the Soviet Union made and distributed biphasic units.

I’d like to remind commenters who will blame everything on “Satan” Putin that Russia is going through exactly the same as Brazil and for very similar reasons: a plunging currency, a chaotic political situation and an economy overly dependent on commodities which still refuse to pick up. This is a common BRICS+ problem.

Last year the Brazilian car market lost 26.6% compared to an already abysmal 2014 and 2016 is predicted to be another unmitigated disaster: predictions have gone from -5% in January to the present -9.4%.

But as the slowdown hit in 2014, it was too late for automaker not merely to stop, but to slow down: in 2015 car production in Brazil actually increased by 8% despite that horrible drop in sales. This year will be no different: a number of manufacturers, including Hyundai and Nissan/Renault, will add more capacity to their Brazilian factories from here to the end of the year.

To compound the difficulties, Brazil is part of Mercosur and many manufacturers, chiefly Asians, are investing enthusiastically in it. For example Toyota trucks manufactured in Argentina are crushing GM’s former stranglehold on the important Brazilian market. There’s little GM can do but cut prices and offer incentives.

And despite hefty custom duties, the boom in Mexican automotive is being felt in Brazil as well: apart from components (for example VAG engines), made in Mexico cars such as the Honda HRV and the Nissan Kicks are now cheap enough to make their import into Brazil feasible.

The present “caretaker” Brazilian government is obviously hard at work to come up with incentives to “revitalize” the local car industry. Manufacturers are circling Brasilia like a pack of hungry wolves.

The common problem is the same everywhere: demand is stagnating or contracting while supply keeps on increasing.

Since automotive is so important, governments are expected to step in and introduce indirect incentives or downright handouts (see France’s €7 billion “gift” to PSA) to artificially stimulate demand.

Coupled with shareholders’ increasingly irrealistic expectations of eternal growth (preferably in double digit), this makes executives unwilling to cut production. Very unwilling.

Just to give an idea of how distorted our present market is, sales growth throughout Europe continue at over 7%/month, but dealership are sitting on an average 100 days of stock. In China sales grow even faster but dealerships sit on far larger stocks. VAG dealerships alone have an average 180 days of stock.

This results in the usual stories about getting massive discounts on new cars and trucks with minimal, if any haggling.

Be it in Russia, Italy or the US this automotive market is completely broken in a way it has never been broken before.

Blame everything on Putin comes mostly from a reclusive scary NEOfok who sadly may very well soon be picked as our new Secretary of State. Funny… Drain the Swamp? He could ask Ron Paul, that would help. The morass doesn’t look like it’s going to dry out anytime in the future, in fact it appears he will inundate the bog with same old stinky slime.

http://www.politifact.com/punditfact/statements/2014/mar/06/john-bolton/did-vladimir-putin-call-breakup-ussr-greatest-geop/

Wow, Lexus is up 50.6% since 2012? Any reason for them to be so different? Units sold 2016 YTD is small, but something seems to be working for Toyota’s high-end subsidiary.

“High-end subsidiary” is the answer to your question. The rising tide is lifting the yachts, so they have the funds to buy nice things.

Yr almost there …

“The ruble has lost about half its value against the dollar since 2013, making imports of all kinds, including auto components and fully assembled cars, much more expensive for Russian consumers, already struggling with a big bout of inflation on day-to-day items.”

Poorer customers don’t buy gasoline and the fuel price keeps falling which cuts top line revenue to drillers which in turn means greater demand on their part for credit. This, in turn starves the customers who become poorer, still.

This is energy deflation, a cycle that feeds on itself: fuel shortages => poorer customers => lower prices => stranded drillers => more fuel shortages … etc.

Those subsidies can only come from the same customers who are too poor to afford the cars in the first place. Not too hard to figure out how this brilliant economic strategy ends up.

I should not have to point out that the energy deflation cycle, once it has taken hold, cannot be broken.

Just to add: Gasoline and diesel prices in Russia, in rubles, have NOT gone down, despite the collapse in oil prices. They have RISEN since 2012. This is from….

http://autotraveler.ru/en/russia/trend-price-fuel-russia.html

Click chart to enlarge:

… which strands the (marginal) Russian customer, making everything worse.

Then add the currency depreciation in other countries including Mexico, UK, EU and China … all driven to a large degree by QE and other central bank funny business.

Then add all the OTHER externalities looking for a place to land.

The auto makers long term trend is NOT their friend.

The US car and light truck market sector, has been flat to down over the past decade. This long term trend has recently steepened and is now approaching that “waterfall” moment.

As the article stipulates, the Russian auto market is tiny compared to the US and China. What is beginning to happen in the US and Chinese auto sectors, will make the current Russian market down turn look like childs play!

https://www.wsj.com/mdc/public/page/2_3022-autosales.html

What would be the effect on new car sales in the US if the Government exited the auto debt market.

Same question for the single family home and student loan debt markets.

I dread the thought of buying a new car because the experience is so abusive and exhausting. The elephant in the room is that the dealership model is already obsolete. This is why they hate Tesla so much. I would love to buy a car online or in a showroom where the experience can be like any other quick trip to the mall. The dealerships can still keep their foothold in the maintenance area which is another financial crime scene. Maybe this is why people hold off buying as long as they can.

Your bank / credit union probably has a “car buyer” where you tell them the make, model, features, and color – and they line up a dealer at fleet prices for you.

That said, the real reason why consumer-level purchases are down while luxury-level purchases are up follows the old Watergate mantra: follow the money. Have the top-earners been earning more? Yes. Are they buying more luxury goods? Yes. Are the rest of us barely scraping by, with no money to spend on discretionary purchases? Yes.

On a side note: cars have gotten more reliable and last longer – if they don’t need to be replaced, people aren’t replacing them just to have a new car.

“sales were up”

Who the hell are they selling to ?

How many cars can one person buy ?

In the current financial down turn .. who can afford to roll over their vehicle every few years .. no one.

We have accepted / not accepted .. that the population of planet earth is ever decreasing .. ?

If Yay .. as a result of the ever decreasing population global auto sales have fallen steadily each year.

If Nay .. get a grip man.

Russia should build cars with duel fuel like The Holden Volt & the black marketeer will sell them like hot cakes.

Do not believe the bad publicity .. the car was just meant as a token gesture .. Holden never expected that anyone would actually buy it & weren’t the shocked when is sold.

this is total crap harper was a joke on the world stage and in canada easiestly the fastest forgotten canadain pm what a total loser.

the Canadian PM, Harper, took it up personally with Putin.

It ended up with Putin telling the Russians: settle with the Canadians or go to jail.

harper was canadas most boring person